Upwards movement was expected for Monday’s session, which is what has happened.

Summary: Price needs to break out of the best fit channel on the hourly chart before confidence may be had that a low is in place. Risk remains at 1,302.93 while price remains within the channel. The mid term target remains the same at 1,585. If price breaks above the channel, then expect upwards movement to gather momentum.

New updates to this analysis are in bold.

Last weekly charts are here.

Grand SuperCycle analysis is here.

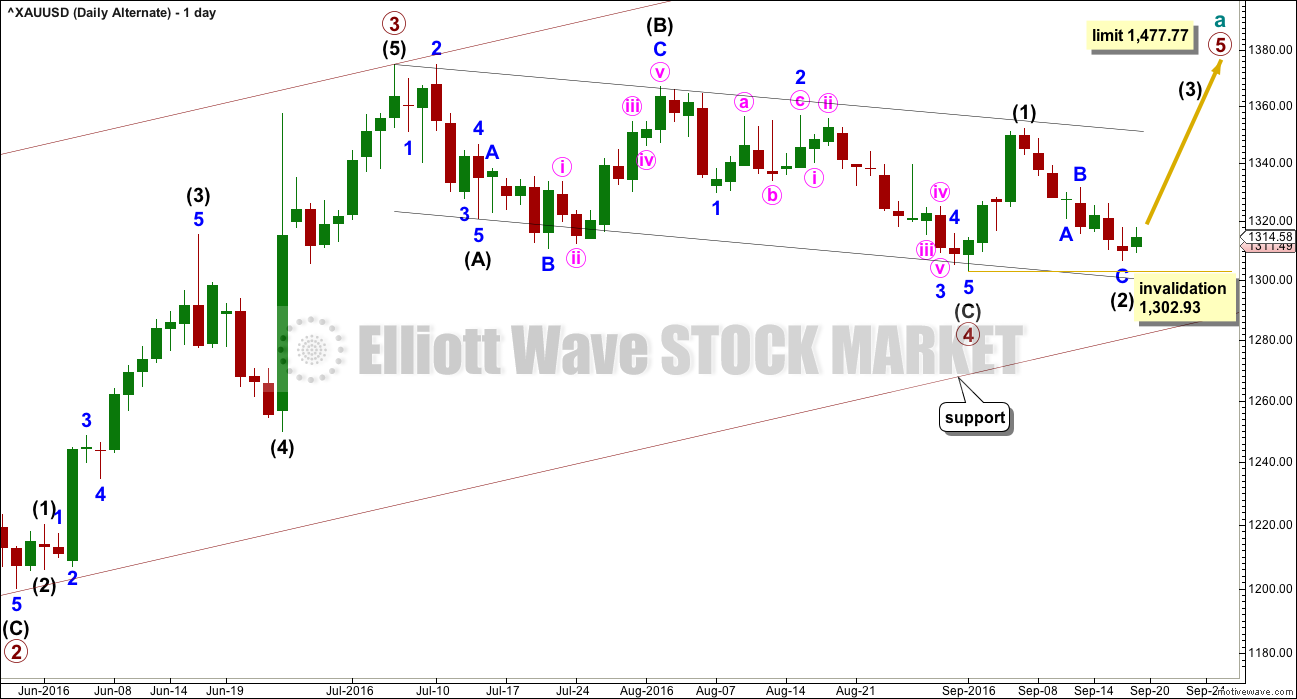

DAILY ELLIOTT WAVE COUNT

Primary waves 1 and 2 are complete. Thereafter, this wave count differs from the alternate.

This main wave count will expect primary wave 3 to be longer than primary wave 1. Because this is very common, this is the main wave count. It expects the most common scenario is most likely. At 1,585 intermediate wave (3) would reach 1.618 the length of intermediate wave (1).

Intermediate wave (2) may now be complete ending just below the 0.382 Fibonacci ratio of intermediate wave (1) and lasting 40 days. Within intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 1,302.93.

Draw a channel about intermediate wave (2) using Elliott’s technique for a correction (blue lines). Price is finding some resistance on the way up about the upper edge. After breaking through resistance at the upper blue line price may then turn down to find support about there.

With this wave count expecting a third wave at two large degrees to begin, look out for surprises to the upside at this stage.

Intermediate wave (1) lasted 27 days and intermediate wave (2) lasted 40 days. Intermediate wave (3) may be reasonably expected to last longer than intermediate wave (1) in both time and price. A Fibonacci 55 days would be a first expectation. Intermediate wave (3) may end with a blowoff top.

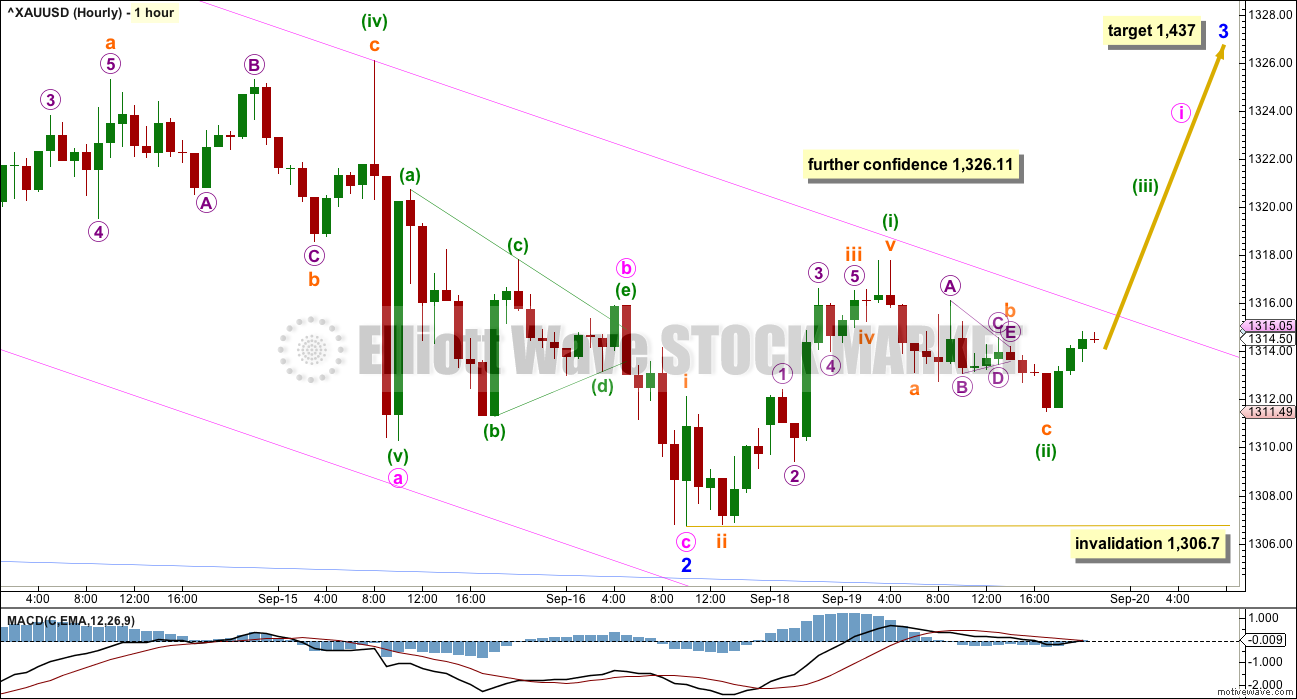

FIRST HOURLY ELLIOTT WAVE COUNT

This wave count was the second wave count for last analysis. A new high above 1,311.27 has given a little confidence to this wave count.

Minute wave c may have ended at Friday’s low.

Minute wave c would be just 0.67 short of 0.236 the length of minute wave a.

Ratios within minute wave a are: minuette wave (iii) is 0.54 longer than 6.854 the length of minuette wave (i), and minuette wave (v) has no Fibonacci ratio to either of minuette waves (i) or (iii).

Ratios within minuette wave (iii) are: there is no Fibonacci ratio between subminuette waves iii and i, and subminuette wave v is 1.34 short of 0.618 the length of subminuette wave iii.

The Fibonacci ratios for this wave count are slightly better than the alternate wave count below.

Problems:

1. The triangle of minute wave b looks a little forced. Also, it is not supported by MACD hovering at zero while it unfolded. This is a judgement based upon experience; no guidelines are breached nor rules broken.

2. Minute wave c looks like a three wave structure when it should be a five.

Further confidence may be had with a breach of the upper edge of the best fit channel (in pink). Further confidence may be had in a trend change if price makes a new high above 1,326.11.

So far there may be a five wave structure upwards for the start of minor wave 3. This is labelled at minuette degree. Minuette wave (ii) may be complete as a relatively deep 0.57 zigzag. It may also continue further as a double zigzag, double combination or flat correction. It may not move beyond the start of minuette wave (i) below 1,306.70.

At this stage, price remains contained within the best fit channel. A breach of this channel is required before reasonable confidence may be had in this wave count.

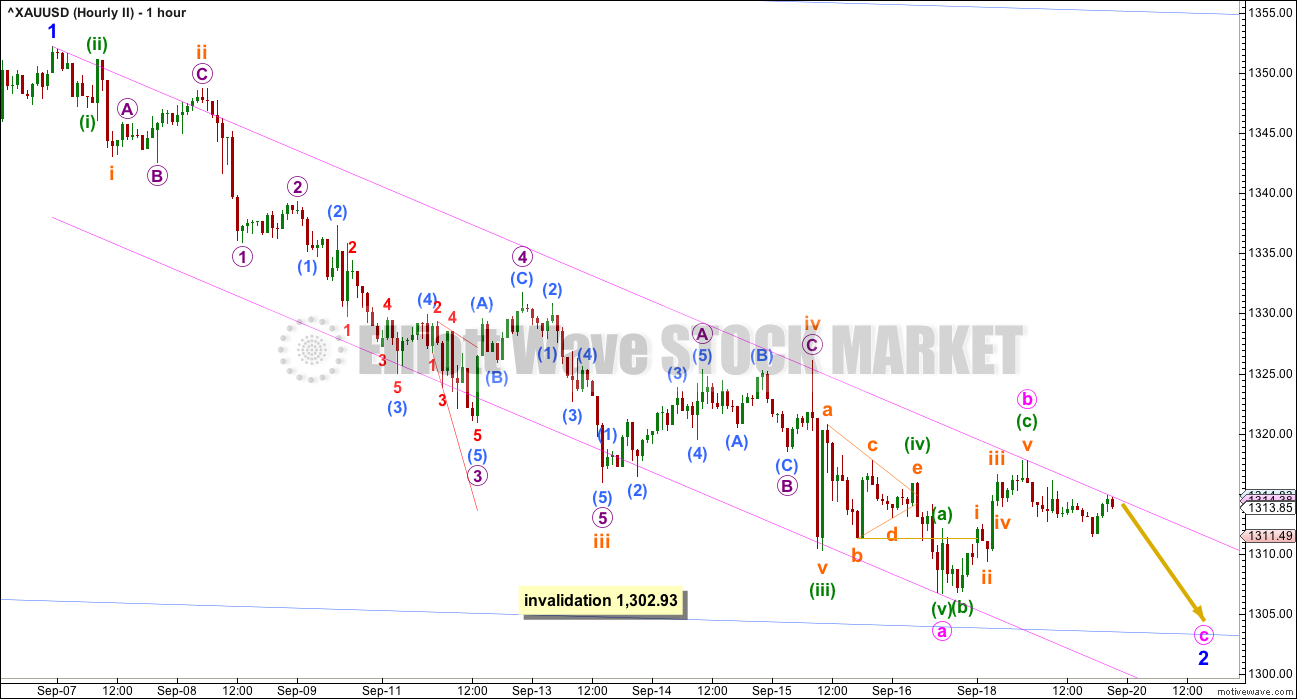

ALTERNATE HOURLY ELLIOTT WAVE COUNT

This alternate wave count looks at the possibility that minor wave 2 is still not over and may yet have one more low before it is done. If it does move lower, then it should find strong support at the lower edge of the dark blue channel copied over from the daily chart.

It is possible that minute wave a ended at the last low. Minute wave b may be over here, or it may continue higher as a double zigzag. Unfortunately, this means that there is no price point below the start of minute wave a at 1,352.19 which would invalidate a continuation of minute wave b. Minute wave b may move higher, but it may not move beyond the start of minute wave a if minute wave a is labelled correctly as a five wave impulse.

Ratios within minute wave a are: there is no Fibonacci ratio between minuette waves (i) and (iii), and minuette wave (v) is 0.42 short of 0.236 the length of minuette wave (iii).

Ratios within minuette wave (iii) are: subminuette wave iii is 1.44 short of 4.236 the length of subminuette wave i, and subminuette wave v has no Fibonacci ratio to either of subminuette waves i or iii.

While price remains within this best fit channel (which is drawn in the same way on both wave counts today), then risk of another slight low will remain. If the channel is breached, that shall provide some confidence in the main wave count over this alternate.

ALTERNATE DAILY ELLIOTT WAVE COUNT

It is possible that primary wave 3 is over and shorter than primary wave 1. Primary wave 3 shows stronger volume than primary wave 1 (see technical analysis weekly chart).

If primary wave 3 is over, then the current consolidation for Gold would be primary wave 4.

Primary wave 2 was a relatively shallow 0.35 expanded flat correction. Primary wave 4 may be a deeper zigzag which would exhibit perfect alternation.

Within primary wave 5, no second wave correction may move beyond the start of its first wave below 1,302.93.

Primary wave 5 would be limited to no longer than equality in length with primary wave 3, so that the core Elliott wave rule stating a third wave may not be the shortest is met. Primary wave 5 would have a limit at 1,477.77.

The hourly chart would be exactly the same.

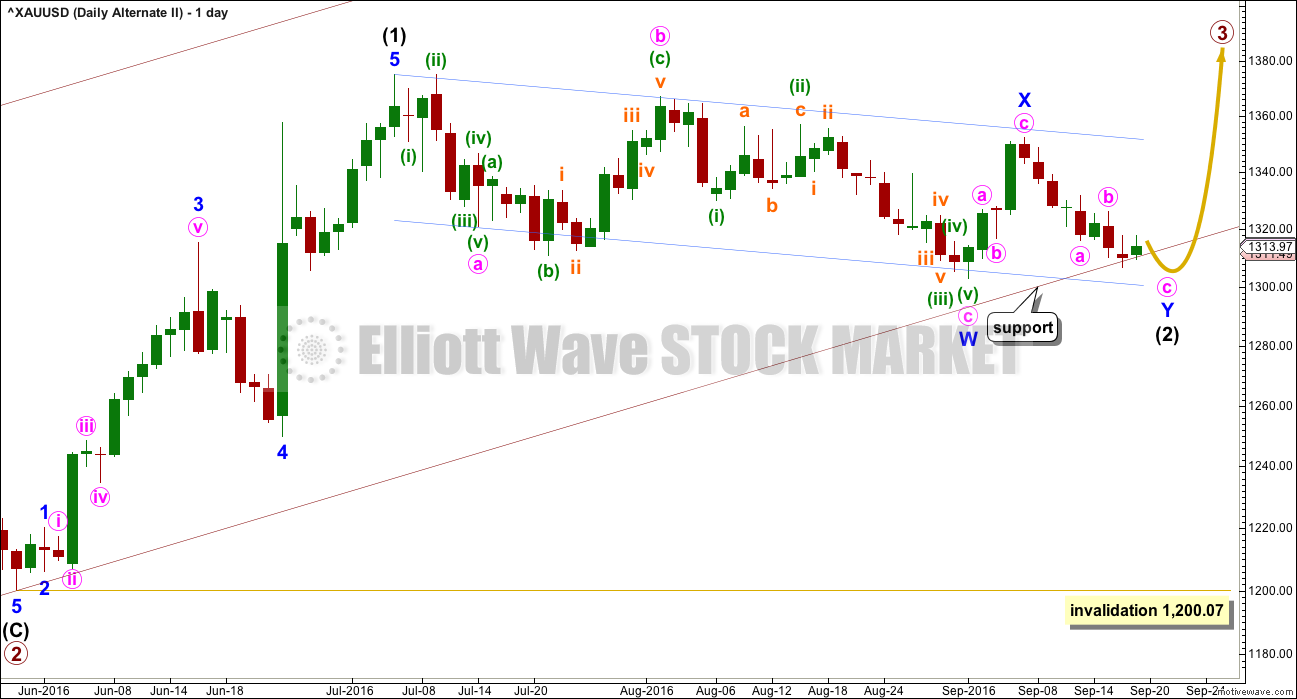

SECOND ALTERNATE DAILY ELLIOTT WAVE COUNT

What if the price point of 1,302.93 is breached? How would the Elliott wave count look and would it make sense?

In the unlikely event that happens, then the most reasonable explanation would be a continuation of intermediate wave (2).

The lower maroon trend line would be important. This is the lower edge of a base channel drawn about primary waves 1 and 2. Lower degree second waves should not breach base channels drawn about first and second waves one or more degrees higher. This is usually how Gold’s impulses behave, but almost is not the same as always. Occasionally base channels are breached.

The structure of intermediate wave (2) would not make sense unless it moves substantially lower and strongly breaches the base channel. It will fit as a double zigzag, but this so far has a sideways look. The purpose of the second zigzag in the double is to deepen the correction when the first zigzag does not move price deep enough. Minor wave Y should end substantially below the end of minor wave W to achieve this purpose.

Double zigzags usually have a clear slope against the prior trend; they look very much like single zigzags. So far this movement looks more like a combination, but it will not fit the rules for a combination. Again, almost is not the same as always. Very occasionally a double zigzag does not have the right look.

This wave count is possible in that many things are possible. However, it must be judged to have a very low probability due to the problems with the base channel and the structure of intermediate wave (2).

It is published primarily to illustrate the low probability of a new low below 1,302.93 at this stage.

TECHNICAL ANALYSIS

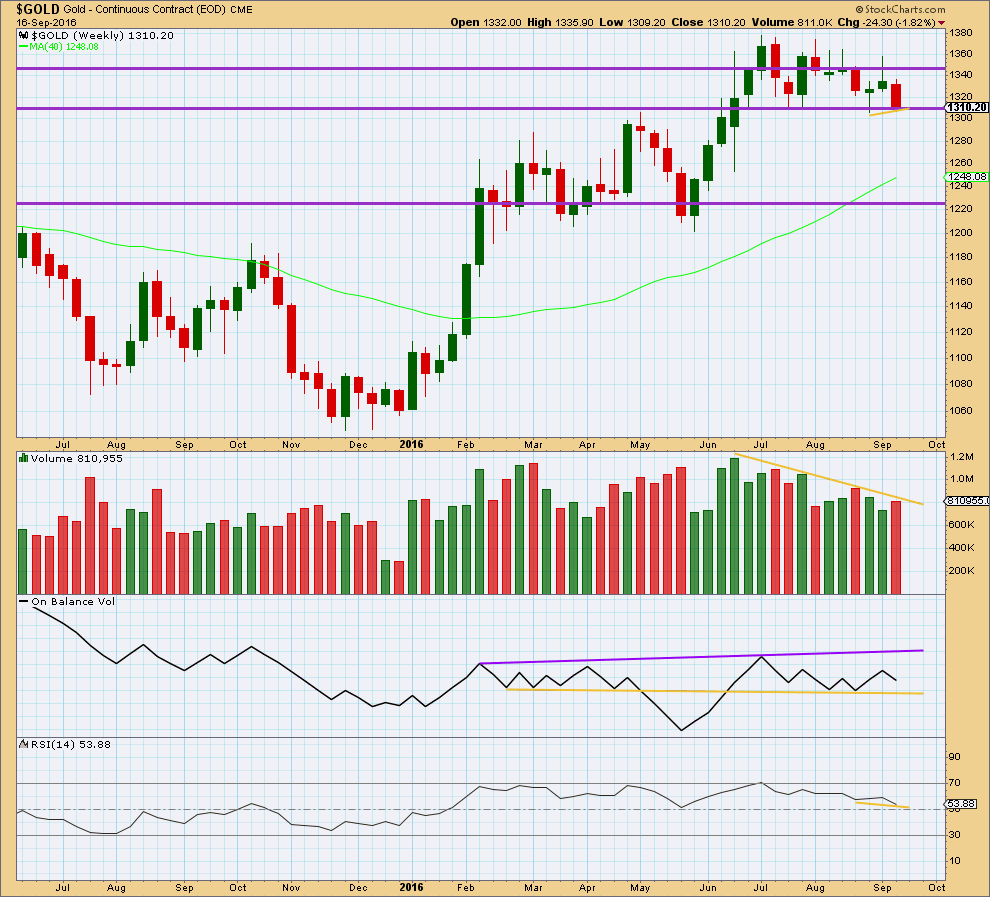

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term stronger volume for last week compared to the prior green weekly candlestick is short term bearish. Again, it is important to look inside last week at daily candlesticks to have a clearer picture to what is happening here.

Mid term price is again finding support about 1,310 – 1,305. Volume is declining as price has been moving sideways. This sideways movement is more likely to be a consolidation than the start of a new trend.

On Balance Volume remains overall bullish with the last signal a bounce up from support at the yellow line. A break above the purple line would be a strong bullish signal. A break below the yellow support line would be a reasonable bearish signal.

RSI is close to neutral. There is room for price to rise or fall. RSI exhibits short term divergence at last week’s low with its last low, indicated by short yellow lines on price and RSI. This divergence is bullish and indicates weakness in the downwards movement from price last week. For Gold this divergence at the weekly chart level at its lows is usually a fairly reliable signal of a bottom. This reliability in the past means this divergence should be given reasonable weight in this analysis.

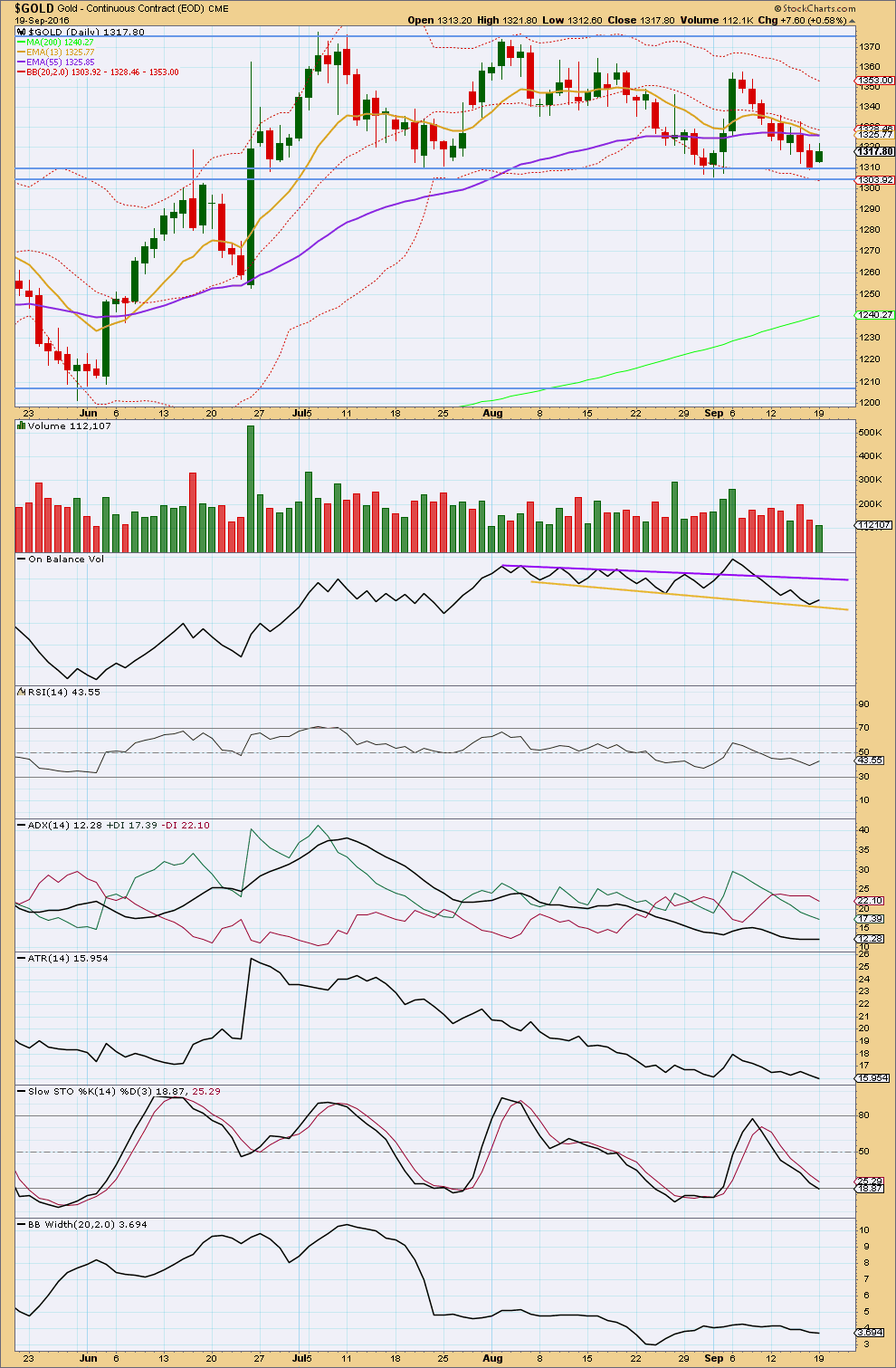

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small range upwards day with light volume is concerning for the Elliott wave count. The rise in price does not have support from volume at this stage. An upwards day with stronger volume would be required for confidence that a low is in place. In the short term, this signals the likelihood of one more downwards day to find support finally at 1,305 before a trend change and the end of this downwards swing.

On Balance Volume has moved up and away from the yellow line, which is now very slightly adjusted. This is a reasonable bullish signal. Because this line cannot be much steeper than this, it should offer final support for OBV. This line is reasonably long held and has been tested at least twice before, so it is likely to offer reasonable support. This bullish signal supports the Elliott wave count. OBV works reasonably well with trend lines and this bullish signal may be given reasonable weight today in this analysis.

ADX is very slightly declining today. ADX is indicating that this market is not trending. ATR overall still agrees because it is still flat to declining and is very low. Bollinger Bands are still tightly contracted. With all three of these indicators still in agreement that the market is not trending, it is reasonable to conclude still that this downwards movement is a counter trend movement and will end when price finds support.

RSI is below neutral. There is plenty of room for price to rise or fall. At the daily chart level, there is no additional divergence between price and RSI to indicate any weakness.

The bottom line is the market is consolidating. It is range bound with resistance at 1,375 and support at 1,310 – 1,305. During the consolidation, it remains three upwards days which have strongest volume. This strongly suggests an upwards breakout is more likely than downwards.

The 200 day moving average remains pointing upwards. Price remains above it. The mid term Fibonacci 55 day moving average is flat. It remains above the long term average. The short term Fibonacci 13 day moving average is pointing lower, and is now touching the mid term average. These averages so far indicate the longer term trend remains upwards and that downwards movement is a counter trend movement.

Assume the trend remains the same until proven otherwise. At this stage, the weight of evidence points to the longer term trend remaining upwards.

This analysis is published @ 9:54 p.m. EST.

It’s the quiet before the storm:.. BOJ decides on action tonight/ tomorrow morning and the Fed delivers their decision tomorrow afternoon. So many thoughts on the way gold breaks but I know that if it drops below 1302, it’s very bad news….per your summary. Typing from phone

It’s awfully quiet here today. This market is being very slow.

Volatility will return, it’s just taking it’s time.

This is what I have so far for the first hourly wave count.

Waiting for a bullish sign

Or this?

I agree Dreamer, not enough yet for confidence. And I also think that the way you’ve drawn the line on your first chart is more correct.

When I draw my upper trend line as you have yours on this chart, it shows a breach. I don’t know why this is, it looks like we’re using the same data?

This is how it looks when I draw it; hourly, arithmetic scale, BarChart XAUUSD data.

That’s weird how it looks different.

This line looks like there’s been a breach and now backtest.