Downwards movement continued as expected for Tuesday. The target at 1,275 was passed and price remains above the invalidation point on the hourly chart and still within the channel.

Summary: A new target for this pullback to end is 1,266, at the lower edge of the blue channel. Thereafter, price should turn upwards. The final target is now at 1,320.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts and alternate weekly charts are here, video is here.

Grand SuperCycle analysis is here.

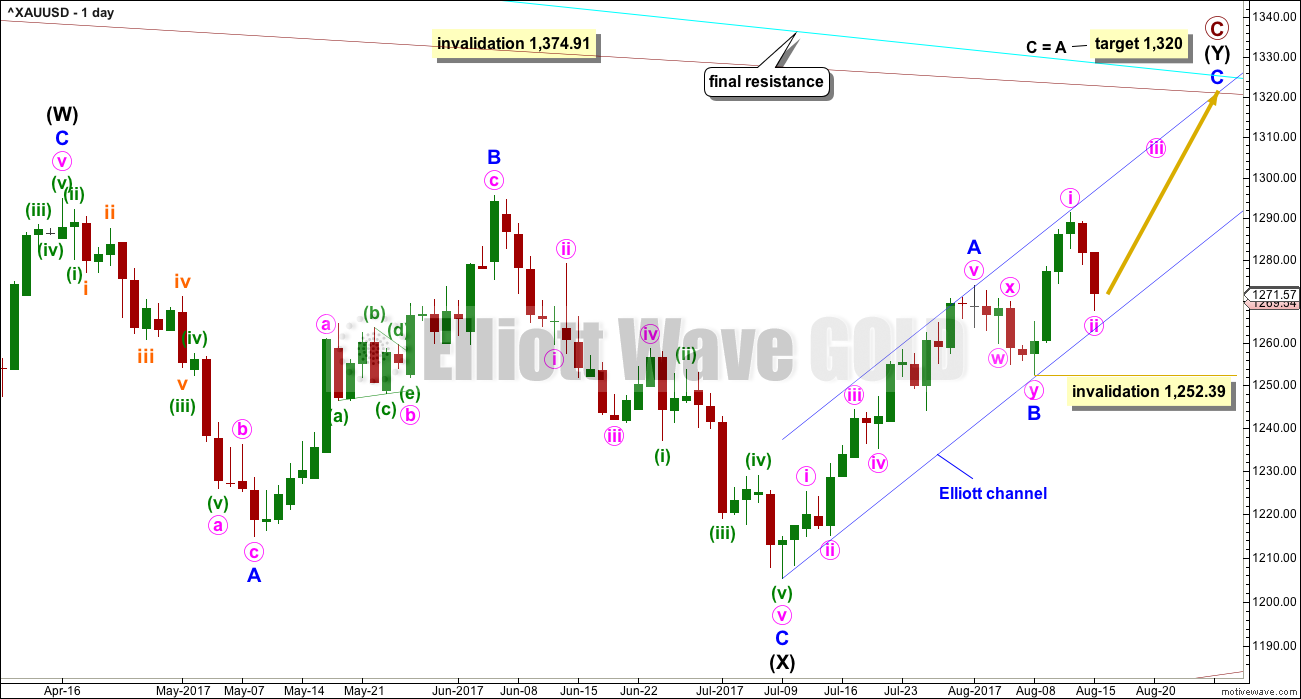

MAIN ELLIOTT WAVE COUNT

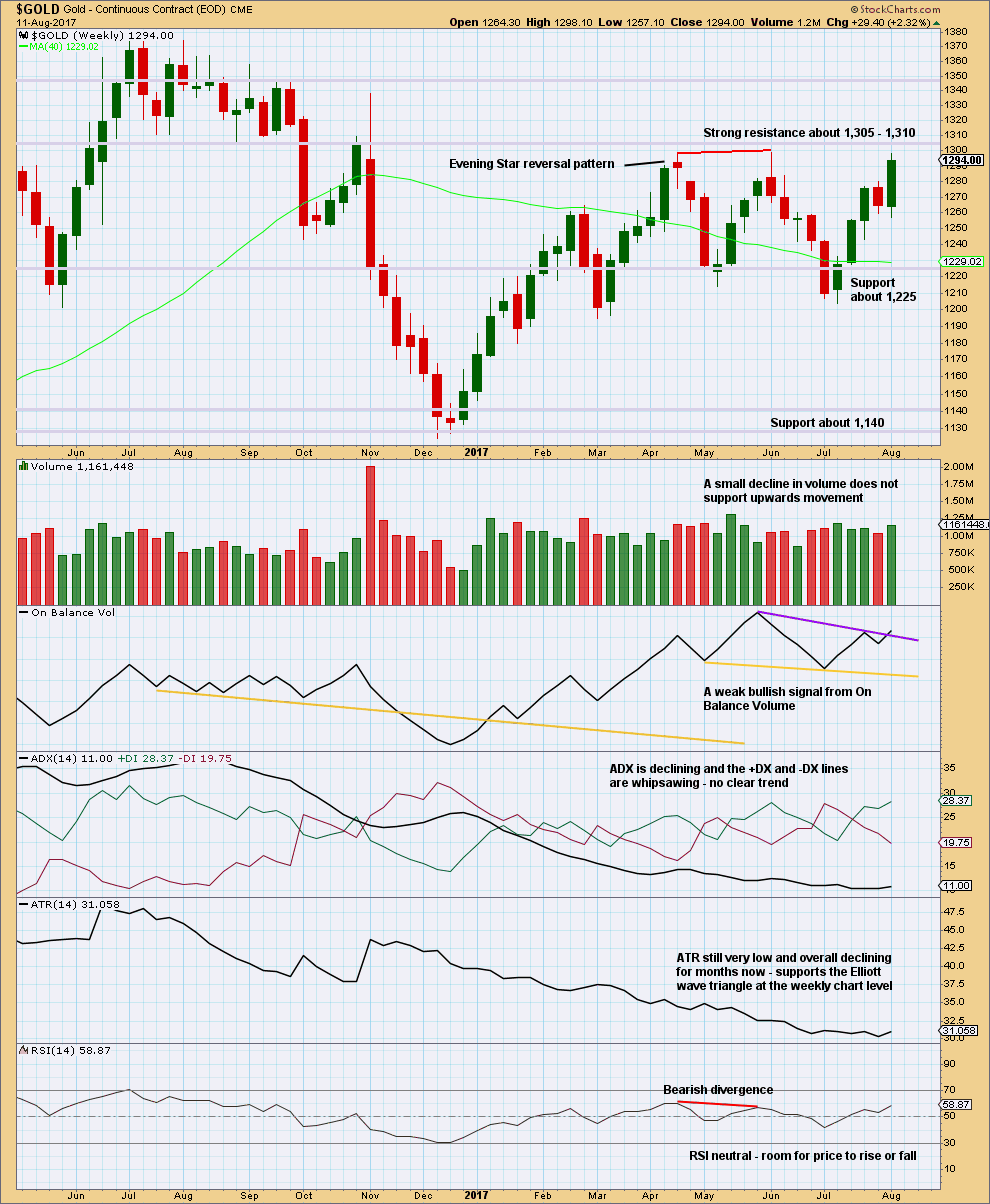

WEEKLY CHART

The Magee bear market trend line is added to the weekly charts. This cyan line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012. This line should provide strong resistance.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has some support from declining ATR and MACD now beginning to hover about zero.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a developing zigzag at the weekly chart level, and minor wave B within it shows up with one red weekly candlestick. Primary wave C may end at the Magee trend line.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C may now have just completed its 34th week. A double zigzag may be expected to be longer lasting than single zigzags within a triangle, and so this continuation of primary wave C is entirely acceptable and leaves the wave count with the right look at this time frame.

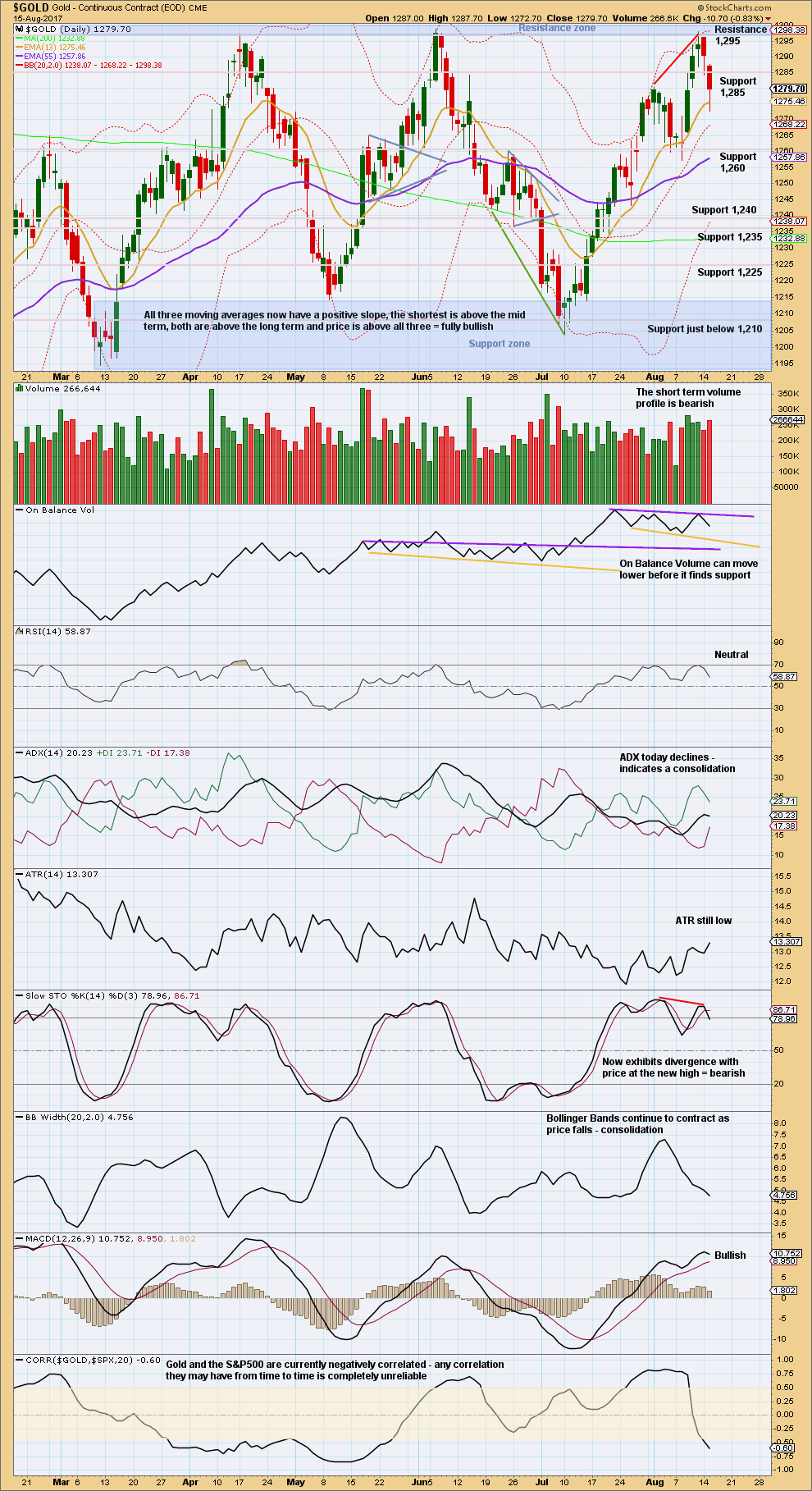

DAILY CHART

A target for primary wave C to end is calculated using the most common Fibonacci ratio between minor waves A and C. If the target is wrong, it may be too high; there is very strong resistance about 1,305 to 1,310.

Within minor wave C, no second wave correction may move beyond the start of its first wave below 1,252.39. Along the way up, corrections should find final support at the lower edge of the blue Elliott channel.

Minor wave C may only unfold as a five wave structure, either an impulse or an ending diagonal. An impulse is much more common and will be expected until shown otherwise by price.

Within an impulse for minor wave C, the corrections of minute waves ii and iv would most likely show up on the daily chart, like they do within minor wave A. Minute waves ii and iv within minor wave A both lasted two sessions, so they may also last about two to three sessions within minor wave C.

Minute wave ii now shows up with two red daily candlesticks. If it ends within the next 24 hours at the lower edge of the Elliott channel, it will still have a typical look.

Minute wave ii may be used as an entry opportunity to join the current upwards trend.

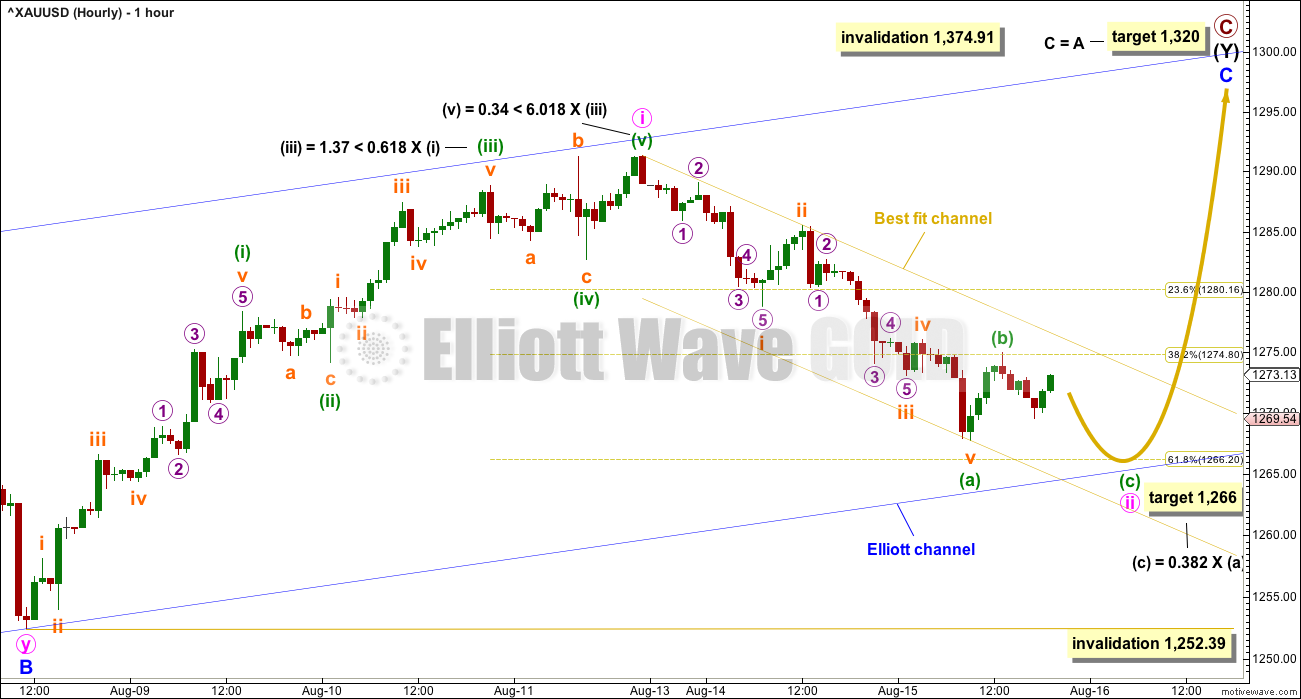

HOURLY CHART

The expanded flat no longer had the right look because its C wave was too long in comparison to its A wave.

Minute wave i may have ended at the last high. Minute wave ii may be an incomplete zigzag. The target expects price to find strong support at the lower edge of the Elliott channel.

A best fit channel is drawn about minute wave ii. When this channel is breached by upwards movement, it may be an early indication that minute wave ii may be over and minute wave iii may be underway.

Minute wave iii should exhibit an increase in upwards momentum.

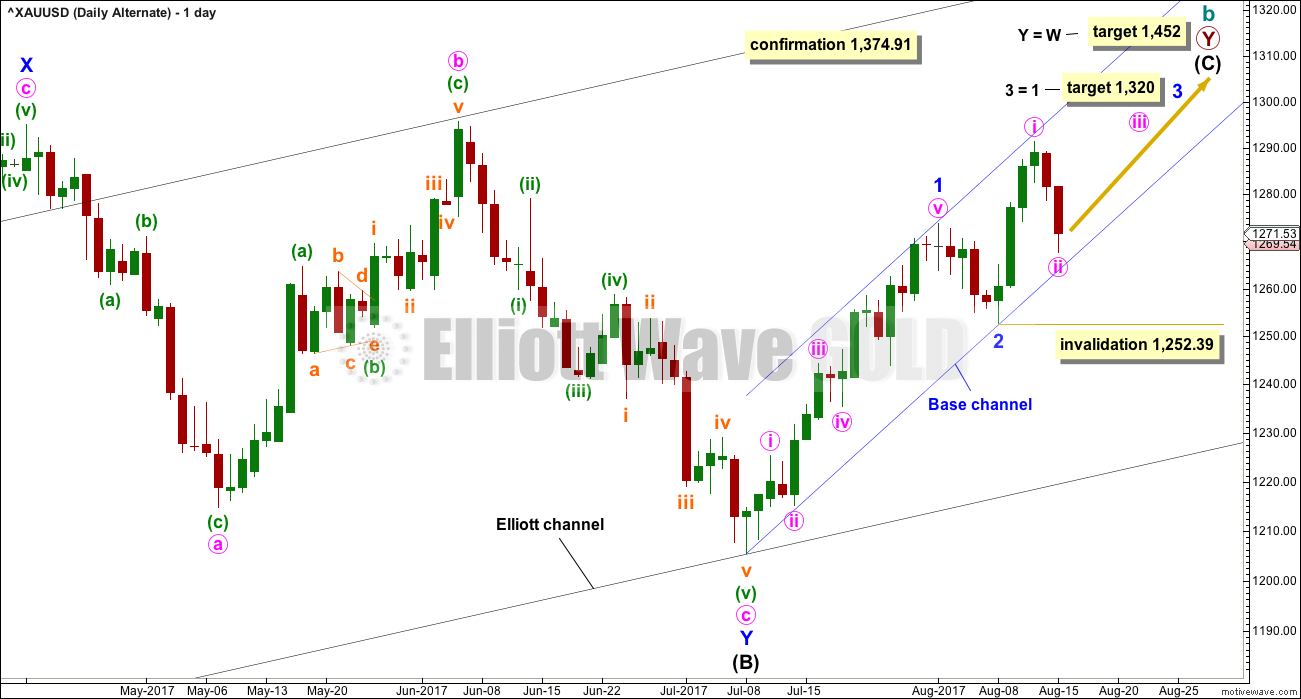

ALTERNATE ELLIOTT WAVE COUNT

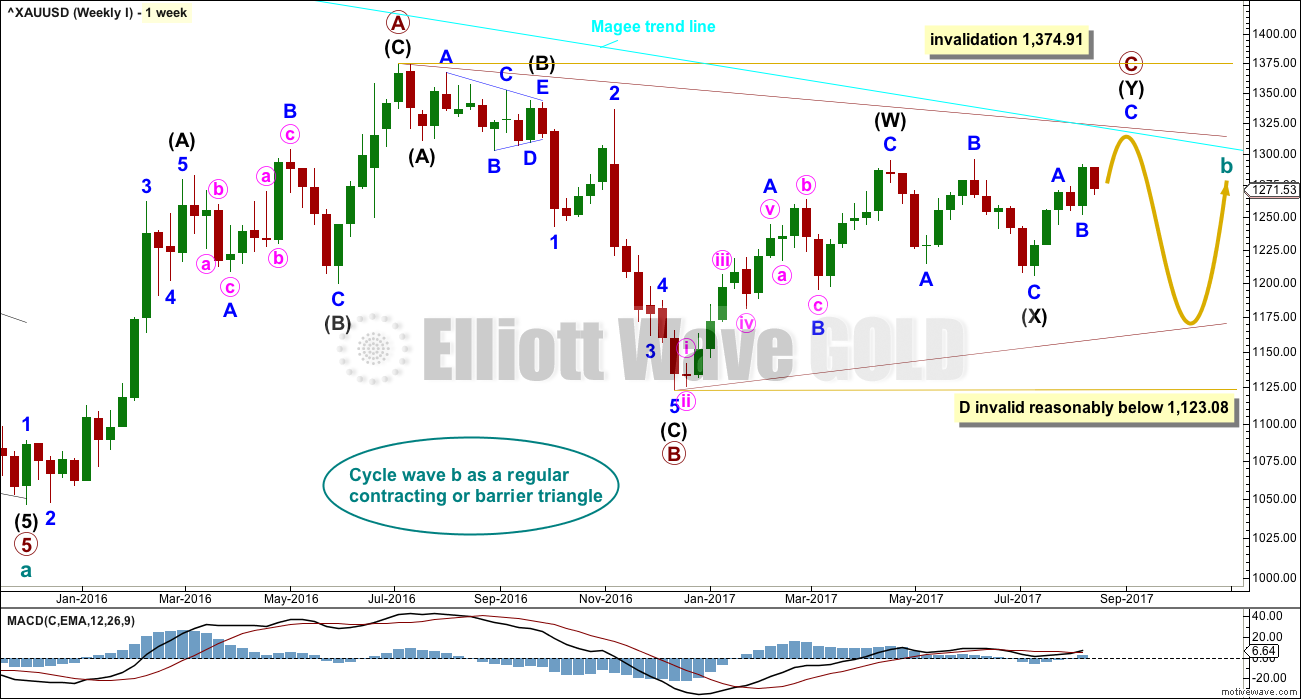

WEEKLY CHART

This wave count has been published only in historical analysis. At this stage, it will be published on a daily basis.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b fits best at this stage as a triangle (main wave count), it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same as previously published for this wave count.

Along the way up, some resistance should be expected at the cyan Magee trend line. Because this wave count requires price to break above the Magee trend line, it must be judged to have a lower probability for this reason. This trend line is tested multiple times and goes back to 2011. It is reasonable to expect price to find resistance there, until proven otherwise.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

DAILY CHART

Intermediate wave (C) may be unfolding as an impulse.

Only minor wave 1 may have been over at the last high. Minor wave 2 may have begun. Minor wave 2 today may be continuing further as an expanded flat correction. It would be possible to label it over at the last low, but that would see minor wave 2 remarkably brief and shallow. It would still have better proportion and be of more normal depth if it continued as a very common expanded flat.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

A-B-C of a zigzag subdivides 5-3-5, exactly the same as 1-2-3 of an unfolding impulse. The hourly chart now for both Elliott wave counts would be exactly the same in terms of subdivisions and short term expectations. The blue channel which should provide support for any deep pullbacks would also be exactly the same.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Last upwards week has support from volume. Look out for strong resistance now close by. A pullback about 1,305 to 1,310 is a reasonable expectation.

On Balance Volume gives a weak bullish signal. This supports both Elliott wave counts.

ADX and ATR both support the main weekly Elliott wave count. This is what a triangle should look like.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Two long lower wicks in a row now is bullish. However, volume today offers a little support for downwards movement, which suggests it may not be over here. Next support is about 1,260.

The upper resistance line for On Balance Volume was not working, so it is today redrawn. On Balance Volume is constrained offering no signal today; it allows for a little more room for price to fall before it finds support at the yellow line.

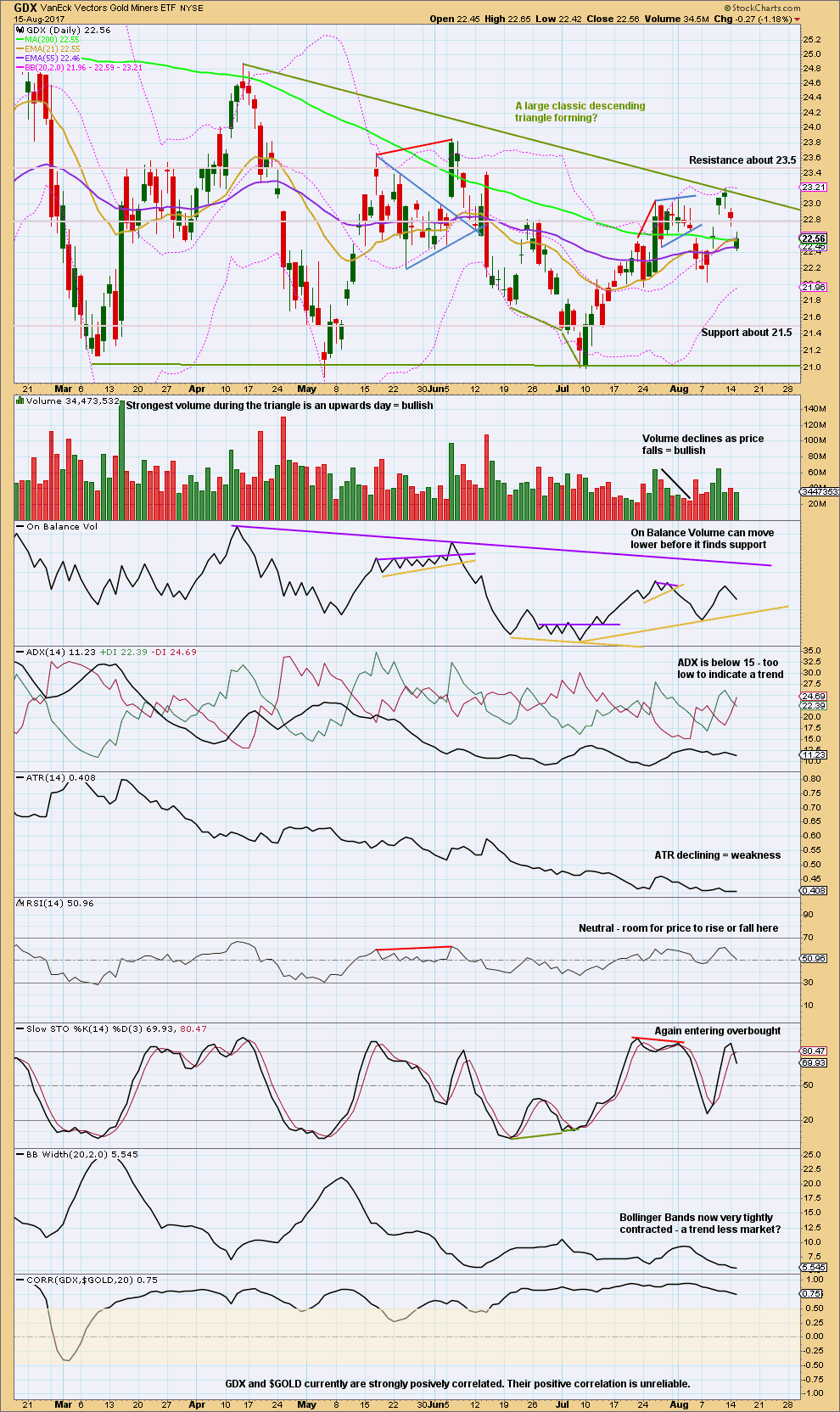

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

With price now back below the upper green triangle trend line, it looks like the upwards breakout was false despite having some support from volume. The triangle trend line is redrawn today.

ATR continues to decline and is now very low. Bollinger Bands remain tightly contracted. This does suggest a large consolidation is continuing.

A descending triangle usually breaks out downwards, but in this case volume suggests an upwards break which contradicts the pattern.

On Balance Volume for both Gold and GDX suggests price can fall further before On Balance Volume may assist to halt the fall.

Published @ 09:39 p.m. EST.

Hourly chart updated:

Minute ii was already over at yesterdays low. This breach of the channel is clear and strong, but upwards movement not sideways.

Now minute iii has to move above the end of minute i, once it can overcome overhead resistance then look for upwards momentum to increase.

Look out for the end of minute iii to possibly be quite strong.

So Lara, we are in the beginning stages of iii?

still in 1 of iii IYO?

Thx

Yes. Still in minuette (i) of minute iii.

Hello Lara,

Buy the dip has worked in this maket(S&P) and had been lucky with some stocks like NVDA, AMD, VRX.

Has correction arrived or you are waiting for higher highs before correction.

Any input will be highly appreciated.

Thanks

For the S&P I expect a deeper multi week pullback has just begun.

Thanks a lot!!!

Hi Lara, does that mean it is a good time to invest in the volatility index if you are expecting a correction with the S&P?

I got in GDX 22.50’s now GDX 23.12. Nice gain in NUGT. Out for now. Thank you Lara

Wonderful. You’re welcome 🙂

I’ve been hiding in a corner terrified that fed minutes today might precipitate a drop down to 1250, where sideways movement from there would have carved out a pretty large head and shoulder topping pattern. It looks like bulls have been saved again, although not out of the woods yet. Now needs to hold the 1280 level it has regained. Should be up from here, but watching carefully

Lara: Current target is 1320 per main count. If gold reaches this target would’n this be considered break out from long resistance (Magee) line?

Every one will be calling for new bull market by then.

That target would be very close to the Magee trend line, and not above it. If the target is wrong then I expect it may be a little too high, the Magee trend line may provide strong resistance.

That line is the line in the sand between bear and bull. Gold has been in a bear market since 2011 when the line began. Using it as Magee describes, while price is below the line assume the bear market remains intact. If the line is breached properly (and because this is a long held line I would want it breached by at least one or two full daily candlesticks) then it indicates a trend change from bear to bull.