More downwards movement was expected to a target at 1,250 for the main Elliott wave count.

Price reached 5.65 below the target to reach 1,244.35 during the session.

Summary: The main wave count expects upwards movement from here to a short term target at 1,415 and a longer term target at 1,477. The main wave count would be confirmed with a new high above 1,288.30. The alternate remains viable but has a lower probability. It expects continuing downwards movement and would be confirmed with a new low below 1,237.97. Risk to any long positions entered here must remain at 1,237.97 while there is no price confirmation of a trend change.

New updates to this analysis are in bold.

To see last weekly charts click here.

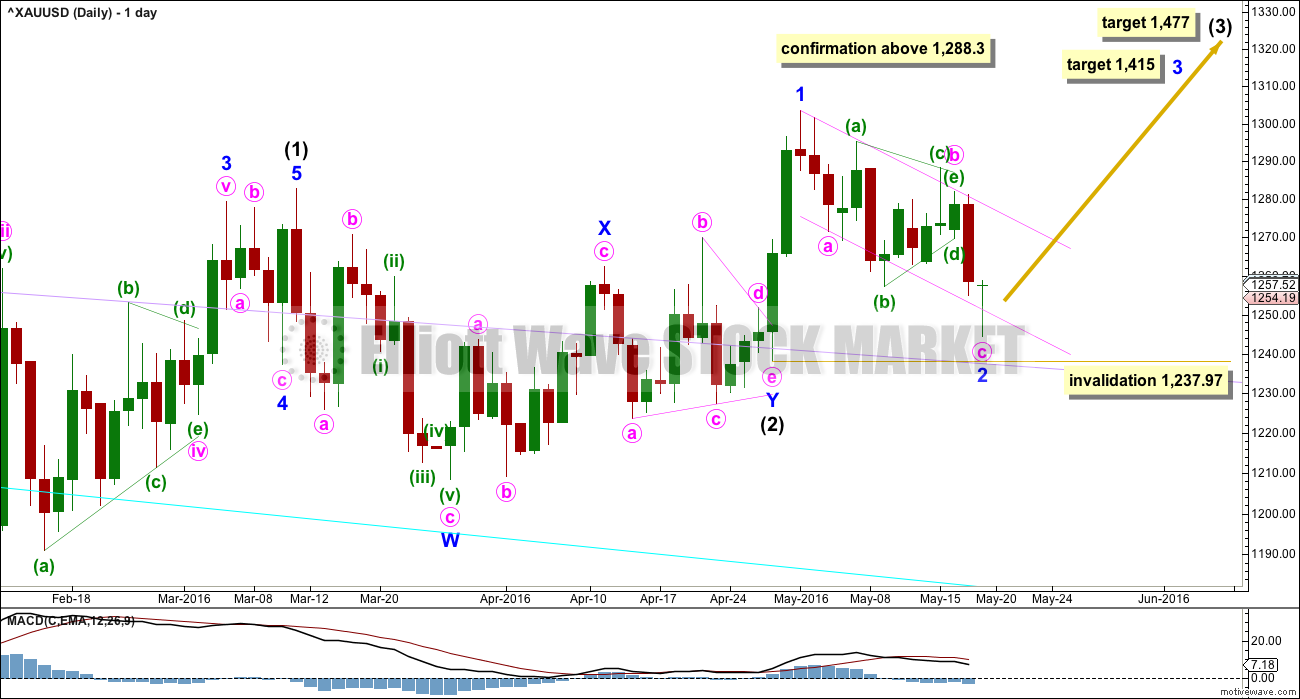

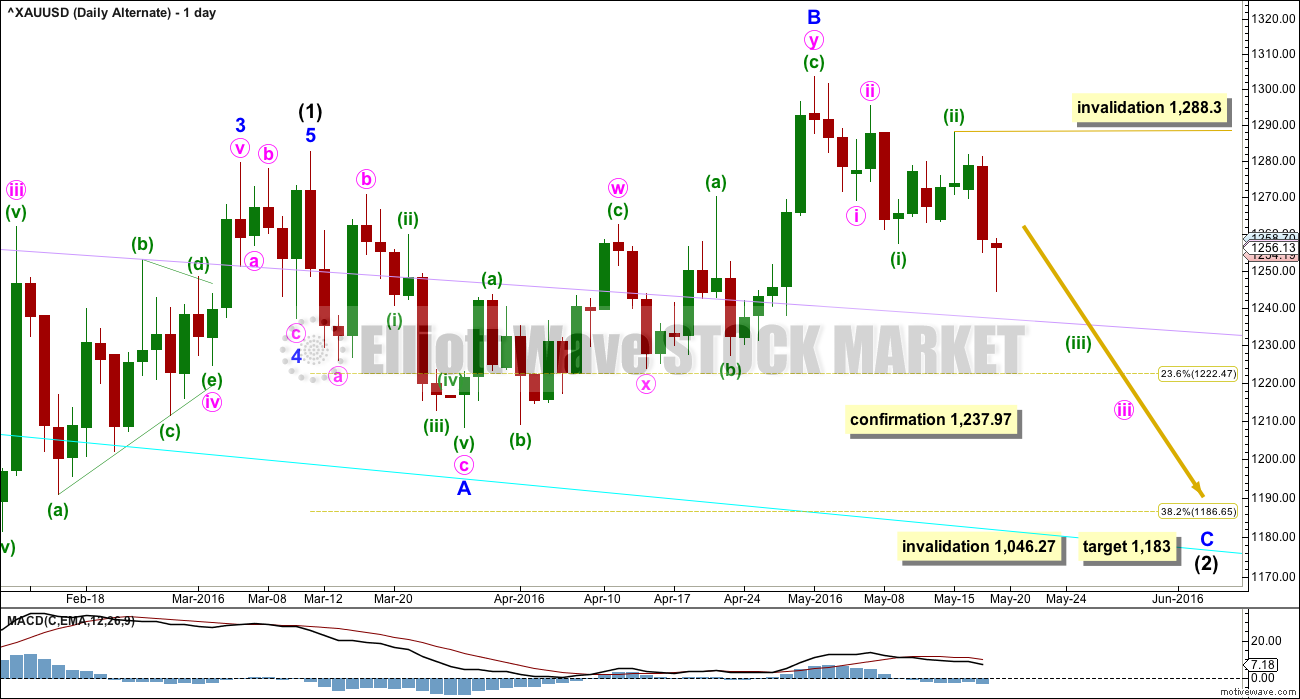

DAILY ELLIOTT WAVE COUNT

Intermediate wave (2) may be a shallow 0.19 double combination.

Minor wave W is a zigzag, the first structure in a double. The two structures in the double may be joined by a simple zigzag for minor wave X in the opposite direction.

Minor wave Y may be a running contracting triangle. The triangle is supported by MACD hovering at the zero line here on the daily chart.

The next wave up for intermediate wave (3) should be swift and strong. It must move above the end of intermediate wave (1) at 1,282.68. It must move far enough above this point to allow room for intermediate wave (4) to unfold and remain above intermediate wave (1) price territory.

At 1,477 it would reach equality in length with intermediate wave (1). This target is reasonable because intermediate wave (2) was very shallow.

If intermediate wave (2) is over as labelled, then it may have totalled a Fibonacci 34 sessions.

Minor wave 2 is a zigzag with a triangle for minute wave b within it. Minor wave 2 may be a very deep correction. So far it is 0.90 the depth of minor wave 1. Draw a small channel (pink) about minor wave 2 using Elliott’s technique for a correction as shown. Copy this over to the hourly chart.

Minute wave a lasted two sessions. Minute wave b triangle lasted nine sessions. Minute wave c may be complete also lasting two sessions. Minor wave 2 now totals a Fibonacci 13 sessions. It is very likely to be over here.

Minor wave 2 may not move beyond the start of minor wave 1 below 1.237.97.

Gold often begins new trends slowly. The beginning of intermediate wave (1) saw brief impulses and time consuming deep second wave corrections at minor, minute and minuette wave degrees.

Golds impulses, particularly its third waves, normally accelerate at the middle and explode in a blowoff at the end of the fifth wave.

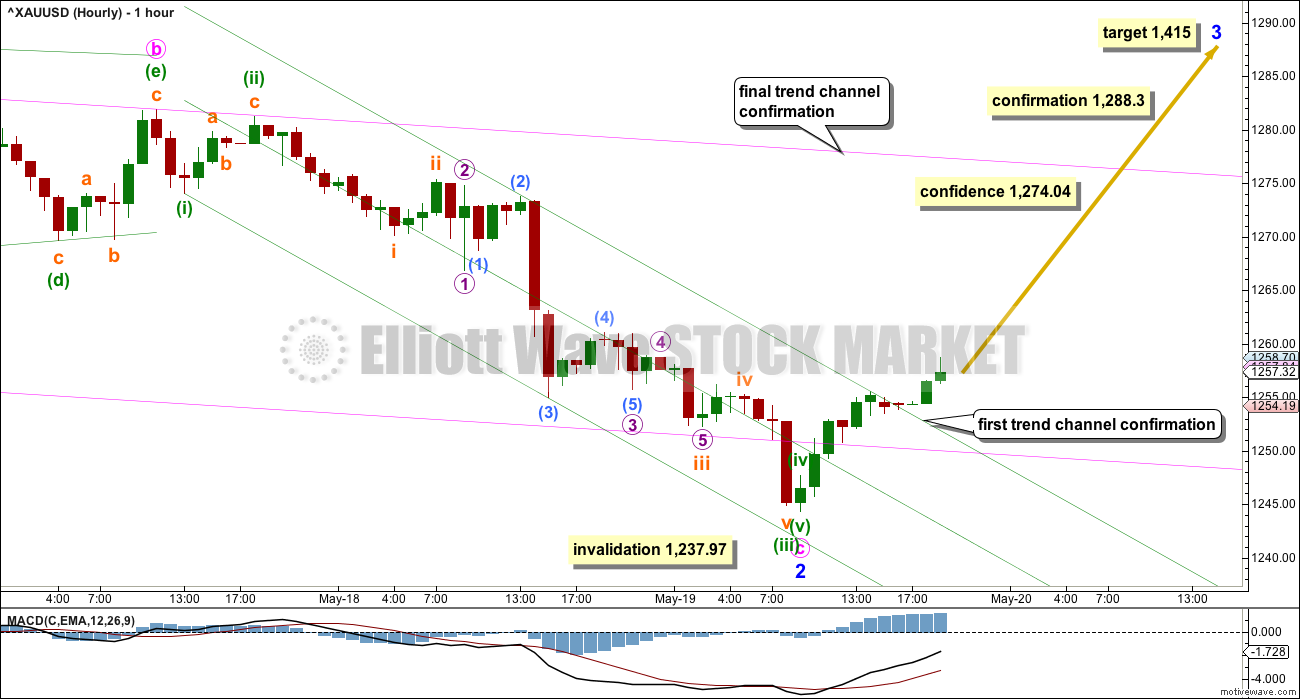

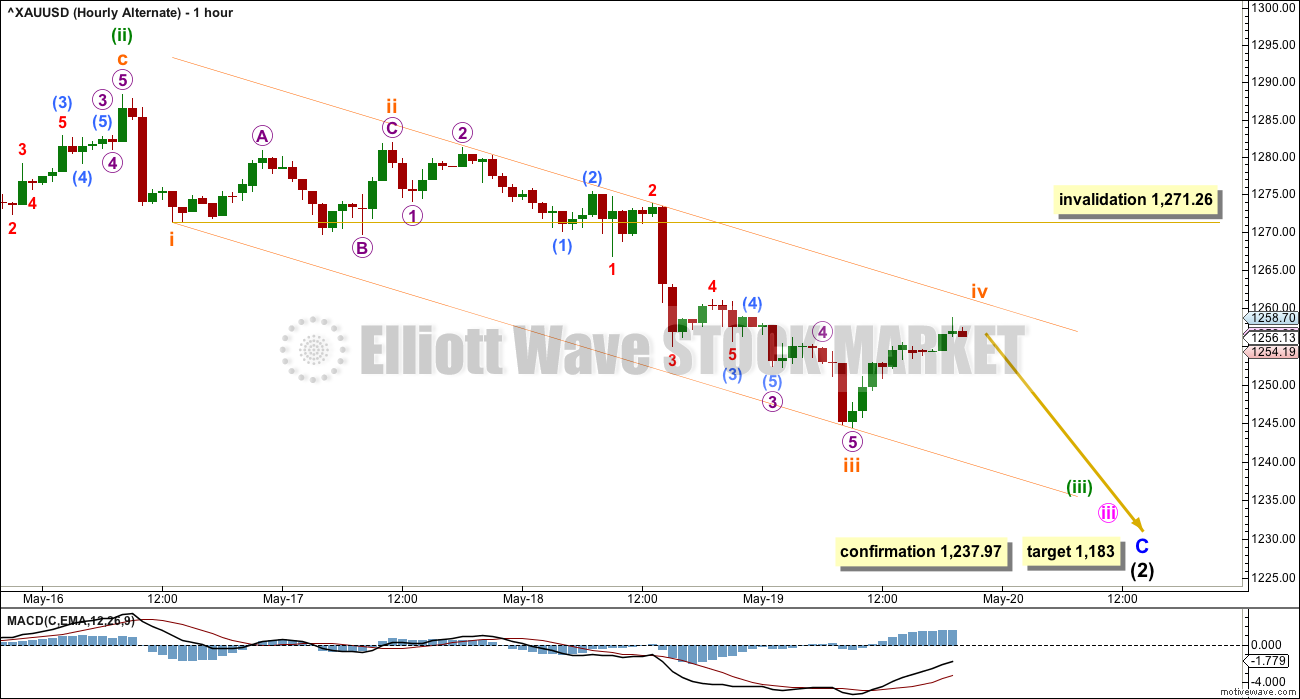

HOURLY ELLIOTT WAVE COUNT

The impulse downwards for minute wave c begins at the high 1,281.88 on 17th May.

The hourly chart shows all of minute wave c. It is possible to see this downwards movement as a complete impulse. With price now breaking above the best fit channel, which contains minute wave c, that is an indication that Gold may have just seen a trend change.

At 1,415 minor wave 3 would reach 1.618 the length of minor wave 1.

The next correction downwards may find support at the lower pink trend line now that price is back within the pink channel. Keep drawing this channel on daily and hourly charts as it may continue to be useful.

The invalidation point and risk must remain at 1,237.97 while there is no price confirmation that minor wave 2 is complete. If it continues any lower, it may not move beyond the start of minor wave 1.

A new high above 1,274.04 would add confidence to this main wave count and reduce the probability of the alternate.

A breach of the upper edge of the pink trend channel would add further confidence.

Finally, a new high above 1,288.30 would add final price confirmation for this wave count. At that stage, the alternate would be discarded.

Depending upon risk appetite, members may choose to enter long here or wait for one or more confirmation conditions to be met first. Risk today remains at 1,237.97. It is possible still that a final fifth wave down may be required to complete the impulse of minute wave c.

ALTERNATE DAILY ELLIOTT WAVE COUNT

It is still possible that intermediate wave (2) is not over. The probability of this wave count has slightly increased. It would be my judgement that this alternate has about a 30% probability and the main count about a 70% probability. The probability has reduced today because of structure and the dragonfly doji candlestick for this session.

Normally, the first large second wave correction within a new trend is very deep, often deeper than the 0.618 Fibonacci ratio. The main wave count sees intermediate wave (2) as very shallow at only 0.19 of intermediate wave (1). This is unusual. And so this alternate must be considered.

If any members have long positions on Gold already it is essential that stops are used in case this alternate unfolds.

Intermediate wave (2) may be an expanded flat correction. Minor wave A is a three, minor wave B is a three and a 1.28 length of minor wave A. This is within the normal range of 1 to 1.38.

At 1,183 minor wave C would reach 1.618 the length of minor wave A. This would be the most likely target. If price keeps falling through this first target, then the second target would be at 1,108 where minor wave C would reach 2.618 the length of minor wave A.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,046.27.

A new low below 1,237.97 by any amount at any time frame would immediately invalidate the main wave count and confirm this alternate. At that stage, more downwards movement would be expected.

There are two structural options for minor wave C: either an impulse or an ending diagonal. If minute wave c is an ending diagonal as yesterday’s alternate expected, then it would now be a contracting diagonal. It would not be able to move below the end of minor wave A; it would be enormously truncated. The probability of that is so low it must be discarded.

This alternate reverts again to looking at minor wave C as a simple impulse.

Within the impulse, minute waves i and ii would be complete. Minute wave iii may only subdivide as an impulse. Within minute wave iii, minuette waves (i) and (ii) would be complete. Minuette wave (iii) cannot be complete because it has not moved below and stayed below the end of minuette wave (i) price territory.

This change makes no difference today to the invalidation point. Within minuette wave (iii), no second wave correction may move beyond the start of minuette wave (i) above 1,288.30.

ALTERNATE HOURLY ELLIOTT WAVE COUNT

The impulse downwards for this alternate begins at a different point than the impulse downwards for the main wave count. Here, minuette wave (iii) begins at 1,288.30, the high of 16th May. This makes a difference to how the impulse is counted and how the channel about it is drawn.

So far within minuette wave (iii) the final fifth wave down only may be required to compete the structure. Gold often exhibits swift strong fifth waves to end its third wave impulses. That may happen here to the downside.

Draw a channel about minuette wave (iii) using Elliott’s first technique: draw the first trend line from the ends of subminuette waves i to iii, then place a parallel copy on the end of subminuette wave ii. Subminuette wave iv may end very soon, if it finds resistance at the upper edge of the channel.

Subminuette wave iv may not move into subminuette wave i price territory above 1,271.26.

If price breaks above the upper edge of the orange channel, then the probability of this alternate would be slightly reduced. However, sometimes fourth waves are not always nicely contained within channels which is why Elliott developed a second technique to redraw the channel when the first technique does not work.

If this channel holds, then subminuette wave v may end about the lower edge. If it does not, then subminuette wave v may overshoot the lower edge with very strong downwards movement.

TECHNICAL ANALYSIS

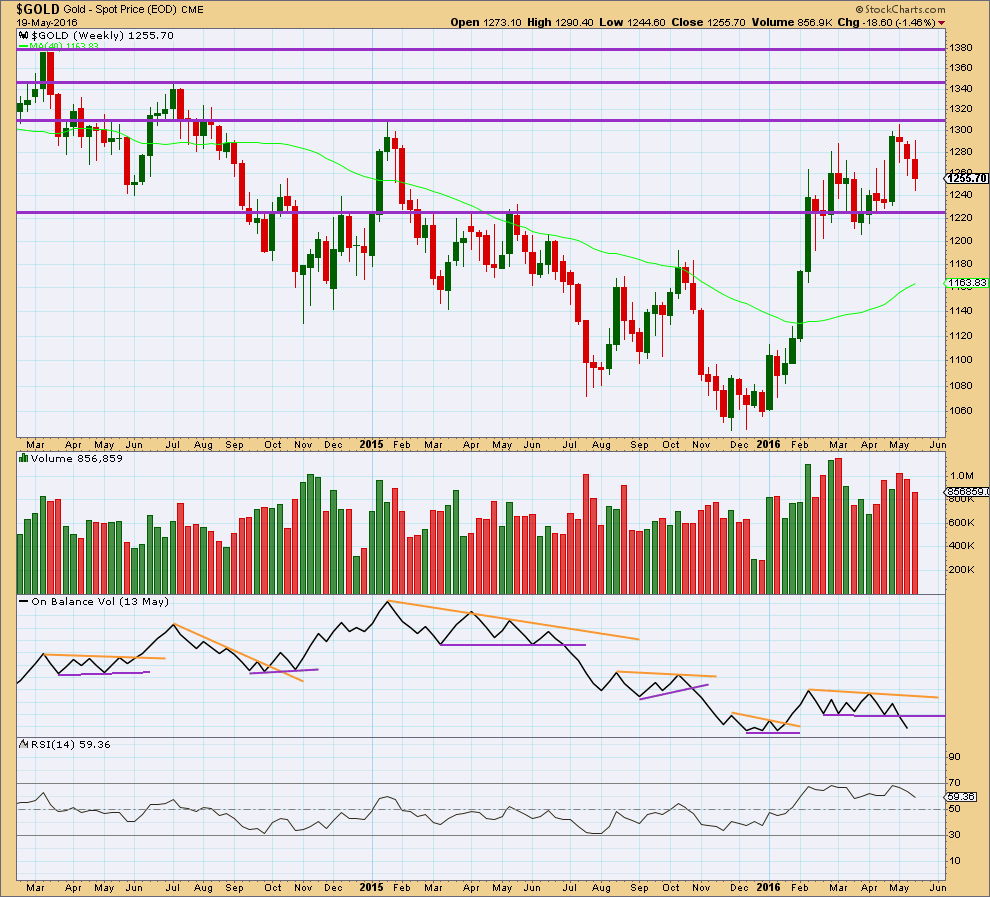

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is breaking below a reasonably long held and clearly defined consolidation zone. It would be entirely reasonable to expect price to follow by continuing lower for a few weeks. This piece of evidence strongly supports the alternate daily Elliott wave count.

Price has found resistance at the horizontal line about 1,310. The first support line may be about 1,225.

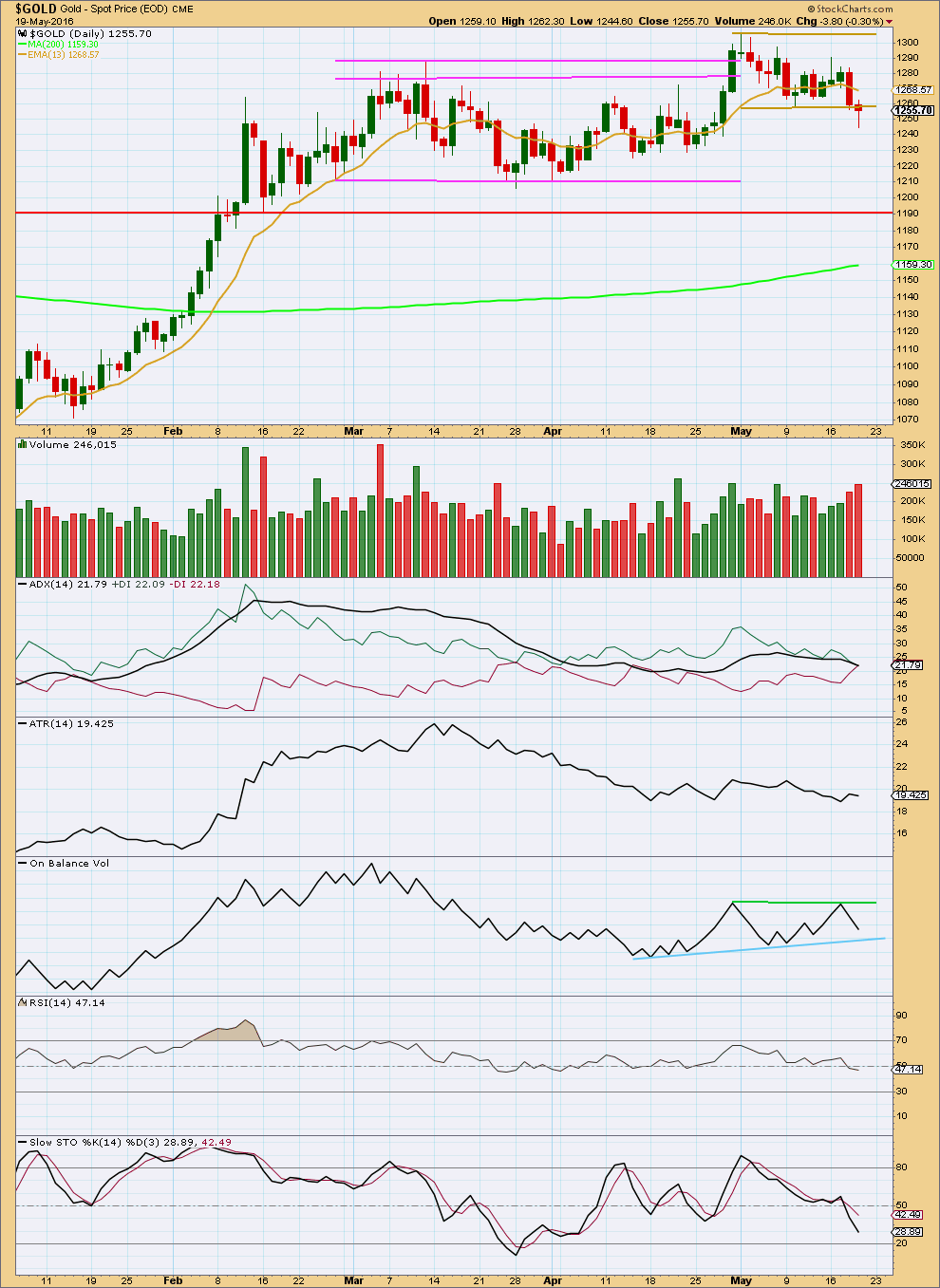

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The candlestick for today’s session completes as a hammer. From “Japanese Candlestick Charting Techniques” by Steve Nison, page 34:

“The hammer and hanging man may be recognised by three criteria:

1. The real body is at the upper end of the trading range. The colour of the real body is not important.

2. It has a long lower shadow that should be at least twice the height of the real body.

3. It should have no or a very short upper shadow”

and

“A hammer is valid even if it comes after a short-term decline, but a hanging man should emerge after an extended rally…”

This candlestick comes after a short decline and meets the criteria for a hammer. This is a reversal candlestick pattern. It is important to remember that a reversal does not mean a shift from down to up or vice versa. It means a trend change. That could be from down to sideways or up to sideways equally as well as a full reversal.

The hammer candlestick pattern today supports the main Elliott wave count. This is one reason why I have judged that wave count to have a higher probability today.

The breakout above resistance on high volume for 29th April now looks like it may have been a false breakout. Price today has returned to close comfortably back down in the prior consolidation zone, delineated by pink trend lines.

If it is accepted that the consolidation began in February, then the day with the strongest volume during this period is the downwards day of 4th March, suggesting a downwards breakout.

However, if it is accepted that the consolidation began after the high of 11th March, then the days with strongest volume are 29th April and 21st April, suggesting an upwards breakout.

It may be more helpful to break the consolidation into separate zones. A new consolidation may be forming delineated by brown lines. The lower edge will be left as it is today. If price moves up from here, then the hammer candlestick today may be an overshoot of the lower edge. The hammer suggests the lower edge is providing support. This smaller consolidation began from the high on 2nd May. So far within it the upwards day of 6th May still has strongest volume suggesting an upwards breakout.

ADX is slightly declining today and for several days has been flat to declining, so no clear trend is indicated. The +DX and -DX lines are touching today. ADX may be about to indicate a trend change but has not done so yet. ATR overall still agrees; it is still flat to declining.

On Balance Volume is constrained within two contracting lines. A break above the green line would be a bullish signal. A break below the blue line would be a bearish signal.

Both RSI and Stochastics are neutral. There is room for price to rise or fall. Downwards movement may be expected to continue within the consolidation until price reaches support (yet to be determined) and Stochastics reaches oversold at the same time.

There is no divergence between price and either of Stochastics or RSI to indicate weakness at this stage.

This analysis is published @ 09:24 p.m. EST.

The spike in NUGT very near to closing time on lower price is absurd. It smacks of manipulation, or some people buying in the hope of a surge in gold price prior to market opening on Monday.

The bullish after hours news on gold is that the trading volume is low.

http://stockcharts.com/h-sc/ui?s=%24gold

Lara – “How this sessions closes, it looks like a red candlestick, will help decide. Volume will be important. If we have heavy volume for a red day that will favour the alternate count.”

Yes, however, the weekly volume increased on another down week. OBV continues to decline and MACD is close to a bearish crossover. I think this still gives the edge to the Daily Alternate and the bears.

Good morning every body.

This slow sideways move fits the alternate better than the main wave count at this stage.

If the main count is right I’d have expected Gold to move up more strongly than this. This is anaemic, it looks corrective so far.

How this sessions closes, it looks like a red candlestick, will help decide. Volume will be important. If we have heavy volume for a red day that will favour the alternate count.

Bottom line now is we need Gold to break out of it’s range; above 1,288.30 now or below 1,237.97, to tell us which wave count is correct.

I’m sitting on hands waiting for clarity before I enter any position here.

So which is it? Long gold or short?

I’m on the fence, however I’d say some Long and some on the fence.

I have already made my position clear.

Not completely sure at this stage.

Any new probability predictions for the main vs the alternate? Last prediction was 70/30 main/alternate.

SMA/EMA crossover 5 minute time frame had NUGT as a Sell from 9:35 am until 12:25 pm when it became a Buy then at 2:55 pm NUGT became a Sell.

Gold at SMA/EMA crossover 5 minutes became a sell at 2:50 pm.

However gold and NUGT can turn fast at the end of the day, faster then that indicator turns.

Got a buy Signal on nugt in at 88.

Shanab great call as some of my indicators Fired Buy on NUGT at 3:20 pm and I was distracted and missed that. Good trade for you.

NUGT went from 86.86 to 89.54 by 3:39 pm up 2.68 in 19 minutes.

Will hold for a few days, trying a new system out

Shahab, I’m interested in how your new system turns out and also on which signal gave you the timely Buy this afternoon?

A brief assessment of Gold now that I just got from 2 top trusted Technical Analysts and gold traders that Gold is heading much higher by July.

However perhaps this weekend may be best left to the famous King Midas of Greek mythology and see if gives gold’s path the Midas touch, laden rich with gold.

I could be wrong but I am playing for the alternate count which appears to fit better with the price movement so far.

I bought NUGT at the gold low of 1248.85 and exited at 1253.63. It was a good trade while it lasted: 82.43 to 89.18. That was probably the third wave of micro 2 of subminuette 5 of minuette 3 of the alternate count.

The next high of the alternate count is around 1256 and it would drop thereafter. The main count would see gold price reach up to at least 1275 next. So, if price exceeds 1256, then I’ll be tempted to go with the main count, especially if it exceeds 1260.32, today’s high. Otherwise I’m off for the weekend (It’s a holiday weekend over here in Singapore).

Excellent tips Alan as usual. Enjoy your holiday weekend in Singapore.

Thanks Richard. You, too, have a great weekend.

At 1:58 am at 1252.31 are we now ending a 4th wave and starting a 5th wave up just now?

I didn’t see gold climbing and found it stuck in a tight channel today, so I’m wondering if you’re seeing it break up and out now? GDX/ NUGT has rebounded this afternoon but gold doesn’t appear to have a great deal of strength.

My accessment is the last 3 days really weakened gold enough to put Daily SMA/EMA from a bought and hold to a Sell. Weekly is weak but still a hold and Monthly is still a Buy for May when February was a buy but March and April were in consolidation limbo.

195 minutes is still in a decline but leveling off 78 minutes is almost level.

I think Gold had a two day hard crash but may of had a 1st big wave up since Thursdays low and today had a 2nd wave down and now gold is slowing turning up and like turning a Battleship it takes time.

I wouldn’t want to load up on a mining 3x ETF over the weekend, however likely next week more confidence and confirmation signals.

I made two NUGT trades this morning both profitable at lows

Bought $84.78 at 10:32 sold 86.50 at 11:11 am

Bought 82.92 at 11:58 sold 84.49 at 12:08 pm

Looking to do some more quick trades for profits in minutes.

Are we right now at the end of a C wave of an A-B-C wave down from 9:13 high?

I think the B wave may of ended at 11:12 am?

Have you seen Lara’s Silver post? Its calling for the lower target, minor wave not complete yet. Plus we’re heading into seasonal lows.

That was out Thursday real early morning and it almost high the low target Thursday and not as accurate as gold so it’s history to me.

I don’t have as much confidence in my Silver analysis as I do in Gold. Silver is much harder to analyse. The technical indicators, particularly volume, don’t work as well.

Lara, your analysis is as good as possible on Silver. It’s a beast to track as untamed with a “Fast and the Furious” behaviour.

The volume for DUST was incredibly high yesterday; 52 week high by far. Is this something that you can trust for a directional signal?

Dreamer – Nice work! Richard… as always, thanks for your posts!

Housing numbers released at 10:00 this morning were favorable potentially giving the Fed more data to help support their case to raise rates or at least providing more strength in the US dollar. http://www.bloomberg.com/markets/economic-calendar

GDX volume would be better as a guide

Any wave counts or comments?

Possible retrace targets todays high 1259.62 minus yesterdays low 1243.90.

.50 = 1251.76

.618 = 1249.91

High was at 1,260.32 at 9:13 am today so .618 Fib would be at 1,250.17 retrace.

Curious, have you any gold trades on at the moment?

This looks like more than an overshoot of the trendline. A break and back test of this trend line of the entire move up seems like it will have more follow through to the downside. This seems to support the Daily Alternate for gold. Chart by EagleSeagle.

Dreamer your Snakes and Ladders GDX bear chart may be manifesting.