A new low below 1,334.06 invalidated the main Elliott wave count at the hourly chart level, indicating more downwards movement ahead.

Summary: Price should move a little lower to complete a five wave impulse. The short term target is at 1,315. If price breaks below 1,310, then a target for downwards movement to end is at 1,279. The longer term trend is still upwards. Corrections are an opportunity to join the trend.

New updates to this analysis are in bold.

Last weekly charts, and a more bearish weekly alternate, are here.

Grand SuperCycle analysis is here.

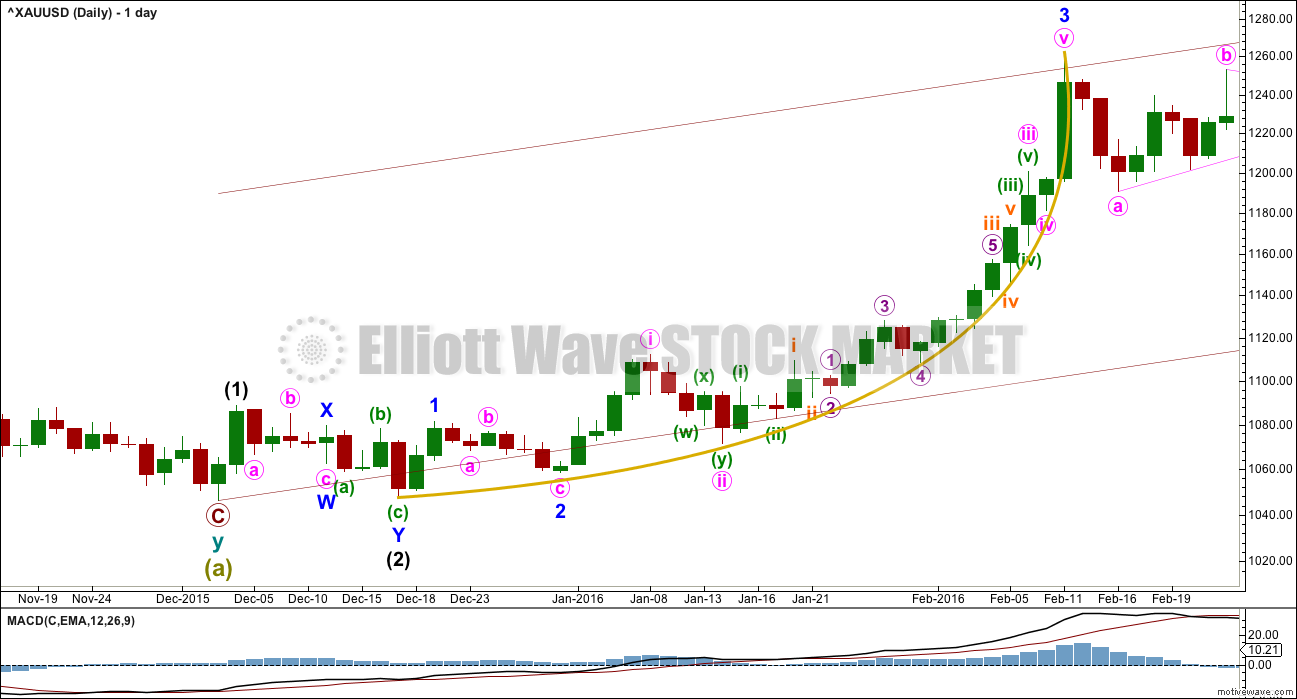

DAILY ELLIOTT WAVE COUNT

Primary wave 2 is a complete expanded flat correction. Price from the low labelled primary wave 2 has now moved too far upwards to be reasonably considered a continuation of primary wave 2. Primary wave 3 is very likely to have begun and would reach 1.618 the length of primary wave 1 at 1,582.

Primary wave 3 may only subdivide as an impulse.

So far intermediate waves (1) and (2) may be complete within primary wave 3. The middle of primary wave 3 may have begun and may also only subdivide as an impulse.

Within intermediate wave (3), the end of minor wave 1 is moved up to the last high. This fits on the hourly chart although it looks odd here on the daily chart. There was a small fourth wave correction up at the end of minor wave 1 and it subdivides on the hourly chart as an impulse. Minor wave 2 may be a complete zigzag, also subdividing as a zigzag on the hourly chart. If minor wave 2 is over, it would be 0.50 the depth of minor wave 1.

Minute wave ii is incomplete. It may be subdividing either as a double combination or double zigzag. Within the second structure in the double, labelled minuette wave (y), the structure is incomplete.

Minute wave ii may not move beyond the start of minute wave i below 1,310.84. This is the final risk to any long positions entered here or which members may still be holding. At this stage, I have chosen to close long positions, taking a little profit. I will wait for minute wave ii to be over before entering again.

At 1,437 intermediate wave (3) would reach 1.618 the length of intermediate wave (1). If price keeps going upwards through this first target, or if it gets there and the structure is incomplete, then the next target would be at 1,552 where intermediate wave (3) would reach 2.618 the length of intermediate wave (1).

A new high above 1,356.85 would invalidate the alternate wave count below and provide price confirmation of this main wave count.

Primary wave 1 lasted 14 weeks and primary wave 2 lasted 12 weeks. Primary wave 3 should be longer in both price and time as it should be extended. It may be about a Fibonacci 34 weeks. So far it has lasted eleven.

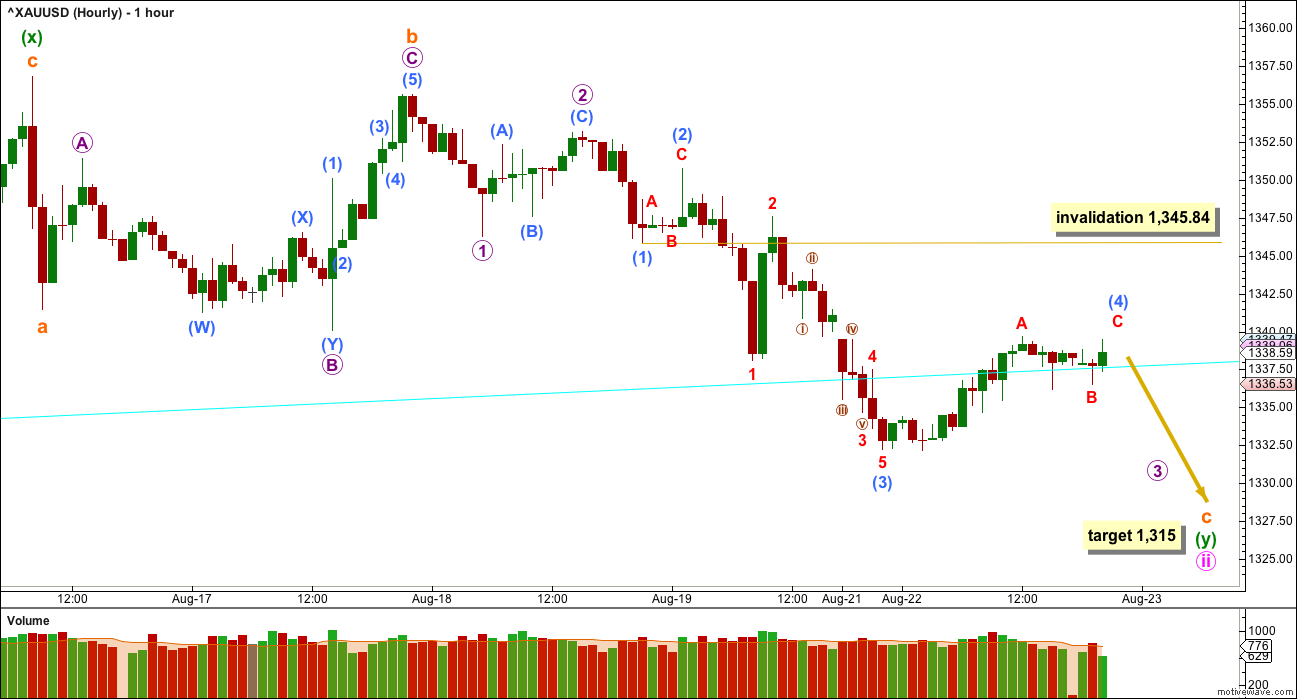

HOURLY ELLIOTT WAVE COUNT

Minute wave ii fits as either a double combination or a double zigzag. The first structure in the double (seen on the daily chart) fits as a zigzag labelled minuette wave (w). The double is joined by a three in the opposite direction labelled minuette wave (x), which fits perfectly as a zigzag.

The second structure in this double may be either a zigzag or a flat correction. Subminuette wave a may be seen on the five minute chart as either a three (a quick zigzag) or a five.

At 1,315 subminuette wave c would reach 2.618 the length of subminuette wave a. Subminuette wave c must subdivide as a five wave structure. It is not a diagonal. It is unfolding as a more common impulse. Within subminuette wave c, the structure looks to be incomplete.

If this wave count is invalidated short term with a new high above 1,345.84, then my labelling of subminuette wave c as incomplete would be wrong. Invalidation of this hourly wave count by upwards movement would indicate that minute wave ii is over and a third wave up should then be underway.

THIRD WAVE EXAMPLE – DAILY CHART

In discussing the curved look to Gold’s impulses, particularly for its third waves, here is an example.

Within primary wave 1, the third wave of minor wave 3 had a strong curved look to it. The impulse begins more slowly and has deep and relatively time consuming second wave corrections: Minor wave 2 was 0.68 of minor wave 1, minute wave ii was 0.76 of minute wave i, minuette wave (ii) was 0.56 of minuette wave (i), and subminuette wave ii was 0.64 of subminuette wave i.

The curved look comes from the disproportion between second and fourth wave corrections within the impulse. Here, minute wave ii lasted 4 days and shows clearly on the daily chart yet minute wave iv was over within one day and does not show up with any red candlesticks or doji on the daily chart.

Momentum builds towards the middle of the impulse, continuing to build further during the fifth wave and ending in a blowoff top. This is typical of Gold and all commodities.

This tendency to blowoff tops and curved impulses is particularly prevalent for Gold’s third waves.

Notice also how this third wave began with a series of overlapping first and second waves. When third waves extend, which is very common, this is very often how they begin. When that happens, they convince us the market will not move strongly and the wave count must be wrong, and they do that right before the trend moves clearly with increasing momentum and volume.

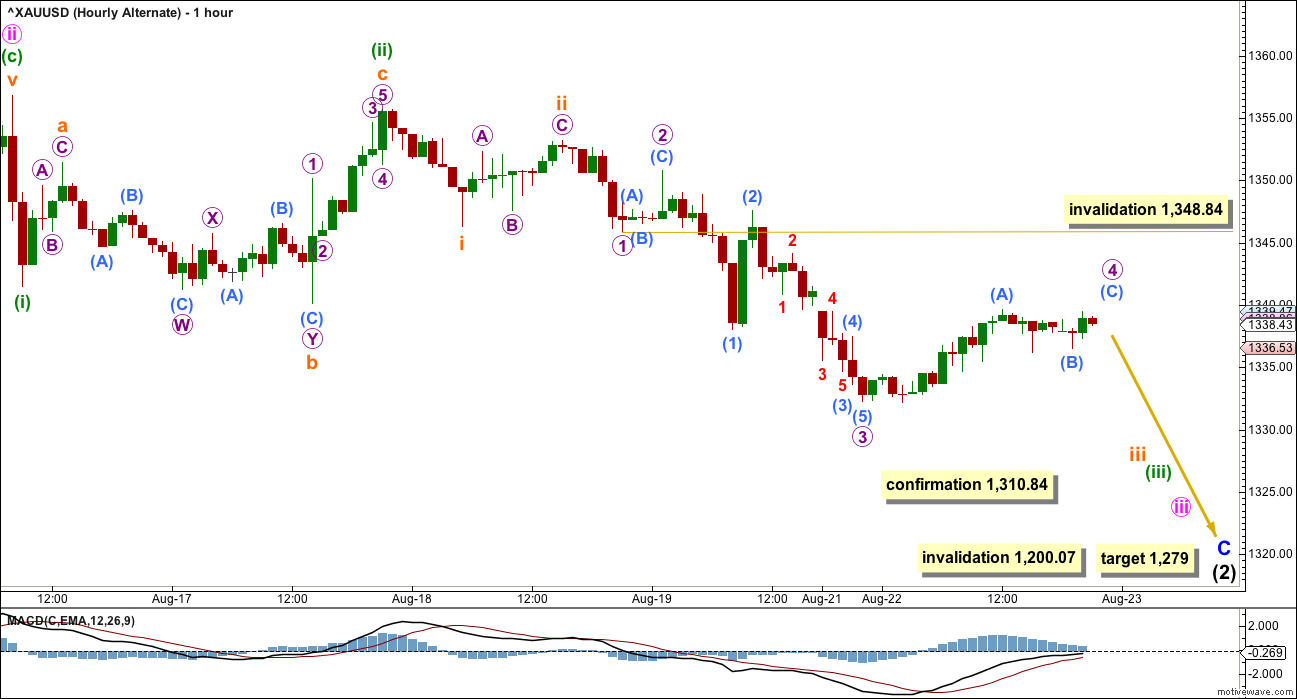

ALTERNATE DAILY ELLIOTT WAVE COUNT

This wave count is identical to the main wave count up to the end of primary wave 2. Thereafter, what if only intermediate wave (1) ended at the last high?

This movement will fit as a five wave impulse, although it does not have a very good look on the daily chart. This reduces the probability of this wave count.

If intermediate wave (1) was over at the last high, then it may have lasted 27 days. So far intermediate wave (2) may have taken 33 days and would still be incomplete. However, the hesitancy with the last four days of overall sideways movement does not look like a third wave down at minute degree. For this reason this alternate still is judged to have a lower probability than the main wave count today.

Within minute wave iii, no second wave correction may move beyond the start of its first wave above 1,356.85.

At 1,279 minor wave C would reach 1.618 the length of minor wave A. Price may end downwards movement when it finds support at the lower edge of the maroon base channel drawn about primary waves 1 and 2.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) below 1,200.07.

ALTERNATE HOURLY ELLIOTT WAVE COUNT

In order to make a reasonable judgement of each Elliott wave count, it is important to see how each wave count sees recent structure at the hourly chart level.

Within minuette wave (iii), the structure looks to be incomplete. This part of downwards movement is essentially seen in the same way for both wave counts, only the degree of labelling differs. Both see an impulse unfolding lower.

Minor wave C must subdivide as a five wave structure. If price makes a new low below 1,334.06, then the probability of this alternate would increase. It would be confirmed with a new low below 1,310.84.

If price moves below 1,310.84, then expect more downwards movement for a deeper pullback to end about 1,279. Look also for price to find support at the maroon channel on the daily chart. The target at 1,279 may be a little too low; the maroon trend line may stop price before it reaches the target.

TECHNICAL ANALYSIS

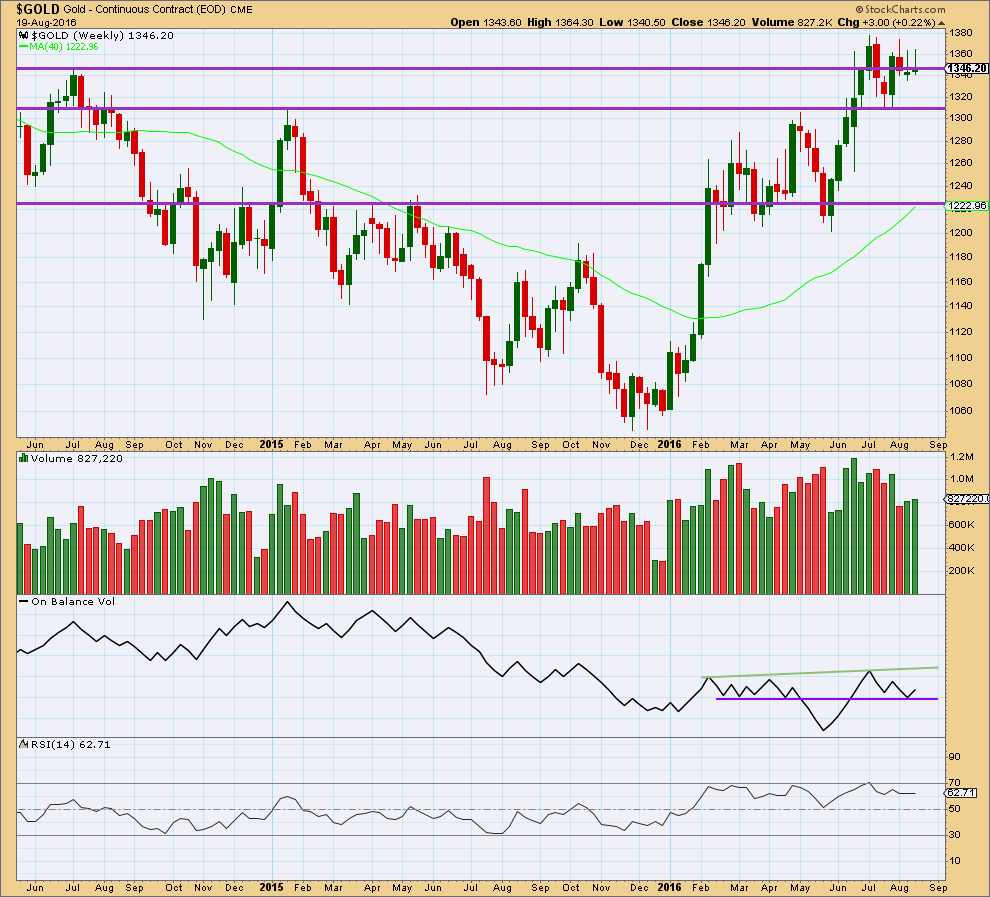

WEEKLY CHART

Two green weekly candlesticks in a row come now with a small rise in volume. Volume for both weeks is stronger than the prior downwards week. Short term, at the weekly chart level, the volume profile looks bullish.

Last week completes a weekly candlestick with a higher high and a higher low than the week before. Overall, price has moved upwards last week.

It is concerning for the main wave count that both of these last two weeks have long upper wicks on the candlesticks. These wicks are bearish and indicate caution. For this reason please manage risk carefully. The alternate wave count is possible and illustrates the risk currently to long positions.

On Balance Volume last week has moved up from the lower purple trend line. This is a reasonable bullish signal week.

RSI is still not extreme. There is room for price to rise.

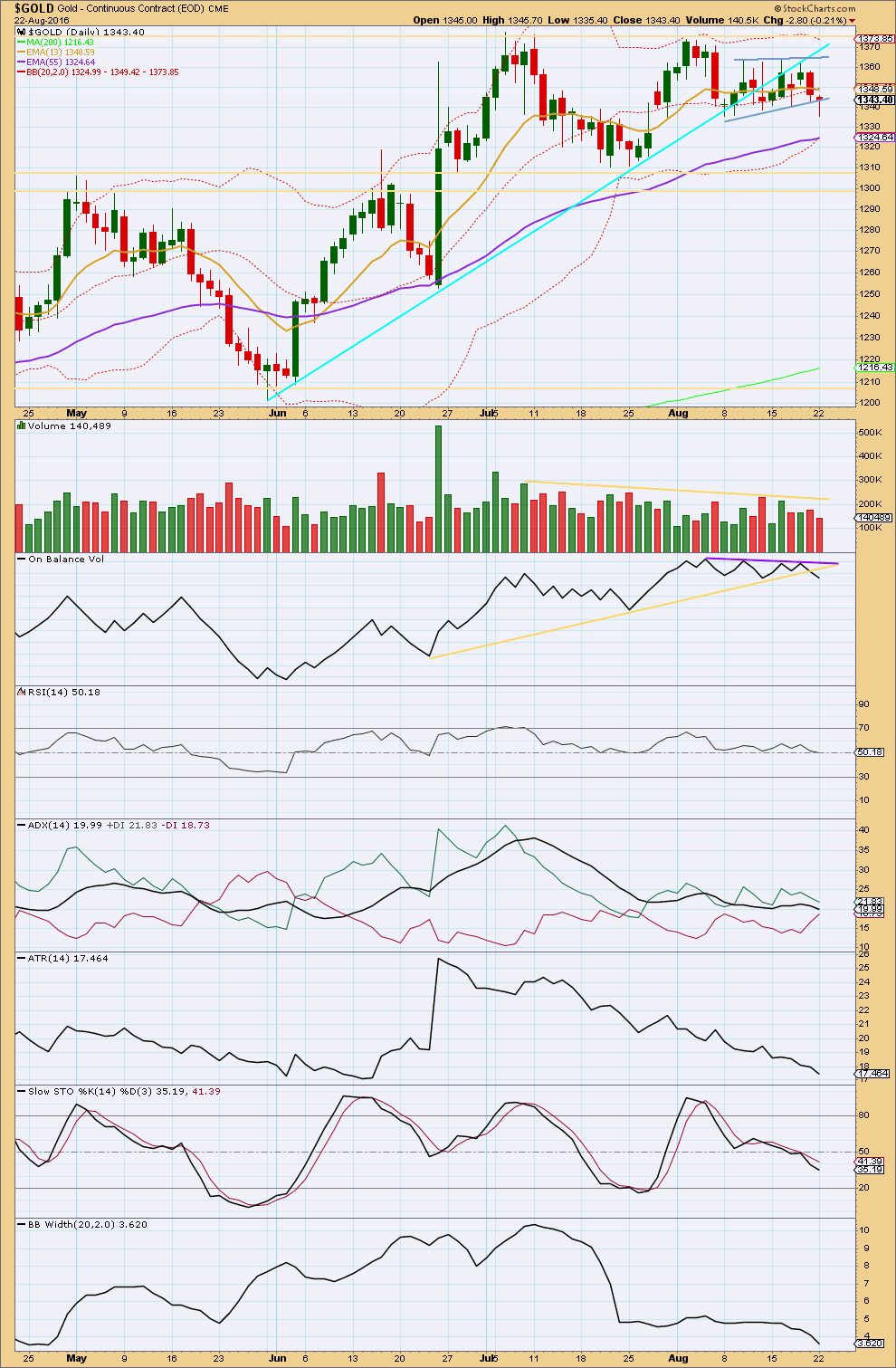

DAILY CHART

Monday’s candlestick has printed red. Overall, price moved lower and comes with lighter volume. The fall in price was not supported by volume, so it is suspicious.

The long lower wick on Monday’s candlestick is bullish, along with light volume. If the main Elliott wave count is wrong, it would be in expecting a little more downwards movement that may not arrive.

On Balance Volume is giving a strong bearish signal with a break below the yellow support line.

Price is still range bound with resistance about 1,375 and support about 1,310 – 1,305. A breakout above or below this range on a day with increased volume is required for confidence in a returning trend and price direction. If this consolidation continues for a few more days, it should find support about the 55 day moving average.

RSI is neutral. There is plenty of room for price to rise or fall.

ADX is declining, indicating the market is consolidating and not trending. ADX has not indicated a trend change from up to down: the +DX line so far remains above the -DX line. ATR agrees as it too is declining. Bollinger Bands further contracted today.

A continuation of a downwards swing may be expected until price finds support and Stochastics reaches oversold at the same time.

This analysis is published @ 09:56 p.m. EST.

The wave count remains valid, but I’m concerned that submicro (4) is so long in duration.

It looks like now price is starting to move lower for submicro (5).

I’ll be spending some more time on the five minute chart to see if my labelling of submicro (3) is right… or wrong.

It would look better if micro 3 and 4 were complete, and a final low for micro 5 would complete the whole structure.

Short term still a new high above 1,345.84 would indicate my labelling of subminuette c is wrong, and it was over. A new high above 1,345.84 would be a strong indication that price should keep going up with increasing momentum and volume for a third wave. Finally.

Good Morning Lara and other traders,

has anybody an update on Oil, was this just a mini correction to go further North to the >50 targets?

Thanks for any updates

Ursula

I will be updating Oil later today (my time). And Silver too if I can manage it today.

Is the micro 3 completed of the first hourly wave count?

How long the subminuette wave c will complete?

Inverse relationship between gold, stocks has never been this extreme

Aug 23, 2016 3:05 p.m. ET

http://www.marketwatch.com/story/inverse-relationship-between-gold-stocks-has-never-been-this-extreme-2016-08-23?mod=MW_story_latest_news

But low bond yields could provide a lift for both, analyst says

Hello Gold,

What is the current Elliott wave count?

Thank you very much!

Pete, I normally jump in early my morning, in the NY afternoon.

Please could you cease asking for an update. It will happen. You don’t need to be asking regularly.

And a final addition to this comment, this is a once a day analysis service. That’s what the subscription gets you. That, and access to the membership forum to engage with experienced professionals.

It is not an intraday service.

Although I almost always do provide a comment or update just before the NY close, that is not actually a part of the subscription.

Hello Lara,

Thank you so much!

I truly appreciate your valuable comments and your updates just before NY close.

Yes. I ask simple question regarding the wave count, as simple as I can ask.

I am experienced professional and value any note.

I read all the posts everyday and every time, and am not a day trader.

Elliott is brand new for me.

I engage in harmonic trading, I use Gann and Pitchforks.

Please excuse me for my simplicity.

No worries Pete.

It’s all good.

Today was a sell bullish positions at the open or at the 9:59 am high.

This is still the most bullish GDX count, but I think its probability has been reduced some by the recent breach of the channel.

There are other counts that we can use that are still bullish in the intermediate term if this count gets invalidated with a move below 27.45

Thx. for the EW chart update. Awesome!!

Thank you very much Dreamer for keeping us all updated with your GDX counts!

Love your work 🙂

Thanks Lara and weiquan for your support!

GDX move down is on lower volume, but other technicals suggest more down at least in the near term

GDX likely continues down to the 28 range

Dreamer, thanks for the chart update. I really appreciate it. 🙂 Have a good night!!

Yep. A several months old channel decisively broken…more downside ahead….

Avi Gilburt EW – August 18, 2016

Which Way Do Interest Rates Have To Go For Gold To Rally?

http://seekingalpha.com/article/4000556-way-interest-rates-go-gold-rally

Avi Gilburt Thursday am – As long as the GDX maintains over the 28.50-29 level, we are setting up to run to the 39-41 region, which can even be struck within the next month should this bullish set up trigger over the coming week or so.