Upwards movement was expected, but this is not what happened. We have a small red doji completing for Friday’s session.

Summary: The main wave count still expects one more day of upwards movement for Monday to 1,243. I have a new alternate which sees a third wave gathering downwards momentum, which would be confirmed with a new low below 1,201.61, and the target is 1,124.

Click on charts to enlarge.

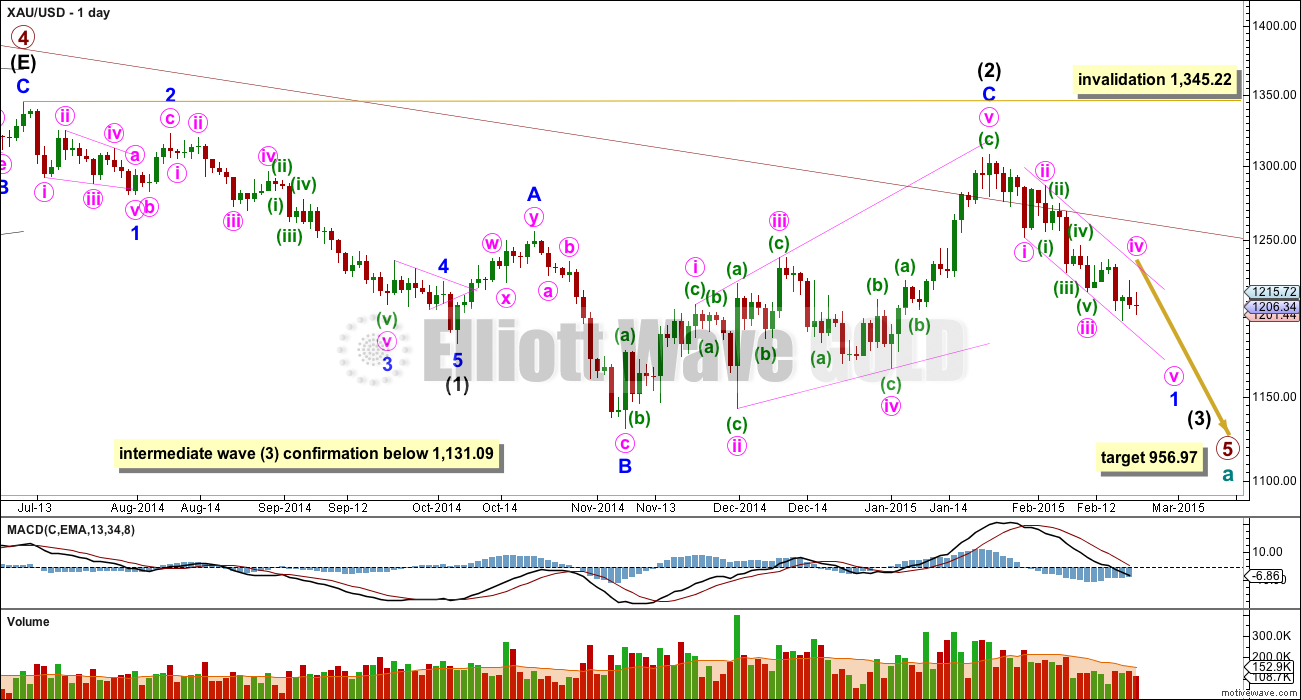

Main Daily Wave Count

The wave counts for Silver and GDX, which see a cycle degree (Silver) or primary degree (GDX) trend change at the last low, have both been invalidated. This will reduce the probability that Gold has had a cycle degree trend change, and so I am swapping over the daily wave counts today and giving this main wave count a higher probability.

This main wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) is in its early stages. At 956.97 primary wave 5 would reach equality in length with primary wave 1.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks, and is now also breached on the weekly chart by one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel is a warning this wave count may be wrong, and so I will retain the alternate.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart).

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1.

Intermediate wave (2) is an expanded flat correction. Minor wave C is a complete expanding ending diagonal. Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. Expanded flats are very common structures and ending diagonals are more common than leading diagonals.

This wave count has more common structures than the alternate wave count, and it has a better fit.

A new low below 1,131.09 would confirm that a third wave down is underway.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. If this invalidation point is passed this wave count would be fully invalidated.

Use Elliott’s first technique to draw a channel about minor wave 1: draw the first trend line from the ends of minute waves i to iii, then place a parallel copy on the end of minute wave ii. Copy this over to the hourly chart.

From January 23rd onwards, since the expected trend change, volume is highest on down days. This supports the idea that we may have seen a trend change and the trend is now down. Volume for Silver is even clearer, with a big spike on the down day there for 29th January.

The short to mid term outlook for both wave counts is identical. The structure and labelling on the hourly charts are identical for both daily wave counts.

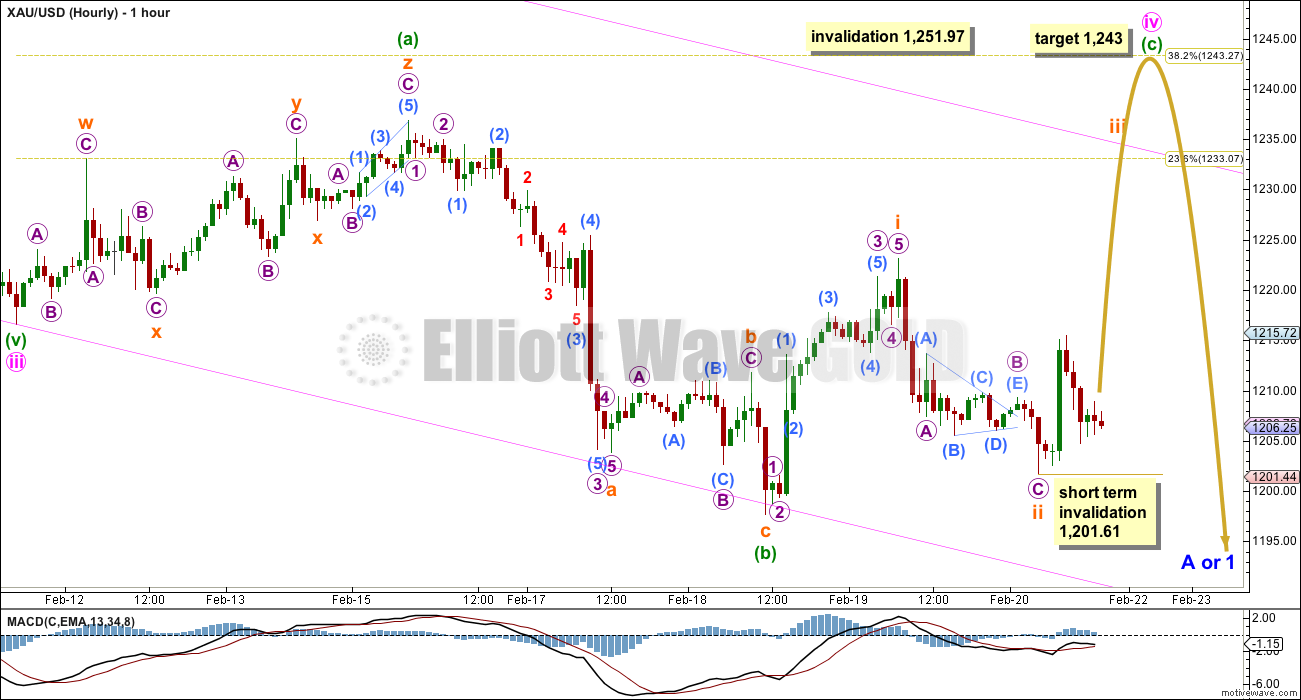

Main Hourly Wave Count

This wave count still has a good fit and still has the right look. Within minor wave 1 (or minor wave A for the alternate daily wave count) minute waves i, ii and iii may be complete. Minute wave iv may be an incomplete expanded flat correction, which are very common structures.

If minute wave iv manages to complete in just one more day it may total a Fibonacci eight days, and it would be 2.618 the duration of minute wave ii at three days.

If minute wave iv completes as an expanded flat it would show perfect alternation with the double zigzag of minute wave ii. Minute wave ii was a deep 0.6 correction, so minute wave iv would show alternation in depth if it ends about the 0.382 Fibonacci ratio of minute wave iii at 1,243.

Minuette wave (c) of the expanded flat must subdivide as a five wave structure. So far the first and now second waves are complete and a third wave up should have begun. I don’t have a target for subminuette wave iii for you because were it to reach 1.618 the length of subminuette wave i this would take price right up to 1,243. Maybe the fifth wave will be very short, or maybe the fifth wave may even be truncated. Or the third wave may not exhibit a Fibonacci ratio to the first wave.

Minute wave iv may not move into minute wave i price territory above 1,251.97.

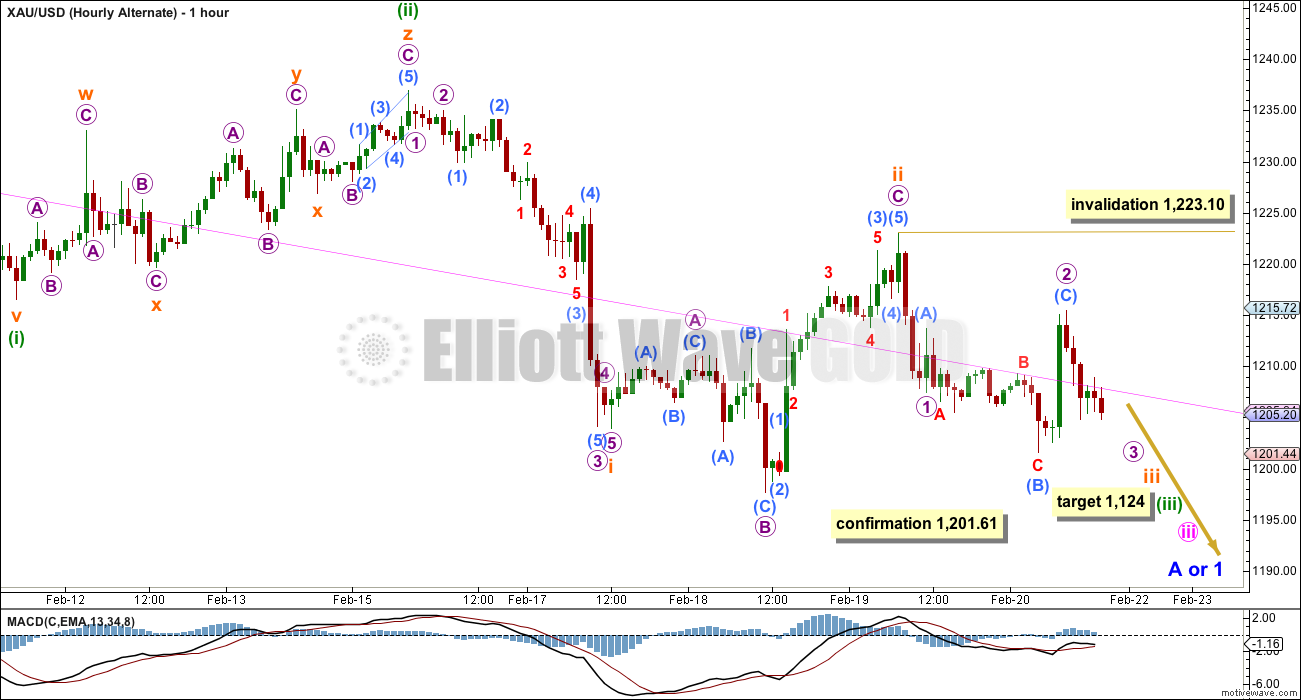

Alternate Hourly Wave Count

This alternate simply moves the degree of labelling within minute wave iii all down one degree to see it as only minuette wave (i) within an incomplete third wave.

This gives a series of four overlapping first and second waves. If this wave count is confirmed with a new low below 1,201.61 then I would expect to see a strong increase in downwards momentum.

Minuette wave (ii) shows up on the daily chart, and it lasts three days. For the wave count to have the right look at the daily chart level minuette wave (iv) should also show up on the daily chart. The next interruption to the downwards trend should come at the end of minuette wave (iii). At 1,124 minuette wave (iii) would reach 1.618 the length of minuette wave (i).

It is very common for third waves to begin like this, with a series of overlapping first and second waves. When they do this they often convince us a movement is over, and they do this right before they take off strongly in the direction opposite to that expected.

The other alternate I was considering yesterday was the possibility that minute wave iii is over (as labelled on the daily chart and the main hourly chart) followed by minute wave iv as a triple zigzag and an ending diagonal beginning for minute wave v. This idea has too many problems for me to want to publish it, and publishing it would give it too much weight. It has little alternation between the double zigzag of minute wave ii and the triple zigzag of minute wave iv. Minute wave i was a leading diagonal so it is unlikely minute wave v would also be a diagonal. The guideline of alternation should be applied flexibly; first and fifth waves also may show alternation in that both are less likely to be diagonals, although it is common for both to be impulses.

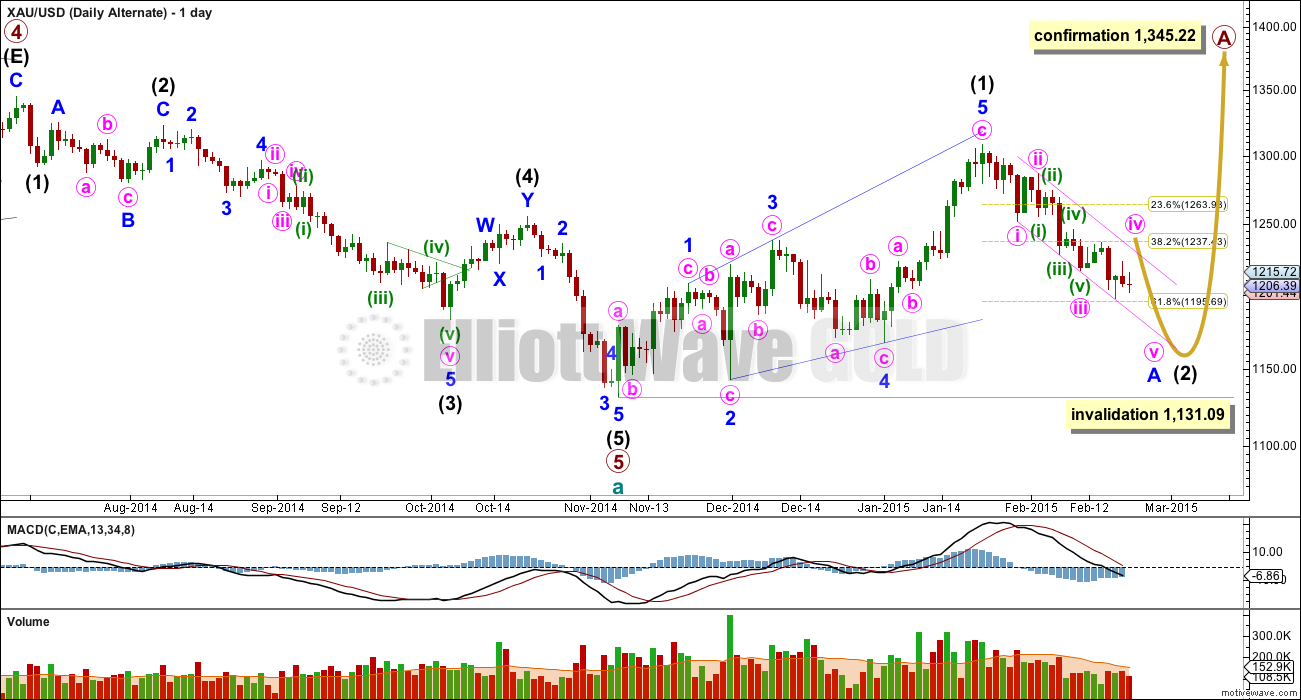

Alternate Daily Wave Count

At this stage I judge this alternate wave count to a lower probability. The structure of downwards movement, and momentum, will determine wave count is correct over the next few weeks. At this stage they both expect more downwards movement so there is no divergence in the expected direction.

This wave count sees a five wave impulse down for cycle wave a complete, and primary wave 5 within it a completed five wave impulse. The new upwards trend at cycle degree should last one to several years and must begin on the daily chart with a clear five up.

The first five up may be a complete leading expanding diagonal. Within leading diagonals the second and fourth waves must subdivide as zigzags. The first, third and fifth waves are most commonly zigzags but they may also be impulses. This wave count sees minor waves 1, 3 and 5 as zigzags.

Leading diagonals are almost always followed by deep second wave corrections, sometimes deeper than the 0.618 Fibonacci ratio. This wave count expects a big deep correction downwards, and it should subdivide as a clear three on the daily chart.

My biggest problem with this wave count is the structure of intermediate wave (2) within primary wave 5. This is a rare running flat but the subdivisions don’t fit well. Minor wave C should be a five wave structure, but it looks like a clear three on the daily chart. If you’re going to label a running flat then it’s vital the subdivisions fit perfectly and this one does not. This problem is very significant.

Within intermediate wave (5) minor wave 3 looks like a three on the daily chart, where it should be a five. This movement may also be labelled with minor wave 3 ending higher and minor wave 5 looking like a three. Either way, one of the actionary waves within this downwards movement will look like a three and not a five which does not have the “right look” at the daily chart level.

Intermediate wave (2) is most likely to subdivide as a zigzag, which subdivides 5-3-5 at minor degree. When this 5-3-5 is complete then how high the following movement goes will tell us which wave count is correct.

Intermediate wave (2) of this new cycle degree trend may not move beyond the start of intermediate wave (1) below 1,131.09.

This analysis is published about 01:52 p.m. EST.

GOLD Elliott Wave Technical Analysis – 23rd February, 2015

Gold in possible ABC up short term:A =1191, B=1210, C=1198

D target = 1198+19=1217.

papudi, Very interesting, thank you. If does hit 1,217 then I take it that gold would continue down trend towards target $1,124?

I personally am not feeling a strong downtrend in the near future . Looks like some consolidation phase , perhaps even for an up move . There is daily trendline support that market seems to be respecting at this point . But I have been wrong before . Maybe Lara’s 3rd alternative choppy Minute V diagonal is in play but that would not reach down to 1124 I don’t think .

Lara’s alternate hourly chart has a lot of 3 iii waves so many retracements on the way down and one would be high enough to bring gold back up to what has happened today. Also nothing invalidated and even stayed below 2 circle at 1,215.72 so overall down trend continues to 1,124.

I already took my profit twice today on DUST and now waiting for Lara’s analysis for best place to buy into DUST again today. Her analysis just arrived perfect timing.

My concern is gold broke below 1196 and bottomed at 1190 and bounced back inside the trading range.

If gold is in wave 3, III,III,III than may be it should not have happen.

Like Lara wrote many times pull of wave iii will be strong to increase downward momentum.

Waiting for todays report.

Gold Bulls Hooked Ahead Of Yellen Testimony

By Kira Brecht of Kitco News Monday February 23, 2015 9:00 AM

http://www.kitco.com/news/2015-02-23/Gold-Bulls-Hooked-Ahead-Of-Yellen-Testimony.html

Includes interesting chart.

Originally I was thinking 1210 but now perhaps 1220….

Scott

If goes to 1220 and above 1223 expanded flat wave count gets validated.

So you think 1210 tops…

What if 1210-1211 breaks

that’s 4h resistance at the moment

Originally I was thinking 1210 but now perhaps 1220…..

1210 is 4h resistance at the moment…….. and below is daily chart today gold finds support exactly at the trendline…. if 4h channel breaks then daily resistance is about at 1237-1241

and that is where my Head n Shoulder pattern will be completed

this is 4h channel

I would expect if a break above 1210-11 did occur to be curtailed under 100dma (1216). Should 1216 be taken out, opens up 1238-39!

for me it looks like it is minute 5th wave unfolding as an ending diagonal and now it is in 4th wave

So you think 1210 tops….

most likely yes, for 4th wave. 1223 is invalidation for this ending diagonal idea

Yeah, after that it’s 1240…hehe

If that happen Joy???

the 4th wave is probably done and now heading to 1185, invalidation 1177

If we’re in the middle of 3rd wave of impulse up, is 1220 out of the question?

Gold bounce is happening. It may bounce to $1210 , 618 fib from 1223 to 1190.

If it takes out 1223 expanded flat back on the table???

Richard

Is next stop $1124??

Rambus public post on gold, jr. miners, & stock mkts. Supports Lara’s bear targets.

http://rambus1.com/?p=33237

Yes He supports Lara’s target. On weekly chart for gold wave 5 down equals wave three from 1800. is chartoliogy complements EWG analysis.

General market up trend and PM sector in bear trend. Just begun.HiHAA!!!!!

Thanks for pointing us to this!

$1,190.97 at 3:52 am down $7.41 in 1 minute, Lara analysis forecast gold heading down, just need to know next bounce as may be able to trade it once get next analysis.

Monday 3:31 am gold dropped to $1,197.65 dropping below Thursday’s invalidation of 1,197.71 of the main hourly wave count. So if anyone had any doubts about switching over to Friday’s alternate hourly wave count, hopefully this should clarified it.

Gold may bounce atleast fib .618 of wave B 1998 low to 1215 on Monday?????

Friday’s alt wave now is going to be Primary wave (Lara wrote below).

I am ready for short.

Gold will not bounce. Gold will drop and already setting up on the hourly chart as hit the upper hourly trend line and bouncing down.

Friday’s Main and Alternate hour count had a completely different wave count and different confirmation/invalidation point than the main hourly from Thursday’s main hourly invalidation so did not need to get hit. Friday’s alternate is now the main hourly.

Down Gold goes, Up DUST goes.

Gold did bounce to $1204 from low of $1198. But yes the bounce did not happen during NY trading hour. It may still bounce from low of $1190 to $1196.

Ultra long term Gold chart

Thanks for sharing a great chart. Lara has posted Grand super cycle EW of gold from 1930. It is a nice analysis.

If one counts EW waves from when gold became free market price than I believe gold just had wave 5 completed in 2011.

This chart does not show LBMA pricing of gold from 1960’s. Before 1970 gold was traded higher on London LBMA. much higher say around $100/oz. Finally US gave up against the free world market. US tried to cap gold price in LBMA but failed.

A competitive analysis of grand EW count of London PM fixes would be interesting.(1961 to 2015).

Bob B, thanks for posting this. Terrific info there!

Looks like HNS pattern in daily chart.

It can go to 1188 or previous low at 1167 to complete the neckline….. then it should move up to complete the shoulder at 1237…..that is where is Head n Shoulder should complete and then it have to break the neckline….

Hi Waseem: Your studies are quite fascinating and of great benefit to the forum members here. Thank you for your valuable contribution!

Thanks. Its really nice if forum members getting some help from my analysis..

1188 almost done……….if breaks below 1188 then 1167….as per my analysis

If gold breaks 1211 then it will head to 1237…. as per the target i mentioned… so far so good…

with trendline support and resistanes

Alternate wave by default is now assumed to be a new P hour wave.

Wave (i) green low 1216

Wave (ii) green high 1236

Wave 4 of wave (iii) green ended @ 1225

Wave ii pink ended @ 1223.08 current invalidation.

Isn’t corrective wave not supposed to enter the price territory of wave (i) green?

That rule applies to waves of same degree only . So if wave (iv) green entered wave (i) green territory , that would be a violation . I think it is best if you refer to the waves by name i.e. Minute etc . Wave ii isn’t pink according to my monitor ; it is orange .

Thanks. I realized it after posting.

HERE IS MY SENTIMENT: Gold price remains bearish, down trending. Initiate shorts for the week. Pullback (drop) is expecting. Upside risk 1220/40…. With support currently coming in at 1200-1198, Gold price is having difficulty getting above 1202-03…. Can expect on Monday a short term rally within few bars as gold price try’s to reach out to its pivot 1204-05 for a possible 1208-1212 (Stochastic is oversold, bullish, indicative of a possible rise) and probably no further up than 5dma/100dma…. A break below the 1200-1198 support would open up 1185. Gold price has failed in its several recent attempts to reach 1240 and has kept dropping from lower highs; I would expect to see 1135 fairly quickly and would go with Lara’s 1124 target anytime! Good luck.

Lara: Feb 20th report missed the last 4 hour action in gold. This weekend being an important for a correct wave count these 4 hour price actions are important.

Your favourite count expanded flat (i like it) deserves a review.

If one ignores the last report and read the Feb 19th report gold’s Friday’s action has not invalidated hour Pwave. Gold did not take out short term invalidation 1197.71. (per pjay)

I am attaching hour chart: which shows( may be I am not an expert)wave WXY and at Y wave c and wave ii ended?????

If it is not too much trouble and work may be Lara can update the Friday hour chart.

Thanks in advance.

Firstly; I don’t have access on my FXCM data feed to Gold data at the moment. FXCM often take the data feed down on the weekend, and I don’t have the last few hours cached.

I probably wouldn’t say much different to what I say in the analysis above. I like the new wave count very much; it follows a very common scenario, it fits with the main daily wave count (and that scenario is the only viable one I can see now for Silver and GDX) and it resolves the problem I had of minute wave iii being shorter than 1.618 the length of minute wave i. It now expects minute wave iii to be a more common length, longer, more like 2.618 the length of minute wave i.

To see the expanded flat of minute wave iv continuing further the B wave would be longer than twice the length of the A wave (for a start) so that idea should be discarded. I will discard it on that basis alone. You’d also have to resolve the problem of how the B wave subdivides. And now you also have a problem of proportion; minute wave ii lasted only three days, minute wave iv has lasted…. eight? days…. it’s just too long and too big in proportion to minute wave ii if it is incomplete. That has the wrong look.

Here’s the problem with getting the end of week analysis out before the market closes. Members want it before market close so you can use my analysis to make judgements and adjust your positions. That means that in the last few hours, as we have seen, the analysis may change. Which is exactly why I provided the alternate, and I think it’s a great viable wave count.

When the market does this in the last few hours you’ll have to use my alternate and read what I’ve written about it there, but I’m not going to redo it. I’m not doing it twice. I’d write the same thing anyway.

I notice many members commenting that they’ve lost money this week with my analysis, and I am sorry for it. But I must say, I am surprised that members are trading against the trend. It’s a minute degree correction. If you’re trading against the trend (which is very clearly down, the big arrow on the daily chart makes this clear) you’re not following conventional advice given in all the TA books I’ve read. It’s risky, so you’ll have to accept the risk.

From an EW point of view, corrections are tricky because there are many possible corrective structures they can take, which means the analysis must change and be flexible as a correction unfolds.

Awsome Lara thanks for your response. I feel better now with your explanation. Looking forward to put more shorts o next week.

Okay, FXCM is back on now.

I could label this move a continuation of subminuette wave ii I guess. But the problem of proportion is now getting… big. Minute wave iv has lasted 7 days compared to minute wave ii lasting 3 days, and minute wave iv is incomplete. It would need at least another 2 days. That just looks wrong now.

I am discarding that wave count.

Thanks Lara. To clarify, I’m not blaming you for any loss I had this week, I took the risk of trying to make some gains on the correction and I’m accountable for that. Your analysis allowed me to gain 100+% last month. I’m learning more about tricky corrections and the fast moving/decaying 3x ETFs. I didn’t like being against your advice on Friday holding JNUG, and thought I better go flat to evaluate my trading plan for the coming weeks. Keep up the great work, it’s valuable to me.

That’s okay, I know you’re not blaming me. Clearly, you didn’t do that.

I’m just… surprised? members are trading against the trend. Everything I read about TA and trading, and everything I know from the little trading I do and have done over the years, tells me that to trade against the trend rarely ends well. Only seasoned experienced traders should be trying it.

“The Trend Is Your Friend”.

I’m flat for the weekend. Lost some money on JNUG. I’m going to wait for some confirmation right now. Still long oil.

I also lost a fair amount this week. Moved into DUST for next week. Rough close of play. I follow 4 analysts at varying level and now all agree that the movement is down. Good luck

Gold Could Fall Next Week On Yellen, Tentative Greece Deal

By Neils Christensen of Kitco News

Friday February 20, 2015 2:45 PM

http://www.kitco.com/news/2015-02-20/Gold-Could-Fall-Next-Week-On-Yellen-Tentative-Greece-Deal.html

Silver already made a recent newer low; I hope Gold will not increase its momentum to make a immediate drop on 23 January early morning as I am not able to trade at that time. AUD and NZD are at high point and touch the high side of channel either, they seems to ready drop together with Gold in the coming drop.

I already sold all my GDX and bought DUST and may buy more by close in 7 minutes.

LARA, “If this wave count is confirmed with a new low below 1,201.61 then I would expect to see a strong increase in downwards momentum.”

Richard

Lara’s opening sentence is :” The main wave count still expects one more day of upwards movement for Monday to 1,243.”

Feb 19 2015 count main wave invalidation is still 1197.71

Gold only broke to 1198.44.

Yes I bought some DUST and JDST also.

Thinking only one day reversal and then main trend is powerful down.

Good Trading!!!!!

papudi

I don’t understand why you mention Feb 19th invalidation is still 1,197.71 as that was yesterday.

Today Lara’s summary, “I have a new alternate which sees a third wave gathering downwards momentum, which would be confirmed with a new low below 1,201.61, and the target is 1,124.”

On the, Main Hourly Wave Count, Lara has, “Short term invalidation below 1,201.61.”

When a ‘short term invalidation’ happens it cancels the expected target above it as the above action is no longer required as gold has given the signal of a change in wave counts.

It just takes crossing below 1,201.61 by 1 penny for 1 second for the main hourly chart to be invalidated and the alternate hourly chart to be confirmed until gold crosses above 1,223.10 to invalidate the alternate.

At this point only the alternate hourly wave count is valid whether we like it or believe it or not.

I am still not clear on what “short term” invalidation means .

On the, Main Hourly Wave Count, Lara has, “Short term invalidation” below 1,201.61.”

When a ‘short term invalidation’ happens it cancels the expected target above it as the above action is no longer required as gold has given the signal of a change in wave counts or direction.

I have seen “short term invalidation” with Lara a dozen times since summer of 2013.

I expect next Lara contact about 1 to 2 pm Monday and not before. She may explain it more then. Perhaps you can ‘google’ it in the meantime. Lara may or may not explain her change of invalidation point more then or answer your question then or you can ‘google’ it before then.

Google it ??

lol

when I can see FXCM data again I’ll take a look and explain it then.

for now, short term means short term on the hourly chart. It means while the expected structure is unfolding. Once the C wave up should have completed then a new downwards wave should begin, which would necessarily take price below the invalidation point. So the invalidation point is only short term, not mid term.

I hope that makes sense.

Thanks for clearing that up Lara . Makes sense now .

Here is my interpretation of “short term invalidation”. Short term means the hourly chart. Lara has labeled the waves on the hourly chart and the invalidation point being hit means that labeling no longer conforms to EW rule and so is invalid. At that point, Lara or you can examine the latest hourly chart and label it in a new way that confirms to EW rules. That new labeling may be similar to the invalidated labeling or very different. “Short term invalidation” means a new such labeling will be possible without invalidating the longer term daily chart labeling (although the probability Lara assigns to that daily chart scenario might change).

Depends on your view of the evolving counts….because Feb 19th invalidation was 1,197.71 means it could have been start of 1st wave which 2nd wave cannot violate (which it didn’t). Though you can say it retraced almost 100% of wave 1 it did not break EW rule and hence it could have ended with 100% retrace which opens possibility of 3rd wave up from here. C should be an impulse so we may be in for a move up since wave 1 was not violated and C up would then still be in play. Thinking that 100% retrace if it is so, is supposed to shakeout all weak longs before 3rd up. Obviouslyy, we have to wait and see….actually this was a good day I think for going with a collar having nice time value…I couldn’t due to today’s options exp pain!!! Though, I thank God despite the hard hit to my novice account I am still in the game.

With gold having gotten within $1 of the low, the chances of it popping up more than a few points is highly, highly unlikely.

This we will have to see…and per EW rule not violated yet would be the beauty of EW in real-time (until proven otherwise). Stop at 1196 gives us minimal pain while waiting for the rule to prove it as a correction rather than 2nd wave that corrected 100%.

See my comments to papudi above.

Richard Pjay and Alex

I did not read any reasoning for changing or moving higher the prior invalidation to 1201.61. Like Pjay wrote previous waves are in place and price points are still there. What changed. The wave ii was not complete or declared complete. It just extended further down during the trading hour. ??????

I was focused on only the 1197.

Hopefully Lara will update us Sunday so in the morning we get an update short one before trading begins.

Today was just an another disturbance in the wave by monetary news similar to FOMC< SWISS FRANC and now Greek deal.

Have a good weekend.

I don’t think you can have such a severe correction (within $1 of the low) and still have it turn around. To the best of my knowledge, the only exceptions are triangles or diagonals. Even if gold were in one of these structures now, the next move out of these would be with the trend….namely down.

movement below 1,201.61 may not be a second wave correction within subminuette wave iii.

If we have a new low (I can’t see the data today, FXCM has taken their data feed down for the weekend) then the B wave may now be longer than twice the length of the A wave of that possible flat. and the flat is just getting too big in comparison to minute wave ii which lasted only three days.

I like the new alternate wave count; it follows a common scenario and will see minute wave iii a more reasonable length in relation to minute wave i. It is now my only wave count.

When FXCM bring the data feed back up (tomorrow?) I’ll take a look. If anything jumps out at me as needing to be said I’ll say it. Otherwise my new wave count looks very good at this stage.

Hi Lara, gold is back above 1201.61. Is the main count still good?

Give it a minute…

Now gold is below 1201.61 at 3:42 pm

Once alternate is confirmed, then gold MUST cross above $1,223.10 invalidation point.

Ok…decisions, decisions….

It may be possible that (ii) just finished, and that (iii) of C just started? 1197 prior days invalidation was not taken out, so todays move down could have been 100% retracement. Anything is possible..

PJay

You have a good point. Invalidation for PM wave is 1197. AND Lara is calling for a green candle on Monday move towards 1243.

Update GDXJ HnS. There are two HnS with two NLs.

One is already broken and GDXJ is just sitting on the 2nd one. Once GDXJ trades below this 2nd NL it will impulse move down like in the past.

The Eurogroup’s statement of accord with Greece

http://www.marketwatch.com/story/the-eurogroups-statement-of-accord-with-greece-2015-02-20

It’s had time to move lower but seems stubborn…

There is a major daily trendline support in this area . But it looks like it is ready to break soon on the daily chart . Maybe not today but soon .

Well that’s it for me . I missed the beginning of Minute iii . And now I can’t find any entry point for this downtrend . Very disappointing . Have to wait now .

Lara a new low has already been made below $1,201.61 as Gold now at $1,198.61 at 2:17 pm.

So your Alternate Hourly Wave Count has already been confirmed.

“If this wave count is confirmed with a new low below 1,201.61 then I would expect to see a strong increase in downwards momentum.”

Well one thing is sure the trend is settled. On any bounce here go short.

I hope Lara had just waited bit more to see 1201 taken out.

Gold has only one wave count down.

I kind of believe in the alternate hourly ( now main count ? ) but I don’t how am every going to have to guts to go short Gold here . Big decision .

“to have the guts to go short”

I believe the market is overreacting. We could get a quick snap back. I,m only down 2% on NUGT. I’m going to hang on. Good luck all…

Kicking myself for missing a good opportunity. The Miners were slow to react. could have switched to DUST early.