Gold is still range bound.

On Balance Volume is giving a clear and strong signal today of what direction price should be expected to break out of this range.

Summary: Gold is still technically range bound but an upwards breakout may be imminent. On Balance Volume is giving a clear signal that price is very likely to break out upwards. In the short term, a little downwards movement may unfold for a few hours to about 1,250. Thereafter, a new high reasonably above 1,270.08 would provide confidence that price is very likely to break out upwards. After price breaks above 1,280 with a day on increased volume, then it may throw back to retest 1,280 a few days later. If price behaves like that, it may offer a perfect set up to join a confirmed upwards trend.

New updates to this analysis are in bold.

Last published weekly chart is here.

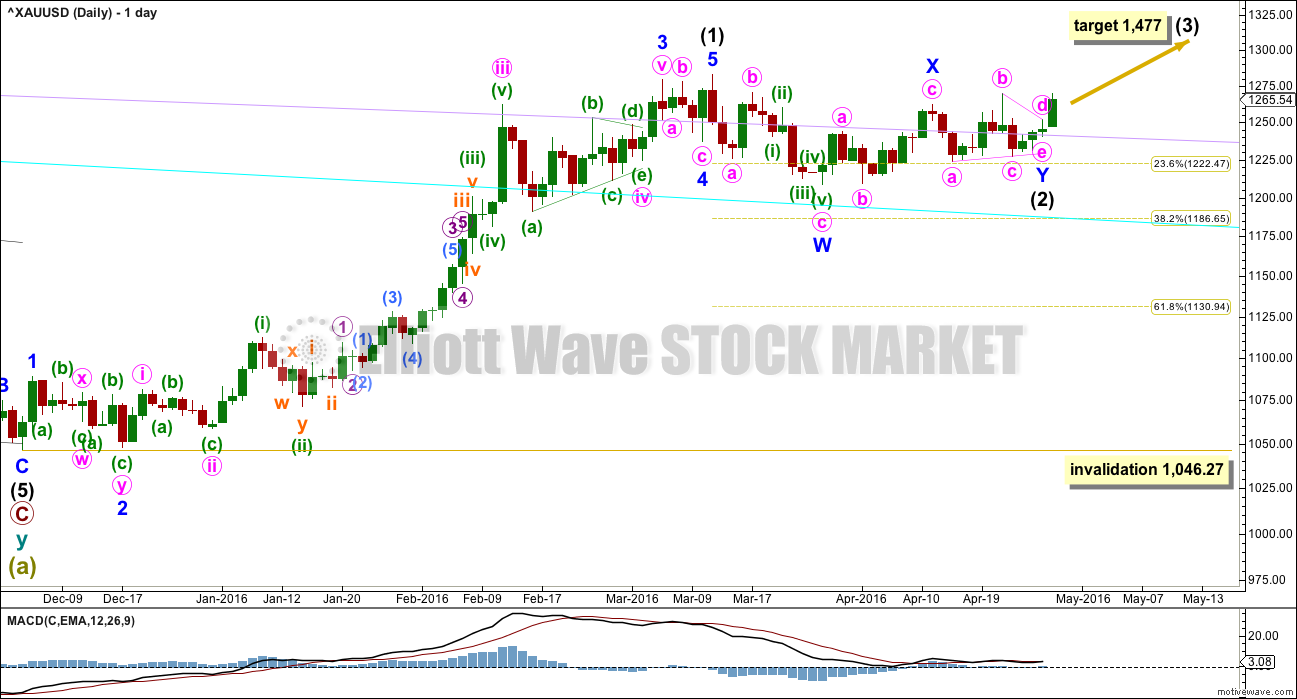

DAILY ELLIOTT WAVE COUNT

Intermediate wave (2) may be a double combination with minor wave X ending earlier as labelled.

Minor wave W is a zigzag, the first structure in a double. The two structures in the double may be joined by a simple zigzag for minor wave X in the opposite direction.

Minor wave Y may now be a complete running contracting triangle as labelled here and on the main hourly chart, or it may be an incomplete running barrier triangle as labelled on the alternate hourly chart below. The triangle is supported by MACD hovering at the zero line here on the daily chart.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,046.27.

The next wave up for intermediate wave (3) should be swift and strong. It must move above the end of intermediate wave (1) at 1,282.68. It must move far enough above this point to allow room for intermediate wave (4) to unfold and remain above intermediate wave (1) price territory.

It is possible today that intermediate wave (3) has just begun. At 1,477 it would reach equality in length with intermediate wave (1). This target is reasonable because intermediate wave (2) was very shallow.

If intermediate wave (2) is over as labelled, then it may have totalled 33 sessions, just one less than a Fibonacci 34. Minor waves W, X and Y may all have been of even duration, all over in 11 sessions.

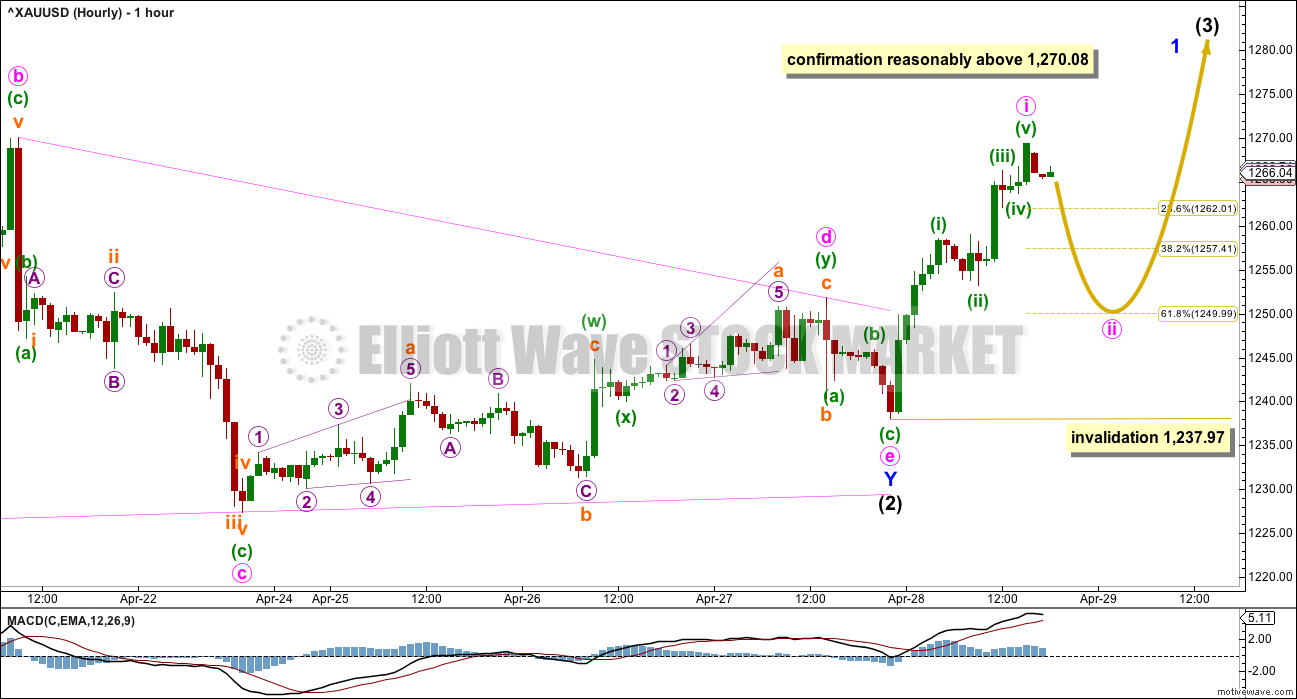

MAIN HOURLY ELLIOTT WAVE COUNT

The triangle for minor wave Y may now be complete as a running contracting triangle.

Minute wave e subdivides as a zigzag and falls short of the A-C trend line which is the most typical look for an E wave of a triangle.

The first wave up may subdivide as a five wave impulse. This should be followed by a three down. Minute wave ii would most likely correct to the 0.618 Fibonacci ratio of minute wave i at 1,250. It may not move beyond the start of minute wave i below 1,237.97.

When minute wave ii is a complete three wave structure, then a small third wave up should unfold and should show some increase in upwards momentum.

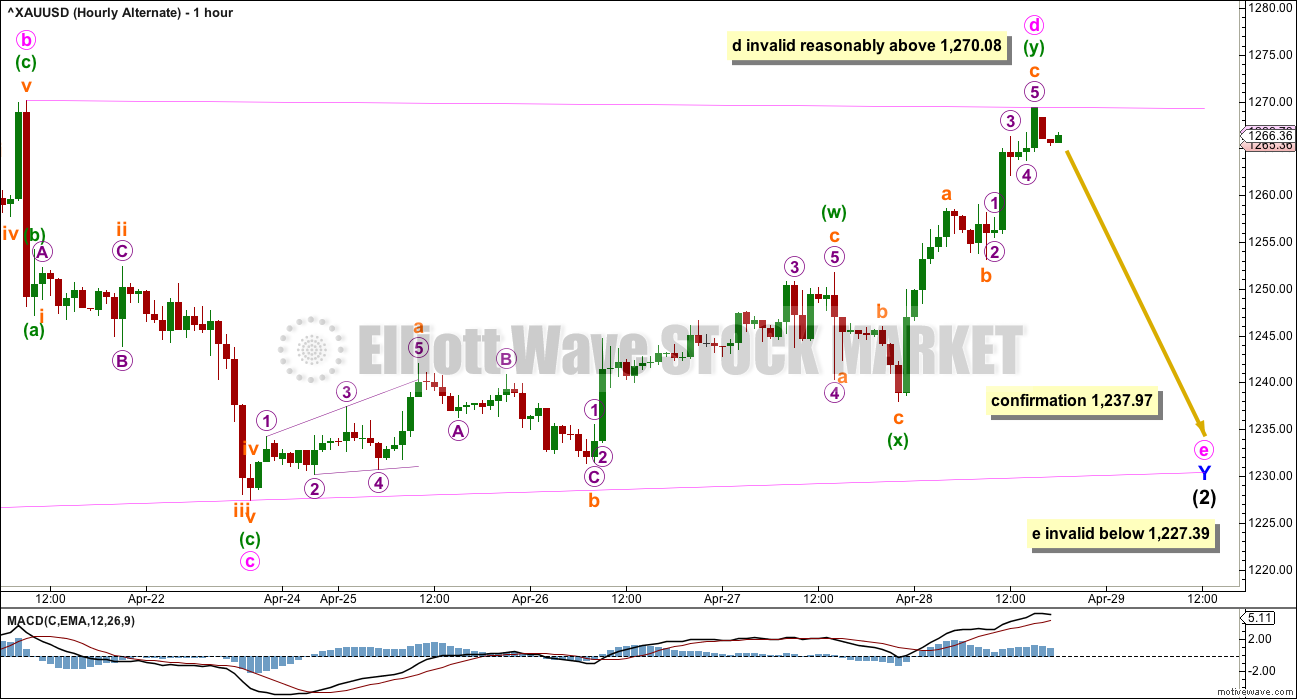

SECOND HOURLY ELLIOTT WAVE COUNT

It is possible that the triangle is an incomplete barrier triangle.

A barrier triangle has a B-D trend line which is essentially flat. In practice this means minute wave d may move slightly above the end of minute wave b at 1,270.08. As long as the B-D trend line remains “essentially flat” this wave count will remain valid. Unfortunately, this is the only Elliott wave rule which has any grey area. A new high reasonably above 1,270.08 is required to invalidate this idea.

If the triangle is incomplete, then it would be confirmed with a new low below 1,237.97. At that stage, not much more downwards movement would be expected. Minute wave e would be most likely to end short of the A-C trend line.

Minute wave e of a barrier triangle may not move beyond the end of minute wave c below 1,227.39. This invalidation point is black and white.

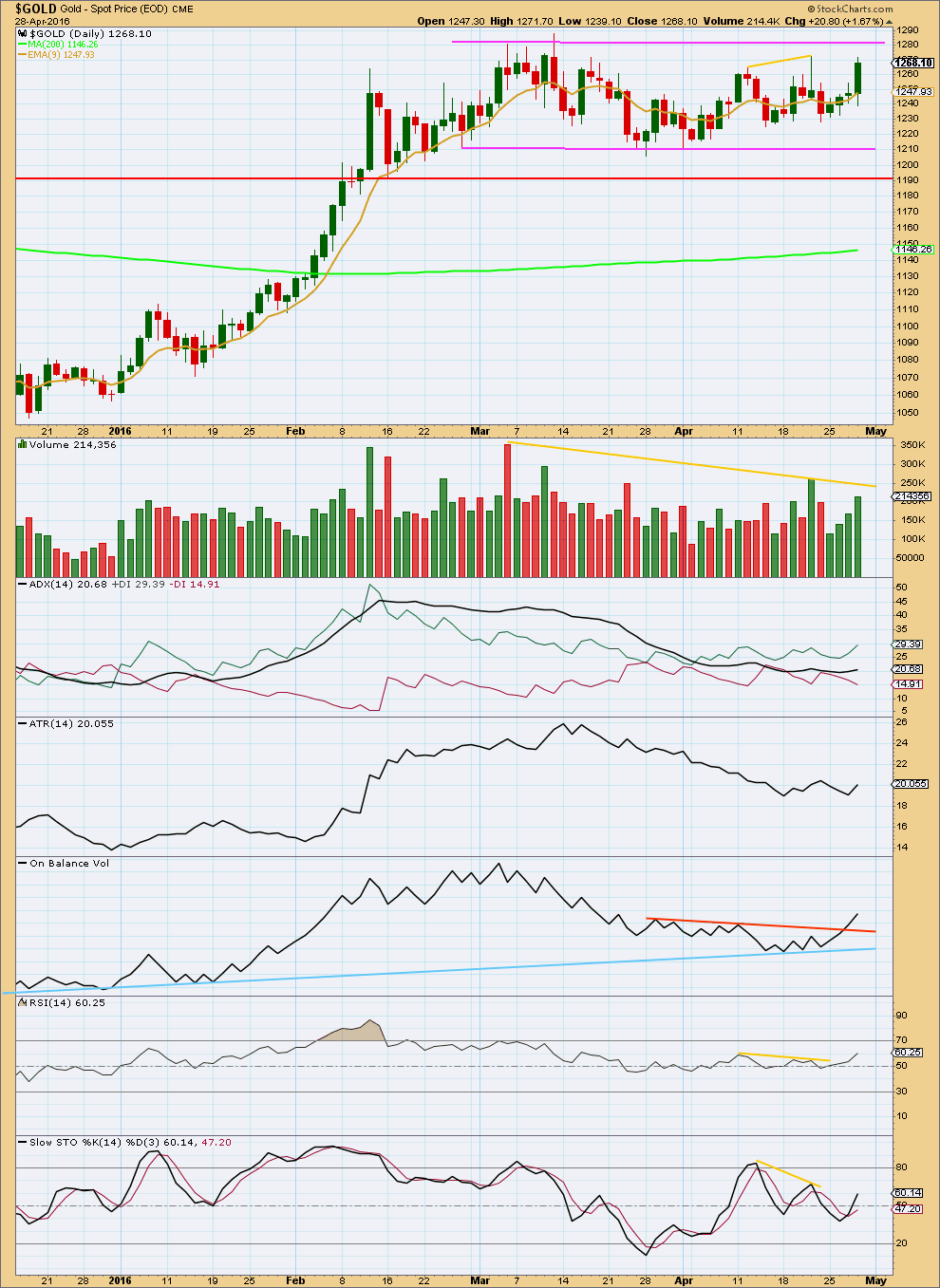

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

Four days in a row of upwards movement on increasing volume indicates there is support for this rise in price. On Balance Volume is today giving a clear bullish signal. The balance of probability has shifted to an upwards breakout and it looks imminent.

Price is still range bound though. There has not yet been an upwards breakout. Some resistance may be expected about 1,280. How price behaves when it gets to this round number which is providing resistance will be indicative. An upwards breakout would be seen by a strong green daily candlestick closing comfortably above 1,280 on a day with increased volume, preferably a volume spike.

Sometimes after a breakout price turns back to retest the prior line of resistance / support a few days later. When price behaves like that, it offers a perfect opportunity to join what is most likely a trend. If that happens here after an upwards breakout, then the opportunity should be taken to enter long there.

Prior to an upwards breakout, the risk is that price may continue further sideways within the range of 1,280 to 1,210 before a breakout.

ADX is today increasing. The +DX line is above the -DX line. ADX is indicating a new upwards trend is developing.

ATR may be beginning to agree as today it too is increasing.

On Balance Volume is giving a clear strong bullish signal with a break above the orange line. OBV is a fairly reliable signal of price direction for a breakout from a consolidation.

Neither RSI nor Stochastics are extreme. There is room for price to rise further.

This analysis is published @ 06:54 p.m. EST.

Great Great Lara..

You with your skills proved that you are the best…you proved that EW is the most wonderful concept…

I just had a thought that does EW only works on financial market or it works on each and every aspect of the world…??..

Yaa im sounding funny but when we go back in history everythings changes and nothing is permanant…In mordern world too…Early it was British era than the Russian eraa than the American era and now its a sense of Chinese era begining…

So just want to know that EW works only for financial markets or does it work on each and every aspect of humanity…

Thank you.. 🙂

Financial guru Robert Prechter argues forcefully for the applicability of Elliott wave patterns as an organizing principle for many types of social behavior outside the realm of finance [2].

Prechter’s basic idea is that the units in a social system—investors, voters, music fans, shoppers—tend to make their individual decisions on the basis of what they see others doing. In other words, they herd. These decisions are then translated into a “social mood,” which is measured by things like the DJIA, hemlines levels in women’s skirts, types of musical lyrics, or attendance levels at baseball games. What sets Prechter’s “socionomics” apart from conventional wisdom is that he completely turns around the idea of cause-and-effect in social systems.

If social moods have a definite pattern, they certainly cannot be the result of random events. And there is not a shred of evidence to suggest that a social mood is the result of events that are themselves structured to produce the Elliott Wave patterns they display. Thus, the only possible direction of causality is to assume that events do not shape social mood; rather, social mood shapes events. Thus, collective mood shapes the nature of social interaction, and consequently the resulting social actions and events.

So, for instance, production, recession, political news and even major conditions such as war and peace to not buffet the social mood; rather, the trends in social mood induce people to take actions that show up as economics, politics, and all other manner

of social trends that make history.

ProfitSource EW Gold from Today. What do you think?

Possible.

The problem is the how it doesn’t fit into any channel. The fifth wave would have breached a channel drawn using either of Elliott’s techniques.

The channel breach indicates it’s something else.

Why would anyone want to pile into the gold when it’s up almost 25% since the beginning of year and GDX is up over 100%? Over the last 10 years, gold has had the biggest/best 3 month return…On a risk/return basis…Wouldn’t it be wiser to take the opposite trade and short gold/GDX? Please advise. Thanks.

25% increase may sound like a lot but in the longer time frame it is pennies on the dollar increase in what it used to be worth.

GDX and GDXJ lost about 85% of their value from their 2011 highs so add 20% to the 15% and and the value is only back up to 18% of the 2011 high so they are still cheap.

DUST lately has been a HIGH RISK venture as it is losing value every week.

Investing with the trend is safer and the trend is up until it isn’t.

Buying DUST now you’d be lucky to break even. I tried it in April and OUCH, it was no good, so no more DUST until the trend changes.

I second that. It is always much easier to trade with the trend, to go with the flow. There is less headwind that way, and you can sleep easier. Like Richard said, ETFs are very notorious. When you trade with the trend, they decay very slowly. Once you trade against the trend, the decay becomes very significant. And if you do not trade intraday, these losses compound day by day. The absolute worst thing that one can do is to put down good money after bad, that is, trying to average losses. I too have learned this truth the hard way.

Going short here would be to go against a trend. Or rather, trying to pick a top. Generally that doesn’t end well.

If you want to go short then wait for some confirmation that the trend has changed. Today we have absolutely zero indication the trend has changed.

Second idea.

What if this impulse is not over? How else could it be labelled?

If a first wave is seen as over higher up where I have subminuette i labelled, then we can see it as part of a larger extended first wave for minuette (i).

Which means minuette (ii) may only just be over.

A fifth wave up may be ready to begin when minuette wave (iv) is complete. It is possible that minuette (iv) may already be complete.

The structure of minuette (iii) fits very well on the five minute chart, although it doesn’t look perfect on the hourly chart. It had time consuming second wave corrections and quick shallow fourth wave corrections within it. This is absolutely typical for Gold when its fifth waves extend, and at the end of minuette (iii) it has a strong fifth wave within it. So no problems with that curved look there.

Minuette (iii) is shorter than minuette (i). Minuette (v) would be limited to no longer than equality with minuette (iii) at 1,313.

Lara, just off-the-cuff; can today’s break out be labeled/viewed as “B” of an expanded flat?

Yes, and that will be an alternate today.

Remember that miners are stronger than gold so gold corrections aren’t guaranteed to lower miners, depends on several factors. Many corrections the miners went up anyways.

I see GDX has shot up with a big breakaway gap. And another gap. Strongly up.

Exactly Lara, so unless the gold correction is soon and significant and happens in a short period of time than it may not be worth waiting for the correction to buy GDX or NUGT.

And DUST is lately usually a waste of time as quite lucky to break even.

Good morning everybody.

My analysis so far this morning is focussed on the upwards movement out of the triangle. The question to answer, is it due for a correction yet? Is the structure complete?

So far I have two ideas. Here’s the first. I checked it on the five minute chart. I prefer to see a first wave over where I have labelled minuette (i). That fits best on the five minute chart.

This labelling sees Gold may be ready for a larger correction. The structure can be seen as complete.

BUT always assume the trend remains the same, until proven otherwise.

Here the trend is up. Assume it will continue to be up until it is proven it’s not. That would mean a breach of the best fit channel to indicate a correction has arrived. We don’t have that indication yet.

Gold had a minor correction today down to 1:30 pm it may have been shallow due to strong bullish wave.

I just checked the open for the last 5 Mondays and GDX opened higher than the Friday’s close. Likely Sunday or Monday morning pre market it went up.

The last 4 days the miners are going up in an increasingly hectic pace.

Is this the new normal with aggressive miners buying on intra day dips even with gold dropping slowly a few dollars an hour.

Gold and even more so the miners are high on the technical indicators is there a sizable correction due real soon?

If not then just buy into this up trend of intermediate (3) stronger bullish wave?

It looks like the miners still go up even if gold corrects but slowly down a few dollars an hour as the miners set a new high in each up move on the way down due to strong buying on all intra day dips.

Lara, brief update available?

Sure, let me get a cup of tea first. Just woke up.

Just wanted to thank those that post comments/ charts. ALL are greatly appreciated. (Stephen K. – CT).

Agree totally, really valuable comments and charts on this board, a big thanks to all posters.

Me too. Thank you all of those who share experience and knowledge here.

We have a big membership with a combined experience well over 200 years. Quite amazing the depth here.

Those who share are giving us all an edge, including me.

THANK YOU

A WIN-WIN situation and now with the long, long awaited intermediate wave (3) with almost $200 to the $1,477 target, then may we all,

“Live long and Prosper in Lara’s Golden community, Cha-Ching $”

FWIW CORRECTION LOW, if the top is at 1298.8 today, would possibly be at 1278 Sunday night overseas . ( Gun to my head ,best guesstimate) Stephen C. (Close to Lara’s 1280)

Although the “commercials” (basically the precious metals mining industry and some large users of precious metals) did not lose money on the runup in gold and silver since they put on their large short positions , they did NOT MAKE MONEY either. There will be a lot of in-house “analysts” having to explain to the CEO’s and Boards of directors and shareholders just WHY they put on all these short positions! You can bet some CEO’s were involved. You can also bet that the mining industry will now be more careful about “hedging” their bets on Gold (and silver) going forward. IMVHO (As an ex member of the P.M. mining community). Stephen C. New London CT.

As indicated yesterday I added to long gold positions at 1272.5, so I do not see a pull –back to that area (maybe ever). As Elliot foretells events , we are seeing them come to pass in the movement of the YEN and slide of the Dollar. These events happened BECAUSE we are in that phase of the elliot wave ,(as affected by world consciousness), to cause world leaders to behave in the way they are behaving. Thus causing Events which affect the markets (not the other way around). If it quacks like a duck, it’s a duck!

This time may be different however, since 11:20 am TOS Think or Swim gave plenty of SELLING time signals not buying signals for gold and GDX. There were all BUY at the open today.

We are obviously in a third of a third wave of intermediate 3. As this is the longest and strongest wave ,we should not expect much of a correction in here . I count the intermediate wave 2 bottom at 1204 and the beginning of intermediate 3 from there. As to the action from there I leave it to Lara.,but I think we did one small wave up and a small second down already and are now in a 3,of 3 of 3 . (IMVHO)

We shall have to agree to disagree on this particular point.

And I think that’s okay.

I’m really struggling to see intermediate (2) over in just 11 days to intermediate wave (1)’s 69 days.

It does make a difference going forward though, and so I will give weight to your knowledge and experience and keep that chart updated. I may publish it again as an alternate if it has significant divergent expectations.

Lara , could you please ,when you have time, re-examine the decline in gold from its top in 2011 at $1921 to the $1045 (double bottom) in Dec. 2015. Could you let me know the Possibility of the decline ending in a major C wave bottom ,rather than an A wave bottom? NOT the probability, but the possibility? This of course would have important implications for the next high in gold over the next 2 to 5 years . Thank you. There is only ONE TRUTH in the markets i.e. when a low probability (as judged by some or calculated by some ,but the low probability turns out to be correct, Then it was in fact a 100% probability (because it happened) and it becomes the TRUTH. So I am always interested in finding the ONE TRUTH in the Markets. Sincerely Stephen C. New London CT

Okay.

I have already spent considerable time on that.

It’s obviously not a flat, combination or triangle. So it can only be an impulse, diagonal, zigzag or zigzag multiple.

I’ll look again at those possibilities over the weekend and let you know what I can see.

Was the Minute 2 correction fast and shallow ending at 1271.19? Circa Fib 0.236.

If so, then the subsequent rise today will be minuette 1 of Minute 3, nearing completion now. (My computation puts the end point at 1298.53 or 1300.50, at different wave degrees).

If otherwise, Minute 2 as an expanded flat now has the B wave in excess of Fib 2.0 retracement.

Any alternative wave counts?

Alan, it does appear that a correction began at today’s high of 1.296.81 at 11:21 am price and many indicators began giving SELL signals which would usually apply. However today may be an exception? Price dropped from 1296.81 at 11:21 am to 1290.29 at 12:08 pm

Alan or anyone how low may this correction since 11:21 go this afternoon?

Hi Richard.

If I am right, Minute 3 began at 1271.19. Minuette 1 ended at 1296.81. Minuette 2 @ 0.618 Fib = 1280.98.

Alan, $1,280.98 possible minuette wave 2 retrace point it’s good to know, thank you.

Alan your minuette 2 retrace point of $1,280.98 sounds like Lara’s pullback target?

Might that happen today or next week?

“After price breaks above 1,280 with a day on increased volume, then it may throw back to retest 1,280 a few days later. If price behaves like that, it may offer a perfect set up to join a confirmed upwards trend.”

Richard. I think there may be a possibility that it will happen either today or Monday. This is because, if minuette 2 is a simple zigzag, then it has already completed waves A and B, and is now dropping in C. However, it could also become something else as it might not reach the low around 1280.98, 0.618 retrace. Then it may take a few days. The other alternative is that the retrace is more shallow. I find that strong uptrends (and downtrends) have very shallow retrace. When that happens, I will heed Lara’s advice: join the uptrend.

Looks like minuette 2 has evolved into a combination. W is definitely completed, X almost. Have to wait till next week for Y to complete.

PMBULL.com shows previous high was 1284.71 March 11th and gold high today of 1286.97 at 9:57 am in a $13 rally in 90 minutes up to that from 8:15 am

Heavier buy stop orders lie just above the March high of $1,287.70 in June gold futures.

Morning Richard. Are you thinking there will be a little correction around those numbers?

I don’t follow gold futures, so can’t say.

However may be resistance like Jim Wynncoft at kitco said in his quote.

pmbull has spot gold at 1291.07 high now 10:58

This raging bull breakout is amazing! Witnessing S&P breakdown as well. Not sure where to put the rest of my pile, lol.

Having a feel that today is a breakout day…

Tempting to go long..

But a H&S Head test is going in my mind…

It was a testing period for we all throughout the month…and i want to be patient for one more day…a clear breakout and im in.. 🙂

I think you’re potential H&S pattern has been invalidated.

Maybe the EWI count on the USD that I posted a couple of days ago is wrong. Here’s a chart by JenkinsLane showing a H&S breakdown. This could help fuel the run up in gold.

Yen extends surge, hitting 18-month high against dollar – Apr 29, 2016 2:48 a.m. ET

http://www.marketwatch.com/story/yen-extends-surge-hitting-18-month-high-against-dollar-2016-04-29

Jim Wyckoff, contributing to Kitco News -Thursday April 28, 2016 13:11

Gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at the March high of $1,287.80.

The weaker greenback recently has been a bullish underlying factor for the precious metals and for the entire raw commodity sector.

Technically, June gold futures prices closed nearer the session high and scored a bullish “outside day” up on the daily bar chart today. The gold bulls have the firm overall near-term technical advantage. Bears’ next near-term downside price breakout objective is pushing prices below solid technical support at today’s low of 1,239.10. First resistance is seen at the April high of $1,272.40 and then at $1,280.00. First support is seen at $1,260.00 and then at $1,250.00. Wyckoff’s Market Rating: 7.0

GUNNER24 Analysis April 10, 2016 of GDX, GDXJ, HUI gave targets that were hit today.

The article said the targets needed to be hit in 3 weeks and it happened.

The targets are half way to higher targets of HUI 260

HUI target was 217 then 260

GDX target was $24.10 then about $27

Great charts and details in article.

http://www.gunner24.com/newsletter/nl-041016/

Great call lara..

Great analysis..

As we are very sure that this is Int3 on its way…i just want to wait for one more day to add my longs as the small chart below see that this could be a head test of the H&S pattern and could break down…

The chart above is two days back…head test area 1280 to 1284

For the first time in 3 years since Feb 2013, when it went bearish with a sell, Gold EMA/SMA Monthly time frame went bullish with a crossover up for a BUY this month April 2016, that is a strong signal.

Likely part of the reason and confirmation a breakout up may happen in Gold.

At this moment GOLD – MACD and EMA/SMA are all bullish BUY for month, week, day, 195, 78 and 39 minutes time frames.

Difficult to say when gold will correct down.

Avi Gilburt EW – April 27th – GDX -we will need to break down below 22.20, any strong break out over 26 … and on our way over 40.

Lastly, in order for me to believe the “correction” has begun in GDX, and the overhead resistance will not be struck, we will need to break down below 22.20 to make it less likely that this drop is a 4th wave in the last 5 wave structure higher. Moreover, any strong break out over 26 in GDX places me in the green count, and in the heart of wave 3 of iii, and on our way over 40.

A look at GDX

Dreamer, amazing GDX chart, wow thanks. Now I can dream about it.

Ben Lockhart, EW analyst said in his gold article April 18th.

“The key level on the upside is $1266 and a breakout that consolidates above would be a strong indication that gold is going much higher. Resistance in that case comes in at $1311, $1343, $1375 & $1415.”

Gold at 9:30 pm EST went above $1,270.08. Just hit a high of $1,276.35 at 9:30 pm.

Thereafter, a new high reasonably above 1,270.08 would provide confidence that price is very likely to break out upwards. (Main hourly wave count.)

A new high reasonably above 1,270.08 is required to invalidate this idea. (Second Hourly wave count.)

Lara, your on the leading edge of clarifying an intermediate wave (3) breakout up.

A very exciting and profitable frontier. I want to get on the ship before it leaves without me or maybe it can go test the waters and tune everything up and come back for me? Where can I buy a ticket and can I get a cabin with a window seat and are there drinks I’ll need one after these weeks of rangebound maze? Meanwile I’ve been tuning up my trading platform.

LOL

LOL

Sometimes Gold moves fast. When it does that and its in a clear trend the best thing to do is just jump on board. Positions usually become profitable within a few days if not sooner.

For now the probability of an upwards breakout within the next few days is very high. But it hasn’t happened yet.

If I’m right any entry here should remain profitable after the breakout, even during a throwback to resistance.

There is more risk right now though.

I’ve just entered my first long position for Gold. Stop just below 1,237.97. Target 1,477. I’m risking only 3% of equity on this one. Entry point 1,276.08, risk reward ratio of 5.

Thanks for sharing that.