A little downwards movement followed by more upwards movement is exactly what all three hourly Elliott wave counts expected for Monday’s session.

Summary: Upwards movement may end within the next 24 hours below 1,313.91. Thereafter, there may be a sharp trend change and a violent downwards movement.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts and alternate weekly charts are here, video is here.

Grand SuperCycle analysis is here.

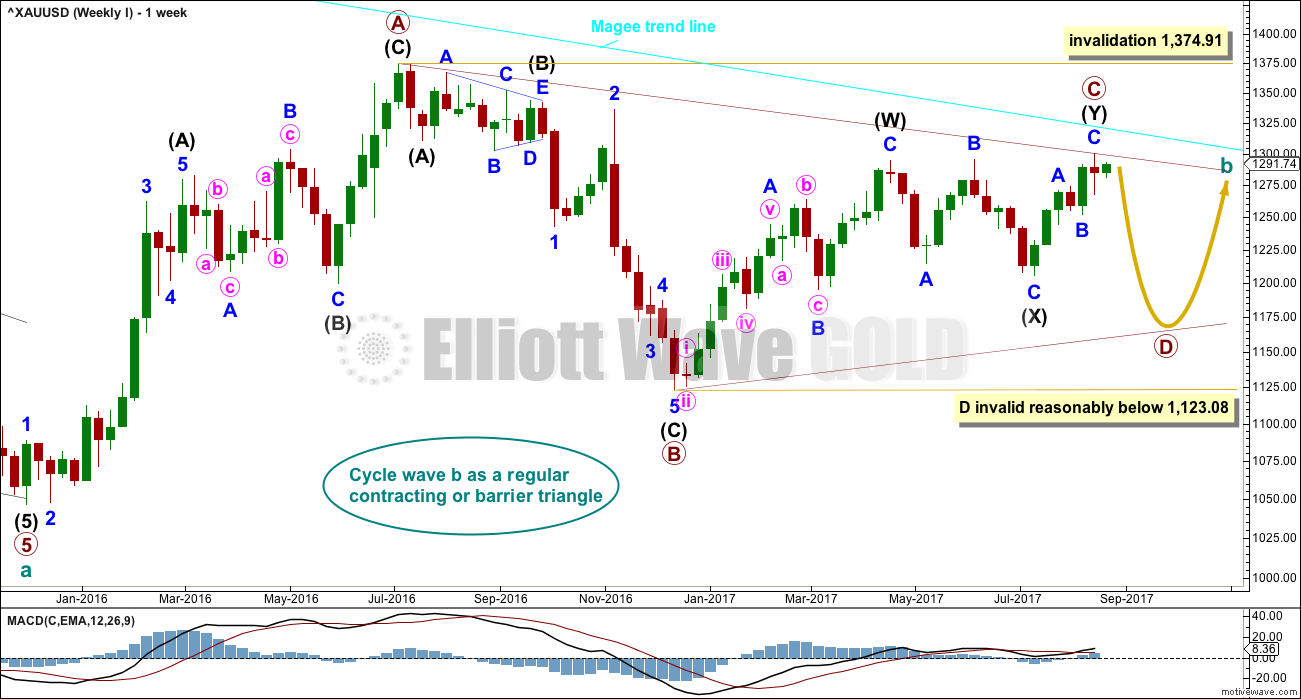

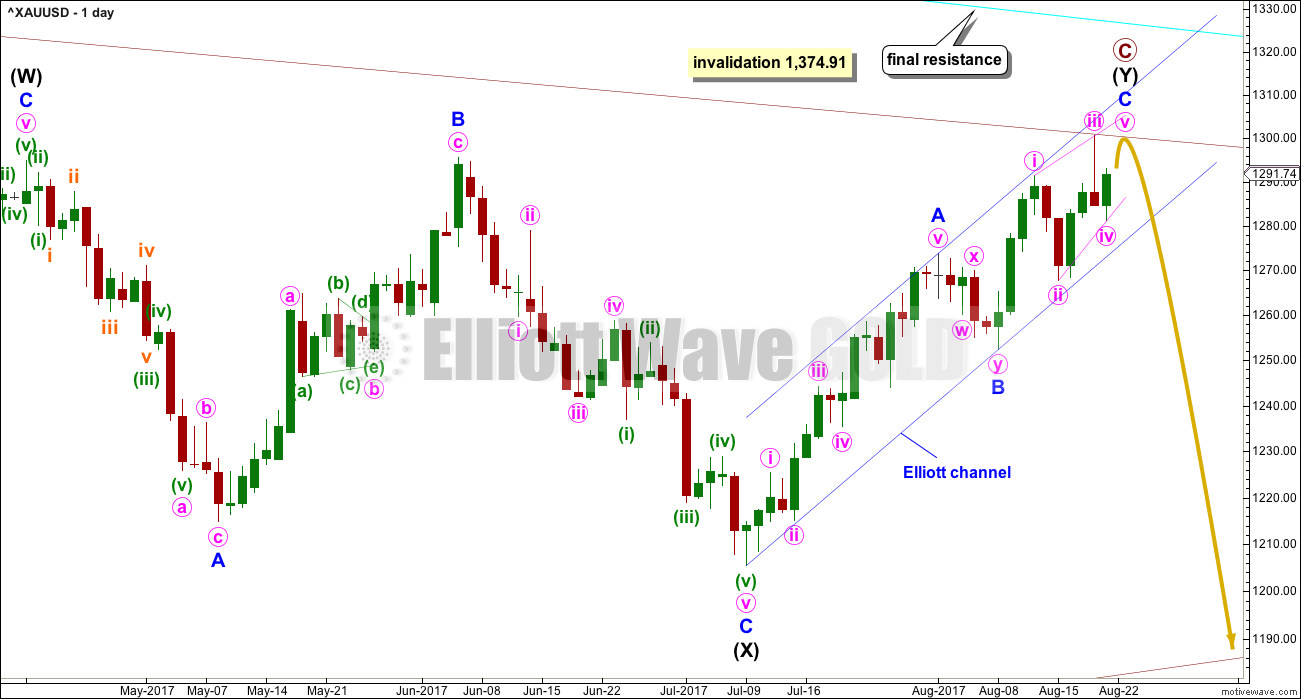

MAIN ELLIOTT WAVE COUNT

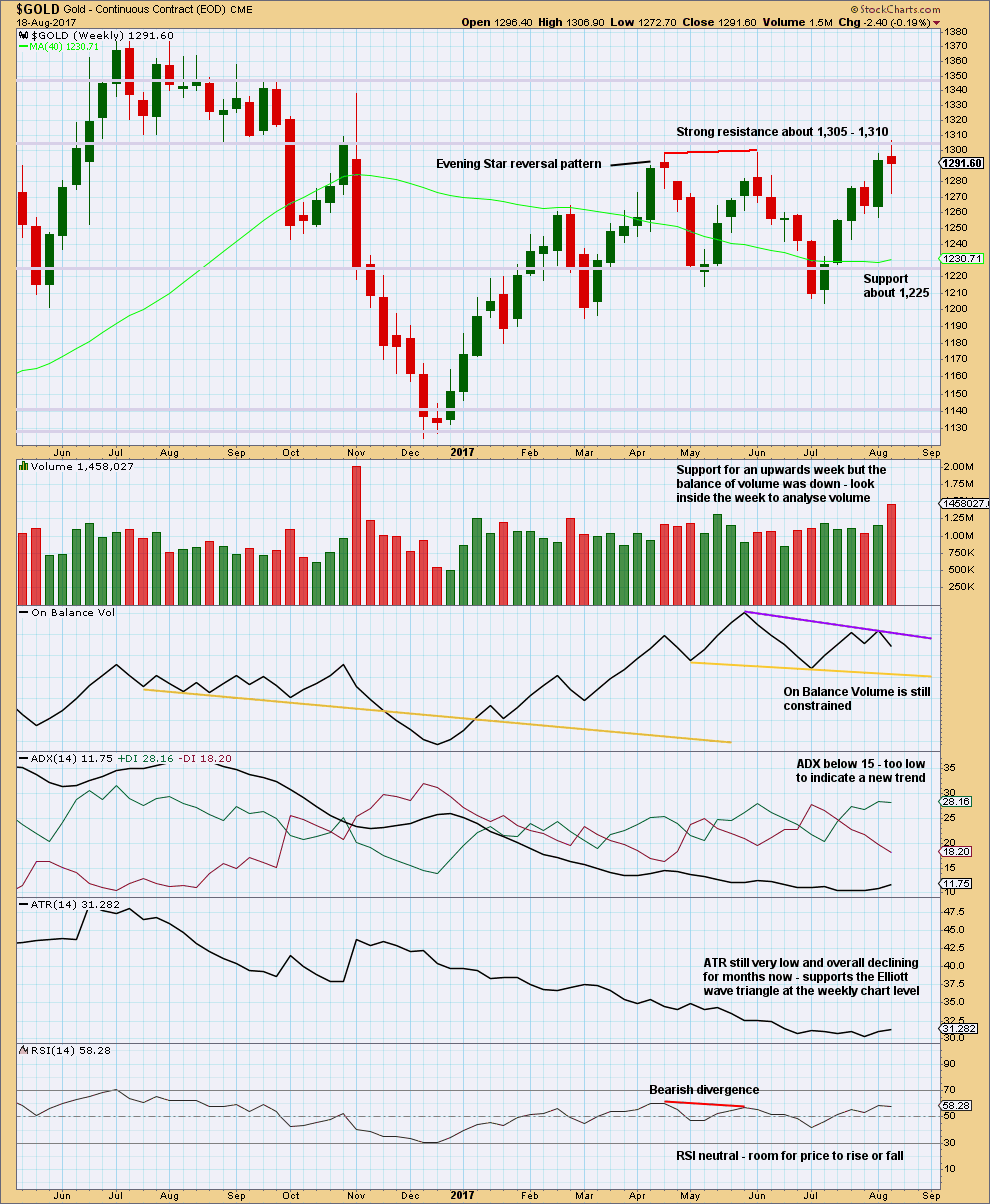

WEEKLY CHART

The Magee bear market trend line is added to the weekly charts. This cyan line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012. This line should provide strong resistance.

To use this trend line in the way Magee describes, we should assume that price will find resistance at the line if it gets back up there. If the line is breached (by at least one or two full daily candlesticks above it), it will be signalling a major trend change from bear to bull. At that point the alternate Elliott wave count should be preferred.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has strong support now from declining ATR and MACD hovering about zero.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a developing zigzag at the weekly chart level, and minor wave B within it shows up with one red weekly candlestick. Primary wave C may end at the Magee trend line.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C may now have just completed its 35th week. A double zigzag may be expected to be longer lasting than single zigzags within a triangle, and so this continuation of primary wave C is entirely acceptable and leaves the wave count with the right look at this time frame.

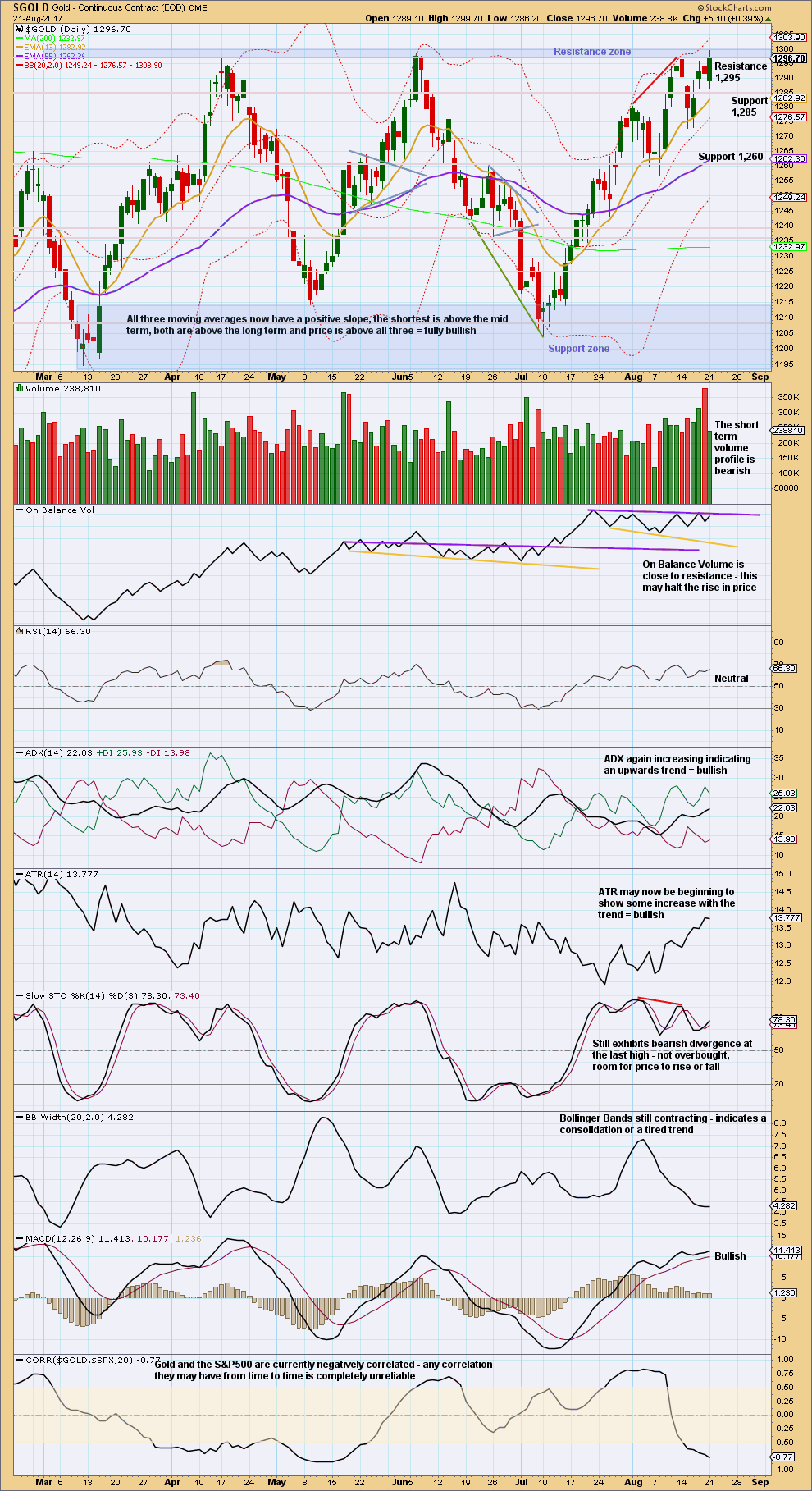

DAILY CHART

A target for primary wave C to end is calculated using the most common Fibonacci ratio between minor waves A and C. If the target is wrong, it may be too high; there is very strong resistance about 1,305 to 1,310. At this stage, the target at 1,320 may see upwards movement end about the Magee trend line.

Along the way up, corrections should find final support at the lower edge of the blue Elliott channel.

Minor wave C may only unfold as a five wave structure, either an impulse or an ending diagonal. Two hourly charts are provided below for both possible structures of minor wave C.

At this stage, an ending diagonal looks most likely for minor wave C, shown in the second hourly chart below.

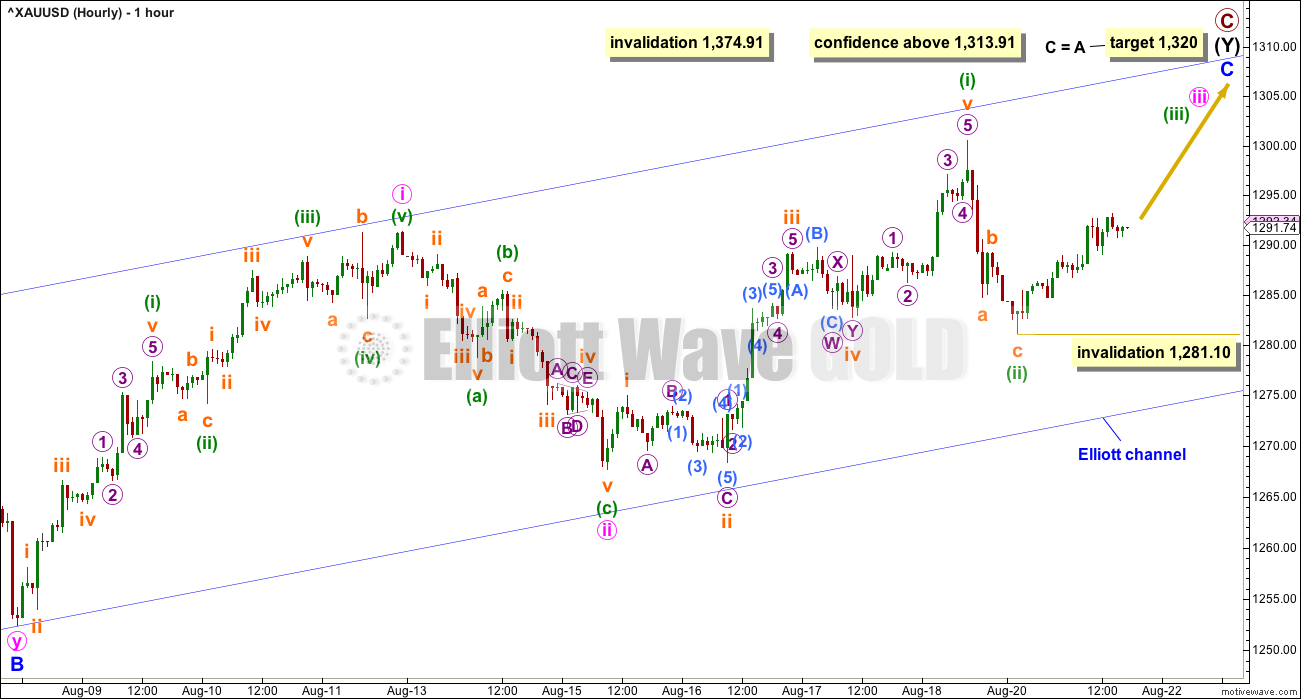

FIRST HOURLY CHART

If minor wave C is an impulse, then it must have begun with two overlapping first and second waves.

This wave count now looks like the final target at 1,320 may not be high enough. It may not allow enough room for the structure of minor wave C to complete as an impulse. A higher target could be calculated, but that would require an overshoot or breach of the Magee trend line. That should not happen for this wave count.

At this stage, this first hourly wave count now expects to see a very strong increase in upwards momentum.

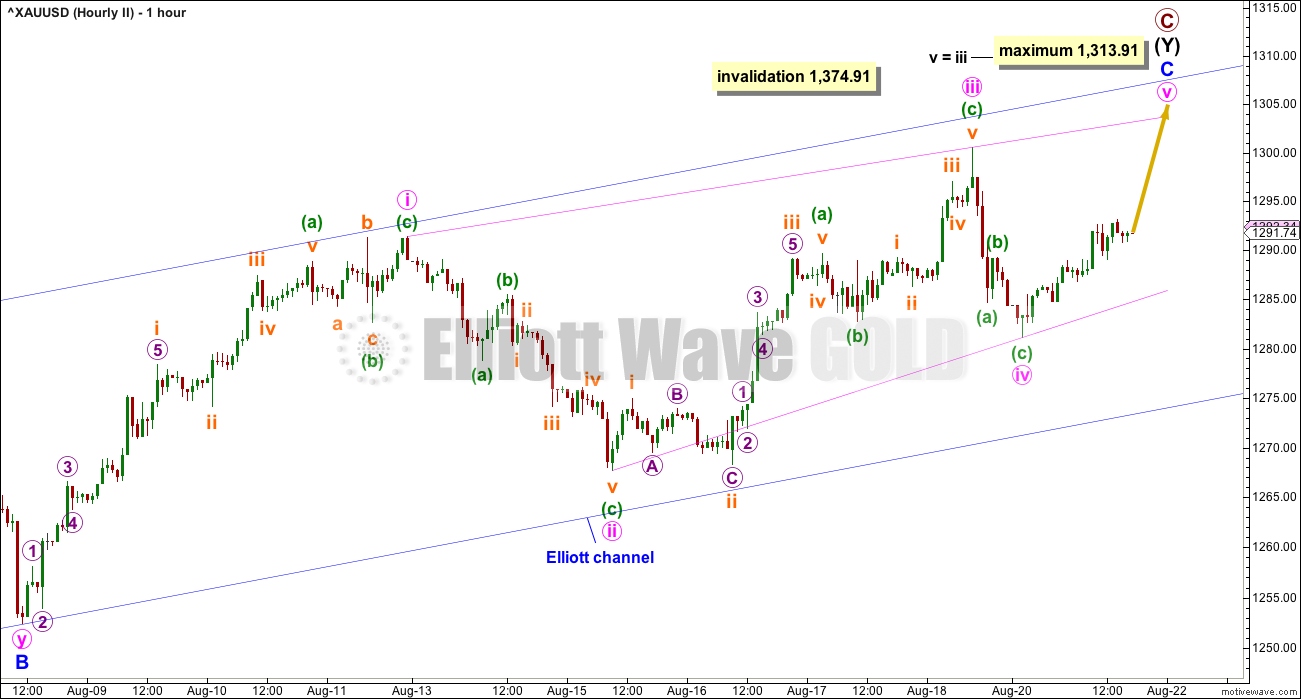

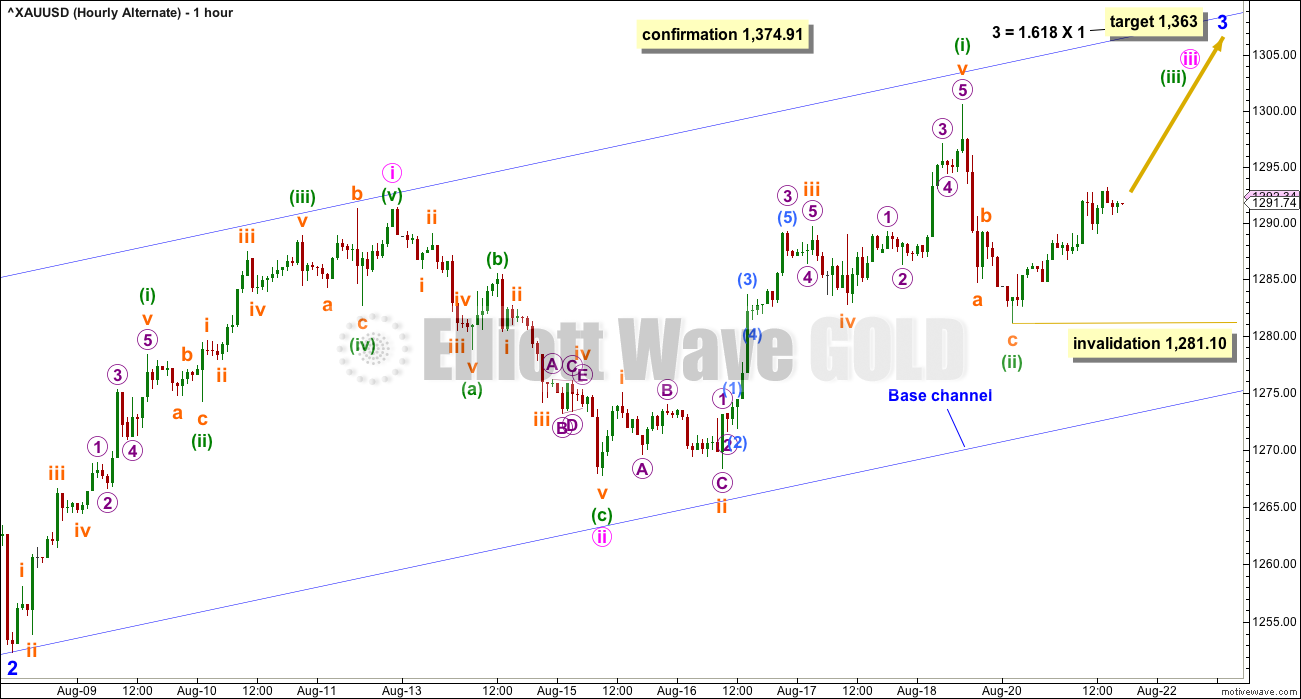

SECOND HOURLY CHART

At this stage, this is the preferred Elliott wave count.

The other structural possibility for minor wave C is an ending diagonal, which are more commonly contracting than expanding. The classic pattern equivalent here is a rising wedge. They are terminal structures.

This diagonal would be contracting because minute wave iii is slightly shorter than minute wave i. Minute wave iv now looks complete and is shorter than minute wave ii. The trend lines converge. At this stage, this wave count meets all Elliott wave rules.

No target is provided for minute wave v to end, and it may not exhibit a Fibonacci ratio to minute waves i or iii. The i-iii trend line should be used to indicate when minute wave v may be over. If price moves above the end of minute wave iii at 1,300.53 and then overshoots the i-iii trend line, then the diagonal may be complete. Contracting diagonals almost always end with overshoots of their i-iii trend lines.

Ending diagonals are commonly followed by sharp reversals. If this wave count is correct, then the first downwards movement after the diagonal is complete may be very strong and fast.

Use the blue Elliott channel as an indication of when primary wave C is over. A breach below the lower edge of the channel would be a strong indication of a trend change.

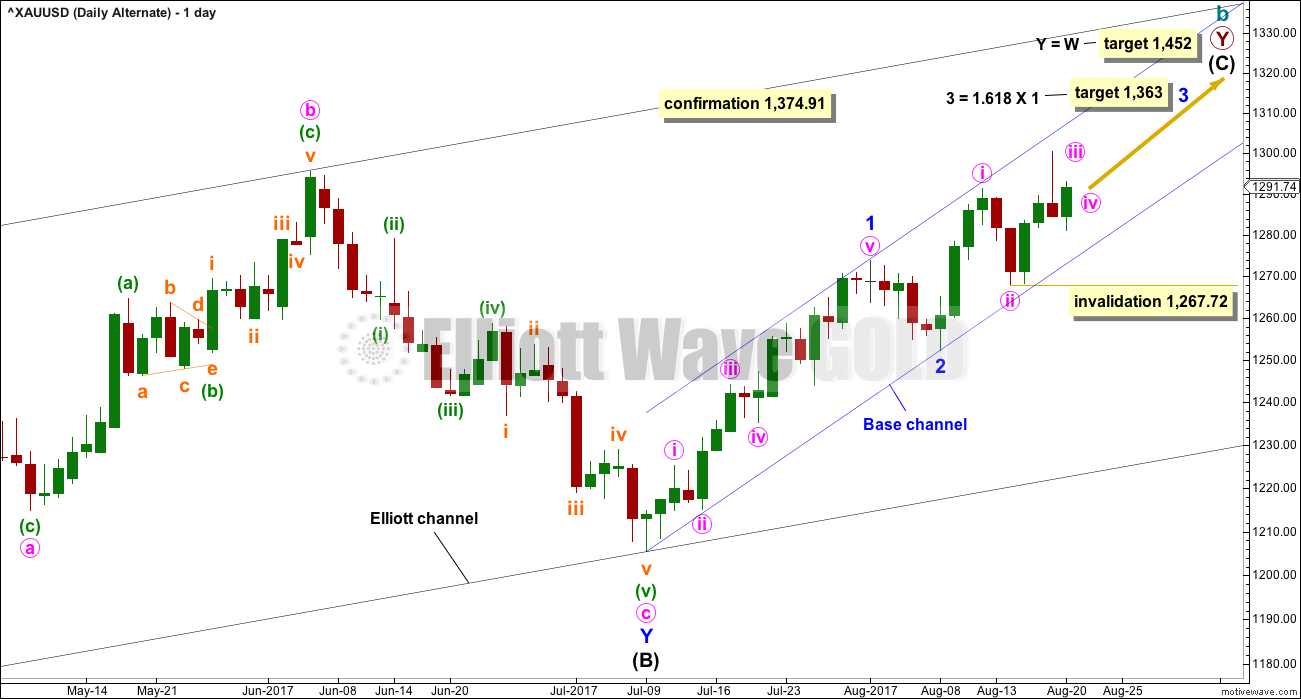

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has been published only in historical analysis. At this stage, it will be published on a daily basis.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b fits best at this stage as a triangle (main wave count), it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same as previously published for this wave count.

Along the way up, some resistance should be expected at the cyan Magee trend line. Because this wave count requires price to break above the Magee trend line, it must be judged to have a lower probability for this reason. This trend line is tested multiple times and goes back to 2011. It is reasonable to expect price to find resistance there, until proven otherwise.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

DAILY CHART

Intermediate wave (C) may be unfolding as an impulse.

Within the impulse, minor waves 1 and 2 would now be complete. Minor wave 3 must unfold as an impulse, and within it minute waves i and now ii would also be complete.

HOURLY CHART

This hourly chart is exactly the same as the first hourly chart for the main Elliott wave count. 1-2-3 of an impulse subdivides exactly the same as A-B-C of a zigzag.

Minor wave 3 may only subdivide as an impulse for this alternate wave count. Minor wave 3 may not be a diagonal. The second hourly chart for the main wave count does not work for this alternate.

The target is now different. This wave count is more bullish, and it expects to see a breach of the Magee trend line.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is finding very strong resistance about 1,310.

The upper purple resistance line for On Balance Volume is adjusted. On Balance Volume turning down from this line is a bearish signal.

ADX and ATR at the weekly chart level still strongly support the main Elliott wave count.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is more support from volume for downwards movement during Friday’s session than for upwards movement during Monday’s session. This is bearish.

Resistance about 1,305 – 1,310 is very strong. The preferred hourly Elliott wave count expects it may not be overcome.

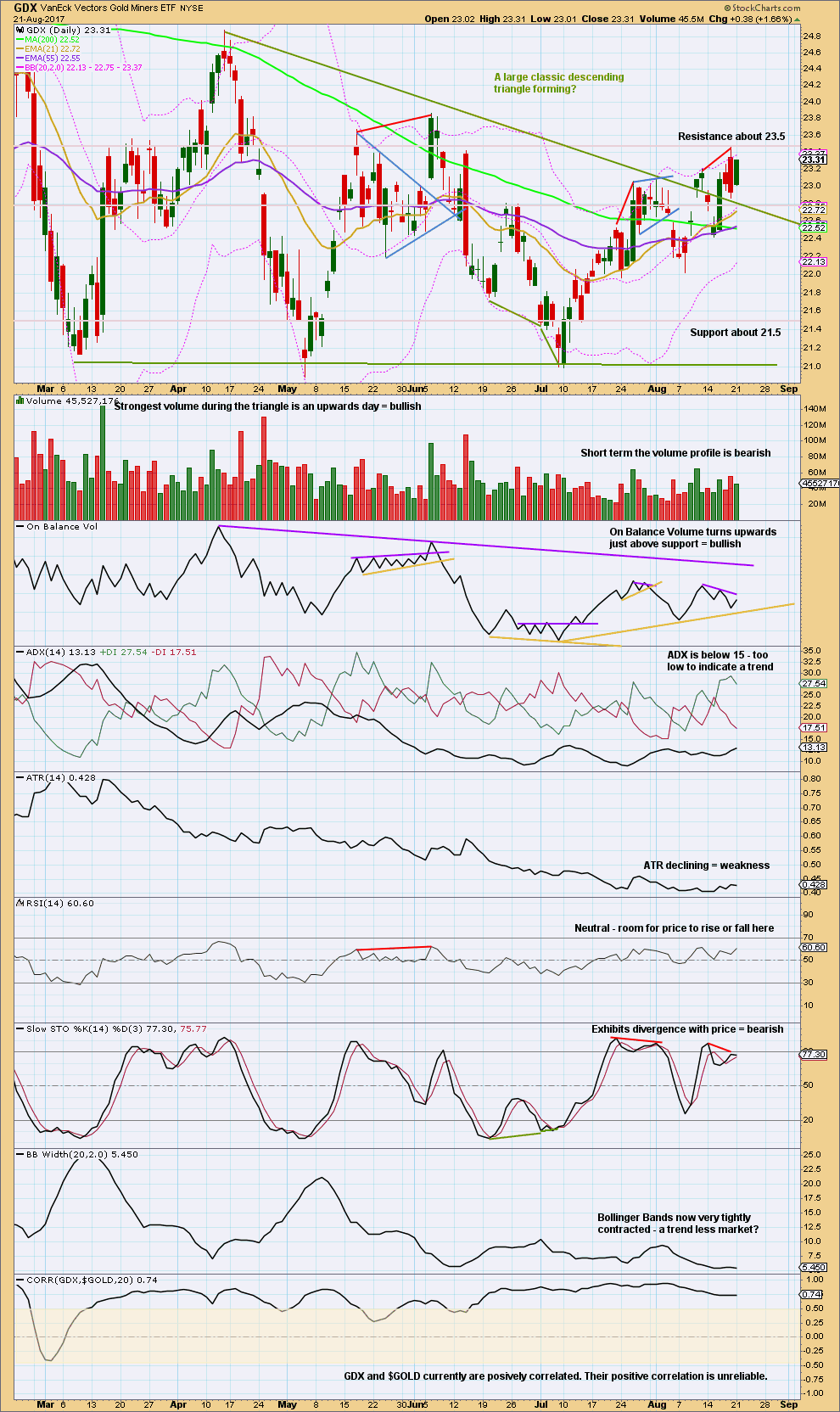

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This market has been trendless for a long time now as a large triangle completes. Descending triangles most commonly break out downwards, but this is contradicted by volume during this triangle being strongest for upwards days.

The upper triangle trend line is adjusted today. If there was an upwards breakout seven sessions ago, then Friday’s downwards day may have been a back test of support at the trend line.

The view that an upwards breakout may have occurred is contradicted by volume. There was more support for downwards movement during Friday’s session than there was for upwards movement during Monday’s session. Also, if there was a breakout, then Bollinger Bands should by now be widening and ATR should be increasing.

Published @ 06:31 p.m. EST.

Gold pretty scary right now. Topping-like patterns being painted on multiple time frames. I guess we’ll soon see what it wants to do. I had thought that staying long prior to a break out, IF it were going to happen, would be extremely difficult.

I’m long but with a pretty small line. Part of me actually wants to be short. After looking at everything I’m having trouble reading in between the lines on what is going to happen.

Maybe we’ll just go sideways for a long time lol

Oh and update on my biz partner (who is the golden goose when it comes to market timing). I had lunch with him today, and he is in no way worried about the market. And he just showed me a fund he is into along with the other stocks he told me about, which is pretty much holding FANG stocks. Time will tell whether he is perfectly wrong again!

I feel this is germane because gold and the stock market are pretty negatively correlated at the moment

Hourly chart updated:

This is the preferred hourly count. Minute iv looks like it’s moving sideways.

The trend lines still converge. A new limit is calculated. This still looks right, and still needs a final high.

What is the preferred hourly wave count at this time?

Still the second.

Thank you Lara!