Both hourly Elliott wave counts in yesterday’s analysis expected at least some upwards movement.

Price has moved higher as expected.

Summary: It looks likely today that a correction will continue lower to end about 1,291. This target may be met in about two days time. Thereafter, the upwards trend should resume to 1,582.

Trading Advice: Long positions if held may be underwater for a few days. Risk and stops should be set just below 1,249.94. If price does move lower to 1,291 or below, then enter long there or add to long positions there. Invest no more than 3-5% of equity on any one trade (if adding to longs, then invest no more than 5% in total for all long positions), and always use a stop loss. The trend is up, so stick with the trend. More experienced traders may like to hedge here with a short position, but be very careful indeed with a big third wave up waiting in the wings that stops are used and applied.

New updates to this analysis are in bold.

To see last weekly charts click here.

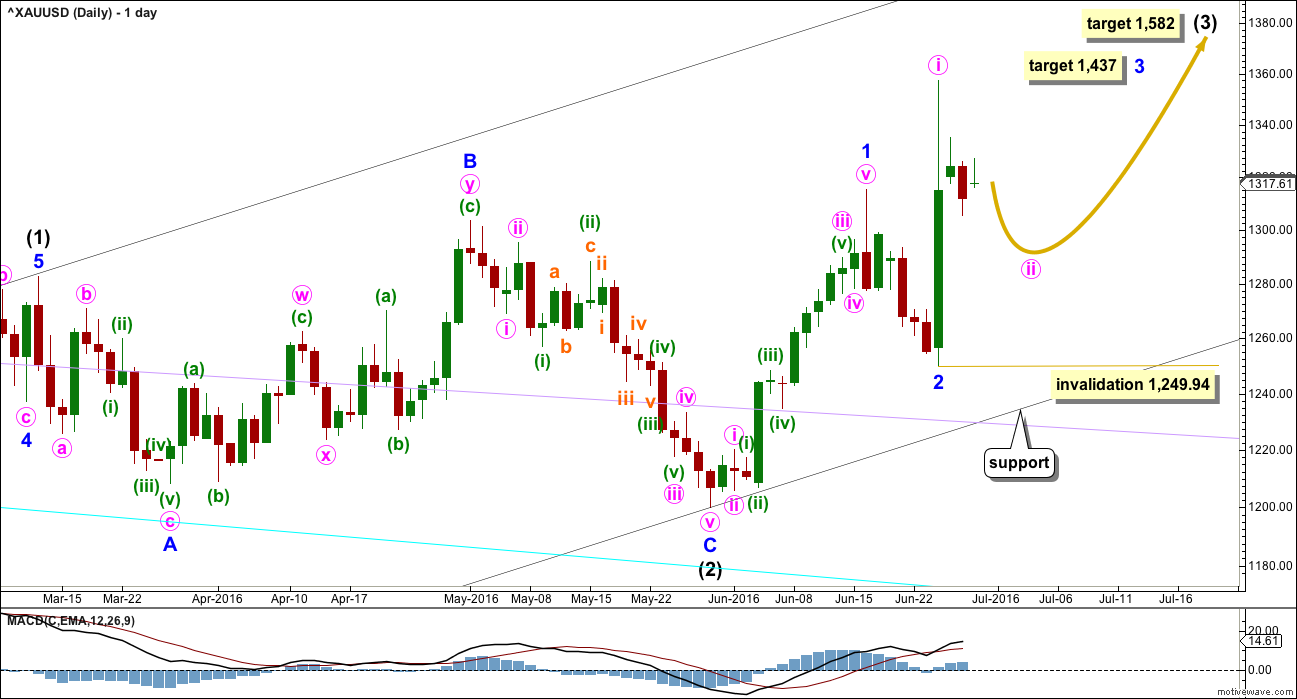

DAILY ELLIOTT WAVE COUNT

Intermediate wave (2) is a complete expanded flat correction. It is a shallow 0.350 correction of intermediate wave (1) lasting 56 days, just one more than a Fibonacci 55. There is no Fibonacci ratio between minor waves A and C. Minor wave C is a complete impulse.

I have looked back at the last two big cycle degree up movements within the last bull market: the first move from the low at 255.05 in April 2001, and the next move from the low at 682.75 in October 2008. Within the first move, the beginning series of corrections were 0.76, 0.6 and 0.96 in depth. Within the second move, the beginning series of corrections were 0.82, 0.68, 0.57 and 0.45. Early corrections within a new trend are most often deep.

Minor wave 2 may have been a quick, deep 0.57 zigzag over in just six sessions. If minor wave 3 has begun there, then at 1,437 it would reach 1.618 the length of minor wave 1.

Add a base channel (black lines) to intermediate waves (1) and (2). Draw the first trend line from the low at 1,046.27 on 3rd December, 2015, to the low labelled intermediate wave (2), then place a parallel copy on the high of intermediate wave (1). Along the way up, downwards corrections should find support at the lower edge of the base channel, if they get that low. At this stage, it looks like corrections are shallow and may not reach back down to the base channel.

Minute wave ii may not move beyond the start of minute wave i below 1,249.94.

At 1,582 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Prior analysis had an alternate wave count which looked at the possibility that minor wave 2 may not be over and may continue lower as an expanded flat correction. This is still possible, but the probability today is judged to be too low for publication. It will be followed and published again if it shows itself to be correct.

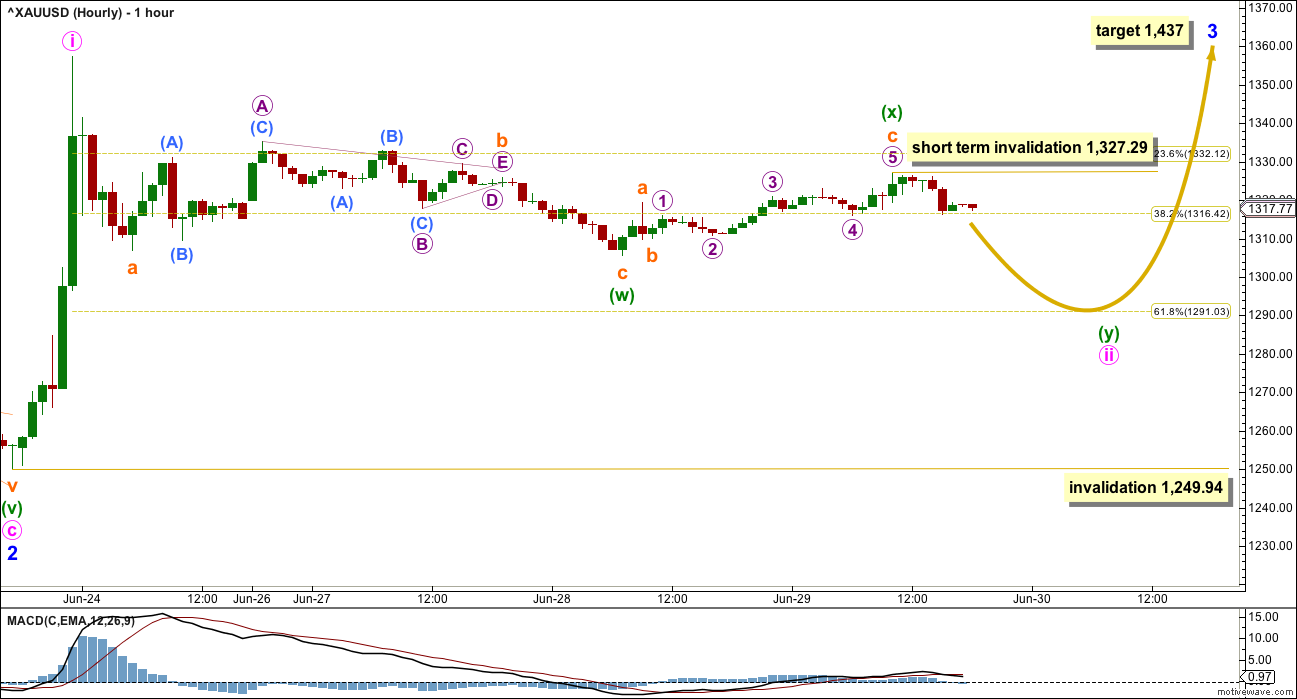

MAIN HOURLY ELLIOTT WAVE COUNT

At this stage, this wave count looks most likely of the three presented today. Minute wave ii may be an incomplete double zigzag. The first zigzag in the double was shallow, labelled minuette wave (w). The double is now joined by a three in the opposite direction, a zigzag labelled minuette wave (x) which is relatively shallow.

A second zigzag in the double may take price down to about the 0.618 Fibonacci ratio of minute wave i at 1,291.

Minute wave ii so far has lasted three days. If it continues for two more, it may complete in a total Fibonacci five days and would be a more typically deep second wave correction.

The structure of upwards movement labelled minuette wave (x) fits best as a single zigzag. This slightly increases the probability of this wave count today and is one reason for swapping the wave counts over.

Within minuette wave (y), as a zigzag, no second wave (nor B wave) may move beyond its start above 1,327.29.

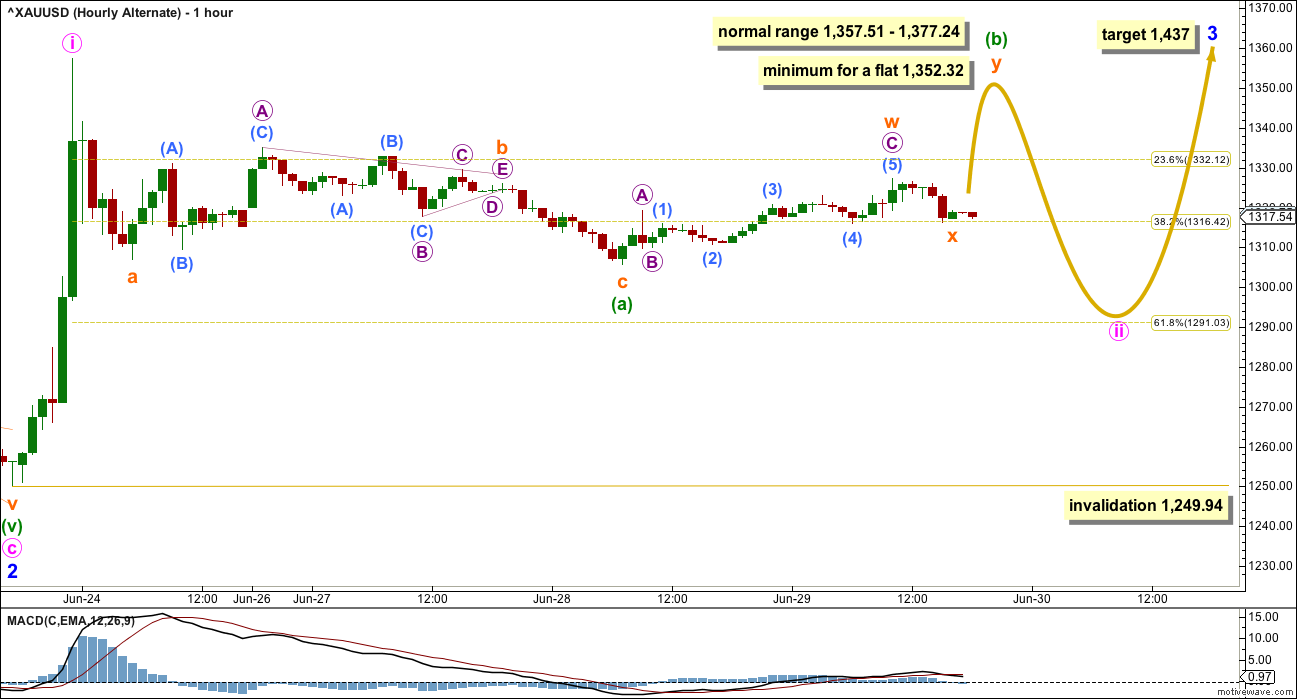

ALTERNATE HOURLY ELLIOTT WAVE COUNT

Minute wave ii may still be unfolding as a flat correction. This idea was presented yesterday in the same chart as a double zigzag but today it is time to separate the two ideas out.

If minute wave ii is unfolding as a flat correction, then within it minuette wave (a) is a completed three, a zigzag. Minuette wave (b) must subdivide as a three and must be a minimum 0.9 length of minuette wave (a) at 1,352.32.

Minuette wave (b) may be unfolding as a double zigzag.

The normal range for minuette wave (b) within a flat is 1 to 1.38 the length of minuette wave (a) giving a range of 1,357.51 to 1,377.24. A new high above 1,357.51 may still be part of minute wave ii as in an expanded flat, which are very common structures.

If a new high is seen, then careful attention to volume and RSI will indicate the probability of this wave count vs. the main hourly wave count.

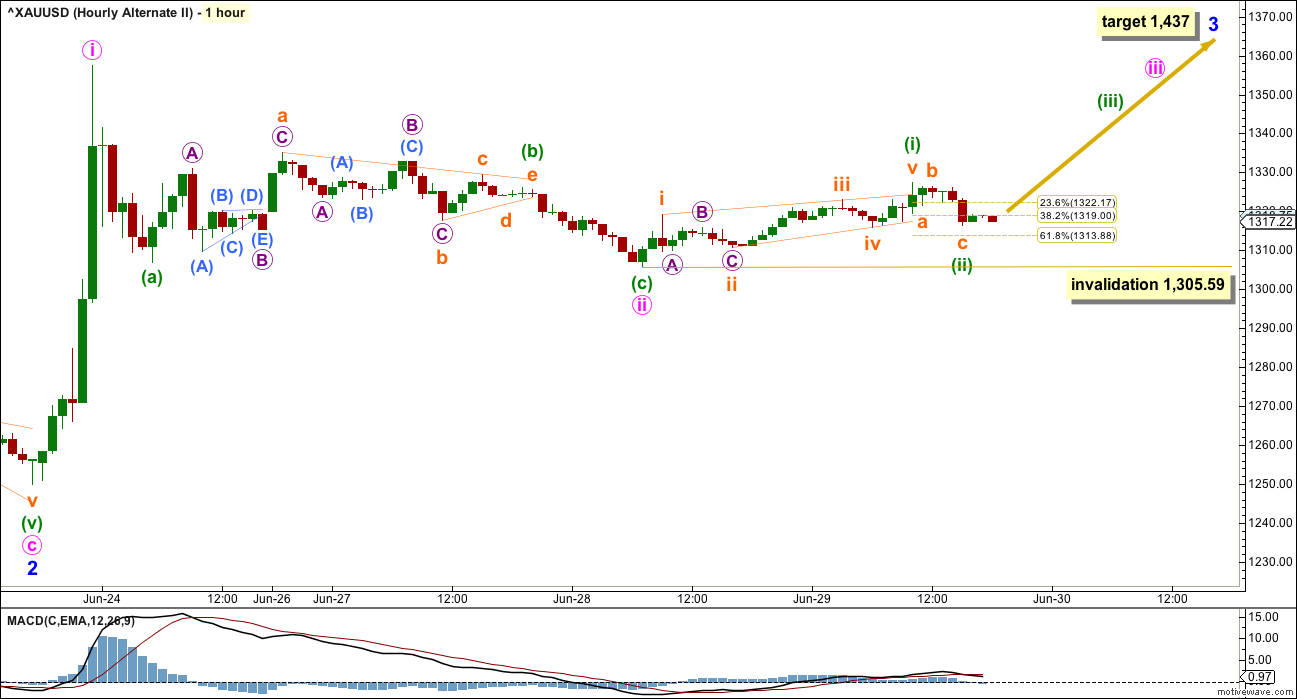

SECOND ALTERNATE HOURLY WAVE COUNT

This wave count today sees minute wave ii over as a complete zigzag ending just below the 0.382 Fibonacci ratio as a relatively shallow 0.48 correction.

If this is correct, then a third wave up may be underway. The target for minor wave 3 remains the same. At 1,437 minor wave 3 would reach 1.618 the length of minor wave 1.

If minute wave ii was very quick as labelled, then minute wave iv may be quicker still. A target is not given for minute wave iii because the following correction for minute wave iv may be too quick to show up on the daily chart.

Within minute wave iii, no second wave correction may move beyond the start of its first wave below 1,305.59.

I am concerned today with the subdivisions of minuette wave (i) as a leading contracting diagonal. This structure meets all Elliott wave rules, but for it to fit micro wave C within subminuette wave ii is truncated. This reduces the probability of this wave count to an alternate (along with a concern about volume).

When minor wave 3 is complete, then the invalidation point will move up to the high of minor wave 1 at 1,315.35. The following correction for minor wave 4 may not move back into minor wave 1 price territory.

TECHNICAL ANALYSIS

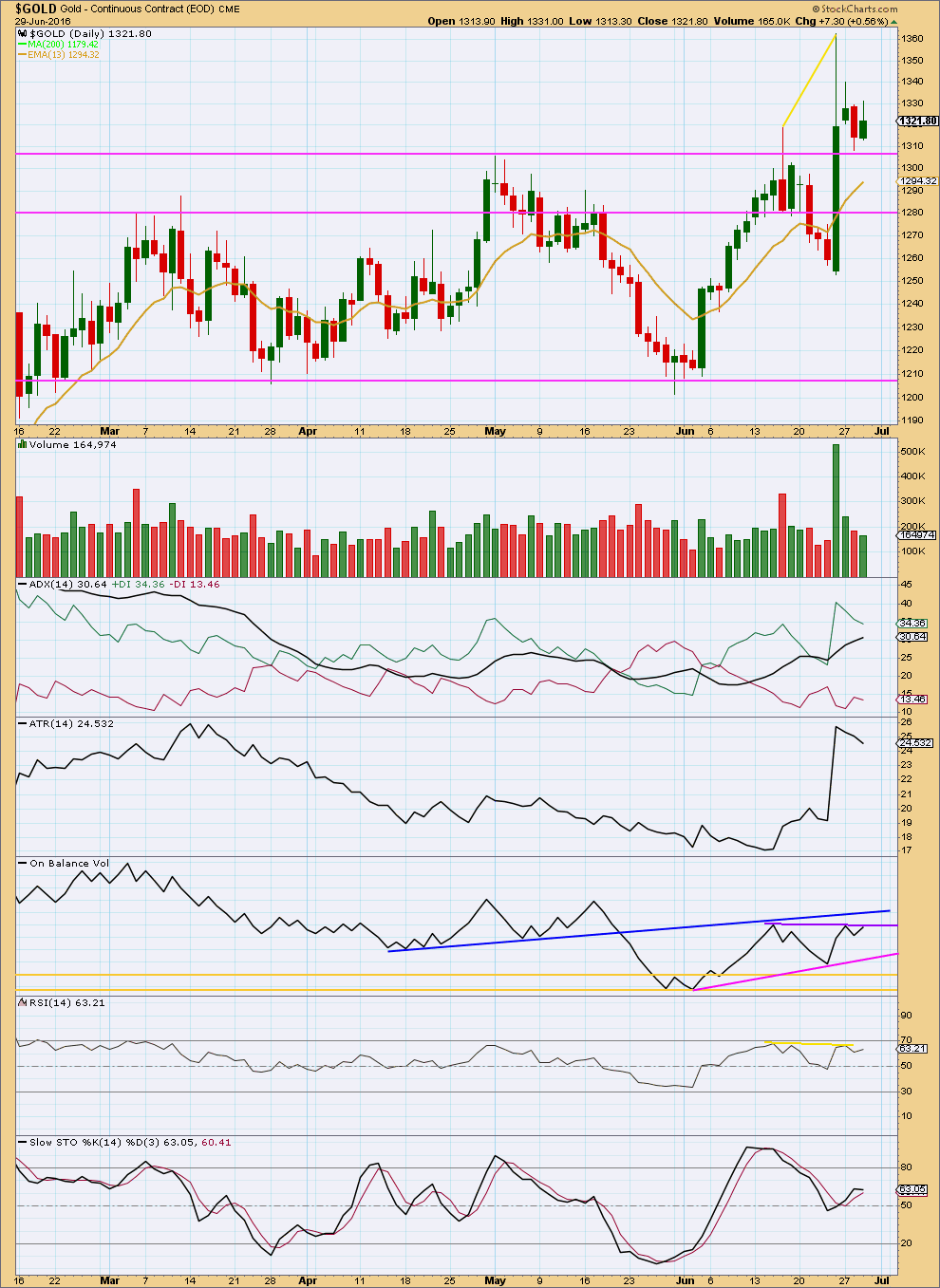

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Upwards movement today with a relatively small real body and lighter volume looks corrective. This looks like the correction has not ended.

The strong upwards day of 24th of June still looks like a classic breakout from a consolidation zone, and it is strongly supported by volume. Price broke above the horizontal trend line at 1,308 and then turned down to find support. Price may be coming back down to this area for a second test. On throwbacks price usually ends at a support / resistance line but not always. Price may move below 1,308 to back into the consolidation zone before the correction is over.

ADX remains clear. There is a trend and it is up. ATR today is clearer; it disagrees with ADX as it is declining. It looks like there is most likely an upwards trend and the last three days are a smaller counter trend movement.

If this market is trending as ADX suggests, then price may find support about the 13 day moving average. This is now at 1,294 which closely fits with the target for the Elliott wave count and the Fibonacci ratio of the last wave upwards.

A new trend line is added today to On Balance Volume. OBV has come up to test this purple line. This line does not have much technical significance, because it is not long held and has only been tested once before. But it may provide resistance. If it does, then OBV may move lower as price falls for at least a couple of days before OBV finds support at the pink line. But that line too does not have strong technical significance.

The lower limit for OBV is the lower yellow line. That should provide support, particularly if the larger picture for the Elliott wave count is correct and Gold is in an upwards trend.

RSI is not extreme. There is room for price to rise or fall. RSI and price showed bearish divergence (yellow lines) at the last high. Three days may or may not be enough to resolve that divergence, but it should be resolved soon.

Stochastics is relatively close to neutral. There is room for price to rise or fall.

This analysis is published @ 07:50 p.m. EST.

Updated hourly chart.

If this is correct (and remember, there are two alternates) then the second zigzag may have completed the B wave. At 1,288 C = 2.618 X A. This is the calculation I’m using because it’s close to the 0.618 Fibonacci ratio of minute i at 1,291.

Lara,

Silver has made a new high for the year, unlike gold. Some analysts use that non-confirmation as a signal, in this case a bearish one.

In your experience is such a signal reliable?

No.

Was today’s gold high of 1,323.09 at 11:22 am the top of the B wave of the A-B-C zizzag down from yesterday’s high toward’s the target of $1,291 for minuette wave (y) or do we still have the 5th wave up to complete today’s high?

I think so Richard. Let me finish my chart for you…

What is the current Elliott wave count?

Please advice.

Thank you

Lara,

When we are in a Minor 3 , usually Minute [ii]’s have shallow retraces to 38.2%-50% range? Also Minuette (ii)’s have shallow retraces as part of Minor 3’s.

Is it your experience in Gold?

Nope. That’s why I’ve gone back to the last big cycle degree bull market in Gold and published in the analysis above what the first series of retracements were.

“I have looked back at the last two big cycle degree up movements within the last bull market: the first move from the low at 255.05 in April 2001, and the next move from the low at 682.75 in October 2008. Within the first move, the beginning series of corrections were 0.76, 0.6 and 0.96 in depth. Within the second move, the beginning series of corrections were 0.82, 0.68, 0.57 and 0.45. Early corrections within a new trend are most often deep”

So conclusion: this is different this time.

Lara,

Is your second hourly alternate still valid with sub divisions, after todays action?

Thank you

Lara u ve mentioned that it may not be enough to resolve the divergence…

I just want to know how to see that..??

I ve understood that last high of gold price did not make a new high in RSI…but how to see that it got resolved..??

I’ve closed my small buy on Gold. I’m out, with an order to open another long at 1,271.

Lara, I think you meant, an order to open another long at the $1,291 target.

Thanks for your analysis, it is always very appreciated.

Interesting how powerful the 61.8% Fibonacci retracements is.

You had it on Friday’s analysis and it’s back.

.618 retrace of the Gold $110.19 spike from Friday’s low at 6:05 pm at $1,250.38 up to Friday’s high of $1,358.57 at 11:50 pm (the high since March 19, 2014) brings gold back down to your $1,291 target.

I just remembered the mid March 2014 high. I was still new to Lara, whom after I had read hundreds of articles on gold forecasting by other people but Lara’s was the best and she had introduced me to and hooked me on Elliott Wave for gold and I had bought some GDXJ and SIL the end of November 2013 and again some mid January 2014 and let them ride and gold rallied from the December 31st low up to the March 14th high, where it hit Lara’s exact target and I sold it all for a $23,000 profit on the two buys and one sell.

Nice one Richard! 🙂 🙂 🙂

Darn it, you’re right Richard. 1,291. Yep.