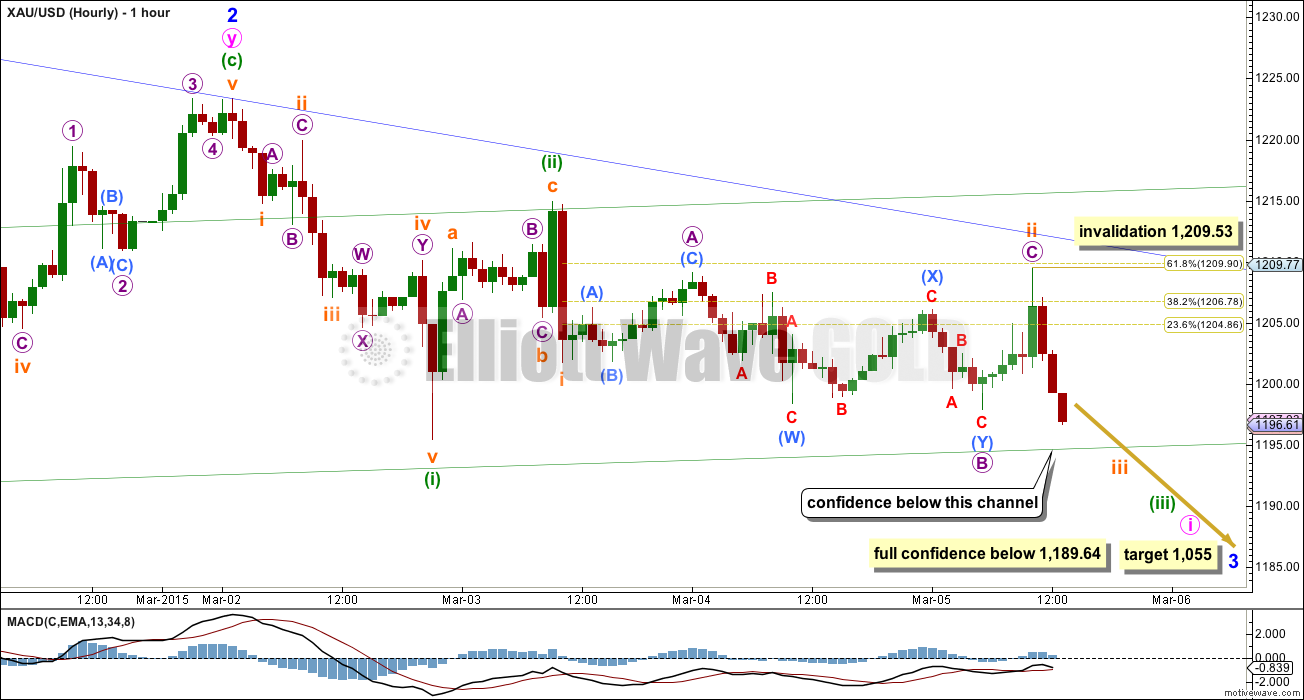

A slight new low below 1,198.39 invalidated the main hourly Elliott wave count and confirmed the alternate hourly Elliott wave count. At that stage a leading diagonal was complete, and I expected it to be followed by a deep second wave correction to find resistance at the upper blue trend line. This is pretty much what happened.

Summary: A third wave within a third wave down has most likely begun. I will have more confidence in this idea when the green channel on the hourly chart is breached. I will have full confidence in this idea with a new low below 1,189.64. This confirmation may come now within the next 24 hours.

Click on charts to enlarge.

Main Daily Wave Count

This main wave count sees Gold as still within a primary degree downwards trend, and within primary wave 5 intermediate wave (3) has begun. At 956.97 primary wave 5 would reach equality in length with primary wave 1. For Silver and GDX this idea, that the primary trend is down, is the only remaining wave count. This main wave count has a higher probability than the alternate below.

The maroon channel about cycle wave a from the weekly chart is now breached by a few daily candlesticks and one weekly candlestick. If cycle wave a is incomplete this channel should not be breached. The breach of this channel is a warning this wave count may be wrong, and so I will still retain the alternate.

Draw the maroon trend line on a weekly chart on a semi-log scale, and copy it over to a daily chart also on a semi-log scale (see this analysis for a weekly chart).

Within primary wave 5 intermediate wave (1) fits perfectly as an impulse. There is perfect alternation within intermediate wave (1): minor wave 2 is a deep zigzag lasting a Fibonacci five days and minor wave 4 is a shallow triangle lasting a Fibonacci eight days, 1.618 the duration of minor wave 2. Minor wave 3 is 9.65 longer than 1.618 the length of minor wave 1, and minor wave 5 is just 0.51 short of 0.618 the length of minor wave 1.

Intermediate wave (2) is an expanded flat correction. Minor wave C is a complete expanding ending diagonal. Within an ending diagonal all the sub waves must subdivide as zigzags. The fourth wave should overlap first wave price territory. Expanded flats are very common structures and ending diagonals are more common than leading diagonals.

This wave count has more common structures than the alternate wave count, and it has a better fit.

A new low below 1,131.09 would confirm that intermediate wave (3) down is underway.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 1,345.22. If this invalidation point is passed this wave count would be fully invalidated.

Within intermediate wave (3) minor wave 1 is a completed impulse lasting 18 days. Minor wave 2 is a completed double flat correction which lasted 9 days, exactly half the duration of minor wave 1. Because this is a second wave correction within a third wave one degree higher I would expect it to be more shallow than normal.

Looking at the duration of minor degree waves within intermediate wave (1): minor wave 1 lasted 18 days, minor wave 2 lasted 5 days, minor wave 3 lasted 31 days, minor wave 4 lasted 8 days, and minor wave 5 lasted 2 days. Corrections do tend to be more brief than an actionary wave of the same degree, so for minor wave 2 within intermediate wave (3) to be over in 9 days looks perfectly normal. I would expect minor wave 3 to most likely last a total Fibonacci 34 sessions. It is just completing its third session.

Draw a base channel about minor waves 1 and 2. Minor wave 3 should have the power to break through support at the lower edge. Along the way down upwards corrections should find resistance at the upper edge. Copy this channel over to hourly charts.

Since the top labelled intermediate wave (2) volume is still strongest on down days. Volume for 2nd March, a down day, was the highest since 5th February, also a down day.

Today On Balance Volume shows a slight positive reversal, which does not fit with the wave count at the hourly chart level. This gives a slight cause for concern and leaves me to state clearly that some confirmation is required as outlined on the hourly chart below before I have confidence that minor wave 3 has begun. The thing about divergence is it often indicates a reversal is coming, but it should be used as confirmation not as an indicator. I am less experienced in interpreting positive and negative reversals, and I am assuming they are confirmations and not indicators in the same way divergence is.

So far within minor wave 3 down it is unlikely that minute wave i is complete. It is most likely that the first wave within minor wave 3 is still in its early stages.

Within minute wave i minuette wave (i) is a five wave impulse and minuette wave (ii) is a completed zigzag.

Within minuette wave (iii) subminuette wave i does not correctly fit as a leading diagonal as labelled on yesterday’s alternate hourly wave count: the diagonal would be neither contracting nor expanding, the actionary waves would be decreasing in length while the reactionary waves would be increasing in length and the trend lines would diverge.

I expect that subminuette wave i ended earlier and subminuette wave ii was a time consuming flat correction. I have checked the subdivisions within micro wave C on the five minute chart; this movement is ambiguous, it may be either a double zigzag (a “three”) or it may be an ending diagonal (a “five”). Here I am seeing it as a five.

Within subminuette wave ii micro wave C is just 0.27 short of 1.618 the length of micro wave A. Subminuette wave ii has ended very slightly below the 0.618 Fibonacci ratio of subminuette wave i. It is highly likely this correction is over, especially considering the duration.

This wave count now expects an increase in downwards momentum as a third wave of a third wave unfolds down, within minute wave i.

Within subminuette wave iii no second wave correction may move beyond its start above 1,209.53.

This next wave down should have the power to break through support about the lower green trend line. To see how to draw this green channel look at the hourly chart here.

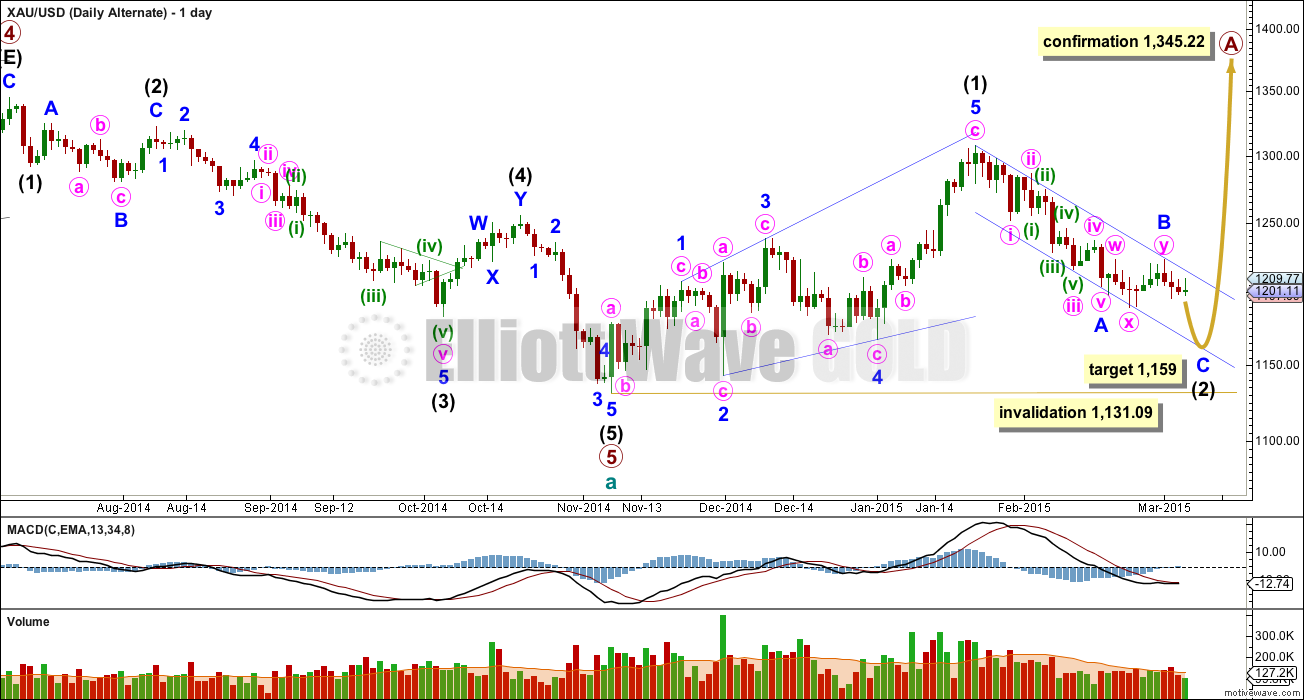

Alternate Daily Wave Count

At this stage I judge this alternate wave count to have a lower probability. The structure of downwards movement, and momentum, will determine which wave count is correct over the next few weeks. At this stage they both expect more downwards movement so there is no divergence in the expected direction.

This wave count sees a five wave impulse down for cycle wave a complete, and primary wave 5 within it a completed five wave impulse. The new upwards trend at cycle degree should last one to several years and must begin on the daily chart with a clear five up.

The first five up may be a complete leading expanding diagonal. Within leading diagonals the second and fourth waves must subdivide as zigzags. The first, third and fifth waves are most commonly zigzags but they may also be impulses. This wave count sees minor waves 1, 3 and 5 as zigzags.

Leading diagonals are almost always followed by deep second wave corrections, sometimes deeper than the 0.618 Fibonacci ratio. It is possible now to see intermediate wave (2) as a deep 0.67 single zigzag. If it is over it may have lasted just a little under half the duration of intermediate wave (1).

My biggest problem with this wave count is the structure of intermediate wave (2) within primary wave 5. This is a rare running flat but the subdivisions don’t fit well. Minor wave C should be a five wave structure, but it looks like a clear three on the daily chart. If you’re going to label a running flat then it’s vital the subdivisions fit perfectly and this one does not. This problem is very significant.

Within intermediate wave (5) minor wave 3 looks like a three on the daily chart, where it should be a five. This movement may also be labelled with minor wave 3 ending higher and minor wave 5 looking like a three. Either way, one of the actionary waves within this downwards movement will look like a three and not a five which does not have the “right look” at the daily chart level.

Intermediate wave (2) may be an incomplete zigzag, which subdivides 5-3-5. The subdivisions within intermediate wave (2) for this alternate are exactly the same as for this movement on the main wave count which sees a first, second and now third wave unfolding subdividing 5-3-5.

For this alternate wave count minor wave C down must subdivide as a five wave structure. The hourly chart would see the subdivisions exactly the same as the main wave count above, so to keep the number of charts at a minimum I will publish only one. For this alternate at 1,159 minor wave C would reach 0.618 the length of minor wave A.

For this alternate the channel is drawn in the same way, but here it is correctly termed a corrective channel. Minor wave C should find support and end at the lower edge of this channel. The main wave count expects the power of a third wave to break below support at that trend line. How price behaves when it gets to the lower trend line will provide an indication of which wave count is more likely at the daily chart level.

Intermediate wave (2) of this new cycle degree trend may not move beyond the start of intermediate wave (1) below 1,131.09.

This analysis is published about 02:03 p.m. EST.

Updating this chart, although it seems like Tuesday is a long way back in time considering today. My analysis of the COT says we should be ready for a decent bounce soon. The Bank Participation Report also shows big banks closing shorts as of last Tuesday.

Gold FIBs based on Lara’s note below:

Bounce from 1163.86 from top 1209:

0.236: 1174.51

0.382= 1181.10

Hi papudi: That’s what I am pondering about of where to initiate a sell with 1174-75-78 and 1192-93 on the outside…. Downside pressure for a break below 1166-64 is still quite high…. I guess it is best to be neutral and let this rise and then take it from there. Concerned about daily RSI tagging below 30, it wont stay there long, taking price up with it.

Syed, just curious… what are you trading?

After your earlier comment about daily RSI being near 30, I looked back at RSI before and during the 12 April 2013 takedown. In that situation, RSI went well below 30 before the bounce happened.

So while a bounce is a possibility, it is not guaranteed.

Thanks papudi for those Fib #s

i took the Fibs from green candle high just before decline (1198.38) to same low?(1163.93). Did i start at wrong candle?

Upside appears to be limited to 1182-86 with 1196-97 on the outside. Gold price easily broke below the 1168/67 low of 02Jan15 (from where gold price went on up to 1308); the next probable downside target now is 1147/46 low of 01Dec14…. With both the hourly and daily RSI tagging below 30 and gold price below the lower band is of concern for an eventual upside move…. Let’s see how this closes today. Undoubtedly fantastic work by Lara. Has helped me a lot! Thank you.

In Lara’s update below :”My short term target is 1,153 for subminuette wave iii”

The target may happen Sunday-Monday trading hours.

Fibs are calculated from wave ii price point to wave iii end todays’ low at hand.

Any bounce I am adding shorts.

Its times like these we really could use an intra-day update — ah ha — my comment is too late – Lara did one. Yes!!!

Hello all, I have to go out again this morning so won’t be back until after NY closes. Here’s an hourly chart for you before the close. My short term target is 1,153 for subminuette wave iii. Subminuette wave ii didn’t show on the daily chart though, so I don’t expect subminuette wave iv to show up either. This short term target should be a brief interruption to this trend, the interruption should be over within 24 hours and is unlikely to show as a green candlestick.

On the daily chart it looks like price is almost at the blue trend line. On the hourly chart it looks like price is just above the trend line. It may very well stop there for a short term consolidation to bounce up a little. If it does that then draw a Fibonacci retracement along the length of subminuette wave iii. Look for subminuette wave iv to bounce up to either the 0.236 or 0.382 Fibonacci ratios.

If the target is met then the blue line may be breached. If that happens look for subminuette wave iv to find resistance at the blue line.

Lara is there a targt for Minute 1?? I misread 1055 for that wave instead of Minor 3. Let us know, thanks

No, not yet. I won’t be able to calculate a target for minute wave i until minuette waves (i) through to (iv) within it are completed.

Gold just dropped $5 in 2 minutes down to 1,166.67 at 12:02, now then low 1,165.98 at 12:12

I’m thinking that may be a sign of either a temporary bottom or else some large party/billionaire or fund or bank just dumped tons of gold?

Gold has gone down $54 since high 1,209.55 at 10:40 am Thursday.

I am thinking of even a $10 retrace that may be due soon, unless this is an all day major drop event in gold???

In that case of all day extended drop then maybe best to wait for Lara analysis and next targets. before buying any bullish ETF, including GDX. As they say, “don’t try and catch a falling knife.”

Tham did mention, “I reckon we will hit 1168 first before reaching 1158. 1055 comes much later, if it does.” … “This is pretty close to the low of 1167.30 established on the last week of December 2014.”

“I would reckon that once price breaks the 1180/1160 region (which incidentally had been tested three times already), there will be very strong selling.”

Chapstick_jr mentioned

“First support lies at $1177, $1170, and $1160. Gold must break these levels decisively to have any confidence in main count. I plan on selling at least half of my short around $1170.”

Waseem mentioned

“it breaks below 1189 then 1169-1170 possible today”

I sure hope Lara does an early analysis today like yesterday, would be especially valuable today.

There aren’t any signs of retrace yet. Lets c

Either gold will retrace from this level according to daily chart….. and either gold can retrace according to 4h channel. and that is from 1155

By my estimate we just retested the low of the blue channel. Lara said, How price behaves when it gets to the lower trend line will provide an indication of which wave count is more likely at the daily chart level.

I don’t see many people buying, rather the moves up are most likely short covering/profit taking.

I got stopped out of a big part of my short a little earlier, definitely too soon, but I had no choice. Expiration today and I couldn’t take a chance. Have some left that expires next week and may unload or get stopped out later today.

We are below the lower bollinger band on the daily chart. That’s where pros may lighten up on or get out of short positions, not necessarily go long though. It can definitely stay there or go even lower. This was huge new today

U.S. Economy Added 295,000 Jobs in February; Unemployment Rate at 5.5% By DIONNE SEARCEYMARCH 6, 2015

Instead, the report prompted a new round of optimism about the economy’s recovery and speculation on Wall Street that the Federal Reserve might be inclined to move to raise interest rates midyear rather than wait until fall.

The market expected 235,000 new jobs in February and anything over 250,000 would of good for US dollar and expectations of earlier US Fed interest rate hike, which is bad for gold and pushed it down as gold doesn’t earn interest. 295,000 February jobs was devastating for gold.

http://www.nytimes.com/2015/03/07/business/economy/jobs-report-unemployment-february.html?partner=rss&emc=rss&_r=0

knew we had a good report based on gold’s action (opposite USD) but didn’t look up how good. Thanks 4 posting.

How low may gold go this morning before retracing?

Would it be a .618 retrace?

I see gold is now1 full hour under 1,195 trend line now.

I see gold has dropped to 1,175.53 at 9:22 am the low of the day and far below Lara’s requirement of 1,189.64 for providing full and final confidence that the minor degree trend is down.

i think hourly bottom being put in – as a hammer bottom – just my opinion. Real question i have is are we trading to 1055 or 1159 and bounce up?? Big difference between those targets w/ regard to overall outcome. Sorry not much help on smaller time frames.

8:56am oops – no hammer happening

Let’s wait for Lara to work this out in detail. So far, based on the price movement, I think we have completed micro 3 at 1775.53. The continuation will be choppy as we will then be negotiating a nest of 4th and 5th waves. (This gives opportunities for nimble day trading). I reckon we will hit 1168 first before reaching 1158. 1055 comes much later, if it does. This is because the move up from 1158 leads to a bifurcation between the main (downwards to 956.97) and alternate (up, up and away) counts.

Do you see the lower blue trend line at 1168?

Or some other support.

I base it on EW calculation assuming standard Fibonacci ratios. This is pretty close to the low of 1167.30 established on the last week of December 2014.

Thanks

thank u Tham

Wow. The 1180s level has been defended successfully a few times before. When price sliced cleanly through it, as if it wasn’t even there, the drop continued unabated. The next stop at 1167.30, the low from the last week of December 2014, did not brake it either. But apparently, it slowed it down. Looks like it might. A rebound towards 1180s would then occur but as eli said, this is a short covering rally. It would be worth buying only for playing the rangebound trade, as price will then be rangebound between 1180s and the 1160s, making several tests of the 1180s. Once it breaks through, it will be decision time. Will price breakout sky high, or drop back to its resting place at 956.97? If we follow history, it would fall back and retest 1131.09. It should succeed, leading to a second waterfall reminiscent of the events in 2012.

You are correct. Passing 1189.64 down gives confidence to the minor degree trend, possibly up to Minute 1 low. The criterion for the full downtrend to 956.97 comes at 1131.09 at Minute 3 level.

Good Morning everybody!!!

WOW! We are confirmed — Marvelous 3rd wave!! 🙂

On hour chart the green line is resistance at 1195. Like TKL and Chapsticks wrote gold may reach 1180 today.

SENTIMENT: With gold price remaining under 1198-99 adequately opens up 1190-1180 with upside risk 1203-06…. Happy and profitable trading to all!

Gold now at 1,194.11 at 4:14 am, confidence below 1,195 channel needs 1 hourly candlestick under and not touching trend line.

Will one 30 minute do it instead of 1 hour not touching???

It looks like an almost certainty gold will breakdown after NFP release, but the question is how far? First support lies at $1177, $1170, and $1160. Gold must break these levels decisively to have any confidence in main count. I plan on selling at least half of my short around $1170.

af it breaks below 1189 then 1169-1170 possible today…… but until the 1189 support stands it is still possible that gold can take a bounce…..

ADP and Jobless claims are weak on Wednesday and yesterday…. so NFP can also come weak…

From what I know (and I may be wrong), when NFP report comes out better than expected, gold price drops.

yes

if it comes weaker than expected than gold can take a bounce

We are correct. Rejoice.

Congrats… But I never said that it won’t go down,, i mentioned if it breaks 1189 then 1169-1170 …

But NFP generally based on ADP data and Jobless claims if both of those data are weak then how NFP can come higher than expected… Manipulation

We are correct.

The next support level for gold is 1181. Probably will reach it today.

Gold’s now hitting the lower trend line at 1195…

Micro 2 is chugging along. It looks like a simple 3-wave structure. We have probably completed the first two waves, and is working on the third and final one. The third wave should not go higher than 1209.53, the start of micro 1. If it retraces the normal 61.8%, it should hit 1204.60. The count from the simple 3-wave structure yields 1203.41. It may be reached when the NFP report is released. In any case, Lara predicted that the confidence level of 1189.64 will be breached by today. Time to load up.

I would reckon that once price breaks the 1180/1160 region (which incidentally had been tested three times already), there will be very strong selling. Thie chart pattern for this area bears strong resemblance to the 1520s region in mid 2011 to mid 2012. That was THE strong support which many analysts said could never be broken. It was tested three times. On the fourth, a waterfall occurred and the rest is history. There was something like a 10% price drop in three days! Now, analysts are saying the same thing about the 1180s. I would say that on current price strength, the region will be tested two more times and rebound. On the next attempt, most likely during the Minute 3 wave, the big splash will take place. That would be the time to go all in.

Although history does not repeat itself exactly, it often rhymes. May prosperity be with you all.

Is it possible that micro 2 is very short, that it ended at 1200.82 before the larger drop? It would then be a regular flat.

Great report by Lara.

Some price points to watch:

Breach of 1195= will have confidence in the wave count

Breach of 11989,64 – will have full confidence.

Friday March 6, at 8:30am ET – US NFP non-farm payroll data released.

This is very important to the stock market, the US Dollar and GOLD.

So it is very important to own the right gold ETFs overnight tonight.

Richard, are you going to keep your DUST?

I sold my GDX and didn’t buy DUST because of confusion on another wave coming. Now I have no Gold ETF and am nervous on holding an DUST overnight in case 8:30 am NFP release makes gold go up instead of down.

I sold my DUST at the end. It wasn’t acting right….

I have no Gold ETF. Sat on fence today will get off fence Friday. LOL

I noticed that as of 3:00 pm gold moved slowly down about $2 but DUST didn’t move. Then last 6 minutes gold dropping and so was DUST dropped 17 cents because GDX went up 5 cents from last minute bargain hunters.

If Friday 8:30 am US NFP drops gold then I can buy it with confidence before or soon after the open knowing the level of confidence Lara has in downward momentum.

If US NFP spikes gold I may buy GDX in an intraday rally.

We will see in the morning how US market, US dollar and Gold handled first few minutes of news then what the trend is by the open although still could be volatile at the open. Who knows maybe the news will have little effect?

Wise move, congrats on profits to all today.

NFP data will jerk around the market and then the trend will continue.

How true this is. Reminds me of an anecdote I came across some time ago.

An army of ants was marching merrily in a straight line, bringing food home to their nest. Some joker deliberately threw a stick in their path to amuse himself. The ants stopped short of the obstacle, scurried around aimlessly for a while, but eventually found their bearings and continued doggedly to complete their mission.

In science and engineering, we describe this phenomenon as an initial disturbance to the system. After the perturbations die down, dynamic stability follows. I’m sure EW analysis follows the same characteristic pattern.

TKL

You are asset to this board. Thank you for your comments giving us words of encouragement and explanation of Lara’s fabulous wave analysis.

many such perturbations such as Swiss franc decision, FOMC, NFP, Euro QE, Greek on and on…..

Gold’s 1308 level would have not happen in absence of SWZ. In the end it did not make the difference for SWZ. Franc is lower again.

How about the ants climb up the stick to get over (gold up), then down the stick to continue on to their nest located 3 feet lower (gold down)…

Hi Lara,

Regarding the EW analysis… “some confirmation is required as outlined on the hourly chart below before I have confidence that minor wave 3 has begun.” How would Minor 2 be labeled if it were still continuing? Since we only have the one hourly can you pop up a chart? This alternate perspective could be of help. Thanks.

P.S. movement below 1189.64 invalidates my request. lol

I think the market answered your question while I slept.

Minor wave 2 is over.

Smart woman!