A little upwards movement was expected to 1,180 before more downwards movement, but this is not what happened.

At the daily chart level, a new low below 1,162.80 strongly favours the bear Elliott wave count.

Summary: It is increasingly likely that the trend is down. Final confirmation would come with a new low below 1,131.09. In the very short term, a small upwards correction should complete then be followed by more downwards movement.

To see the bigger picture and weekly charts go here.

Changes to last analysis are italicised.

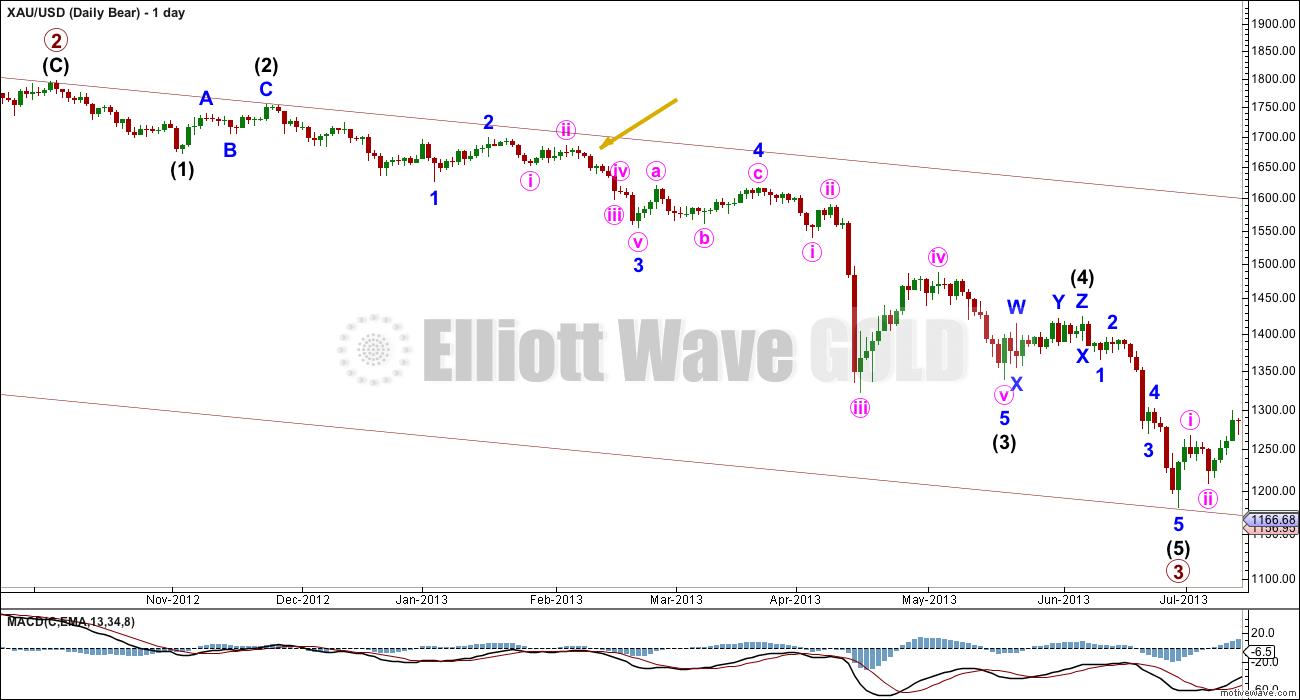

Bear Wave Count

The bear wave count has increased in probability with a new low below 1,162.80. Full confidence may be had in this wave count with a new low below 1,131.09.

This wave count follows the bear weekly count which sees primary wave 5 within cycle wave a as incomplete. At 957 primary wave 5 would reach equality in length with primary wave 1.

Pros:

1. Intermediate wave (1) (to the left of this chart) subdivides perfectly as a five wave impulse with good Fibonacci ratios in price and time. There is perfect alternation and proportion between minor waves 2 and 4. For this piece of movement, the bear wave count has a much better fit than the bull wave count.

2. Intermediate wave (2) (to the left of this chart) is a very common expanded flat correction. This sees minor wave C an ending expanding diagonal which is more common than a leading expanding diagonal.

3. Minor wave B (to the left of this chart) within the expanded flat subdivides perfectly as a zigzag.

4. Volume at the weekly and daily chart continues to favour the bear wave count. Since price entered the sideways movement on 27th March, it is a downwards week which has strongest volume and downwards days which have strongest volume, five of them.

5. On Balance Volume on the weekly chart breached a trend line from back to December 2013. This is another bearish indicator.

Cons:

1. Intermediate wave (2) (to the left of this chart) looks too big on the weekly chart.

2. Intermediate wave (2) (to the left of this chart) has breached the channel from the weekly chart which contains cycle wave a.

3. Within minor wave 1 down, there is gross disproportion between minute waves iv and ii: minute wave iv is more than 13 times the duration of minute wave i, giving this downwards wave a three wave look.

4. Minor wave 2 is much longer in duration than a minor degree correction within an intermediate impulse normally is for Gold. Normally a minor degree second wave within a third wave should last only about 20 days maximum. This one is 44 days long.

Minor waves 1 and 2 are complete. Minute waves i and ii are also complete. Gold may be ready to move to the strongest middle of intermediate wave (3).

Minute wave ii may not move beyond the start of minute wave i above 1,232.49.

Minute wave ii is now very likely to be over here. If it moves any higher, then it should find strong resistance at the blue trend line.

At 1,093 minute wave iii would reach 1.618 the length of minute wave i. If minute wave iii ends in a total Fibonacci twenty one days, then this target may be reached in another eleven days time.

Hourly Bear Wave Count

Third waves are commonly extended. An extension must begin with a series of overlapping first and second waves. This scenario is very common, so it has the highest probability of the two hourly wave counts.

There may now be a series of six overlapping first and second waves, with micro wave 2 completing.

This sees subminuette wave ii as a very quick expanded flat correction. Within it, micro wave C subdivides perfectly as a five wave impulse (I cannot see this move as a three). This correction looks to be too quick so the alternate below must be considered.

Micro wave 2 may be unfolding as a zigzag. Submicro wave (C) must complete as a five wave structure. Micro wave 2 may not move beyond the start of micro wave 1 above 1,179.17.

Alternate Hourly Bear Wave Count

I am considering this idea for three reasons:

1. The long lower wick on today’s candlestick along with lower volume is a small bullish indicator. A green candlestick for Friday may resolve this bullishness.

2. It would be most likely for subminuette wave ii to be long lasting enough to show up on the daily chart, giving the impulse for minuette wave (iii) a clear five wave look.

3. The downwards wave labelled micro wave B looks corrective and fits better as a double zigzag than it does as an impulse.

The big problem with this alternate wave count which reduces its probability is the depth of micro wave B at 2.17 times the length of micro wave A. The common depth for a B wave within a flat correction is between 1 to 1.38 times the length of the A wave, and the maximum conventional depth is twice the length of the A wave. Because this is more than twice the depth, the probability of this hourly wave count is low.

However, there is no rule stating the maximum allowed length of a B wave to its A wave within a flat correction. I have seen a few flat corrections where B is more than twice the length of A, such as in this wave count where minuette wave (ii) surprised us with its B wave being 2.9 times the length of its A wave. The subdivisions fit perfectly, and in hindsight minuette wave (ii) did unfold as an expanded flat correction.

If subminuette wave ii is unfolding as a flat correction, then micro wave C would be extremely likely to make at least a slight new high above the end of micro wave A at 1,179.17 to avoid a truncation and a very rare running flat.

At 1,184 micro wave C would reach 2.618 the length of micro wave A. At 1,181 subminuette wave ii would correct to the 0.618 Fibonacci ratio of subminuette wave i.

Subminuette wave ii may not move beyond the start of subminuette wave i above 1,188.16.

Overlapping Waves

This daily chart shows how primary wave 3 began, with a series of overlapping first and second waves. Within intermediate wave (3), it was the fifth wave, minor wave 5, which was the strongest. This is typical of commodities.

The gold arrow is for a “you are here” and points to the equivalent location in primary wave 5 which may now be currently unfolding.

Notice how Gold has strong fifth waves and short quick fourth waves. This often gives its impulses a three wave look, with a slow start and an acceleration towards the end.

Bull Wave Count

The bull wave count sees primary wave 5 and so cycle wave a a complete five wave impulse on the weekly chart.

Pros:

1. The size of the upwards move labelled here intermediate wave (A) (to the left of this chart) looks right for a new bull trend at the weekly chart level.

2. The downwards wave labelled minor wave W looks best as a three.

3. The small breach of the channel about cycle wave a on the weekly chart would be the first indication that cycle wave a is over and cycle wave b has begun.

Cons:

1. Within intermediate wave (3) of primary wave 5 (to the left of this chart), to see this as a five wave impulse requires either gross disproportion and lack of alternation between minor waves 2 and 4 or a very rare running flat which does not subdivide well. I have tried to see a solution for this movement, and no matter what variation I try it always has a problem which substantially reduces its probability.

2. Intermediate wave (5) of primary wave 5 (to the left of this chart) has a count of seven which means either minor wave 3 or 5 looks like a three on the daily chart.

3. Expanding leading diagonals (of which intermediate wave (A) or (1) is) are are not very common (the contracting variety is more common). There is also now a second expanding leading diagonal for minute wave i.

4. Volume does not support this bull wave count.

For volume to clearly support the bull wave count it needs to show an increase beyond 187.34K (30th April) and preferably beyond 230.3K (9th April) for an up day. Only then would volume more clearly indicate a bullish breakout is more likely than a bearish breakout.

Intermediate wave (A) (to the left of this chart) subdivides only as a five. I cannot see a solution where this movement subdivides as a three and meets all Elliott wave rules (with the sole exception of a very rare triple zigzag which does not look right). This means that intermediate wave (B) may not move beyond the start of intermediate wave (A) below 1,131.09. That is why 1,131.09 is final confirmation for the bear wave count at the daily and weekly chart level.

The only option now for the bull wave count is to see intermediate wave (B) or (2) continuing sideways as a double combination. The first structure in the double is a zigzag labelled minor wave W. The double is joined by a brief three in the opposite direction labelled minor wave X, a zigzag. The second structure in the combination is an expanded flat labelled minor wave Y which is incomplete.

Within minor wave Y, minute wave b is a 1.15 times the length of minute wave a indicating an expanded flat. Both minute waves a and b are three wave structures.

Minute wave c downwards must subdivide as a five, and because the first wave within it is an impulse and not a zigzag minute wave c may only be unfolding as an impulse.

Within minute wave c downwards, the third wave is incomplete for minuette wave (iii). At the hourly chart level, this bull wave count sees the subdivisions in exactly the same way as the bear (the bull sees everything one degree lower) so the hourly charts are the same. For this reason I will publish only hourly charts for the bear because they work in exactly the same way for the bull.

There does not look to be enough room for minute wave c to complete as a five wave impulse and remain above the invalidation point at 1,131.09. This is now the biggest problem with the bull wave count.

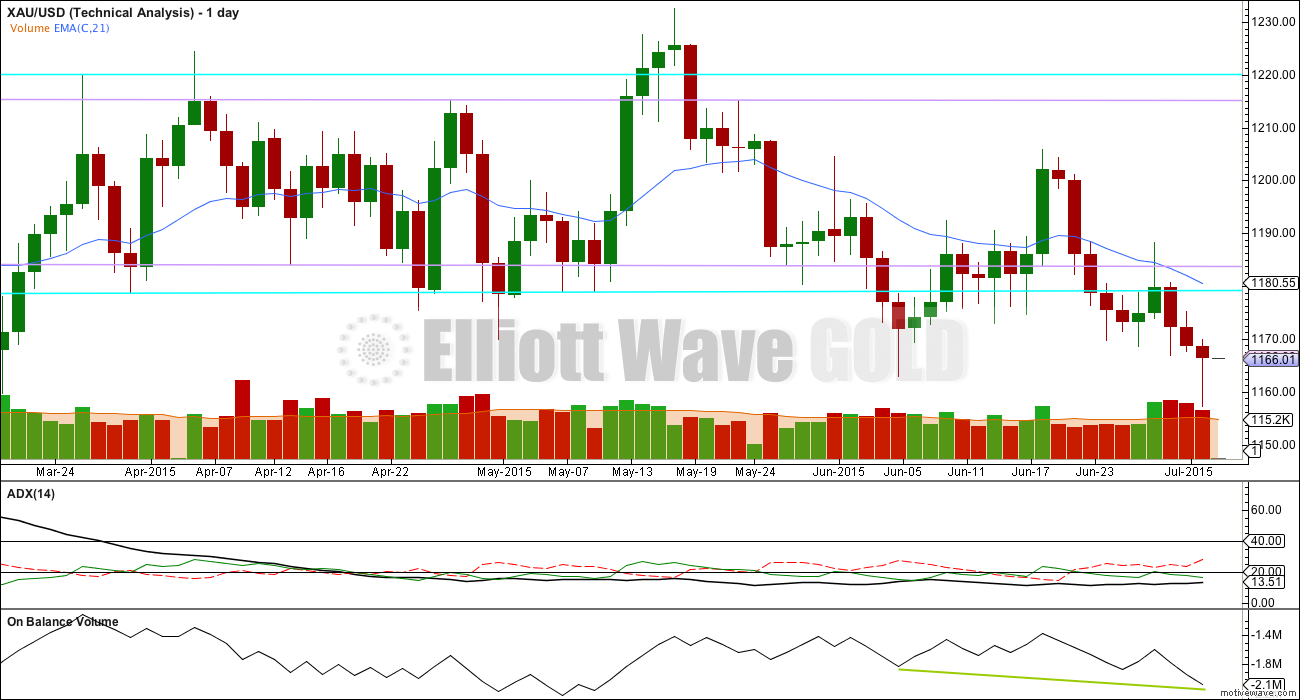

Technical Analysis

Weekly Chart: Overall volume still favours a downwards breakout eventually. During this sideways movement, it is still down days and a down week which have higher volume. On Balance Volume breaches a trend line (lilac line) which began in December 2013, and the breach is significant.

While price has made higher lows, On Balance Volume has made lower lows (green trend lines). This small rise in price is not supported by volume, and it is suspicious. Price is now breaking below support at the green trend line, which is another bearish indicator today.

At the weekly chart level, volume is strongest in a down week. Overall volume is declining, typical of a maturing consolidation. Each series of down weeks includes a week with stronger volume than the following series of up weeks. The breakout should come very soon now and volume indicates a downwards breakout is more likely than upwards.

Daily Chart: While ADX still indicates no clear trend yet, price is making new lows. I will no longer illustrate a range bound trading system, because it is too risky to expect an upwards swing from here to be substantial. The sideways consolidation is now so mature the breakout is imminent; the breakout may be beginning now.

A close 3% or more of market value below the lower blue horizontal trend line would confirm a downwards breakout. That price point would be at 1,142.23.

Volume is high for the last three down days, but each day sees volume slightly decline which is a cause for concern. This fall in price is only somewhat supported by volume. The long lower wick on Thursday’s candlestick is a short term bullish indicator. We may see a green candlestick for Friday to resolve this short term bullishness. Look for price to find resistance at the lower blue trend line, which previously provided support.

On Balance Volume at the daily chart level agrees with this fall in price; there is no divergence between the last two lows.

Overall the regular TA picture is more bearish than bullish.

This analysis is published about 06:17 p.m. EST.

I’ve finished my analysis but it needs to be proofed. It may not be published quite before markets close, so here is my summary for you:

” It is likely that Monday will see a little more upwards movement to 1,181 – 1,184. Thereafter both wave counts, bull and bear, need more downwards movement. The bear wave count is more likely, it expects a strong third wave down is nearing it’s middle.”

Have a great weekend everyone, and good luck for Monday!

Lara,

Could subminuette i have ended where you have micro B? That would then mean we are at the beginning of subminuette ii instead of nearing the end of it.

I cannot see how that wave down would subdivide as a complete impulse. The problem is all the overlapping in the middle, trying to see a third wave impulse in the middle of it… I can’t see it.

So no, I don’t think so.

Lara: really hope that you will do your analysis today, despite the early holiday closure. While activity since yesterday has been rather muted, it would be helpful to get an update on the wavecount(s) before markets re-open next week. Thanks.

If not the full analysis (video + text), perhaps one of the two? Thanks again.

I’m here, and yes, the market has traded so of course I’ll be doing analysis.

It looks like the alternate hourly bear wave count is correct. Which fits with the regular TA.

Lara,

Someone requested a timing estimate to complete the bear count. Looking at the 2012/13 weekly you shared, it seems we might have 6 months left potentially. Can you provide some thoughts on that?

That’s such a hard question to answer. Months is the vague reply.

Primary wave 1 lasted a Fibonacci 3 weeks and primary wave 3 lasted 37 weeks, 3 more than a Fibonacci 34. So far primary wave 5 has lasted 51 weeks and it’s not quite at the halfway mark so it probably won’t be able to complete in a Fibonacci 55 weeks (unless the final fifth waves are all quick and strong).

The next Fibonacci number in the sequence is 89. Which would see primary wave 5 very time consuming indeed, continuing for another 38 weeks (give or take up to 4 either side of that number).

I think that looks to be too long, I think it may end more quickly and not exhibit a Fibonacci duration nor ratio in terms of duration to either of primary waves 1 or 3.

Which means that a prediction on exactly when it may end is only a vague guess at best.

Excellent analysis Lara. Thank you. The hourly count you have is consistent with the move up in miners today. And since it may take a few days to play out on the way down and then move up, it fits with where I think miners are headed for options expiration in 2 weeks. It will relieve some of the oversold conditions, and set us up for a significant draw down through August (non-Gold delivery month) and September. As I look back in history for similar patterns, October 2014 could be similar to how this is playing out now in July. Miners were cut by 30% in less than 60 days. That would put GDX near your target of $12/$13 and GDXJ around $16/$17.

Time to mow the lawn.

Ben, do you mean as written “it may take a few days to play out on the way down and then move up” ?

Yes, since the bear doesn’t invalidate until 1232, I’m expecting some sideways to downward chop for the next couple days, followed by the move up to 1180’s. I expect that move to take 5 to 8 days, then another 1-2 down with the 2 potentially being deep to fool Bulls into thinking its a third wave up beginning.

What I’m learning is that it is not happening as quickly as we would like it too, and consistent with Lara’s weekly charts from 2012/2013, it could easily take us 3 more weeks to get started. I think she even mentions that in the video. So that all fits with where GDX and GLD option max pain is, about $19 for GDX and around $114/$115 for GLD (about $22-$33 higher than current price).

Miners may only make it back to the middle of the daily bollinger band or just above it, I’ll be watching for that.

Ben Thanks. Also really great you almost made $2 a share on JNUG buy & sell Wednesday for 11.5%. Wish it were me. Would like to have better success intraday and long term. Find the constant changing daily direction along with EW’s many rules confusing to master. Hope that you are succeeding short and long term.