Downwards movement was expected to continue for the main Elliott wave count after last analysis.

The target remains the same and the alternate now has a new target.

Summary: The target for downwards movement to be interrupted is at 1,115 or 1,064. A break above the yellow best fit channel and then above 1,163.25 would indicate either a trend change or a consolidation has arrived. GDX looks bearish; use the target 14.50, and use the breakaway gap for resistance.

New updates to this analysis are in bold.

Last monthly and weekly analysis is here, video is here.

Grand SuperCycle analysis is here.

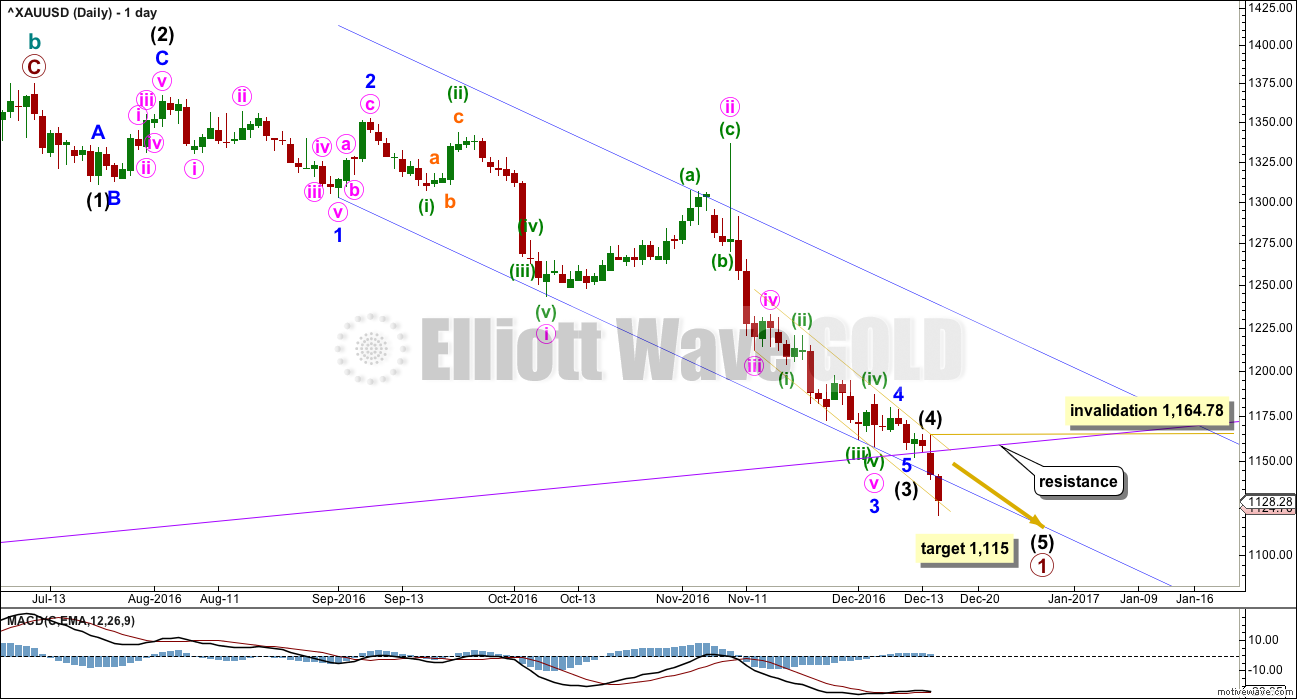

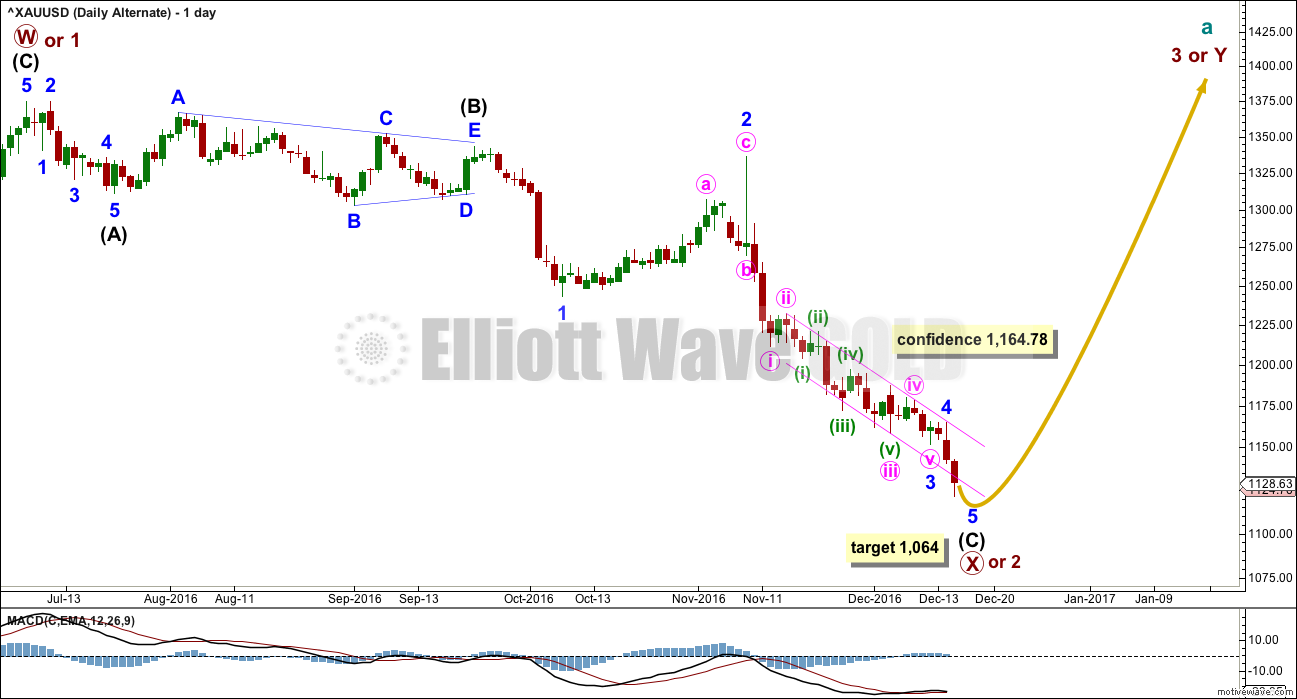

DAILY ELLIOTT WAVE COUNT

Primary wave 1 may be close to completion.

Corrections are more brief and shallow than expected.

The purple trend line is copied over from weekly charts. Downwards movement has now broken below this important support line, so this line may now provide resistance forcing upcoming corrections to be shallow.

There is no Fibonacci ratio between intermediate waves (1) and (3). At 1,115 intermediate wave (5) would reach equality in length with intermediate wave (1).

Ratios within intermediate wave (3) are: there is no Fibonacci ratio between minor waves 3 and 1, and minor wave 5 is 1.92 longer than 0.382 the length of minor wave 1.

Ratios within minor wave 3 are: there is no Fibonacci ratio between minute waves i and iii, and minute wave v is 2.52 short of 0.618 the length of minute wave iii.

Ratios within minute wave v are: there is no Fibonacci ratio between minuette waves (i) and (iii), and minuette wave (v) is 0.62 longer than equality in length with minuette wave (i).

Within intermediate wave (5), no second wave correction may move beyond the start of its first wave above 1,164.78.

This wave count still has a problem of proportion between minute wave ii and minor wave 2 and intermediate wave (2). Minute wave ii should be more brief than second wave corrections one and two degrees higher, and a triangle may not be seen for a second wave in this position because second waves may not subdivide as triangles.

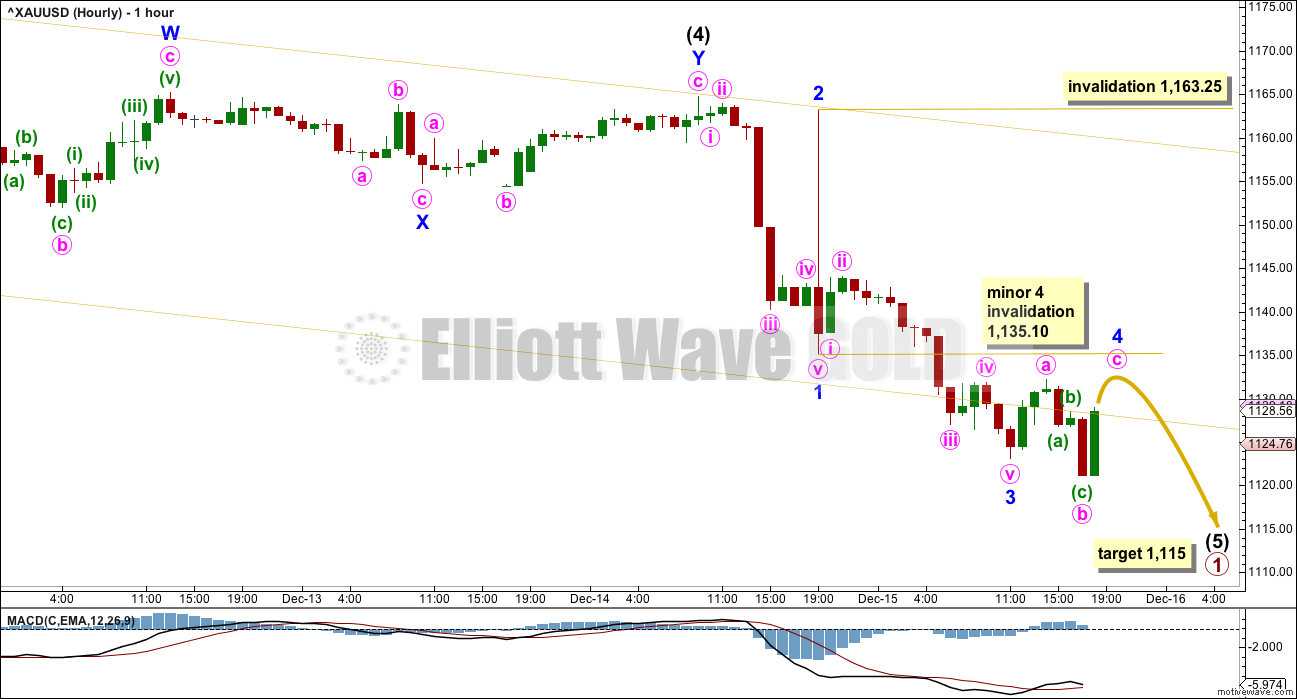

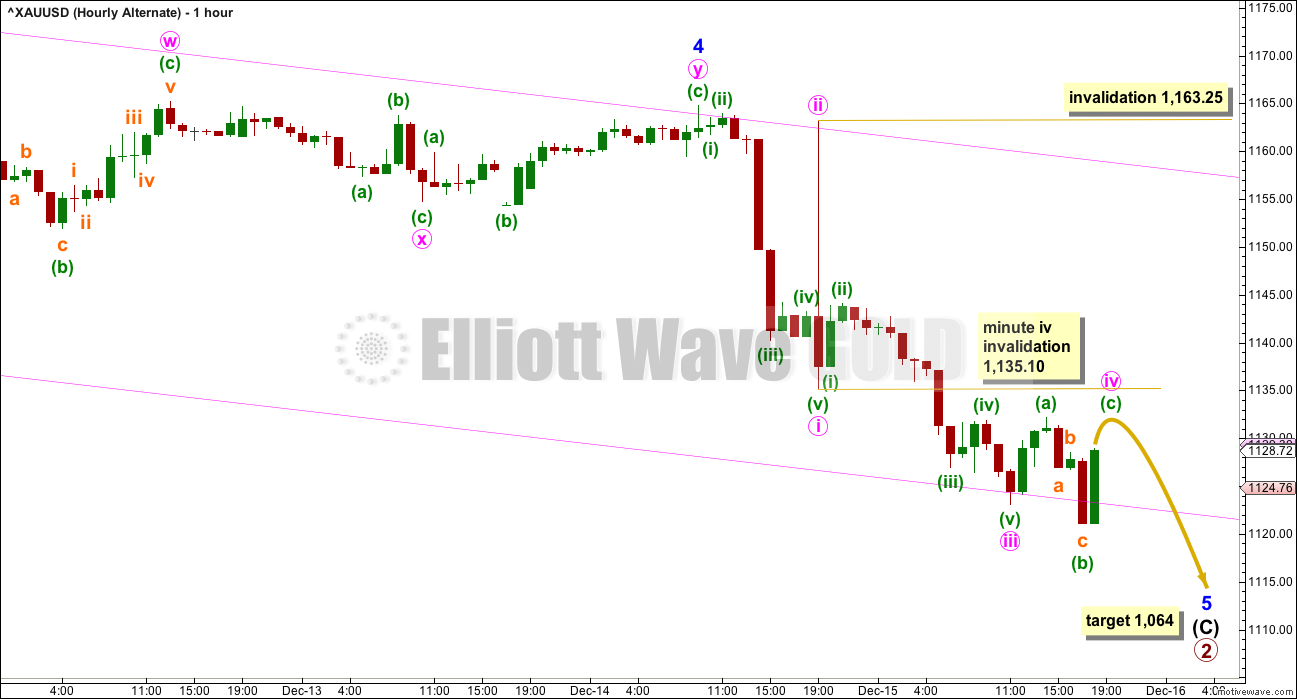

HOURLY ELLIOTT WAVE COUNT

Intermediate wave (5) must subdivide as a five wave structure. So far minor waves 1 and 2 are complete within it.

Within minor wave 3, if the degree of labelling here is moved down one degree and it is extending, then no second wave correction may move beyond its start above 1,163.25.

If the degree of labelling within minor wave 3 is correct, then minor wave 4 may not move into minor wave 1 price territory above 1,135.10.

Minor wave 4 may be unfolding as either an expanded flat, running triangle or combination.

A new high above 1,135.10 short term could not be a fourth wave correction, which would mean that minor wave 3 is not over and is extending. If this happens, then the target at 1,115 would be inadequate.

At 1,115 intermediate wave (5) would reach equality in length with intermediate wave (1).

ALTERNATE DAILY ELLIOTT WAVE COUNT

Downwards movement for primary wave X or 2 fits as a single zigzag.

Within downwards movement, this wave count sees a triangle labelled intermediate wave (B). This has a better fit than trying to see this as first and second waves (a second wave may not subdivide as a triangle). This wave count does not suffer from the problems of proportion that the main wave count does.

Primary wave X or 2 is now a very deep correction.

Initial confidence in a trend change may come with a breach of the upper edge of the small pink channel.

Within intermediate wave (C), minor wave 3 has no Fibonacci ratio to minor wave 1. At 1,064 minor wave 5 would reach equality in length with minor wave 1.

Ratios within minute wave iii are: there is no Fibonacci ratio between minuette waves (i) and (iii), and minuette wave (v) is 0.62 longer than equality in length with minuette wave (i) (this piece of movement is seen in the same way as the main wave count; for the main wave count it is a fifth wave and here it is a third wave).

ALTERNATE HOURLY ELLIOTT WAVE COUNT

At the hourly chart level, both wave counts today require a five wave impulse to complete downwards. The targets are different, but the short and mid term invalidation points are the same.

The structure is seen in the same way for both wave counts, but this alternate is one degree lower.

TECHNICAL ANALYSIS

WEEKLY CHART

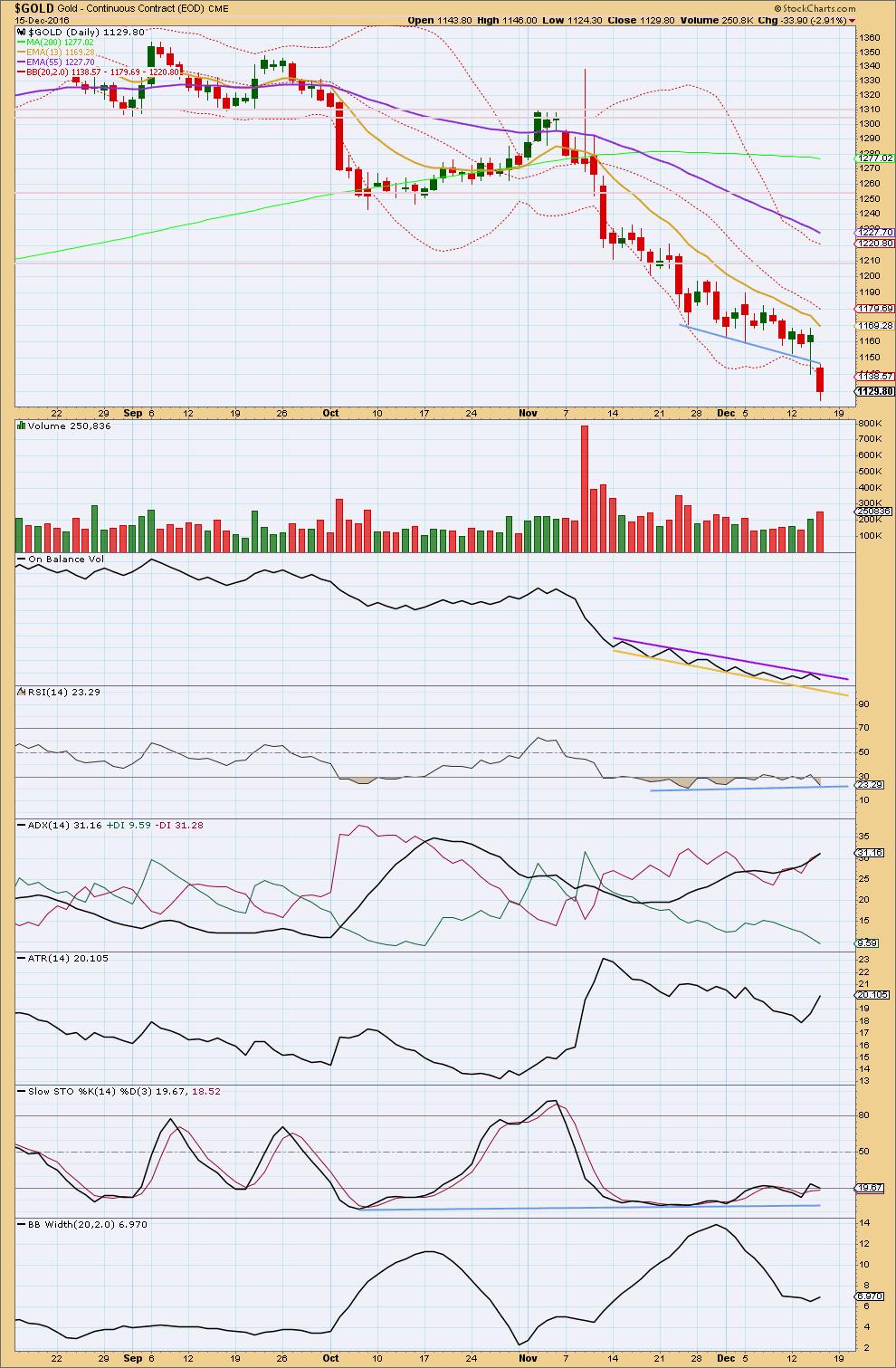

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is falling as volume is declining. The fall in price is not supported by volume. Price is falling of its own weight, and it can continue to do this for some time. But for a healthy sustainable trend volume should be supporting the movement and that is not the case here.

There is no support line here or close by for On Balance Volume.

RSI is not yet extreme. There is still a little room for price to fall further.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Up until today’s candlestick, a reasonable analysis of this chart would have noted the following:

– A bullish long lower wick on yesterday’s candlestick.

– A balance of volume upwards for yesterday’s session with some increase.

– Multiple divergence with price and RSI and Stochastics.

– Declining ATR and contracting Bollinger Bands.

Taken together this picture is fairly bullish. The only warning yesterday to a bullish conclusion may have been that price continued to find resistance at the short term Fibonacci 13 day moving average.

Now today the picture looks less bullish.

There is now only smaller and single divergence with price and RSI.

A downwards session for today closes well below the short term blue support line for price on a day with an increase in volume. This is bearish.

ADX still indicates a downwards trend in place and it is not yet extreme at 35.

ATR is now showing some increase and Bollinger Bands may be beginning to widen.

Stochastics shows still multiple and longer term bullish divergence with price.

On Balance Volume is still constrained. The upper purple resistance line has now been slightly adjusted.

Overall, some strength has returned to this market to the downside. There is still room for price to fall further.

The 13 day moving average will be expected to continue to provide resistance, until it does not. A break by price above this average would indicate an end to the downwards trend and either a trend change or a longer consolidation.

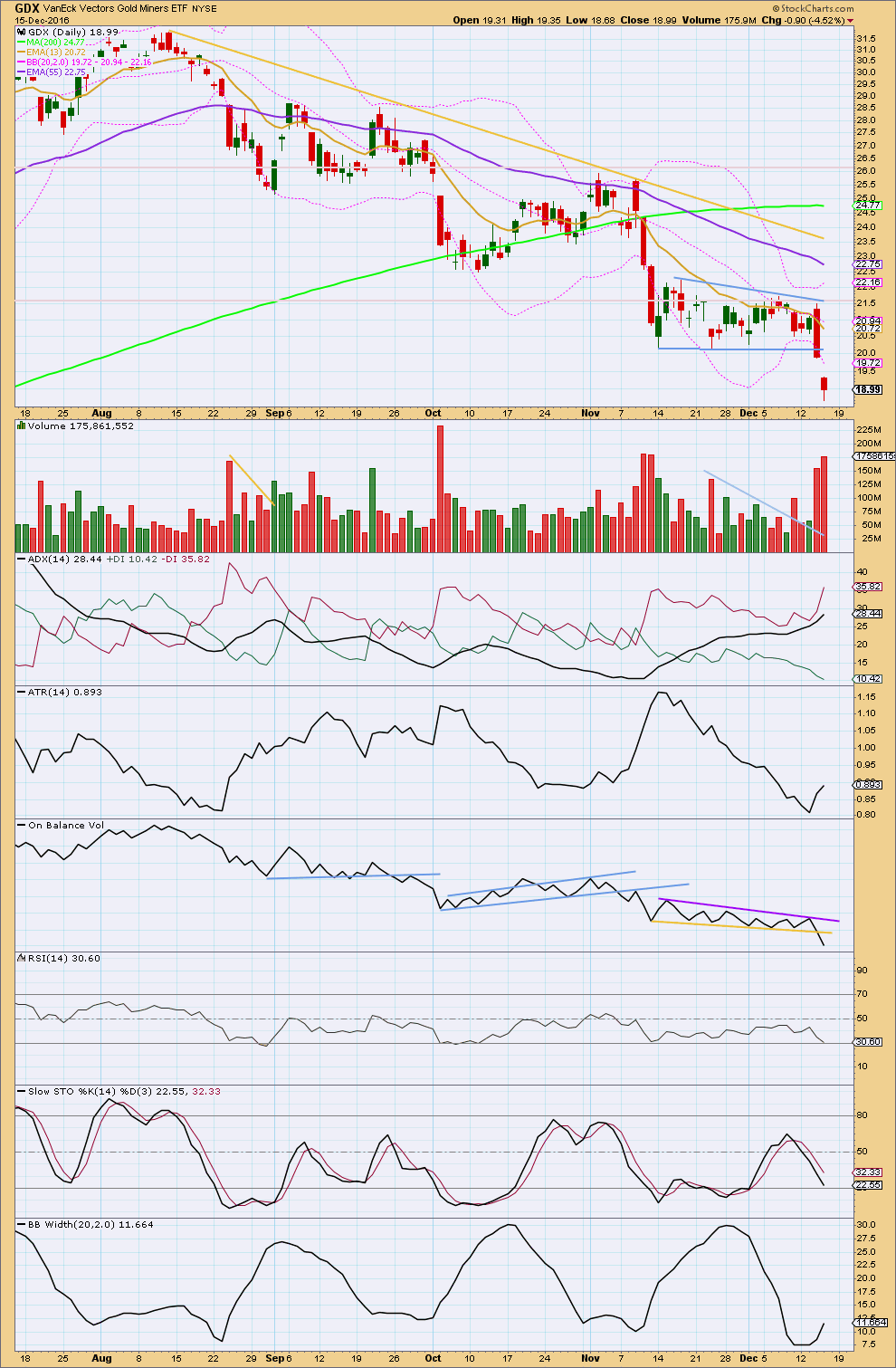

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The gap down today looks like a breakaway gap out of the bear flag pattern. Do not expect this gap to be filled short term; breakaway gaps are often not filled.

The increase in volume for another downwards day supports the fall in price.

Using the measure rule, a target about 14.50 is expected.

ADX indicates a downwards trend is in place.

ATR shows further increase today. The trend may be beginning again after consolidation within the bear flag pattern.

Bollinger Bands are beginning to widen.

On Balance Volume has finally broken below support, adding confidence to the bearish picture from price. If OBV turns up here or soon, then some resistance should be expected at the yellow line.

GDX is in a downwards trend, so I expect the target at 14.50 is fairly likely to be reached. The breakaway gap may be used as resistance.

This analysis is published @ 07:43 p.m. EST.

Thomas and Dreamer ,

Many Thanks .

Regards ,

Raymond .

Hi ,

I am waiting to send the message on the new thread , 16 DEC 2016 .

Below are just the links .

NIKKEI is red . USDJPY is falling ( GOLD Up ) . See if it bounces / reverses from 117

Regards ,

Raymond

Links only :

http://stockcharts.com/h-sc/ui?s=%24TYX&p=D&st=1986-1-17&en=1989-1-16&id=p44984464557

http://stockcharts.com/h-sc/ui?s=%24TYX&p=D&yr=0&mn=9&dy=0&id=p86027546527

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&yr=1&mn=0&dy=0&id=p01573452280

http://stockcharts.com/h-sc/ui?s=%24TYX&p=D&yr=1&mn=0&dy=0&id=p74097122016

SP500 in black overlay .

http://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=5&mn=0&dy=0&id=p51967283838

https://www.wellenreiter-invest.de/cot-daten/gold

Raymond .

Is there a break in analysis?

No. It was just a little later than usual this week.

This has to be the best thread of comments in a long time. Some great sharing and interaction between members and with Lara. Excellent! Keep it up all… this is great!

The prize for the best posts of the week has to go to Raymond! Thanks for adding your wisdom and concrete analysis with USDJPY, etc!

Sometimes gold feels like this ??

Lately its been like this ????

This next week is critical. If we’re lucky it will end like this ????

Or if we are unlucky, it will end like this ????

Thanks again to all the posters!

Hi Verne ,

Nice to hear about a similar Ending Diagonal at the SP500 , from the Institute .

The depth of its Pullback to the lower TL will be roughly about 80 points . I’m not trading this but it is about GOLD , whether we can get a multi – month SP500 pullback for GOLD to rally multi- month , or GOLD will get smashed again very soon, following the Main count . This is through the SP500/ NIKKEI / YEN correlation . The YEN Up / NIKKEI Down correlation is quite reliable . We will face a decision very soon at the next decent bounce for GOLD , Main or Alternate , like ” do or die . ” This is more my main concern .

There is another ABCDE structure within a parallel channel that may cause a deep SP500 Pullback too . Its coming Top is slightly higher ( but still below 2300 ) becos the upper channel line is drawn from a higher peak on the left , APRIL , I think .

I have not checked the US Bonds yet to see if it will also reverse to give GOLD a decent break .

Lara is of course very good with the SP500 ! , her flag ship

Are you playing SP500 ? I feel dizzy looking at all the recent moonshots !

Best of luck with GOLD . Lara ‘s two counts will capture the GOLD’s reversal . We see how to deal with the subsequent Bounce .

Thank you so much ,

Best Regards ,

Raymond .

Hi Lara and fellow members ,

USDJPY is now pulling back from its 118.70 peak , a (iii) ,…….. and GOLD is rising in inversed correlation , still lockstep and at mirror image .

USDJPY has rallied from its (i) at 116 , watch this line .

a) IF USDJPY reverses and turns Up above 118.70 , while still above 116 , then it has done its (iv) and moving Up to its (v) , and that will give GOLD another hit , hopefully the last hit . EWI has this count I last checked . All counts are subject to reality check , we will know soon .

b) IF USDJPY drops below 116 , then it is possible that its 118.70 peak is not a (iii) but a (v) , which means USDJPY has already topped out . Start looking for a bottom for GOLD . Allow a margin to test 114 ( GOLD mirror image reading here stands at 1163 )

What supports the (b) case ? I think the USD has also topped as a 5 , (3) , see here : http://stockcharts.com/h-sc/ui?s=%24USD&p=D&yr=3&mn=0&dy=0&id=p74198667477

3 at 100.71 ,……., 4 at 91.88 ,………… 5 , (3) just done at 103.11

Where is its (4) , how long will it take to get there ? Who knows for sure, just assume the usual projection . For now , there is still no observable chart evidence that the USD has reversed at 5, (3) – just an EW count and Fibonacci concurrence .

There will be no help yet from the SP500/ NIKKEI / Yen inter- correlation . The SP500 has to complete its present (iv) Pullback, then make a dash to (v) , a 3 . Then the 3 to 4 Pullback will help GOLD , via the NIKK fall/ YEN rise correlation .

Is this a 3 to 4 Pullback ? Depends on the EW count , there are many as usual , but still a Pullback .

They all point to a GOLD reversal , and likely at multi- weeks / months .

The EWI’s USDJPY Daly chart and the YEN monthly Futures chart are both showing multi- months rally for GOLD but they are just probable models based on EW counts by the respective Elliotticians . Those who have access to Avi Gilbert can check if his GOLD’s Bottom at ii is still valid . He has a funny count with a bigger 2 at the 1050 Bottom , I recall seeing it .

The question remains , will GOLD be able to lift up to 1375 ?

Good enough for me if GOLD has multi – months to rally .

This will fit the Alternate GOLD count better , until proven wrong .

As it stands now , Lara’s Alternative count has a deeper projected fall to 1064 before reversal , then a rally to 1375 and beyond .

The Main count has an earlier reversal at the projected 1115 , but will have a limited upside , before GOLD crashes to new Low . This is the killer count , pay attention to possibly sell at the bounce .

For USDJPY , 116 is critical . The mirror image reading of this value for GOLD is at 1151 . Lara’s chart will determine the actual GOLD’s reading , it is too simplistic here by mere sight and symmetry . The SP500 and DOW Industrial are highly correlated but the magnitude of the moves , tho in the same direction , are different – hence they have different counts , as is the SP500 cash and SP500 Futures , We are playing GOLD , not USDJPY , it is just a correlated proxy to be discarded soonest . USDJPY says

Either one more hit for GOLD , or no more we may have seen the worst .

The (a) and (b) mentioned above .

This is for short term to find a trade -able bottom to resume the game .

My generation first traded the market almost half a century ago with our first year paycheck and savings . Some made money and smart enough to buy properties worth millions today . Most lost and had given up . Some still around today want to play their last game in the biggest game ever invented , a ponzie game with the best minds , predators algorithms in HFT computers , sharks and giant squids . For greed , for protection , for adrenaline rush , to prove a point ,……… ?

It will not be easy playing against the rising USD , Bond Yield and Equities . Those who play by fundamentals will advise ” quit GOLD , don’t believe in reading tea leaves ” . They may be right , no point debating this , to each , his own . This is about making money , not ego bashing or religion . Just let Avi Gilbert continue his ranting against the non- believers .

I think we will see a reversal in USD , Yield and Equities shortly, supporting the case for GOLD . YEN must strengthen against the USD , against fundamental reasoning . Why not , the market is chaotic , probabilistic , non- deterministic ( thanks , Allan, for Chaos Theory , agree ) .

The Weekly COT Report will show how the big Buyers and Sellers are positioned prior last Tuesday nite . Who can read the reversal trigger point in an outdated report ? GOLD may have fallen becos of the fundamentals , but the execution of the raid was at the leveraged futures market , by the smart Commercials . The spot prices we see at largely determined there than at the physical market , than how much physical GOLD is sold in India or China , or London price fixing . At peak , the Commercials can hold shorts equivalent to say 8 months of the world annual GOLD production from the ground . Do they have so much of GOLD to short ? Not necessary . No one is yet persecuted .

The oversold indicators , EW , sentiments reading, etc were pointing to a Bottom for a while . It will bottom when the smart Commercials decide they have bought enough GOLD from the dumb money . Then they will sell again , the dumb money buys , following the price Up . A new game starts , wash and rinse .

When the price is trending , everything works again , till the next major raid .

I recall a similar raid when they cracked GOLD thru the 1500 support . I hope they don’t do it this time after the coming Bounce – that will be Lara’s Main count . Check the GOLD chart from 2012 . So we are lucky here . We have 2 counts to play the next bounce/ rally . Or we already have 2 pre- counts for beyond .

All the Best ,

Regards ,

Raymond .

Thank you Raymond. good stuff!

Thomas

Lara, I’ve got a slight change to your Alternate Daily count for your consideration. What if you move Minor 3 & 4 further up? I think this will allow the structure to complete it’s downward movement close to 1,115.

What do you think? Can this work with your data feed?

Here’s a zoomed in look at the hourly of the proposed update to your Alternate count. Will this work?

Yep. That works. I think I’ll use this idea as a second alternate. With a slight variation of the alternate published in this analysis as a first alternate, seeing primary 2 over down here and a big trend change.

The problem that I have at this stage is the great amount of overlapping and multiple corrections along the way down since the 16th of November now means that there are multiple ways to count this wave down.

With so many alternates available… which ones do I choose? Which one is the right one?

I’m going to have to chart several, check all the subdivisions, then analyse the Fibonacci ratios. The one which has the best fit, best look and best Fibonacci ratios will have the highest probability.

And even after all that work I can say which count has the highest probability, but I can never say with certainty which one is the right one.

Low probability outcomes do occur. And when they do, they’re never what you expected. Due to the nature of probability.

Aaaargh. I does my head in sometimes 🙁

Last time there was divergence like this, look what happened…

Interesting, another clue perhaps

There’s a lot of weakness, divergence and support from COT for a big trend change.

The problem with all of this though as we have seen from my analysis this week, is it points to an upcoming trend change, but it’s not really very good at pinpointing exactly when that change will happen.

Or at least, I haven’t been helpful in picking it.

With 20 minutes left in after market trading, there’s a $3.6 million bid for NUGT shares. Doubtful they will find a seller, but this seems to show some strong interest at these levels…

Some anecdotal evidence of a major low:

Newcrest Mining is Australia’s largest and most liquid gold stock by far. For this reason it is the favourite for big players that need the liquidity. Everyday after the close, an auction takes place which normal investors cannot participate in. Yesterday afternoon there was a large volume spike after the close and the share price finished 2.3% higher than the ‘official’ close at 4pm.

I remembered that I had seen this before and looked back to early December 2015 which was the comparable low to gold bottoming at that time. The same thing happened. The volume in the 10 minute auction was approaching half the total day’s volume.

My first reaction is to be angry because it is obvious that one or more big players have access to information that the rest of us don’t. (Note, gold wasn’t doing much at the time). Then I thought getting even rather than angry was a better strategy. I will probably go long Newcrest on Monday morning regardless of what gold is doing.

Interesting. I do think these levels are getting enticing for buyers. I still think there’s a good chance for another small low in GDX on Monday before a stronger bounce at minimum.

Hi,

Is Newcastle traded in the USA?

Thomas

Yes OTC. Symbol NCMGY.

Interesting Stuart. We’ll see what happens.

Symbol is NCMGY

This volume is due to GDX GDXJ quarterly rebalance. Volume is very high on these days.

Thanks for that information Stuart. That’s really important to know!

Commercials took off another 5 thousand contracts from there short positions. That was at tues prices, around 1160 or so. Since gold is now down another 30 bucks they may be down another 20 k contracts on the short side and probably long about 10 k contracts (in options they are long 5 k contracts this week). See below Link. Note options contracts are also a vehicle for commercials and are tracked to see which way they are leaning.

http://news.goldseek.com/COT/1481920248.php

This slow overlapping upwards movement now looks to be too large to be part of the last wave down.

So I think my labelling of the last fourth wave correction within the last wave down was wrong. If that was two, not one fourth wave correction then the last wave down can be a complete five.

And the following movement… it is either a second wave correction, or we can move the degree of labelling within minor 1 here up one degree and Gold could have had a trend change of primary degree here.

After a horrible week of getting it wrong on the end to this wave down I’m so hesitant to call it again. So I’d rather let price do that for us.

Assume the trend remains the same… until proven otherwise. Assume the trend is down until price tells us it is not with a move above 1,164.78.

At this stage a new high above 1,164.78 could not be a second wave correction so the downwards wave should be over.

Thanks Lara. So generous of you to give intra-day guidance that is so clear and objective. I am waiting for price confirmation per your advice regarding the trend. I did exit my short positions yesterday and nibbled on a small long trade. Patiently waiting for a move above 1164.78 to jump in. 🙂

Thank you Verne, you’re most welcome.

After posting charts and watching for a bit, I took off today to do my very first volunteer day withMarunui Conservation. I have just come back after about 5 1/2 hours trekking through the bush, re baiting and cleaning out traps.

No dead possums, rats or stoats today on the route I did. Just horrible old stinky salted rabbit bait. 3 or 4 rats and one possum on other routes. For 423 hectares that’s pretty good.

And safe Kiwi 🙂

I feel SO GOOD.

I was in the South Island a few years back and I believe the possums, not native are running amuck. They can get rid of them. They came from Australia where there are natural predators, but none in New Zealand. Lots of possum fur hats down south

They’re running amok all over the country. They eat native plant species, stripping the bush. They eat bird eggs and kill chicks. (Humorously in Australia their possums are endangered. I’m like, come on over Aussies and take them all back!)

They destroy habitat. They’re a real menace.

Then there’s the mustelids. Stoats, weasels and ferrets. They’re killing machines, ferrets can kill an adult Kiwi easily. And they’re smart, really hard to trap and kill. Just one can wreck havoc on a population of endangered birds.

Then we have humans who take their dogs into areas where Kiwi live, and adjacent areas. Or they are irresponsible enough to let their dogs get lost. It really makes me so angry.

Our flightless birds don’t have a breast bone, they don’t need it. So pressure on their breast, a bite from even a small handbag dog, can kill them.

The No. 1 killer of Kiwi here in Northland is dogs.

So Kiwi need the help from everyone who cares for them and wants to see them survive, if they are to. My biggest problem is what to say to people who are irresponsible with their dogs, some of whom are my friends 🙁

Are they edible? Are they tasty, love? 🙂 🙂 🙂

Over the past few weeks I’ve noticed on this thread that a lot(not all) of the comments were still showing some optimism for a bullish case to be made and slowly more and more it seems pessimism is gaining strength, to the point where is seems we’ve given up hope that a turn up in Gold will ever happen. Isn’t that the way Socionomics and Elliott Wave works? At extremes of optimism and pessimism, a change of direction is about to occur. It may not always coincide perfectly, but closely. In EWI tonight they where talking about levels of pessimism only seen a few times in the past with gold, but the past 21 days have seen record pessimism that had not been seen in the past 29 years. Gold is currently at 4% bulls and it appears almost everybody never wants to buy Gold again.

Help me understand this better if I’m saying something wrong.

Thanks

Thomas

Makes perfect sense. I’m still hanging on to my bullish counts, BUT gold really needs to turn up strongly next week IMHO. Since it has now broken below major support clusters, it need a strong move up ASAP to prove this is just a bear trap!

I’m glad you all spend so much time labeling and re-labeling all the counts and alternate counts for us, because after a while for me it’s like a pig looking at a Rolex watch, it’s beautiful, but I’m not sure what to do with it. Thanks for all your work for us.

Thomas

Thomas. Your observation is correct.

Traders have to be nimble in order to make a living. Gone are the days of buy-and-hold, unless you have a seemingly endless supply of money. Warren Buffett is one such example. But, how many people has the pecuniary muscle to emulate him? Most of us are not billionaires, and we trade day to day, which means our time horizon is very much shortened. Our action, or reaction, to the market mood has to be deft. “He who fights and runs away lives to fight another day” is an apt descriptor.

That aside, let’s look at the fundamentals which outlines the social mood. I submit that the only thing that still makes the bulls hang on is the (remote) possibility of a total collapse of the financial system. Even an obscene national debt hardly moves them. To prove my case in point, take a look at Japan. It has probably the world’s largest debt, and yet its currency and market are still very strong, ongoing for decades.

The entities that buy a lot of gold are the ETFs, China and India. The recent demonetization debacle in India has curbed the gold trade there to almost a trickle. China had quietly enforced measures to stifle monetary outflows, and that obviously includes gold. So, the common people buy less. ETFs, while they make the purchase of gold (or rather its derivatives) much easier, is proving to be the undoing of gold. In the past, gold, in the physical form, used to be an investment, a hedge against the vagaries of the market. Paper instruments are issued for unallocated gold, meaning that they keep a minimum amount of gold and leverage on that. Gold now becomes a speculative instrument. This means it moves ahead of the market, instead of following it. The winds of uncertainty and ambiguity blow stronger, and the direction of gold movement changes just as quickly as that of the wind.

In the US, the recent stock market mania fanned by Trump’s win had siphoned off a lot of resources from the gold market. The announcement of an unprecendented series of rate hikes was perhaps the final nail in the coffin. Gold has no intrinsic value. It pays no dividends. Its value is largely determined by demand. An increase in interest rate robs gold of much of its lure. To add insult to injury, the rise in the US dollar makes gold much more expensive to buy, if one looks at the comparative cost vis-a-vis stocks.

So, is there any wonder that gold has been relegated to being the unwanted child? As small-time players, and not market movers, we just have to grin and bear it (pun intended).

Wow! Thanks Alan. That was much more than I expected and it’s very much appreciated.

I’ve made money buying and selling NUGT and DUST and I remember reading last year that someone was predicting DUST was going to drop to $0. I didn’t know whether to laugh or cry, but having DUST in my portfolio at the time caused me to seriously consider selling to minimize my loss, but I held on and ended up making money..it took a while longer than I wanted and $0 never arrived. Now it’s almost implied the same will happen to NUGT though I haven’t heard anyone say $0 in this case.

Again, thank you for your input both to me personally and to the entire group with all your Intel.

Thomas

Lara, what about considering Intermediate 5 as an ending diagonal? The count as labelled above will be very squeezed from Minor 2 down to 1115. I don’t like its look.

My suggestion is to move the labelling of the minute waves up one degree, such that:

Minute i becomes Minor 1

Minute ii becomes Minor 2.

The point labelled Minor 1 is changed to Minor 3.

The rise becomes Minor 4.

The final drop can then target 1115 (the 0.786 retrace that many people think is the low).

The movement down from 1164.78 will be the same for both Main and Alternate.

Yes, that will work.

The diagonal has to be expanding because minor 3 > minor 1.

So minor 4 > minor 2 = above 1,151.23.

Then minor 5 > minor 3 = longer than 40.17.

Except minor 1 and minor 3 both look more like impulses than they do zigzags. And so I suspect that although the wave lengths work and it has mostly the right look for a diagonal, it’s not the right count.

Like this…

Silver has formed a bullish pattern in 1 hour period. Small body candles with two tall green candles on both side.

Let see what happens next few days in coming week.

Lara and fellow members ,

EWI has updated their Hourly chart on USDJPY : It now says (iii) is done and it is doing its (iv) Pullback ( GOLD bounces now ) . IF correct , the next move is Up , to (v) , say at 119.59 ( GOLD falls ). That is the USDJPY Top . And if you check their Daily chart as a free member , this Top is for USDJPY to reverse down to 99 , say .

That means a multi- months rally for GOLD , which I think is enough time to take GOLD above 1375 . The link I posted yesterday said the same thing based on YEN Futures monthly chart but mentioned DEC to MAY next year . Their chart is monthly , so you can size up the number of months ( not days or weeks ) for GOLD to rally by direct correlation with YEN ( JPYUSD ) .

On my part , I will follow the SP500’s Pullback from 3 to 4 in an Ending Diagonal , drawn from SP500 at 1810 . This is for the SP500 / NIKKEI / YEN intercorelation , a bit obtuse but will give the same results .

As I have mentioned before , USDJPY at 116 is important becos it is (i) .

The mirror image reading of this on the GOLD Hourly is 1150.

To be more conservative , take the USDJPY 114 or GOLD 1163

( I have 2 Hourly charts with USDJPY on top , GOLD at the bottom .)

Check out below Lara’s ” IF price breaks above 1163.25,………. intermediate (5) may be over ” . Sweet words for the ears and battered souls .

Irrespective of the EWI ‘s count on USDJPY Hourly , correct or wrong , once below 116 , go seriously looking for a GOLD bottom . I will start Buynig below 114 , per Lara’s comments above . I believe all these will be sorted out soon in Lara “s GOLD chart .

Personally , the Bull or Bear count is more important to me , ie I’m looking for a multi- month rally at other inter- markets . Will there be one , to support Lara ‘s Alternate count ?

Regards ,

Raymond .

Hi Raymond:

Interesting comment about an SPX ending diagonal. Peter Temple of WCI (World Cycles Institute) is also seeing one and I ran it past Lara but she does not see quite that kind of wave structure. We should know for certain by the depth of the wave four pullback as an ED fourth wave would be quite deep, going back into wave one territory. If that happens it would certainly dislodge quite a few bulls ahead of the final wave up. It would also in my opinion be the most awesome trade set-up of a lifetime.

Like this guys?

It all fits so far; subdivisions are correct, wave lengths so far would fit.

But I expect this count is wrong because diagonals normally adhere neatly to their trend lines. This one doesn’t.

I’ll keep this chart on the back burner and may use it if proven true. But it has to prove itself, because IMO at this stage the probability is very low. A simple impulse is easier and doesn’t have the trend line problem.

Or is it this?

This is better, and a contracting diagonal would be more common. No trend line problems. P4 must overlap P1 so must move below 2,193.81. P4 may not be longer than P2 so can’t move below 2,163.98.

I know I’m putting charts of the S&P up here at EWG. But the two markets are going to move in opposite directions again soon.

I do keep both in mind when doing my analysis, it’s an important consideration. Lately there have been periods of time when they’ve moved together. So the relationship is fluid.

So now down into this range, then one final short wave up to overshoot the 1-3 trend line and it’s all over.

Lara you are really amazing! I actually like that count. My thinking is that this bull is going to do something to curb the current market enthusiasm before the final jaunt higher. Thanks for charting that idea! 😀

OK , that’s for the update Lara.

think it’s gone now. Is this the start of wave 3 or Y up?

I would move the degree of labelling within minor 3 down one degree.

I would now label to the last low minute i of minor 3, now this upwards move is minute ii of minor 3.

And I’d leave it like that while price remains below 1,163.25.

Like this

If price breaks above 1,163.25 then I’m wrong and intermediate (5) may be over.

Lara.

The assumption for minuette c is an ending diagonal.

This will be negated if price goes higher, but less than 1163.25. Then, the point labelled subminuette v may only be the first subwave of subminuette iii, i.e. micro i. This count will yield minute ii to be close to 0.618 retrace of minute i @ 1147.91.

My mistake.

Minute B unfolds as a combination WXY. It could now be over at 1140.79.

The movement was 1123.08 – 1132.15 – 1124.00 – 1140.79.

I’ll use the final drop target as 1064.

This implies one more nice flush to the downside. It would be great to see that. I exited my PM short positions yesterday and am 1/4 into my long trades waiting for confirmation. It sure would be good to see some strong reversal signals the next day or two.

May be some sort of wave ended here at 1135.1 and above. Yes hope this correction in alt wave count is over. Beginning of wave Y or wave3 ????

Next is the 1163.25 to be taken out???

Minor 4 is now invalidated

BarCharts data has it at a top of 1134.48, which is below the invalidation point of 1135.10.

Yes. Close, but not there yet.

Hi ,

Elliott Waves International (EWI ) has updated their 2- Hourly USDJPY which shows an arrow pointing upwards to (iii) , ie (iii) is not finished yet . IF this is correct , then GOLD should be falling further with (iii) . Wait and see , no other way to know for sure .

In USDJPY the 116 level is important . IF it falls below that , then 114 ,… and below that , I will think seriously that USDJPY may have even topped out ! Good for GOLD then , start looking for a bottom then . Still very fluid but critical juncture if the USD Daily confirms a (3) and start rolling Down .

Refer here : http://stockcharts.com/h-sc/ui?s=%24USD&p=D&yr=5&mn=0&dy=0&id=p92891275599

Possible count : 3 at 100.71, ………… 4 at 91.88, ………. 5 at 103.11 last nite , called a (3) above . The 3 to 4 took about a year . What about the coming (3) to (4) ? The plot thickens and we are in a blind spot, some of us bleeding .

Visit the EWI site , sign in immediately as a free member to access their FX charts including the USDJPY chart for yourself . The free access closes tonite . EWI is very generous with a lot of freebies for free members .

You will find their FX charts by Marten very different from Lara’s GOLD charts.

Their intraday charts are at 120 and 360 minutes , and quite bare , without confidence / invalidation lines , trend channels , and targets .

They use compressed bar charts , with no smaller degree intermediate counts/ tags in between , like say just a (ii) jumping to a (iii) , bare in between . The GOLD chart here is Hourly, showing every hourly candle and almost every turn is painstakingly counted and tagged, for checking and retracing , and education .

A class of its own , no point comparing .

EWI is a big name with the respectable Prechter behind it . Learn about Socionomics , a new body of knowledge with Prechter driving it . EWI lost a bit of their reputation when they kept calling for SP500 to top . But who on earth can count this uni- directional runaway train correctly , with all the Central Banks pumping fuel in non- stop , and with zero interest rates ? Things may start to change now with the US doing the opposite finally . So in SP500 , I will give the Ending Diagonal a shot , and stay with GOLD .

Regards .

Raymond .

EWI is a real mystery to me Raymond. They clearly have some very talented people in that outfit but I am completely befuddled by their years’ long inability to recognize a bull market. Prechter is very bright, but also maddeningly obstinate and will rarely concede when he is indisputably wrong. Hulbert’s Digest ranks their forecasting ability as the absolute worst of all the players they have scored, a position they have occupied perennially. Go figure! 🙂

Lara, if possible, two requests before you enjoy your Holiday:

1) Can you please update your GDX EW count(s) next week?

2) Can you make sure your last Gold post stays “open” for comments at least 17 days? (last year I think it was only 14 days as we were locked out for the final Fri-Mon until you came back and posted a new Gold analysis)

Many thanks!!!

Yes Lara.

Leaving the Gold final post open before you go for the holidays is a good idea.

It allows us to exchange ideas on the price movements.

Thank you, yes. I will do that, and I’ll make sure it covers the entire period for which I’m not here.

Excellent! ?♀️

I second that.

GDX may bounce tomorrow after another small 5th wave down to around 18.30.

A strong bounce with a gap fill and continued move up is the only chance for the BULL count.

A small bounce and a continued move lower confirms the BEAR!

Updated GDX “Last Stand” chart. Gap down today does not look good for the BULLS…

Here’s my updated “Gold Last Stand” chart. Not looking good for the BULLS…

What an interesting situation in the PMs!

The possibility of a primary third wave to the upside is quite something. I know Gold tends to begin a new uptrend haltingly but it sure would be nice to see some break-away gaps to signal we were in a P3 and not a P2 to the upside. Perhaps the action in some of the inverse indices will give us a clue. If they announce a reverse split in NUGT that could be probative! Similarly if they do for DUST…. 🙂

Lara I found this article on some site:

Why Fed is tilting at Windmills

“I grew up surfing in Southern California. Sure, I played baseball and basketball like most other boys along with a lot of soccer but these never really captured me like surfing did. I was eight years old when I first stood up on surfboard and rode a wave to the beach at Latigo Point and from that moment I was hooked. There was truly something magical about harnessing the power of Mother Nature for nothing other than the pure joy of essentially walking on water. Over the next decade I surfed as much as I could and I think those experiences taught me much of what makes up the foundation of my investment approach today……….”

“In other words, great surfers are highly attuned to natural cycles. It doesn’t take very long at all after sitting out in the water to see that waves come in to the beach in sets….”

Read on….

https://www.thefelderreport.com/2016/12/14/why-the-fed-is-tilting-at-windmills/

Most interesting. I agree with the writer’s sentiments that the charade will ultimately come to an end, despite its seeming interminable longevity. The thing I find most amusing is how all the talking heads are acting as if the FED is leading the way toward higher rates, as opposed to clearly following the market, which is always the case. If they do not, they will be unable to sell a single T-bill on the market (data dependence my hiny!)