Last week expected upwards movement for Silver. This is what happened.

Summary: An upwards trend is in place. The target is at 25.63 to 26.87. Use the new trend channel. If price comes up to touch the upper edge, then look for signals of exhaustion to exit long positions. If price again comes down to touch the lower edge, it will be offering a low risk high reward opportunity to join the trend at an excellent price. If this market is kind enough to offer us this again, take the opportunity.

New updates to this analysis are in bold.

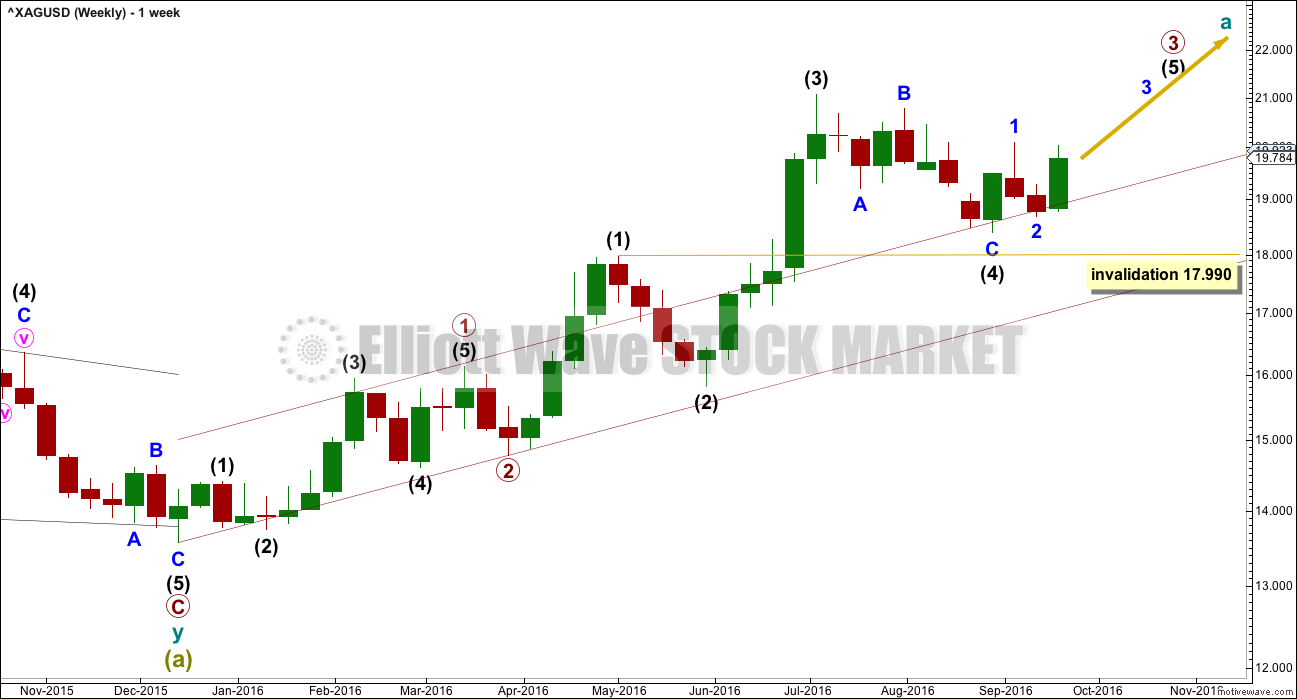

WEEKLY WAVE COUNT

Within primary wave 3, intermediate waves (1), (2) and (3) may be complete. Intermediate wave (4) may be unfolding.

Intermediate wave (4) may not move into intermediate wave (1) price territory below 17.990.

Intermediate wave (5) may be a swift sharp extension. It may end with a blowoff top.

A base channel about primary waves 1 and 2 is added this week. Intermediate wave (4) has found support about the upper edge.

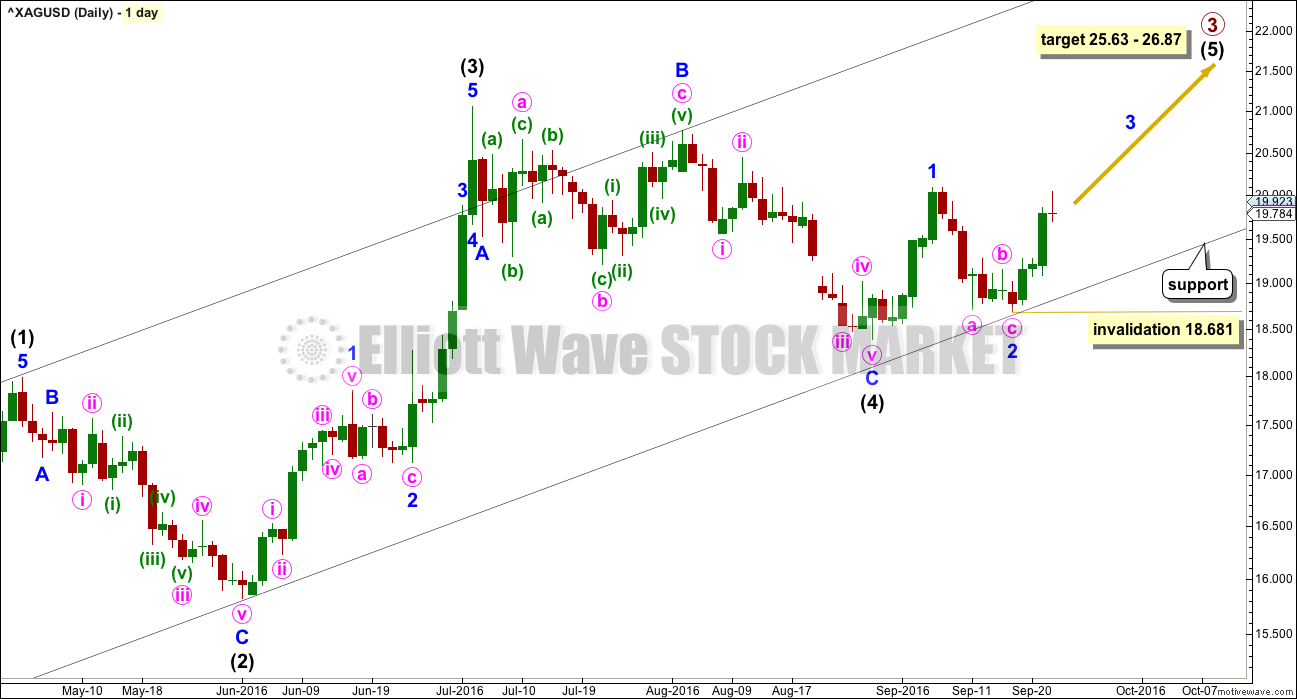

DAILY WAVE COUNT

The trend channel is redrawn this week as a best fit. A daily chart is provided below to illustrate exactly how it should be drawn.

At 25.63 primary wave 3 would reach 4.236 the length of primary wave 1.

At 26.87 intermediate wave (5) would reach 1.618 the length of intermediate wave (3). This gives a 1.24 target zone calculated at two wave degrees.

There is inadequate alternation between intermediate waves (2) and (4) because they are both subdividing as zigzags. There is some alternation so far within the structure: within intermediate wave (2) minor wave B was very brief and within intermediate wave (4) minor wave B is very time consuming. Intermediate wave (2) was a 0.68 correction of intermediate wave (1) and intermediate wave (4) is a 0.51 correction of intermediate wave (3), so there is no reasonable alternation in depth.

Minor waves 1 and now 2 are complete within intermediate wave (5). This wave count now expects to see an increase in upwards momentum as a third wave unfolds.

Within minor wave 3, no second wave correction may move beyond the start of its first wave below 18.681.

Corrections should find very strong support at the lower edge of the new channel. If price again comes down to touch this trend line, it may offer a good opportunity to join the trend.

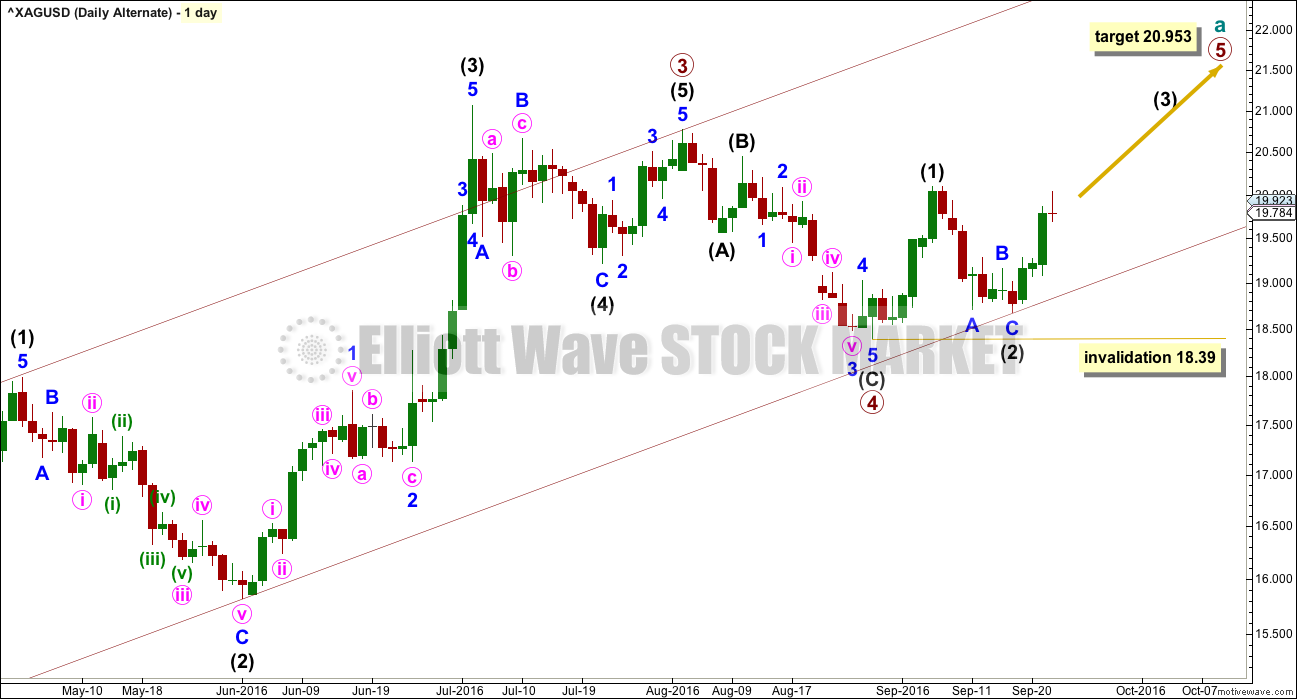

ALTERNATE DAILY WAVE COUNT

It is possible that primary wave 3 is already over. Intermediate wave (5) would be truncated by 0.294, which reduces the probability of this alternate.

Primary wave 3 has no adequate Fibonacci ratio to primary wave 1. At 20.953 primary wave 5 would reach equality in length with primary wave 1.

Within primary wave 5, intermediate waves (1) and (2) may now be complete. This wave count now also expects to see an increase in upwards momentum. Within intermediate wave (3), no second wave correction may move beyond the start of its first wave below 18.681.

Corrections should find strong support at the lower edge of the channel.

TREND CHANNEL

Draw a parallel channel on the daily chart, on a semi-log scale. Draw the first trend line from the high of 11th of February to the high of 2nd of August. Place a parallel copy on the low of 1st of June. This channel perfectly shows where the last pullback ended and where price turned. The upper edge is overshot by a third wave, which typically is very strong and overshoots channels.

This trend channel has a very good look. Expect the larger trend is up while price remains within the channel. Each time price touches the lower edge presents an opportunity to join the trend at a good price. Stops may be set just a little below the trend line. Each time price touches the upper edge look for signals to exit positions.

As always: do not invest more than 3-5% of equity on any one trade and always use a stop for all trades.

TECHNICAL ANALYSIS

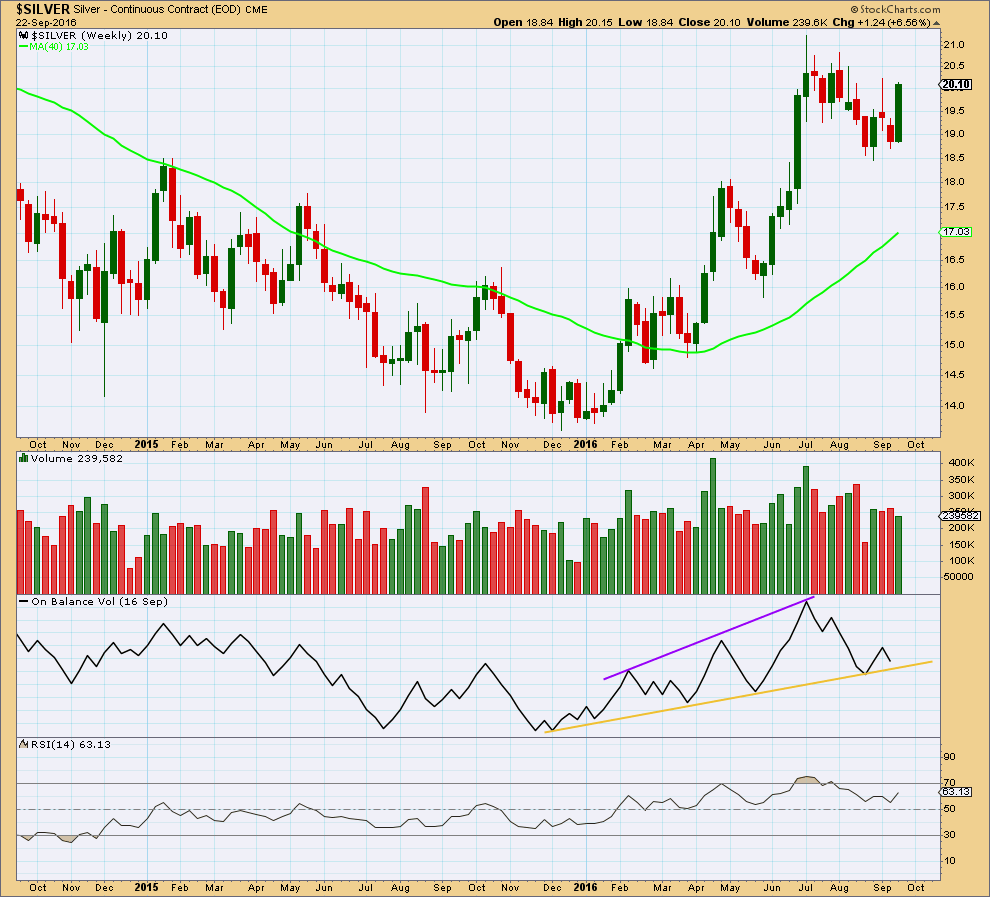

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This week is very likely to complete a bullish engulfing candlestick pattern after Friday’s session. If it does, that may be read as a strong bullish signal after the prior fall in price.

The prior long rise in price came on strong and increasing volume. Since the last high for Silver on the 5th of July, the subsequent fall in price has come on lighter volume, with very low volume for the week of the last low on 22nd of August. Overall, the mid term volume profile at this level looks reasonably bullish.

On Balance Volume gave a bullish signal with a move up and away from the yellow support line. This line may assist to halt any fall in price; it should offer support to OBV.

RSI is not extreme at the weekly chart level. There is room for price to rise. At this stage, there is no divergence between price and RSI to indicate weakness.

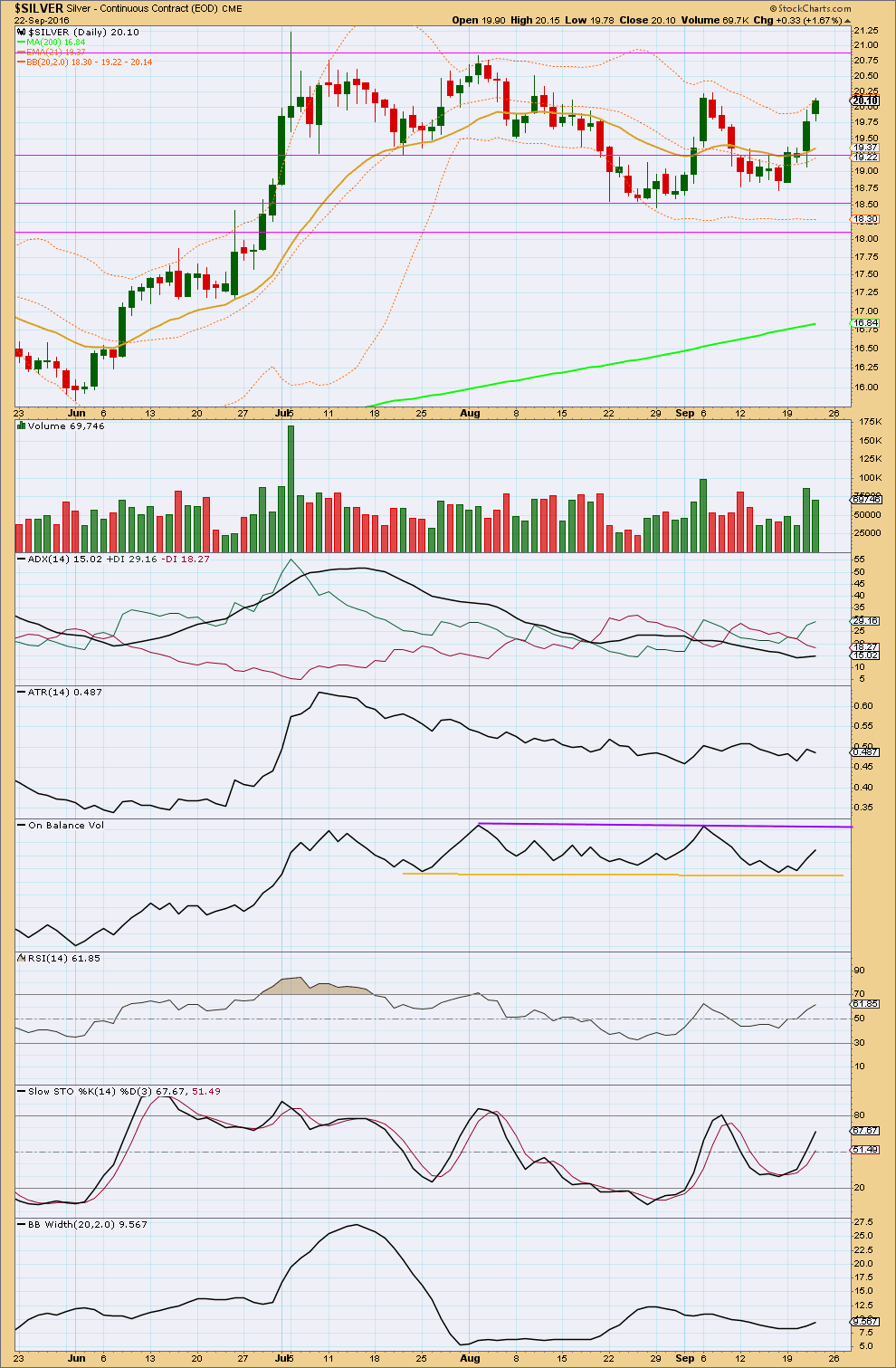

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Silver is still within a consolidation zone with resistance about 20.90 and support about 19.00. During this time, the strongest days are two upwards days. This suggests an upwards breakout is more likely than downwards. This trick sometimes works for Silver (it is my estimate that it works more often than not).

Volume for yesterday was very strong. Today’s volume is slightly lighter but still relatively strong. The rise in price has less support from volume today, so a small pullback lasting a day or two would be a reasonable conclusion.

ADX is now increasing and above 15 indicating an upwards trend is in place. With price recently bouncing up from support, it is reasonable to expect more upwards movement from here especially as it has some support from volume.

ATR has not yet shown a clear increase though. Bollinger Bands are beginning to widen. An upwards trend may be returning.

RSI is not extreme and at this stage exhibits no divergence with price at the daily chart level to indicate weakness.

Stochastics is not extreme, but it may move into overbought and remain there for reasonable periods of time during a trending market.

This analysis is published @ 01:11 a.m. EST.

Thanks for the update, Lara!

Thanks for the silver analysis 🙂