Downwards movement fits the bear Elliott wave count best.

I have a new bull hourly Elliott wave count today.

Summary: The bear wave count expects more downwards movement to a target at 1,164 which may be met tomorrow. The new bull wave count requires upwards movement to 1,195.71 minimum. A new low below 1,162.80 would very strongly favour the bear wave count at this stage. Gold remains range bound; there is no clear trend. At this stage, the Elliott wave count which looks best is the bear, and it expects Gold is within a low degree correction.

To see the bigger picture and weekly charts go here.

Changes to last analysis are italicised.

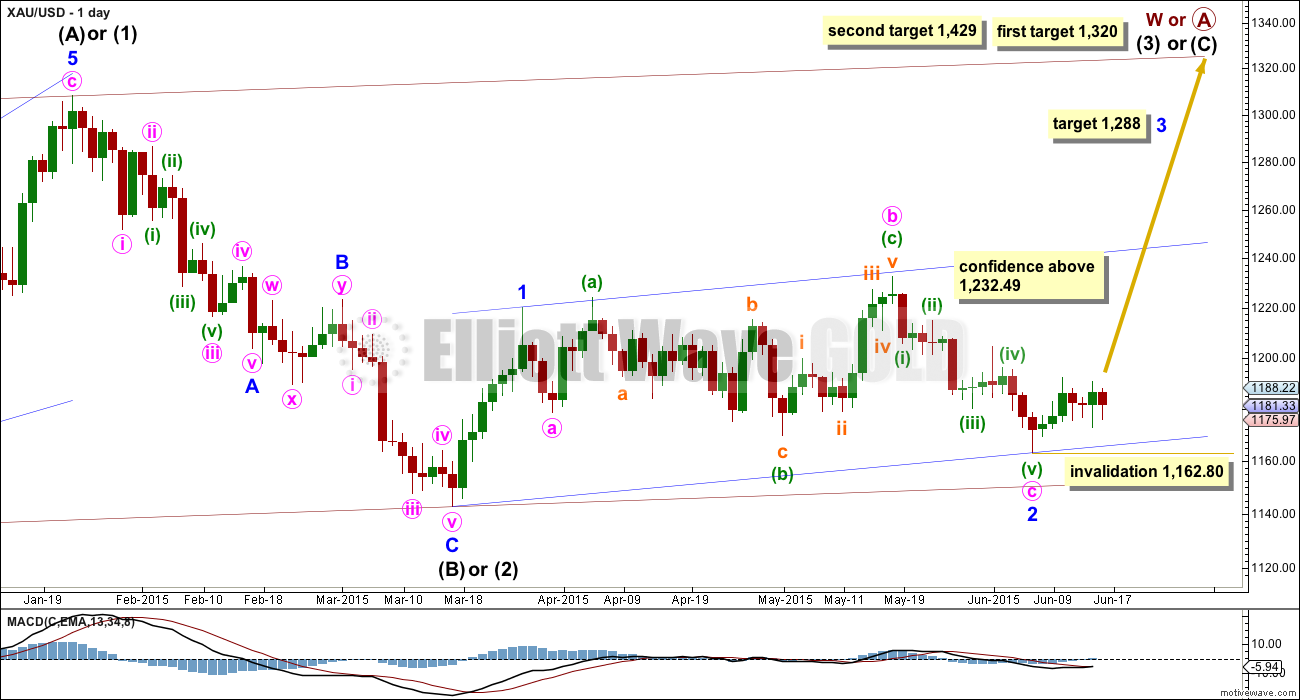

Bull Wave Count

The bull wave count sees primary wave 5 and so cycle wave a a complete five wave impulse on the weekly chart.

Pros:

1. The size of the upwards move labelled here intermediate wave (A) looks right for a new bull trend at the weekly chart level.

2. The downwards wave labelled intermediate wave (B) looks best as a three.

3. The small breach of the channel about cycle wave a on the weekly chart would be the first indication that cycle wave a is over and cycle wave b has begun.

Cons:

1. Within intermediate wave (3) of primary wave 5 (now off to the left of this chart), to see this as a five wave impulse requires either gross disproportion and lack of alternation between minor waves 2 and 4 or a very rare running flat which does not subdivide well. I have tried to see a solution for this movement, and no matter what variation I try it always has a major problem.

2. Intermediate wave (5) of primary wave 5 (now off to the left of the chart) has a count of seven which means either minor wave 3 or 5 looks like a three on the daily chart.

3. Expanding leading diagonals (of which intermediate wave (A) or (1) is) are are not very common (the contracting variety is more common).

4. Volume does not support this bull wave count.

For volume to clearly support the bull wave count it needs to show an increase beyond 187.34 (30th April) and preferably beyond 230.3 (9th April) for an up day. Only then would volume more clearly indicate a bullish breakout is more likely than a bearish breakout.

Within cycle wave b, primary wave A may be either a three or a five wave structure. So far within cycle wave b there is a 5-3 and an incomplete 5 up. This may be intermediate waves (A)-(B)-(C) for a zigzag for primary wave A, or may also be intermediate waves (1)-(2)-(3) for an impulse for primary wave A. At 1,320 intermediate wave (C) would reach equality in length with intermediate wave (A) and primary wave A would most likely be a zigzag. At 1,429 intermediate wave (3) would reach 1.618 the length of intermediate wave (1) and primary wave A would most likely be an incomplete impulse.

Intermediate wave (A) subdivides only as a five. I cannot see a solution where this movement subdivides as a three and meets all Elliott wave rules (with the sole exception of a very rare triple zigzag which does not look right). This means that intermediate wave (B) may not move beyond the start of intermediate wave (A) below 1,131.09. That is why 1,131.09 is final confirmation for the bear wave count at the daily and weekly chart level.

Intermediate wave (C) is likely to subdivide as an impulse to exhibit structural alternation with the leading diagonal of intermediate wave (A). This intermediate wave up may be intermediate wave (3) which may only subdivide as an impulse.

Minor wave 2 is over here. Minute wave c is just 2.7 longer than 1.618 the length of minute wave a. At 1,288 minor wave 3 would reach 1.618 the length of minor wave 1.

Within minor wave 3, no second wave correction may move beyond its start below 1,162.80.

A new high above 1,232.49 would eliminate the bear wave count and provide full confidence in the targets.

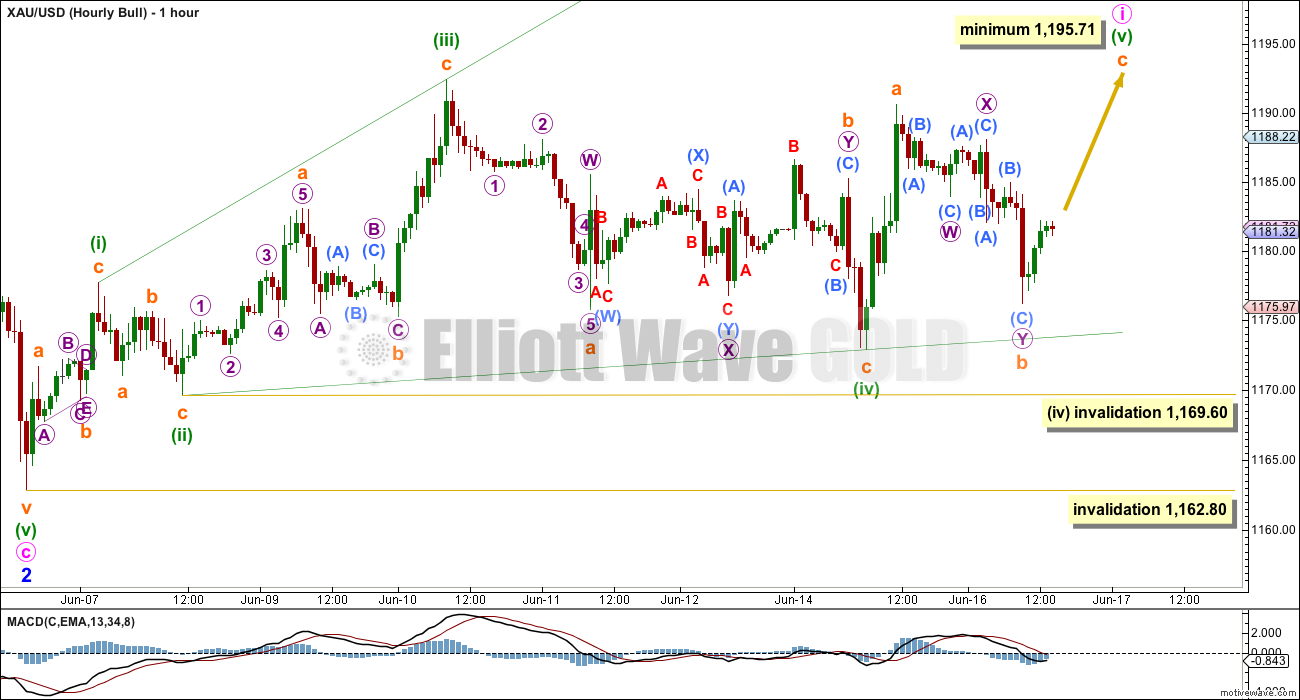

Hourly Bull Wave Count

Yesterday I was not confident with the wave count at the hourly chart level for the bull wave count. This idea above has a higher probability and has a more reasonable look.

Minute wave i must subdivide as a five wave structure, either an impulse or a leading diagonal. Leading diagonals are most commonly contracting, with the expanding variety not so common. This rarity reduces the probability of this wave count.

Leading diagonals require the second and fourth waves to subdivide as zigzags, and the fourth wave must overlap first wave price territory, which this one does. The first, third and fifth waves are also most often zigzags.

The most common depth of second and fourth waves within diagonals is between 0.66 to 0.81 the prior wave. Here minuettte wave (ii) is 0.54 and minuette wave (iv) is 0.86. Neither are within normal range slightly reducing further the probability of this wave count.

Within minuette wave (iv) zigzag, subminuette wave b is labelled as a double zigzag, but it has an atypical look. This structure moves sideways, whereas double zigzags should have a clear slope against the main trend and not a sideways look. If minuette wave (iv) continues further, then this problem may be resolved. Minuette wave (iv) may not move beyond the end of minuette wave (ii) below 1,169.60.

If minuette wave (v) has begun, then it must be longer than minuette wave (iii), because the diagonal is expanding, and must reach above 1,195.71. Leading diagonals may not have truncated fifth waves so minuette wave (v) must end above the end of minuette wave (iii) at 1,192.44.

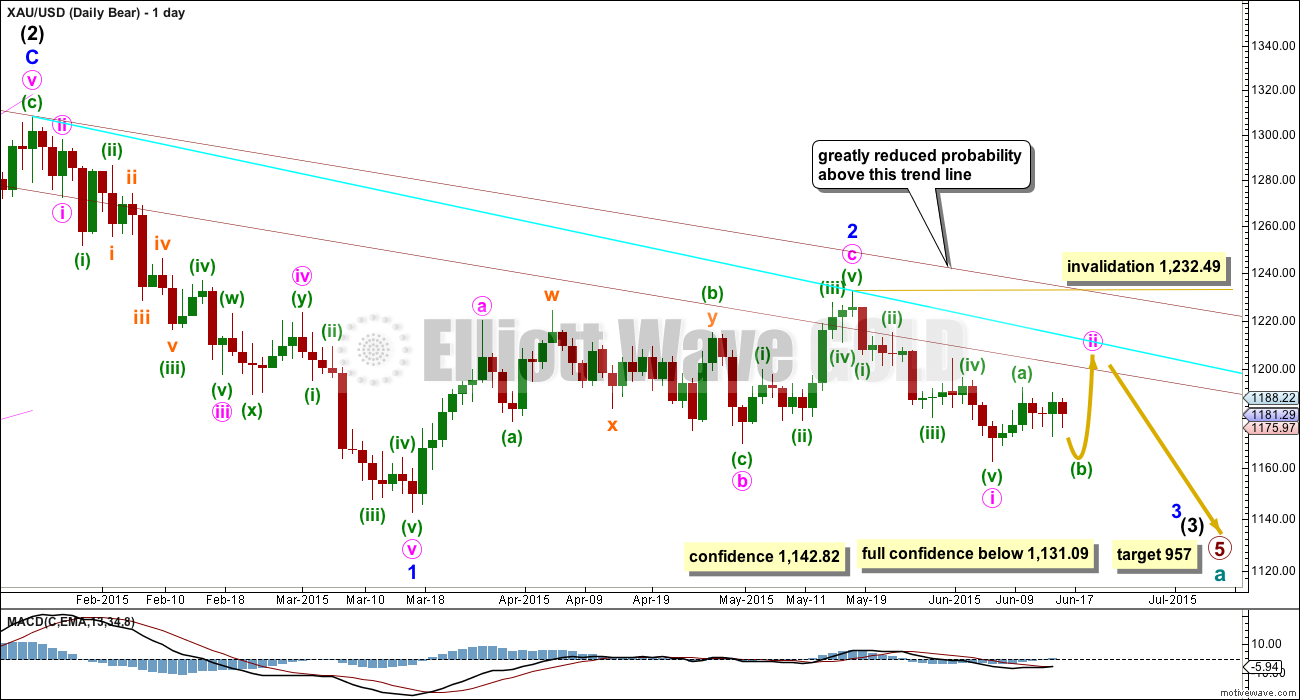

Bear Wave Count

This wave count follows the bear weekly count which sees primary wave 5 within cycle wave a as incomplete. At 957 primary wave 5 would reach equality in length with primary wave 1.

Pros:

1. Intermediate wave (1) (to the left of this chart) subdivides perfectly as a five wave impulse with good Fibonacci ratios in price and time. There is perfect alternation and proportion between minor waves 2 and 4. For this piece of movement, the bear wave count has a much better fit than the bull wave count.

2. Intermediate wave (2) is a very common expanded flat correction. This sees minor wave C an ending expanding diagonal which is more common than a leading expanding diagonal.

3. Minor wave B within the expanded flat subdivides perfectly as a zigzag.

4. Volume at the weekly and daily chart continues to favour the bear wave count. Since price entered the sideways movement on 27th March it is a downwards week which has strongest volume, and it is downwards days which have strongest volume.

5. On Balance Volume on the weekly chart recently breached a trend line from back to December 2013. This is another bearish indicator.

Cons:

1. Intermediate wave (2) looks too big on the weekly chart.

2. Intermediate wave (2) has breached the channel from the weekly chart which contains cycle wave a.

3. Minor wave 2 is much longer in duration than a minor degree correction within an intermediate impulse normally is for Gold. Normally a minor degree second wave within a third wave should last only about 20 days maximum. This one is 44 days long.

4. Within minor wave 1 down, there is gross disproportion between minute waves iv and ii: minute wave iv is more than 13 times the duration of minute wave i, giving this downwards wave a three wave look.

Minor waves 1 and 2 are complete. Minute wave i within minor wave 3 may be incomplete on the hourly chart.

Minute wave ii may not move beyond the start of minute wave i above 1,232.49.

A new low below 1,142.82 would provide a lot of confidence in this bear wave count. At that stage, the bull wave count may not be continuing its second wave correction. But only a new low below 1,131.09 would invalidate any variation of a bull wave count and provide full and final confirmation for a bear wave count.

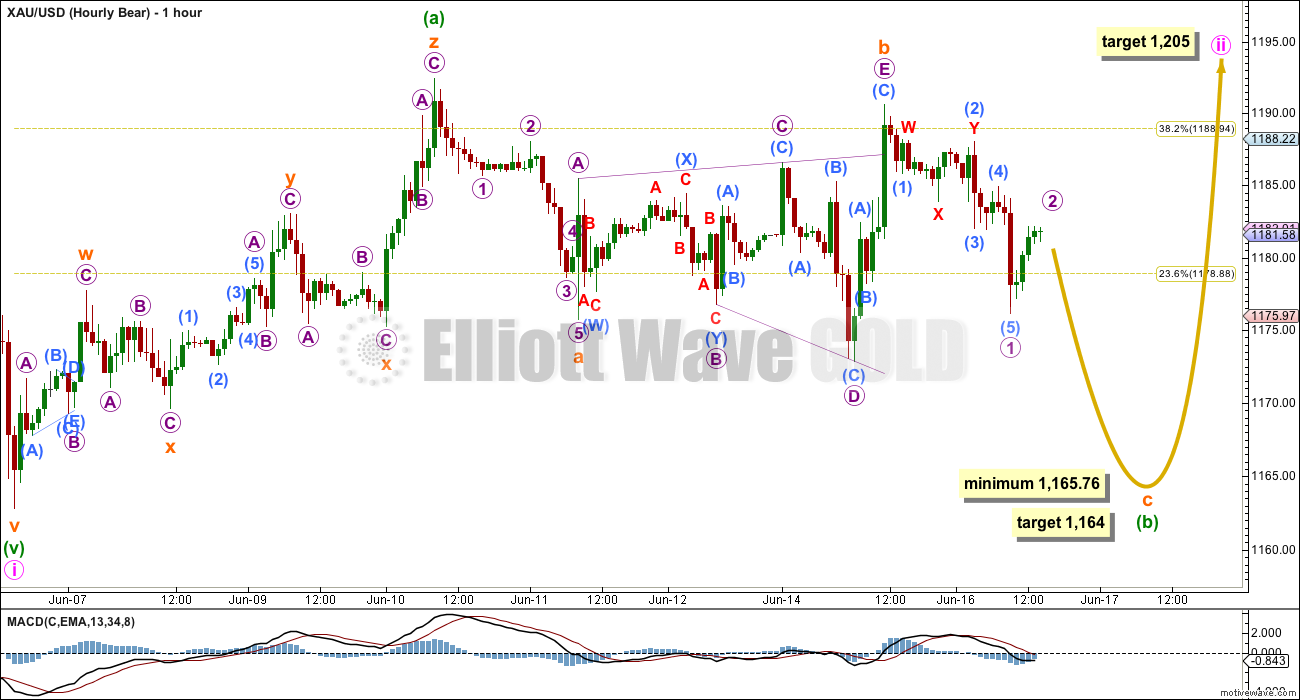

Hourly Bear Wave Count

Sideways movement does not look like the start of a third wave down; I will discard yesterday’s alternate hourly bear wave count because the subdivisions no longer fit.

Minute wave ii is likely continuing sideways as a flat correction. Minuette wave (a) is a “three”, a rare triple zigzag, and minuette wave (b) is unfolding lower as a zigzag. At 1,164 subminuette wave c would reach 1.618 the length of subminuette wave a.

Flat corrections require a minimum 90% retracement of their B waves, so minuette wave (b) must end at 1,165.76 minimum.

Minuette wave (b) may make a new low below the start of minuette wave (a) at 1,162.80, and is likely to do so because the most common type of flat is an expanded flat, which would require minuette wave (b) to be a 105% length of minuette wave (a) or more, at 1,161.32 or below.

The most common length of a B wave within a flat is between 100% to 138% the A wave. This gives a range for minuette wave (b) between 1,162.80 to 1,151.54.

When the length of minuette wave (b) is known, then the type of flat would be known. At that stage, the ratio between minuette waves (a) and (c) may be used to calculate a target for minute wave ii to end. For now I leave it at 1,205 which is the 0.618 Fibonacci ratio of minute wave i. This target may change.

Technical Analysis

Weekly Chart: Overall volume still favours a downwards breakout eventually. During this sideways movement, it is still down days and a down week which have higher volume. On Balance Volume breaches a trend line (lilac line) which began in December 2013, and the breach is significant.

While price has made higher lows, On Balance Volume has made lower lows (green trend lines). This small rise in price is not supported by volume, and it is suspicious.

Daily Chart: ADX is declining and below 15; there is no clear trend. A range bound trading system should be employed. Trading a range bound market is more risky than trading a trending market, so good money management rules are essential to ensure your account is not wiped out in this kind of market. A good rule would be to invest no more than 2% of equity in your account on any one trade.

The downwards sloping trend line which was providing resistance is weakening. The range bound system illustrated here uses fast Stochastics and horizontal support and resistance lines. With Stochastics returning from oversold to within normal range, and price moving higher from the lower support line, this approach would expect another upwards swing is likely.

The best fit Elliott wave count at this stage is the bear, particularly at the hourly chart level. Because it expects downwards movement from here, which may make a new low below 1,162.80, it does not agree with the regular technical analysis picture entirely. It is possible that another swing low may be made before the next upwards swing begins to take price up again to resistance, and that is the problem with this range bound market. It is impossible to tell exactly where one swing ends and another begins, which is why trading this kind of market involves greater risk.

Volume continues to favour the bear wave count. Within this range, it is downwards days which have highest volume. This is an indicator that the breakout, when it comes, will be more likely down than up. This often works, but not always.

Most recently, the last four up days have not managed to complete with higher volume than the prior down day of 4th June. This indicates that upwards and sideways movement from the last low may be a correction against a downwards trend, which fits the bear wave count.

This analysis is published about 04:15 p.m. EST.

Excellent moves in the miners this afternoon.

I updated the COT graph that I post here every once in a while.

Lara just mentioned regarding hourly bear, “it’s invalidation point at 1,190.61”.

Since the FED FOMC 2:00 pm news release today and live conference since 2:30 pm gold started slowly then continued up $10 on the fact that the FED didn’t commit to any interest rate this year and will wait for ongoing data before committing to an increase.

This news is clearly positive for gold, as the market was expecting for an announcment of an increase this year perhaps in September or December at the latest.

The US dollar has dropped .8% since 1:55 pm today which pushes up gold.

Gold may have peaked at 1189.28 at 3:19 pm?

For the bear count: If it moves above 1,190.61 then minuette wave (b) is not a single zigzag, it must be a double zigzag or double combination.

It still needs to move down to that minimum at 1,165.76 because minuette wave (a) was a three, it can’t be seen as a five. So minute wave ii is definitely still unfolding sideways and it’s a flat correction.

This is a low degree B wave within a second wave correction. There are multiple structural possibilities. B waves have the greatest variety in form and structure, they’re the most difficult of all waves to analyse. They’re often very complicated sideways movements.

For the bull count: probability would increase above 1,192.44 because the fifth wave of a leading diagonal may not be truncated.

One would think if the bear count is correct, we would have dropped $10 on the FOMC and not risen $10. The bullish has much less probability so tough to say.

Results of big US news does not have to agree with EW forecasts. They may accelerate or slow down an EW forecast. I don’t assume an agreement of US new results on gold with EW forecasts I take them as independent of EW forecasts.

Instant news on FED FOMC 2:00 pm EST

http://www.marketwatch.com/newsviewer

Some are only headlines others are articles

Lara expects Hourly bear target today: 1164, but range is 1165.76 to 1151.54

Then bounce up to $1,205 Target may change.

It looks like micro 2 of the Bear count is developing as an expanded flat 1176.19 – 1182.82 – 1174.67 – ongoing. Submicro c should terminate at the 1.618 retrace at 1185.40. This ties in well with the 0.618 retrace one degree higher (at 1185.06). Thereafter, the third wave drop (micro 3) is expected.

At the moment, submicro c has probably completed only one of five waves. Yawn! Might as well take a quick nap before the FOMC release.

I will scrap this if price is going to drop below 1176.19, and go for the alternative that micro 2 has completed at 1182.82, and we are in a third wave down (micro 3).

However, be aware that if the Bull is in play, the current rise targets 1212 thereabouts.

My strategy is to watch 1185-1186. If it rises higher than that, then the Bull is more probable.

Alan: Thanks for your quick analysis…. IMHO requires a rise through 1178-81 to seek 1186-87 with 1189-91 on the outside and requires a drop below 1175 to open up 1163-62…. Lets see what happens~!

Glad I’m not the only one still expecting a bounce to the mid-1180s. I was thrown off by the move below submicro a, but then realized that this could be an expanded flat for submicro b.

Exactly. But I can’t see submicro wave (C) as complete now on the five minute chart, I think the structure needs more upwards movement to complete an impulse.

It’s getting very close indeed to it’s invalidation point at 1,190.61 and so I’m wondering if something else is happening… maybe subminuette wave b is moving sideways as a double flat or combination?

I’ll chart that idea and see how it looks.

Yes, it is too close. Something is off.

A VIEW: Let’s look at it this way: As long as Gold price remains within the confines of the recent highs 1227-28 / 1232-33 it would remain in the bear camp. As Lara put it, Gold price is likely to fall by its own weight and I would consider downside 115x-114x-113x and lower a not too distant possibility. The E/W studies and analysis helps to sketch out the possible parameters of where price could or could not go. I think all of us are subscribed here to benefit from such studies. Personally I have found this very satisfying and it has helped me a lot. It really does not matter to me if Gold price heads for $2000 or $1000; as long as one can catch the tide and drift along with it~!! Good luck all and may it be profitable.//// It is unusual that Gold price has not yet taken out last weeks H / L….

Silver and Gold: Don’t Have a Reason to be Bullish

Tuesday, 16 June 2015

http://news.goldseek.com/GoldSeek/1434484800.php

Gary Savage sees gold below 1,000 like Lara’s bear count.

http://www.gold-eagle.com/article/gold-surviving-last-few-months-bear-market-part-iii

Good evening to all the lurkers out there. One thing to recall is that in the last few ‘major’ (GDP, BLS) gold moving announcements, gold didn’t do much at all.

Eventually something will move, or Lara is going to have to run to the store to buy more A’s, B’s, C’s, W’s, X’s, and Y’s .

See you all tomorrow.

B

Gold still needs to complete a smaller 3 wave corrective structure up, which I thought would have occurred over the last few hours. I am expecting gold to reach the mid 1180s soon, either now (next 5 hours) or as a knee-jerk reaction at beginning of FOMC. That would be followed by a sharp move down to lower 1160s or below (1150s?). This could carry through to tomorrow. Then perhaps by Friday, gold is ready to rocket up to 1205-1210 area, only to be followed by the real drop to at least 1100 for now. So today will be the start of a wild ride. The days of sideways movement are over.

Matt., I like it! Don’t waffle around, go on the record, state your position and let gold decide who is correct.

We’re in the calm before the storm. The next few trading days will be very rocky and not easy to ride.

I keep looking at the GDX and GLD options sweet spots for Friday which are around ~$19.50 for GDX and if I recall, about $115 for GLD. With all of the put volume in the last week or more, it feels like its going to be harder to drop before Friday, unless it’s a quick one.

I picked up my last tranche of NUGT at $8.95 this morning. I am ready for the fireworks.

Typical! As soon as I put it in writing, it goes wrong. 🙂 Guess I missed the 3 wave correction and gold is going right to the lows. Sorry if I misled anyone.

lol…at least its finally moving! I would love to see gold complete most of that c (b) down move over the next few hours, although I could see it dragging into tomorrow with all of the data coming out in the morning.

FYI, Gold open interest rose by over 8,000 contract yesterday, and silver by over 2800.

Gold doesn’t have far to go to reach the minimum target for this b wave, but I’m going to avoid guessing the timing of it. My main objective over the next few weeks is to capture the meat of the move down. Everything else is just extra.

Perhaps I spoke to soon. Gold should be making a 5 down, with the first wave complete according to the last analysis. That is why I was looking out for a small 2nd wave. Could be a little expanded flat that takes gold there. The 3rd wave could then take gold close to the target. Then there are still the 4th and 5th waves of this downwave, so it could very well take until tomorrow or early Friday until the c wave begins.