Both Elliott wave counts expected a trend change, but upwards movement has continued. This changes the probability of these two Elliott wave counts.

Summary: Both the main and alternate daily wave counts still expect downwards movement from here, and both expect a trend change at intermediate degree. The depth, structure and momentum of downwards movement will tell us which wave count is correct in coming weeks. At this stage I would judge these two wave counts to now be even in probability.

Click on charts to enlarge.

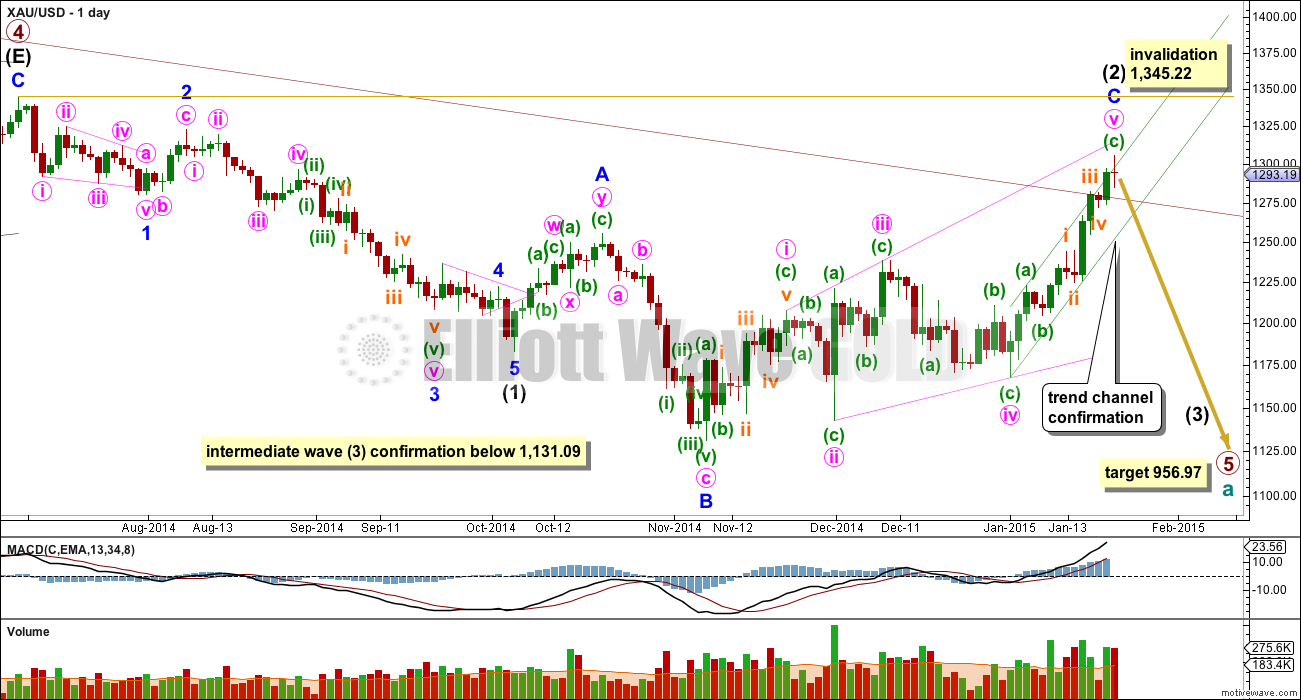

Main Daily Wave Count

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1. Although I am still confident this movement is a complete impulse, the alternate wave count is also reasonable (but has a lower probability).

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. If this invalidation point is passed this main wave count would be invalidated and the alternate daily wave count would be confirmed.

Intermediate wave (2) is now a complete expanded flat correction. Minor wave C is longer than 1.618 the length of minor wave A, and there is no Fibonacci ratio between them. Minor wave C is now a complete expanding ending diagonal.

Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. The rule for the end of a fourth wave of a diagonal is it may not move beyond the end of the second wave.

Within the final zigzag up of minute wave v minuette wave (c) now looks like a clear five wave structure on the daily chart. Minute wave v now has a clear corrective count of seven.

Draw a “best fit” channel about minute wave v zigzag. When this green trend channel is clearly breached by a full daily candlestick below the lower green trend line and not touching it, then I would have a lot of confidence that there has been a trend change at intermediate wave degree. Only a new low below 1,131.09 would provide full and final price confirmation that downwards movement is intermediate wave (3), but we should be alerted to it before that price point is passed by looking at structure and momentum. Intermediate wave (3) may only subdivide as a five wave impulse, and it should show a clear strong increase in downward momentum.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart). This trend line is now clearly breached with one full daily candlestick above it and not touching it. This reduces the probability of this wave count substantially to about even with the alternate. If this maroon trend line is breached on the weekly chart, with one weekly candlestick above it and not touching it, then I would discard this wave count in favour of the alternate. At the end of this trading week we may have an answer.

The breach of this trend line should be taken as a strong warning that this wave count may not be correct.

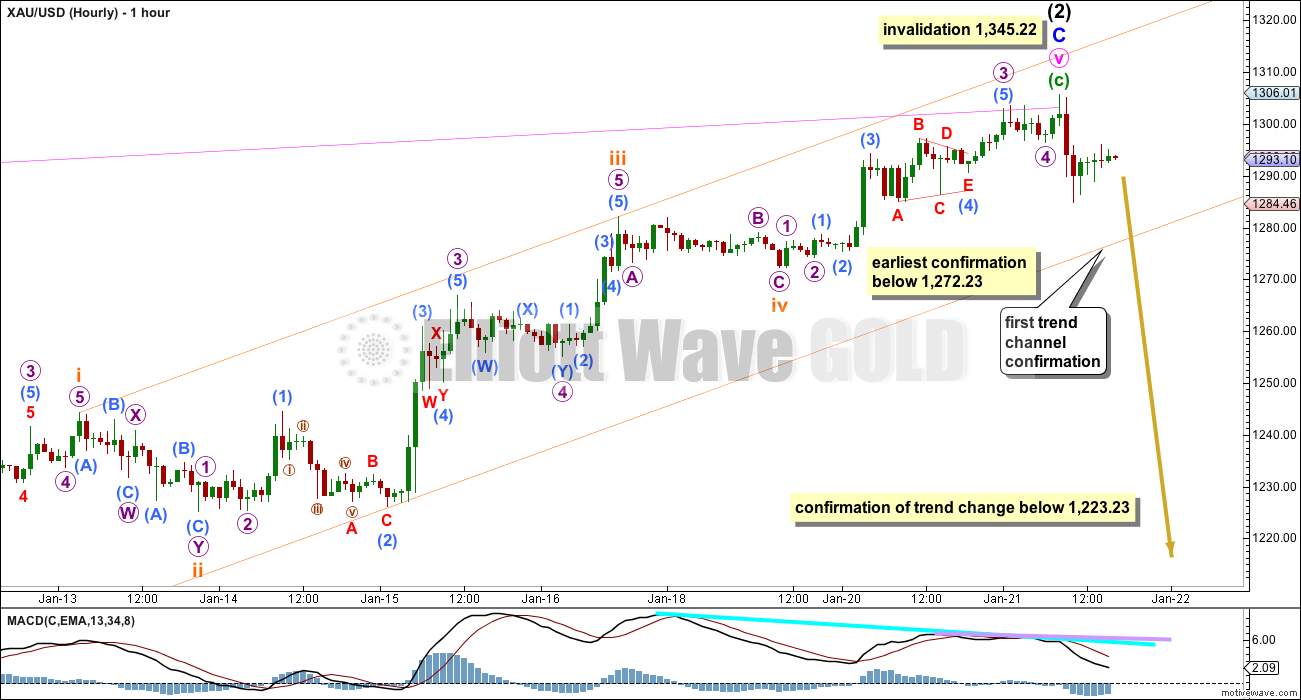

Minuette wave (c) is again a complete five wave impulse, with the final fifth wave extending higher. A new low below 1,272.23 would be earliest confirmation of a trend change, as at that point downwards movement may not be a second wave correction within subminuette wave v, and so subminuette wave v would have to be over.

Ratios within minuette wave (c) are: subminuette wave iii has no Fibonacci ratio to subminuette wave i, and subminuette wave v is now 1.18 short of 0.618 the length of subminuette wave iii.

Draw a best fit channel about minuette wave (c). When this orange channel is clearly breached with downwards movement that would provide early indication that there has been a trend change. A new low back into minuette wave (a) price territory below 1,223.23 would provide strong price confirmation of a trend change, as that would eliminate the possibility that this upwards wave of minute wave v is a continuing impulse because price would be back in what would be its first wave territory.

Once the orange channel is breached I will move the invalidation point down to the end of intermediate wave (2) for this wave count. While we still have absolutely no confirmation of any trend change I must allow for the possibility that this final fifth wave could continue higher again today, although the probability of this happening now is further reduced.

On the one minute chart the first downwards wave fits perfectly as a zigzag. This does not support the idea of a high in place, and so I must allow for the possibility that the high has not quite been reached.

This wave count for minuette wave (c) fits perfectly with momentum. Subminuette wave iii exhibits the strongest upwards momentum. There is now double divergence on the hourly chart. This is an indicator of a trend change here or soon.

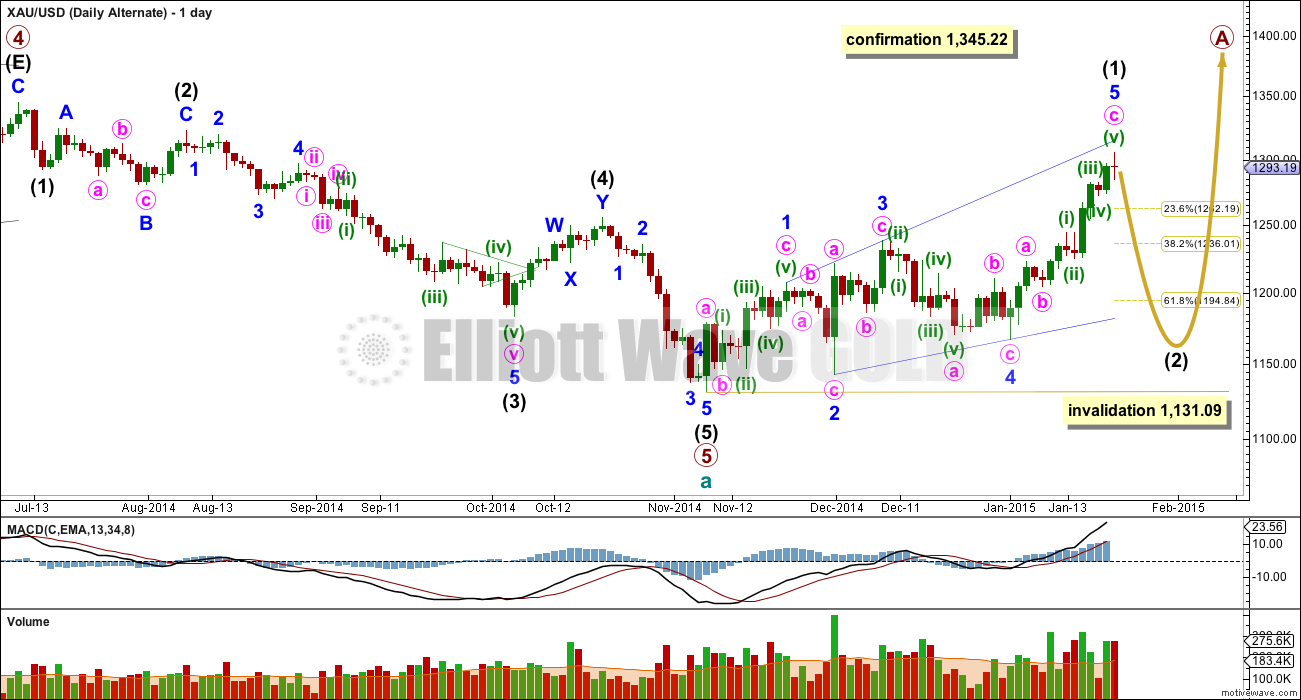

Alternate Daily Wave Count

If price breaks above 1,345.22 this would be my only wave count. At this stage, despite its problems, I judge this wave count to have a about an even probability with the main daily wave count.

Intermediate wave (2) is a rare running flat. This is entirely possible just before a strong third wave, with the downwards pull of a third wave forcing minor wave C to be slightly truncated. However, within intermediate wave (2) minor wave C looks clearly like a three wave structure on the daily chart and this is a considerable problem. If you’re going to label a running flat it is essential that the subdivisions fit perfectly. This is still my main problem with this wave count.

Intermediate wave (2) is a 58% correction of intermediate wave (1), and is a running flat. Intermediate wave (4) is a 52% correction of intermediate wave (3) and is a double zigzag. There is little alternation in depth, but perfect alternation in structure.

Ratios within primary wave 5 are: intermediate wave (3) is just 1.09 longer than 2.618 the length of intermediate wave (1), and intermediate wave (5) has no Fibonacci ratio to either of intermediate waves (1) or (3).

Intermediate wave (5) still looks like a zigzag rather than an impulse, and has a corrective wave count. This also reduces the probability of this wave count.

It is entirely possible that there was a leading expanding diagonal as the first five up within primary wave A. For diagonals the contracting variety is more common than expanding, and ending diagonals are more common than leading. While a leading expanding diagonal is not rare, it is not very common either. This very slightly also reduces the probability of this wave count.

Leading diagonals are almost always followed by very deep second wave corrections, often deeper than the 0.618 Fibonacci ratio of them. This wave count expects a big deep correction downwards. It should subdivide as a clear three on the daily chart, where the main wave count now expects a clear five down.

I have tried to see if this upwards movement could subdivide as a series of overlapping first and second waves, and I cannot yet see a solution which has a good fit.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,131.09.

This analysis is published about 5:19 p.m. EST.

Gold is stalled up against a confluence of trendlines like the 3×1 TL mentioned before (not shown) and the upper TL of this pitchfork off the Nov low, which if broken clears the way to 1320+. But if gold cannot break above this resistance, then gold would be at risk near-term of a pullback toward the 1262-68 fib support area on the chart, which is also the 2×1 TL support (not shown). Looking to add more longs down there with fairly tight stops. But a close below that area would invalidate this otherwise bullish tone which eventually targets the thick teal TL and 1320-1345 fib lines shown.

Thanks Bob B. for the chart tool recommendation.

Lara, charted it this time around.

This my first try using this charting tool and I am new to

Elliott wave, so there may be errors on labeling. I just really want to get

this idea out for thoughts. Hopefully the chart helps to convey this idea. I

couldn’t match the ticker symbol in this chart to the ones Lara uses, but this one was close in structure. I tried matching the labels to Lara’s chart. Again, it’s the idea I want to convey.

Per Robert Prechter, an ending diagonal is a special type of

wave that occurs primarily in the fifth wave position at times when the

preceding move has gone “too far too fast”. I don’t know what “too

far too fast” means, so need help to validate subdivisions at Primary degree. What I was suggesting in an earlier post is the possibility of Primary V being an Ending Expanding Diagonal, which is a more complex structure. Also, I remember that an ending diagonal structure suggests an upcoming major trend change, which is still currently in play. From what I understand regarding expanding diagonals, all Waves at Intermediate degrees should be a zig zag structure

(5-3-5). I tried my best at identifying the zig zags, and would like help to validate the subdivisions within Primary V. I am just too new to this to see it clearly so hoping someone can help validate this. Everything looks like a zig zag…haha

I will continue this thought assuming that all subdivisions

fit, and of course they must. Within Primary Wave 5, I used Lara’s Intermediate Wave (1) and (2) labeling. Wave (2) is around the 61.8% retrace of Wave (1), which looks good. The second part of the Wave (2) zig zag (labeled c) looks truncated, but I don’t believe there is an Elliott rule that this cannot occur. In this structure, Wave (4) is near completion as a deep correcting zig zag within this expanding ending diagonal, and is very close to a 100% retrace to Wave (2), which I believe is allowable too. Specifically, Wave (2) started near 1320 and we are not there at current prices. Also, I believe that Wave (4) can go into Wave (1) price range in an expanding diagonal structure (only exception to this Elliott Wave rule). At current prices, this structure is still valid. So when Wave (5) starts soon on the downward trend, it would again

be a zig zag structure and deep. In my opinion, sentiment seems very bullish lately, which is a perfect set up as this downward trend continues as Wave (5) in Primary 5. I also remember Lara mentioning that there is a trend line still in play due to an ending triangle structure that occurred in Primary 4 a few months ago. The apex to this trend line is approaching within a few weeks/ months (I don’t know the exact target date ~ around April?). Anyways, she mentioned that 5th waves could truncate in this pattern (I believe she showed that type of structure on her current charts/videos). So could it be possible that as Wave (5) approaches the apex of this trend line, it becomes truncated in structure too? Within this expanding diagonal structure, it would be a potential deep correction, but may truncate due to this. Just a thought.

All in all, have at it on this idea. To me this is a learning experience and would like comments.

Here you go.

I see the idea now. Thanks, a chart is so helpful.

It looks weird, because the first and second waves are so very small. There is a problem with that first wave down, its C wave looks like a zigzag. You have to either resolve that problem (I don’t think you can actually) or if it stays it must reduce the probability of your idea.

Overall diagonals should look like diagonals, and this one doesn’t. Its hard to explain what I mean by that, take a look at minor wave 1 down on my main wave count, thats a typical diagonal looking movement.

What Prechter means I think by “too far too fast” is a fifth wave may be a diagonal after a particularly strong third wave. In this case for Gold primary wave 3 did have very strong momentum. So this could fit that description. I would wonder though that the triangle of primary wave 4 being a typical time consuming sideways movement would have dispersed that energy, and so a diagonal for primary wave 5 is not needed to do that. Does that make sense?

Move the end of your second wave to the prior high, just to the left. That avoids the truncation, you don’t need it, and now the second wave looks like a zigzag where you have it looking like a five with a truncated fifth wave.

Thanks for taking the time! Explanation of diagonals and Pretcher makes sense.

Here is a prior example (this is within the sub waves of primary wave 4 triangle) of Gold diagonals on the daily chart. They look pretty typical.

Nice job with the chart. That’s what I “pictured” based on your original description, but much better to see it in a chart. Always good to get Lara’s opinion, and now you have it. Who knows, there’s many options on the table now, so it may work out.

Thanks for your help! I’m a big picture thinker, but need to keep learning the details of wave counts. Just going to follow Lara and pick up things from her explanations.

Oh and I think I’ll discard this thought based on Lara’s explanation haha. When going through the various EW rules this idea was making more sense. But I was trying to fit a square peg into a round hole. Going to focus on learning counts.

Chart of $gold:$wtic. Makes you wonder how this will reconcile given strong correlation of commodities (and gold as an inflation hedge, which is typical). Also chart of $gold:$xau. The historical average is about 5:1 gold to xau. If a reversion to the mean is coming, either gold stocks are going to skyrocket (and a healthy rebound in oil and other commodities), or gold drops in line. I find it hard to believe that gold is the leading indicator here for so many other assets. It seems the simplest solution is that gold falls. A move below 1270 tomorrow would be welcome and a good first sign.

Even as gold is creeping up the miners are becoming more bearish.

See the volume on the miners bailing at the end of trading.

GDX and Silver Updates here now for January 22, 2015

Both silver and gdx show primary pointing down, alternate pointing up.

Too much uncertainty. I wait.

Davey, it is an eerie feeling looking at those two opposite results with equal probability. Definitely not reasuring about investing either way in gold right now.

Today’s report not to expect much change from yesterday. Gold continued higher.

Probabilities remain same. Just saying.

Yes. Exactly.

Also, look at the now very strong divergence with momentum on the hourly chart.

But thats the problem with that old school divergence; its an indicator to be aware of an upcoming trend change, but it does not pinpoint when the trend change will be. Its just a warning, which is now very loud.

And res is pushing on 70, but not above yet,

as I posted/charted last hour.

Thus the notion of corrective behaviour like a minute iv of minor 3 as I described today, but it didn’t really show. As I’m no EW, yet.

Can expect gold price back down to 1294-84 to go long again with downside risk 1279-78 for possible upside target 1313+…. Fascinating, gold price has today broken below and above Wednesday range 1284.6 L / H 1207…. What next to expect? I wonder what the wave count will be now?

In TOS Daytrading platform using 8 top indicators gold is Bullish as of 11:10 am bullish in 1,5,15, 30 minute, 1 and 4 hour, 1 day and weekly. As of this minute I have no gold stocks. That may change very soon maybe today or Monday after Greece weekend vote which may cause them to leave Eurozone.

Once this vote over PM may may stabilize. In yesterday’s summary Lara wrote:Both the main and alternate daily wave counts still expect

downwards movement from here, and both expect a trend change at

intermediate degree.

Lara also said Both Elliott wave counts expected a trend

change, but upwards movement has continued. This changes the probability of

these two Elliott wave counts. While we still

have absolutely no confirmation of any trend change I must allow for the

possibility that this final fifth wave could continue higher again today,

although the probability of this happening now is further reduced.

10:36 am EST, Is Gold in a 3 or 5 wave or zig zag up from this morning low and ECB QE announcement. Any EW estimates on how this gold intraday rally peaks and where gold closes today?

Draghi decided today was the day to learn to tie a self-tie bowtie and underestimated how long it would take. #WhyDraghiIsLate

ECB Draghi says ECB Asset Buying 60B/month in March,

To Continue Until Sept. 2016. Gold & silver up, euro down.

Silver stronger. Euro erases post-EBC losses.

Might silver eventually test next ohead Res at 18.6?

Precious metals up. Euro testing 12 year low

Gold might go back down to <1280 if gold is in a-b-c correction in minute wave iv

(see my next post below and chapstick's)

gold plummeting before ECB announcement….will it hold? It has finally broken the hourly channel, but not $1272. Like Lara suggested, it does look corrective however IMO.

Why Lara used 1272???

Lara said:

“at that point downwards movement may not be a second wave correction within subminuette wave v, and so subminuette wave v would have to be over”

Also there is 2×1 TL support now just below 1270.

So as I been saying, prefer long side while at 1270+

I be back later after the ECB circus. Good luck.

Yep…You guys are good at this..What we can learn from u !

Draghi surprise resignation; to become member of EWGold

#Draghi2goEWgold

Yes it looks corrective. Like an incomplete a-b-c for minute wave iv of minor 3 up? With minuette a down to $1280 hours ago, then b finished up $1304 last hour, and now in c down to 1270s. Then wave v of 3 to complete up ~1320-40.

??

I am watching the a-b-c possibility also.

Hello, what do you think of wave C down now that it hit 1307? You also mentioned that you are bullish.

Yes Scott I am still bullish, conditionally of course. Plz see my post above minutes ago.

My abc didn’t show today. I’m no EW guru.

thanks J

If gold opens below yesterday’s doji with gap that will constitute bearish candle reversal pattern Evening star. Means halting price rise.

If at opening COMEX boyz can take gold to 1272,

Lara’s Wrote: ” A new low below 1,272.23 would be earliest confirmation of a trend

change, as at that point downwards movement may not be a second wave

correction within subminuette wave v, and so subminuette wave v would

have to be over.”

Bullish sentiment must be very high.!!!!!

There may be a minor sign of a trend change down. Gold just dropped down to 1,283.44 which is lower than Wednesday’s low of 1,284.73 after the $20 drop in gold. Also on 1 hour chart at http://www.pmbull.com gold for the first time since January 14th just had a full hourly candlestick below the lower hourly trend line. Lets hope the ECB QE news this morning 7:30 am EST also sends gold even lower today and Friday another drop Then we may use the main daily count and discard the alternate daily.

The Euro has already dropped overnight to an 11 year low versus the US dollar.

Good to see you up and really into this :)… Hey, gold is a bearish Gartley butterfly with proper fib pts at Oct hi, Nov low, Dec hi, Dec low, January hi. See it on your daily chart?

http://thepatternsite.com/GartleyBear.html

Correction: upper right point of butterfly wing (Jan. high) hasn’t gone high enough yet to reach fib pt.

The comparable EW trade point is the end of a zigzag wave 2. That EW situation is somewhat more restrictive than that butterfly pattern. The EW trade will be successful as long as you are right that it really is a wave 2.

At 1283 gold came close to bottom pink channel line on hour chart.

American Bulls is giving DUST a buy based on candlesticks reading today.

https://www.americanbulls.com/SignalPage.aspx?lang=en&Ticker=DUST

American bulls for JDST says stay short???

Hi and Good day all! With 1255 having formed a bit of a floor; gold price remains bullish when 20dma crossed above 100dma a few days ago and rising…. A drop is expecting for a break below 1286, 1283-82 for possible 1278-77/1264 (downside risk 1245) to go long on the drop for a break above 1303-05 to target down trending resistance at 1313 – upside move is likely and expecting …. 🙂 Good luck.

Yep, 1255 is important support from Oct and it’s also Gold’s 200 dma. Silver touched its 200 dma on Wednesday, just sayin.

Hi J: It will be very difficult to trade this today. A bearish key reversal is in play now but hard to say how far down gold price will get; a break below 1283 would be welcome! Lol …. Gold price seems to have stalled here and looking a little hesitant to get below 1283; that’s interesting; I’d still prefer to wait for some more downside though, as long as gold price

is below its pivot 1294-95…. On the other hand, gold price remains bullish and up trending. MACD / Momentum etc are pointing for an upside move to occur…. With downside risk 1260/1246, I am inclined to Buy the drop/s (I hope it does drop below 1283!) to target a break above 1303-05; at least that’s the plan…. Let’s see what happens. As long as 1333-34 is not taken out, I’d look for gold price to give us all the downside trend change confirmation we are looking for lol. On the other hand, a break above 1333-34 would be early confirmation for gold price to go the other way! Thank you. Good luck.

I agree it is difficult. Particularly given the potential for ECB-induced volatility in 3 hrs.

That is really a crap shoot. I exited my XAG position and hedged my XAU to neutral.

Let’s see what happens and then react after.

Rather than shoot first and then look after.

Happy trading.

And on a very volatile day (if we get one), I give more weight to closing price than to the intraday price. And more to tomorrow’s weekly close price. It’s just good TL analysis.

Traders might find this site useful. Just plug in the symbol and the site returns a short term buy or sell signal. For example, GDX issued a sell signal today. https://www.americanbulls.com/Default.aspx?lang=en

Why do they call it “bulls” but signal a “sell”? LOL

j / kidding

Props to Lara for filtering out the noise we are confounded by in the media and for being an EW purist. Reading everyone’s posts to me is therapeutic whichever side I’m on, and the community vibe of traders is nice.

That being said, this ECB thing tmr seems so much like the Swiss gold vote in the media – propped up with hype and expectations giving little or no respect to the actual decision that needs to be made by those who need to make it.

TA – prices extended beyond Bollinger bands with MFI confirming a no signal. All the while GDX fails to close above 200MA today. Isn’t it fair to say whatever ECB does; that it is priced in and Gold falls tomorrow?

Ominous doji on the daily. wouldn’t want to be long tomorrow

Some times a doji can be a midway point and bull continues with a gap up.

BUT in this case with EW turn coming possibility of that happening may be less.

Lara, with the GDX update, it would be good to see if there is a bullish alternate to match the gold alternate. Thanks,

working on it

Lara, I’d respectfully vote to delay the Silver analysis until Friday or tomorrow, after the temp noise of a major event (ECB) passes.

It looks like Silver (and gold) might turn this week, perhaps from my target of 18.5 which was reached today, or early next week. At the least a minor turn.

I think you have done a superb job with gold. People here should have been easily able to make winning trades for the January pop regardless of whether the Main or Alt win out.

More importantly, as an experienced trader new to EW, I really appreciate how you provide the means for someone to learn a new skill for our trading repertory. I hope that in so doing, you are somehow rewarded for your efforts, such as by sharpening your own skills in the process.

As another trader who referred me here said, “She is very good”.

Do you still want testimonials?

I want to see silver and how it relates to gold to help me make decisions. I don’t want to wait. Let’s stick with Lara’s original plan.

To be blunt, given the event risk, IMO if you haven’t already planned how to trade this yourself, then you have no business trading it. Sit this out for a day til the dust settles unless you’r experienced with a plan

Learned from school of hard knocks when I began.

I’m not sitting out period. Don’t be rude to those that happen to disagree with you.

Okay, no intent to be rude or offend.

Would you like to share your trade?

I will share mine. Fair is fair.

Np, I’m leaning towards the alt wave count but expect to retrace lower in the near future. I’d like the latest silver analysis to see how gold and silver synch.

I agree and I’d also like to see EW silver analysis, even a bit more often if I could 🙂

I exited silver today near my published target of 18.5. My current silver trade currently is no trade, haha, as you might guess from my above. I find silver often whippy and difficult, so I’m cautious with it.

Good luck and my respect.

What trade plans? Not trying to be wise guy but both primary and alternate are pointing down. Yes there is always the possibility both primary and alternate plans fail but probability says gold is or will be soon turning down. So what trade plans other than short and ride out any move up?

Hi Davey,

Well to start, what is/are your entry pt, target and SL? Have you established your risk:reward and approx probabilities of each? And of course you must decide in advance your max $$ for your trades and stick to it. Basic but important stuff like that, which you should plan before rather than decide during the emotions in a real-time trade (at least I have to or I panic and screw-up).

So you expect gold will go down then up more. Okay fine, then are you in that for just a quick short scalp, or are you looking to jump on a good long entry pt on the spike down, or trying to perfect both (good luck), maybe playing a spread, or hedging an existing primo long?

Don’t listen to me then listen to Lara as I suppose you will if you pay to read her blog… She has mentioned the need for a good trade plan and also recommended a book or chapter about it too.

But I’m a woman and, like Lara, we tend to be risk-averse, yet women are good traders… think about it.

Trading is a zero-sum game, in which about 10% ultimately get all the money from the other 90% who eventually lose all theirs, often suddenly. I know what it’s like to make a bundle over months and then quickly lose it all in some volatility on the wrong side, cuz I was inexperienced, overconfident and not practising good risk mgmt. Not saying that’s you; I just don’t want others to live my past mistakes 🙂

Best wishes for you.

J. If that works for you congrats. I appreciate reading your comments.

Hi everyone,

My first post and wanted thoughts on this. Also, new to Elliott waves so I am still learning. Unfortunately, I don’t own charting software so I am trying to be as descriptive as possible. This thought may have been addressed earlier too. Note that I am looking at this from a high level perspective on the Main Daily Wave Count chart.

Could it be possible that where blue B labeled of Intermediate 2 is end of Wave (3)? Assuming Wave 1 (in blue) and 2 (in blue) are Wave (1) and Wave (2). Where blue A labeled in Intermediate 2 would be the wave iv within Wave (3), It is a deep correction and alternates with wave ii (all I know is its shallow) in this downward movement and I see a long wave iii in this structure.

We are in and near the end of Wave (4), which could look as a corrective 3 wave structure, and deep which also alternates with the shallow Wave (2) noted above. All I know is that I do believe we are due for a trend change down, but maybe as Wave (5) of Primary wave 5. A question I have is can a corrective fourth wave go near wave 2?

This would potentially align with GDX wave count, which expects a final fifth wave down, and shorten the time frame to conclude Primary wave 5. Since this is a potential deep fourth wave, wave 5 tends to be deep too and could still hit Lara’s target. I don’t know how this potential structure looks in terms of Fibonnaci ratios in terms of days or wave lengths.

Does it have the right look? 🙂 Would appreciate thoughts.

Sorry looking at wave (1 ) and wave (2) positions from the Alternate daily charts not the main daily.

It’s a little hard to visualize without a chart, but it sounds like your proposed count would need to be a very large primary degree ending expanding diagonal for the entire downtrend since 2011. It would need to be charted and the subdivisions would need to checked. A 4th wave cannot overlap into a 1st wave unless the structure is a diagonal. Interesting idea.

Hi Bob B. Yeah I know it is hard to visualize without a chart. I referred to the Main instead of the Alternate daily for Wave (1) and (2) which is a mistake on my end on the original post. Should be the Alternate daily. Let me rephrase based on Alternate Daily chart. From where Lara has Wave (5) ending is Wave (3) and we are about to conclude Wave (4) which in this case does not go into Wave (1) territory. Wondering if this is possible?

I still think that the structure would need to be an ending diagonal to have the right look, since the 4th wave would be so long. That would require an overlap.

Trading view, stockcharts (limited), and freestockcharts are some free options if you want to try and chart your idea. Lara likes to see a chart to give feedback on more complex ideas.

Great! Thanks for the tip!

John H

Below is the link to stockchart.com

Many professionals and individuals use this service.

You can explore it.

no, because your first wave price territory would reach down to 1,292.25, and your fourth wave would reach up to 1,305.68. so there would be an overlap which breaks a rule

I know this is a long winded way to do it, but I used to take screen shots from the charts on my trading station and put that into photoshop and put labels on there. I did this for a long time.

So if you don’t have software that will put the labels on the charts you’re using, use photoshop or something similar. you only need to put a very few labels on to show what you mean, but that way everyone is really clear of your wave count.

Lara, thanks for your reply! Just proposing an expanding diagonal idea for primary wave 5. Thinking wave (1) and (2) are the same as you placed them your Alternate daily chart and recommended wave (3) is where you placed wave(5) on the alternate chart. This wave (4) is near completion, so far does not seem to pass wave (1) on the Alternate daily chart. I saw the error with the main wave count where wave 4 cannot pass wave 1, noted it earlier. Thinking wave (5) is beginning. Also, thinking that when the apex on the triangle trend line noted in primary wave 4 is close to completion in a few weeks/ months, it could potentially truncate this final wave (5) down in this expanding diagonal.

Will play around with software more for visualization. Thanks for ur time.

Yes, thanks. In everything else I look at in making my trading decisions, I just can’t reconcile the movement of the alternate count. Glad the main wave count is still in play.

Lara thanks for your honesty and doing your best in these indecisive times for gold.

Richard

Two ???

R U still in yr trade?

Is alternate daily wave count is indicating that the bear trend in gold is over with wave v complete??? AND gold already in wave 1 the other way???

It is hard to stay in DUST lately with every day or two Gold going sky high against your trade. There are hazards trying to catch a falling knife, meaning buying DUST is hazardous when gold hasn’t finished climbing wave V even though both main and alternate wave count are point down as least until 1,131.09

I panicked and sold my DUST at the open Wed when gold was peaking not knowing gold would immediately drop $20. I did buy some DUST back and hope that ECB QE news Thursday 7:30 am causes gold to drop like the news article about it today was thought to have an effect in gold dropping $20. Lets hope gold has actually stopped climbing and continues down Thursday and so on, instead of another overshoot of wave V.

You’re welcome. Sometimes, as you know, I’m wrong.

I hate to be wrong, but its best to admit it at the earliest possibility than be stubborn and stick with a wave count that’s wrong. Then everyone loses.