Upwards movement was expected after last analysis, which so far is what is happening.

Summary: A consolidation for a B wave should complete this week. Short term upwards movement should reach a minimum of 1,302.74. Thereafter, a downwards swing should unfold.

For the short term a new high above 1,283.24 would add further confidence that an upwards swing is underway.

The larger trend for at least the mid term remains upwards. The target would be at 1,320 in the first instance. It may be as high as 1,412, but this looks less likely.

Invest only 1-5% of equity on any one trade. Always trade with stops.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

The wave counts will be labelled first and second. Classic technical analysis will be used to determine which wave count looks to be more likely. In terms of Elliott wave structure the second wave count has a better fit and fewer problems.

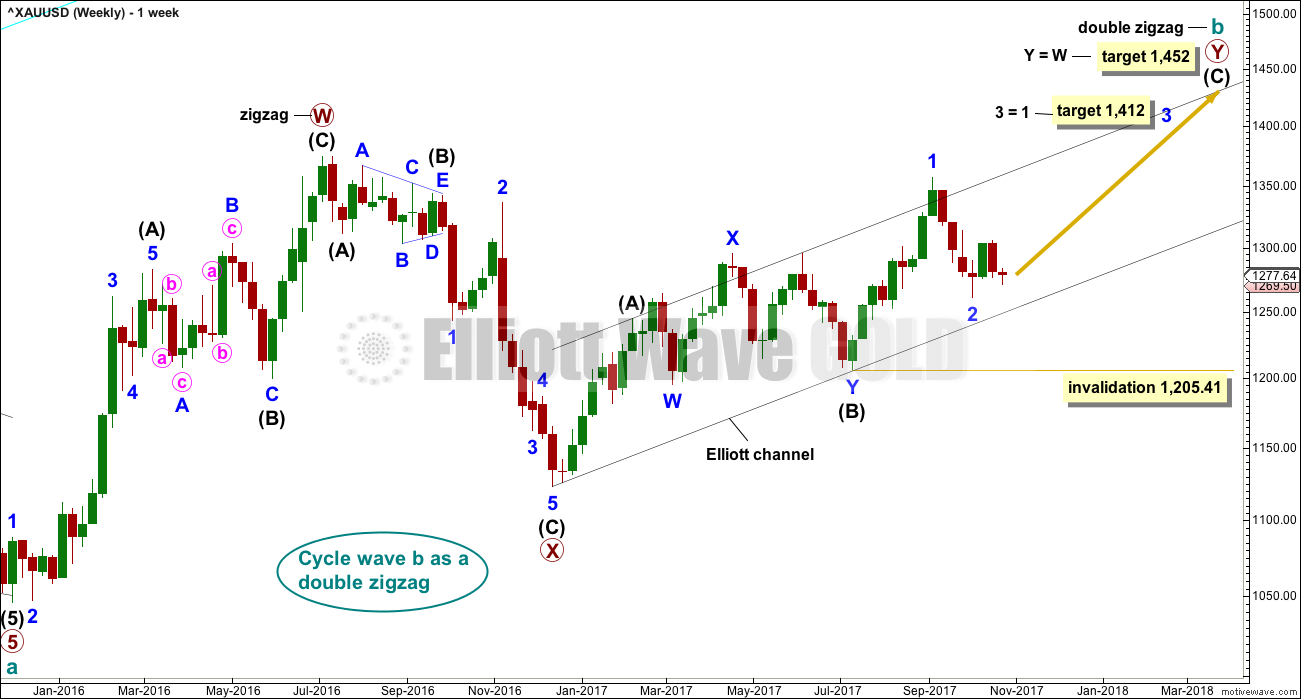

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

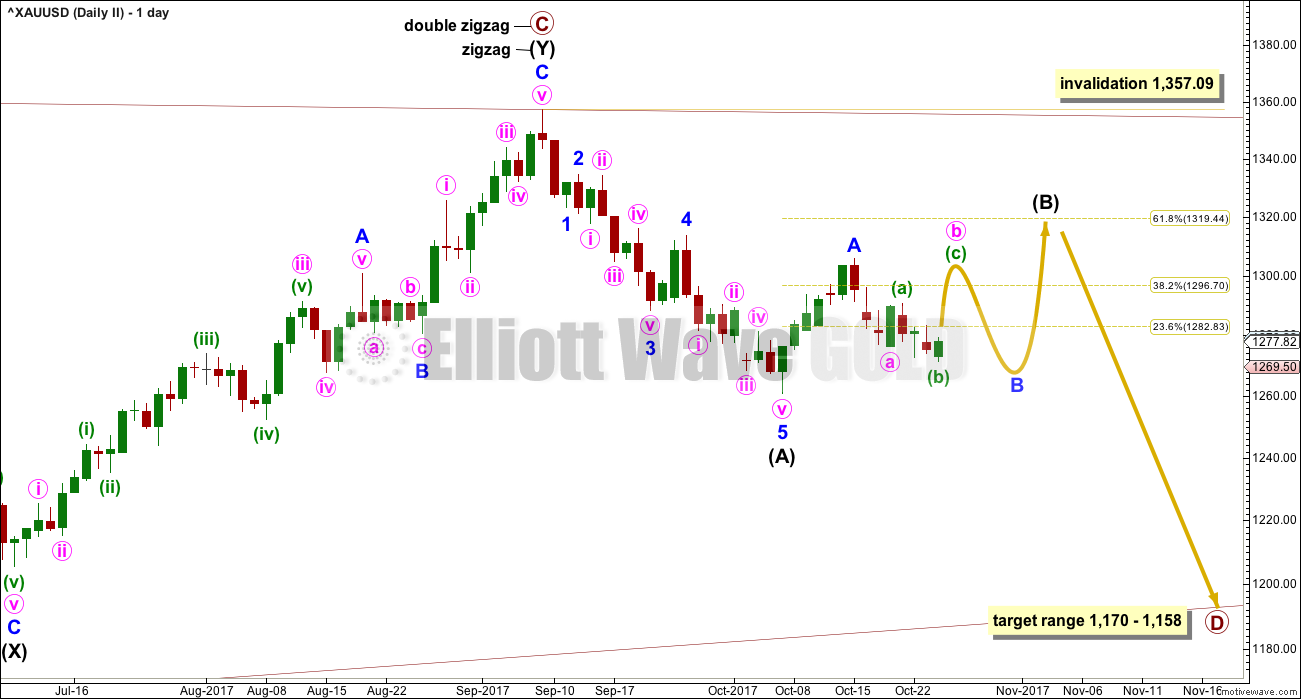

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits well at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

There are now three problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

3. Although intermediate wave (C) should be continuing so that primary wave Y ends substantially above the end of primary wave W, the duration and depth of minor wave 2 within it now looks to be too large at the weekly time frame.

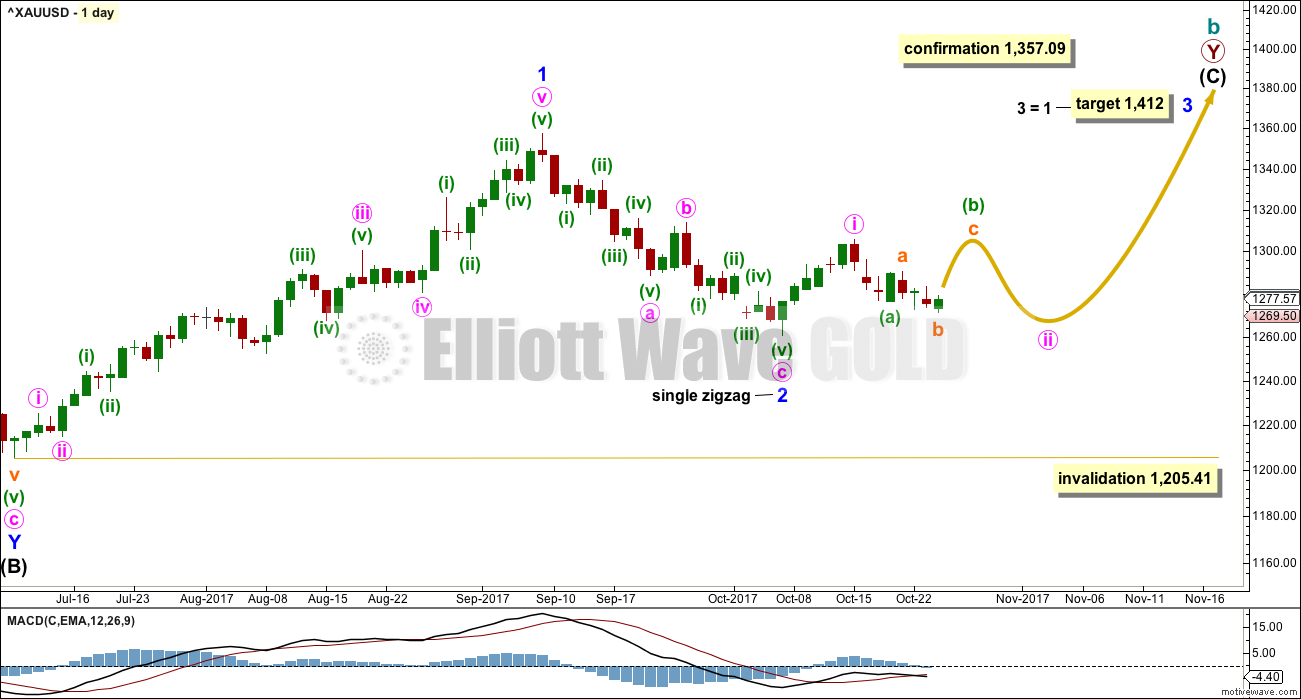

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

It is possible that minor waves 1 and now 2 may both be over. Minor wave 2 may have ended very close to the 0.618 Fibonacci ratio. If it continues lower, then minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

Minor wave 1 lasted 44 days and minor wave 2 may have lasted 20 days, just one short of a Fibonacci 21.

It is of some concern now that minor wave 3 appears to be starting out rather slowly. This is somewhat unusual for a third wave and offers some support now to the second Elliott wave count. With StockCharts data showing a steady decline in volume as price rises, this concern is now validated.

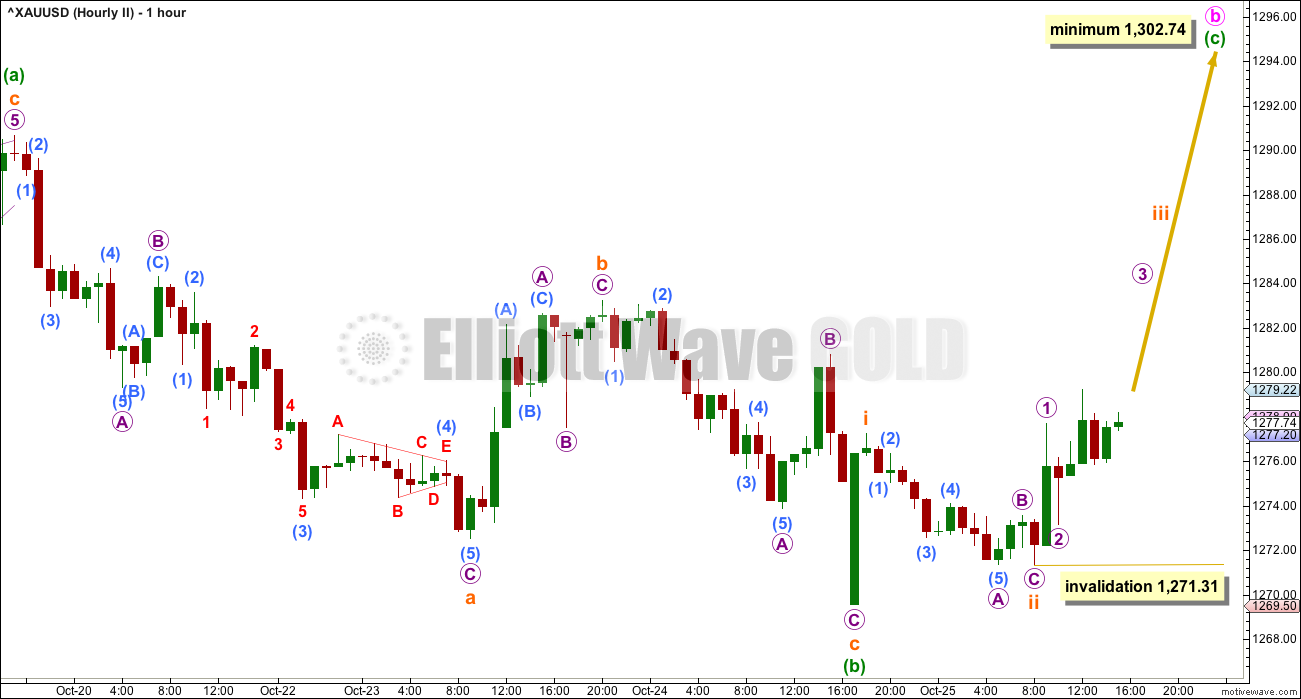

Attention now turns to the structure of minute wave ii. Minute wave ii cannot be over and may be continuing further as a flat correction. Within minute wave ii, minuette wave (b) may be an expanded flat.

HOURLY CHART

Within minute wave ii, only minuette wave (a) may be complete. Minuette wave (b) may be just over half way through.

Minuette wave (a) downwards, which ended on the 19th of October (not seen now on this hourly chart, seen on the daily chart), will subdivide very well as a double zigzag. It is difficult to see this downwards wave as a five wave impulse.

If my analysis of minuette wave (a) as a double zigzag is correct, then that gives us some strong clues as to what structure minute wave ii may be unfolding as.

When A waves subdivide as threes, then either a flat, triangle or combination is indicated. In this case, because the correction is a second wave for minute wave ii, a triangle can be eliminated as second waves do not subdivide as triangles.

A combination may also be eliminated as minuette wave (a) is already a multiple. This double zigzag cannot be relabelled as minuette wave (w) within a combination, because that labelling violates an Elliott wave rule. The maximum number of corrections within a combination is three (counting W, Y and Z), so within each of W, Y and Z they may only be labelled as simple A-B-C (or A-B-C-D-E for triangles) structures. To label multiples within multiples would increase the number of corrections beyond three.

A simple process of elimination leaves minute wave ii as most likely unfolding as a flat correction.

Within the flat correction, minuette wave (b) has not yet retraced the minimum 0.9 length required, so more upwards movement would be expected.

While price has now broken above the trend channel, which contains subminuette wave b downwards, it is not doing so with conviction. It is concerning that upwards movement is not showing an increase in momentum here.

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

It is still possible that cycle wave b is unfolding as a regular contracting or barrier triangle.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a complete zigzag at the weekly chart level.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C lasted 38 weeks.

The A-C trend line now has too weak a slope. At this stage, this is now a problem for this wave count, the upper A-C trend line no longer has such a typical look.

Within primary wave D, no part of the zigzag may move beyond its start above 1,357.09.

DAILY CHART

This second wave count expects the new wave down may be deeper and longer lasting than the first wave count allows for.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

If primary wave C is correctly labelled as a double zigzag, then primary wave D must be a single zigzag.

Within the single zigzag of primary wave D, intermediate wave (A) is labelled as a complete impulse.

Intermediate wave (A) lasted twenty days, just one short of a Fibonacci twenty-one. Intermediate wave (B) may be about the same duration, so that this wave count has good proportions, or it may be longer because B waves tend to be more complicated and time consuming.

So far intermediate wave (B) has lasted thirteen sessions. The next Fibonacci number in the sequence is twenty-one which would see it continue now for another eight sessions.

Intermediate wave (B) may be a sharp upwards zigzag, or it may be a choppy overlapping consolidation as a flat, triangle or combination. At this stage, it looks most likely to be incomplete because an intermediate degree wave should last weeks. At its conclusion intermediate wave (B) should have an obvious three wave look to it here on the daily chart.

Minor wave B may be expected to be an incomplete flat correction in the same way as minute wave ii for the first Elliott wave count. Here, the degree of labelling is one degree higher.

Minor wave B may not be continuing sideways as a triangle. The subdivisions do not fit for minute wave a to have ended at today’s low.

One important difference between the two wave counts is here minor wave B may make a new low below the start of minor wave A at 1,260.72, whereas this is an invalidation point for the first Elliott wave count.

HOURLY CHART

Subdivisions, invalidation points, minimum requirements and targets are the same at this stage for both wave counts.

TECHNICAL ANALYSIS

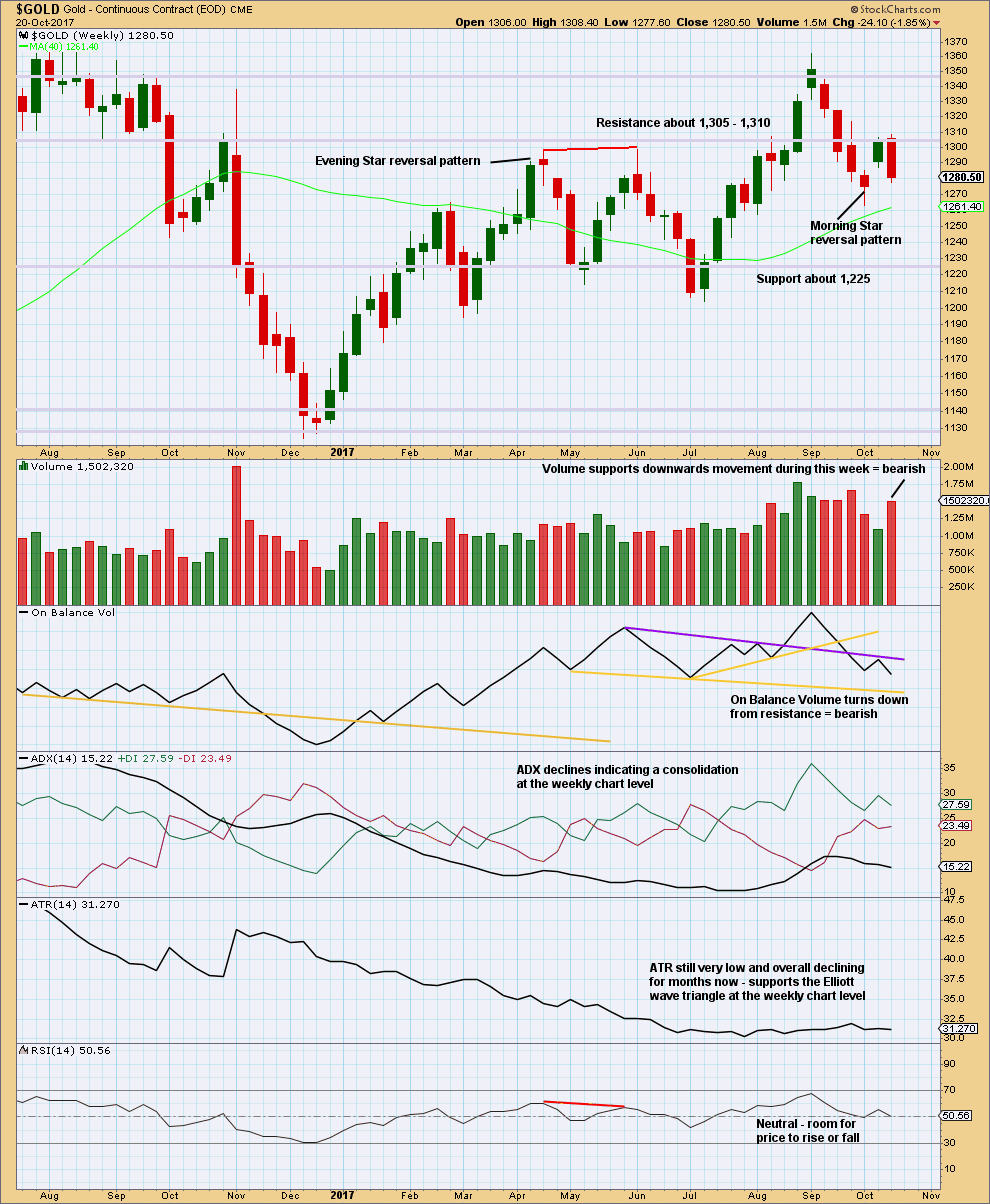

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Resistance on On Balance Volume has served to halt the rise in price and initiate a downwards reaction. This weekly candlestick is not correctly a Bearish Engulfing reversal pattern because it does not come after much upwards movement. There is almost nothing to reverse here. But the strong downwards week is certainly bearish.

Support from volume is also very bearish.

The upside may be very limited here.

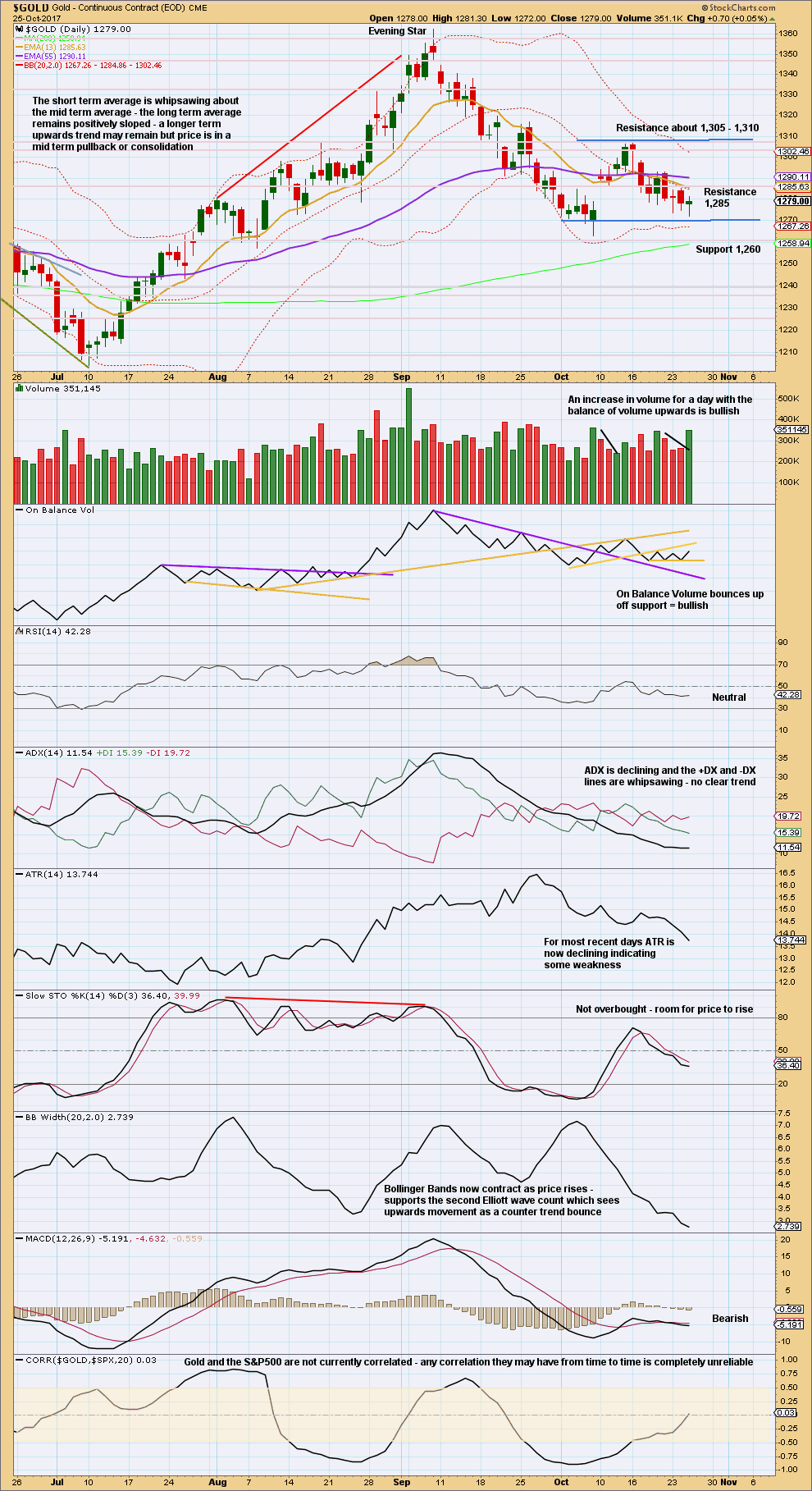

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A lower low and a lower high has moved price lower, but the candlestick has closed green and the balance of volume for the session is upwards. There is strong support for upwards movement during this session.

It looks like a downwards swing within a consolidation has ended and an upwards swing may begin here. But Stochastics is neutral, so there is still room for price to fall further.

Published @ 05:26 p.m. EST.

I just don’t know what to make of this huge spike today here on BarCharts data. It often does this, and they don’t usually disappear.

Lets see what StockCharts have when NY closes.

Anyway, its still possible an expanded flat is unfolding. B is now over the most common range of up to 1.38 but still reasonably well within the maximum of up to 2 times A.

Price seems to follow in the direction of those “phantom” spikes over the following hours… Let’s see if that pattern repeats again.

I can see a DZZ complete for Minute 2 with my Trading View data. Can you see that with Barchart?

Yeah, I’ve noticed that too. A spike up… often followed by upwards moment. And vice versa. So if this is right price should go up….

And yes, I just checked subdivisions and a double zigzag fits neatly.

For the First EW count, I think Minute 2 has most likely become too deep of a correction for a flat. Either it is over about now as a deep Double ZigZag or price will continue below the Oct 6th low and Minute 2 will be invalidated. If Minute 2 gets invalidated, then Minor 2 could be continuing.

Since I posted the chart above price has moved lower again. It is now close to 2 X A, and so I’m discarding the idea of an expanded flat and I’ll go with the double ZZ

As expected, short lived rally only to have reversed and broken below 1270. Can expect further lows ahead once a break below 1268 occurs….

Oh well, Gold price has adequately broken below 1268. Needs a further break below 1262 to go deeper. VIEW: Remains to be seen if in coming days Gold price is setting up for a 5% decline from 1306 high. Upside presently limiting 1278-82 and would need for Gold price to rise and hold above 1286 to track higher.

Everyone

Enclosed is the Dollar chart. Clear inverse H&S pattern has formed…..

Your thoughts are appreciated

The pattern warned us. The ECB caused the big move today

https://www.cnbc.com/2017/10/26/euro-sinks-after-ecb-plans-a-dovish-taper.html

Thank you Dreamer for your single handed support , guidance and for being the knowledgeable resource for this forum at all times. Sincerely appreciated.

GDX may head to about 22.35???

I had noted that yesterday. I’m usually a little leery when a pattern is that obvious, but looks like it is indeed playing out. Will be very difficult for gold to rally hard with USD acting like this. Staying short for that and other reasons noted yesterday. And given the reluctance to break down in the past couple of days/weeks, when it does, i’m afraid it may go down further than expected. But will see. Letting it run for now

Madam, trouble in paradise for the high heeled boys in blue with the 5dma heading for a break below 100dma; should see Gold price drop!

Both GDX & GDXJ have closed below 200sma for some time. It’s less convinced gold would start a massive run up when miners are not leading… IMHO.

Weiquan,

To be fair, GDX just dropped below it’s 200 MA a couple of days ago after trading above it for 50 days or so. Granted, GDXJ has been much weaker.

That said, I agree we need to see the miners reverse up and take the lead to the upside on increasing volume if the bullish scenarios are correct.

Dreamer, Why do miners lead the metal, please? I have read this many times and in many sites but do not know the logic or the answer behind this statement. Seeking your help, if possible, please. Thank you kindly.

David, I don’t know if there is a definitive answer. Here’s my thoughts:

Gold and the miners mostly bottom and top around the same times, within days or weeks of each other. I don’t know that one always turns first, would need to research that.

What is clear, is that during a strong trending move for both, the miners outperform gold exponentially. The price of miners is leveraged to gold price because they have relatively fixed costs and can make or (lose) much more money when gold price is high or low. Sure, fuel and labor costs are variables, but the price of gold really can affect their profitability.

When you look at a ratio chart of GDX:$Gold, you can see how much miners outperformed gold during the strong move up in the 1st half of 2016, hence the saying “miners lead”

Hope this helps.

Thank you very much Dreamer. I sincerely appreciate your help. And, yes, your explanation does make sense.

We got the drop that I was looking for in the miners and GDX did make a lower low as expected.

If these triangles are correct, I think we are now close enough to the lower trendlines for the E waves to be complete.

Need to see if price can start moving up on volume for any confidence.

November is an up month for Gold Seasonality

https://www.tradingview.com/x/qHcOztoP/

Thank you Dreamer for posting your charts for the membership. You are a huge asset to EWG and I really do appreciate your contributions 🙂

Thanks Lara. Looking forward to a GoPro video from you this week. Hope your having some fun!

I love triangles. I don’t believe I have ever seen one that huge! If you are right the move out of it should be quite strong due to its size. I think that chart potential merits a few well-placed mid-term calls! 🙂

GDX still looks mostly bearish, although the tail on the daily candlestick gives hope for a bounce

Sometimes classic analysis makes the analysis simple and maybe more accurate…