Last week’s analysis of US Oil expected more upwards movement to come up to touch the upper edge of a channel.

This is what happened.

Summary: An upwards impulse is complete. Downwards movement is expected from here. How low downwards movement goes may indicate which wave count is correct. Downwards movement may only be a second wave correction to end about 31.21. A new low below 26.06 would confirm an extending fifth wave to move substantially lower with the next target at 11.98.

New updates to this analysis are in bold.

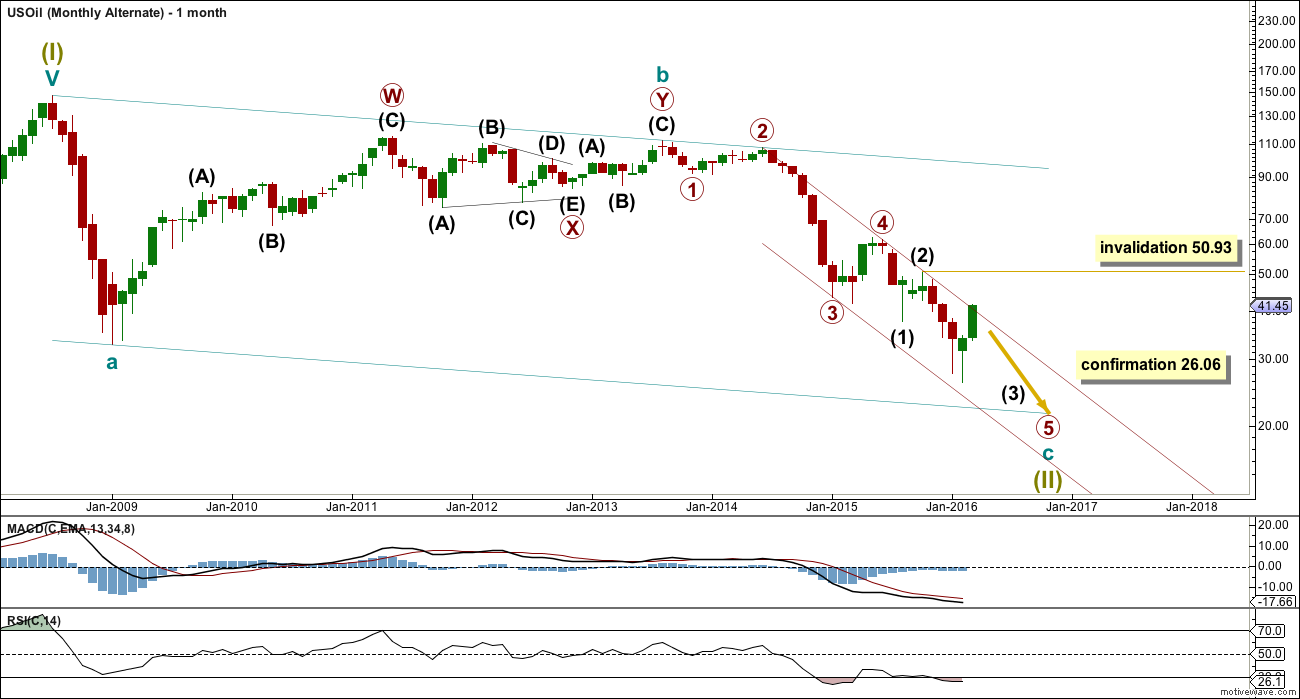

MONTHLY ELLIOTT WAVE COUNT

US Oil has been in a bear market since August 2013. While price remains below the upper edge of the maroon channel drawn here and below the 200 day simple moving average it must be accepted that the bear market most likely remains intact. Price is overshooting the maroon channel and touching the 200 day moving average today. Oil is at a critical juncture.

The structure of primary wave 5 may be complete. This wave count has a problem though: primary wave 5 looks like a three wave structure at the monthly chart level. It may only subdivide as a five.

If primary wave 5 is complete, then the zigzag of Super Cycle wave (II) would also be complete. Super Cycle wave (III) must move above the end of Super Cycle wave (I) at 146.76. Within Super Cycle wave (III), no second wave correction may move beyond the start of its first wave below 26.06.

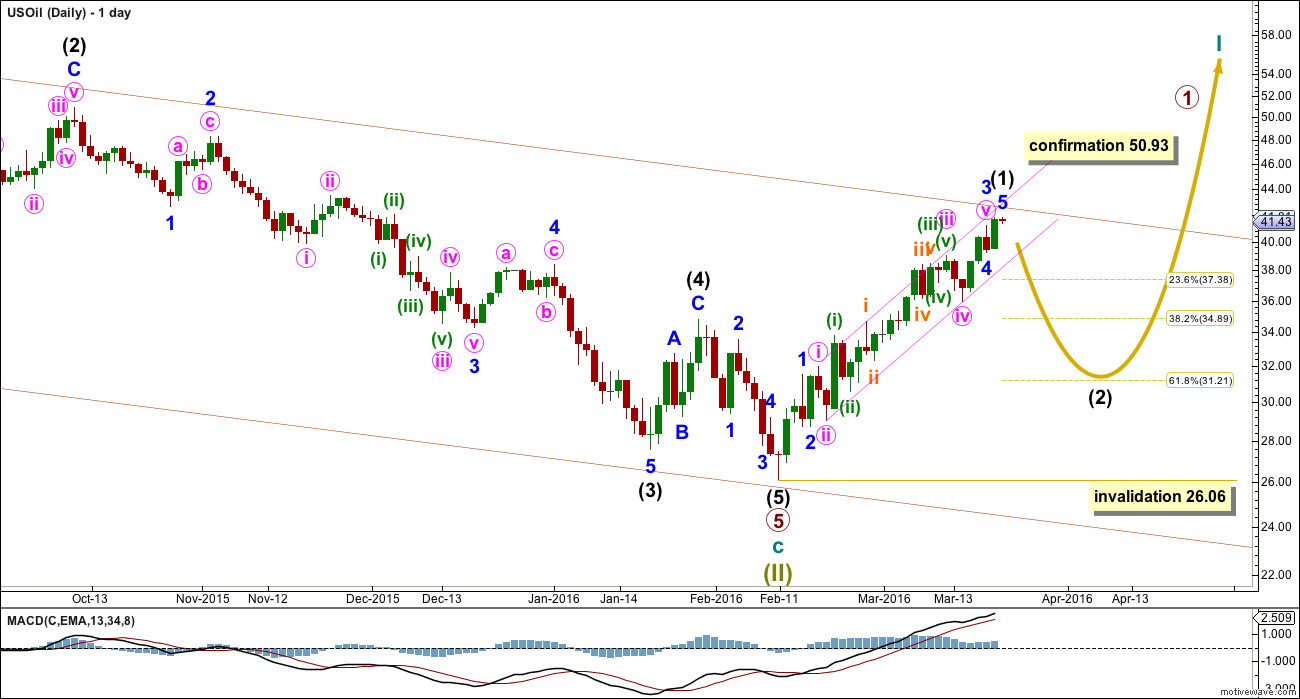

DAILY ELLIOTT WAVE COUNT

This wave count is identical to the alternate below (which up to now has been the main wave count) up to the high labelled intermediate wave (2).

The maroon channel is slightly redrawn. Draw the first trend line from the ends of primary waves 2 to 4, then place a parallel copy on the end of primary wave 3. Today’s candlestick is above the upper edge of the channel. If this daily candlestick closes and remains above the channel, then it would be providing trend channel indication of a trend change.

If Super Cycle wave (II) is a complete zigzag, then Super Cycle wave (III) must begin upwards. So far intermediate wave (1) may now be complete as an impulse.

Intermediate wave (1) lasted 28 days (not a Fibonacci number). Intermediate wave (2) should last longer; corrections are usually more time consuming than impulses, particularly first wave impulses. Intermediate wave (2) is most likely to be a zigzag and most likely to end about the 0.618 Fibonacci ratio at 31.21.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 26.06.

ALTERNATE MONTHLY ELLIOTT WAVE COUNT

This was the main wave count last week. With the maroon channel being overshot, now this wave count has reduced in probability.

This wave count expects to see an extended wave for primary wave 5, which is common for commodities. This wave count expects primary wave 5 to look like a five wave structure on the monthly chart when it is complete.

Cycle wave c may end with an overshoot for the lower teal trend line for this wave count.

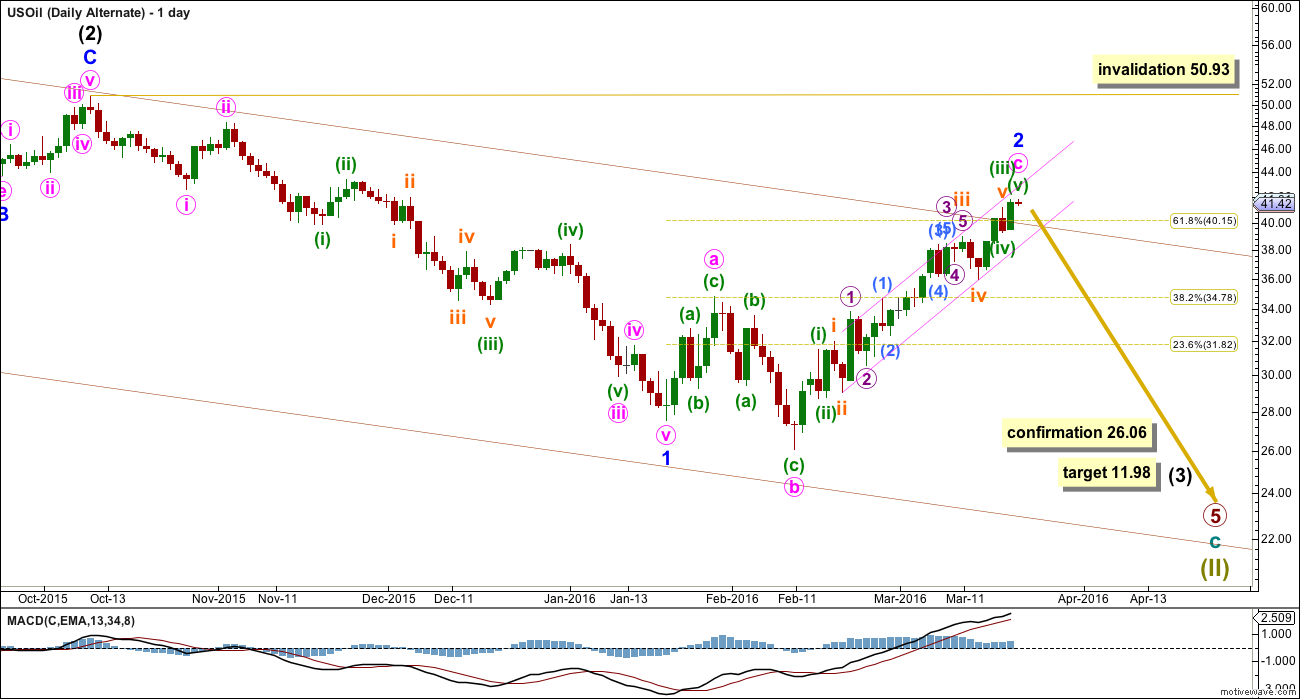

ALTERNATE DAILY ELLIOTT WAVE COUNT

If there has been no trend change and if primary wave 5 is incomplete, then at this stage this is the best wave count I can see.

This wave count is identical to the main wave count up to the high labelled intermediate wave (2).

Thereafter, it sees only minor wave 1 within intermediate wave (3) complete. Minor wave 2 is seen as an expanded flat correction.

Minor wave 2 is now ten days longer in duration than intermediate wave (2) one degree higher. This wave count now has a problem with proportions.

Minor wave 2 should have found strong resistance at the upper edge of the channel. It should not be showing up so strongly on the monthly chart. This now gives the wave count an atypical look which reduces its probability.

Minor wave 2 may have ended just above the 0.618 Fibonacci ratio of minor wave 1.

At 11.98 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

If price makes a new low below 26.06, this wave count would be confirmed.

Minor wave 2 may not move beyond the start of minor wave 1 above 50.93.

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price shows divergence with RSI as price moved lower.

The fall in price was supported by volume.

The candlestick for 1st February is a doji. If the candlestick for March closes well into the real body of the candlestick for January, this will complete a morning doji star candlestick reversal pattern.

On Balance Volume has broken below two trend lines. If OBV can break above the lower line, this would be a bullish signal and would support the main Elliott wave count.

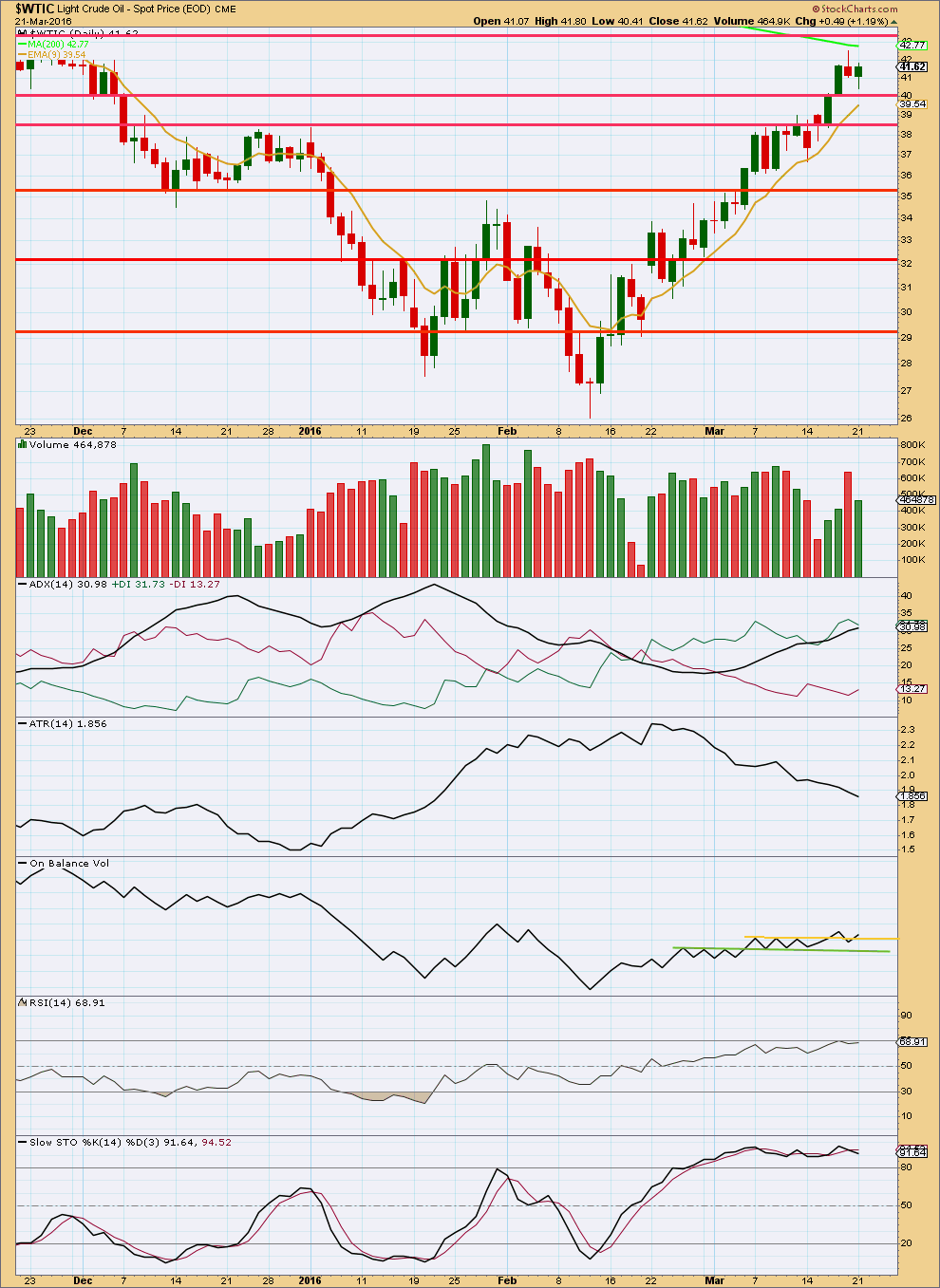

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Along the way up, price has continued to find support at the 9 day EMA. Price needs to move below the 9 day EMA for confidence in a trend change here (at least short term).

The volume spike of 18th March looks like a reasonable blowoff top typical of commodities. This indicates a correction may arrive from here.

ADX is still increasing indicating the market is trending. But ATR still is declining. There is something wrong with this trend. Normally, range increases and not decreases as a trend unfolds. This supports the alternate Elliott wave count.

On Balance Volume looks like it is trying to break above the yellow trend line, but the break has not been sustained so far. If OBV can make a new high then the break would be clearer. If OBV breaks back below the yellow line that would be a weak bearish signal. OBV needs to break below the green line for it to indicate confidence in a downwards movement from here.

RSI is not quite overbought. There is still room yet for price to rise.

Stochastics is overbought, but this oscillator may remain extreme for periods of time during a trending market. It does not show divergence with price at the last high, so it is not indicating a trend change about here.

This analysis is published @ 12:25 a.m. EST on 22nd March, 2016.

200 SMA providing resistance

http://niftychartsandpatterns.blogspot.in/2016/03/crude-oil-chart-update_23.html

Pretty much matches Lara’s count. Turn down now or one more new high. Wednesday oil inventory may be the key.

To short crude oil i should wait until breach the pink channel lower side.

I’m going with the Alternative Elliott Wave Count here; a long term oil bottom doesn’t make sense here, at least not fundamentally. Too much supply and weaker demand coming from China in the future.

US Oil may have bottom. Monthly chart 9ema may provide resistance. If price moves down from here it may resume downward trend similar to past action.

Lara”It should not be showing up so strongly on the monthly chart.”

It did this back in march 2015 also.

Yes, it did. And that morning star pattern didn’t indicate a low, price moved lower.

Candlestick patterns don’t always work. Just often.

My problem this time is the correction must be at a lower degree and it is showing up strongly on the monthly chart. A correction at minor degree shouldn’t look like that. And it shouldn’t breach the channel. But today we have a breach if the channel is drawn using Elliotts second technique.