The Elliott wave structure still looks incomplete. A target may now be calculated for the end of it.

Summary: I expect upwards movement from US Oil this week to a target at 51.20 to 51.40. This target may be met in two days time. Thereafter, the downwards trend may resume.

Changes and additions to last analysis are bold.

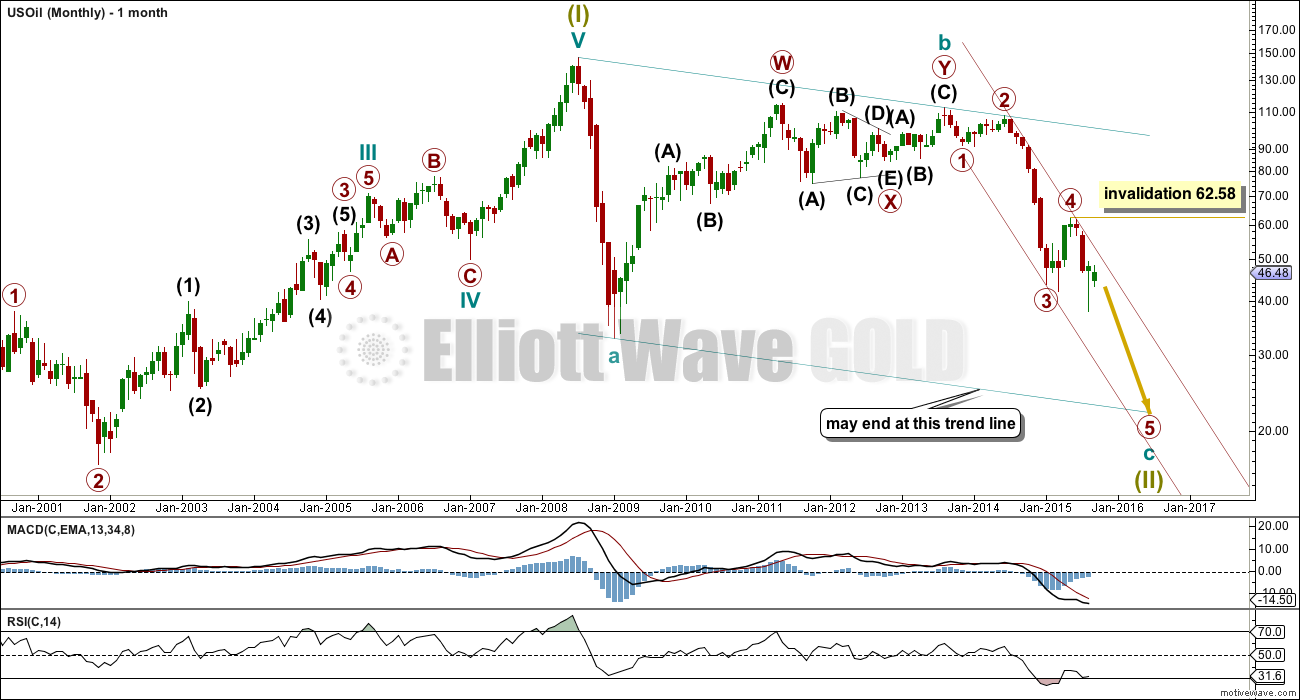

MONTHLY ELLIOTT WAVE COUNT

US Oil has been in a bear market since August 2013. While price remains below the upper edge of the maroon channel drawn here and below the 200 day simple moving average it must be accepted that the bear market most likely remains intact. I will not publish a bull wave count while this is the case and while there is no technical confirmation of a trend change from bear to bull.

The structure of cycle wave c is incomplete.

This wave count sees US Oil as within a big super cycle wave (II) zigzag. Cycle wave c is highly likely to move at least slightly below the end of cycle wave a at 32.70 to avoid a truncation. Cycle wave c may end when price touches the lower edge of the big teal channel about this zigzag.

Within cycle wave c, primary wave 5 is expected to be extended which is common for commodities.

Within primary wave 5, no second wave correction may move beyond its start above 62.58.

Draw a channel about this unfolding impulse downwards. Draw the first trend line from the highs labelled primary waves 2 and 4 then place a parallel copy on the end of primary wave 3. Next push up the upper trend line slightly to contain all of primary waves 3 and 4. Copy this channel over to the daily chart. The upper edge should provide resistance.

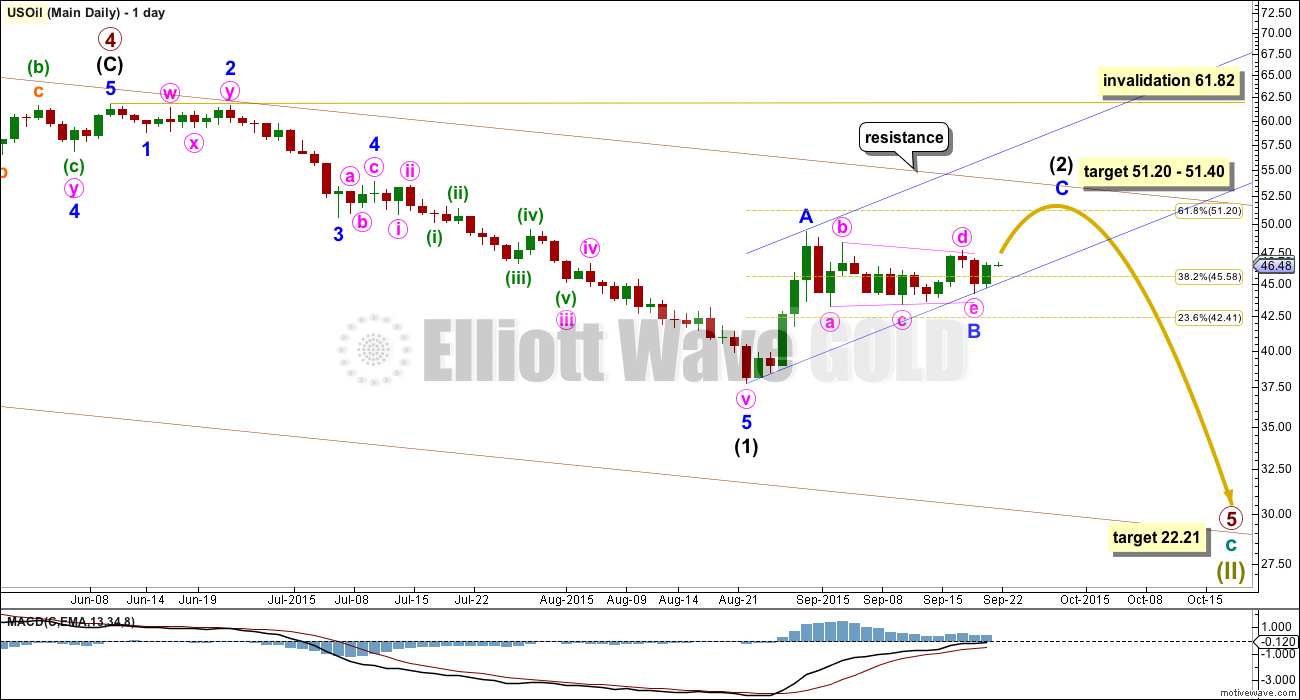

DAILY ELLIOTT WAVE COUNT

First: I am aware that today my analysis of Gold expects downwards movement for the bear wave count, which there is still slightly preferred, and Gold’s bull wave count expects and allows for upwards movement.

My analysis today for US Oil expects a little upwards movement from here for about two days. This does not mean that Gold must also move up. Gold and US Oil do not always move together. As an excellent recent example, note the movement on both markets from 7th August to 24th August: during that time Gold moved higher from 1,083 to 1,170 while US Oil moved lower from 45.14 to 37.75.

These markets have different wave counts and quite simply do not always move in the same direction at the same time. One should not be used to determine the direction of the other.

The intermediate degree corrections were brief and shallow within primary wave 3 down. Now, within primary wave 5, this correction for intermediate wave (2) is neither brief nor shallow.

Minor wave B now fits as a complete regular contracting triangle.

Intermediate wave (2) may end when price reaches up to about the 0.618 Fibonacci ratio of intermediate wave (1) at 51.20. At 51.40 minor wave C would reach 0.618 the length of minor wave A. This target may be met in two days. If that happens, then intermediate wave (2) would complete in a total Fibonacci 21 days.

When minor wave B is complete, then minor wave C upwards should unfold and is very likely to end at least slightly above the end of minor wave A at 49.32 to avoid a truncation. The breakout of this sideways movement is most likely to be upwards, but it may be a brief false breakout before the downwards trend resumes.

Intermediate wave (2) is likely to find resistance at the upper edge of the maroon channel copied over from the monthly chart.

At 22.21 primary wave 5 would reach 0.618 the length of primary wave 3.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 61.82.

Draw a channel about intermediate wave (2) using Elliott’s technique for a correction: draw the first trend line from the start of minor wave A to the end of minor wave B, then place a parallel copy on the end of minor wave A. Minor wave c may end midway within the channel. When the channel is clearly breached by subsequent downwards movement it shall provide trend channel confirmation that intermediate wave (2) may be over and intermediate wave (3) may have begun.

Once intermediate wave (2) is over, if price turns down as expected, then look for some support initially about the lower edge of the blue channel. If price breaks below support there, then look for a throwback to that trend line. If a throwback to the line ends at resistance, at the line, then the trend line strength is reinforced. When price behaves like that it provides a perfect opportunity to join a trend.

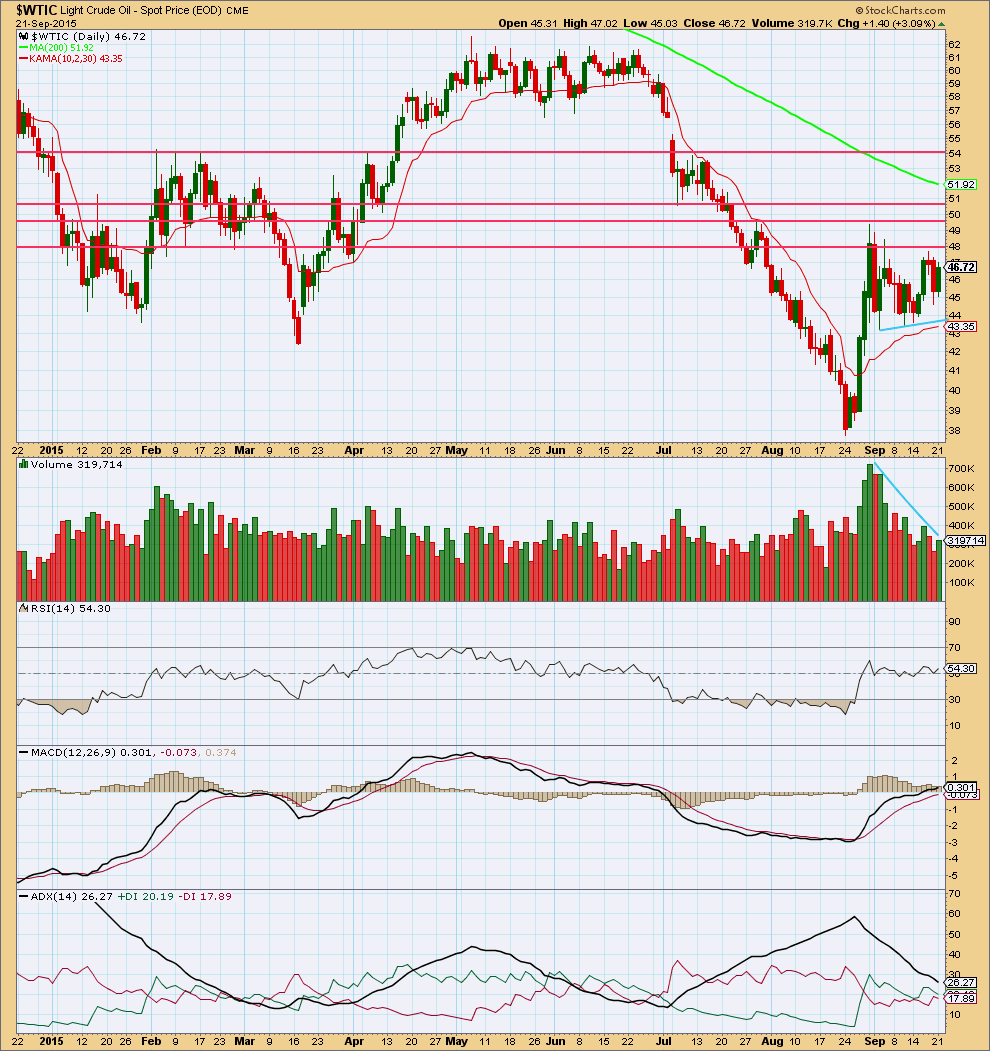

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

For the last 14 days, as price drifts sideways volume declines. Volume supports the idea that this sideways movement is a consolidation. During sideways movement it is an upwards day which has strongest volume, which supports the idea that an upwards breakout may be more likely than downwards. This supports the Elliott wave count.

However, it should be noted that for the last big fall for US Oil seen on this chart the market has fallen of its own weight. Although the strongest volume came on upwards days from 24th June to 24th August, the trend was clearly down.

Price is finding resistance about the horizontal trend line which previously provided some support. If price breaks above the first horizontal line of resistance, then it may find resistance at each subsequent line.

A breakout from this triangle would be indicated by a breach of either of the sloping blue trend lines, up or down, coming on a day with an increase in volume.

ADX is declining indicating the market is consolidating. A range bound system should be used for trading, or traders may choose to wait until a clear trend is evident before entering this market.

This analysis is published about 09:50 p.m. EST.

US oil still in consolidation. Needs to break above the red line and then above the top line thus break out from the bullish flag.

Not sure of EW count right now????

Lara: US oil had lower low 44.41 on Sept 23 than wave e at 44.59. Does that change the location of wave e??

WTIC takes a beating today of 4.21% ouch.

http://stockcharts.com/freecharts/gallery.html?$WTIC

I don’t invest in oil as no daily analysis. Best wishes.

Oil and gold tend to head the same direction.

I don’t understand Oil heading up almost 10% this week when gold’s next move is down.

Unless gold only drops 1 day then heads up strong the 2nd day then they both go down together..

Except they don’t always move together in the same direction.

Today is a good example. Gold went up and Oil went down.

Which was exactly the opposite of what I had expected for both markets 🙁

I wasn’t invested in either today and it was an unusual day.

I am sure you understand them better than I do.

Enjoying the great analysis for US Oil, which IMO still offers a potentially better setup to sell a rally than is the case for gold. Despite the big bear market in oil, the specs are still heavily long, which indicates more potential for a funds-fueled liquidation later.

Yes, it gives us another market to find a trend in.