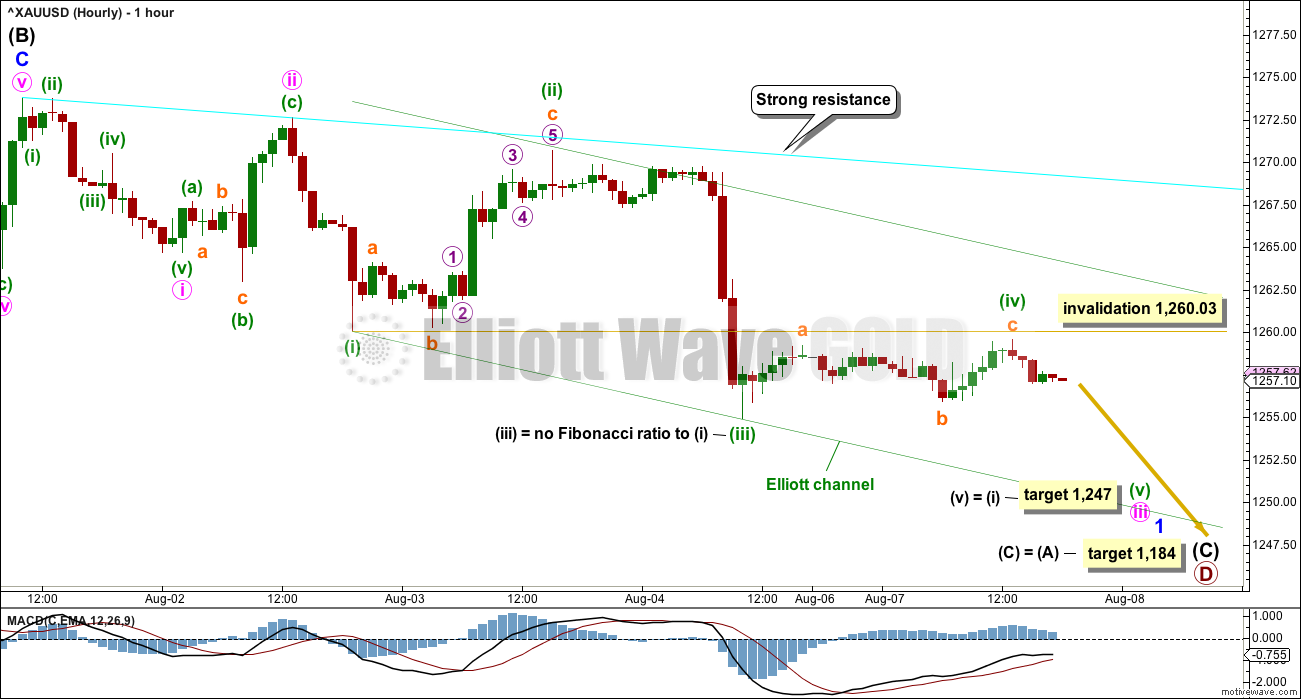

A very small range inside day only changes the Elliott wave count at the hourly chart level, slightly. The bigger picture and the target remain the same.

Summary: Gold has likely had a trend change. The target is at 1,184. This may be met in about five weeks.

For the short term, the target is now at 1,247 for tomorrow’s session.

Always use a stop. Invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts and alternate weekly charts are here, video is here.

Grand SuperCycle analysis is here.

MAIN ELLIOTT WAVE COUNT

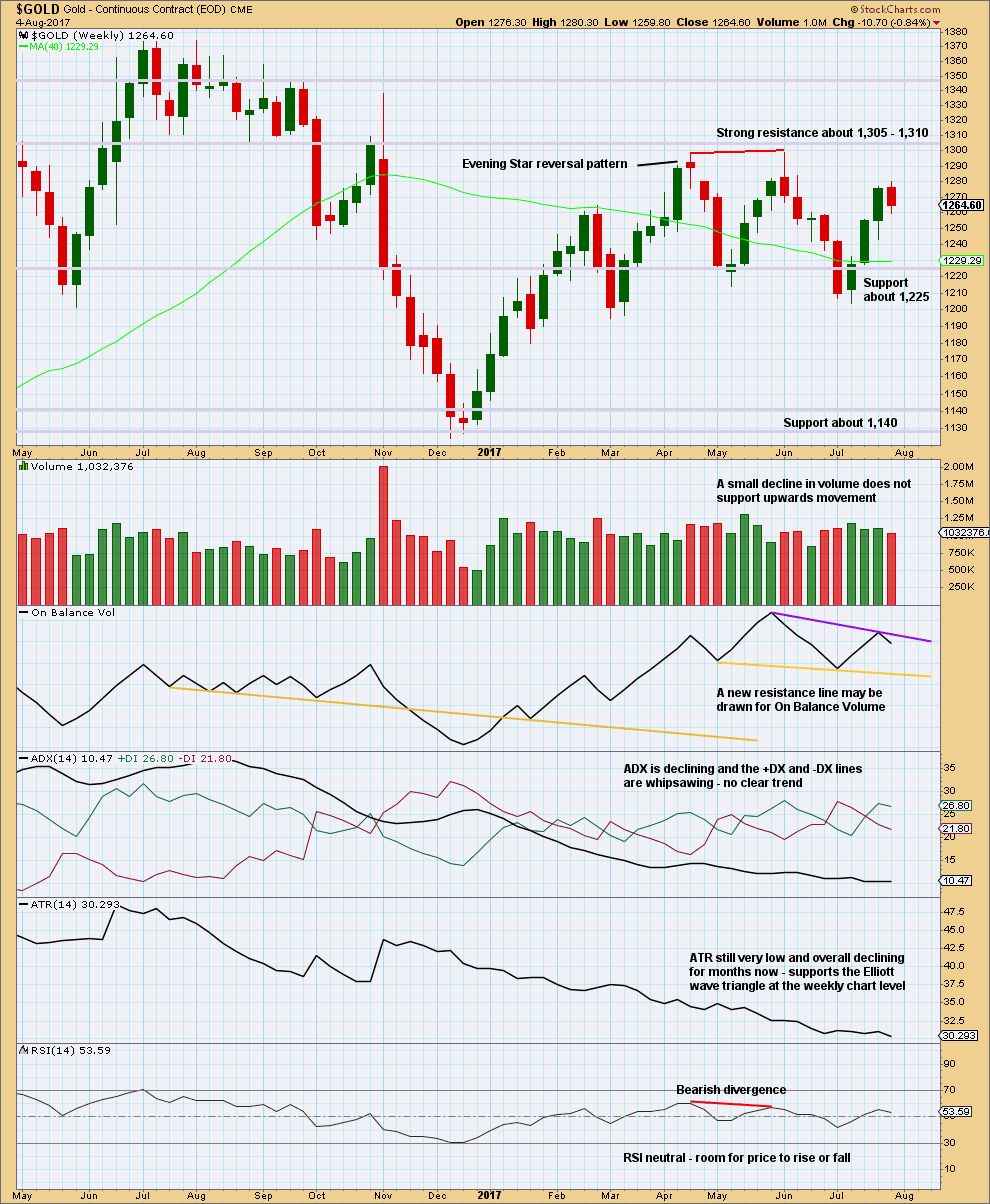

WEEKLY CHART

The Magee bear market trend line is added to the weekly charts. This cyan line is drawn from the all time high for Gold on the 6th of September, 2011, to the first major swing high within the following bear market on the 5th of October, 2012. This line should provide strong resistance.

At this stage, a triangle still looks possible and has the best fit for cycle wave b. It has some support from declining ATR and MACD now beginning to hover about zero.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Triangles normally adhere very well to their trend lines. So far the A-C trend line has been tested 11 times; this line has very strong technical significance. If this wave count is correct, then intermediate wave (B) may have ended just short of this trend line, finding strong resistance just below it.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C may have been complete in 25 weeks.

Primary wave D should now be expected to last a Fibonacci 13 or 21 weeks in total. It has now lasted 8 weeks, so a further 5 weeks minimum would now be expected.

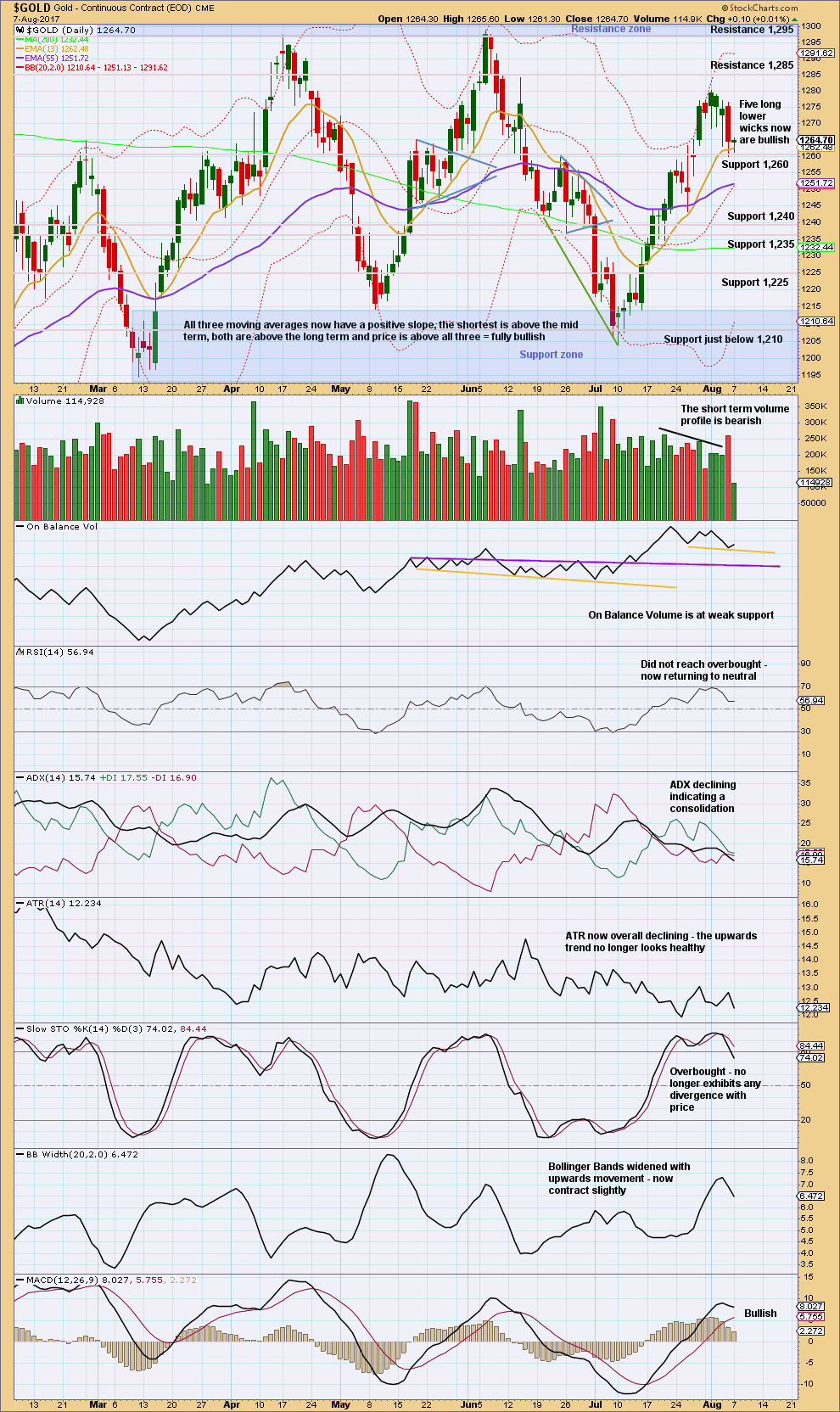

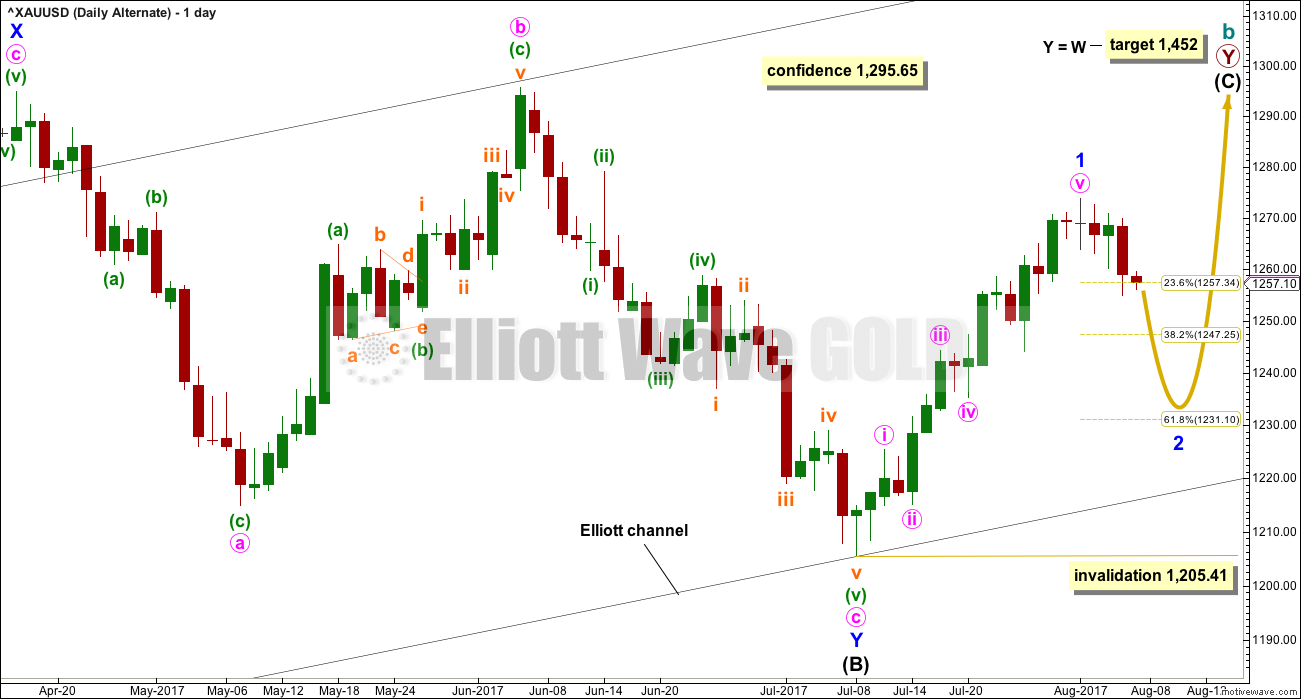

DAILY CHART

The channel about intermediate wave (B) has been fully breached at the hourly and daily chart level. This is a strong indication that intermediate wave (B) is over and intermediate wave (C) has begun.

The target calculated uses the most common Fibonacci ratio for intermediate wave (C).

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave above 1,273.83.

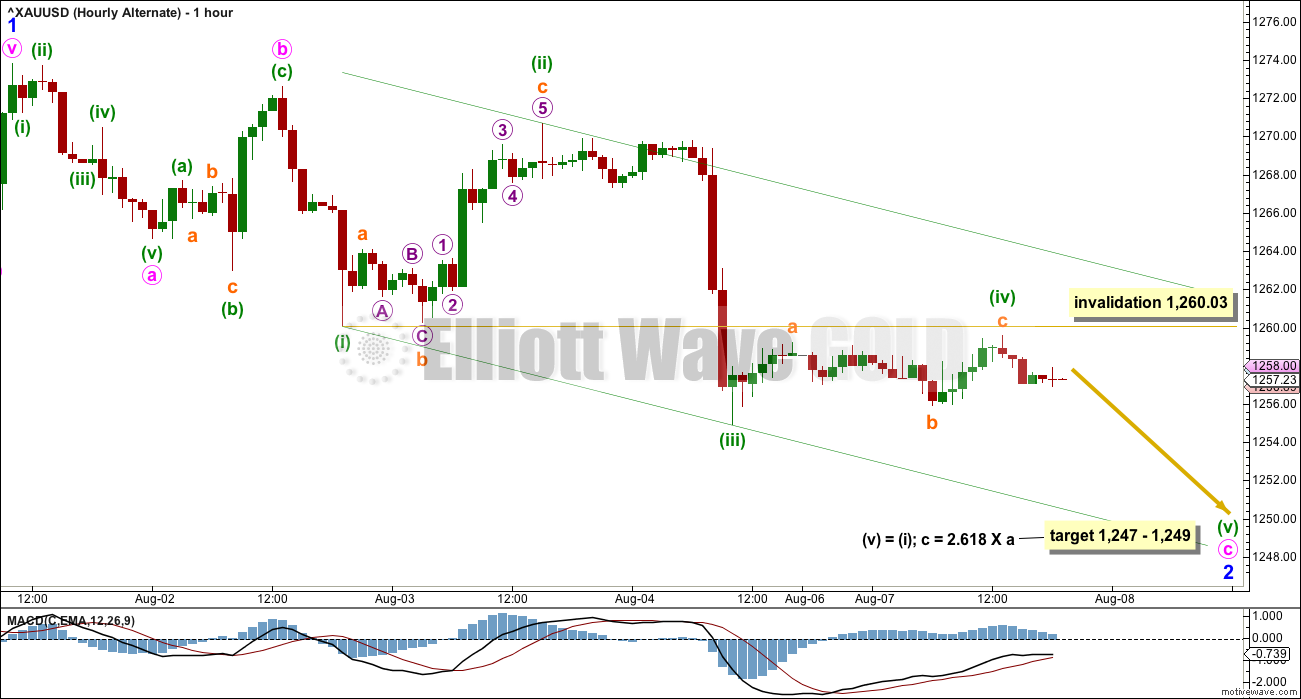

HOURLY CHART

The first five down is incomplete. When minor wave 1 is complete, then a deep bounce should unfold for minor wave 2. This may turn up at the end of next week.

For now the structure downwards of minor wave 1 is incomplete, so further downwards movement would be expected overall next week.

Labelling of the small sideways correction that took up all of Monday’s session is moved up two degrees. This leaves minuette wave (iii) looking like a curved three wave movement; this is very typical of Gold’s impulses, particularly its third waves. With minuette wave (iii), the fourth wave corrections may have been more brief and shallow than their counterpart second wave corrections while the fifth wave may have been a swift strong extension. Strong fifth waves are a characteristic of commodities.

There may be perfect alternation between the deep zigzag of minuette wave (ii) and the shallow flat correction of minuette wave (iv). If it continues further, minuette wave (iv) may not move into minuette wave (i) price territory above 1,260.03.

Draw an Elliott channel about this downwards movement. Look for minuette wave (v) to end about the lower edge. A subsequent breach of the upper edge of the channel would indicated minute wave iii may be over and minute wave iv may be underway.

Along the way down, any very deep bounces may find very strong resistance at the cyan trend line. This line should not be breached if this wave count is correct.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count has been published only in historical analysis. At this stage, it will be published on a daily basis.

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b fits best at this stage as a triangle (main wave count), it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same as previously published for this wave count.

Along the way up, some resistance should be expected at the cyan Magee trend line.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41.

DAILY CHART

Intermediate wave (B) subdivides as a double flat correction: expanded flat – X – regular flat. While all the subdivisions have a neat fit, double flats are very rare structures. In my now 9 years of daily Elliott wave analysis I can say with certainty that I have only ever seen one before. For this reason, this wave count must be judged to have a low probability.

It will remain as labeled though because this labelling has a good fit, and threes and fives look as they are supposed to.

Intermediate wave (C) may be unfolding as an impulse.

Only minor wave 1 may have been over at the last high. Minor wave 2 may have begun. Minor wave 2 may reach down to the 0.618 Fibonacci ratio of minor wave 1 at 1,231.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

HOURLY CHART

If only minor wave 1 was over at the last high, then the decline in volume and momentum at its end makes sense.

Minor wave 1 would have lasted 16 days. Minor wave 2 may be expected to last about three weeks also, so that the wave count has good proportions.

The most likely structure for minor wave 2 would be a zigzag. If the labelling here on this hourly chart is wrong, it may be in assuming minute waves a and b are over already. It is also possible that minute wave a is unfolding as an impulse and is incomplete.

It is also possible that minor wave 2 may be unfolding as a double zigzag, combination or flat correction. The zigzag labelled here may also be moved down one degree, it may be only minute wave a.

When the next wave down is complete, then multiple structural options must be further considered for minor wave 2.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

An upwards week closes with a red weekly candlestick.

To correctly analyse volume for this week it should be done at the daily chart level, to look “inside” the week.

On Balance Volume gives no signal. It is constrained.

ADX and ATR both support the main weekly Elliott wave count. This is what a triangle should look like.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stepping back and looking at the larger consolidation, Gold moved into a range back in February this year, delineated by support and resistance zones. During this consolidation, it is two upwards days of 7th of April and the 17th of May that have strongest volume. This suggests an upwards breakout is more likely than downwards, and it supports the alternate Elliott wave count and not the main Elliott wave count.

However, this signal is not a strong one. The third strongest day of the 18th of May is a downwards day, and it is very close in volume to the two upwards days.

A fifth day in a row now with a long lower candlestick wick again looks bullish, but so far this has not resulted in any upwards movement. This may be indicating an upcoming bounce.

Price is finding support about 1,260. Next support is about 1,240.

Friday’s strong downwards day had good support from volume and range. Now Monday completes a small inside day with the balance of volume upwards, and very light volume. Upwards movement during Monday’s session did not have support from volume.

At this time, declining ADX and ATR and contracting Bollinger Bands support that this movement may be a counter trend movement. Volume strongly disagrees.

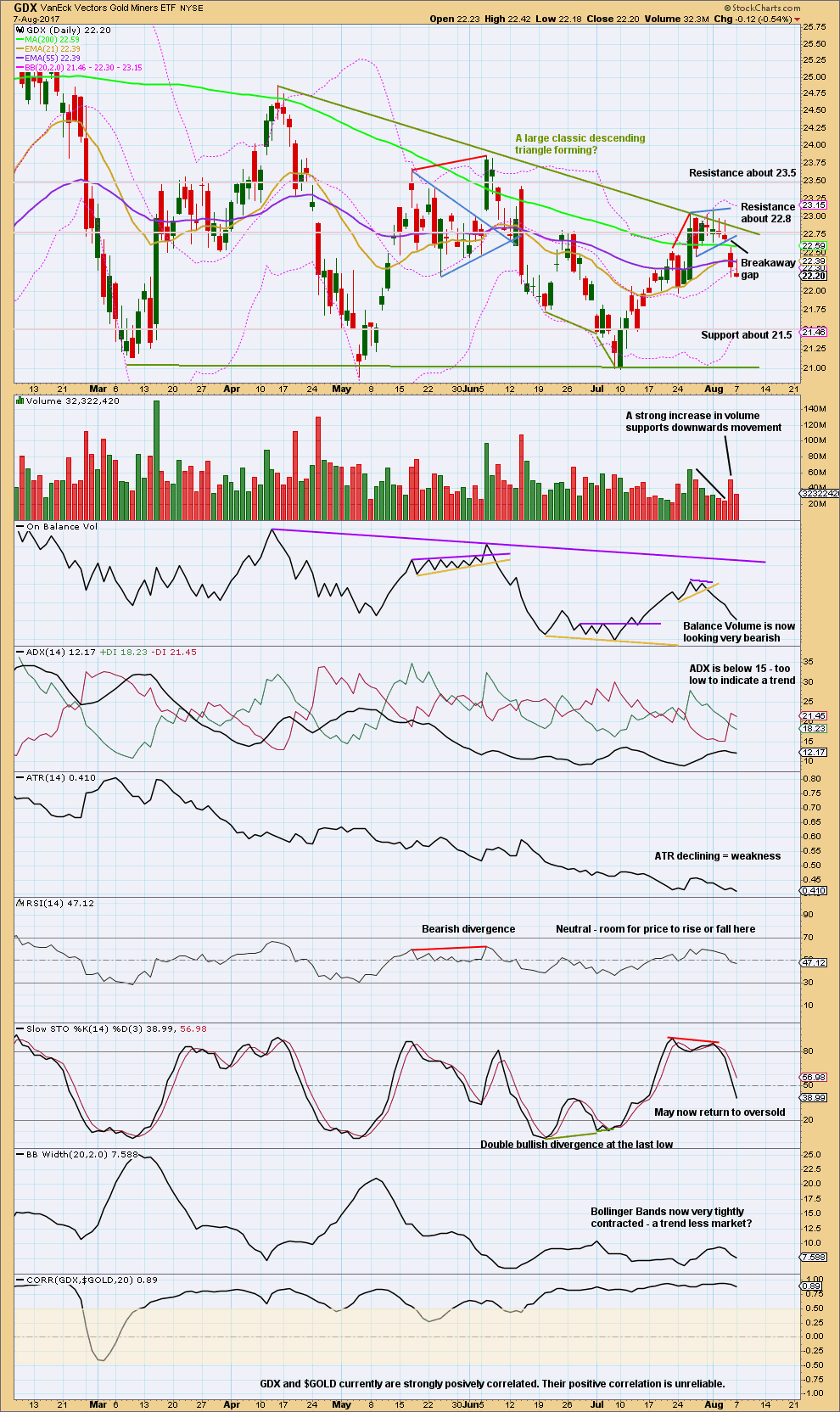

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stepping back for GDX too, to look at the past six months, a large descending triangle looks like it has formed and may be close to a breakout. Breakouts from descending triangles are usually downwards.

During this structure though it is an upwards day for the 15th of March that has strongest volume suggesting an upwards breakout may be more likely than downwards.

Price has found resistance at the upper triangle trend line at the same time as Stochastics was overbought. Now price is reacting down from that line and Stochastics may return now to oversold.

Expect a downwards swing to continue overall until price finds support and Stochastics reaches oversold at the same time. Price does not have to do this in a straight line though; it may be choppy and overlapping.

The long upper wick on today’s candlestick is bearish even though downwards movement during the session did not have good support from volume.

Published @ 07:06 p.m. EST.

For those of you that saw my post the other day about my biz partner having an uncanny ability for making exactly the wrong trading moves at exactly the wrong time, you may find some amusement in that it is just a few days later that the stock market is showing some signs of an interim top. Remains to be seen of course, but his trading record is perfect so far (as in perfectly wrong!) lol

I did see it, and found it amusing. It is true that when everyone gets in on the trend, the trend is ready to end.

North Korea news, bearish day in the stock market, making things a little fuzzy. Treacherous trading right now. Despite my vow not to try and short the market, i saw a sell signal and tried yesterday and got stopped out today before this fall, which is now looking like a nice outside reversal day. Sigh. Coming back to gold. As rare as leading expanding diagonals are, i likewise hate hunting for nested 1s and 2s. Looking at the bullish alternate very carefully…

Good point Eli.

The ALT would have bottomed at todays low.

Strong bouncy and now hovering at ~1260

Looks to me like if we take out 1265 (top of orange ii)

that would be the nail in the coffin for the bear count IMO

thoughts?

To really feel good about it, i think a close or pretty strong move over 1270 is necessary. If it moves over 1265 with no follow through, then it could still be another wave 2 perhaps an expanded flat

I’ll have both, the LD as an alternate.

Updated hourly chart:

It could be a leading diagonal, as per Dreamer’s chart below. Or it could be three overlapping first and second waves.

I’ll go with the latter as it has a higher probability. Leading expanding diagonals aren’t rare, but they’re not common either. Impulses are much more common.

lol… the market makers sure don’t miss a trick – pump & dump! Need to see a break below 1251-50 (50% retrace H 1295 / L 1205); will we get it? hmmm….

Yep. Very predictable by the banksters to rattle the cubbies after the start of a move down. The reason it reverses so quickly is a lot of savvy traders know exactly what they are doing ( I usually join the party) and hammer ’em immediately.

It a beautiful thing to see near dated GLD 120 strike puts double in a matter of minutes! 😀

lol obviously those who matter are not in it for a marathon. Appears they are preferring a sprint trade of late. A quick zip upwards, flash drop and back up. Making a mockery of this really. I wonder if this is gradually building up to an eventual drop to 1050-1030… It should!!

GLD faced stiff resistance after slightly penetrating bottom of yesterday’s gap at just above 120.00

No change I don’t think. Just a few short futures stops being run as is common at the outset of a trend change. 🙂

We could also have potentially a continuation triangle. Which would be bullish I think.

Do you mean for that to be an EW triangle?

Because if it is…. it completely does not work.

You’ve started the labelling in the wrong place.

Uh Huh! 🙂

With the invalidation of Lara’s hourly count, it’s prudent to look at other options. One option is a leading expanding diagonal. If this is the case, expect a deep retrace as shown.

https://www.tradingview.com/x/DY2rxboE/

VIEW: Imo Gold price should really not get to & past 1261-62; if it does then something else is going on and likely target 1265-67. A pullback in the making to look out for and would need to see a break below 1256. Two sided trade really scalp short and long on the pullback….Gold price appears stuck in 1275/1215 range with very little joy on offer lol…. GL all!

Did we just pass the invalidation on hourly chart?

Yes, @ 1,260.49, the main hourly is invalidated. It’s possible that Lara was too quick at moving the count up 2 degrees. Although that will make the current 4th wave a bit out of proportion, it moves the invalidation point up to 1,267.33 or 1,267.97.

Dreamer could the move down to 1253 on Friday be counted as some sort of nested I and now in ii?

See above for another option.

The hourly GDX wave count is progressing nicely. It’s likely that only one more small 4th wave is needed before a larger 2nd wave correction up.

Since this is not expected to be a breakout move to the downside, it’s likely that the gap from Friday will be filled in full or part. If you’re not already short, you may want to wait a few days for a move up as high as 22.69 to initiate or add to shorts.

https://www.tradingview.com/x/s9kfeVin/

What is your target for the upcoming small 4th wave? I’m currently short gold. Thanks, Dreamer.

I believe gold should rebound to roughly 1262-1263. Silver around 16.45. good luck John.

Subminuette 4 could end around the same level as Micro wave 4 around 22.42