Last analysis expected downwards movement, which is what has happened.

Members who took last week’s trading advice to enter short on the bounce of the 14th of June should now have profitable positions. Advice is given this week on how to manage those profitable positions.

Summary: The target for downwards movement to continue remains at 15.17. Corrections are an opportunity to join the trend. Stops may be set just above 16.726 or at breakeven now if positions are profitable.

Expect price to keep going down while it remains within the best fit channel on the first daily chart. If the channel is breached, take profit on short positions.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly chart is here.

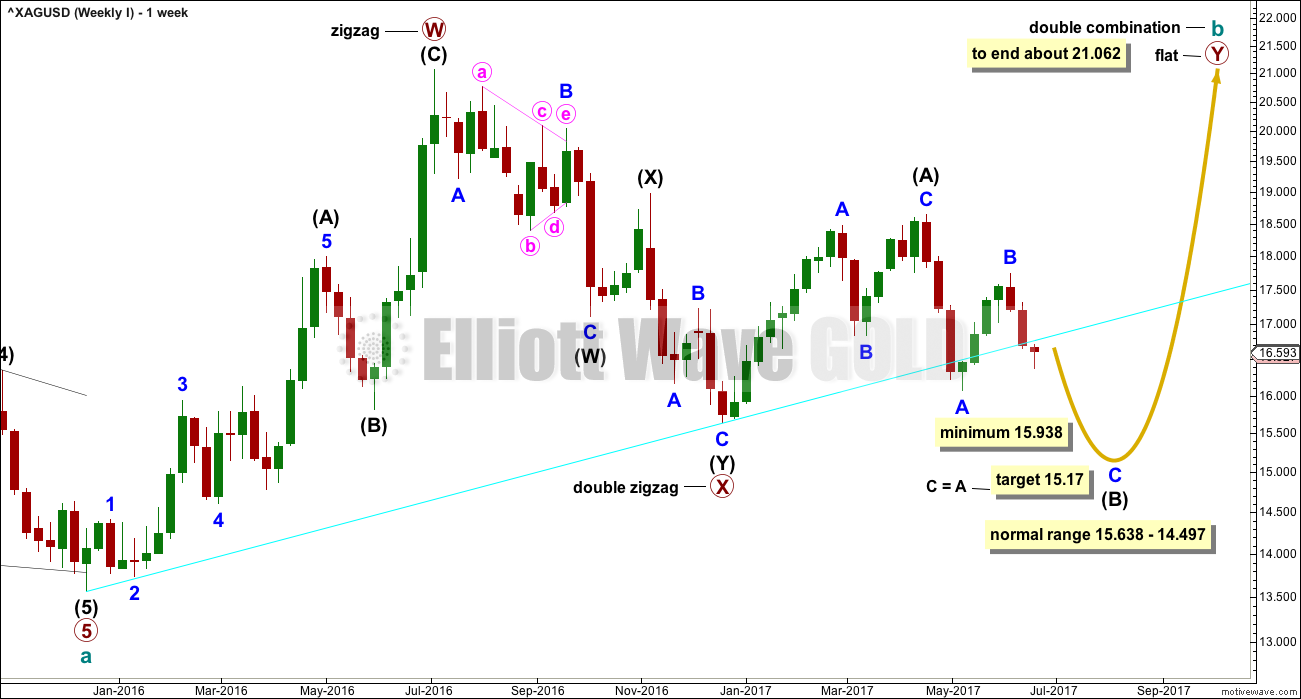

ELLIOTT WAVE COUNT

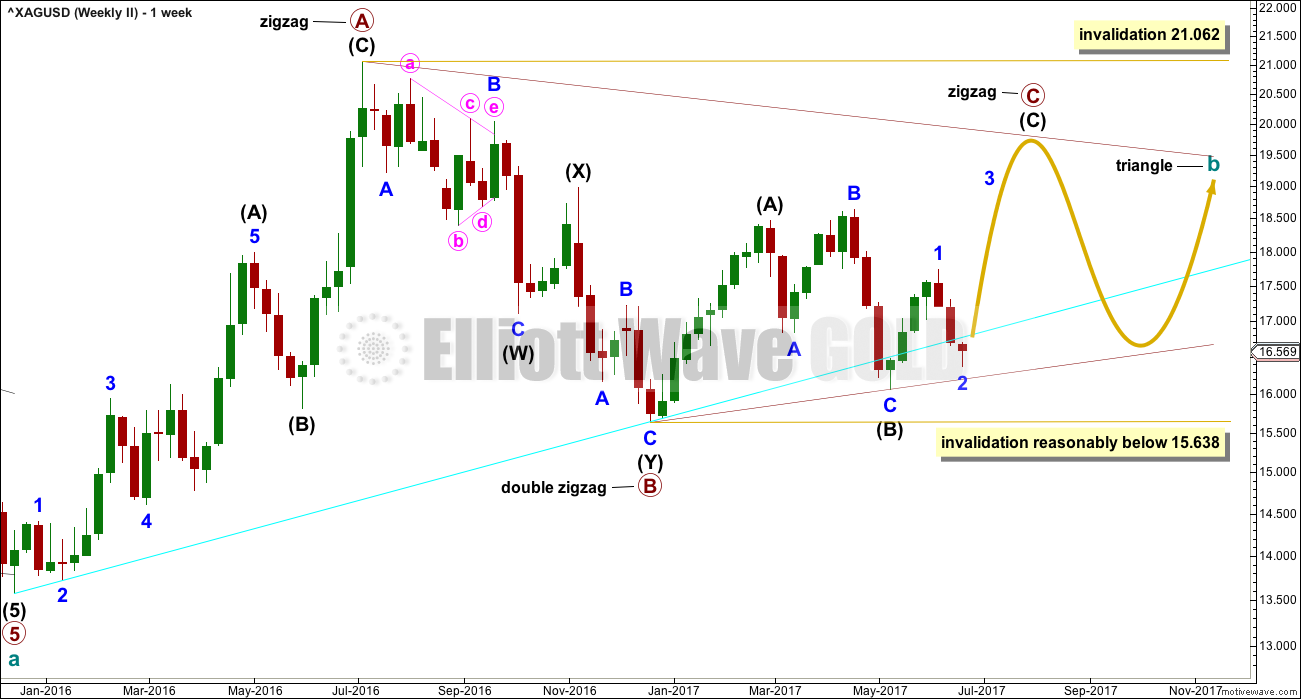

FIRST WEEKLY CHART

Cycle wave b may be completing as a double combination: zigzag – X – flat. The second structure, a flat correction for primary wave Y, may be underway.

Within a flat correction, intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 15.938. The common range for intermediate wave (B) is from 1 to 1.38 the length of intermediate wave (A). The target calculated this week would see intermediate wave (B) reach to within the common range and pass its minimum requirement. If minor wave B moves any higher, then the target for intermediate wave (B) must also move correspondingly higher.

Intermediate wave (B) may make a new price extreme beyond the start of intermediate wave (A), as in an expanded flat, which are very common structures.

The bigger picture for cycle wave b would expect primary wave Y to end about the same level as primary wave W about 21.062. The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double normally ends about the same level as the first.

The maximum number of corrective structures is three within combinations (and multiple zigzags). This maximum applies to sub-waves W, Y and Z. Within these structures, they may only be labelled as simple A-B-C corrections (or A-B-C-D-E in the case of triangles). They may not themselves be labeled multiples as that would increase the number of corrections within the structure beyond three and violate the rule.

X waves are joining structures and they are not counted in the maximum total of three (otherwise the maximum would be five). X waves may be any corrective structure, including multiples.

While the combination wave count at the weekly chart level does not currently work for Gold, it does still work for Silver. They do not have to complete the same structures for cycle wave b, and fairly often their structures are different.

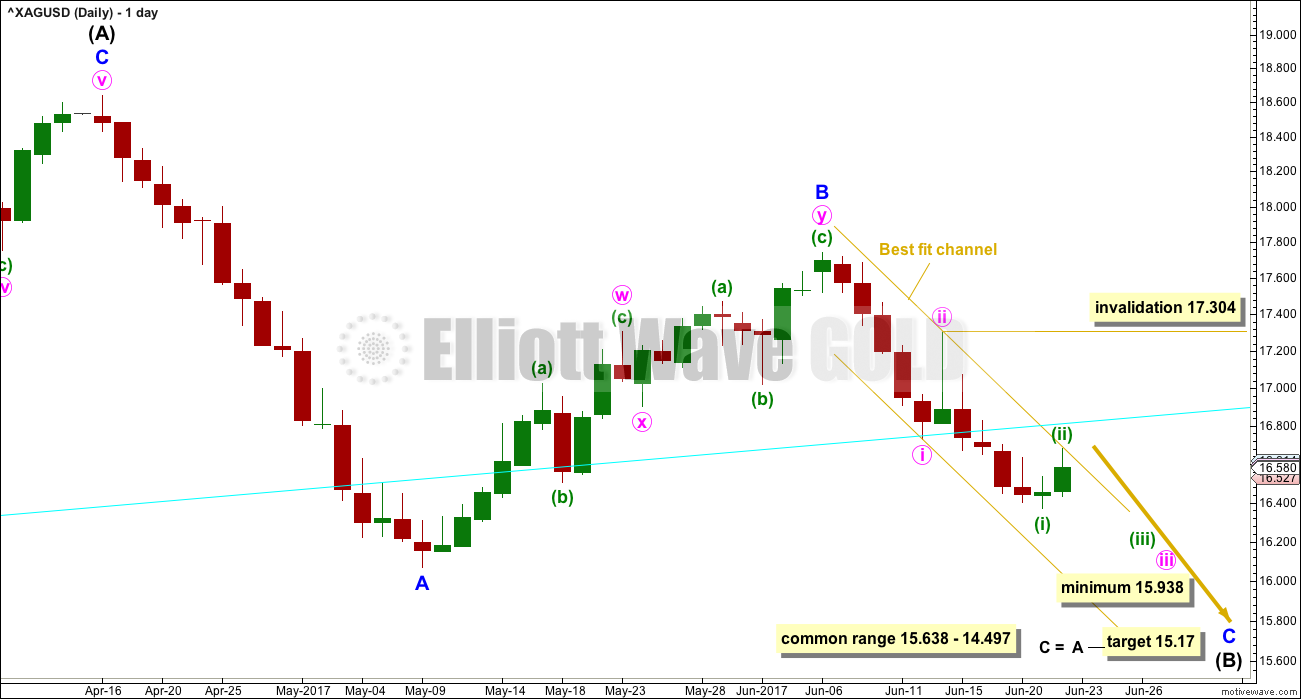

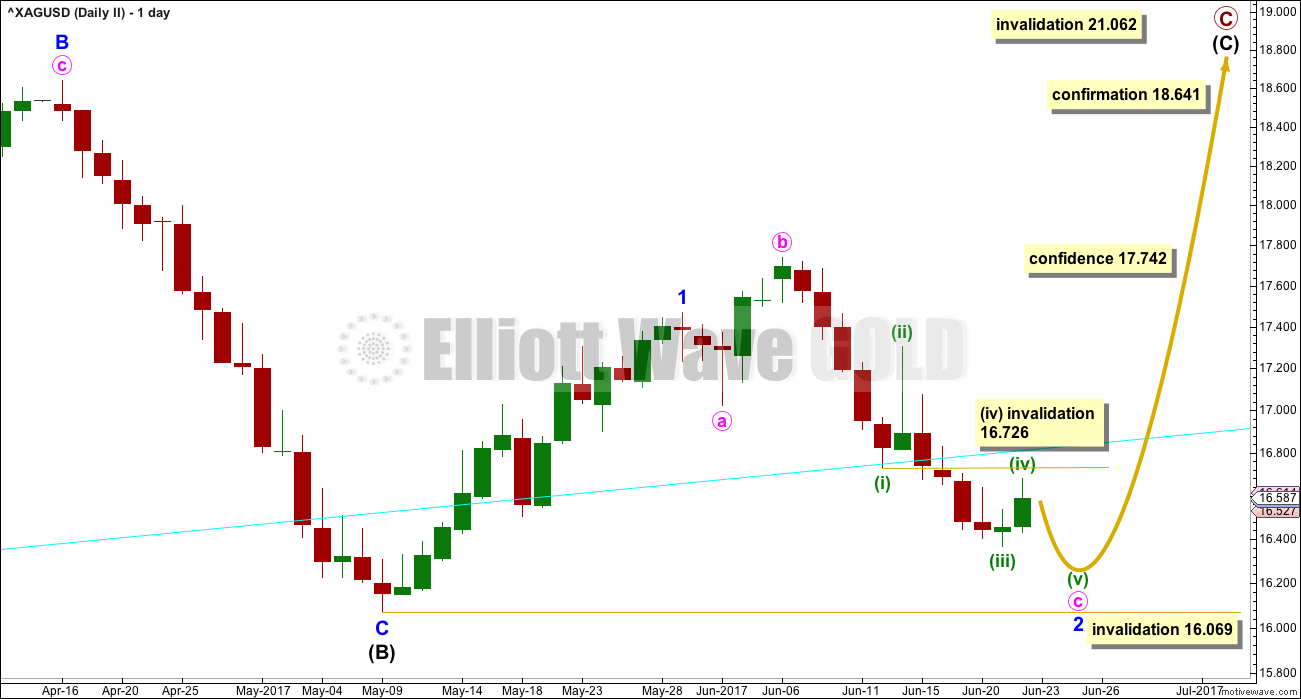

FIRST DAILY CHART

Minute wave ii was over as expected in last analysis, and has provided a perfect entry to join the downwards trend. Members who took that advice last week should have profitable positions, so now move stops to at least breakeven or lower to protect some profit. Use the best fit channel to calculate a daily trailing stop, and set stops just a little above it; allow for an overshoot but exit shorts if the channel is breached.

If this channel is working correctly, then today’s session should also have its high in place now. Technically minuette wave (ii) may not move beyond the start of minuette wave (i) above 17.304.

SECOND WEEKLY CHART

It is also possible that cycle wave b may be completing as a triangle. Mostly because combinations are more common than triangles is this a second wave count.

Within a triangle, only one of the sub-waves may be a more complicated multiple. Primary wave B subdivides as a double zigzag. Primary waves C, D and E may only be single threes.

Within a contracting or barrier triangle, primary wave C may not move beyond the end of primary wave A above 21.062.

To label primary wave C over at the last high of the 17th of April would see the A-C trend line too steeply sloped to have a normal look. It would be only a 0.55 length of primary wave B, which is unusually short for a triangle sub-wave. It would look more likely that primary wave C is not over.

Within a contracting triangle, primary wave D (nor any part of primary wave C) may not move beyond the end of primary wave B below 15.638.

Within a barrier triangle, primary wave D should end about the same point as primary wave B. As long as the B-D trend line remains essentially flat the triangle will remain valid. In practice, this means that primary wave D may move slightly below the end of primary wave B (this is the only Elliott wave rule which is not black and white).

The final wave of primary wave E may not move beyond the end of primary wave C. It would most likely fall short of the A-C trend line.

This second wave count expects a large consolidation to continue for months.

SECOND DAILY CHART

Primary wave C may be an incomplete zigzag.

A new high above 18.641 would at this stage invalidate the first wave count and provide some confirmation of this second wave count.

Minor wave 2 may have continued lower. Minute wave c must complete as a five wave structure; the fifth wave is incomplete. Minuette wave (iv) may not move into minuette wave (i) price territory above 16.726.

Minor wave 2 may not move beyond the start of minor wave 1 below 16.069.

TECHNICAL ANALYSIS

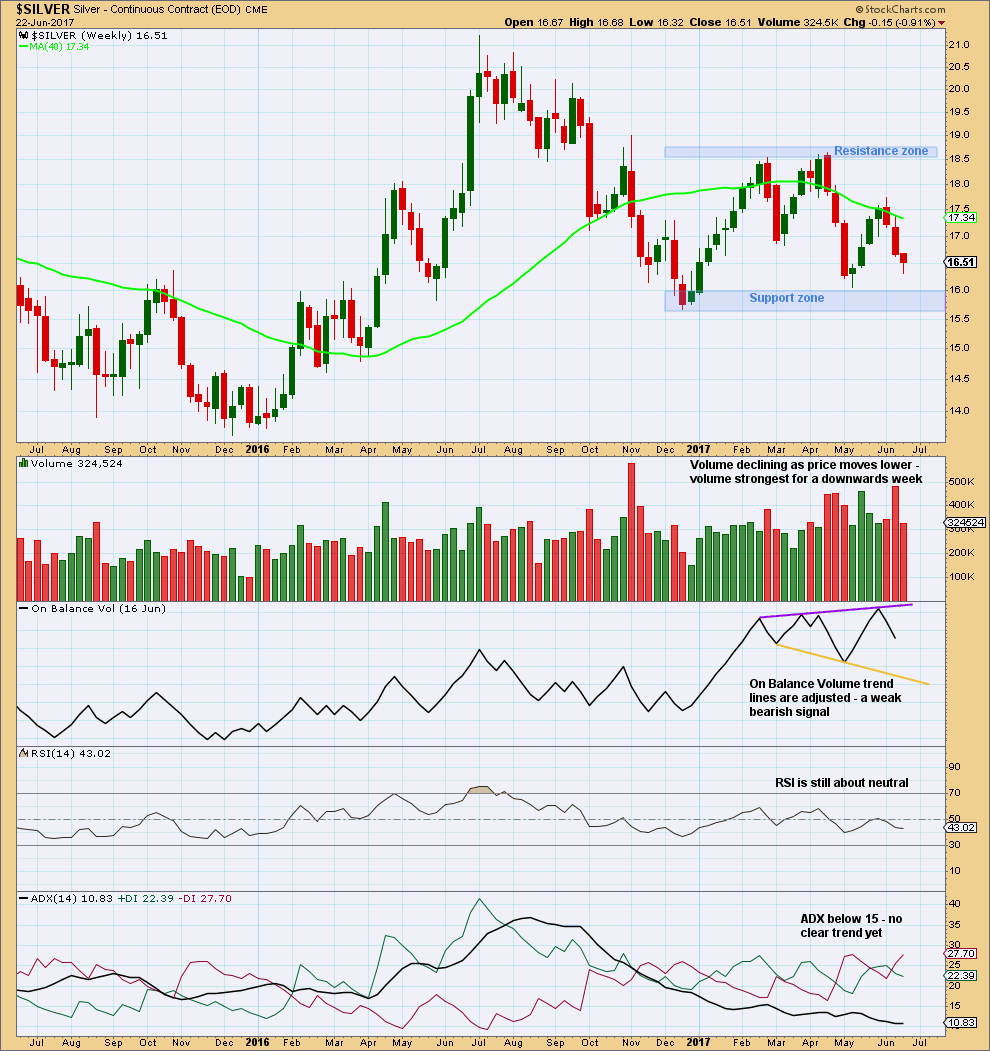

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Volume now suggests a downwards breakout from the trading range is more likely than upwards.

Overall, Silver is now in a large consolidation at the weekly chart level. Support is about 16.05 – 15.70 and resistance is about 18.55 – 18.65. ADX agrees that price is consolidating.

A weak bearish signal from On Balance Volume suggests only that a downwards swing within the larger consolidation may be underway now.

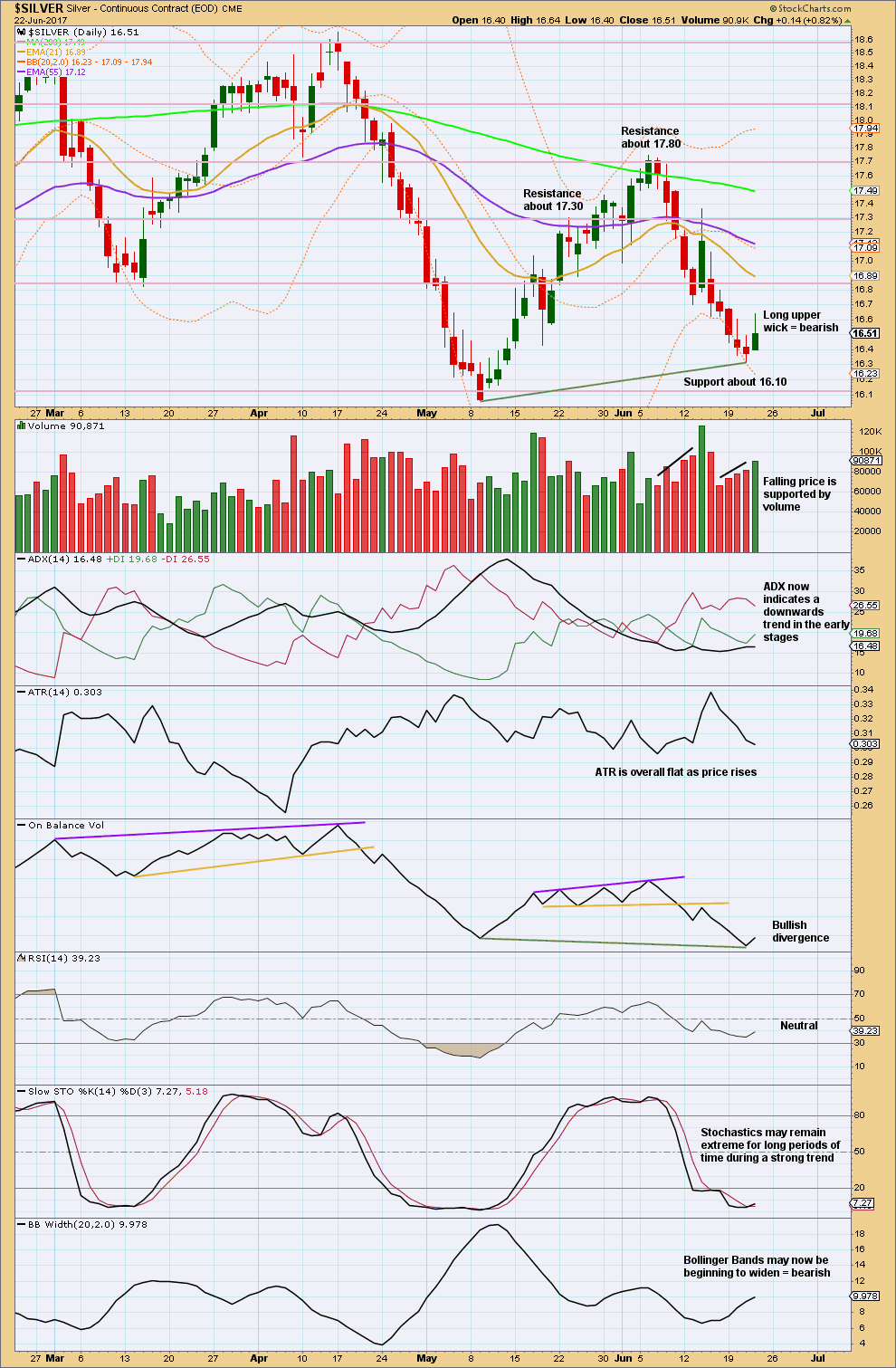

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart is sending mixed signals this week.

While I give reasonable weight to trend line signals from On Balance Volume, I do not give so much weight to divergence between price and On Balance Volume.

Today’s candlestick is bearish. Volume is bearish. ADX is bearish. Bollinger Bands are bearish.

On Balance Volume gives a bullish signal.

This analysis is published @ 10:34 p.m. EST.

Silver moving higher and has breached Elliott channel. Perhaps this time the white metal is the follower?

Silver could be giving us a clue about where Gold is headed. Today”s candle looks counter trend and quite anemic. I plan on reloading short trade via short SLV calls.