The target at 1,279 was expected to be a little low. A trend line higher up was expected to halt upwards movement. However, this is not what has happened, and the trend line is overshot.

The main Elliott wave count is changed today.

Summary: An upwards trend now looks likely to be in place. Price is at resistance and shows a slight decline in volume today; look out for a pullback about here which may end about either 1,280 or 1,266 and last about two to three days. If this is how price behaves, it may offer us an entry opportunity to join the upwards trend. The final target is now at 1,320.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts and alternate weekly charts are here, video is here.

Grand SuperCycle analysis is here.

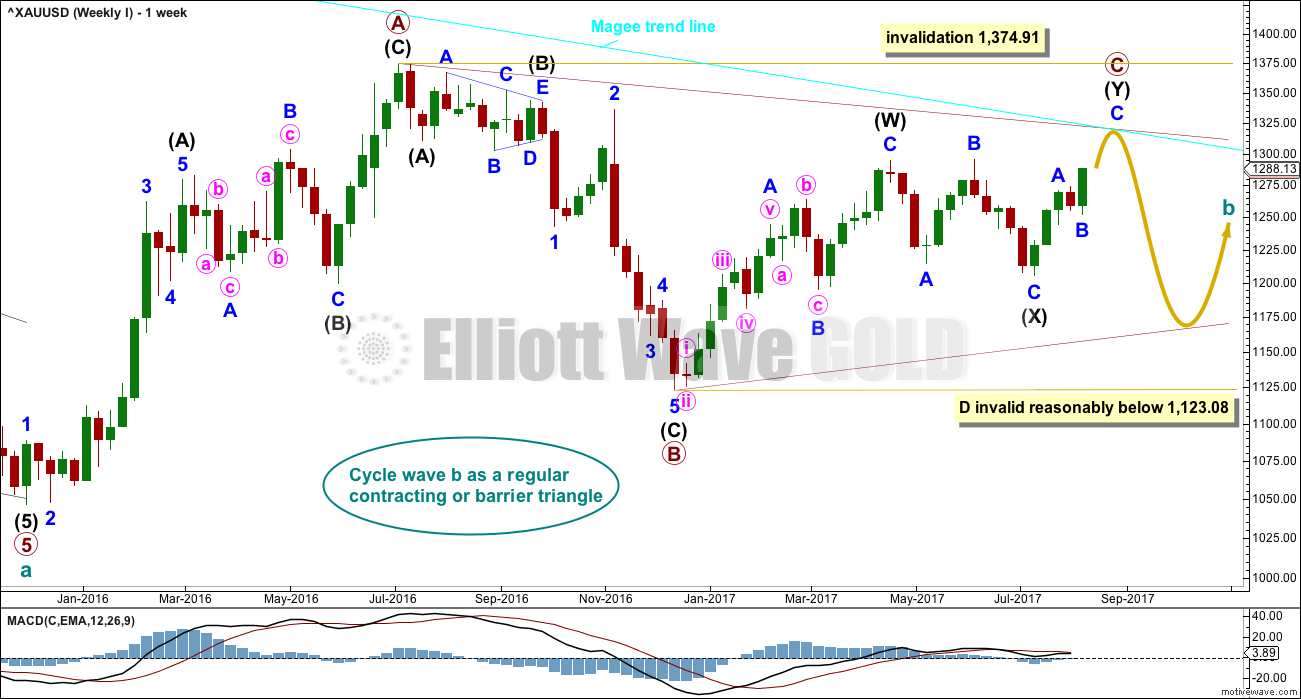

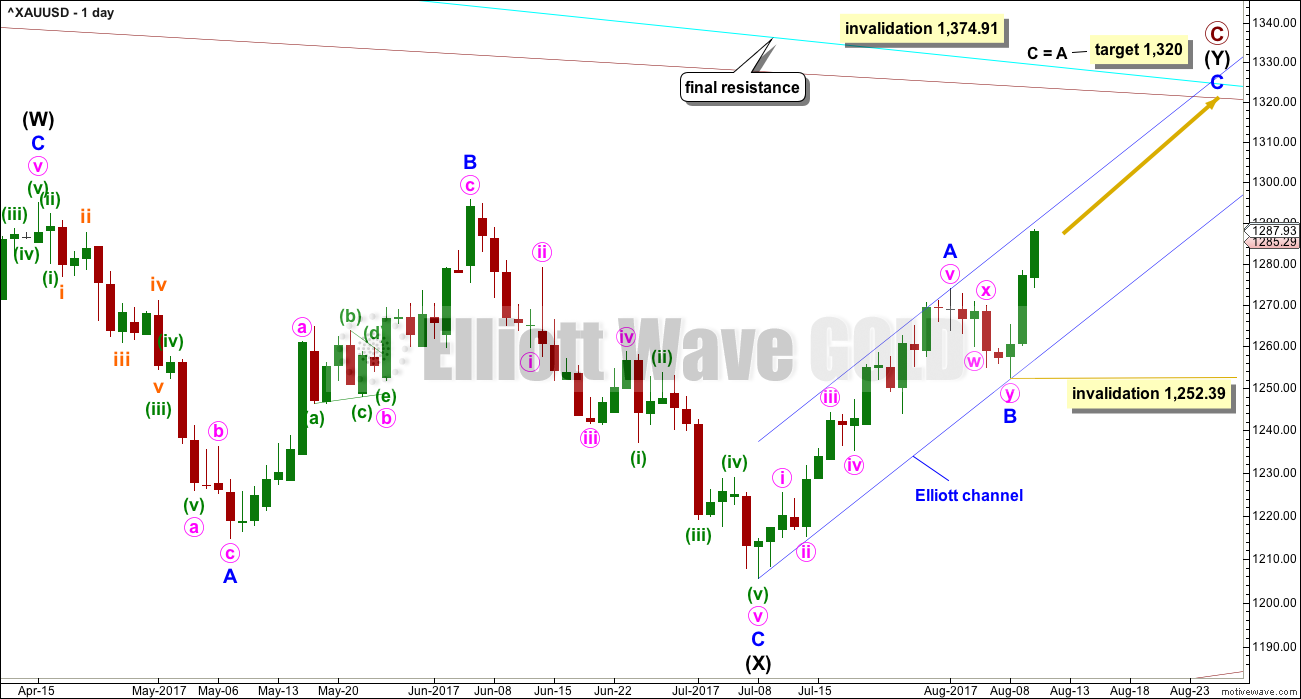

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

The Magee bear market trend line is added to the weekly charts. This cyan line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012. This line should provide strong resistance.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has some support from declining ATR and MACD now beginning to hover about zero.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

The wave count today is changed at the weekly chart level to see primary wave C an incomplete double zigzag. The material change is to see intermediate wave (X) over later as a regular flat correction. Intermediate wave (Y) now looks like a developing zigzag at the weekly chart level, and minor wave B within it shows up with one red weekly candlestick. Primary wave C may end at the Magee trend line.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Triangles normally adhere very well to their trend lines. With the A-C trend line in yesterday’s analysis now strongly overshot, that labelling of primary wave C now looks wrong. This is the reason for the change today.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C may now be in its 34th week. A double zigzag may be expected to be longer lasting than single zigzags within a triangle, and so this continuation of primary wave C is entirely acceptable and leaves the wave count with the right look at this time frame.

DAILY CHART

The last two upwards days have necessitated a change to the wave count. A new target for primary wave C to end is calculated using the most common Fibonacci ratio between minor waves A and C.

Within minor wave C, no second wave correction may move beyond the start of its first wave below 1,252.39.

Minor wave C may only unfold as a five wave structure, either an impulse or an ending diagonal. An impulse is much more common and will be expected until shown otherwise by price.

Within an impulse for minor wave C, the corrections of minute waves ii and iv would most likely show up on the daily chart, like they do within minor wave A. Minute waves ii and iv within minor wave A both lasted two sessions, so they may also last about two to three sessions within minor wave C.

Minute wave ii may reasonably be expected to begin about here, with price at the upper edge of the Elliott channel providing resistance.

Minute wave ii may be used as an entry opportunity to join the current upwards trend.

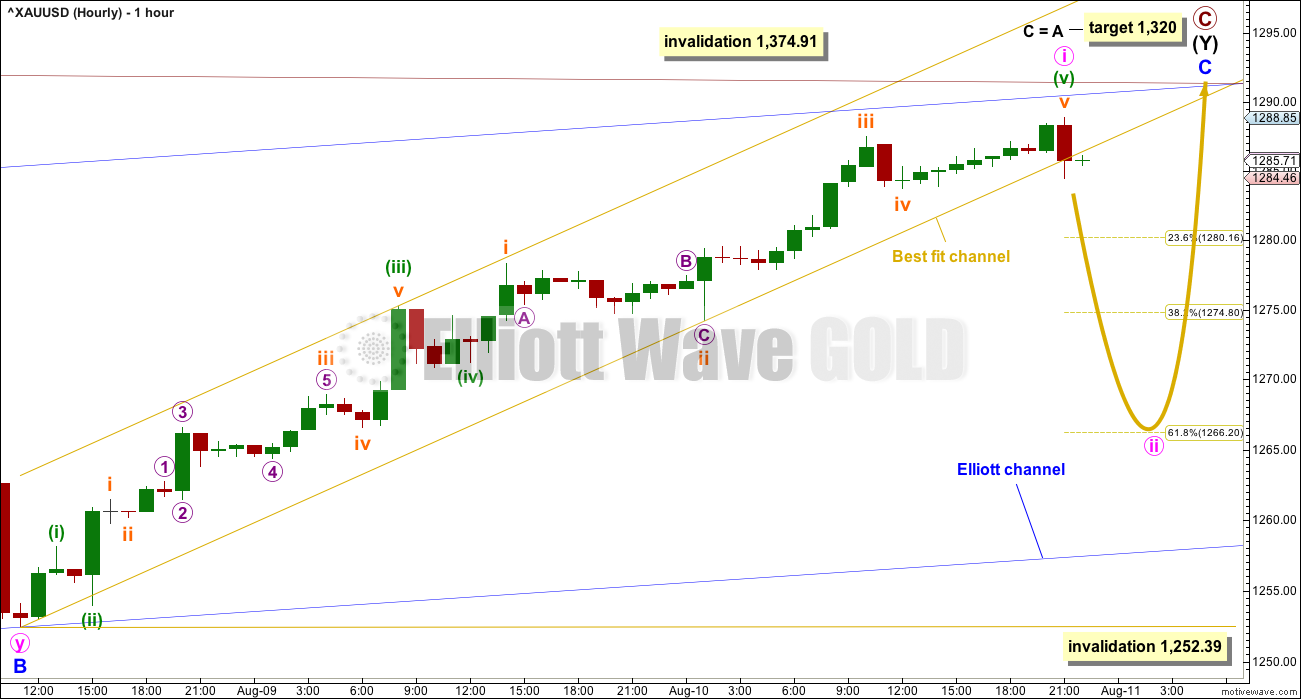

HOURLY CHART

Downwards movement looks like it may be beginning to break below the gold best fit channel about minute wave i. Price may have found some resistance about the upper edge of the blue Elliott channel, copied over from the daily chart.

Minute wave ii may correct to either the 0.382 or 0.618 Fibonacci ratios, with the 0.618 Fibonacci ratio favoured. It may be choppy and overlapping, lasting about two to three days.

Minute wave ii may not move beyond the start of minute wave i below 1,252.39.

Thereafter, upwards movement should continue and should show an increase in momentum, if this wave count is now correct.

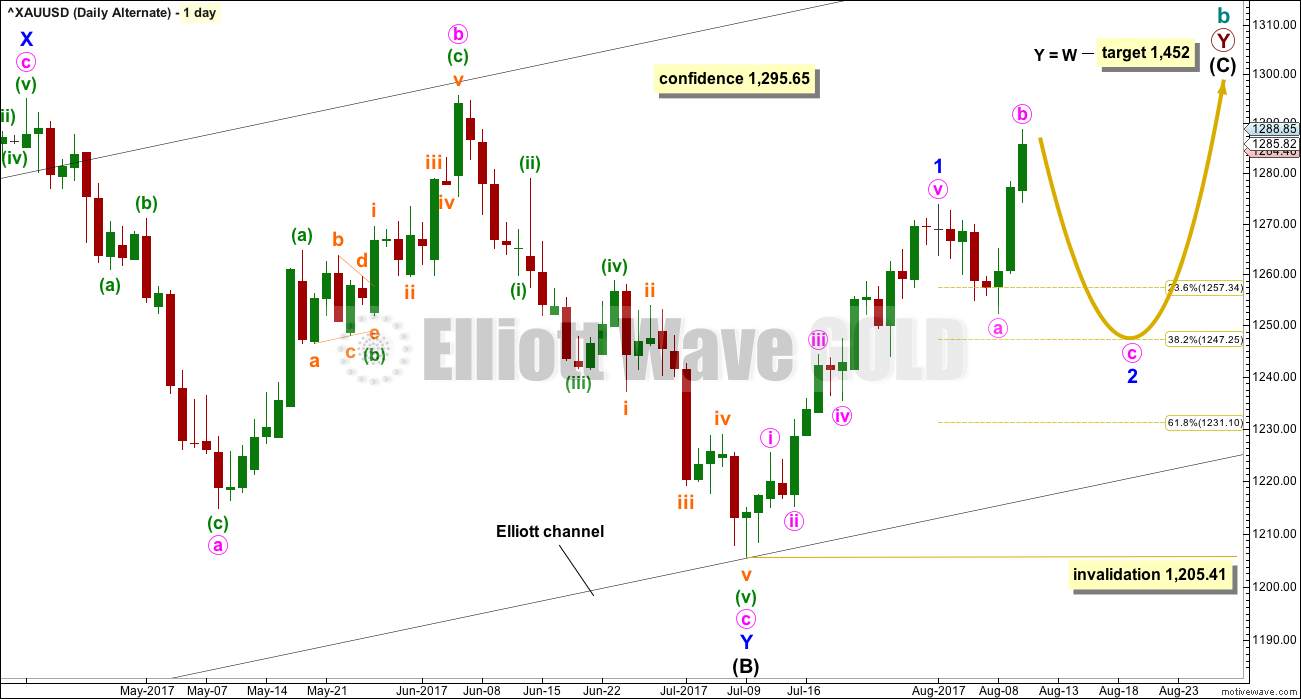

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has been published only in historical analysis. At this stage, it will be published on a daily basis.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b fits best at this stage as a triangle (main wave count), it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same as previously published for this wave count.

Along the way up, some resistance should be expected at the cyan Magee trend line. Because this wave count requires price to break above the Magee trend line, it must be judged to have a lower probability for this reason. This trend line is tested multiple times and goes back to 2011. It is reasonable to expect price to find resistance there, until proven otherwise.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

DAILY CHART

Intermediate wave (C) may be unfolding as an impulse.

Only minor wave 1 may have been over at the last high. Minor wave 2 may have begun. Minor wave 2 today may be continuing further as an expanded flat correction. It would be possible to label it over at the last low, but that would see minor wave 2 remarkably brief and shallow. It would still have better proportion and be of more normal depth if it continued as a very common expanded flat.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

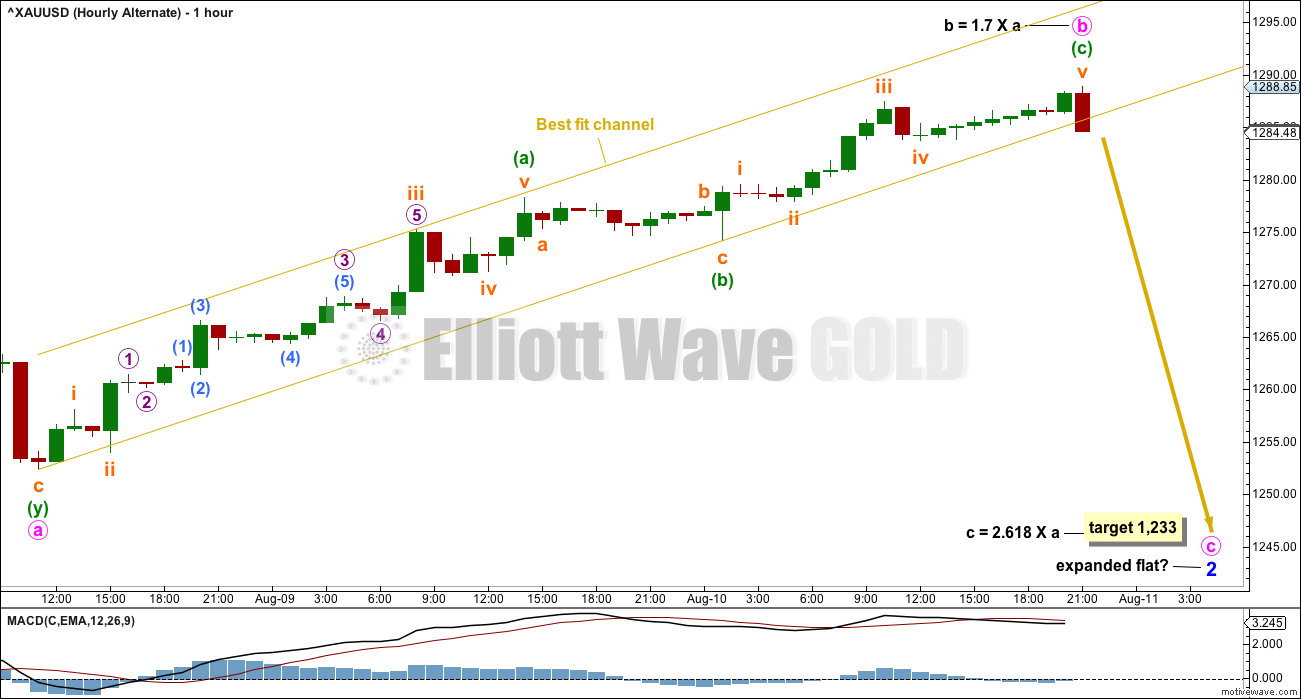

HOURLY CHART

Minor wave 2 may be continuing as an expanded flat subdividing 3-3-5.

Minute wave b may be complete and may be slightly longer than the normal range for B waves of flat corrections.

A target is now calculated for minute wave c to exhibit a reasonably common Fibonacci ratio to minute wave a.

TECHNICAL ANALYSIS

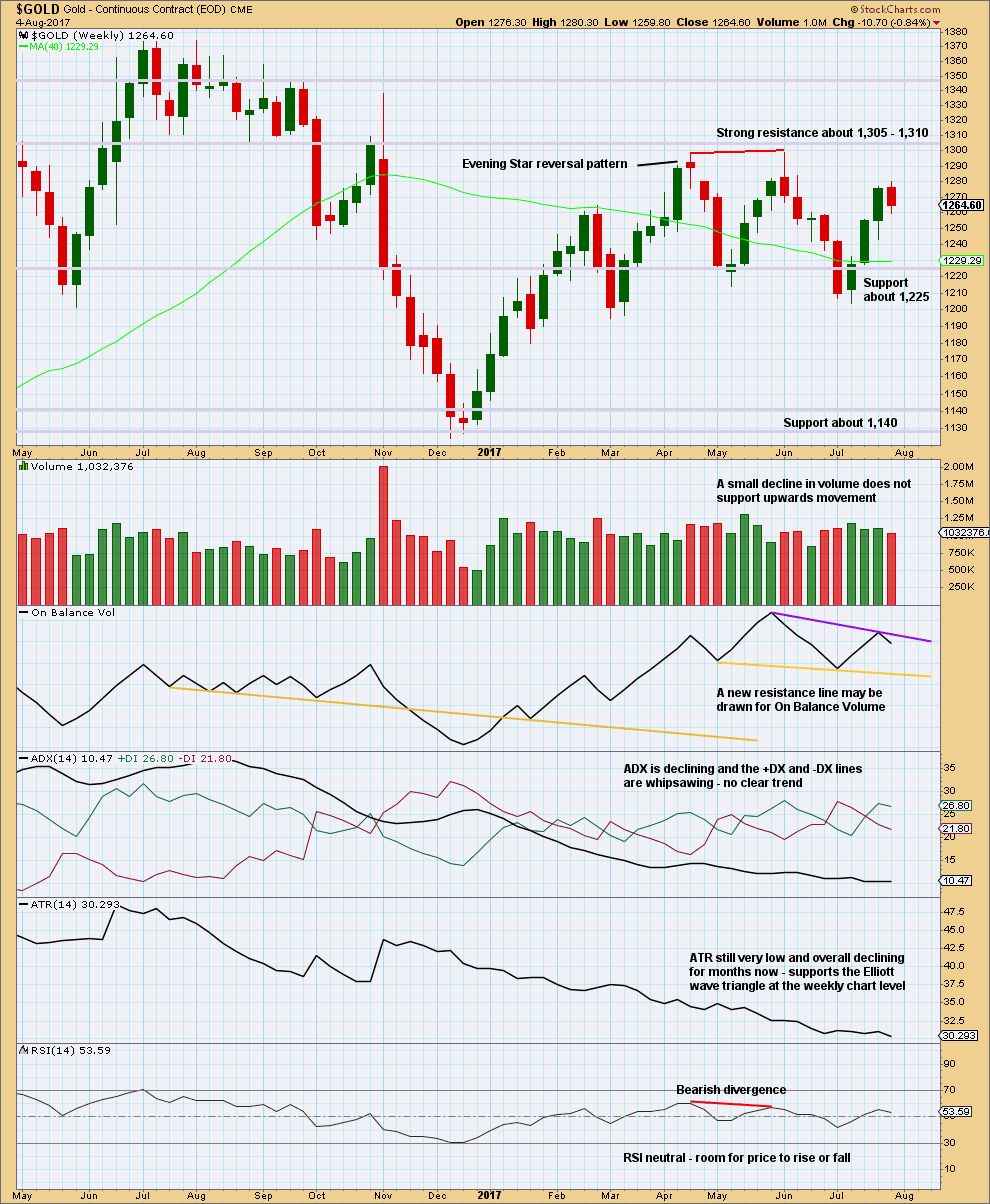

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week closes with a red weekly candlestick.

To correctly analyse volume for this week it should be done at the daily chart level, to look “inside” the week.

On Balance Volume gives no signal. It is constrained.

ADX and ATR both support the main weekly Elliott wave count. This is what a triangle should look like.

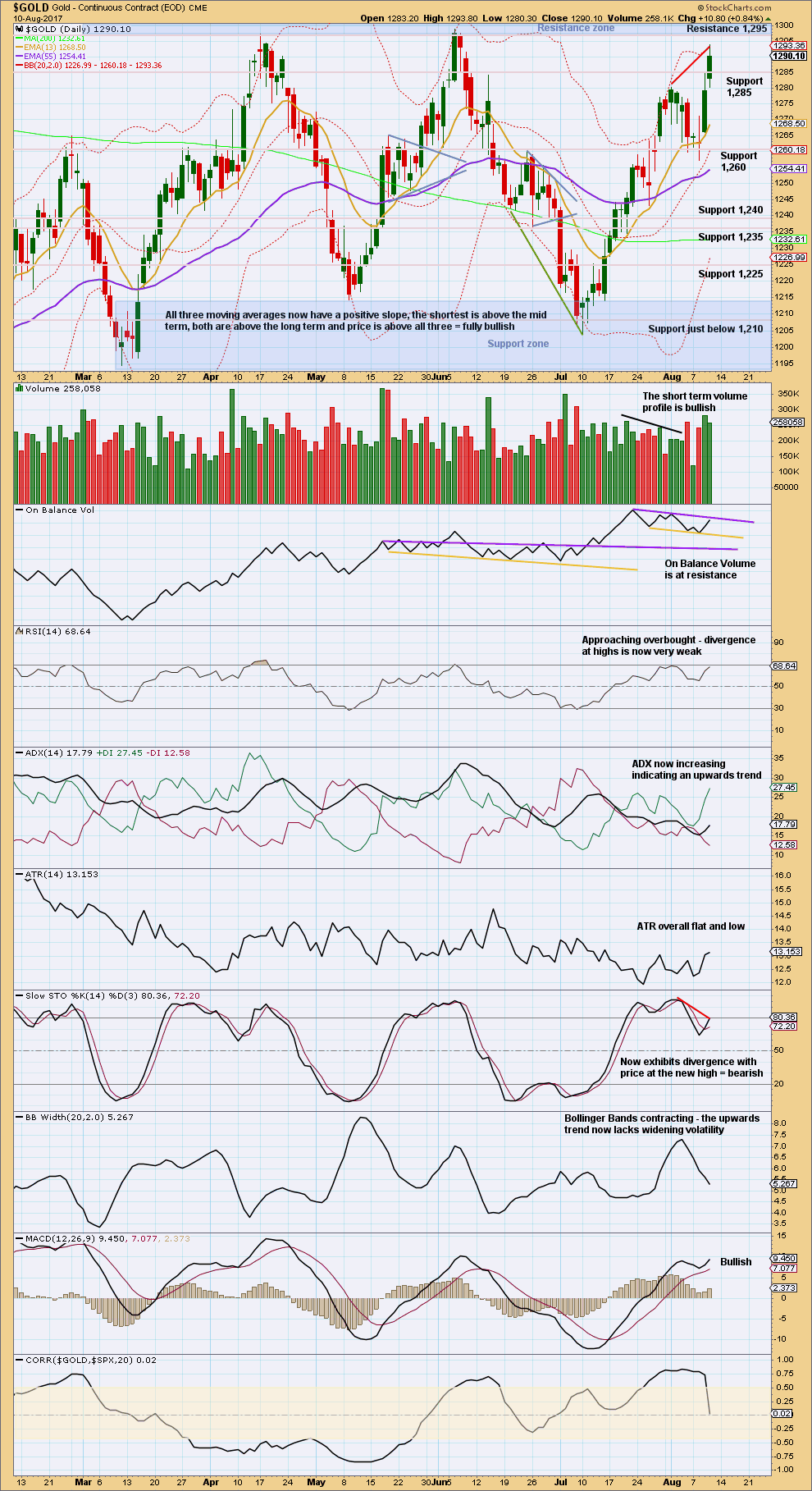

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stepping back and looking at the larger consolidation, Gold moved into a range back in February this year, delineated by support and resistance zones. During this consolidation, it is two upwards days of 7th of April and the 17th of May that have strongest volume. This suggests an upwards breakout is more likely than downwards. With the main Elliott wave count now expecting a small false upwards breakout, this now may make more sense.

However, this signal is not a strong one. The third strongest day of the 18th of May is a downwards day, and it is very close in volume to the two upwards days.

Bearish divergence between price and RSI is disappearing; it is now very weak. Bearish divergence still exists between price and Stochastics. This supports the idea of a pullback about here.

On Balance Volume at resistance also supports the idea of a pullback here.

ADX now supports both wave counts. Both see an upwards trend continuing further. MACD also supports both wave counts.

A member has asked about the correlation between Gold and the S&P500. While my wave count for Gold now expects more upwards movement and my wave count for the S&P500 now expects downwards movement, this may alleviate members concerns. However, these two markets are absolutely not correlated. Any correlation which may appear from time to time is unreliable and vulnerable to a complete shift. A correlation coefficient which is between 0.5 and -0.5 shows two sets of data which are not correlated. The correlation coefficient between Gold and the S&P500 is currently close to zero.

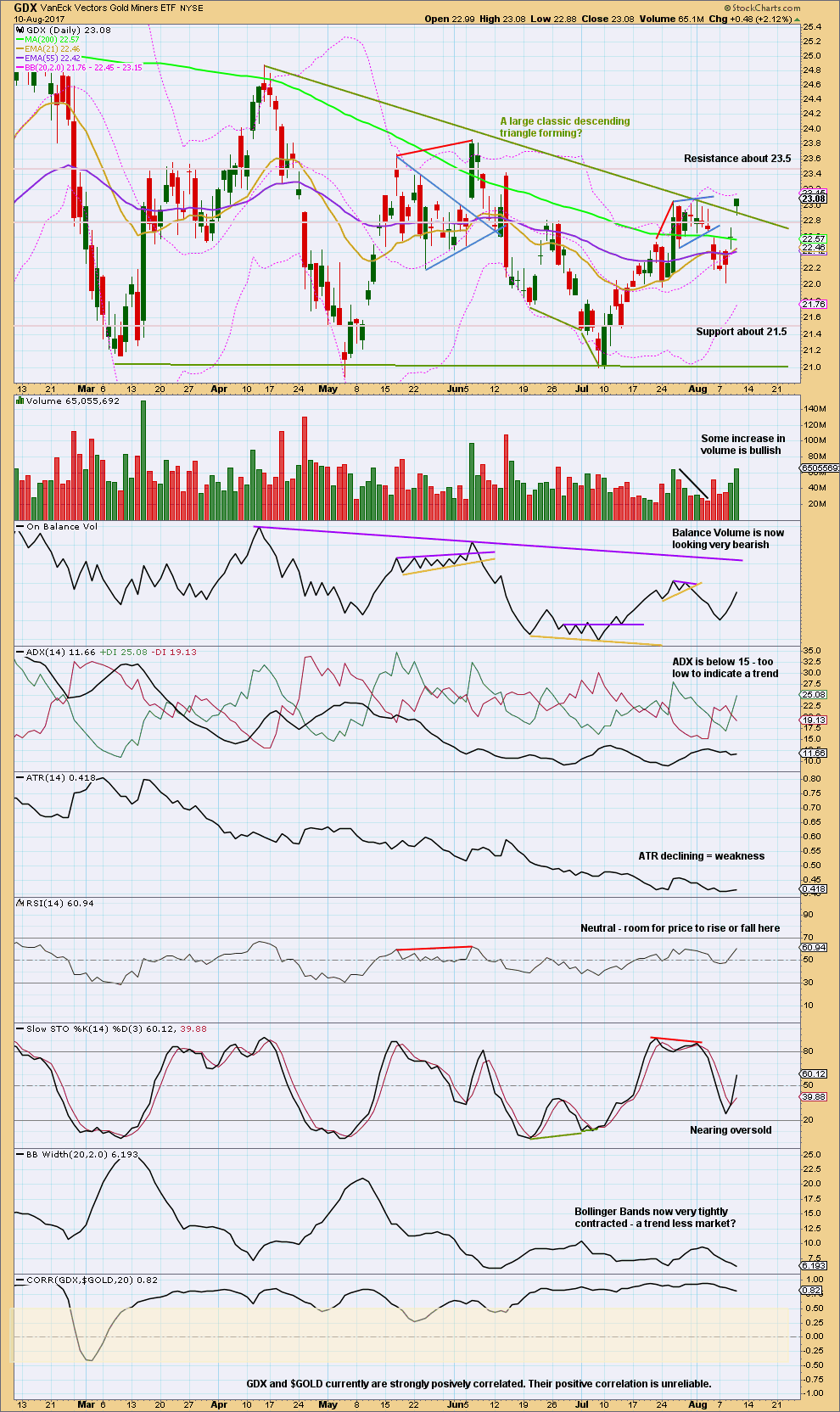

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stepping back for GDX too, to look at the past six months, a large descending triangle looks like it has formed and may be close to a breakout. Breakouts from descending triangles are usually downwards.

During this structure though it is an upwards day for the 15th of March that has strongest volume suggesting an upwards breakout may be more likely than downwards. This signal is also not a strong one for GDX. The next two strongest days are both downwards and both very strong.

Price has gapped upwards today to close above the triangle trend line on a day with an increase in volume. This looks like a classic upwards breakout. Expect price may now curve down to test support at the triangle trend line, before moving up and away. That would be typical behaviour. If price does behave like that, it may offer an entry opportunity to join the upwards trend after some confidence in a breakout. Stops may be set just below the triangle trend line. Today’s breakaway gap may also be used for stops. If this is indeed a breakaway gap, it should not be closed. The gap has its lower edge at 22.71. Patience is required for this trade set up.

Published @ 10:55 p.m. EST.

just sold a little more longs into this late day surge, but going to hold the rest over the weekend. Good luck all!

not a lot of movement in the COT reports, which is interesting

Updated hourly chart:

Because the channel which contained the last two days upwards movement is so well breached, it looks like that wave is over and the next wave is underway. It looks like minute ii may be shallow, and a flat or combination.

My guess is that there’s not much more movement in price today going into the weekend. Then on Monday, assuming that the geo political front stays mostly quiet, price moves down near the .382 Fib @ 1,275.

Risk shorted Gold at 1287+ with a stop at 1292. Lets see what happens.Too bad if the stop gets taken out; monthly cycle would probably then be in play for 1293-95-98. Expecting Silver to top and Gold price to follow. Happy weekend all and GL.

That looks like a big “oh, hell no”, on the 15 minute gold chart. Any big move up is being immediately sold off. The bears are still alive.

One way of looking at the gold chart – daily semi log. There is potentially some significant damage to the gold bears if you accept a slight overshoot of resistance at the 2012 high. I would not be surprised to see gold power higher if this is a classic breakout.

So GDX is stronger than expected, but still weak compared to gold. That said, I agree that it looks like gold is heading toward 1,320 – 1,325 range.

I went back to my weekly GDX chart and reworked it. I have expected an upward breakout from the purple falling wedge for some time now. The problem was that I thought we would get another touch of the bottom rail of the wedge first before the upwards breakout.

This updated count expects that an upwards breakout of the wedge is imminent in the coming days. This count expects a new high above 25.71 for Primary wave C of the triangle to end. That’s a pretty strong move up from here yet. Not sure if GDX can get there. Let’s see.

I have some work to do to update my hourly chart.

https://www.tradingview.com/x/XL7MO3bL/

https://youtu.be/NrfvMnKbtqM

I hope this is ok Lara. Just want to add further information for discussion about oil. The link above contains YouTube clip of elliot wave of crude oil. Start watching from about the 8th minute onward. Can some tell me how his wave count may differ to Lara’s, if there is any.

He has everything down one degree.

He sees the current movement for Oil as a fourth wave and incomplete. My wave count for Oil now sees that fourth wave complete.

The thing I can’t reconcile is his channel. How did he get the channel to sit like that? His upper edge is way above where mine is. Compare his chart at 8 minutes to this:

Anyone have an opinion on oil?

Sorry for posting on gold discussion, but I’m not sure if I post in oil discussion anyone will see it since it’s 3-4 days old now…

Hi Ari, I was going to ask the same thing to Lara about oil. I feel like we just started a new wave down with oil. Not sure what the wave count is for that.

Thank you guys for posting here, I don’t look at Oil comments as often as I should. But I do follow these comments daily.

While price remains above 47.32 then I would have to go with this wave count. It would look still like minor C is incomplete.

If price breaks below 47.32 then Oil may be on the next wave down to new lows. If that happens I’ll calculate a target and update the wave count.

I’ll give a detailed analysis once Lara posts her Friday report. Off the cuff, I am bearish, and fortunately so as there had been a head fake in the oil price breakout last week. Had I gone long, I would be tearing my hair out, at least what is left of it.

I actually went long when it closed above the tenkan, and moved my stop to break-even quickly the next day, fortunately for me.

Looked pretty good there for a while, until they hit the sell button all at once.

So here’s another look at Lara’s revised target. By expanding the triangle, this shows that the retrace of wave C to the previous B wave will be approximately 80% at 1,325. This will help the triangle meet Lara’s guideline for triangle wave retraces and provides for another important test of the Magee Bear trendline.

I agree with the new target.

https://www.tradingview.com/x/hA7g8JGh/

Re Magee trend line. When I go to trading view and plot trendline from high Sept 2011 to next high Sept 2012 I have current price above that line? So I assume this is with log scale. Is Magee based on log scale.

Daniel, It’s my understanding that Daily charts and above are best plotted using log scale, so that’s what I do.

I always plot my hourly charts using arithmetic (non-log) scale.

Pretty sure that’s how Lara charts also.

I’ve searched the internet and read many articles and the general agreement does seem to be that log scale should be used for longer term charts. That said, I can’t say that I have seen definitive reasons why. I do realize that you will get different results with arithmetic scale on longer terms than you do with log scale.

Maybe Lara can give a more definitive reason / reference as to when each one should be used and why.

Maybe the Edwards and Magee technical analysis book has the answer. I have the book, but haven’t read it yet.

Thanks for response. I have the book too. Need to be retired to have time to read it. Lol

Looked it up last night. They use semi-log scale for their charts. When I do that I get same Cyan trendline as Lara. Other point is they want t o see a 3% rise above the trendline.

Yep. Using the book index, I scanned many pages on semi log charts. Nothing definative that I saw, but I think Lara’s interpretation is correct. There may be some value in plotting both ways as price sometimes will seem to treat both ways as resistance and support, but for long term, I think semi log is the more important one. 😣

Lara, in the summary at the top, you state in part: “look out for a pullback about here which may end about either 1,280 or 1,266 and last about two to three days.

I think you meant 1,275 instead of 1,280 as the minimum expected correction as that is the .382 Fib. 1,280 is only the .236 Fib.

Correct?

Yes sorry, you are correct.

Lara, I must be missing something here.

When did the main count $1295.65 fall?

Why raise the invalidation point now?

Not trolling or hating, just confused.

Fair enough John, and I knew this change would ruffle some feathers. That’s entirely understandable.

The change is because the trend line on yesterday’s daily chart is well overshot by today’s upwards movement.

And when I looked again at that new high, and then considered primary C, it occurred to me that primary C may not be as I had labelled it. That it may be moving higher.

If that’s the case then the invalidation point had to move from the end of where I had primary C, to where I have primary A. C may not move beyond A.

It is very unfortunate that I had not seen the idea earlier. That is the nature of the work, I get stuck sometimes in seeing it how I’ve labelled it and can’t always see alternate ideas until price shows them.

In short: triangles are very difficult structures. They’re hard to get right as they unfold.

I got it wrong.

Or…

the alternate is correct. but I still don’t think so.