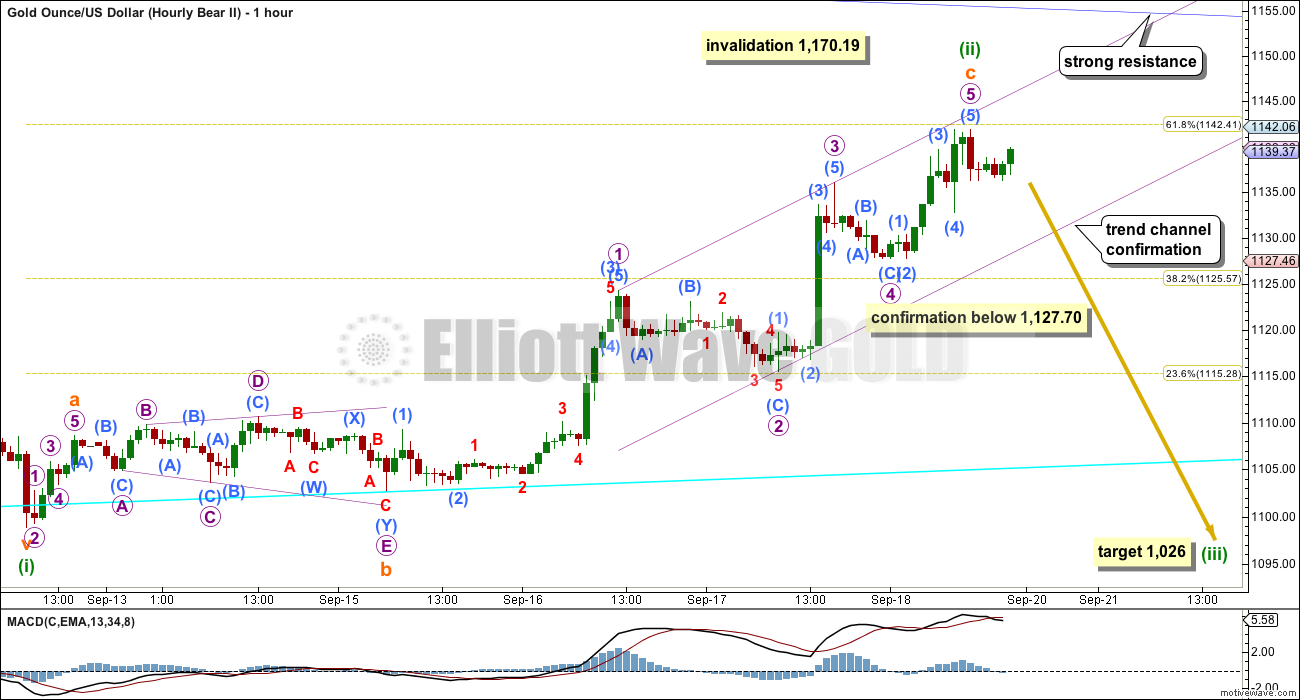

Short term the bear wave count expected upwards movement to 1,143.

Price has moved higher to 1,141.83.

Summary: Both wave counts expect downwards movement from here: the bear for the middle of a big third wave and the bull for a fourth wave correction which should show up on the daily chart. If upwards movement continues, the differentiating line is the upper edge of the blue channel on both daily charts. A breach of that line would very strongly favour the bull over the bear. To the downside, some confirmation is required to have confidence that price will move lower for the short term: first, a breach of the channel on the hourly chart; and second, a new low below 1,127.70.

Changes to last analysis are bold.

To see the bigger picture on weekly charts click here.

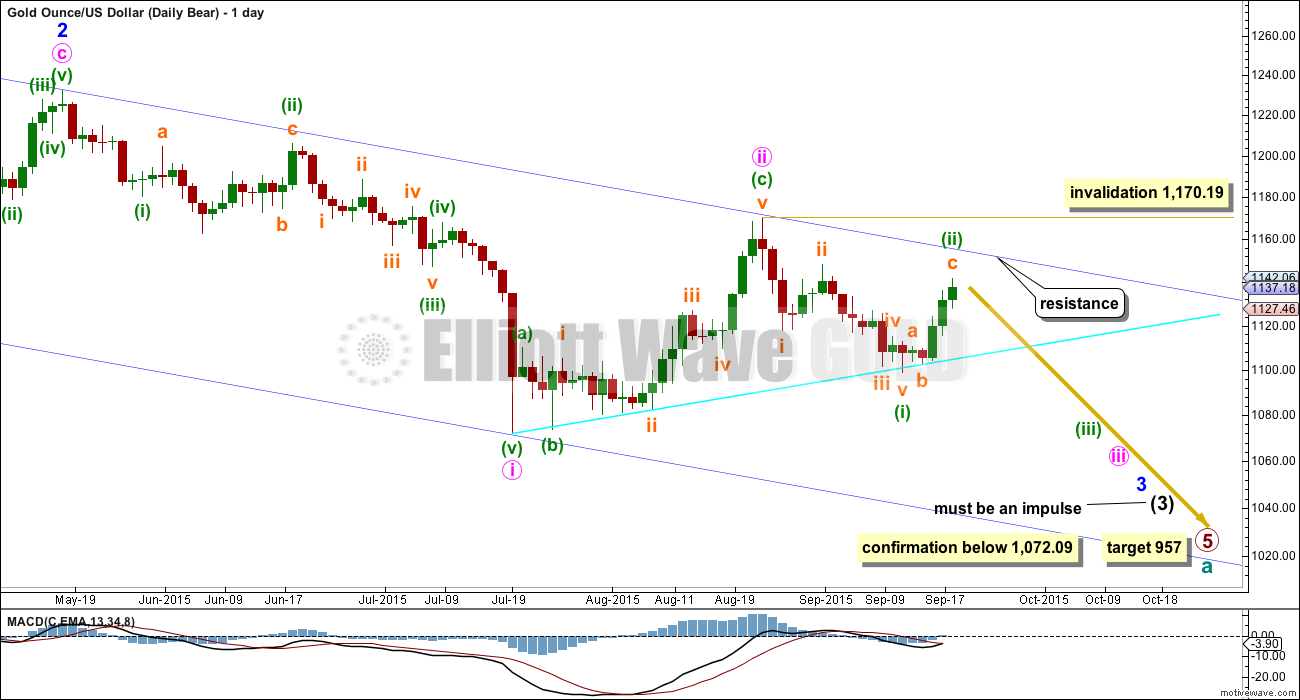

BEAR ELLIOTT WAVE COUNT

Gold has been in a bear market since September 2011. There has not yet been confirmation of a change from bear to bull, and so at this stage any bull wave count would be trying to pick a low which is not advised. Price remains below the 200 day moving average and below the blue trend line (copied over from the weekly chart). The bear market should be expected to be intact until we have technical confirmation of a big trend change.

This wave count now sees a series of four overlapping first and second waves: intermediate waves (1) and (2), minor waves 1 and 2, minute waves i and ii, and now minuette waves (i) and (ii). Minute wave iii should show a strong increase in downwards momentum beyond that seen for minute wave i. If price moves higher, then it should find very strong resistance at the blue trend line. If that line is breached, then a bear wave count should be discarded.

The blue channel is drawn in the same way on both wave counts. The upper edge will be critical. Here the blue channel is a base channel drawn about minor waves 1 and 2. A lower degree second wave correction should not breach a base channel drawn about a first and second wave one or more degrees higher. If this blue line is breached by one full daily candlestick above it and not touching it, then this wave count will substantially reduce in probability.

Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,170.19. A breach of that price point should see this wave count discarded as it would also now necessitate a clear breach of the blue channel and the maroon channel from the weekly chart.

Downwards movement from 1,170.19 will subdivide as a complete five wave impulse on the hourly chart, but on the daily chart it does not have a clear five wave look. Subminuette wave iii has disproportionate second and fourth waves within it giving this movement a three wave look on the daily chart.

Full and final confirmation of this wave count would come with a new low below 1,072.09.

If primary wave 5 reaches equality with primary wave 1, then it would end at 957. With three big overlapping first and second waves, now this target may not be low enough.

Minuette wave (ii) is now a completed zigzag ending very close to the 0.618 Fibonacci ratio of minuette wave (i) at 1,142.

Within minuette wave (ii)’s zigzag, subminuette wave b fits perfectly as an expanding triangle (the rarest of all Elliott wave structures). The expanding triangle is supported by MACD hovering about the zero line while it completed.

I think this is only the third expanding triangle I have seen in seven years of daily Elliott wave analysis. I am fairly confident this part of the wave count is correctly labelled, and if it is correct, then only the bear wave count would work because for the bull this movement cannot be a triangle for a second wave.

Subminuette wave c is 2.17 short of 4.236 the length of subminuette wave a.

Ratios within subminuette wave c are: micro wave 3 is 1.09 short of equality with micro wave 1, and micro wave 5 is 0.74 longer than 0.618 the length of micro wave 1.

At 1,026 minuette wave (iii) would reach 1.618 the length of minuette wave (i). If minuette wave (ii) moves any higher, then this target must also move correspondingly higher.

There is not enough downwards movement to eliminate the possibility that micro wave 5 may extend and continue higher. Only a new low below its start at 1,127.70 would eliminate this possibility. At that stage, downwards movement may not be a second wave correction within micro wave 5, so micro wave 5 would have to be over.

Before this price point is passed a clear breach of the channel containing subminuette wave c would provide trend channel confirmation of a trend change.

While there is zero confirmation that minuette wave (ii) is over the risk that it could continue will remain. Minuette wave (ii) may not move beyond the start of minuette wave (i) above 1,170.19.

If price does move higher, then it should find very strong resistance at the upper edge of the blue channel copied over here from the daily chart. That trend line is the line which differentiates bear from bull at this stage.

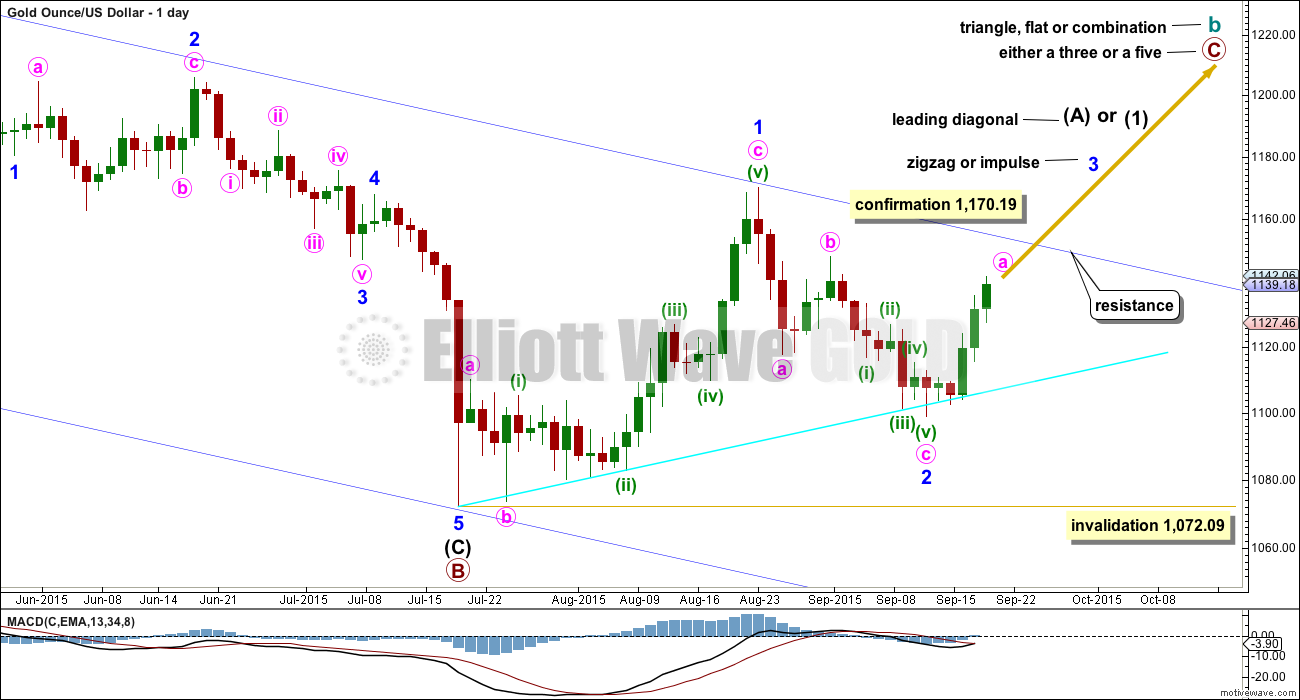

BULL ELLIOTT WAVE COUNT

The bull wave count sees cycle wave a complete and cycle wave b underway as either an expanded flat, running triangle or combination. This daily chart works for all three ideas at the weekly chart level.

For all three ideas, a five up should unfold at the daily chart level for a movement at primary degree. This is so far incomplete. With the first wave up being a complete zigzag the only structure left now for intermediate wave (1) or (A) would be a leading diagonal. While leading diagonals are not rare they are not very common either. This reduces the probability of this bull wave count.

A leading diagonal requires the second and fourth waves to subdivide as zigzags. The first, third and fifth waves are most commonly zigzags, the but sometimes may appear to be impulses. So far minor wave 1 fits well as a zigzag.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,072.09. If this invalidation point is breached, then it would be very difficult to see how primary wave B could continue yet lower. It would still be technically possible that primary wave B could be continuing as a double zigzag, but it is already 1.88 times the length of primary wave A (longer than the maximum common length of 1.38 times), so if it were to continue to be even deeper, then that idea has a very low probability. If 1,072.09 is breached, then I may cease to publish any bullish wave count because it would be fairly clear that Gold would be in a bear market for cycle wave a to complete.

To the upside, a new high above 1,170.19 would invalidate the bear wave count and provide strong confirmation for this bull wave count.

Upwards movement is finding resistance at the upper edge of the blue channel and may continue to do so. Use that trend line for resistance, and if it is breached, then expect a throwback to find support there.

I added a bright aqua blue trend line to this chart. Price has found support there and is bouncing up.

Minor wave 2 can now be seen as a complete zigzag. It is 0.73 the depth of minor wave 1, nicely within the normal range of between 0.66 to 0.81 for a second wave within a diagonal.

Third waves within leading diagonals are most commonly zigzags, but sometimes they may be impulses. Minor wave 3 should show some increase in upwards momentum beyond that seen for minor wave 1. Minor wave 3 must move above the end of minor wave 1 above 1,170.19. That would provide price confirmation of the bull wave count and invalidation of the bear.

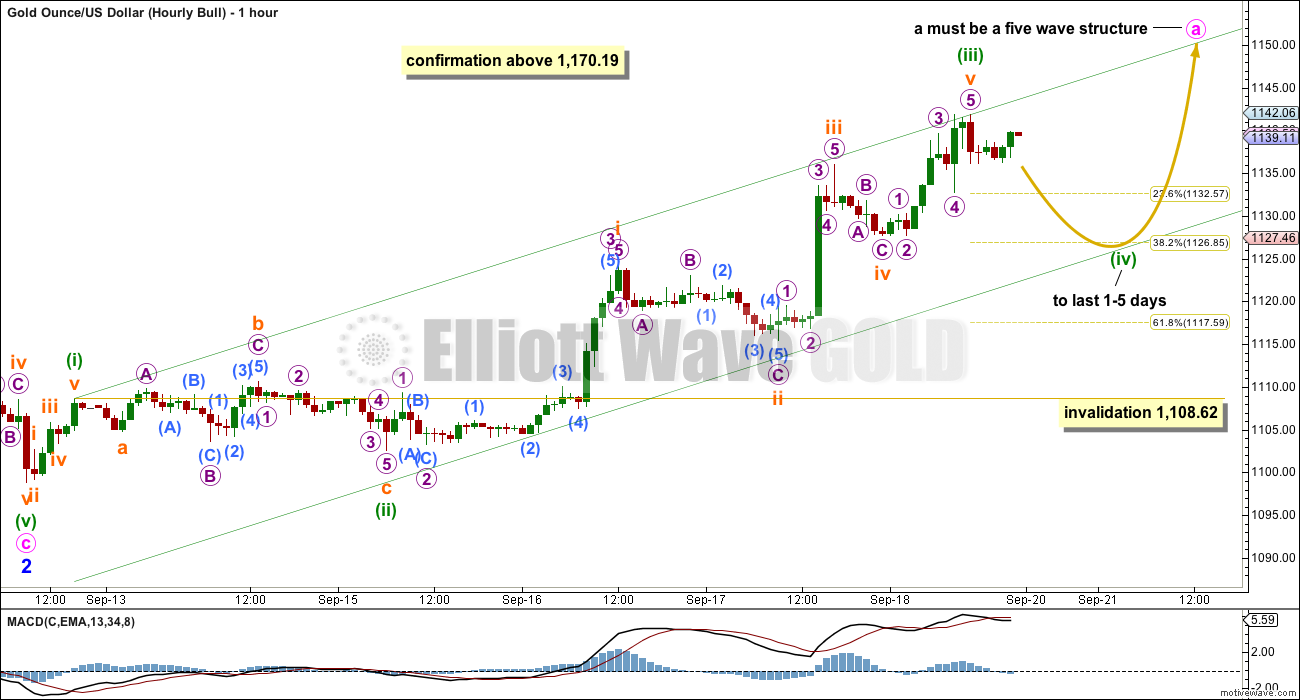

Minor wave 3 is most likely to subdivide as a zigzag. Within a zigzag, minute wave a must subdivide as a five wave structure.

Although it would be technically possible to see minute wave a over as a very short quick five at the high labelled minuette wave (i), that would be far too short for minute wave a. That would look very wrong on the daily chart.

Minute wave a would be an incomplete five wave impulse at this stage.

Minuette wave (ii) shows up on the daily chart and lasted two days. Minuette wave (iv) is most likely to also show up on the daily chart, for the five wave impulse of minute wave a to have the right look on the daily chart, and it may last 1-5 days.

Minuette wave (ii) is seen as an expanded flat for this bull wave count. A triangle may not be the sole corrective structure for a second wave, so the expanding triangle here would be invalid. Within the expanded flat, subminuette wave c does not subdivide well at all as a five wave impulse. The structure will fit on the five minute chart, but on the hourly chart micro wave 3 within it has a three wave look where it should be a five.

The channel drawn here is a best fit, and it is not the same as the smaller channel on the hourly bear chart. For this bull wave count, minuette wave (iv) may end if / when price comes down to touch the lower trend line.

Minuette wave (ii) was a deep time consuming flat correction. Minuette wave (iv) may be a quicker zigzag, so it may last only one day. Alternatively, minuette wave (iv) may also be a combination or triangle; both would provide structural alternation with the flat correction of minuette wave (ii). Combinations and triangles tend to be very time consuming structures, so minuette wave (iv) may last up to five days. Minuette wave (iv) may be expected to be shallow, with the 0.382 Fibonacci ratio the most likely target.

If minuette wave (iv) is an expanded flat, running triangle or combination, then it may include a new price extreme beyond its start above 1,141.83.

Minuette wave (iv) may not move into minuettte wave (i) price territory below 1,108.62.

TECHNICAL ANALYSIS

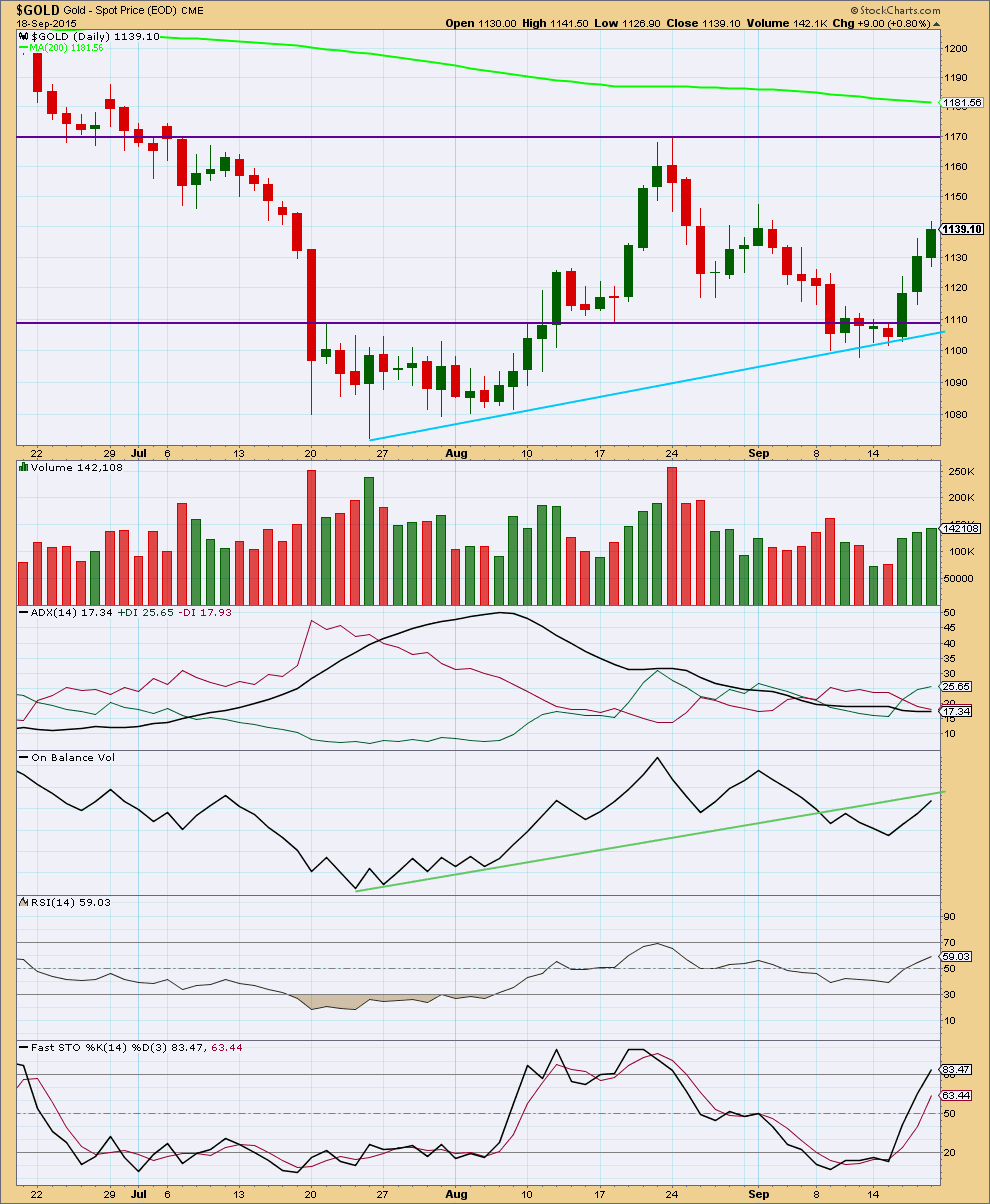

Click chart to enlarge. Chart courtesy of StockCharts.com.

Note: StockCharts data for Friday’s session is now available. This section is now updated.

Daily: Upwards movement for Friday comes with some small increase in volume. The rise in price for the last three days is supported by volume, which is bullish. However, the picture is not as clear as it could be. Overall it is still four downwards days in most recent movement which have strongest volume and that is somewhat bearish.

We now have a three advancing soldiers candlestick pattern moving up from a horizontal support line. This would indicate a continuation overall of upwards movement and favours the bull wave count.

Overall, from the last swing high at 1,170 on 24th August, as price falls it comes on declining volume. There is some small support for the fall in price: each wave down has increasing volume, but the whole movement from its start has overall declining volume. The picture remains unclear.

ADX is flat indicating there is no clear trend and the market is range bound. If a range bound system is used here, then it would expect an upwards swing because price has reached to the lower horizontal line of support and Stochastics has reached oversold. However, trading a range bound market is more risky than trading a clearly trending market. The final swing never comes; that is when price breaks out of the range and begins a trend. An upwards swing may still possibly be developing at this stage. While the Elliott wave bear count remains valid the risk that a bear market may still be intact must be acknowledged. Good money management on any bullish trades is essential. An upwards swing using this system may be expected to continue until price reaches the horizontal line of resistance and Stochastics indicates overbought.

Stochastics is beginning to enter overbought. A swing system would still not expect the upwards movement to end until price also reaches resistance.

While On Balance Volume remains below its trend line it is bearish. OBV is moving upwards and closing in on that green trend line. If there is any further upwards movement in price from here, then look for it to either end or to be interrupted by a consolidation when OBV comes to touch that green line.

RSI at the daily chart level is neither overbought or oversold. There is room for the market to rise or fall.

Overall the regular technical analysis picture remains unclear. I had hoped for clarity this week, but the markets have not obliged. Maybe we shall get it next week.

This analysis is published about 05:20 p.m. EST.

Sold my Dust today for about a 6% gain on 750 shares. Still holding Jdst from $7.90. Looking for a slightly lower open tomorrow for gold, then up for the fifth.

With a narrow trade range and an inside day on Monday, Gold price is encountering resistance at current levels +/- $1-$2 around pivot and looks ready for a drop to test 20dma 1125-24…

… It would be nice to see Gold price back below a retracement zone 1122-21….

So far I can see a three down on the hourly chart.

Currently a small triangle may be unfolding. But we all know how tricky triangles can be! Sometimes what you are sure is a triangle morphs into something else, usually a combination, right at the last minute.

If it’s a triangle then it’s a fourth wave and should be followed by a fifth wave down. If that happens we shall have a five down, which should then be followed by a three up which may not make a new high beyond the start of the five down at 1,141.83.

Alternately the three down is a complete three, and will be followed by a three up which may make new highs.

I think the price point which differentiates these two short term ideas is 1,136.18, the end of the first small wave down. A new high above that point at this stage confirms the downwards move was a three. While price remains below this point a five down may be developing.

The two bull and bear wave counts will be exactly the same at the hourly chart level and daily chart levels. Nothing has changed.

XAU and HUI both have reversal candle pattern: Hanging man or Morning star!!!!

Miners are indicating gold is going to drift down. IMHO

I think gold going down may be likely more than gold going up however I won’t hold DUST overnight tonight as no clarity from Lara or price confirmation yet.

Gold settles with a loss as the dollar strengthens – Sept 21, 2015 2:00 p.m. ET

http://www.marketwatch.com/story/gold-struggles-for-direction-but-hangs-onto-last-weeks-gain-2015-09-21

Also Oil up which tends to move gold up.

2:19 P.M. ET

Oct. oil up $1.89, or 3.2%, at $46.57/bbl on Nymex after $46.60 high

Lara, I dont know about you but I couldn’t count a five down even at the 5 minute chart level…… One more push up.

I concur, although I believe that gold could reach up to the 1150s (blue rail). The upper bollinger band that I am looking at comes in around that level.

A move above 1135 would indicate that you are correct.

or it’s currently in a fourth wave triangle and will break out with one more push down before any upwards movement.

at this stage both possibilities exist

A triangle was my initial thought too, but the ends were a little distorted IMHO. As a result, I dismissed the idea. Look forward to seeing how you are counting it.

Either way, gold should move back up some, as you suggest above, for a 2nd wave (after a completed 5 down) or as a new high to complete the C wave.

Gold at 13:35 pm EST has breached below the channel on the bear hourly chart by 4 hourly candlesticks and 1 candlestick is all that is required for a breach. That is 1st confirmation of the bear hourly count. Next would be price confirmation below 1,127.70.

Did gold break the bottom channel on bear hourly wave count below 1130???

yes

The USD is consolidating at 30 year resistance. For gold to make a big move down at this point, it seems that the USD would need to break up through this resistance. Is that possible, sure, but is it likely?

Nice chart!!! Yes USD is to move to 121 some day

I agree.

Gold and Oil. Looks like they pretty much move in sync with each other, except for the occasional spike by one or the other. Is the current oil glut creating one of those spikes, or does gold move down to catch up with oil?

Dollar on the mend as bulls recover from Fed disappointment

http://www.cnbc.com/2015/09/20/dollar-on-the-mend-as-bulls-recover-from-fed-disappointment.html

Gold daily Fork update::: 4th time gold is at upper rail of this fork???

I count 5 times if you count last Friday. Looks like gold is also bumping up against

that horizontal blue line that was support in Dec and March and now should be resistance. If you extend that line over to today, it looks like that’s right where we are at.

Correct. U r right on money. Gold really needs to drop below the midline of the fork.

That forks chart is just beautiful, but I think it is a bit deceiving, because it looks like something big is about to happen, and it very well might. But if you take a step back and look at the big picture this entire move up since late July looks like a little blip to me. But if gold is to rebound it has to start somewhere right?

Gold put in three green candles. That limits move up and expect downward move from Monday. three white soldiers opposite to three crows in candlestick chart analysis.

What if…

That is an amazing chart. Thanks for sharing.

Wow. $700 is a scary thought. Your count is different from mine and I’m not too experienced at this, but $700 is the bottom of my previous Wave IV of a lesser degree which I think is typical. Or so I’m told. I think if you look below at that chart I posted about “weak support until $1000”, I have a blue line drawn thru the bottom of IV that is at $700.

Who’s wave count R U following? Lara’s primary waves are label different than yours.

The top wave is green wave (iii) at 1923 in 2011. AND gold is in bear wave primary wave 5 which will end the cycle wave a.

Your labeling is different. I do not know what is Lara’s wave labeling is from bottom 2001 to 2011. She did not publish those wave counts on daily chart.

But it look good to me gold to $700!!!!

Barrick gold is already below 2001 price. AND many other seniors are racing towards the low.

can’t wait for the bottom.

I’m sure Lara’s is right. I labelled that chart a long time ago, a few months after gold peaked. When I joined this site last week I just added Lara’s downward count to it. I am very inexperienced in elliott wave theory. I learned some things watching Dan Stinson post his counts but he never really explained anything in detail about why he used the counts that he did. Lara is so thorough that it just fascinates me how she arrives at her wave counts. So I am here to learn what I can.

Yes the miners are just getting destroyed and it’s pathetic to watch but I suppose it could be a buying opportunity. I am wary though that something much bigger may be happeneing so I am hesitant to jump in.

Norman if you are new from last week I suggest you make sure to watch Lara’s video at least once and check the extra EW counts explanations on this site. Lara is the best I have seen with EW in over 2 years since hearing about EW. Prosperous trading.

I’m wondering why you’re looking at an ending diagonal.

I had a lot of trouble fitting Gold into the bigger picture until I found some good historical data. I think I found data back to the 1800’s on Kitco… not sure… but I put it into an excel file, I’ll email it to you if you like.

Once I could see the super cycle picture and enough data it started to make some sense.

Anyway… to your wave count…

I’d check the wave lengths in your cycle wave a of (II). It looks like you’ve got a leading diagonal there, but I’m not sure the wave lengths meet the rules for a contracting diagonal. Same for cycle c of (II). There’s an overlap between primary 2 and 4 indicating a diagonal, but the wave lengths need to be checked.

It’s convention within EW that if you see a diagonal put the trend lines on it. That tells others looking at your wave count the structure is a diagonal as opposed to an impulse.

(III) may fit better as an impulse than it does as a zigzag. Try that movement as an impulse with an extended third (and I thin also a fifth) wave, it will be a better fit I think.

Resistance is extremely thick above current prices. There are a number of converging long and short term markers here. Syed does a good job below noting some of them. I would add that the most important line of all, which keeps the bear market intact, can be seen on Norman’s chart (the one closer to the bottom of the comments section) from the points marked 2 and ii. That is the true line in the sand, because it is the line of resistance that has contained this entire multiyear bear.

While this won’t help the short term traders or scalpers, we know that gold really can’t get past the low 1160s.

Hi Matt: There is a strong confluence of support at 1096-95. I am not too sure yet if Gold price will get much below there as it is still having an inside month H 1169 / L 1080…. Gold price dodged the bullet once by not breaking below 1079-78 and reaching 1169-70 by breaking above 1095-99, now Gold price has declined to respond to break below 1098 and has broken above 1109, 1114…. This is a nerve testing wave down for a break below 1073 if there is to be one~! lol What if there isn’t to be one, then next target is easily 1202….

Downward movement does not look complete to me. The fact that gold broke down to its low in July was the proof that there is more to come. This upward movement is a correction, nothing more. How long it lasts, no one knows exactly.

Based on the current price and resistance lines, I am more confident now that this correction may be short-lived though. However, the following drop may also be brief. Then we may see a longer lasting correction to really fool the masses into thinking that the bear is over. This could occur during Oct, Nov and Dec and would correlate with a 4th wave. Then would come the final drop.

Matt,

If I recall accurately, a few weeks ago you were anticipating a possible move up to the 1140 area. Do I have that right? That fits with the bear count we currently have as well as your bearish perspective. Nice call.

These things always turn out differently than one expects. What I thought would occur is a drop to the 1050 area (slightly below the July low), and then a prolonged sideways/upwards movement for a few months to make many think that the bear is over. Then would come the final drop to 950.

I am still utterly convinced that gold will see 950 before June 2016. That low could occur anytime between Dec 31st and June, by all estimates that I have made. These final $200 down are going to be a roll coaster and will be difficult to ride for anyone who is trading it.

Unless the long term resistance line is broken, I will stick to the plan and add to my short position whenever prices get to a higher range….like now.

Lara: is there a way to click and enlarge images/charts?

I enlarge google chrome (top right corner indicator) if clicking on the chart doesn’t work.

I command + on a Mac to enlarge

I do not know how that works on a PC

The up moves by Gold price are beginning to get a little irksome lol…. IMHO Gold price is short term bullish, currently bottomy at pivot / 1131-30, looking to rally and top… There appears to be no purchase for the bears yet until a break below 20dma / 1127-24 range and subsequently a break below 50dma is seen…. Weaker shorts my want to consider covering their positions and taking to the sidelines… Remains to be seen where Gold price tops – within a previous weeks high 1144-47; the upper band and 100day moving average converging at 1152-53, various Fibo levels or higher at or about 20week moving average 1162 which Gold price has not got to or past since June this year… It is the eventual failure of Gold price to break below 1101-1098 before a break above 1169-70 occurs which is concerning; where, as per September 14, 2015 video, minor three unfolding must move above 1170.19….//// Gold price having got above 61.8% of H 1169 / L 1073 weakens the downside…

Every major correction in gold since 2001 has not ended until it has reached the previous wave 3 high of one lesser degree and that has been accurate to less than $10. I don’t know if my wave 3 highs are correct, but if they are, it would indicate gold still needs to move to the $1023 area which I have as the previous wave 3 high. Not trying to pick a bottom here, just saying it’s further evidence the bear may not have ended last July.

What are proposing for the entire structure of the wave II (red) down? Your chart shows only a 5 wave down, yet overall it needs to be a corrective 3 wave structure.

good point.

I think Edward’s chart above shows a corrective structure and is a possibility. His final wave 5 of C is deeper than I had imagined, but the same idea.

What does your wave count look like? I’d be interested to learn.

Most profitable strategy:

Miners Sell short and hold at top of the run. .

Now 3xetf for PM started market has data to analyse performance of these etf’s.

Inherent structure of these etf is price decay OVER TIME BULL OR SHORT.

Below is the performance of these etf’s since 2014 till today.

GDXJ March 2014 at 45.66. Sept 18 2015 at 21.03

Bear 3xetf JDST Dec 2013 at 79.85 , Sept 18 2015 at 7.45

Bull 3x etf JNUG March 2014 at 416.24 (many splits adjusted price) , Sept 18 2015 at 6.44.

It appears shorting 3xetf in the direction of trend or opposite to PM sector trend trader still earns huge profit by shorting not going long and worrying about up/down every day.

KEY: once short hold it for long time. Price Decay is your guarantee etched on the stone for profit that no one will give you.

Have a good trading.

Disclaimer: Have short position in NUGT at 4.5.

Nice post Papudi, thank you.

HUI Monthly….Any one see a BULL trend in PM Sector here??? May be a bounce of some type. I will stay with Lara’s Bear EW count. I am riding that surf wave.

Like Norman wrote below a swift down wave is upon in this PM sector. Final capitulation in the making.

September month is not over. A series of red candle all the way down!!!!!

Similar to breakout of April 2013-April which led market down.

To me, it looks like gold is just testing the extended resistance line and when it’s done with that, it should resume completing the 5th wave down because there seems to be little support until you reach $1000. Probably bounce around there for awhile, make a final plunge down to the $950 area and hopefully be done with this painful correction. Of course there is no guarantee the retracement will end at the $950 price and there could always be a deeper final 5th wave.

GDX at resistance. RSI overbought. At least a short term pullback is expected.

http://goldtadise.com/?p=351366

GDX close to a bullish breakout on the weekly, maybe after a pullback?

Chart by Alphahunt on Stocktwits

Do you buy NUGT at these bollinger band bottoms with RSI confirmation above 30 or??

If the HUI was to retest the breakdown at the 150 level that would be like a 30% pop from current levels which if you bought NUGT a triple long…..that would be quite a good trade. Plus the 150 breakdown was major support in late 2008 and has never been tested as resistance yet…

For some reason my chart didn’t upload with my post. whoops… there it is.

That looks logical. A backtest of 150 would also provide good symmetry with 2002/2003.

Here’s another chart supporting a move to 150

COT Data: Commercial shorts reduced by 25000. Means gold is bullish here and next week?????

I was expecting shorts to increase.

I’m expecting Gold to go down next week as per my trading setup Buy signal for DUST at the close today.

Here’s the graph

At first glance it may appear that way. However, it could have been some position covering before last week’s FOMC announcement. This week will give us a more accurate reading of the overall trend.

Bull Trap or Bottom in Gold and Gold Stocks?

Friday, 18 September 2015

http://news.goldseek.com/GoldSeek/1442599200.php

Lara I got a short term BUY signal for DUST at the close today on my new set-up.

So I bought some DUST at the close today for that and because you said it may drop next week and also it is the cheapest it has been for almost 4 weeks.

Hi Richard. Hope your system works.

My analysis still shows that DUST is wobbly in the near term. There would be some consolidation before it decides to show a clear trend. At the moment, the projections still favours the bull count in gold, meaning DUST could fall hard.

These past two days, I was into NUGT and made some respectable gains there.

I would return to DUST once the situation is favourable as I’m still inclined to think that gold has one more leg down to sarifactorily complete the years long bear market.

I believe gold has 2 more legs down.

I hope I’m right then! And if I’m wrong, I hope you’ll manage risk so the loss is affordable. But then, I’m sure you will.