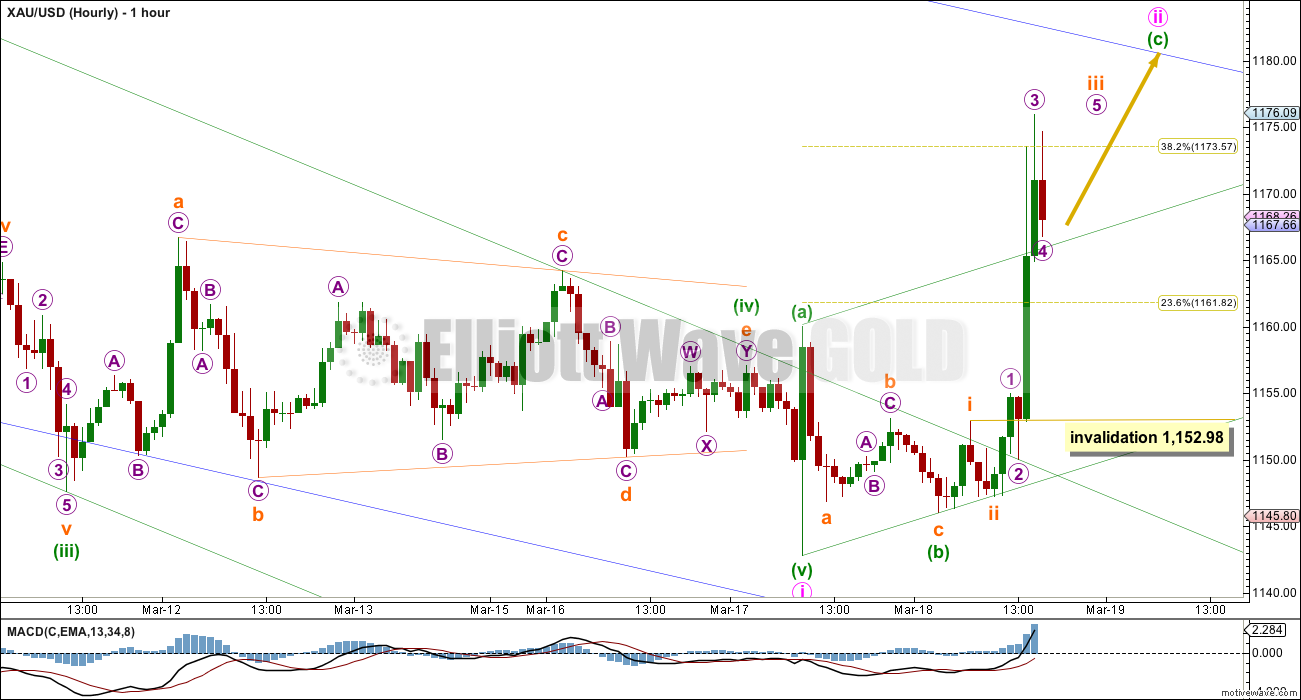

Another one to three days of downwards movement to 1,136 or 1,123 was expected before a second wave correction began. This is not what happened. The hourly Elliott wave count was invalidated with a new high above 1,160.

Summary: Minute wave i is over and minute wave ii is underway. Minute wave ii may end when price touches the upper edge of the blue base channel on the daily chart. It may end quite quickly, in one more day. I will use the corrective channel on the hourly chart to confirm when minute wave ii is over and the next wave, minute wave iii downwards, is underway. The next wave down should be a strong third wave.

Click on charts to enlarge.

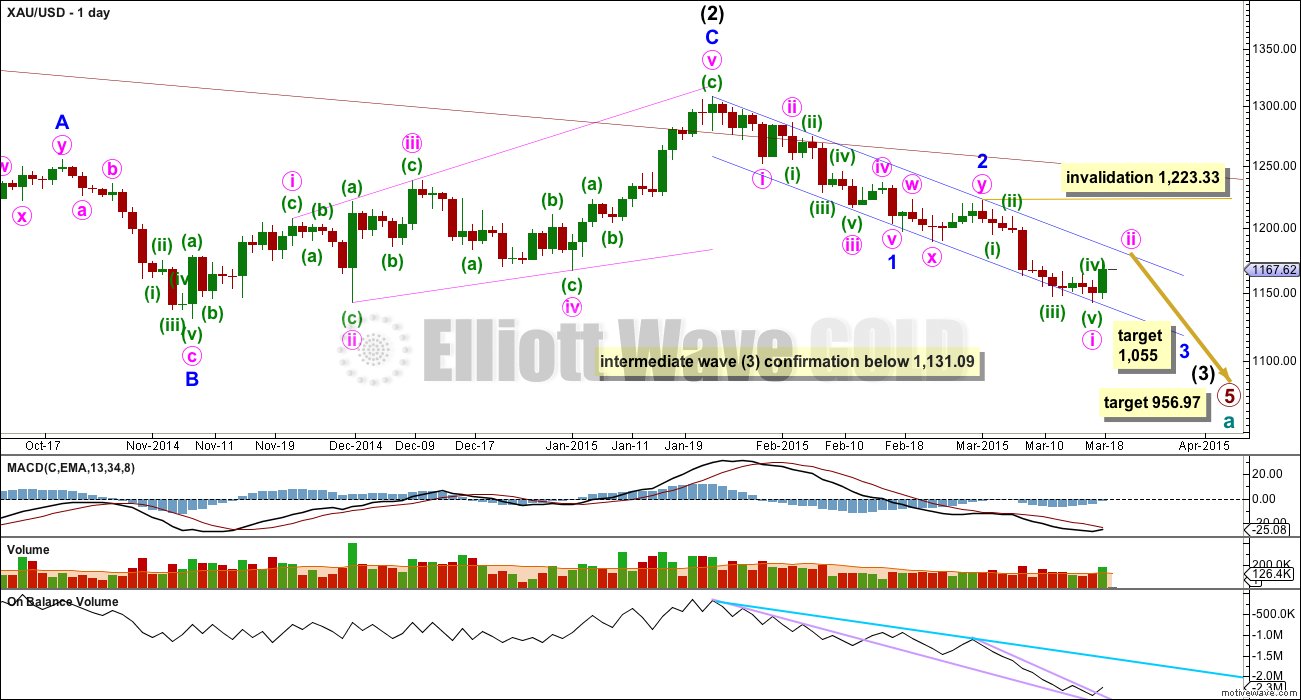

Main Daily Wave Count

This main wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) has begun. At 956.97 primary wave 5 would reach equality in length with primary wave 1. For Silver and GDX this idea, that the primary trend is down, is the only remaining wave count. This main wave count has a higher probability than the alternate below.

Within cycle wave a primary wave 1 lasted a Fibonacci 3 weeks, primary wave 2 lasted 53 weeks (two short of a Fibonacci 55), primary wave 3 lasted 37 weeks (three more than a Fibonacci 34), and primary wave 4 lasted 54 weeks (one short of a Fibonacci 55).

Primary wave 5 is now in its 36th week and the structure is incomplete. The next Fibonacci number in the sequence is 55 which would see primary wave 5 continue for a further 19 weeks, give or take up to three either side of this number. Although I am expecting primary wave 5 to be equal in length with primary wave 1 that does not mean it must also be equal in duration.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks and one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel is a warning this wave count may be wrong, and so I will still retain the alternate.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart).

To see daily charts showing the whole of intermediate wave (1) from its start at 1,345.22, and an explanation of why this main wave count has a higher probability than the alternate, see the last analysis showing charts to that point here.

A new low below 1,131.09 would confirm that intermediate wave (3) down is underway.

Within minor wave 3 minute wave ii may not move beyond the start of minute wave i above 1,223.33.

Within intermediate wave (3) minor wave 1 is a completed impulse lasting 18 days. Minor wave 2 is a completed double flat correction which lasted 9 days, exactly half the duration of minor wave 1. Because this is a second wave correction within a third wave one degree higher it is more shallow than normal due to the strong downwards pull of intermediate wave (3).

Minor wave 3 may total either a Fibonacci 21 or 34 days, depending on how long the corrections within it take. So far it has lasted 12 days. At 1,055 minor wave 3 would reach 1.618 the length of minor wave 1. Minor wave 3 may only subdivide as an impulse.

Draw a base channel about minor waves 1 and 2. Minor wave 3 should have the power to break through support at the lower edge. Along the way down upwards corrections should find resistance at the upper edge. While the lower edge is not breached (so far it is only overshot and not clearly breached) the alternate wave count should be considered as a possibility.

Since the top labelled intermediate wave (2) volume is still strongest on down days.

On Balance Volume shows no divergence with price at the end of minute wave i. If the alternate daily wave count is correct OBV should breach the blue trend line drawn there, which would provide confidence in the alternate wave count.

Minute wave i was confirmed as over when yesterday’s hourly wave count was invalidated with a new high above 1,160. Minuette wave (iv) was a regular contracting triangle and not a double zigzag. I had discarded the triangle idea because the trend lines do not converge very clearly and the triangle has an atypical look, but the subdivisions are all correct and all Elliott wave rules are met.

Ratios within minute wave i are: minuette wave (iii) is 5.68 short of 2.618 the length of minuette wave (i), and minuette wave (v) is just 0.05 short of 0.618 the length of minuette wave (i).

At this stage minute wave ii may be close to completion. If price touches the upper blue trend line I would expect it to end there. It looks like it may be much more brief than three or five days and may end in just two daily candlesticks.

Within the zigzag of minute wave ii minuette wave (c) has passed equality and 1.618 the length of minuette wave (i). The next Fibonacci ratio in the sequence 2.618 would see minute wave ii breach the upper edge of the dark blue base channel from the daily chart, which is highly unlikely. Minuette wave (c) may not exhibit a Fibonacci ratio to minuette wave (a).

At this stage the best way to see where minute wave ii should end would be the upper edge of the base channel; when price touches that trend line I would expect minute wave ii is either over or extremely close to completion. It should end there and that trend line should precipitate the next wave down.

So far minute wave ii looks like it may be unfolding as a zigzag, which is a relatively brief structure. Minuette wave (c) is an impulse which is incomplete. Within minuette wave (c) subminuette wave iv may not move into subminuette wave i price territory below 1,152.98.

Draw a corrective channel about minute wave ii: draw the first trend line from the start of minuette wave (a) to the end of minuette wave (b), then place a parallel copy on the end of minuette wave (a). The upper edge of this channel is now breached, and while minute wave ii continues it should provide support. When this channel is breached to the downside by clear downwards movement that shall provide trend channel confirmation that minute wave ii is over and minute wave iii is underway.

If the upper edge of the blue base channel is breached by one full daily candlestick above it and not touching it then this main wave count would substantially reduce in probability and the alternate below would increase in probability.

Minute wave ii may not move beyond the start of minute wave i above 1,223.33. If this price point is breached I will discard this main wave count, and the alternate below would be confirmed.

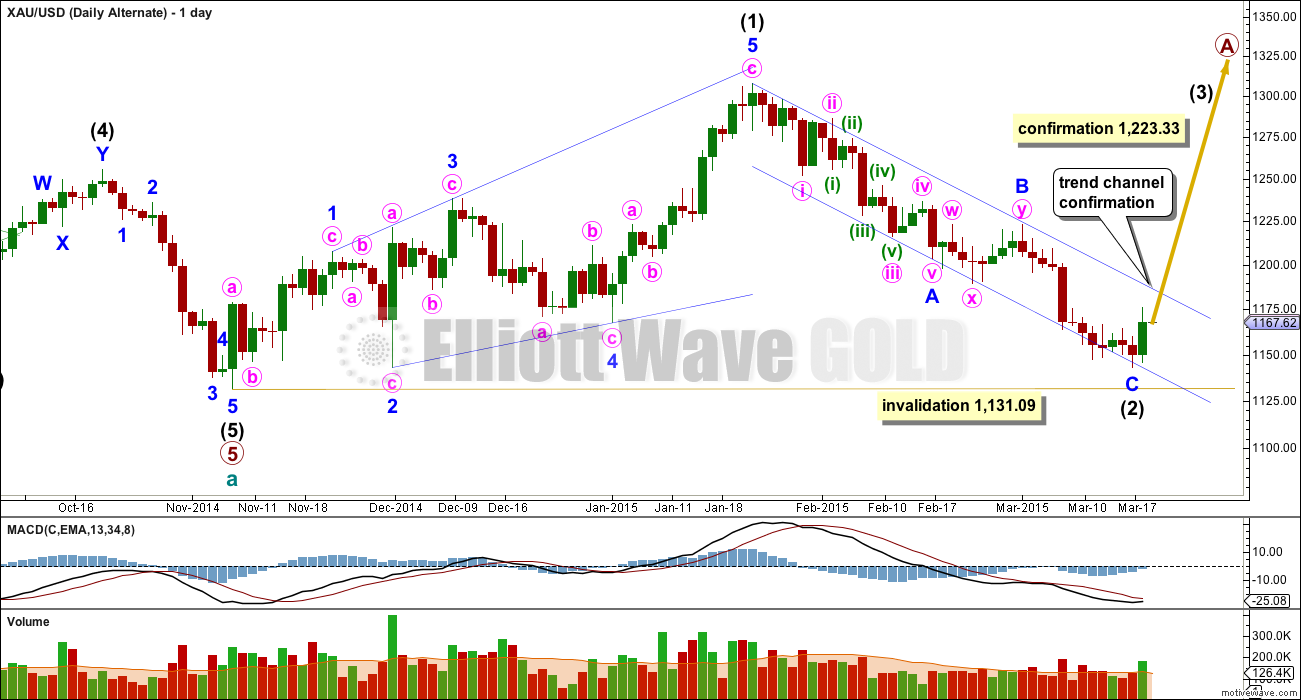

Alternate Daily Wave Count

At this stage I judge this alternate wave count to have a lower probability. This is the point where this alternate wave count now diverges from the main wave count.

A new high above 1,223.33 would invalidate the main wave count and confirm this alternate. Before that price point is passed a clear breach of the blue channel about intermediate wave (2) with one full daily candlestick above the upper blue trend line and not touching it would provide trend channel confirmation for this wave count. At that stage it would substantially increase in probability and I would swap the main and alternate wave counts over.

Intermediate wave (3) must move beyond the end of intermediate wave (1) above 1,308.10. A new high above this point would provide full and final confirmation of this alternate wave count.

This wave count sees a five wave impulse down for cycle wave a complete, and primary wave 5 within it a completed five wave impulse. The new upwards trend at cycle degree should last one to several years and must begin on the daily chart with a clear five up.

The first five up may be a complete leading expanding diagonal. Within leading diagonals the second and fourth waves must subdivide as zigzags. The first, third and fifth waves are most commonly zigzags but they may also be impulses. This wave count sees minor waves 1, 3 and 5 as zigzags.

Leading diagonals are almost always followed by deep second wave corrections, sometimes deeper than the 0.618 Fibonacci ratio. Intermediate wave (2) is complete and 0.93 the length of intermediate wave (1).

Intermediate wave (2) of this new cycle degree trend may not move beyond the start of intermediate wave (1) below 1,131.09. Any breach of this price point by the smallest amount, even intra minute, would invalidate this wave count.

This analysis is published about 06:06 p.m. EST.

I’m so sorry Ursula. It was supposed to be published, it was ready and waiting, but wasn’t published.

It’s done now. Click the short cut right at the top of the page.

Lara,

We have concerns about a trend line breach and if minute ii already peaked?

If hasn’t peak, any guess on if before 4 pm close or 7 pm after hours or overnight or if after Friday’s open, please?

Green hourly trend line support breached.

In video from 7:35 to 7:50 mark, Lara mentioned, “Along the way up now, upwards movement has breached the upper edge of the channel, this green trend line should provide support, while minute ii unfolds upwards.”

That green upper trend line was definitely breached (maybe at about 1,168) when gold dropped down to 1,159.73 at 8:15 am.

It’s the lower green line, the lower edge of the channel, which needs to be breached to provide trend channel confirmation of a change.

I do think it’s most likely that minute wave ii is over falling slightly short of the upper blue trend line, and lasting a Fibonacci 2 days on the daily chart. If it were to continue it would start to be too long in duration and would have to breach that blue trend line. That’s possible, but way less likely.

I would be more comfortable with calling this third wave underway when the lower green line is breached, and there is a clear five down on the hourly chart. So far we have 1-2, it needs to continue for 3-4-5.

Gold price appears to be basing off 1168 positioning itself to take out 1173 for target 1181-90+ range…. This thought does not feel good! lol… Oh well!

yup, the launch!

Lara: is it possible for you to consider an alt hour for primary wave day count as if the minuette wave ii is over at 1177.93? It is if scenario???

That’s my main wave count. Not an alternate.

I’m working on an alternate. I have one, but I may not publish it, it has a very low probability.

Really hope gold minute wave ii peaks at 1,180 before the 4 pm NYSE close today and DUST and JDST go deep diving instead of gold peaking after hours. Or as Dell said, “no buyers at all, DUST and JDST dropped”, gold bullish sentiment hit an extreme low of only 4% before close. “Just imagine”.

Correction: gold bullish sentiment goes up before close so gold hits 1180, then sentiment plunges after close.

Thanks guys for your input, I guess it’s just

the way its said that gets me. A commentator

would state (” gold buyers were out in force”)

I looking at it and said ” no buyers at all, the usd

dropped”

Here a nice link for you: http://www.kitco.com/kitco-gold-index.html

Here is my count: just started sub micro 3 of micro 5, of subminnute wave v. I am looking for a nice sell off in JDST over the next 2 hours as v completes.

JDST may out perform DUST by about 50% as it lost an extra 50% yesterday. JDST is from the wild and untamed frontier of the junior gold miners. Handle with care.

With 1159/58 holding, a pop through 1173 would look to seek 1181…. Upside risk 1193-94…. Need to see gold price coast and remain contained below 1164 to neutralize….

When this lower edge of this green channel (at around 1,152) is breached

to the downside by clear downwards movement of a full hourly candlestick below

the channel that shall provide ‘trend channel confirmation’ that minute wave

iii down is underway.

Minute wave ii may end when price touches the upper

edge of the blue base channel (at about 1,180) on the daily chart it is then extremely

lightly to be over and I would expect a strong bounce down from that trend

line. It is highly unlikely that minute wave ii breach

the upper edge and when price touches that trend line I would expect minute

wave ii is either over or extremely close to completion. It should end there

and that trend line should precipitate the next wave down.

I think we are in 3 of 3 of v right now, expecting a push above 1170 very soon.

do you think price of gold has to go over wave 3 price to complete wave c wave ii?

I am expecting that whatever the ending structure may be, it will be limited to the blue trend line, so I am watching for the trendline to be hit (or come really close)

papudi, your concerns whether gold would go higher today after last night, appears to have been verified as correct, as Lara feels minute wave ii most likely already completed short of the trend line.

Please someone answer a newbe question, why do we look

at gold price and not looking at the usd. Like yesterday

from kitco charts gold dropped around $5 and usd dropped

around 2% there were only sellers of gold, it looked like gold

buyers, all that happened is price in dollars changed. Please give

me some understanding.

These are two different markets. Gold has its own EW counts based on world traders/investors.

Gold is also currency and trades with currencies.

USD has gone higher but Gold price has not declined to the same extent. Some days gold may react to currencies temporarily.

Thanks alot for clearing that up.

I look primarily at gold however I look at both gold and US dollar. I added compare with $DXY to my trading platform so a pink line (US dollar) moves around and I can expand and minimize the time frame to see how US dollar is moving versus gold. It is an eye opener if you look at the two of them 4 minutes before and after 2 pm FED FOMC release. How the US dollar moves definitely effects gold or vice versa.

Before I started seeing /GC and $DXY on the same chart I was in denial of the effect of US dollar on gold.

Thats you, although it seems Lara bases her charts

on gold price not the fact that that move was due

only to usd buyers.

because from an EW perspective it doesn’t matter.

Most traders will trade gold in USD because it’s the worlds reserve currency.

so as long as my EW analysis uses the same data, gold priced in USD, then it should be valid EW analysis.

Thanks Lara

Wouldn’t you like to see gold EW counts without

the usd price move. On kitco site they have a chart

of gold moves in the same basket of currencies

the usd value is against. Do you think that could be

more accurate?

USD is the world’s reserve currency so all commodities are traded in USD. Hence, for pragmatic reasons it is best to reference gold with USD. Some national exchanges may trade in their own currency but most will still cross-reference USD for it. I would only look at gold vis-a-vis other currencies only from an economic standpoint.

If I was trading gold around the world then yes. However I only trade gold on NYSE so I think just one line $DXY together with gold and parabolic SAR and Ichimoku wave is enough otherwise might be information overload.

Looks like minuette wave iii, 5 circle peaked t 1,177.93 at 9:01 pm.

Still waiting for minuette wave v, 5 circle of minuette wave (c) ii circle to end at upper edge of the blue base channel (at about 1,180).

Looks like iv completed and now v/5/c are started. I am looking to add JDST under $11 today.

JDST isn’t looking like it wants to get under $11…maybe one more drive up in gold will convince it to drop to my range.

We have a five down from the top to 1158.50. In order to complete a correction we need another 5 down soon which would reach the lower channel edge – or breach it. In the second case you will know that minute iii has begun (my preference), if not breached all bets are open. I am only looking for now ;-). Everything can happen. Currencies have already recovered most of yesterdays losses/gains.

It sounds like you may think minute wave ii circle, of minuette wave (c) may be over and peaked at 1177.93 at 9:01 pm?

yes, like minuette (c) of ((ii)) peaked and is over, but the situation is not so clear as it seems.

I looked at Lara’s hourly chart comparing it with closely with http://www.pmbull.com and looks to me that only subminuette wave iii, 5 circle topped at 1,177.93. Gold looks then to have completed subminuette wave iv at 1159.76 at 8:15 am. Now in subminuette wave v heading for the upper edge of channel, which is at about 1,180.

Tham estimate for the end of minute 2 (c) is 1179.68.

wave iv down to 1159 looks to be pretty close to .618 retrace.

Agreed, Richard. That is the same as my wave count. We are now in the midst of micro 3.

Now that wave iv is over doses gold wave v c has to go higher than 1179????

I’m expecting it to. Gold hasn’t reached 1179 yet. Lara gave her hourly count chart and target so we watch for the reality of how close to touching or below or above the upper edge of blue base channel.

If possible I’d like gold to peak during market hours and start it’s clear descent today that would be great.

Usually 5th waves have to be higher than wave 3 (in an uptrend), but sometimes they truncate when wave 3 is too strong. In this case, I don’t really know as the third wave seems to be less than 1.618 of wave 1, hence it is not strong. We should watch how the fifth wave develops. Fifth waves in gold can be the strongest wave.

Lara is strict with any truncation. Alarms might go off if truncation. Also her hourly chart shows 5th wave ending above wave iii.

Clearly a 3 right now. however if this is minuette iv in progress, it hasnt even lasted as long as minuette ii so no concerns right now. It could be consolidating to bust through upper trendline. If it’s going to do that, should be no later than tomorrow.

I figure we just completed subminuette iv as an expanded flat and are now in subminuette v up to try 1180 again.

Yes has to be because iv almost moved into i territory.

FOMC DAY!!!!

Knowing FOMC schedule and reaction of PM sector, next FOMC onward it will not go to waist. I refuse to just watch the fireworks from now on.

Strategy: Just one minute before 2PM put order to buy stop loss order for both JNUG and JDST equal amount.

Once the fireworks begins only one order will get filled. Then you know when to take the profit.

No more biased position for the DAY.

Good Day.

There have been some whipsaws in the past so I think you need to figure out how to know if you need to exit those trades.

Any suggestions!!! One is trailing stop once order is filled and remove the other pronto.

Yes one has to work fast.

That is a good method. I might try it next time.

What I do is to get ready to trade one minute beforehand. Enter all the data for one trade in your trading platform, either JNUG or JDST as in your example above, stopping short of confirming the trade. Once an announcement is made, either pull the trigger or just make a minor change (i.e. if you had first selected JNUG, and JDST is the way, then just change “JNUG” to “JDST” and pull the trigger. This will take less than 10 seconds. Then,add to your position if you desire. Be wary of sudden changes; just ride the trend until you discern a change. Be quick to bail out. I usually enter two or three of the same trade along the way, and just take profits one by one. This method will not maximise your gains, but it optimises it and at the same time gives peace of mind.

TKL

I have watched the runup in realtime on PMBULL. Prices run up in nano second you can not change at the moment when it begins. By the time you type you have missed it.

Buy stop loss in very liquid market gets filled at your price.

Examine the prices of JNUG/JDST in 3min/5 min periods. We got hint few minutes earlier what just about to happen.

I just put in a higher price. This has worked for me. I am able to make 50 to 60% gain each time (define 100% as the ideal case, highest possible price minus the lowest possible price). Think Carnot efficiency. Just don’t be too greedy. Remember you are trading in a very volatile market at that time. This is quite good returns for 3 hours’ work!

I agree. As an example yesterday orders could have been place 3minutes to 2:00PM buy stop loss at:

JNUG: 15.59

JDST: 15.25

One gets filled.

Rest is history.

wow!

If you can get 70% to 80% of highest possible price minus the lowest possible price range trader is doing fine.

I tried this 2 times on NFP days. Did not work for me and I lost money. Reason: whipsaws and poor liquidity. So quotations may jump too much and all the positions may loose. Trailing stops is better. I tried them also with 50% success. Here the problem is to know when to close the position that is loosing. Best way for me, now tested 3 times with modest gains but lots of stress: Define resistance and support levels beforehand. Wait until price moves to resistance, buy or sell there. If price breaches the level get out or buy the position in the other direction. Exit at next support/resistance. Set trailing stops.

But your strategy would have worked this time, papudi. Definitely.

And here is something else: If your strategy worked, than it would be easy to create an automatic trading system that does this all the time and not only on FOMC days – and have 100% secure profits every day. Because that has not been done I think the strategy is flawed.

In video Lara talked about the gree line. once the price breaks below the upper green line in hour chart she considers wave ii is complete. and conformation will be once price trades below 1152.98.

Gold is trading below the green line at 1163.33.

Do u think wave ii is complete?

I’m hoping so, papudi, but would also be very interested in others’ input.

I hope some one TKL Ghaneesh weigh in on where the count is along Lara’s wave ii count.

Sorry papudi. Was tied up until now.

From my assessment, we are now in minute 2, minuette c, subminuette 5 and just starting micro 3. The corrective rally should end by today. My estimate for the end of minute 2 is 1179.68.

Hope I’m right. The next drop minute 3 will provide good returns.

Anybody seen the update for Crud Oil and knows where to find it?

Thanks

Looks like Minuette c of Minute 2 may be complete at 1177. We’ll know soon if we go down hard from here!

lets see here another view: As I said before, our view is that gold will continue to melt down, all the way to $700, if not lower because of the great economic crash we forecast for this year. http://research.economyandmarkets.com/X195QB15

Am I the only one favoring the alt count due to technicals? I agree $1180 is huge resistance, but the bollinger band buy setup is bothering me. I just can’t envision this resistance holding or minute ii lasting 2 days since the last 3 bollinger band buy setup have yielded a multi-week rally at the minimum. I’m still long…

Avi Gilbert thinks there’s a good possibility of a larger bounce to suck in Bulls. But he still favors much lower lows in GLD.

I know a world class stock rebound intra-day trader who doesn’t believe in EW and feels that gold is severely oversold and overdue for a bounce up considering gold moved down 10 of last 13 days and feels that GLD bottomed yesterday and miners really depressed.

RSI has been below 30 since 6th March… so that would indicate Gold is oversold. That does seem to occur only for relatively short time periods at the end of an EW wave movement.

We shall see. I favour the main wave count mostly for EW reasons, but I can see some other good TA reasons to expect a more sustained rise from here.

The upper blue trend line will decide for me from an EW perspective, and 1,223.33 would be the price point which makes the EW analysis clear.

Chapstick_jr, you are not the only one. The miners have recently been acting as though they expect a more sustained rally. We’ll see.

I’m a little long here (very short term i think) but I don’t necessarily think it means the alt count is going to play out. And I’m nervous about it because I don’t see an EW way we can have a sustained bounce yet within the main count. So I’m long but it’s a relatively small amount right now because I’m very unsure of things. I just think it’s more likely that some kind of trend change happened this week that may last more than 2 days

Gold price $1180 as resistance. Below is gold’s weekly chart showing breakout below 1180 and now the price is resistance.

Wave ii target to end is about 1180. This level may provide a strong resistance.

papudi thanks for your chart. It is a work of art and helpful!

Looks like iii is done and iv has started. This may very well hit the trend line by morning US time.

Impressive

move by Gold price…. With a bullish key reversal in play, short term rally

(upturn / up move) is expecting…. Upside risk is seen at 1193-94, let’s hope gold price rise is curtailed by 20dma (1181/82) / upper edge of the channel….

Silver (XAG USD) is very impressive too,.. good to go short now? Normally it is sooo quiet at this time of the day

but today it just rises up….

Thank you very much Lara, all working fine now.

It seams everything is in correction mood, Oil and Silver (XAG USD) even Coffee,…

any updates for Crude oil and XAG possible?

Thanks Kindly

Ursula

I’ve done US Oil, it’s being proofed now. I’ll get to Silver tomorrow.

Thank Lara, where can I find it?

Lara wrote recently that this minor 3 has a target length of 21 or 34 days. We have 9 days left to hit the 21 day target. If that’s the case, then this wave ii should not last long at all, and, we have $125 left to drop in just 9 days from hitting the blue trend line. That will be impressive.

The complete primary wave 5 has 19 weeks to go including this one.

Yes i agree this corrective minuette wave ii should end shortly in a day or two.

What a day today was.

Hi Lara,

Ursula or TradeGold here can you please email the logins to me, somehow got in today although it says “You are not currently logged in”. I have renewed my membership on Monday for 6 months must have written my email wrong,… have already sent 2 emails please help as password recovery does not work.

Regards

Ursula Knecht

Lara, please look at these charts for me. Again there is no difference in expected direction and targets, but the issue with the triangle on the hourly would be solved. Your triangle seems to have 2 complex subwaves (A and E) and – as you stated – has not really converging trendlines. Proportions on the daily also look a bit better for me. What do you think?

It’s a nice idea… and minute wave ii would be a flat correction.

I’ve charted it and I see a few problems which make me discard the idea.

Minuette wave (ii) was a .7 zigzag lasting 12 hours, minuette wave (iv) here would be a shallow .28 zigzag lasting 14 hours. There is alternation in depth but they’re both zigzags.

There would still be Fibonacci ratios between all of minuette waves (i), (iii) and (v). So no difference there.

The wave count I have with the triangle has perfect alternation, and triangles are more time consuming structures than zigzags. So I have zero problem with the proportions there, it actually looks pretty typical (except for the triangle trend lines).

Thank you for looking a this! I meant minuette iv to be a triangle. So the alternation is there.