A slight new low in the last few hours changes the Elliott wave count for the short term, but not the mid or long term. This is still expected to be a B wave, which exhibits the greatest variety in structure and price behaviour.

Summary: A consolidation for a B wave should complete this week. Short term upwards movement should reach a minimum of 1,302.74. Thereafter, a downwards swing should unfold.

For the short term use the channel on the main hourly chart for confidence that a low is in place. A new high above 1,283.24 would add further confidence. Accept the risk that the consolidation may continue lower while price remains within the channel.

The larger trend for at least the mid term remains upwards. The target would be at 1,320 in the first instance. It may be as high as 1,412, but this looks less likely.

Invest only 1-5% of equity on any one trade. Always trade with stops.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

The wave counts will be labelled first and second. Classic technical analysis will be used to determine which wave count looks to be more likely. In terms of Elliott wave structure the second wave count has a better fit and fewer problems.

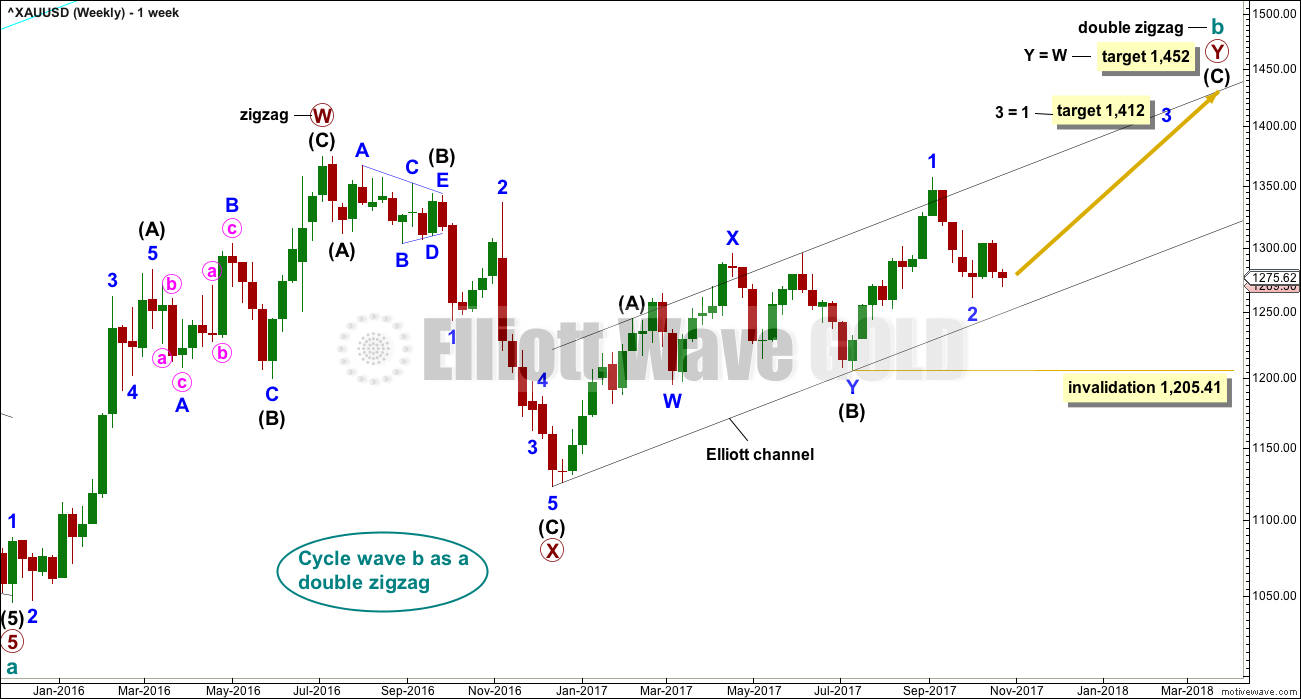

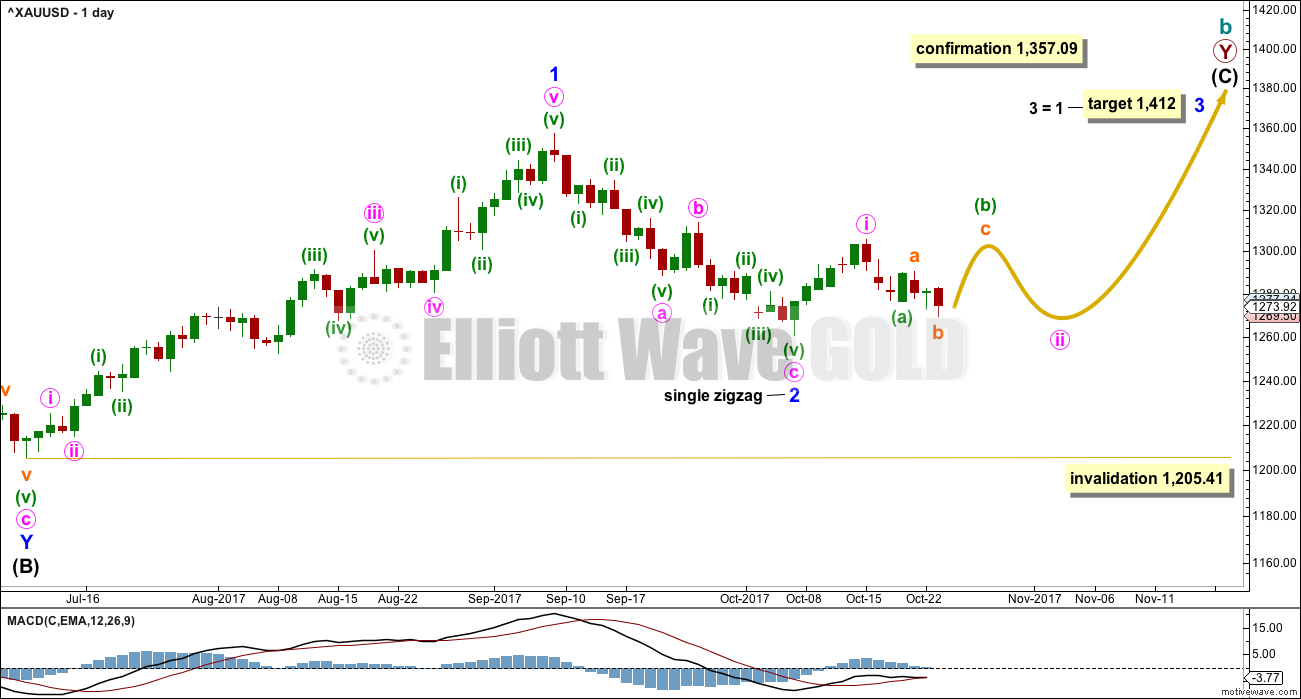

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits well at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

There are now three problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

3. Although intermediate wave (C) should be continuing so that primary wave Y ends substantially above the end of primary wave W, the duration and depth of minor wave 2 within it now looks to be too large at the weekly time frame.

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

It is possible that minor waves 1 and now 2 may both be over. Minor wave 2 may have ended very close to the 0.618 Fibonacci ratio. If it continues lower, then minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

Minor wave 1 lasted 44 days and minor wave 2 may have lasted 20 days, just one short of a Fibonacci 21.

It is of some concern now that minor wave 3 appears to be starting out rather slowly. This is somewhat unusual for a third wave and offers some support now to the second Elliott wave count. With StockCharts data showing a steady decline in volume as price rises, this concern is now validated.

Attention now turns to the structure of minute wave ii. Minute wave ii cannot be over and may be continuing further as a flat correction. Within minute wave ii, minuette wave (b) may be an expanded flat.

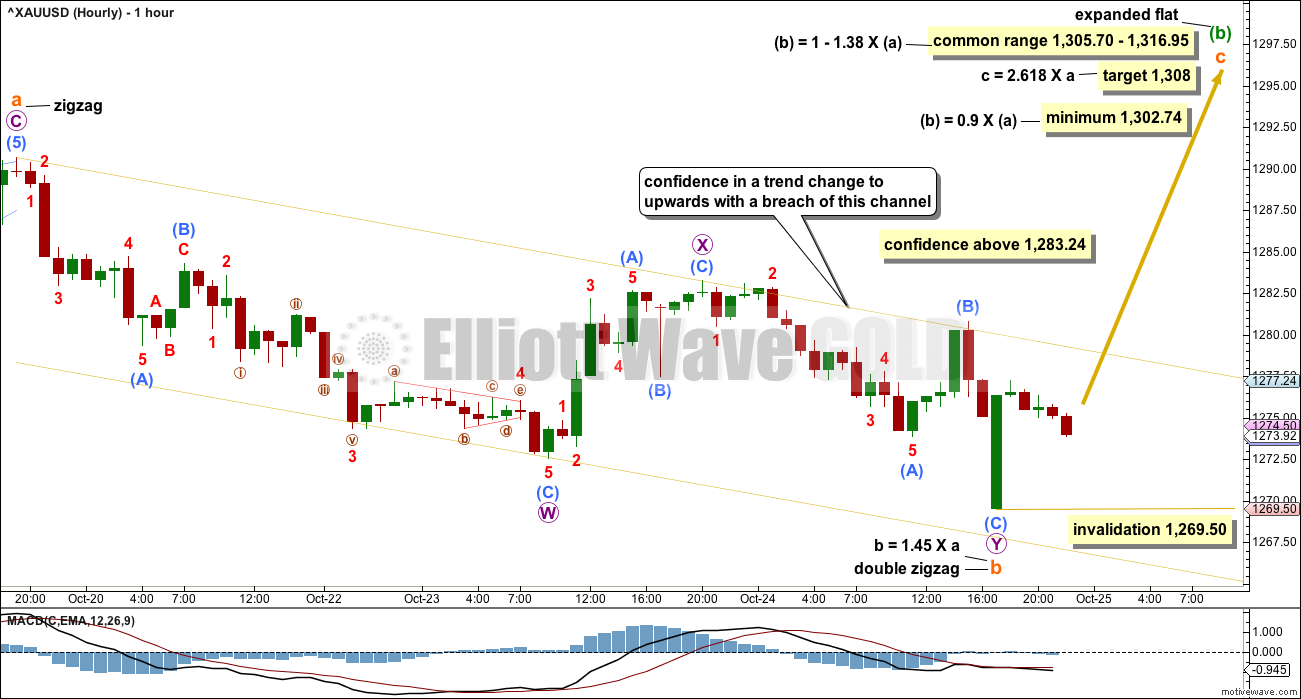

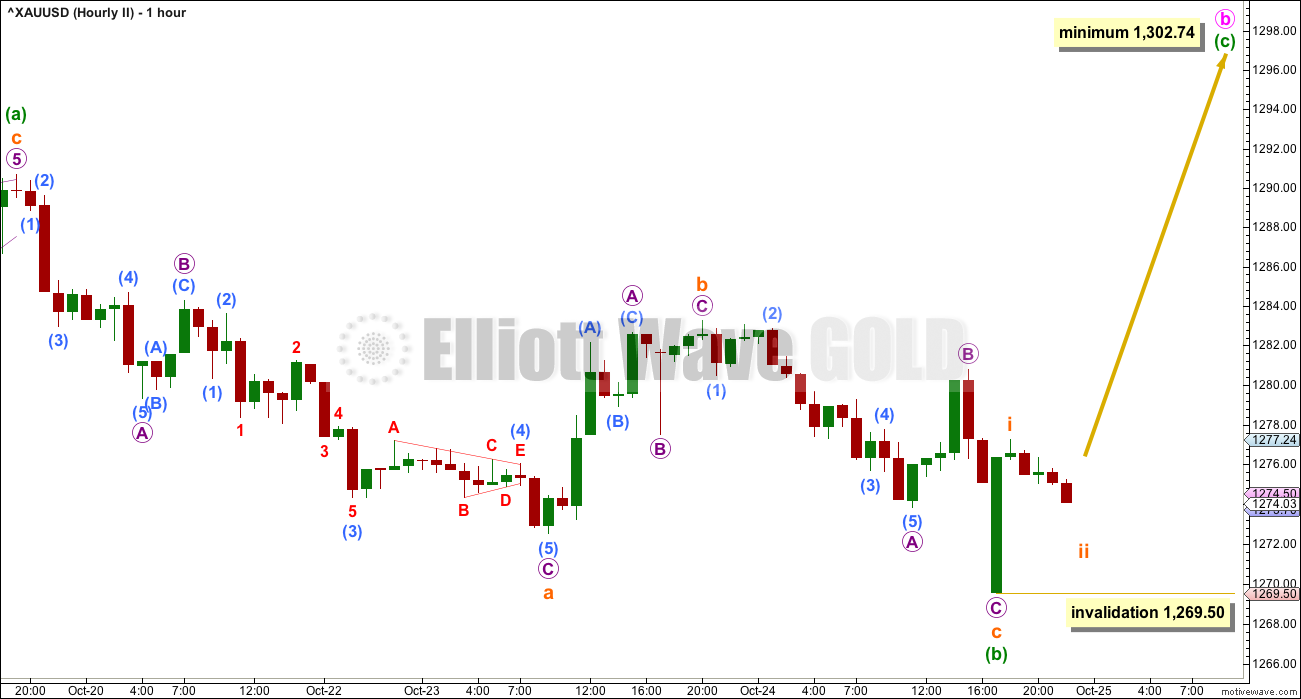

HOURLY CHART

Within minute wave ii, only minuette wave (a) may be complete. Minuette wave (b) may be just over half way through.

Because minuette wave (a) subdivides as a three, minute wave ii may be a flat correction.

The minimum requirement for minuette wave (b) within a flat would be 0.9 the length of minuette wave (a) at 1,302.74. The common range for minuette wave (b) is given on the chart.

Minute wave ii cannot be continuing further as a combination if minuette wave (a) is correctly labelled as a double zigzag. This double zigzag cannot be labelled minuette wave (w) of a continuing combination. The maximum number of corrective structures in a combination is three (this maximum refers to W, Y and Z). To label multiples within multiples is to increase the maximum beyond three and would violate the Elliot wave rule. This is the most common error made by many, so members should always keep this rule in mind when labelling multiples.

Minute wave ii cannot continue further as a triangle as second waves do not subdivide with triangles as their sole corrective structure.

If subminuette wave a is a zigzag, then subminuette wave b must retrace a minimum 0.9 length of subminuette wave a. Subminuette wave b has moved lower and now subdivides as a double zigzag. It is now just a little longer than the common range for a flat from 1 to 1.38 times the length of subminuette wave a. Subminuette wave b is longer than 1.05 times the length of subminuette wave a, so minuette wave (b) may be an expanded flat.

Because subminuette wave b is now longer than the most common length, the appropriate Fibonacci ratio to use to calculate a target for subminuette wave c is 2.618. This target would see subminuette wave c move substantially above the end of subminuette wave a, which is the purpose of C waves within expanded flats.

This is an area of strong prior resistance and support.

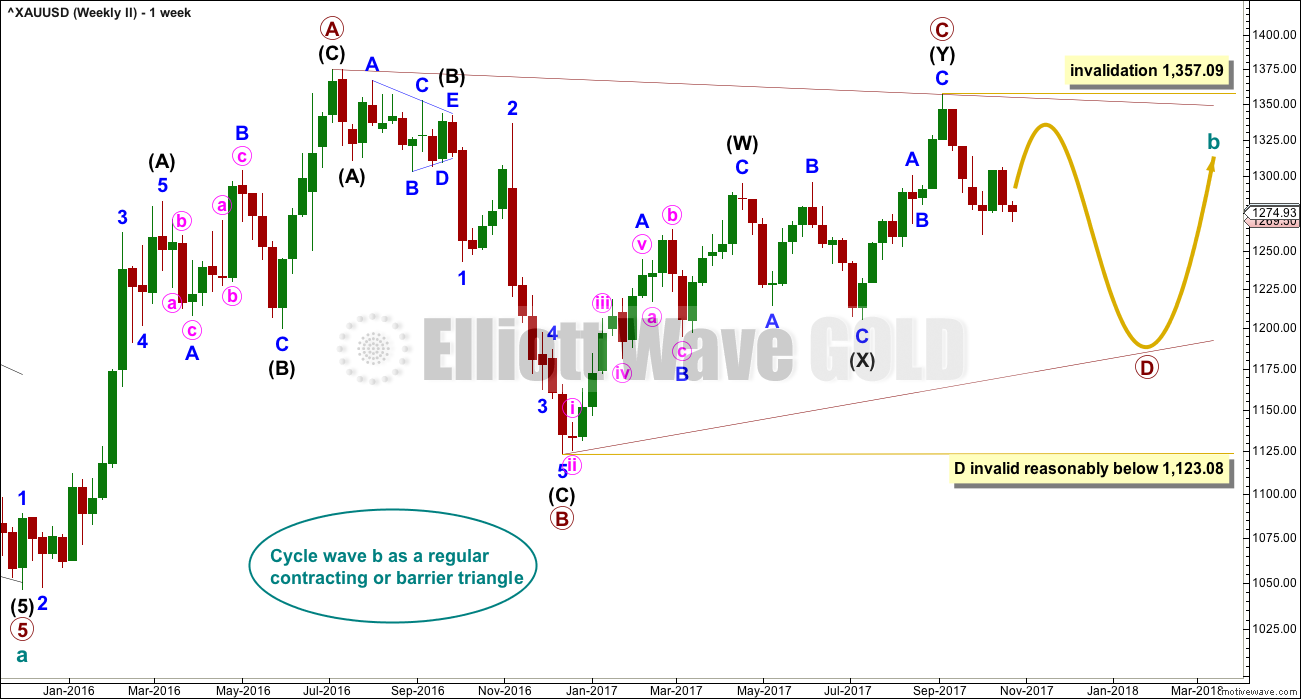

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

It is still possible that cycle wave b is unfolding as a regular contracting or barrier triangle.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a complete zigzag at the weekly chart level.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C lasted 38 weeks.

The A-C trend line now has too weak a slope. At this stage, this is now a problem for this wave count, the upper A-C trend line no longer has such a typical look.

Within primary wave D, no part of the zigzag may move beyond its start above 1,357.09.

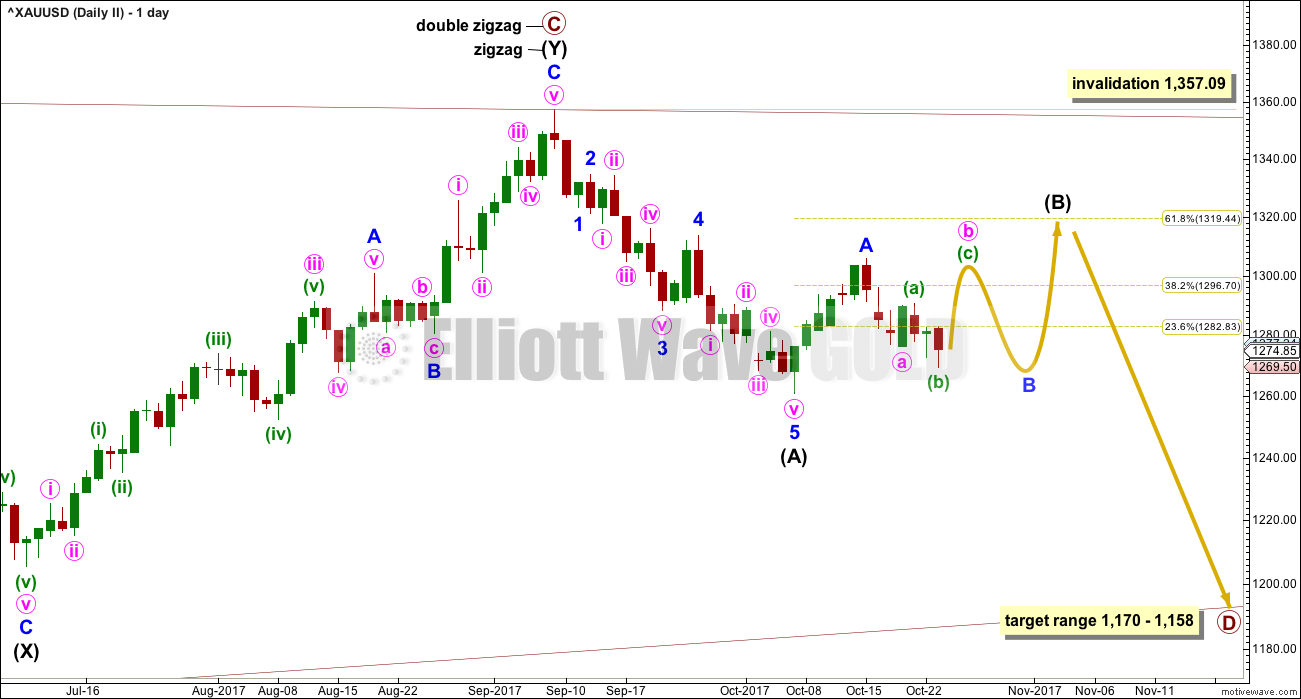

DAILY CHART

This second wave count expects the new wave down may be deeper and longer lasting than the first wave count allows for.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

If primary wave C is correctly labelled as a double zigzag, then primary wave D must be a single zigzag.

Within the single zigzag of primary wave D, intermediate wave (A) is labelled as a complete impulse.

Intermediate wave (A) lasted twenty days, just one short of a Fibonacci twenty-one. Intermediate wave (B) may be about the same duration, so that this wave count has good proportions, or it may be longer because B waves tend to be more complicated and time consuming.

So far intermediate wave (B) has lasted twelve sessions. If it continues to total a Fibonacci thirteen, it may end in another one session. With minor wave B now incomplete, this looks less likely. The next Fibonacci number in the sequence is twenty-one which would see it continue now for another nine sessions.

Intermediate wave (B) may be a sharp upwards zigzag, or it may be a choppy overlapping consolidation as a flat, triangle or combination. At this stage, it looks most likely to be incomplete because an intermediate degree wave should last weeks. At its conclusion intermediate wave (B) should have an obvious three wave look to it here on the daily chart.

Minor wave B may be expected to be an incomplete flat correction in the same way as minute wave ii for the first Elliott wave count. Here, the degree of labelling is one degree higher.

With another new low today, minor wave B may not be continuing sideways as a triangle. The subdivisions do not fit for minute wave a to have ended at today’s low.

One important difference between the two wave counts is here minor wave B may make a new low below the start of minor wave A at 1,260.72, whereas this is an invalidation point for the first Elliott wave count.

HOURLY CHART

Subdivisions, invalidation points, minimum requirements and targets are the same at this stage for both wave counts.

TECHNICAL ANALYSIS

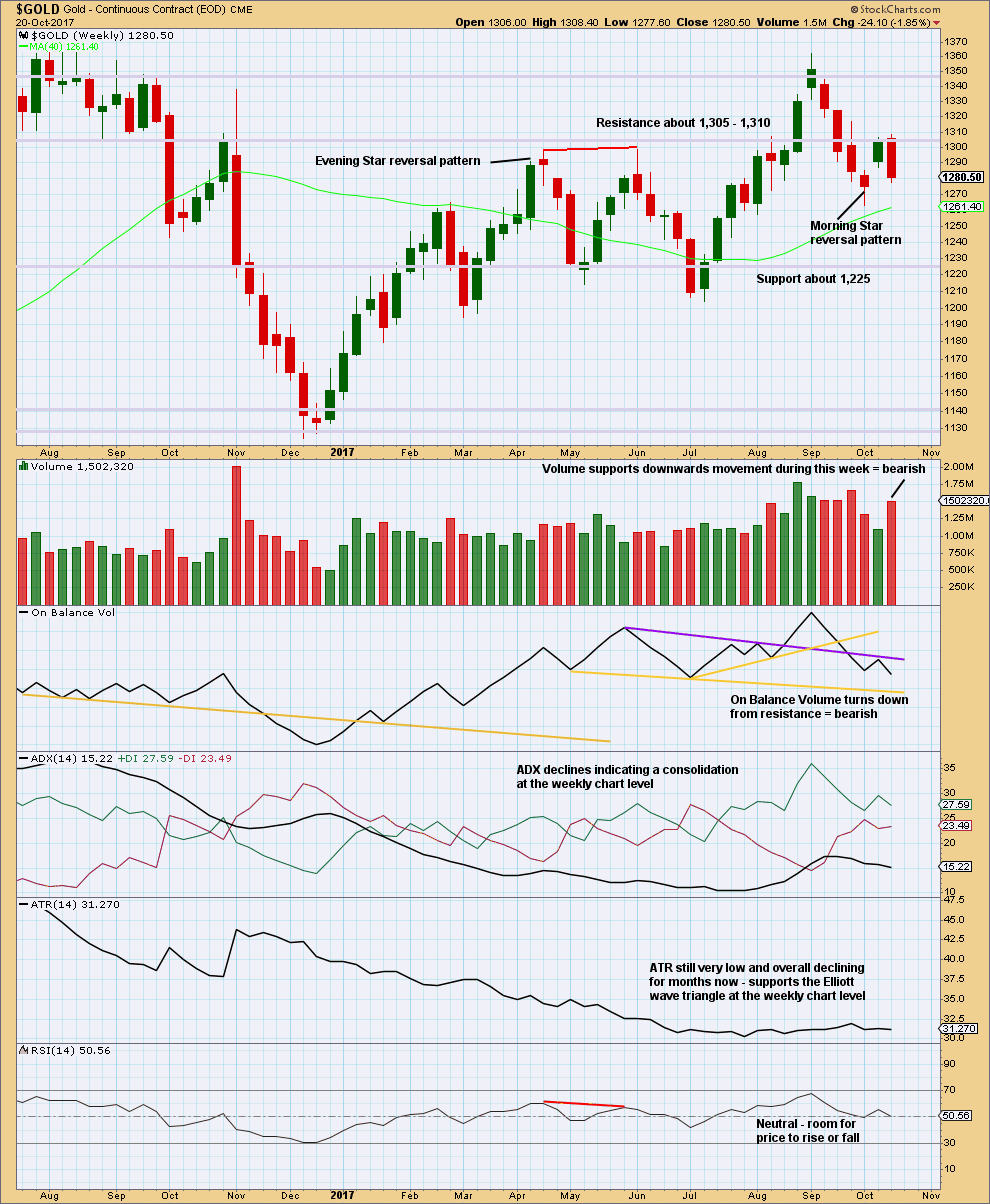

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Resistance on On Balance Volume has served to halt the rise in price and initiate a downwards reaction. This weekly candlestick is not correctly a Bearish Engulfing reversal pattern because it does not come after much upwards movement. There is almost nothing to reverse here. But the strong downwards week is certainly bearish.

Support from volume is also very bearish.

The upside may be very limited here.

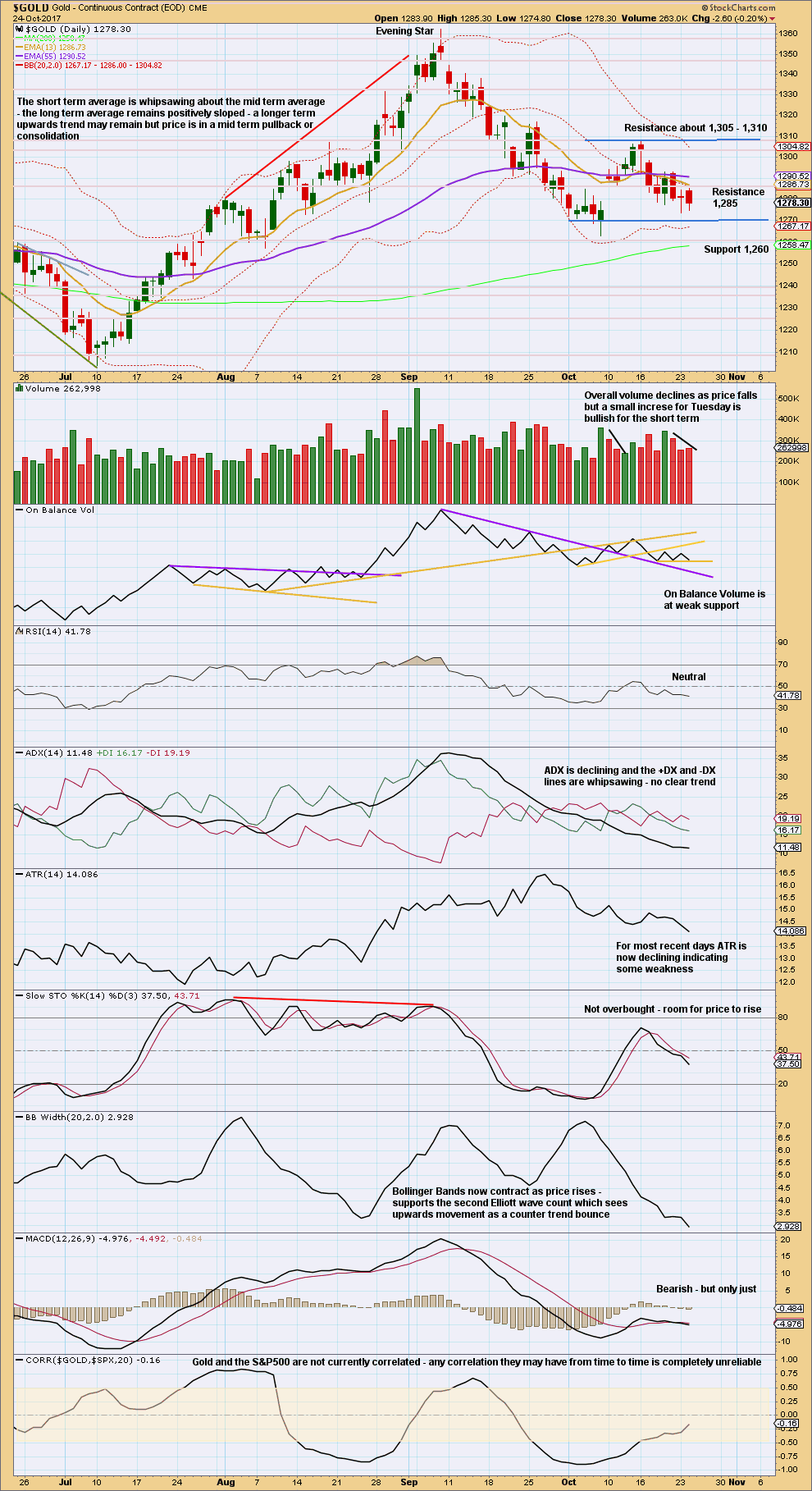

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last two daily candlesticks both have longer lower wicks, which is slightly bullish. But they both closed red, which is bearish. A slight increase in volume today is bearish for the short term.

Weak support on On Balance Volume may halt the fall in price here.

ADX, ATR and Bollinger Bands agree that price is consolidating. Resistance is about 1,305 to 1,310 and support is about 1,270, delineated by blue lines today. It is the two days during this small consolidation, the 6th and 18th of October, which have strongest volume suggesting an upwards breakout is more likely than downwards. This supports both Elliott wave counts.

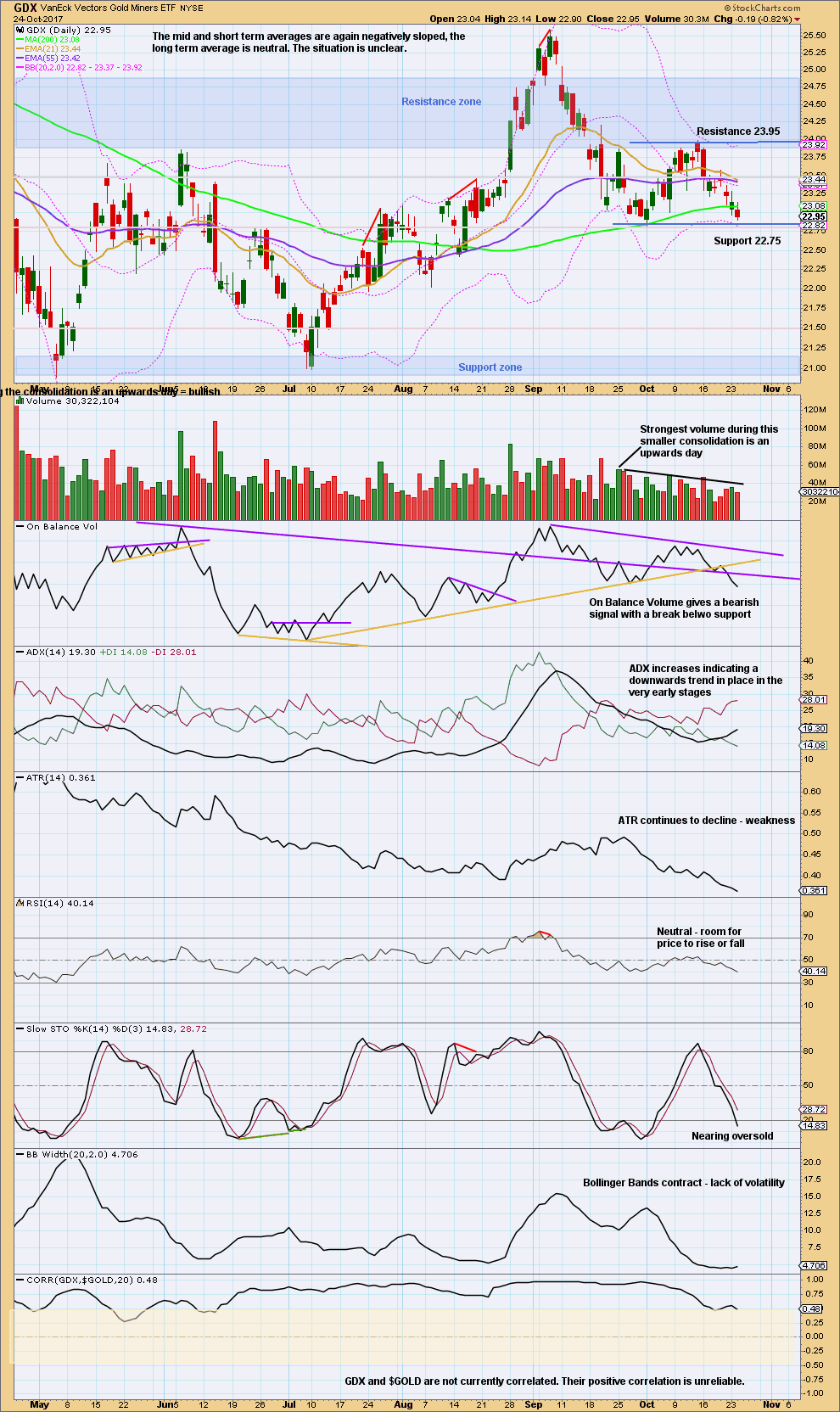

GDX

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX is also range bound, but here ADX indicates a downwards trend.

GDX is more bearish than Gold. A breakout below support at about 22.75 would be required, preferably with some support from volume, to have confidence that a new wave down is underway.

Recent candlesticks look very weak.

Published @ 11:14 p.m. EST.

If this current hourly candlestick can close above the channel we shall have an indication of a trend change.

Watch the falling wedge for clues…

https://www.tradingview.com/x/tFQxMS0a/

I see lower highs and lower lows still, however, there is definitely divergence and it is still trying to bottom short term. Midterm i still see a pretty strong topping pattern in effect, bearish COT structure, bottoming structure in the USD on the daily, and stock market that won’t crash for more than a couple of hours. However, gold has failed to break down so far. Stuck in a sideways chop until market decides to let us all in on what it wants to do. The key may lie in the weakness exhibited by gold stocks which almost always leads. I can’t imagine we don’t see a test of the 200 dma in gold before anything meaningful happens to the upside, but gold has so far refused to do that. Maybe it just needs a little more time…

Thanks Dreamer,

I am hoping it is UP!

Comments on this board have been very scarce lately. I guess all the sideways movement is wearing folks out.

Anyway, noticed that GDX Bollinger Bands are at their tightest since the bottom in early 2016. This portends that a big move is coming.

This chart shows which way the big move was each time the BB’s were constricted. As you can see, unfortunately, BB constriction does not tell you the direction of the big move.

I would like to point out that sometimes a big move will start with a false move in the opposite direction. Look at what happened back in early 2016.

So even though it appears that price is starting to move down now while BB’s are at record low widths, it’s possible that price could quickly reverse soon and the big move to come may be up.

Bottom line, a big move is coming soon….UP or DOWN?

It’s always hard to make $$ in a market which is in a consolidation, and Gold has been consolidating essentially since about February 2016.

This membership does tend to rise when the market is trending, and fall when it consolidates.

DUST poking above upper B band today could portend an imminent trend change. Nibbling on some November 25 strike puts for 0.85 per….

Hi Lara,

In your main hourly, can you please explain why subminuette a could not be minuette (b)?

Sure. Because the last swing low before that which is labelled minuette (a) subdivides as a double zigzag. So that’s a three.

So the following wave B must be a minimum 0.9 length.

This assumes that I have my labelling of minuette (a) as a double zigzag correct. Which TBH may not be correct. If we see another low and another invalidation then I’ve got it wrong 🙁