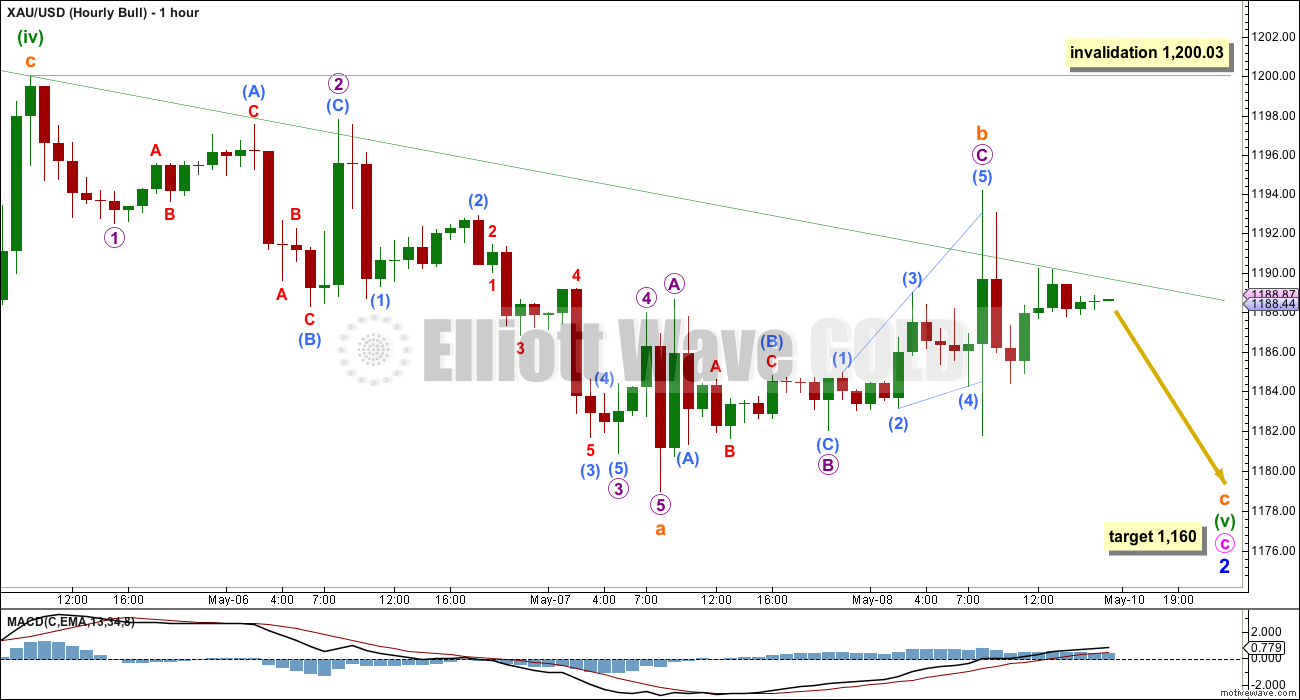

I have a new bull Elliott wave count which resolves some of the problems with the prior bullish Elliott wave count.

Summary: Both bull and bear wave counts expect at least some downwards movement early next week: this new bull wave count down to 1,160 and the bear wave count for a very strong third wave down. Only a new low below 1,142.82 would invalidate the bull wave count and confirm the bear wave count.

Click on charts to enlarge.

This update will provide only a new bull wave count. To see analysis for the bear wave count go here. The new bull wave count presented here will replace the prior bull wave count which I will discard.

Bull Wave Count

I would judge this bull wave count to be about 45% likely. The difference between bull and bear wave counts of about 10% is in my judgement due to volume indicators only.

The bull wave count sees primary wave 5 and so cycle wave a as a complete five wave impulse on the weekly chart. In order for members to judge for themselves I will list all points for and against for bull and bear wave counts.

Pros:

1. The size of the upwards move labelled here intermediate wave (A) looks right for a new bull trend at the weekly chart level.

2. The downwards wave labelled intermediate wave (B) looks best as a three.

3. The small breach of the channel about cycle wave a on the weekly chart would be the first indication that cycle wave a is over and cycle wave b has begun.

Cons:

1. Within intermediate wave (3) of primary wave 5 (now off to the left of this chart), to see this as a five wave impulse requires either gross disproportion and lack of alternation between minor waves 2 and 4 or a very rare running flat which does not subdivide well.

2. Intermediate wave (5) of primary wave 5 (now off to the left of the chart) has a count of seven which means either minor wave 3 or 5 looks like a three on the daily chart.

3. Expanding leading diagonals are are not very common (the contracting variety is more common).

4. Minor wave 2 is now much longer in duration than minor degree corrections within impulses normally are for Gold.

Volume shows a small increase for an up day, but for volume to support the bull wave count it needs to show an increase beyond that for 30th April, six days ago. While up day volume is lower than 187.8K, the bear wave count will be favoured. At the weekly chart level, it is downwards weeks also which have stronger volume.

Within cycle wave b primary wave A may be either a three or a five wave structure. So far within cycle wave b there is a 5-3 and an incomplete 5 up. This may be intermediate waves (A)-(B)-(C) for a zigzag for primary wave A, or may also be intermediate waves (1)-(2)-(3) for an impulse for primary wave A.

Intermediate wave (A) subdivides only as a five. I cannot see a solution where this movement subdivides as a three and meets all Elliott wave rules (with the sole exception of a very rare triple zigzag which does not look right). This means that intermediate wave (B) may not move beyond the start of intermediate wave (A) below 1,131.09. That is why 1,131.09 is final confirmation for the bear wave count at the daily and weekly chart level.

Intermediate wave (B) is a complete zigzag. Because intermediate wave (A) was a leading diagonal it is likely that intermediate wave (C) will subdivide as an impulse to exhibit structural alternation. If this intermediate wave up is intermediate wave (3) it may only subdivide as an impulse.

At 1,320 intermediate wave (C) would reach equality in length with intermediate wave (A), and would probably end at the upper edge of the maroon channel. At 1,429 intermediate wave (C) or (3) would reach 1.618 the length of intermediate wave (A) or (1). If this target is met it would most likely be by a third wave and intermediate wave (C) would most likely be subdividing as a five wave impulse.

This new bull wave count now sees minor wave 1 as a short impulse, and intermediate wave (C) or (3) as an impulse.

Minor wave 2 is an incomplete expanded flat correction. Minute wave b is a zigzag, which looks right on the daily chart. Minute wave c is an ending contracting diagonal. Contracting diagonals most often end with an overshoot of the 1-3 trend line, so I will look out for downwards movement to overshoot that lower green (i)-(iii) trend line before expecting that minor wave 2 may be complete.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,142.82.

Because ending diagonals require all their sub waves to subdivide as zigzags, the problems of subdivisions for the prior bull wave count at the hourly chart level are all now resolved.

Minuette wave (v) must subdivide as a zigzag. So far subminuette wave a is a complete impulse and subminuette wave b is a complete zigzag. Subminuette wave c would be extremely likely to move at least slightly below the end of subminuette wave a at 1,178.97 to avoid a truncation, and minuette wave (v) also would be extremely likely to move beyond the end of minuette wave (iii) below 1,169.94 to avoid a truncation.

At 1,160 subminuette wave c would reach 1.618 the length of subminuette wave a, and a truncation for both subminuette wave c and minuette wave (v) would be avoided. Along the way down the diagonal trend lines should provide support and resistance (diagonals normally adhere well to their trend lines). There are a couple of small overshoots so far, that’s okay, but I wouldn’t expect any clear breaches.

This new bull wave count means that neither 1,178.97 nor 1,169.94 can now provide confidence for the bear wave count.

In the short term, when minuette wave (v) is a completed zigzag, then the low at 1,178.97 will differentiate the bull and bear wave counts. The bull wave count would then require upwards movement above this point and the bear wave count will require a fourth wave correction to not move back into first wave price territory above 1,178.97.

This analysis is published about 09:05 p.m. EST.

Next analysis is now published.

GDX – no reason to change any notations on this chart from 5/1. Looking like another low volume day today in the context of a corrective move before what I suspect will be quite the plunge within a few days if the analogue continues to play out.

Overall gold looks pretty bearish to me right in here. Or maybe I should say it doesn’t look particularly bullish. Either way there does appear to be at least a fair chance of a huge move down coming very soon. Interesting to see how next couple of days play out

Lara is gold looking to drop to 1176 area to complete submicro wave 3?

If so how high could it bounce? Which day could gold drop to 1,160 – 1148 area target for micro wave 2? Then bounce how high?

I have both wave counts now in submicro wave (2) of micro wave 3. Micro wave 3 target 1,172 for bull wave count. This may take another day to get down there.

When micro wave 3 is done then the following fourth wave correction may not move back above 1,181.80 (first wave price territory).

For the bear…. it should be much lower and stronger (maybe to 1,139?) and should take a few days to a week or so to get down there.

I am concerned that volume for today’s down day is much lower. This is the first day I can say that volume is no longer clearly supporting the bear wave count over the bull wave count. For this reason I’m going to have to judge the probability of bull and bear to be pretty close to even.

But for the short term both wave counts require more downwards movement.

Super custom indicator guy sold his JDST to take his $19,000 profits for a few hours as concerns gold may have bottomed. Will wait for next buy to set up as per the indicator.

For some reason I assumed his trading timeframe was longer than an intraday scalp.

It could be 10 minutes or a week or longer. He takes what the indicator tells him.

Understood now. Thanks.

This profit can not be from the trade he did this morning 5 hours ago.

Good for him.

Yes from the one trade he bought JDST this morning. He makes huge buys and sells.

Money Managers Shed Gold Positions, Increase Short Bets – CFTC By Kitco News Monday May 11, 2015 12:04

http://www.kitco.com/news/2015-05-11/Money-Managers-Shed-Gold-Positions-Increase-Short-Bets-CFTC.html

As I see it, two fat ladies at the gate 1188 with upside risk 1191-92 with outside chance 1194-95; on the downside a break below 1171 and subsequently 1168.93 ought to follow but one should watch it here with the lower band at 1176-75….

Any wave count anyone? Is gold heading down or need to bounce up now?

Lara’s bull update has gold dropping to 1160.

Lara’s bear wave count had gold dropping to 1177 target then bouncing back up but below 1195.49 then further back down in very strong third wave down. I would be concerned if gold still has to bounce up from 1177 and would rather sell DUST at that point and wait for top of bounce to buy DUST back, unless that has already happened or else changed due to bull update.

Tham, does this comment of yours Friday still apply?

“So, if I had bought some DUST on Friday, I would monitor price action closely at 1181.80. If it falls below 1178.97, the start of sub-minuette 1 of minuette 3 of the bull count, then my reading of the bull count is wrong and the bear is strongly favoured. If it turns upwards around 1180.10, I would exit.”

Hi Richard, Where did you come up with the drop to 1177 number?

Lara’s Friday hourly Bear chart target 1177. Then “the bear count then expects a fourth wave correction

which may not move into first wave price territory above 1,195.49. The bull

wave count expects new highs.”

I think you mean Thursdays report , are those numbers still valid?

Ram thanks for asking. I checked the reports and I had Thursday mixed up with Friday, which Friday thankfully is more bearish.

With Lara’s updated wave counts, I would say we are approaching the end (fifth wave) of submicro 3 of micro 1 of subminuette 3 for the bear wave count. The bull wave count is exactly the same and will not diverge until after the bounce and the big drop. My best estimates are:

Submicro 3 1176

Micro 1 1171 – 1172

Thereafter the bounce up follows. If the targets are correct, the bounce should rise to 1185 before dropping again. Bear will reach about 1148 while bull will drop to 1160.

Tham, that is awesome, thanks for clarifying.

Tham, I really appreciate your posting when you did. It helped me.

I’d like to ask–To what do you attribute your skill at determining E.W. in motion, and how long have you been doing this? I’ve seen your postings before and you seem confident and have given accurate assessments.

I may have to step away but look forward to your answer.

Thanks dsprospering for your kind comments.

I have been doing analysis for the short term, i.e. intraday, since the beginning of this year. Prior to that, I traded longer term when the trend was very clear. The frustrating choppiness only sets in this year and so I have to change strategy. It was so much easier to trade when the market was trending.

I work on the basis of EW for the overall structure and estimate the price movement based solely on standard Fibonacci ratios among the waves. So all estimates assume a well-behaved action. I make changes as the action proceeds. I believe that price is the overriding factor and do not use any sophisticated tools. In this way, the methodology is simple, no frills. The philosophy is that for a non-linear action, it is not necessary to have the extra accuracy at the expense of time, effort, and maybe the incurring of additional money in buying software. That is only needed if I were to play small changes for huge outlays like millions or hundreds of thousands of dollars (anyway, don’t have that kind of money). I am still an engineer at heart, and for us, a 5 to 10% error is acceptable.

looking good Tham.

Nice place to hover right now

Wave 5’s often ‘gap’ so nice way to complete micro 1 of 3.

I would expect 2 to be shallow….

Lara’s update is correct.

At the close today, we are in micro 3.

For the bear, micro 5 and hence subminuette 3 should end at 1138.80.

The bull would end at 1163.90.

Good luck trading everyone.

Now, back to much needed sleep.

A potential HnS in GDX 2hour .

Your chart seems to indicate GDX should drop from here?

Super custom indicator guy just bought into JDST this morning.

He said he made 100% in 3 months.

Thanks Richard for updating us all. T U buying also???

I bought DUST twice last week. Now I wait to trade some intraday waves.

Richard–appreciate you posting updates from your custom indicator trader friend, obviously I like Lara’s EW analysis (else would not be here) but different ideas and 2nd opinions are great.

Lara, thank you so much for this defining update. The timeliness is very helpful to trading.

I posted a note on the older page (original analysis date) to let others know its here, as I came across this unexpectedly- had no idea it was here

It must turn down now as it’s right at upper green trendline of ED again. If it trends sideways for a few hrs, than ED would have full hourly breach

My thoughts on GLD internal structure over past several weeks shown on the chart. Morphed from bullish to bearish as it rolls over.

Here’s an hourly view of Friday’s GDX backtest which has a bearish look to it. Backtest was on very low volume.

update – the bearish flags keep breaking down….structure continues to unfold predictably.

Lara. This is a brilliant solution. Now both the bull and bear counts are aligned in the near term.

IKR! I was so happy to see this idea for the bull count. Often when I’m expecting a trend change and the first move subdivides as a three, when I consider a leading diagonal it so often turns out to be wrong and there wasn’t a trend change.

So I’m always wary of looking for a leading diagonal…. if I can see a solution which removes it that usually has a better probability.