Gold continues to move overall sideways within a small range.

The main Elliott wave count still expects a breakout in a very few days.

Summary: A small consolidation continues and may continue for another two or five more days. There is no support for upwards movement, so it looks like there is a new downwards trend.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

The last published monthly chart may be seen here.

At this stage, weekly charts will still be published daily to minimise confusion over why the daily charts are so different.

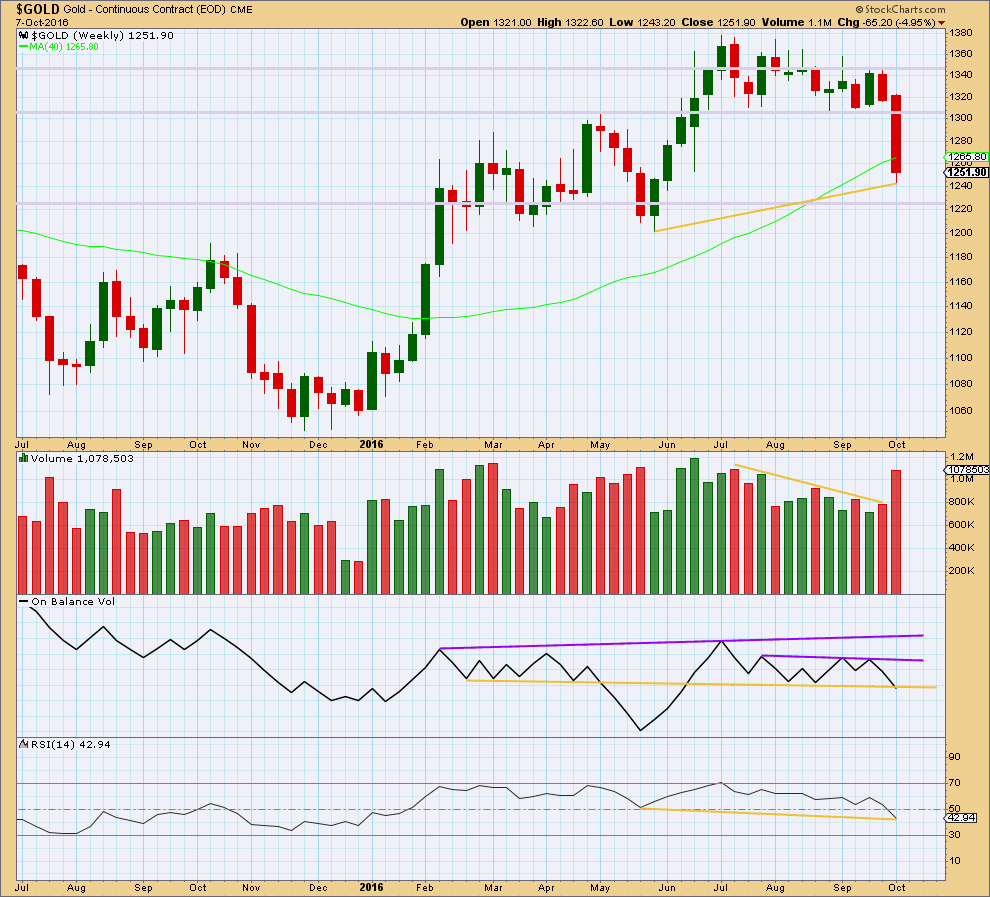

WEEKLY ELLIOTT WAVE COUNT

This first wave count sees the big wave down from the all time high for Gold in September 2011 as a completed five wave structure.

If downwards movement is a five wave structure, it may only be cycle wave a within a larger zigzag of super cycle wave (a). It is more likely that Grand Super Cycle wave IV will be a zigzag, flat or triangle, which means super cycle wave (a) is most likely to be a zigzag. The least likely structure for Grand Super Cycle wave IV would be a single zigzag, so the least likely structure for super cycle wave (a) would be an impulse. This allows for alternation between the single zigzag of Grand Super Cycle wave II and a flat, combination or triangle for Grand Super Cycle wave IV.

Within cycle wave a, there is good alternation between the deep combination of primary wave 2 and the shallow zigzag of primary wave 4. Primary wave 2 is much longer in duration, but that is okay because combinations are more time consuming. Zigzags are the quickest of all corrective structures.

The – – – maroon channel is drawn about cycle wave a using Elliott’s technique. The whole structure is contained within it, with the exception of an overshoot for the middle of the third wave. This is a very common tendency; the middle of a third wave is often the strongest portion of an impulse and it ends with a swift strong fifth wave which commonly overshoots channels. This part of the wave count has a typical look.

If a five down is complete, then a three up should follow.

The problem now becomes to identify which one of more than 23 possible corrective structures cycle wave b may take. It may be a quick relatively shallow zigzag as labelled, or it may be about only half way through. This wave count sees it as possibly complete. If price breaks below 1,200.07, then this first wave count would be considered confirmed.

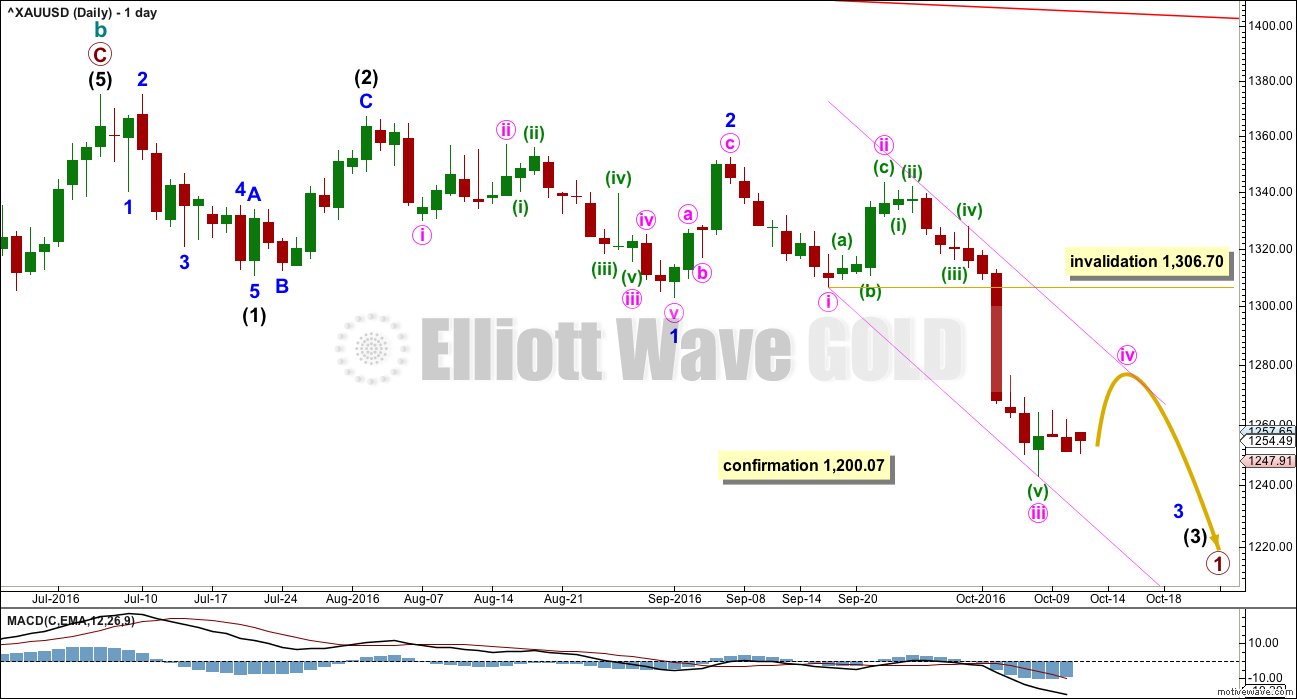

DAILY ELLIOTT WAVE COUNT

If there has been a trend change at a large degree at the last high, then what looks like a rather obvious triangle must be ignored. It is possible that a series of three overlapping first and second wave corrections has unfolded, but this does look less likely than a triangle.

The triangle may not be labelled as a second wave because second waves do not take the form of triangles.

This wave count is reverted to see minor wave 3 incomplete and minute wave iv within it now unfolding. There is no Fibonacci ratio between minute waves i and iii.

Minute wave iv may not move into minute wave i price territory above 1,306.70.

Minute wave ii was a deep 0.81 zigzag lasting four days. Minute wave iv is least likely to be a zigzag to exhibit alternation and most likely to be a sideways flat, combination or triangle. It may last a bit longer than minute wave ii as sideways structures tend to be longer lasting than zigzags. It may last a Fibonacci five or eight days. It may continue now for either two or five more days.

HOURLY ELLIOTT WAVE COUNT

There are more than 23 possible structures that minute wave iv may unfold as. None of the possibilities may yet be eliminated, but a single or multiple zigzag is least likely.

Minute wave iv is most likely to be a flat, combination or triangle. As it continues the labelling within it may change again as the structure becomes clearer.

Today’s hourly chart looks at the possibility of a regular contracting triangle unfolding sideways. If price does not make a new high above 1,264.72 or a new low below 1,247.91, then a triangle will remain valid. Sideways movement for another two or five days would be expected.

If the triangle is invalidated, then minute wave iv may be unfolding as a double combination.

If the triangle is invalidated and price moves below 1,245.06, then a flat correction may be unfolding.

At this stage, it looks like this correction is going to be very shallow and a bounce back up to resistance about 1,305 now looks less likely.

It is not possible to see minute wave iv as a complete three wave structure today.

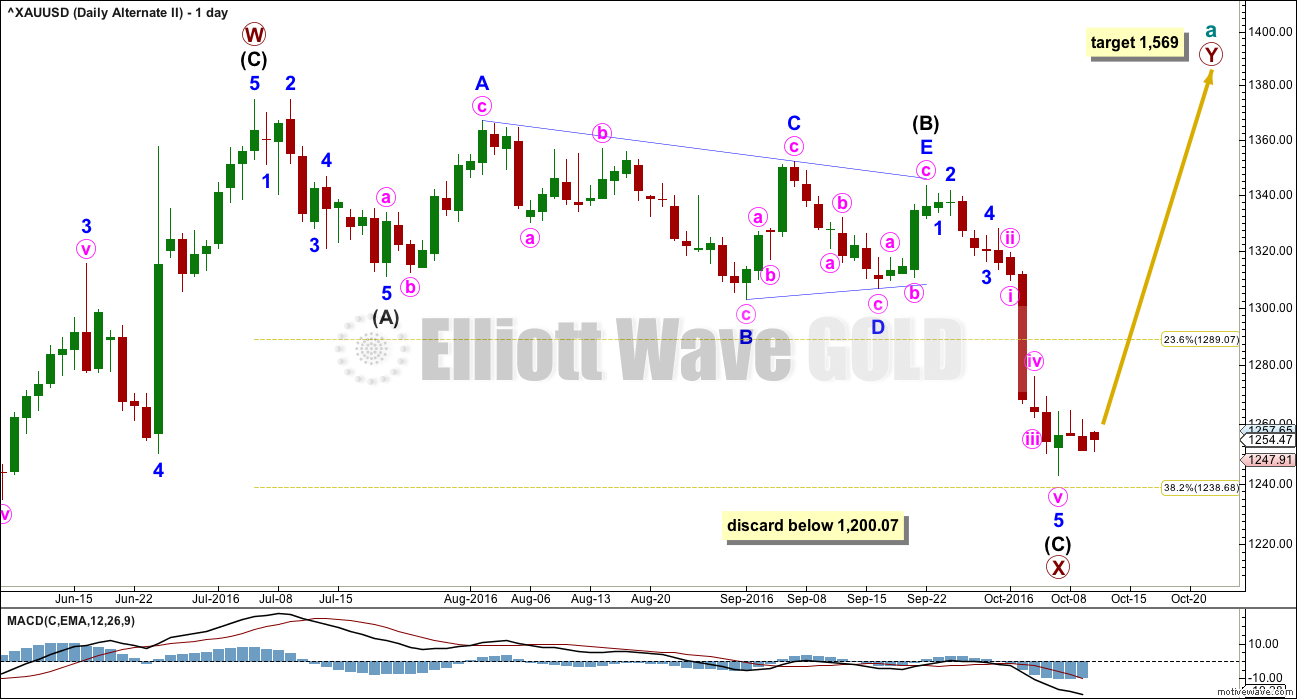

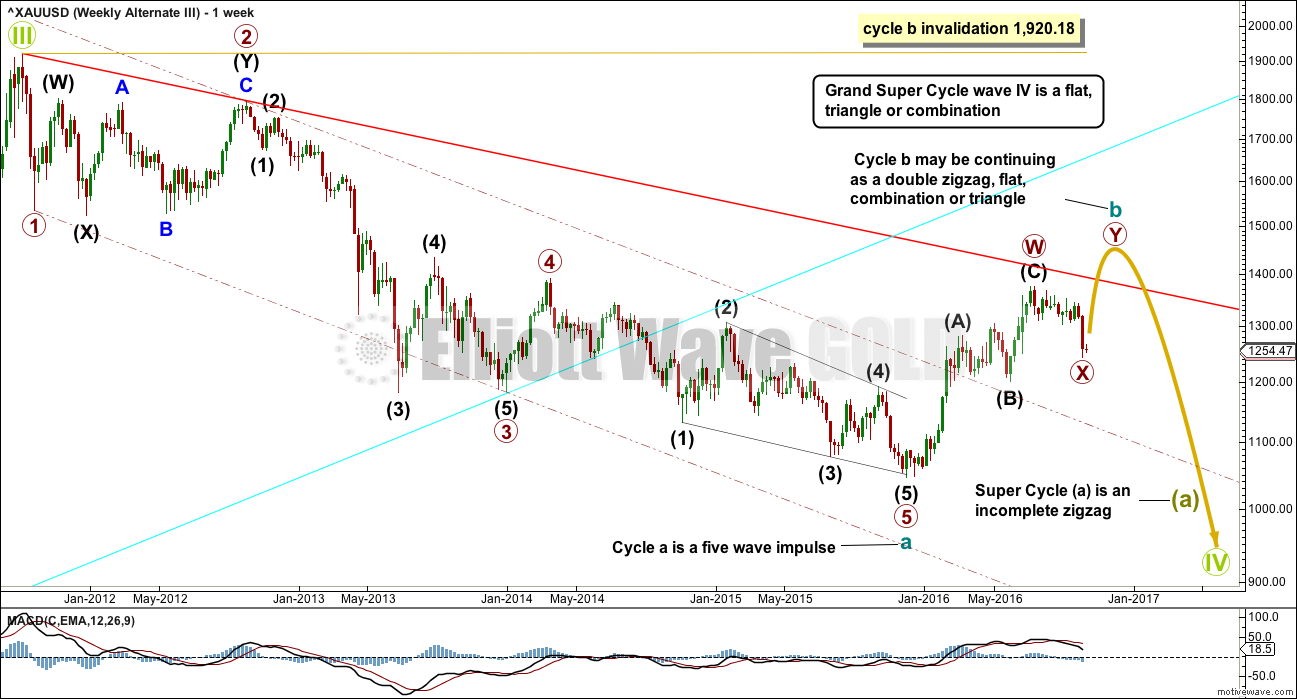

ALTERNATE II WEEKLY ELLIOTT WAVE COUNT

This second wave count sees the big wave down from the all time high in September 2011 as a completed double zigzag. This is classified as a “three”.

If cycle wave a is subdividing as a double zigzag, then that indicates a larger flat correction for super cycle wave (b). Super cycle wave (b) may be unfolding as an expanded flat in order to reach the depth required for it within Grand Super Cycle wave IV discussed with the monthly chart.

The first zigzag in the double is labelled primary wave W. The double is joined by a three in the opposite direction labelled primary wave X, which subdivides as a zigzag, the most common structure for X waves. X waves within double zigzags are normally relatively brief and shallow and so far this one is 12 weeks to the 30 weeks of primary wave W. So far it is relatively brief and corrected only 0.328 of primary wave W, so it is relatively shallow. So far this has a typical look.

The second zigzag in the double for primary wave Y may reasonably be expected to be about even in length and duration with primary wave W.

ALTERNATE II DAILY ELLIOTT WAVE COUNT

There is no rule stating a limit for X waves within double zigzags or double combinations. To achieve the purpose of a double zigzag, which is to deepen a correction, their X waves should be relatively brief and shallow. It would be highly unusual and defeat the purpose if primary wave X moved beyond the start of intermediate wave (C) of primary wave W below 1,200.07. This wave count should be discarded below that point.

Primary wave X is seen as a zigzag. Within primary wave X, intermediate wave (B) fits neatly as a triangle. This is supported by MACD hovering about zero as it unfolded. Any wave count which sees a triangle in this position should have a higher probability than a wave count which does not.

The zigzag downwards for primary wave X may again be complete, at all time frames. A target for primary wave Y upwards would be about 1,569 where primary wave Y would be about even in length with primary wave W.

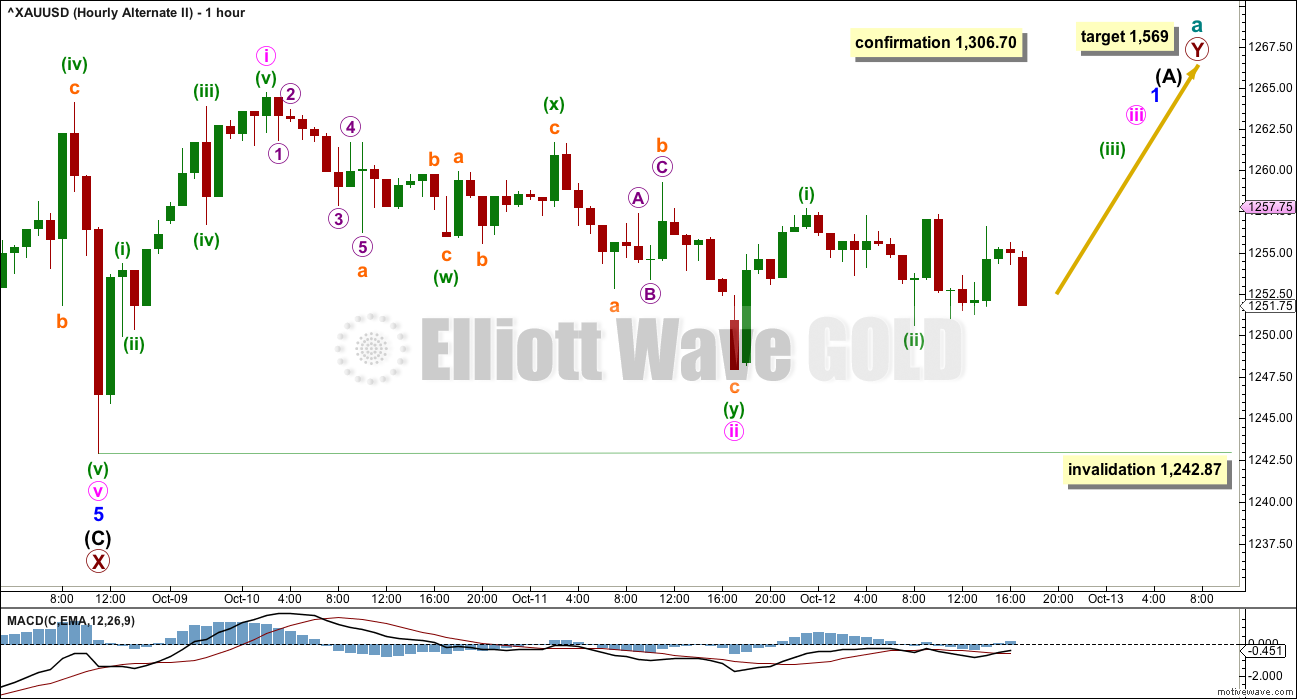

ALTERNATE II HOURLY ELLIOTT WAVE COUNT

The more price moves sideways the lower the probability of this wave count. If there has been a trend change at primary degree three days ago, then price should be moving strongly higher, with support from volume. This is not happening, yet.

Minute wave i upwards does subdivide very well as a five wave structure. Minute wave ii may be over. Or it may be continuing further sideways and may not move beyond the start of minute wave i below 1,242.87.

ALTERNATE III WEEKLY ELLIOTT WAVE COUNT

This alternate wave count is identical to main wave count published above, with the exception of the degree of labelling within cycle wave b.

If the degree of labelling within cycle wave b is moved down one degree, then the zigzag may have been only the first in a double. It may also be a zigzag for wave A of a flat correction or triangle.

If it is not over and if it is continuing further, then a double zigzag looks most likely for cycle wave b at this stage because it would be able to reach higher, so that cycle wave b is closer to the 0.618 Fibonacci ratio of cycle wave a, which is at 1,587. It also looks more likely because primary wave X looks likely to end soon, so to be shallow. Primary wave X looks likely to end soon because it looks like a triangle recently completed for wave B within it, which would be a zigzag.

A daily chart for this wave count would look the same as the daily chart for the alternate II wave count.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong downwards week closes with a strong increase in volume. The fall in price is well supported by volume. Price has broken out of a consolidation to the downside.

A back test to support about 1,305 would be typical behaviour for price after a breakout.

On Balance Volume may be beginning to break below the yellow support line at the end of last week. However, there is a little leeway in exactly how this line is drawn and the break needs to be clearer before it may be interpreted as a bearish signal. If OBV turns up this week, then the line should be slightly redrawn.

There is some mid term divergence at the end of last week between price and RSI: RSI has made a lower low, but price has made a higher low (yellow lines). This divergence is bullish and indicates weakness in price. This divergence supports the main Elliott wave count and the alternate III count.

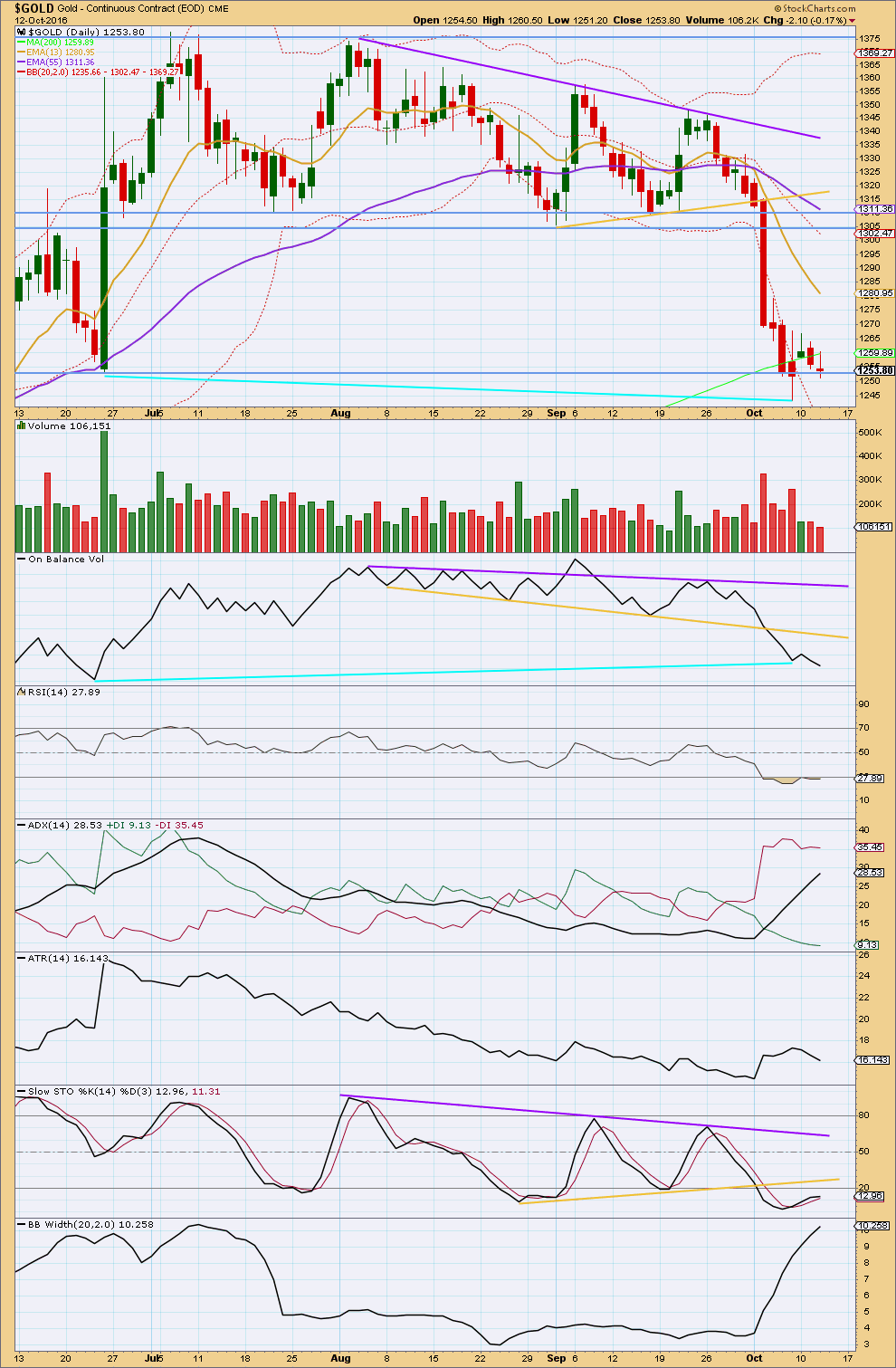

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Another small downwards day comes with a further decline in volume. The fall in price today is not supported by volume. This suggests a small consolidation may be forming and supports the new main Elliott wave count.

The yellow trend line on On Balance Volume may provide resistance and halt the rise in price. Mid term divergence between price and OBV is noted, shown with cyan trend lines. Price has made a new low below the low of 24th of June, but OBV has not made a corresponding new low. This divergence is bullish and indicates weakness in price.

RSI is returning from oversold. Some more upwards movement from price may be expected to bring RSI back into normal territory.

Price broke out of a long consolidation downwards. It would be typical behaviour to now see a counter trend bounce end about prior support, which should now provide resistance about 1,305.

ADX is above 15 and increasing. The -DX line is above the +DX line. Bollinger Bands are widening, so volatility has returned to the market. A downwards trend is indicated.

As price moves sideways for the last three days, ATR is now declining. This may indicate a small correction within the new downwards trend.

With price closing below the lower edge of Bollinger Bands for four days in a row, it would be typical behaviour to now see price move up towards the mid line of Bollinger Bands, to revert to the mean.

This analysis is published @ 07:34 p.m. EST.

Minute wave iv continues sideways. It’s still looking like it may not be able to move price much higher. The triangle so far remains valid, but it may still not be correct. This may still morph into a double combination or even a flat correction.

Another one or two days to complete it? The breakout after it’s done is expected to be downwards.

Labelling of minute wave iv may still change again. MACD is not hovering about zero, so it’s not supporting the triangle. I’ll be keeping an open mind about this structure. It is still impossible to tell with certainty exactly how it will end, only that if the wave count at higher degrees is correct that the breakout should be down.

Miners look strong today. GDXJ stronger than GDX also bullish. Stock market rebound helping.

Main hourly count from Subminuette b a 5 wave up from Wed. 813 am at 1250.61 may have completed up today at 1003 am at 1261.20 for subminuette c. Now gold may drop to 1252 area rough guess?

Fib. of .618 may put the lower target at about 1254.66. Any comments or wave counts?

Gold has formed an inverse HnS in one hour period. The RS is in and it is trying to bO from the NL.

All miners are indicating reversal here. IMHO

Need to wait for 1306 + to invalidate the main count.

GDX showed a small, little, tiny, (you get the idea) bit of strength today:

> GDX had a up day today on a small increase in volume. This up day also came on a down day for gold, a relatively rare occurrence.

> GDX broke above its downtrend line that began in late Sept

> RSI is showing a slight positive divergence with price and is back above 30

> Stochastics is showing a slight positive divergence with price, but is still embedded below 20

> OBV moved up, but is still under resistance

Looking for some follow through to the upside tomorrow