Downwards movement was expected. The main Elliott wave count is changed substantially today.

Summary: The situation is unclear. Use your own judgement in addition to my analysis to decide which wave count you see as most likely. The main wave count expects one final high to 1,319 before a trend change and the beginning of a consolidation to last at least a week. The two alternates expect a trend change at intermediate degree has just occurred.

Click on charts to enlarge.

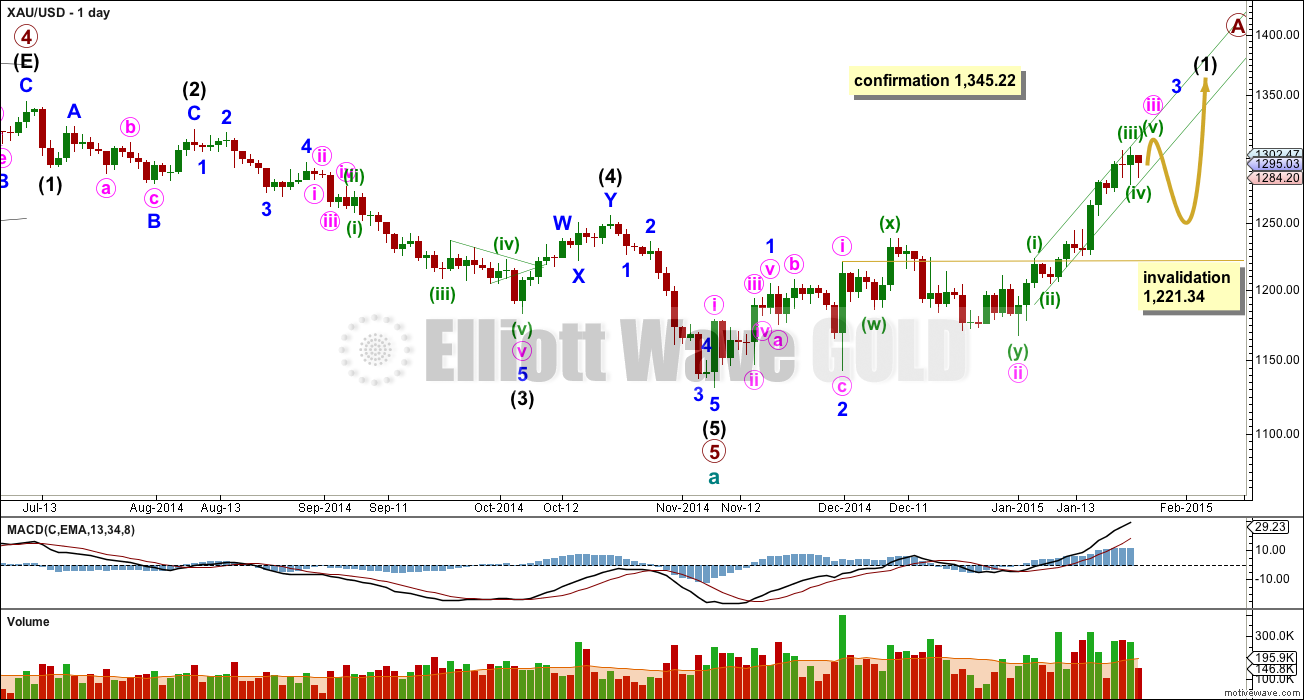

Main Daily Wave Count

Now that the channel on the weekly chart is breached for the last main wave count, this is now the main wave count. Yesterday’s main wave count has been substantially reduced in probability.

This wave count sees a five wave impulse down for cycle wave a complete, and primary wave 5 within it a completed five wave impulse. The new upwards trend at cycle degree should last one to several years and must begin on the daily chart with a clear five up. The first five up is most likely to be an impulse which is what this wave count looks at.

My biggest problem with this wave count, and the reason I will retain the second alternate, is the structure of intermediate wave (2) within primary wave 5. This is a rare running flat but the subdivisions don’t fit well. Minor wave C should be a five wave structure, but it looks like a clear three on the daily chart. If you’re going to label a running flat then its vital the subdivisions fit perfectly and this one does not. I still have a big concern with this wave count for this reason.

Intermediate wave (5) still looks like a zigzag rather than an impulse, and has a corrective wave count. This is also a problem I have with this wave count.

This wave count fits with momentum at the daily chart level. The middle of a third wave may have recently passed, and now a series of two more fourth wave corrections and fifth waves up may be required to complete minor wave 3.

Yesterday’s analysis of this idea had the upcoming correction at minute degree, but that was wrong. Only minuette wave (iii) has ended, and minuette wave (iv) has now also probably just ended within Friday’s session. A final last new high may be required before price moves into a consolidation phase lasting at least a week and probably longer for minute wave iv.

Because minute wave ii shows so clearly on the daily chart minute wave iv should also. Minute wave ii lasted 22 days and minor wave 2 one degree higher lasted 9 days. For the wave count to have somewhat the right look minute wave iv to come may last at least 9 days in total. Minute wave ii was a deep 69% correction so minute wave iv should be shallow.

The green channel about minute wave iii is drawn using Elliott’s technique: draw the first trend line from the highs labelled minuette waves (i) to (iii), then place a parallel copy on the low labelled minuette wave (ii). This almost perfectly shows where minuette wave (iv) is recently finding support. Minuette wave (v) may end midway within this channel.

When this green channel is breached by a full daily candlestick below it and not touching it that would provide confirmation that minute wave iv has begun.

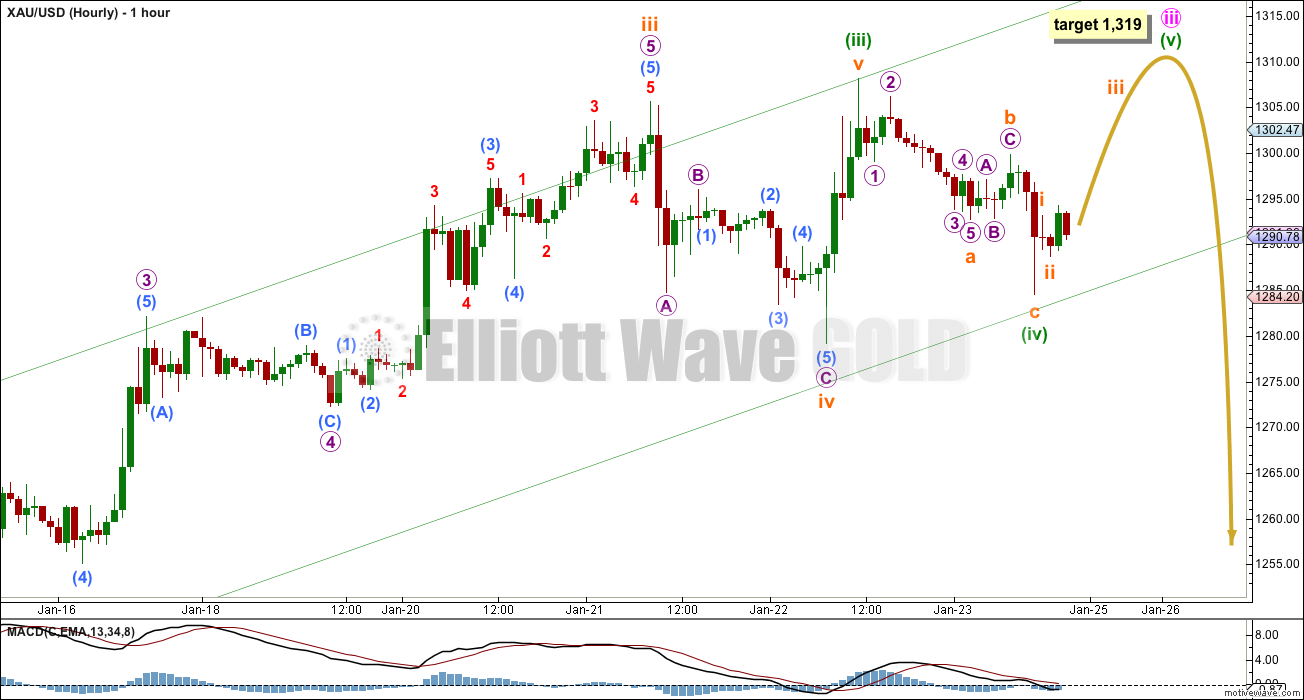

This hourly wave count sees the structure within minute wave iii exactly the same as minute wave v did for yesterday’s hourly wave count. If this upwards movement is a third wave and not a fifth wave zigzag, then it needs one final last fifth wave up to complete an impulsive structure.

There is no Fibonacci ratio between minuette waves (i) and (iii). This makes it very likely we shall see a Fibonacci ratio between minuette wave (v) and either of (i) or (iii).

At 1,319 minuette wave (v) would reach 0.618 the length of minuette wave (i).

A new high does not have to be seen, the fifth wave could be truncated, but it is likely it will not. There is persistent and strong divergence now on the hourly chart indicating that the trend is expiring.

Minute wave iv may not move into minute wave i price territory below 1,221.34.

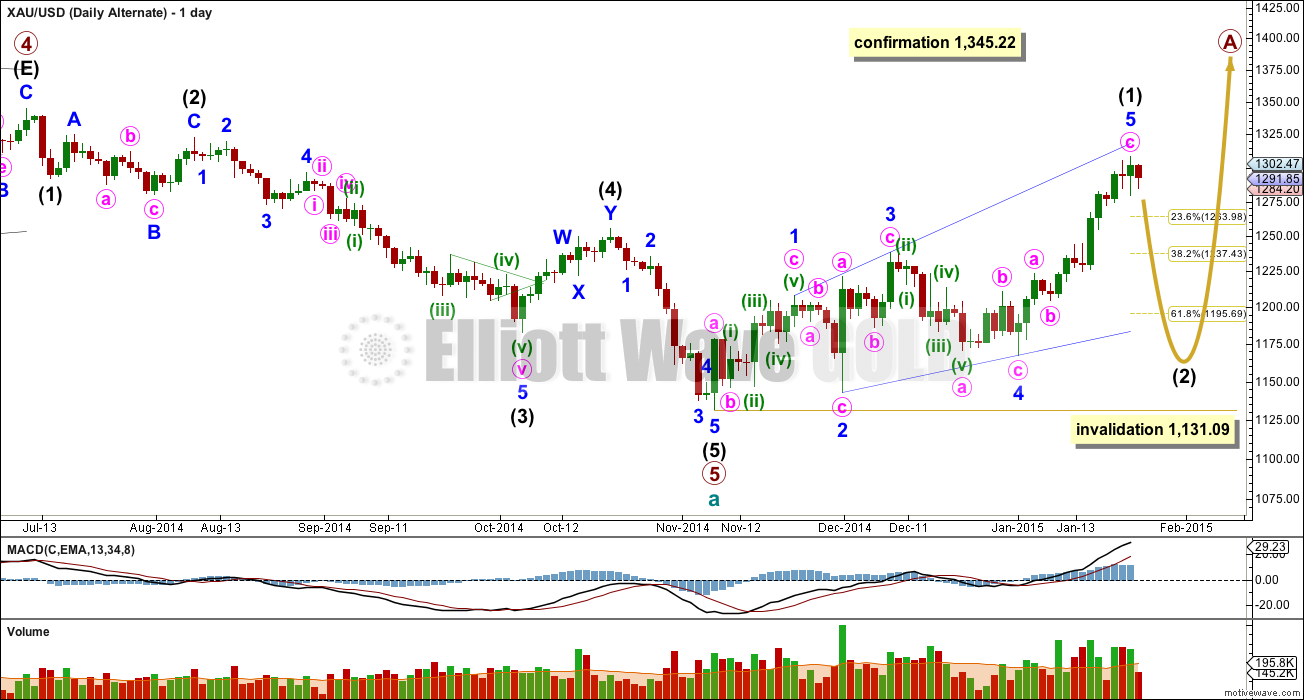

Alternate Daily Wave Count

It is entirely possible that there was a leading expanding diagonal as the first five up within primary wave A. For diagonals, the contracting variety is more common than expanding and ending diagonals are more common than leading. While a leading expanding diagonal is not rare, it is not very common either. This reduces the probability of this wave count to less than the probability of the main wave count above.

Within leading diagonals the second and fourth waves must subdivide as zigzags. The first, third and fifth waves are most commonly zigzags but they may also be impulses. This wave count sees minute waves iii and v as zigzags.

Because minute wave v is a zigzag it would be over here. A-B-C and 1-2-3 (how the main wave count sees this movement) have exactly the same subdivisions. Because I am reasonably confident I have this movement for minute wave c labelled correctly on the hourly chart as a complete five wave impulse this is where the main wave count now diverges from this alternate and the second alternate below. If this upwards wave is a zigzag it must end here. If it is an impulse it needs a final fifth wave up.

If an impulse has just ended (labelled minute wave c) then the main wave count expects only a very small fourth wave correction to be followed by a new high for the fifth wave, where the two alternates expect a trend change at intermediate degree. What happens next over the next few days should tell us what degree the trend change is.

Leading diagonals are almost always followed by very deep second wave corrections, often deeper than the 0.618 Fibonacci ratio. This wave count expects a big deep correction downwards, and should subdivide as a clear three on the daily chart (the main wave count now expects a clear five down).

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,131.09.

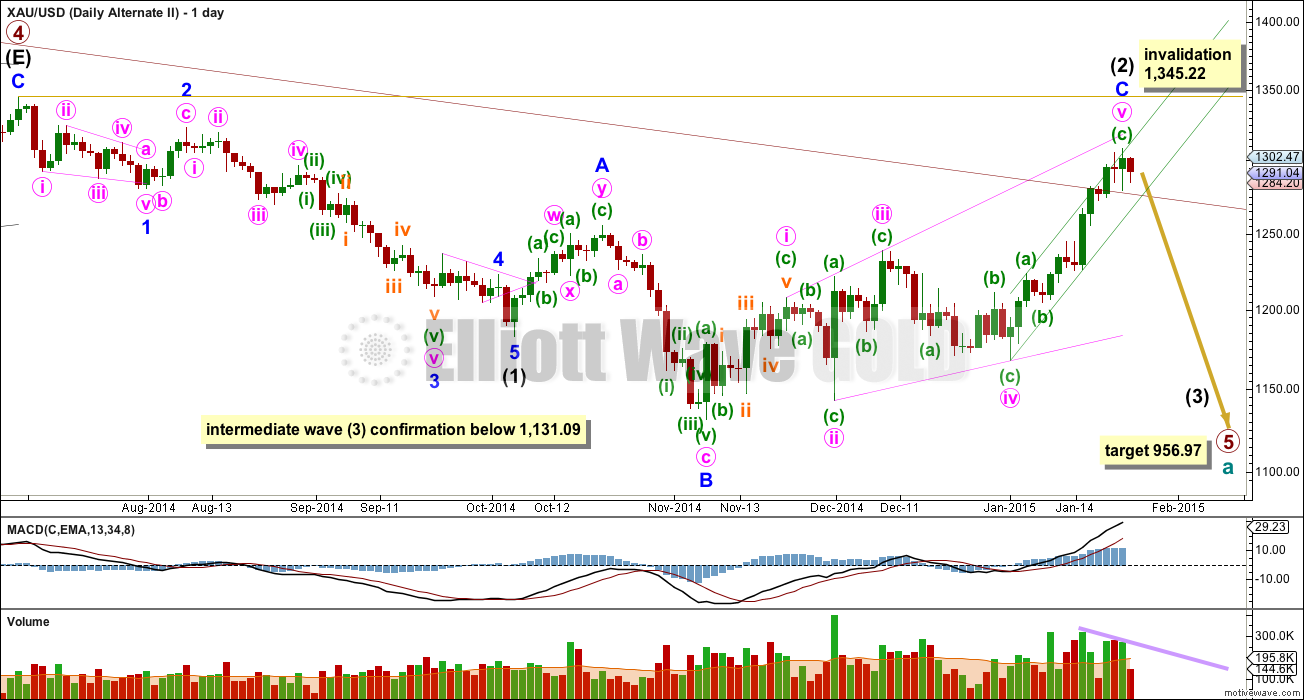

Second Alternate Daily Wave Count

The maroon channel about cycle wave a from the weekly chart is now breached by three daily candlesticks, and is now also breached on the weekly chart by one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. For this reason this wave count, despite having the best fit in terms of subdivisions, must now be relegated to a very unlikely alternate. It now has to prove itself if it is to be considered with any weight again.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart).

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. If this invalidation point is passed this wave count would be invalidated.

Intermediate wave (2) is now a complete expanded flat correction. Minor wave C is longer than 1.618 the length of minor wave A, and there is no Fibonacci ratio between them. Minor wave C is now a complete expanding ending diagonal.

Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. The rule for the end of a fourth wave of a diagonal is it may not move beyond the end of the second wave.

A-B-C and 1-2-3 subdivide exactly the same. For this idea the final zigzag of the ending diagonal must now be complete. If a new high is seen then minute wave v will not be a zigzag and I may discard both the alternate wave counts. But if we see a larger correction develop from here this wave count will still be published, just in case.

Although Gold almost always adheres perfectly to trend channels, almost always is not the same as always. This wave count is still possible. If we see a clear five down begin from here and momentum builds, we may be seeing the beginning of a third wave down.

A new low below 1,131.09 would confirm that a third wave down is underway.

At 956.97 primary wave 5 would reach equality in length with primary wave 1.

This analysis is published about 04:05 p.m. EST.

…

Lara’s Monday analysis is out now 3:07 pm

Who can tell me at what intra day level is the Maroon line right now?

Maroon line last on Friday’s analysis.

It may now be at $1,276. Just my estimate.

thanks Richard

GDX just completed 50% retrace, if gold does not rally soon, we could easily gap below the maroon line in the am. GDX would be in (3) down as well

Lara’a new chart Monday answers your question

Joe

Head and shoulder pattern is the best predictable chart pattern other than triangle and it works in all periods.

I had just posted gold’s HnS on this forum. Below is the update.

This is just one example.

Have a good trading!!!!

Took some profits in JDST at avg. $9.30. Still holding a core position, will be looking to add back soon.

Took a position in JNUG this morning to hedge the rest of my JDST. Leaning slightly to the bull side right now. But just barely.

Gold just double bottomed at 1276 at 10:15 am after 1276 at 7 am.

It if break 1275 and close below then 1268 and 1258 next

Hi guys. I feel that the main count is still correct, except that minuette 4 was not completed as described in Lara’s post above. Minuette 4 appears to be a zig-zag 1308 – 1284 – 1299 – possibly 1276. We are now near the end of wave 4. Wave 5 will be underway soon.

TKL

You think that 1276 will be the beginning of wave 5 up in Main wave count? All EW rules ok with that? No truncation?

Richard

Where is the truncation? Pls give price levels and wave counts. Need to understand ??

papurdi I am asking a question not stating there is a truncation. If wave (v) went below wave (iv) on hourly chart that would be a truncation. Look at post below this by Chapstick_jr for a mention of possible truncation. Although TKL mentions a correction to Lara’s minuette iv count.

I’m looking forward to a bottom then a gradual increase up for months without all these indecisive choppy sideways hard to trade movements since November low.

Amen!!!

TKL

Do u have wave counts on a chart? OR u r using Lara’s main wave count?

I’m using Lara’s chart.

Lara, is $8 too big a truncation for a failed fifth? It must also count as a 5 to qualify. I’m not seeing a 5, but I had good EW analysts show me how to chart a 5 on the S&P rise from 1988-2029 when I agree with your labeling

Yes. That is too big a truncation for me to accept.

I would look carefully at the subdivisions of the possible fifth wave at a lower time frame; it if is a clear five then it might be a truncation. If it is a three then no, it can’t be. If it’s ambiguous I wouldn’t accept it as a truncated fifth, it would have to be clear.

Good article for the COT debate.

http://www.safehaven.com/article/36493/decoding-the-gold-cots-myth-vs-reality

Yep that’s what I tried to explain. He’s a 25-yr trader, hmm

But agree with member(s) here that COT isn’t useful until positioning is extreme. Even so, it’s not a good timing tool.

Plus it’s often obsolete already by the time it’s released.

Rambus public post on Silver. Small IH&S on daily and massive H&S on monthly in play.

http://rambus1.com/?p=32092

Rambus is the best. Daily HnS is in play. But on Monthly the he is looking for back testing from bottom the massive triangle around 19. The blue bullish triangle bottom comes in around 8 for silver. He is hesitantly bullish on PM.

Since Nov he had no clue what was happening but EW was in control.

I have followed his public posts for some time now and have found that his big picture trends are pretty good, but he struggles with short term analysis and often flip-flops on his position. Like you said, EW is more in control for the trader.

I never heard of him. Who doesn’t struggle short-term & flip-flop, lol. Thanks for post!

Rambus chartology recently came in public in 2011 or so.

http://rambus1.com/

As a chartist He is the best.

that guy is terrible…always wrong. but i guess he make a good cartoon!

the only words he knows are Head and Shoulder!

joe

Rambus articles do have very interesting charts, however nobody is perfect. As for a cartoon, I am sure he is laughing all the way to the bank, often.

Right now Rambus is trapped in his last weeks massive long position on USLV,UGLD,JNUG and NUGT. All his stops going to hit today if gold stays here or goes down further.

If knew Lara’s EW he would not have been long.

Gold just dropped down this morning to 1,280.39 at 4:02 am, which doesn’t seem to fit in with the main wave count as that is lower that the 1,284.20 of wave (iv). Greece opposition Syriza won the election Sunday and wants to renegotiate the $270 billion Euros Greece bailout. I would expect gold to go up as a ‘safe haven’ because of increased risk, but instead gold drops?

If I am reading gold correctly then which Alternate is now in play?

Gold did first rise initially about a half-percent near 1300.

I think all three are still in play but still prefer the main unless/until support fails. A minor turn window is due this week so no surprise yet.

Greek election went as expected per the polls. I think Fed decision on Wednesday looms larger. Will fed stay on track to hike or go dovish like some other CB’s did this month.

I will try to answer my own question above, because we said fundies dont matter. Gold will turn down, which implies that Fed wont turn dovish this week.

JR

That helps. Thanks it is clear now.

All eyes on Fed as it sets rates after ECB move.

City A.M. (UK)

By THE WEEK AHEAD

Monday January 26, 2015 12:00 AM

http://www.kitco.com/news/2015-01-26/All-eyes-on-Fed-as-it-sets-rates-after-ECB-move.html

Richard

Good news. I stayed with DUST over the weekend.

papudi good luck, not sure of direction today since open as I’m looking for a strong intra day trend to jump into as is undecided again.

pjay and papudi – Here is a stockcharts $Gold weekly from the web (not mine).

With some res and support lines. Note that interesting blue line back to 2001,

that looks like a possible resistance-turned-support line.

Note the moving average convergence/divergence too, as of w/e Jan 23.

Happy trading.

Gold just completing HnS in 30 min period. If it breaks above 1300 (NL) it will be up tomorrow.

That be good. Chance to short for a minor turn after that 🙂

Regardless of the situation, it appears gold is ready to fall. The magnitude is simply unclear. It could just fall $40 for minute iv. I’m not so sure we are going to get that final fifth wave up for minute iii per Lara’s main wave count. Strong divergence on hourly and 5hr chart indicate at least a correction. Sellers reemerged at the $1300 level as volume was high, but the weekly range was tight suggesting sellers finally showed up to halt the rally. COT data is the highest it’s been since 2013 at the last 3 tops. However, it’s still lower than every top from 2008 on the way to $1900. It’s also lower than most bottoms from 2008 as well so it must all be put into perspective. I’m not ready to declare a new bull trend at cycle degree just yet with the dollar marching to new multi year highs. Every analyst is saying buy any dips in gold, but I’ve seen this story before. Buying every dip turns out to be wrong move and gold just keeps falling. The gold bears have this contrarian indicator going for them now.

A trendline throw-over and failed breakout would be bearish. Indeed we’ve seen this story before, like last winter. Although reversal patterns have been emerging on the weekly and monthly, they’re not yet an uptrend. Lara’s second-alternate could become the main again.

JR

reversal patterns on weekly and monthly…

If you can pls post the chart to show these patterns.

Thanks in advance.

When I try before to post a link to mine at a trading forum, its not published here. You use stockcharts, so u can get weekly $Gold there.

posted one stockchart for you up above.

yes 2nd alternate can still be very much in play – especially since weekly candle is not complete until Tuesday’s close. I only came to know of this when running weekly historical prices on yahoo finance that “weekly” runs from Tuesday to Tuesday.

Weekly ends on friday. Yahoo is wrong that weekly ends monday; maybe it’s a glitch due to US holiday last monday.

no…they push it to Tuesday for Monday holidays like on Jan 19th pushed to the 20th. I read it in a book too once a while ago. I think Lara gets her data uploaded from yahoo finance which is known to be one of the best. Nevertheless…def something to consider or clarify if it makes a difference to you or not. .I used to look at CD charts and that was also the norm

Yahoo is wrong. The weekly ends Friday; the only debate is whether it ends at Comex closing time or when the electronic ends.

Gold traded last monday, but even if it didn’t, the weekly would still end Friday.

If gold was closed for Friday (eg, Dec 25), the weekly would end on Thurs, not monday

BTW, Lara uses FXCM data feed. So do I.

Happy trading.

no worries. to each his own. convergence divergence charts are wrong then. cheers.

Yes, for commodities and forex I’m using FXCM.

I use google / yahoo for indices and equities.

Chapstic_Jr.

However, it’s still lower than every top from 2008 on the way to $1900.

Interesting where do you get the historical data? I am interested to know.

I agree with JR and anxious to see Lara change wave count back to the earlier her fav count.

All three wave counts expect lower price in gold. At what price level these new bullish wave counts get invalidated?

If it is 1130 one does not need any expert TA to tell you that gold is going down. . There must be a higher level.

Here you go papudi

Chapstic_Jr.

Thanks that is lot of work to keep up the chart. WOW.

The net long is for speculators. We r looking at large Commercials shorts which is high up to 422000. Net short 201772 vs net long specs 163000.

Also note at every spec high long gold retraced.

This is interesting.

I have never done COT analysis.

papudi, going by what I’ve picked up from you and Richard this COT data seems important. It’s new to me, could you pm (personal msg) me to explain al little? Are you in Mumbai or just from there? I don’t wanna post further on it as it is for my own learning. Thx.

US but from Andheri.

COT is only important at important high or low level with huge level of net long or short of commercials.

Most impt is the EW turns and chart patterns such as HnS ans divergences to watch.

I wouldn’t put too much importance in COT data. Just because big money is doing something doesn’t mean it shows correct direction.

Thanks Chapstick. For a couple years now, I have done analysis on the COT. While net position is helpful to understand, I look more for the extreme divergences. Here is a chart of the last year of the divergence between Comm and Spec Net Positions. This is one reason I am prepared for a significant gold decline.

MTSLD

Thanks for the chart. This is important chart. Yes indeed the net position that is short is highest. It should spell trouble for longs.

“At what price level these new bullish wave counts get invalidated?”

– at $1,221.34

From a bigger picture: not analytical however:

Does this picture (structure) looks right:

Corrections of Primary waves:

wave P1: $ 388 , Duration: 1 month

wave P2: $ . Duration: 1 year

wave P3 : $619, Duration: 10 months

wave P4: $ Duration: 1 year

Wave P5: $ 216 Duration : 4 months. 0.55 of wave P1 and 0.34 of wave P3.

Is wave 5 supposed to be smallest of all impulse waves down and corrective waves durations are the longest???

There is one more trend line to break before gold is turning in to a new bull trend.

The trend line on line daily line chart connecting wave A and C of int wave (4).

Yes, your A-C TL shows formidable resistance on the daily.

To determine overall trend, we draw TL on charts of higher time unit like weekly and monthly, which have less “noise”.

As I posted and showed a week or so ago, the weekly and monthly already showed reversals up. But that doesn’t preclude retracements on the shorter time-units/charts, like we might see begin (down) sometime next week.

Any one expert on COT data vs gold trading????

Last time commercials were this short:

Commercial spec shorts are 410,000 + last time they were this short was 3-11-14 (289,00) and 3-18-14 (310,000) gold was 1380.

Latest COT data on Friday commercial shorts 410,000 at 1300. hmmmmm?

Checkout the gold chart to see what happend to gold price after those COT report??? AND which EW was completing???

http://www.321gold.com/cot_gold.html

Go to gold-eagle and check out Jack Chan’s weekly article “This Past Week in Gold.” While he is allowing for more upperward movement, he clearly states that COT data does not support higher prices going forward. He calls the current movement a bull rally within a bear market. I completely agree with that.

IMO, gold & silver COT differ from the others. Typically, the COT Commercial category is the “smart” money and right. But for gold and silver, the commercial category is dominated by a few large banks. So for gold and silver, price seems to be driven more by money flows in/out of gold by the Large Speculators (the big funds).

That’s probably because unlike other commodities, gold has comparatively little industrial use.

NOTE that the reporting cut-off for COT is mid-day every Tuesday. Thus yesterday’s COT report reflects positioning as of mid-Tuesday.

Commercials added more shorts, specs added more long; and then Gold rose since mid-Tuesday.

Same thing for the previous week, and week before that.

But for the Dec 30 report, gold was $1200: large Specs added shorts while commercials went long; then gold fell that week ending Jan 2.

See what I mean?

COT data does not support higher gold prices moving forward. That said, gold doesn’t have to move down immediately. Could still move up for a few days. Nonetheless, current data indicates that a strong trend change (if it hasn’t started already) is imminent.

Thank you SO MUCH for that info on the COT data.

Here’s some backup data to go with. Thanks again! 🙂

Thanks for the chart. Shorts are 36% higher at lower price. Some thing to happen in next few weeks. Sure it is not sign of price going higher.

If this commodity index continues down, can gold continue up?

Chart from Kimble Charting

Sometimes gold behaves like a commodity and sometimes it behaves like money. Recently, it has been behaving more like money.

Fully agree with fencepost.

Thus when gold is viewed as an inflation hedge, it goes down (as commodity inflation doesn’t exist).

That’s been so throughout the EW a-wave at cycle degree.

As gov’t and Central Banks suffer loss of confidence, gold rises as money and a hedge against Central Banks.

That’ll be the case throughout the b-wave at cycle degree.

The BOJ has lost credibility, the ECB has diminishing credibilty, but the Fed is still credible. When the Fed eventually loses control, it will be gold’s Time to really shine. We’re not there yet.

EW indicates that Gold will gradually shine in b-wave cycle, as people lose all confidence in Central Banks and government. It should be epic.

Hello & Good day all! Great insight by Lara. Superb. Very helpful and useful. I just hope gold price does not run away to the upside lol…. JUST A VIEW: This is an interesting (tricky) set-up for Monday with Gold price having closed marginally above pivot/5dma with immediate resistance seen at 1295/96 and 1306-07 further out, support comes in at 1284/80…. Gold price remains bullish, trending up and has had an inside day H 1302.9 / L 1284.3 ordinarily indicative to look out for a breakout (usually impulsive) on either side of the range!…. With a bearish key reversal still in play, a pullback (drop) is expecting and It will remain to be seen if gold price can break below the up trending support cluster 1284-80 for possible 1277-76 level…. Upside target remains 1313-20/Upper band…. I would keep it long on the drop/s and look for a top!…. As with last week, my sentiment for this week is also to stay long on the drops…. Dang, just when is gold price going to top and reverse?!! Grrr…. 🙂

Dear Lara,

Your main daily wave count is based on the fact that there are 3 days above the maroon trend line (semi log scale). I have drawn this marron on a normal scale, and the price is STILL below it. How do you manage this fact ?

Lola,

It appears that logarithmic (semi-log) is the preferred chart for longer time frames and big moves in price. Scroll down to the “Price Scaling” section of this article.

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:what_are_charts

i know that, but this a divergence.we should have both scale telling the same

I’m using solely semi-log scales for longer time frames, particularly weekly and higher.

I agree, on an arithmetic scale the trend line has not been breached.

Dear papudi,

Trading is way better than the lottery, because trading has far better odds and it is manageable risk instead of pure luck.

Even so, I wish you good luck 🙂

YES J. PM sector needs to be traded. NO doubt.

But for buy and hold on some equity I will come back at an appropriate time in future.

Thanks.

I think Gold will start falling very soon. i would be surprised when we see 1345. It is the latest target to turn.

Silver i think latest station up is 18,60. On 19,50 you can sell blind. Take a look at COT-data.

The big 4 raised their position about 11 days of world production to 45 days in Silver. Take a look at the speculators. It is time for a long drop very soon.

In Gold they came in with 9 days of world production short.

It is highly likely that there was manipulation now. The sentiment is now like we were on 1392 or 1345 we turned to the downside.

i think this running out laras main count was the SNB descision what was a bit like a shock for the markets. If that wouldnt have happend we never had gone that high i think.

I think the pressure to the upside is closed to an end.

sry my english is not the best.

Lara’s instinct to hold on to now alternate daily count is correct.

I am no EW expert so I do not attempt to show charts backing my position but look at the world economic picture. Eurozone will continue to fail, big money will look for safety in US dollar and equities which means DOWN pressure on gold (in US dollars). Eventually (maybe towards end of 2015) even the US economy will crack, big money will look for safety in gold and silver which will move UP strong.

January 23rd Friday analysis is here now