The main Elliott wave count yesterday expected more upwards movement, which is what has happened.

Summary: At the beginning of this week, the picture is not as clear as last week. The main wave count expected stronger upwards movement. It still does, and the target remains at 1,477, but there is a very real risk that this count is wrong and price may move substantially lower for a few weeks. Risk remains at 1,237.97. If members have long positions, it is essential that risk is managed and stops are used. Do not invest more than 3-5% of equity on any one trade and stops should be set just below 1,237.97. For profitable long positions, members may like to consider moving stops to break even to remove the risk of losses if price moves strongly lower from here.

New updates to this analysis are in bold.

To see last weekly charts click here.

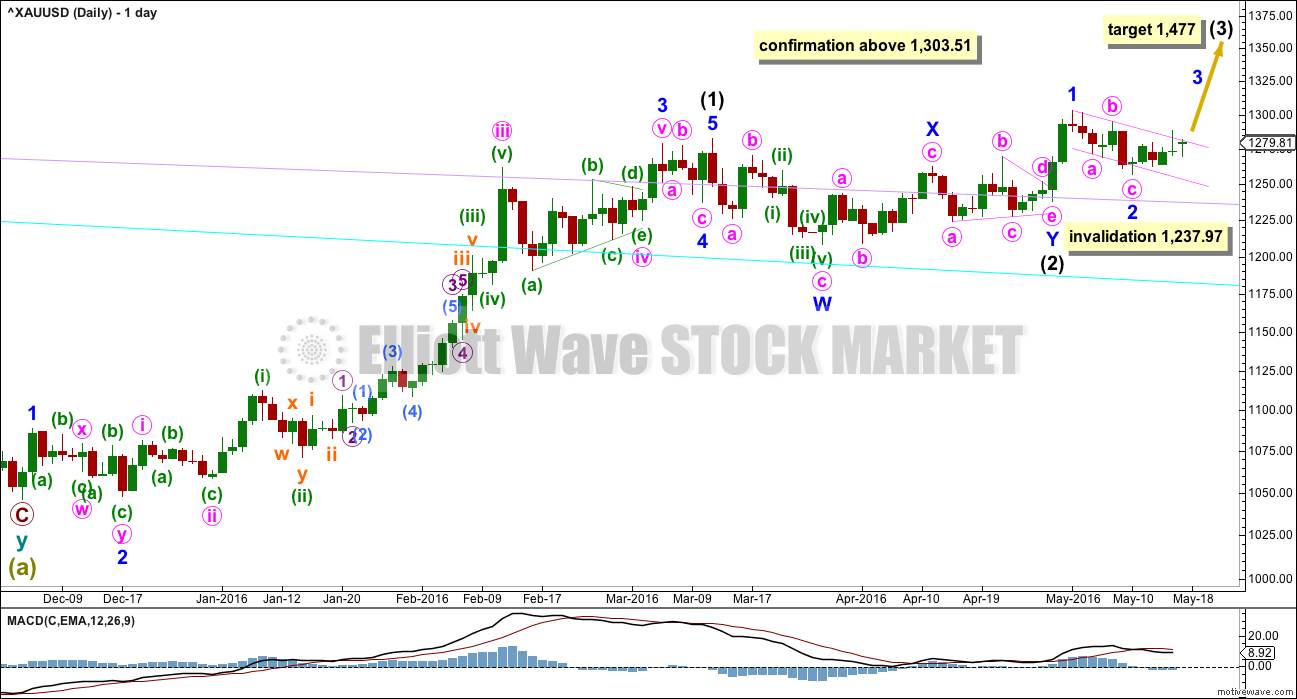

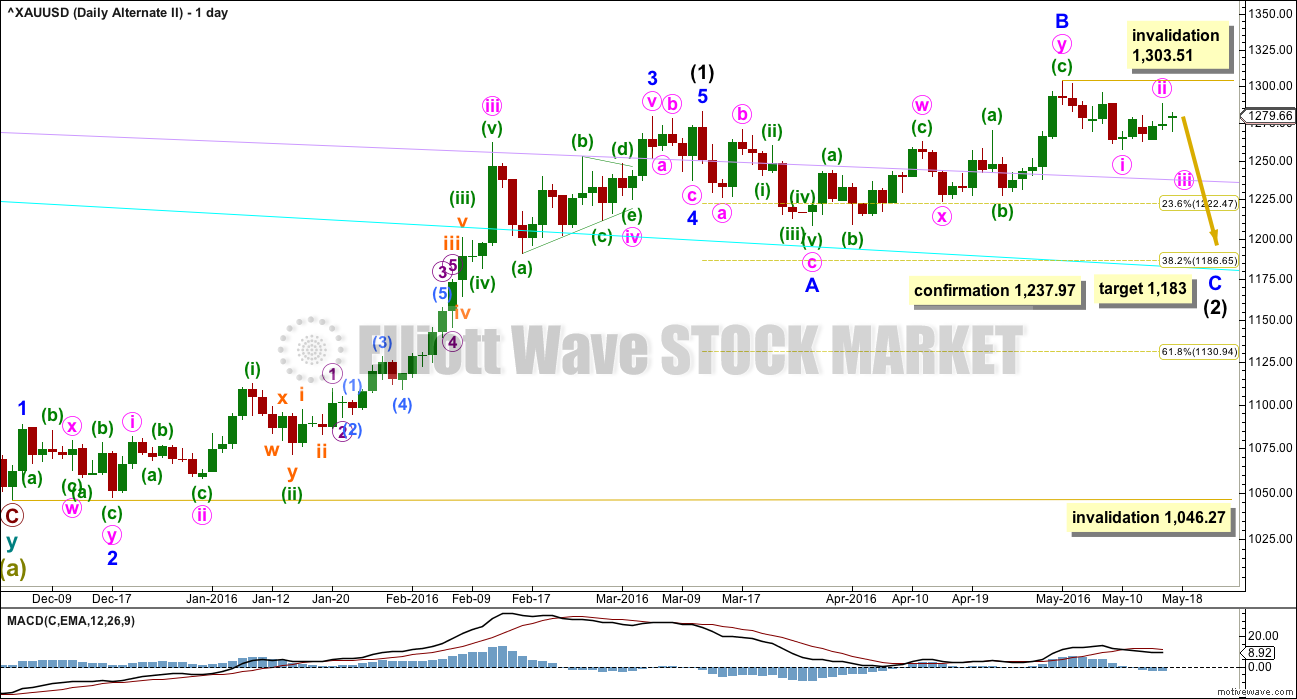

DAILY ELLIOTT WAVE COUNT

Intermediate wave (2) may be a double combination.

Minor wave W is a zigzag, the first structure in a double. The two structures in the double may be joined by a simple zigzag for minor wave X in the opposite direction.

Minor wave Y may be a running contracting triangle. The triangle is supported by MACD hovering at the zero line here on the daily chart.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,237.97.

The next wave up for intermediate wave (3) should be swift and strong. It must move above the end of intermediate wave (1) at 1,282.68. It must move far enough above this point to allow room for intermediate wave (4) to unfold and remain above intermediate wave (1) price territory.

At 1,477 it would reach equality in length with intermediate wave (1). This target is reasonable because intermediate wave (2) was very shallow.

If intermediate wave (2) is over as labelled, then it may have totalled a Fibonacci 34 sessions.

Minor wave 2 is 0.71 the depth of minor wave 1. Minor wave 1 lasted two days. Minor wave 2 lasted six days. If it is over here, it would have good proportion and look like a clear three wave structure on the daily and hourly charts.

If minor wave 2 continues lower it would still look reasonable in proportion to minor wave 1.

Gold often begins new trends slowly. There is a good example on this daily chart: the beginning of intermediate wave (1) saw brief impulses and time consuming deep second wave corrections at minor, minute and minuette wave degrees.

Golds impulses, particularly its third waves, normally accelerate at the middle and explode in a blowoff at the end of the fifth wave.

All hourly charts today will show movement from the low labelled minor wave 2 at 1,257.24 on 10th May.

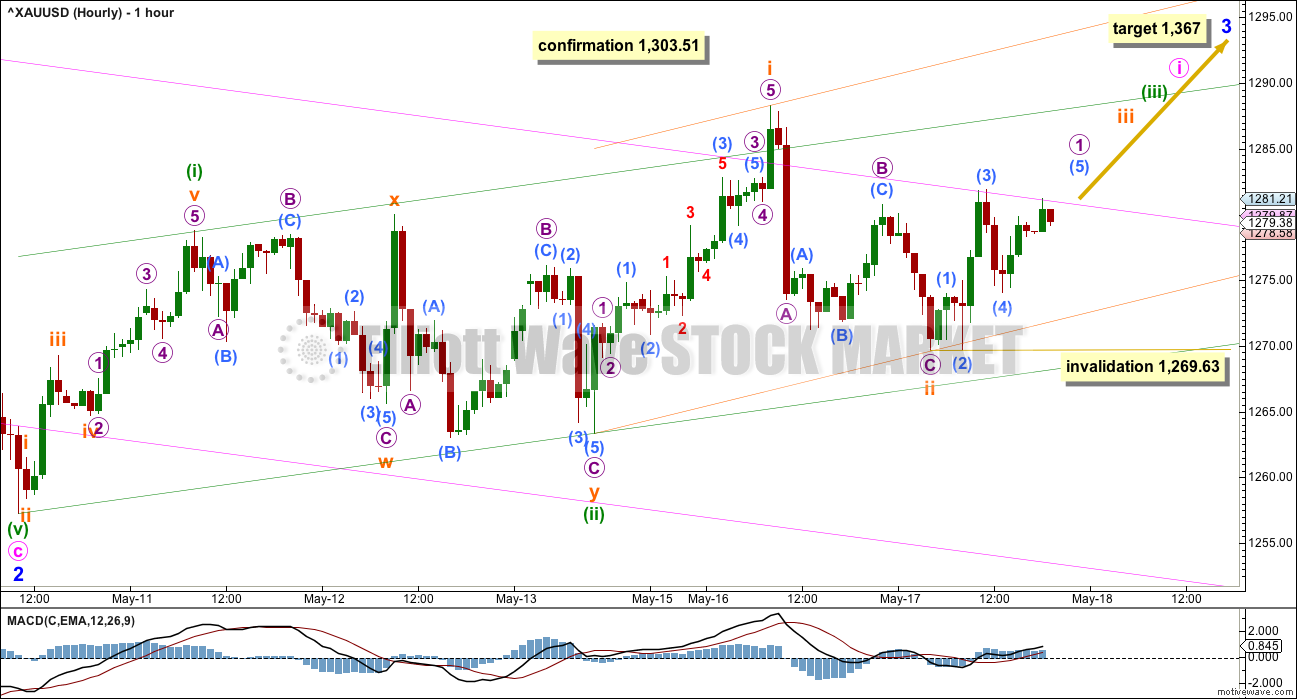

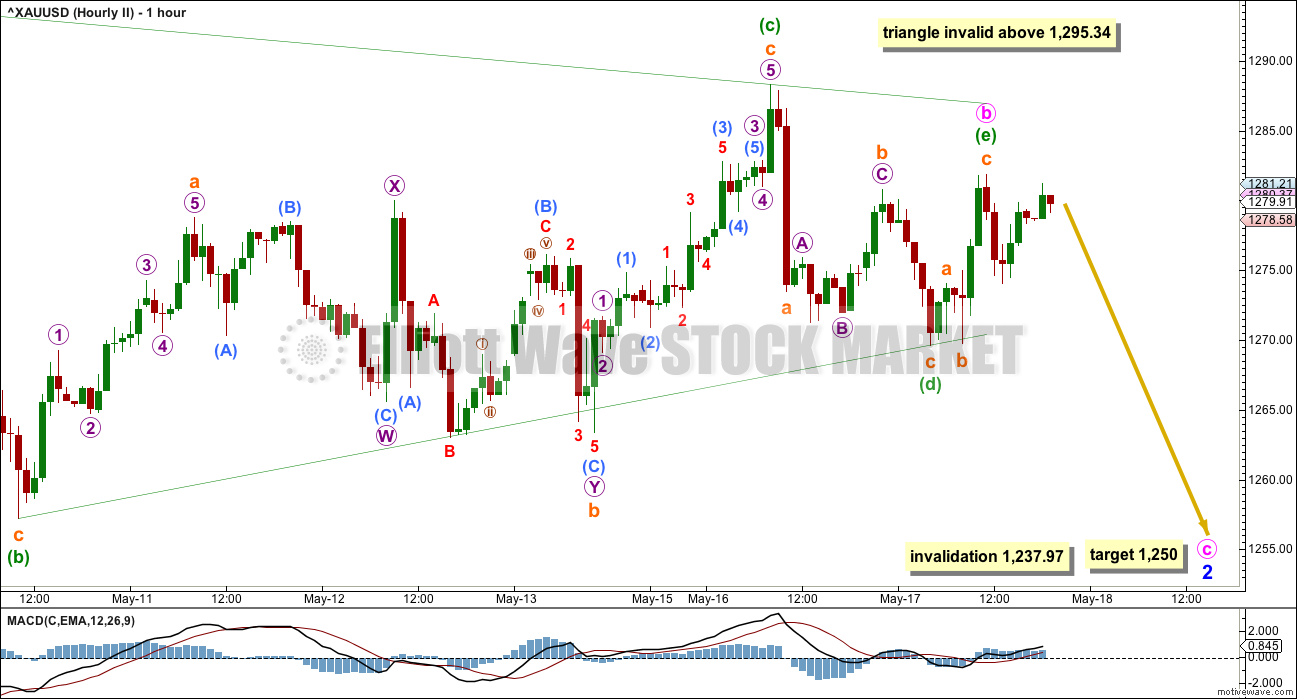

HOURLY ELLIOTT WAVE COUNT

Minor wave 2 fits as a zigzag.

Minor wave 3 may only subdivide as an impulse. Minute wave i is incomplete.

Within minute wave i, there may now be two first and second waves complete: minuette waves (i) and (ii) now followed by subminuettte waves i and ii.

Another base channel is added about subminuette waves i and ii. Along the way up, downwards corrections should find support about the lower edge of this orange channel.

Another impulse is unfolding upwards. This is labelled micro wave 1 today. When micro wave 1 is a complete five wave impulse, then a correction downwards for micro wave 2 may not move beyond the start of micro wave 1 below 1,269.63. Micro wave 2 may find strong support at the lower orange trend line.

At this stage, it looks like price is being squeezed between the upper pink line and the lower orange line. When price breaks out of this squeeze, then movement may accelerate. It is still more likely that price will break out above the pink line. If it does that, then look for a throwback. Price may turn around and find support at the pink line. If it behaves like that, it would present a good opportunity to add to long positions.

At 1,367 minor wave 3 would reach 1.618 the length of minor wave 1. If this target is wrong, it may be too low. The next possible target would be at 2.618 the length of minor wave 1 at 1,433.

Confidence may be had in a trend change with each of these conditions being met, in order:

1. A five up followed by a three down which does not make a new low. This first condition is now met.

2. A breach of the upper edge of the pink channel (copied over to today’s hourly chart). This is overshot, but price quickly returned to below the upper edge. For confidence price needs to break above this channel and stay above it.

3. A new high above 1,295.34 would invalidate the first alternate below.

4. A new high above 1,303.51. This will be final confirmation.

It would not be until the middle that acceleration to the upside may be expected to be clear for minor wave 3. The fourth wave corrections within it may be quick and shallow, and the fifth waves to end minor wave 3 and then the final fifth wave up of minor wave 5 also may be expected to be very strong movements, completing blowoff tops for Gold.

FIRST ALTERNATE HOURLY ELLIOTT WAVE COUNT

What if minor wave 2 is not over?

Sideways movement of the last several sessions is still not convincing as another impulse up so far. However, as noted with the main wave count sometimes these impulses start off slowly.

Minor wave 2 may be continuing further as a more time consuming correction, still subdividing as a zigzag. The last five days may be a running contracting triangle for minute wave b which may now be complete.

Direction of price entry into the triangle is down, so direction of price exit from the triangle should be down.

Within the possible triangle, minuette wave (c) may have moved higher during Monday’s session. If it continues any further as a more time consuming and complicated double, then it may not move above the end of minuette wave (a) at 1,295.34. This is the final upper invalidation point for any triangle idea.

Minuette wave (d) may now be a complete zigzag. It is also possible that it could continue lower and be more time consuming. If it does, then it may not move beyond the end of minuette wave (b) below 1,257.24.

Minuette wave (e) may also now be complete. The entire triangle structure may be over. Minuette wave (e) may have fallen short of the (a)-(c) trend line, which is most typical.

If the triangle continues, then it would expect some more overlapping sideways movement for up to another one to three sessions.

A five wave structure downwards for minute wave c would complete a zigzag for minor wave 2. That may not move beyond the start of minor wave 1 below 1,237.97.

This alternate wave count expects a short sharp downwards thrust which may end close to but not below 1,237.97. At 1,250 minute wave c would reach equality in length with minute wave a. If the triangle for minute wave b continues any further sideways, then this target must be recalculated, so it may change.

Thereafter, the upwards trend should resume.

This wave count is published primarily to illustrate why risk to long positions must remain at 1,237.97 while price remains below 1,303.51.

ALTERNATE DAILY ELLIOTT WAVE COUNT

It is still possible that intermediate wave (2) is not over. With inconclusive sideways / upwards movement for the last six days, the probability of this wave count has slightly increased.

Normally, the first large second wave correction within a new trend is very deep, often deeper than the 0.618 Fibonacci ratio. The main wave count sees intermediate wave (2) as very shallow at only 0.19 of intermediate wave (1). This is unusual. And so this alternate must be considered.

If any members have long positions on Gold already it is essential that stops are used in case this alternate unfolds.

Intermediate wave (2) may be an expanded flat correction. Minor wave A is a three, minor wave B is a three and a 1.28 length of minor wave A. This is within the normal range of 1 to 1.38.

At 1,183 minor wave C would reach 1.618 the length of minor wave A. This would be the most likely target. If price keeps falling through this first target, then the second target would be at 1,108 where minor wave C would reach 2.618 the length of minor wave A.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,046.27.

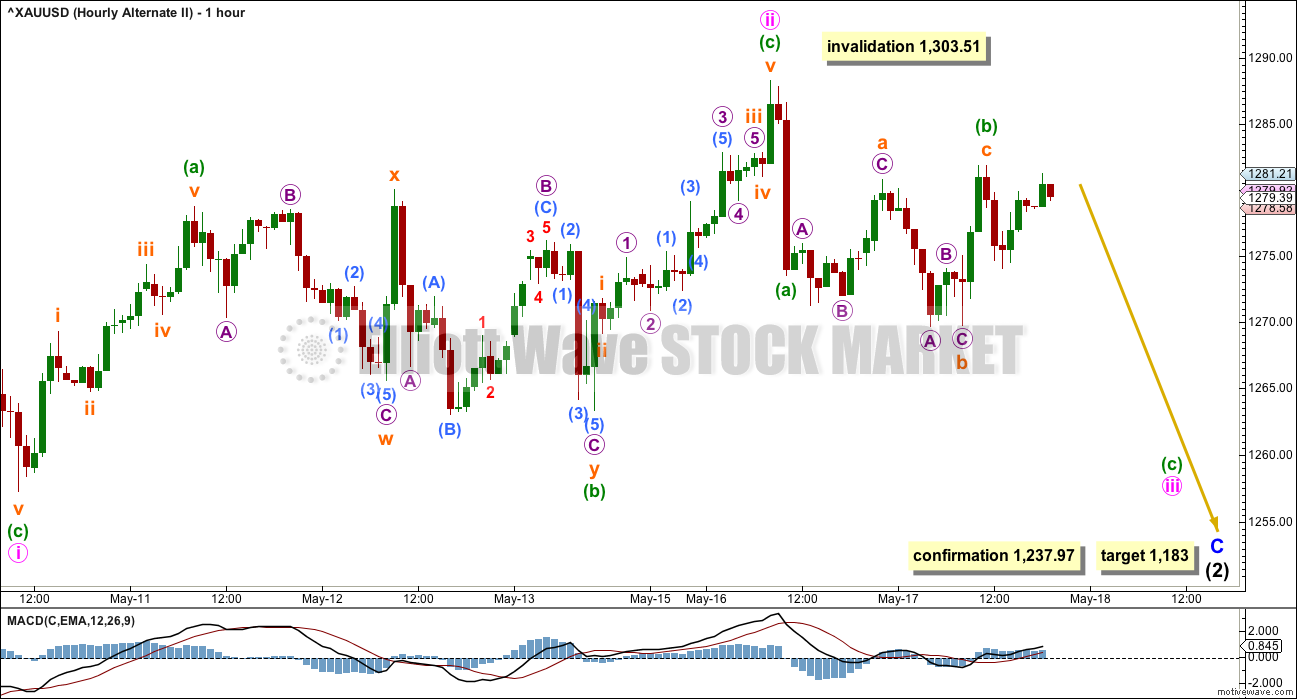

ALTERNATE HOURLY ELLIOTT WAVE COUNT

The main purpose in publishing an hourly chart for this alternate is to determine what price points need to be passed to reduce the probability of this alternate and increase the probability of the main wave count.

A secondary purpose is to remain open to considering what this alternate looks like at a lower time frame. Alternates should always be considered; what if the main wave count is wrong? Alternates provide a road map for what should happen next if the main wave count is wrong.

Minor wave C must subdivide as a five wave structure. With inconclusive sideways movement for the last six days, an ending diagonal must now be considered and published.

Within an ending diagonal, all sub-waves must subdivide as zigzags. The fourth wave must overlap back into first wave price territory and may not move beyond the end of the second wave. Second and fourth waves are commonly from 0.66 to 0.81 the depth of the first and third waves they correct. Thus ending diagonals are choppy overlapping movements. Contracting diagonals, the more common variety, have their classic technical analysis equivalents as falling or rising wedges.

Minute wave i subdivides as a zigzag in the same way as minor wave 2 subdivides as a zigzag for the main wave count.

Minute wave ii is now a complete zigzag most likely. It is possible that it could continue higher. If it does, it may not move beyond the start of minute wave i above 1,303.51.

Here, minute wave ii is 0.67 the depth of minute wave i which is within normal range of 0.66 to 0.81.

Minute wave iii must subdivide as a zigzag and must make a new low below the end of minute wave i below 1,257.24.

When minute wave iii is complete, then the type of diagonal, contracting or expanding, would be known, so a target range and minimum or maximum for minute wave iv may be calculated.

TECHNICAL ANALYSIS

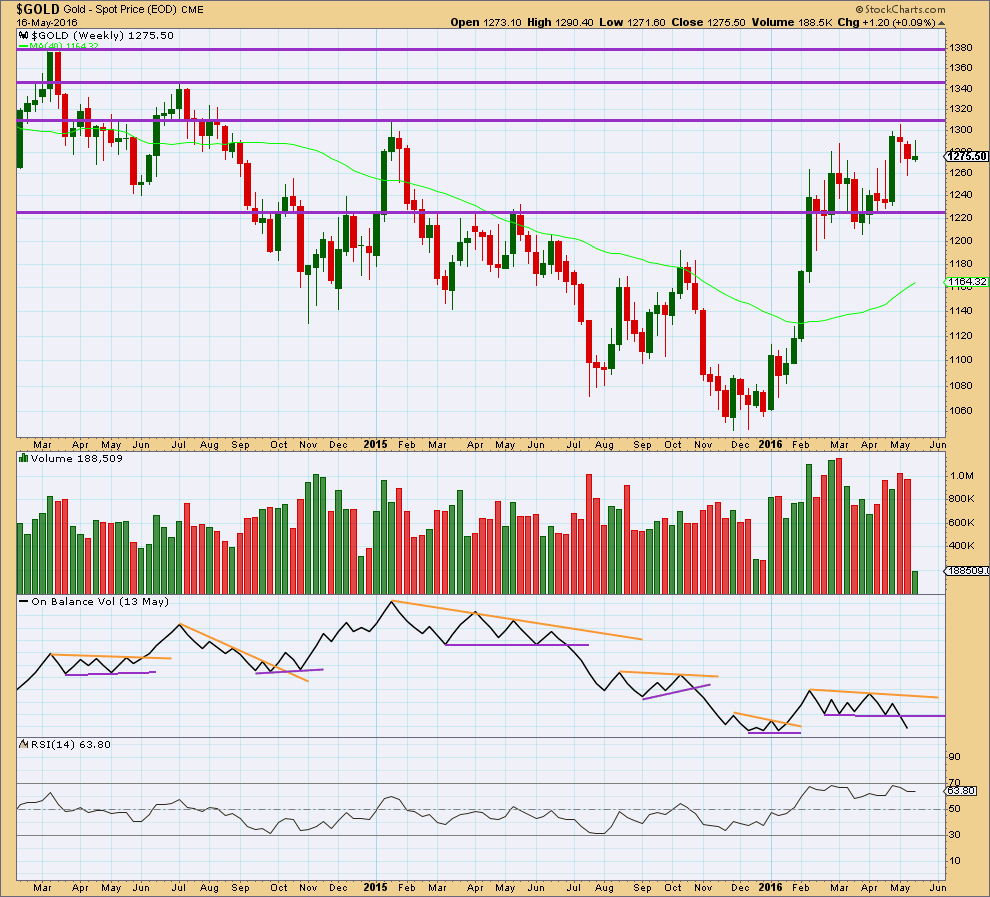

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is breaking below a reasonably long held and clearly defined consolidation zone. It would be entirely reasonable to expect price to follow by continuing lower for a few weeks. This piece of evidence strongly supports the alternate daily Elliott wave count.

Price has found resistance at the horizontal line about 1,310. The first support line may be about 1,225.

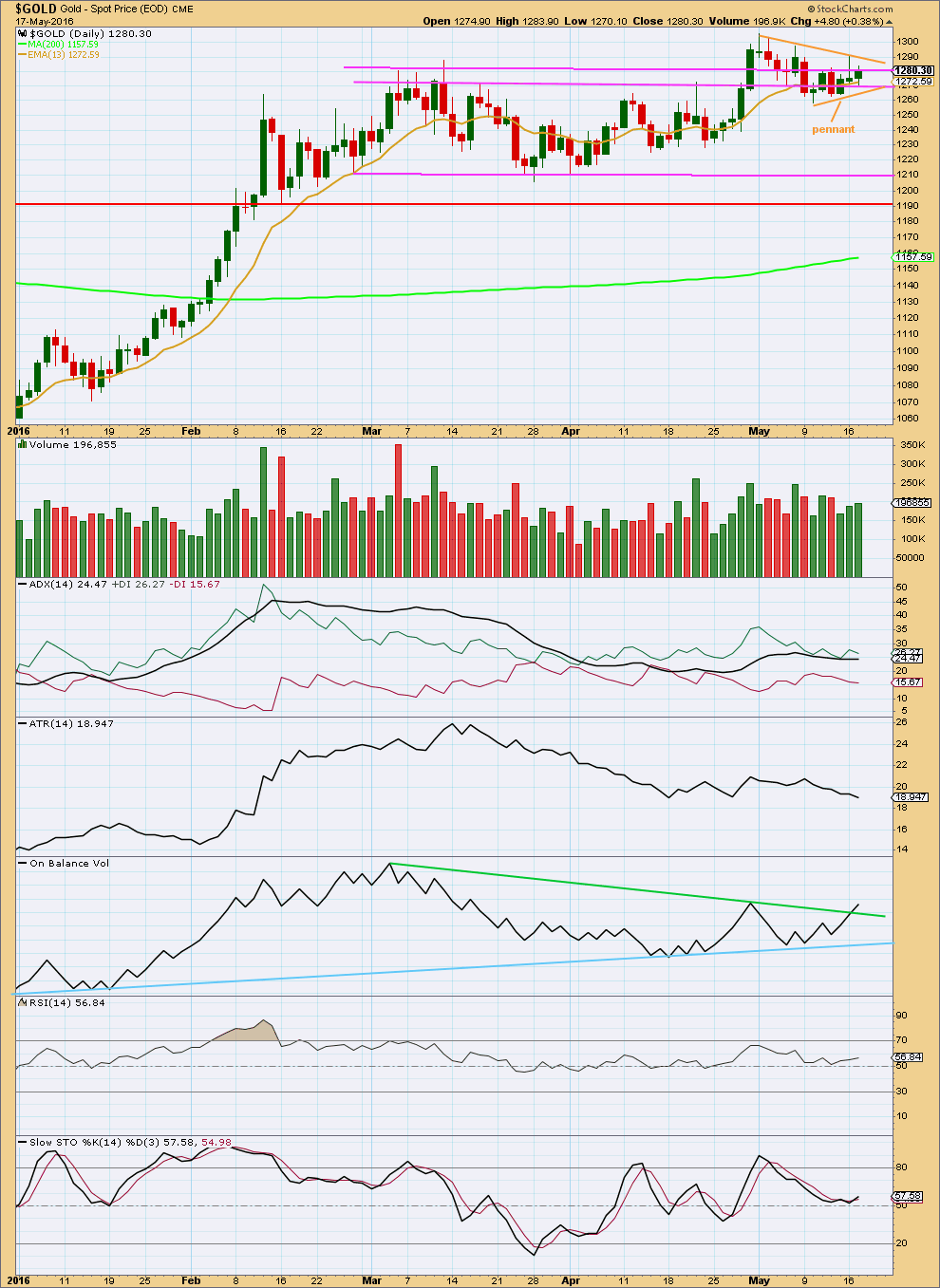

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Three green daily candlesticks in a row now come on increasing volume. There is some support for this overall rise in price, even though it is not strong nor clear. Price is finding resistance at the upper pink trend line about 1,280.

It looks like a pennant pattern is currently forming. These are one of the most reliable continuation patterns. Normally, they last from about 5 days to 3-5 weeks. So far this one is in its third week. Price is finding resistance at the upper trend line of the pattern. The breakout direction would be expected to be upwards. If price moves above the upper edge of this pattern on an upwards day with increased volume, and especially if this is accompanied by a gap upwards, then a classic breakout would be indicated.

Price already has broken out of a longer consolidation zone delineated by pink trend lines on 29th April on a day with increased volume. Subsequent downwards and sideways movement still looks like a typical throwback to find resistance at prior support. The last few slow upwards days however are not so far convincing. Stronger upwards movement away from support would have been expected as more typical behaviour.

ADX is today flat indicating the market is still not trending.

ATR still agrees as it is declining. Both these indicators are lagging as they are based on 14 day averages.

On Balance Volume is today giving an important bullish signal with a break above the green line. This line is not too steep, it is long held, but it has only been tested about once before so it is not highly technically significant. This is a bullish signal but not a strong one. It contradicts the bearish signal from weekly On Balance Volume.

RSI is still close to neutral. There is room for price to rise or fall. Stochastics is still close to neutral.

This analysis is published @ 08:55 p.m. EST.

Members who had profitable long positions should have moved stops to break even, no losses should be incurred today.

For those that did not do that and who have losses, risk remains at 1,237.97. If that price point is passed then quite a lot more downwards movement would be expected and long positions should be exited.

For those who don’t mind holding an underwater position for a few days the hourly II count expects price to turn around in another one or two days.

The risk of course is the daily alternate is correct.

I would make the judgement that the hourly II count is about 60% likely, and the alternate daily about 40% likely.

It is up to each member to determine their risk tolerance and approach to any long positions here.

If 1,237.97 is breached I will not be entering short here, an ending diagonal is not the kind of structure I personally want to trade, it is too choppy and overlapping. I will be waiting patiently for intermediate (2) to end before entering long again.

If 1,237.97 holds and the structure fits the hourly II chart better than the daily alternate then I will enter long again.

So careful attention to structure will be the key over the next couple of days.

This structure for minute c down is incomplete. More downwards movement now is expected for another one to two days overall (with one more likely).

Minor 2 can’t move below the start of minor 1 at 1,237.97.

The alternate daily requires a new low below 1,237.97 for confidence. If price breaks below 1,237.97 that will be the only wave count and more downwards movement would be expected to 1,183.

For now the hourly II chart updated here is the preferred wave count.

Hi Lara,

Thanks very much for your preparedness! You had all the bases covered but my favorite comment was a couple of days ago when you referred to a book/ chapter about an engulfing negative candlestick and what it truly represented; could have been interpreted incorrectly had you not known your tricks of the trade. That was a classic!

Oh, a bearish engulfing candlestick? Was that 9th May?

Sounds like I did something right, but I’m not recalling exactly what 🙂

My preferred count would be the hourly II which sees minute b as a triangle and this downwards move as minute c.

Target 1,250.

Good call Lara. Triangle count gave us a good road map for the sharp drop ??

Great, glad to hear you’re managing to interpret my confusion well.

This market is frustrating me ATM. My long position closed out for a tiny profit (moved stop to just above entry to cover fees). So no nice long term trend following trade on Gold yet…

I live to try another day.

S&P is looking most excellent, shorts there profitable. NZDUSD also today looking fantastic, so overall I’m a happy camper this morning.

According to Lara, we are headed down to either 1250 or 1183.

Exactly!

I recall Alan Tham mentioning a nugt tgt of 77ish.

Sounds closer to hrly alternate to me.

edit: meant hrly II. There’s a II on hrly and on hrly alternate chart so i got confused there.

Hrly II, 1250 tgt

Look where the trend line is… Good buy target

Nice Chart. REALLY like these colors and the layout.

was noticing your entry notations for tripple buy in appears to be my anytime buy in. but i’m not following how you have your macd set up and don’t see it here. Care to explain a bit?

Hi ds,

I can’t take credit for the chart as this is just one that I quickly grabbed to show that the Alan Tham target of 77 for NUGT was supported by the trend line for validation. This is one of the public charts from Joanne Klein. She has some good charts for quick reference.

http://stockcharts.com/public/1107832/chartbook/308234308;

Any wave counts?

Is gold in a 5th of a 5th now heading down since Tuesday high?

May 10th bottom of last week drop.

Gold 1258.30

GDX 23.34

NUGT 85.00

2:54pm Dollar gauge hits a nearly one-month high after Fed minutes

2:53pm Oil futures settle lower, pressured by FOMC minutes

2:50pm Chances of June hike jump after Fed minutes

Today at 2:00 pm EST

FED FOMC minutes from last meeting

Fast news here.

http://www.marketwatch.com/newsviewer

The Metals Complex Is On The Edge Again – By Avi Gilburt – May 18, 2016

EW charts with link at bottom of the article

http://www.gold-eagle.com/article/metals-complex-edge-again

Main Hourly wave count invalidated below 1269.63 as today’s low was at 1,266.60 at 9:04 am.

Hourly II – If the triangle continues, then it would expect some more overlapping sideways movement for up to another one to three sessions.

A five wave structure downwards for minute wave c would complete a zigzag for minor wave 2. That may not move beyond the start of minor wave 1 below 1,237.97.

This alternate wave count expects a short sharp downwards thrust which may end close to but not below 1,237.97. At 1,250 minute wave c would reach equality in length with minute wave a. If the triangle for minute wave b continues any further sideways, then this target must be recalculated, so it may change.

Thereafter, the upwards trend should resume.

Hourly Alternate II is also still a possibility.

Minute wave iii must subdivide as a zigzag and must make a new low below the end of minute wave i below 1,257.24. Also has target at 1,183 to end intermediate wave 2.

Thought I’d issue a comment to help stimulate some conversation.

Treasury yields are an indication that the market believes an interest rate hike is forthcoming. Here’s an article that points to the market anticipating hawkish comments from the Fed Minutes being released today at 2:00 along with a reason why we’re seeing changes in the 2 yr. and 10 yr. treasuries. If proven to be correct, I’d expect that the Alternate would be the path forward.

http://www.marketwatch.com/story/treasury-yields-hit-fresh-3-week-highs-as-investors-brace-for-fed-minutes-2016-05-18

Recent low may have been D of triangle with final E wave now.

With price this morning touching $1,266, is this a sign that we’ll be dropping from here?

Per Lara’s summary:

Another impulse is unfolding upwards. This is labelled micro wave 1 today. When micro wave 1 is a complete five wave impulse, then a correction downwards for micro wave 2 may not move beyond the start of micro wave 1 below 1,269.63. Micro wave 2 may find strong support at the lower orange trend line.

At this stage, it looks like price is being squeezed between the upper pink line and the lower orange line. When price breaks out of this squeeze, then movement may accelerate. It is still more likely that price will break out above the pink line. If it does that, then look for a throwback. Price may turn around and find support at the pink line. If it behaves like that, it would present a good opportunity to add to long positions.

I think it means either the triangle is confirmed or the alt daily. In practice that means either 1250 ish or 1180 ish beckons.

I assume this means it is time to exit long positions?

Yes. Stops should have been moved to break even.