The Elliott wave counts diverged yesterday.

Price remains within the confirmation / invalidation points.

Classic technical analysis, particularly volume analysis, will be used to judge the probability of each wave count today. Price is the ultimate determinator though.

Summary: A new low below 1,258.38 would confirm the main wave count. The target is at 1,227. If this target is wrong, it may not be low enough. It is possible that a swift strong extended fifth wave may unfold lower. If price moves above 1,306.70, the alternate bullish wave count would be confirmed, so look out for a swift strong third wave to end upwards. Classic technical analysis still supports a bearish outlook.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

The last published monthly chart may be seen here.

To fit daily charts into the bigger picture see last analysis of weekly charts here.

DAILY ELLIOTT WAVE COUNT

The movement up from the low of 1,046 on the 3rd of December, 2015, subdivides 5-3-5. Current downwards movement is too deep to reasonably be considered a second wave correction (that idea has been discarded based upon an exceptionally low probability), so the movement up from 1,046 is seen as a complete zigzag. This may be either the entirety of a correction, or it may be the first zigzag in a double zigzag. This main wave count looks at it as an entire correction.

If there has been a trend change at a large degree at the last high, then what looks like a rather obvious triangle must be ignored. It is possible that a series of three overlapping first and second wave corrections has unfolded, but this does look less likely than a triangle.

The triangle may not be labelled as a second wave because second waves do not take the form of triangles.

This wave count is reverted to see minor wave 3 incomplete and minute wave iv within it now unfolding. There is no Fibonacci ratio between minute waves i and iii.

Minute wave iv may not move into minute wave i price territory above 1,306.70.

Minute wave ii was a deep 0.81 zigzag lasting four days. Minute wave iv is least likely to be a zigzag to exhibit alternation and most likely to be a sideways flat, combination or triangle. It may last a bit longer than minute wave ii as sideways structures tend to be longer lasting than zigzags. If it exhibits a Fibonacci duration of eight days, then it should be over now.

The pink channel is a best fit. Minute wave iv may have ended a little higher than expected, finding strong resistance at the upper edge of this channel.

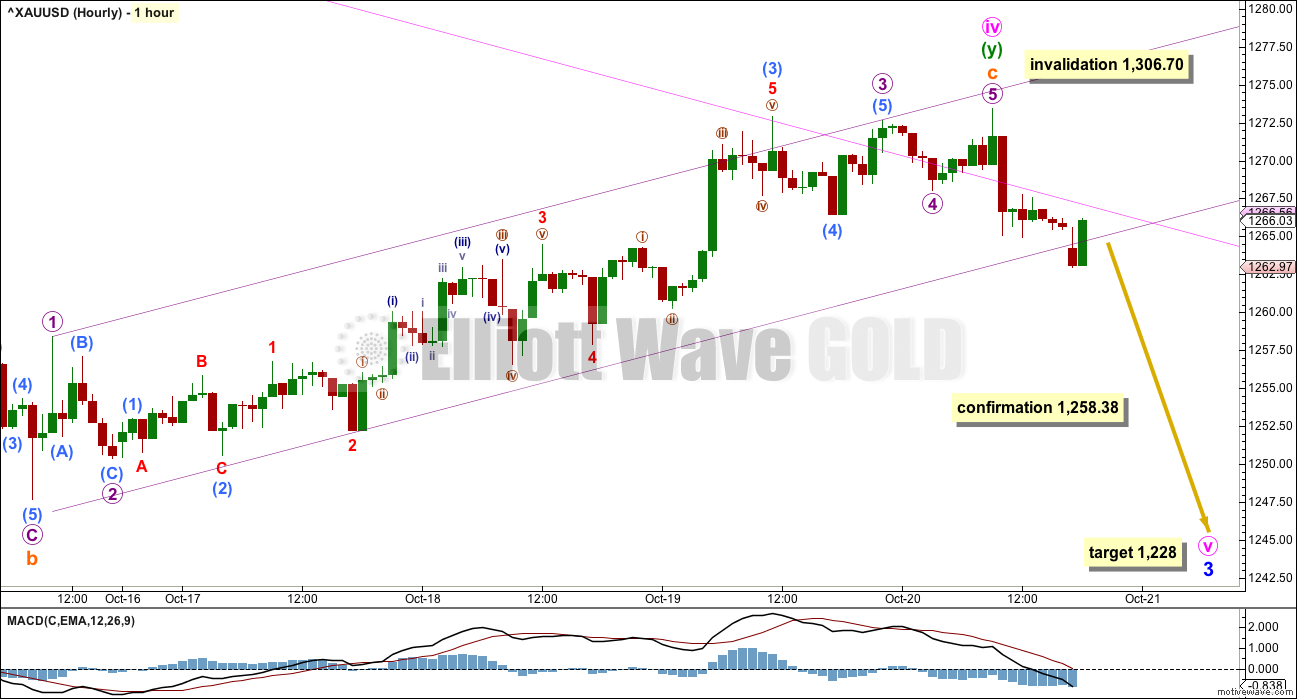

HOURLY ELLIOTT WAVE COUNT

Minute wave iv fits still as a double combination. The first structure in the double was a relatively quick zigzag labelled minuette wave (w). The second structure in the double fits as a regular flat correction labelled minuette wave (y).

Minuette wave (y) was expected to end about the same level as minuette wave (w) at 1,264.72, so that the combination had a sideways look to it, which would be typical. However, minuette wave (y) has ended somewhat above minuette wave (w); so far it is 8.69 above. This gives the combination an upwards slope against the prior trend. This wave count is still valid, combinations do not always look perfect, but the slope must necessarily reduce the probability a little.

There is alternation between the relatively quick deep 0.81 zigzag of minute wave ii and the more time consuming shallow 0.30 combination of minute wave iv.

The pink channel is a best fit copied over from the daily chart. Minute wave iv has now slightly breached the upper edge of this channel. Sometimes fourth waves are not neatly contained within channels. This only very slightly reduces the probability of this wave count today.

The violet upwards sloping channel is a best fit about subminuette wave c. If this channel is properly breached by downwards movement, it shall be an early warning of a possible trend change.

A new low below 1,258.38 would invalidate the alternate below and provide reasonable price confirmation of this main wave count.

At 1,228 minuete wave v would reach equality in length with minute wave i.

Minute wave iv may not move into minute wave i price territory above 1,306.70.

ALTERNATE II DAILY ELLIOTT WAVE COUNT

What if the zigzag upwards from the low of 1,046 on the 3rd of December, 2015, is only the first zigzag in a double?

There is no rule stating a limit for X waves within double zigzags or double combinations. To achieve the purpose of a double zigzag, which is to deepen a correction, their X waves should be relatively brief and shallow. It would be highly unusual and defeat the purpose if primary wave X moved beyond the start of intermediate wave (C) of primary wave W below 1,200.07. This wave count should be discarded below that point.

Primary wave X is seen as a zigzag. Within primary wave X, intermediate wave (B) fits neatly as a triangle. This is supported by MACD hovering about zero as it unfolded. Any wave count which sees a triangle in this position should have a higher probability than a wave count which does not.

The zigzag downwards for primary wave X may again be complete, at all time frames. A target for primary wave Y upwards would be about 1,569 where primary wave Y would be about even in length with primary wave W.

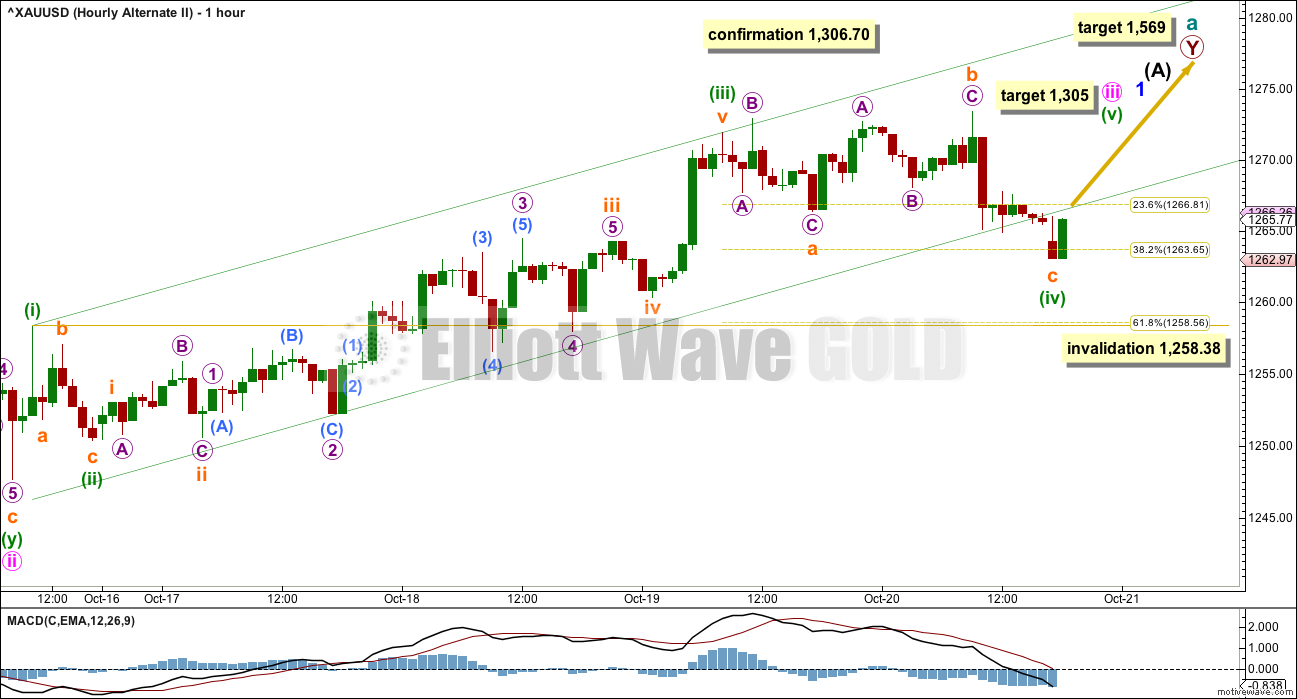

ALTERNATE II HOURLY ELLIOTT WAVE COUNT

Minute wave iii must move beyond the end of minute wave i above 1,264.72. It must move far enough above that point to allow room for a subsequent correction for minute wave iv to unfold and remain above minute wave i price territory. It still has not done that yet.

The conclusion is that more upwards movement is most likely to see minute wave iii come to an end.

Sideways and lower movement for Thursday’s session may have been a continuation of minuette wave (iv) as an expanded flat correction. Minuette wave (iv) may have ended close to the 0.382 Fibonacci ratio of minuette wave (iii) and within the price territory of the fourth wave of one lesser degree.

The green channel here is drawn slightly differently to the main hourly wave count. With this channel, price has breached the lower edge and is now throwing back to test resistance. If price moves down and away from there, then this wave count will reduce in probability.

Minuette wave (v) is a fifth wave to end a third wave impulse. For Gold these are often very swift and strong. Minuette wave (v) may end with a blowoff top. Look out for a surprise to the upside for this wave count in the next one or two days.

At 1,305 minute wave iii would reach 2.618 the length of minute wave i. If price keeps rising through this first target, then the next target would be at 1,340 where minute wave iii would reach 4.236 the length of minute wave i. This higher target is possible if minuette wave (v) is a long strong extension, and because minute wave i was relatively short.

At 1,569 primary wave Y would reach equality in length with primary wave W.

TECHNICAL ANALYSIS

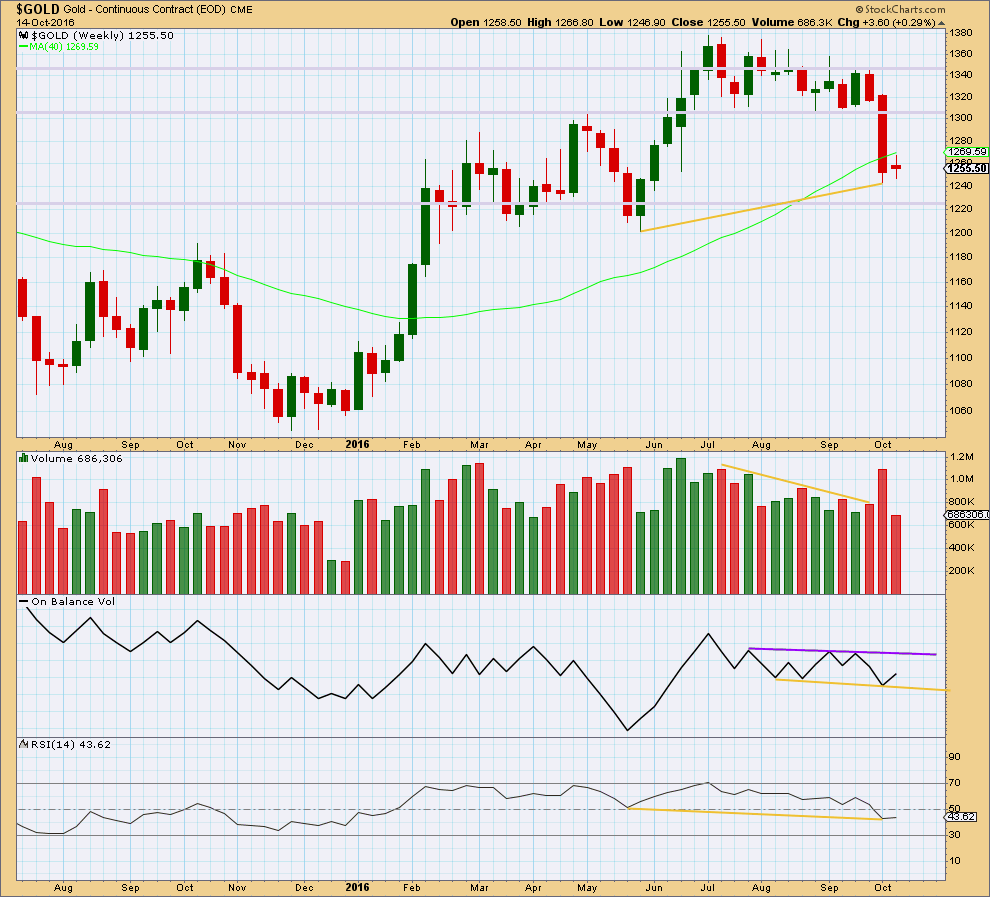

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A small range week with light volume indicates a pause within a new downwards trend.

On Balance Volume remains constrained within support and resistance lines. These lines are slightly redrawn this week.

There is still mid term divergence between price and RSI: price has made a higher low, but RSI has made a lower low (yellow lines).

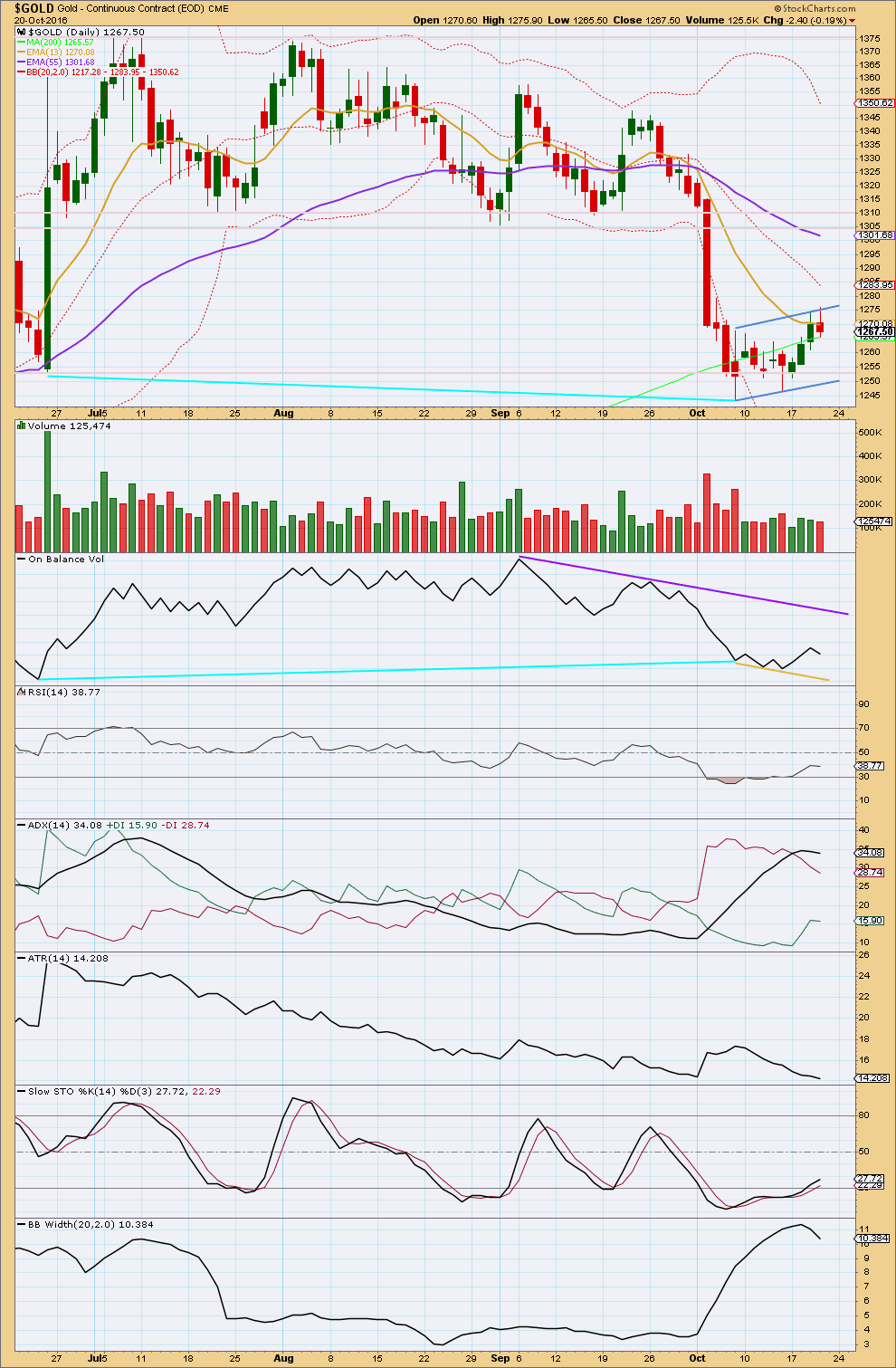

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume continues to decline as price moves in a small range. This still looks like the completion of a bear flag pattern, supported by volume.

Flags and pennants are the most reliable of continuation patterns. Flags normally slope against the main trend, and they should be characterised by light and declining volume. When they are, then the probability of a continuation is higher. That is the case with this potential flag pattern.

On Balance Volume still has some distance to go before it finds resistance. The yellow line should provide some support.

The last few days have brought RSI back up more into normal territory. There is again room for price to fall.

Stochastics is almost into normal territory. This oscillator may remain extreme for reasonable periods of time during a trending market though.

ADX is slightly declining, indicating the market may not be trending. It has not indicated a trend change though because the -DX line is still above the +DX line. ATR is still flat to declining, and today Bollinger Bands contracted further.

All three of these indicators (ADX, ATR, BBs) point to a consolidating market. With price moving overall sideways and now slightly higher, it is reasonable to conclude that a small consolidation is concluding and will be followed by more downwards movement.

This classic technical analysis still supports the main bearish wave count over the alternate bullish wave count today.

This analysis is published @ 06:59 p.m. EST.

Interesting observations I want to share.

I think that that spike on 1240 level was a bull signature on the bigger picture. This is drawn by using the Schiff Pitchfork @ 2 SD.

And something that is also giving away a hint. Coincidence? Maybe…

And for the dollar. It tends obviously to rally inside the circles.

I expect that we see upwards movement in gold when the dollar is topping.

Most likely the USD will top @ about 100. That will give another intermediate lower high for the dollar. Invalidated of course if it goes above the previous intermediate top. I have a feeling it will close just a few cents below last top.

This way the market is pushing things to the extremes in bullish/bearishness, pathing way for maximum moves.

Bjorn, thanks for sharing your charts. I like the different perspectives. Gold has held up well the last couple of days as the dollar has continued to move up.

Yes, agreed.

I think USD will top next week.

Let us not forget that gold gave also a swing low.

The bears are strong, but the bulls seem to be fighting nicely back.

I am out of positions and will enter long when dollar hit my target. Then I think we might see a nice rally out from this deep intermediate cycle low. Remember, oversold always return to overbought. It is just a matter of time.

For the alternate, minuette (iv) may have continued lower as an expanded flat. When fourth waves aren’t contained within the first channel then redraw the channel using Elliott’s second technique: from 2 to 4, a copy on 3.

Targets still the same.

I need to spend time on the five minute chart to see now minuette (i) down unfolds.

there is now a channel breach of the small upward sloping channel on both hourly charts. That’s slightly bearish. It’s not enough yet though to be full bearish short term, confirmation below 1,258.35 is still required for a good level of confidence.

Gold appears to have peaked yesterday morning and a 2nd wave peaked near the open today and is working it’s way lower. Hopefully the classic technical analysis and volume still supports the main bearish wave count.

We’ll wait for golden words of wisdom and a treasure map from our tribal Lead counter of the waves to point the probable path to a pot of investment gold at the end of the rainbow. Possibly buried on a desert island near New Zealand, surrounded by treacherous reefs and only accessible by surfboard.

Richard, You have quite the entertaining writing style. Keep up the good work. ?

Thank you. Once in awhile I am inspired to a funny comment.

Lara, just reviewed the updated Silver wave counts and I see a disconnect with the gold counts. I like the concept of the Main and 2nd alternate counts that could see just a small sharp move lower before resuming the “bull” to new highs.

Then with gold, your current counts are hard up or hard down. Seems to me that there is a count for gold that would nicely correspond with those 2 Silver counts, with one more short leg down, then a move on up to new highs. I think that’s a count that we should be considering now. Thoughts?

That would only work if the daily alternate II for Gold saw intermediate (C) as not over, and needing one more wave down. If it did that then intermediate wave (C) would look very strongly like a three. That movement for Silver is different because a triangle won’t fit on the daily chart, where for Gold it will fit perfectly.

I think in this instance Gold may lead Silver. They don’t always turn together, quite often their lows and highs are separated by days or weeks.

The new low for Silver may be slight for a bullish scenario, maybe when Gold has a second wave correction.

I am still favouring the bearish scenarios for both though.

Yes, a deep 2nd wave for gold may align the bull counts. Thanks for considering all options.

Doji on some price charts in GLD yesterday and a bearish engulfing candle today sure looking like an interim top of some sort…