I have spent some time looking for an alternate bull and / or bear count which could see movement below the invalidation points on the main wave counts.

Summary: I cannot yet see an alternate bull wave count which would allow for more downwards movement from here. I can however see a reasonable bear wave count. It expects more downwards movement for a fifth wave, which may be strong typical of commodities. The price point which differentiates it from the main bull and main bear wave counts is 1,203.43.

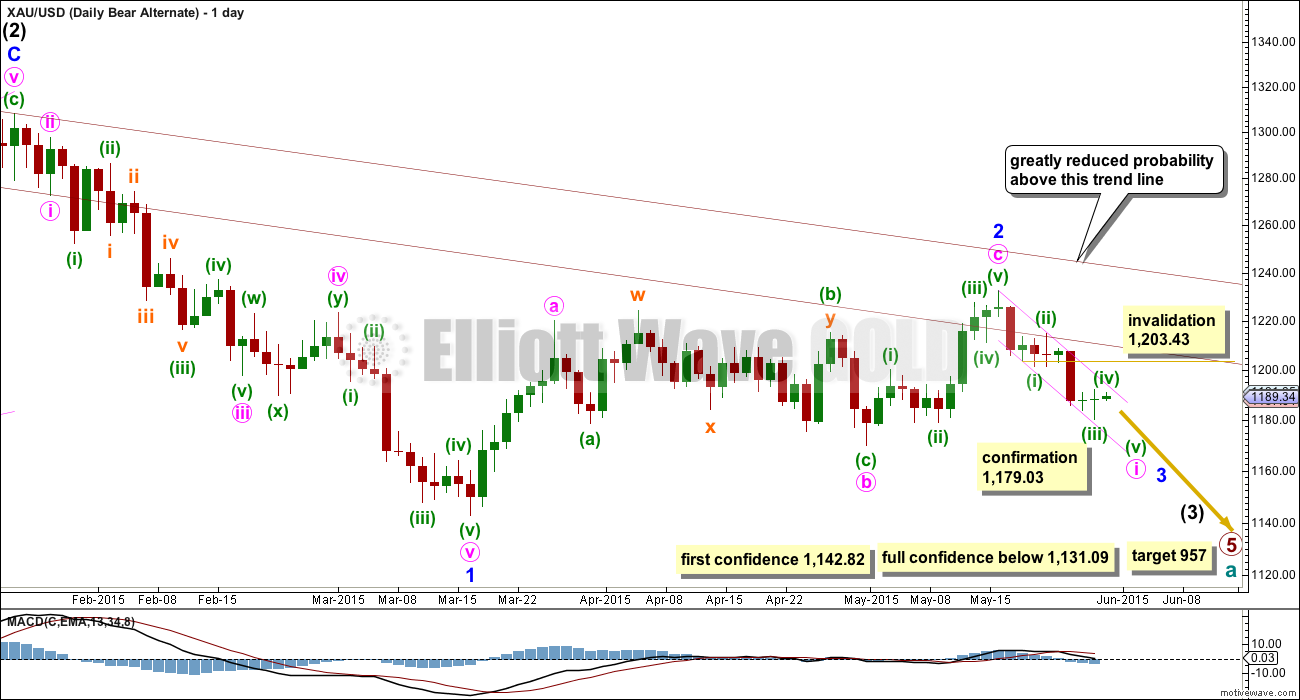

Bear Wave Count

It is possible that minor wave 2 is over. If this is the case, then the biggest problems with this wave count remain as the disproportion between minute waves iv and ii within minor wave 1, and the breach of the trend channel about cycle wave a.

If minor wave 2 is over it may subdivide as a zigzag. Minute wave c within it does not look like a clear five (it looks better as a three) but this is possible.

This wave count would expect a fifth wave down to complete minute wave i within minor wave 3. Minuette wave iv may not move into minuette wave i price territory above 1,203.43.

If minute wave i downward is unfolding it is likely that one of its actionary waves will be extended. So far neither would be. It is common for a fifth wave of a commodity to be extended so the target expects minuette wave (v) to extend.

If both the main bull and main bear wave counts are invalidated with movement below 1,178.08, then this would be the most likely scenario I would expect. I would expect price to continue down to about 1,142.

This analysis is published about 07:13 a.m. EST.

TARGET for pink i down is what?