Price remains above 1,260.72, so both Elliott wave counts remain valid. Volume and On Balance Volume today are giving signals as to what is most likely to happen next to price.

Summary: Upwards movement for a third wave should begin now. The first target is at 1,294 where a small consolidation may unfold. The target for this upwards swing to end is at 1,308, in the first instance, and may be as high as 1,380 (but this looks less likely now).

Reduce risk at this time to only 1-3% of equity on any one trade. Always trade with stops.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

The wave counts will be labelled first and second. Classic technical analysis will be used to determine which wave count looks to be more likely. In terms of Elliott wave structure the second wave count has a better fit and fewer problems.

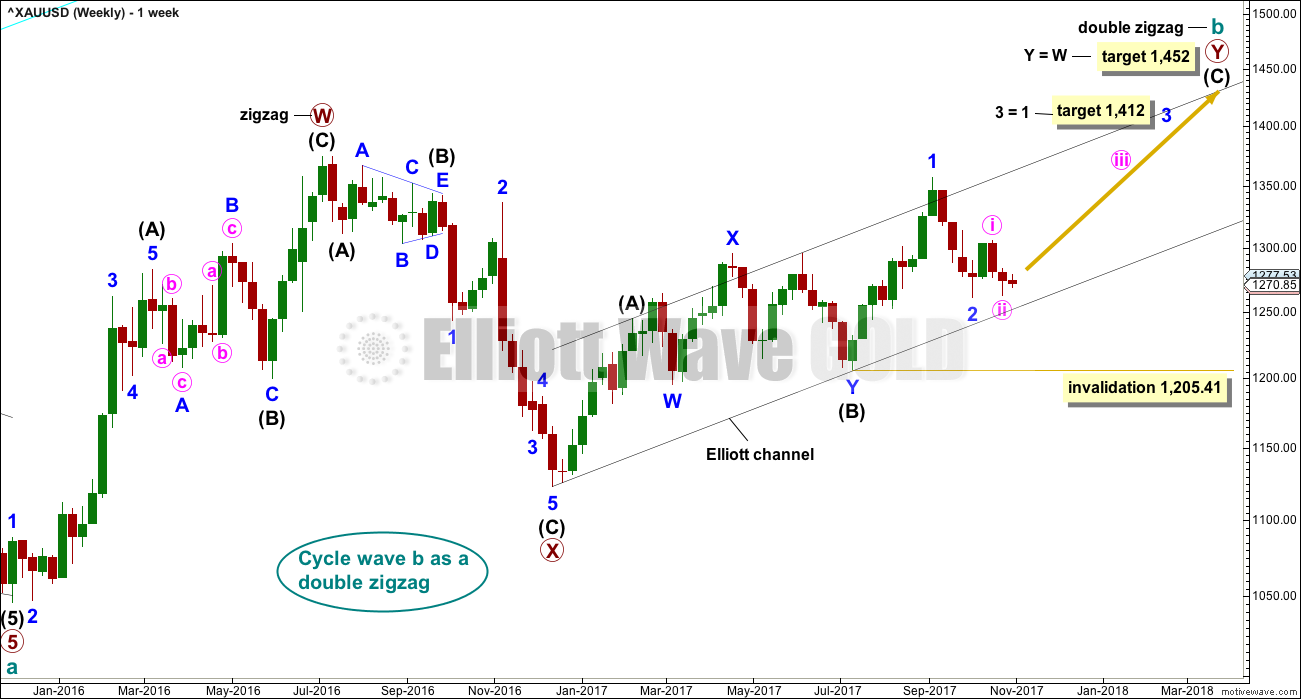

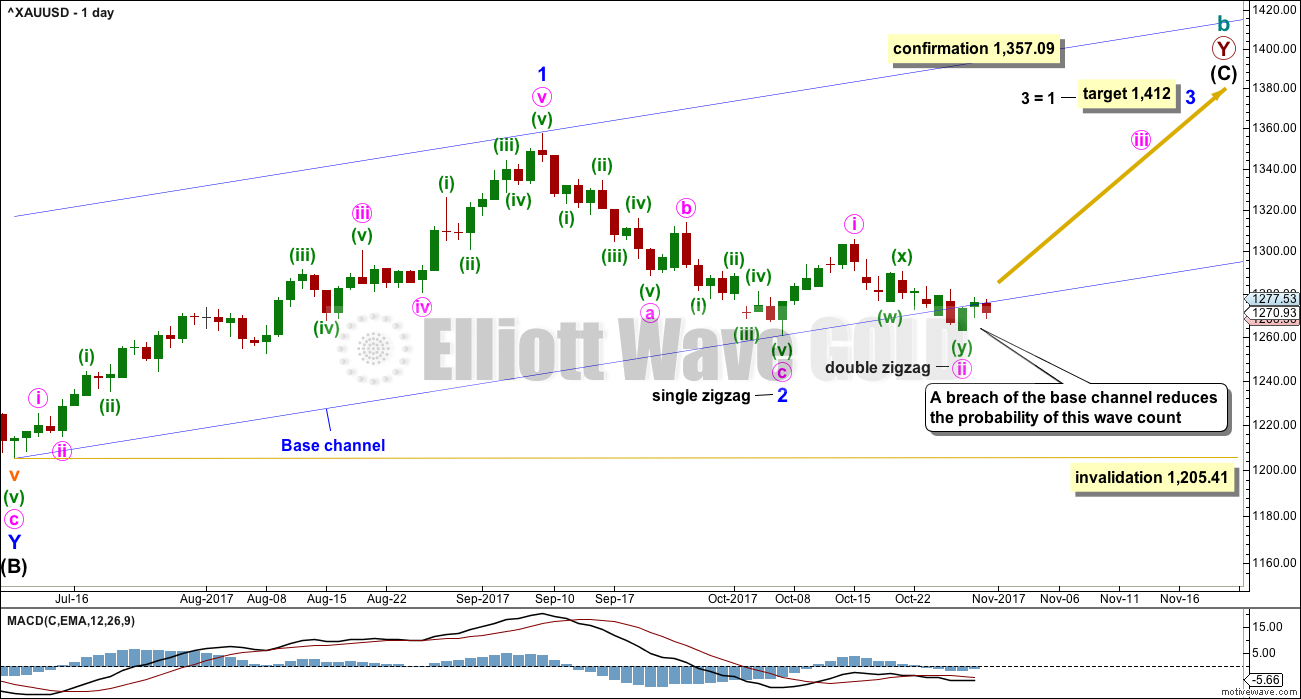

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

There are more than 23 possible corrective structures that B waves may take, and although cycle wave b still fits well at this stage as a triangle, it may still be another structure. This wave count looks at the possibility that it may be a double zigzag.

If cycle wave b is a double zigzag, then current upwards movement may be part of the second zigzag in the double, labelled primary wave Y.

The target remains the same.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

There are now three problems with this wave count which reduce its probability in terms of Elliott wave:

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

3. Although intermediate wave (C) should be continuing so that primary wave Y ends substantially above the end of primary wave W, the duration and depth of minor wave 2 within it now looks to be too large at the weekly time frame.

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

It is possible that minor waves 1 and now 2 may both be over. Minor wave 2 may have ended very close to the 0.618 Fibonacci ratio. If it continues lower, then minor wave 2 may not move beyond the start of minor wave 1 below 1,205.41.

Minor wave 1 lasted 44 days and minor wave 2 may have lasted 20 days, just one short of a Fibonacci 21.

It is of some concern now that minor wave 3 appears to be starting out rather slowly and that minute wave ii within it is now a very deep correction.This is somewhat unusual for a third wave and offers some support now to the second Elliott wave count. With StockCharts data showing a steady decline in volume as price rises, this concern is validated.

A base channel is added to minor waves 1 and 2. If this wave count is correct, then lower degree second wave corrections should find support at the lower edge of the base channel. Friday’s candlestick is below the base channel, which now reduces the probability of this wave count.

Attention now turns to the structure of minute wave ii. Minute wave ii may now be over as a double zigzag structure.

It is again of concern that upwards movement to begin this trading week does not have support from volume. The start of a third wave up at two degrees should be a strong movement.

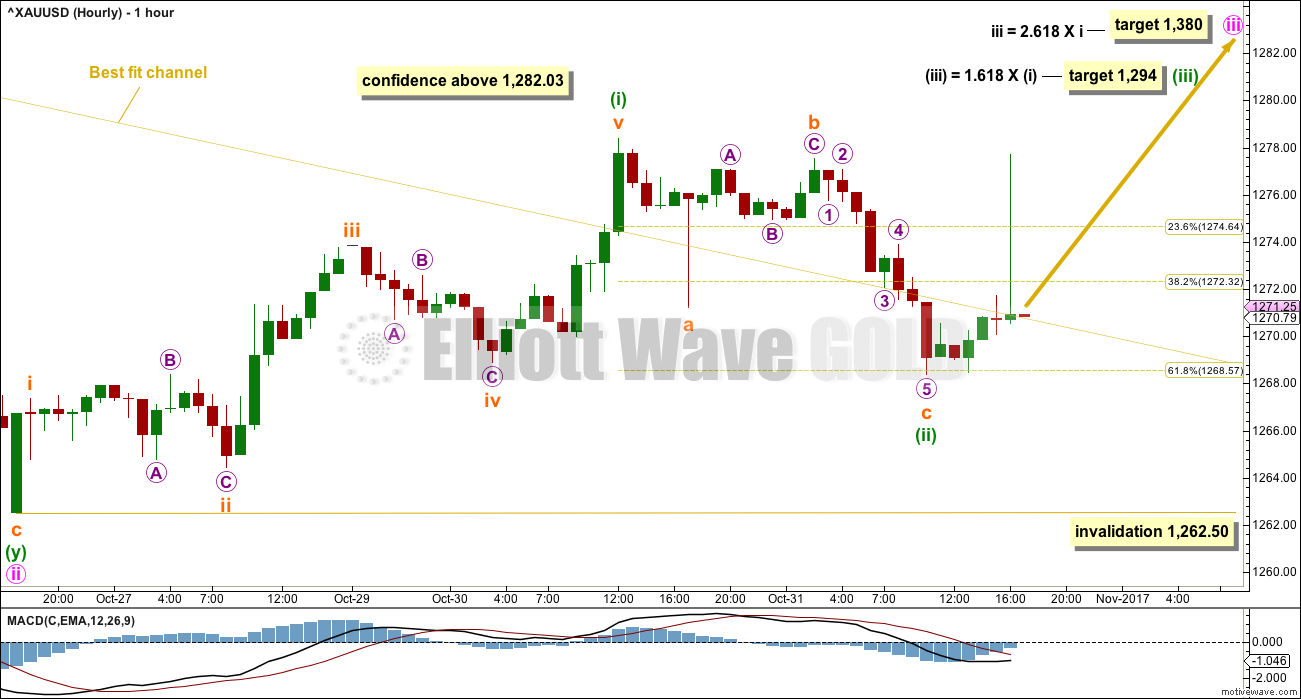

HOURLY CHART

If minute wave ii is over as a very deep double zigzag, then it may have lasted a Fibonacci eight days.

Because minute wave ii here is so deep, the appropriate Fibonacci ratio to use to calculate a target for minute wave iii is 2.618.

Minute wave iii may only subdivide as a five wave impulse upwards. Minuette wave (i) may now be complete. Minuette wave (ii) may also be now complete, ending very close to the 0.618 Fibonacci ratio of minuette wave (i).

The next wave up for this wave count would now be expected to be a third wave at three degrees.

If minuette wave (ii) moves any lower, it may not move beyond the start of minuette wave (i) below 1,262.50.

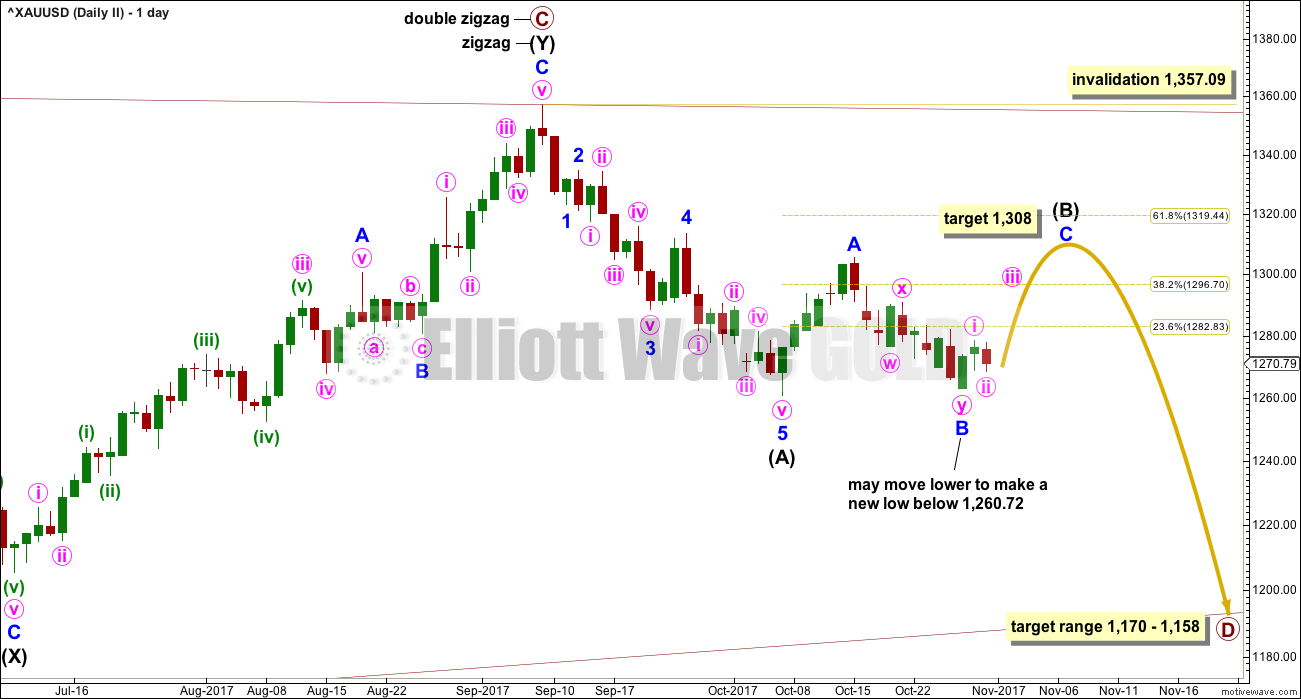

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

It is still possible that cycle wave b is unfolding as a regular contracting or barrier triangle.

Within a triangle, one sub-wave should be a more complicated multiple, which may be primary wave C. This is the most common sub-wave of the triangle to subdivide into a multiple.

Intermediate wave (Y) now looks like a complete zigzag at the weekly chart level.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08. Contracting triangles are the most common variety.

Primary wave D of a barrier triangle should end about the same level as primary wave B at 1,123.08, so that the B-D trend line remains essentially flat. This involves some subjectivity; price may move slightly below 1,123.08 and the triangle wave count may remain valid. This is the only Elliott wave rule which is not black and white.

Finally, primary wave E of a contracting or barrier triangle may not move beyond the end of primary wave C above 1,295.65. Primary wave E would most likely fall short of the A-C trend line. But if it does not end there, then it can slightly overshoot that trend line.

Primary wave A lasted 31 weeks, primary wave B lasted 23 weeks, and primary wave C lasted 38 weeks.

The A-C trend line now has too weak a slope. At this stage, this is now a problem for this wave count, the upper A-C trend line no longer has such a typical look.

Within primary wave D, no part of the zigzag may move beyond its start above 1,357.09.

DAILY CHART

This second wave count expects the new wave down may be deeper and longer lasting than the first wave count allows for. At this stage, in the middle of this downwards wave intermediate wave (B) looks incomplete.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

If primary wave C is correctly labelled as a double zigzag, then primary wave D must be a single zigzag.

Within the single zigzag of primary wave D, intermediate wave (A) is labelled as a complete impulse.

Intermediate wave (A) lasted twenty days, just one short of a Fibonacci twenty-one. Intermediate wave (B) may be about the same duration, so that this wave count has good proportions, or it may be longer because B waves tend to be more complicated and time consuming.

So far intermediate wave (B) has lasted seventeen sessions. The next Fibonacci number in the sequence is twenty-one which would see it continue now for another four sessions.

Intermediate wave (B) may be a sharp upwards zigzag, or it may be a choppy overlapping consolidation as a flat, triangle or combination. At this stage, it looks most likely to be incomplete because an intermediate degree wave should last weeks. At its conclusion intermediate wave (B) should have an obvious three wave look to it here on the daily chart.

Minor wave B may be complete here or close to completion as a double zigzag.

Minor wave A will subdivide as either a five wave impulse or a three wave zigzag. If it is seen as a zigzag, then the whole structure for intermediate wave (B) may be a flat correction, which would allow for minor wave B to move below the start of minor wave A at 1,260.72.

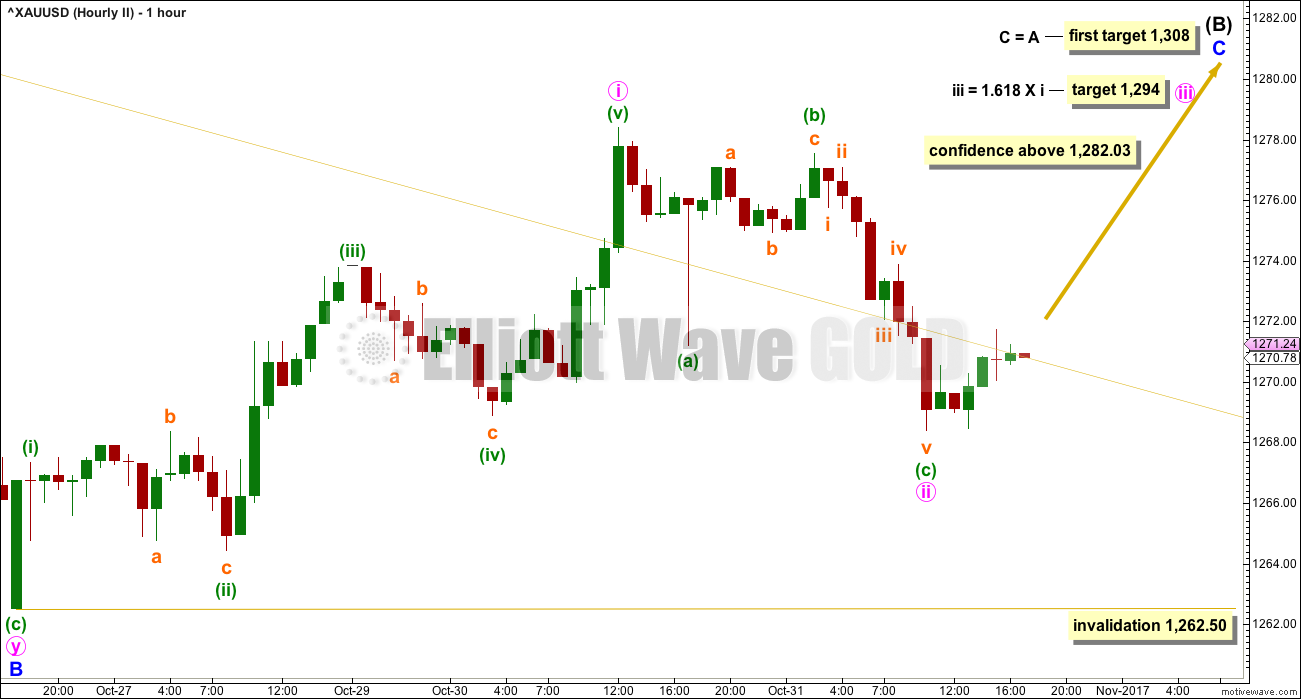

HOURLY CHART

Intermediate wave (B) may be a regular flat correction. Within intermediate wave (B), minor wave B has passed the minimum requirement of 0.90 the length of minor wave A. B waves within 0.90 to 1.05 the length of A waves indicate a regular flat correction. The most common length for C waves within regular flats is equality in length with the A wave.

Minor wave C would be extremely likely to make at least a slight new high above the end of minor wave A at 1,305.72 to avoid a truncation.

Both wave counts require a five wave structure upwards to complete. For this second wave count it would be labelled minor wave C.

So far, within minor wave C, minute waves i and now ii may be complete. This second wave count also expects a third wave up to now begin, but only at one degree. Some increase in upwards momentum should be expected, and it should have support from volume.

If it continues any lower, minute wave ii may not move beyond the start of minute wave i below 1,262.50.

TECHNICAL ANALYSIS

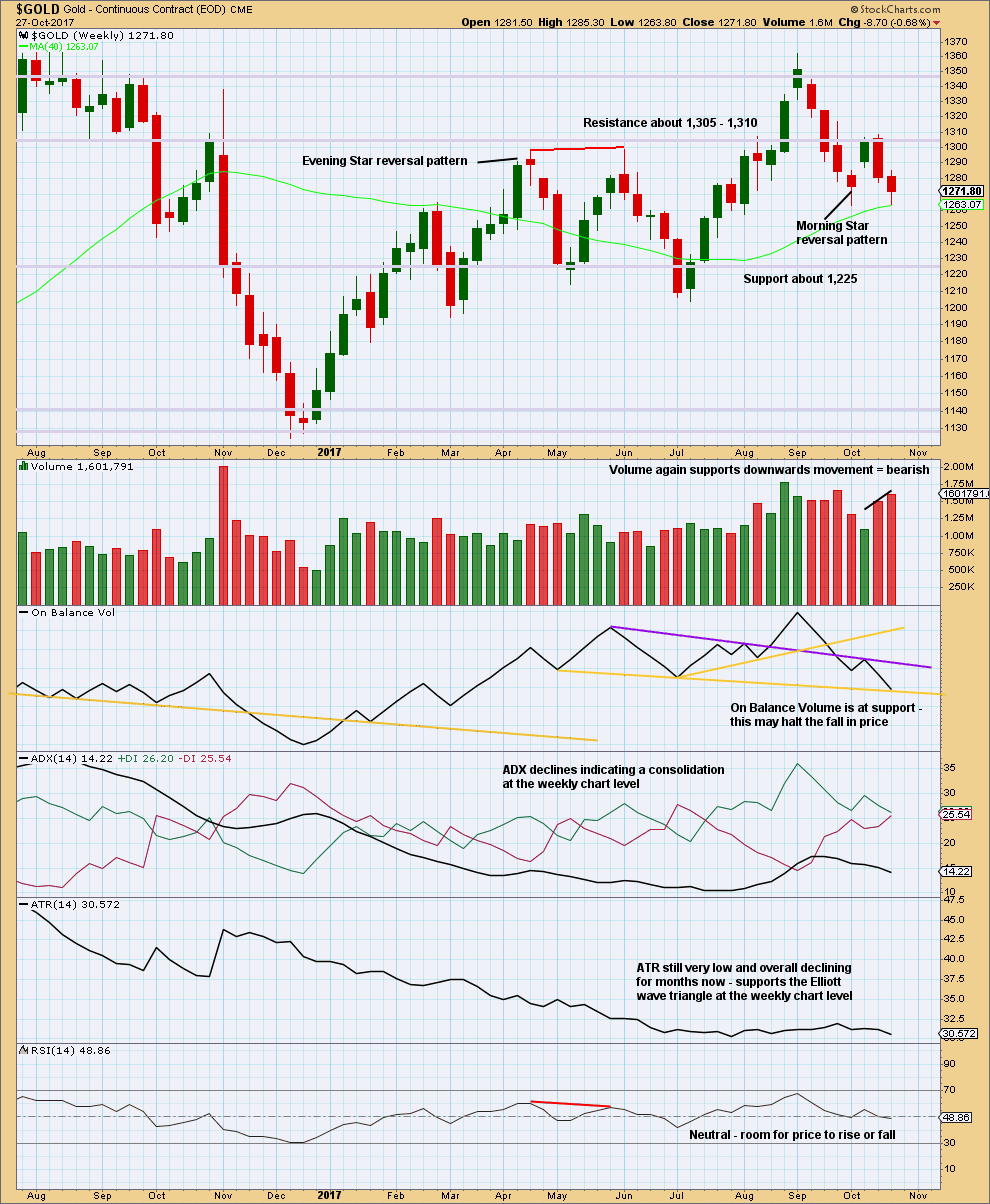

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

What looks like a possible double bottom here with the last swing low three weeks ago is too small to be classified as a correct double bottom. The two troughs of a double bottom should be about 10% from the peak in between. Here, they are only 3.6% from the peak.

The long lower wick on the last completed weekly candlestick is bullish, but volume tells a different story as it is bearish.

On Balance Volume may again lead the way. Support may force a bounce here.

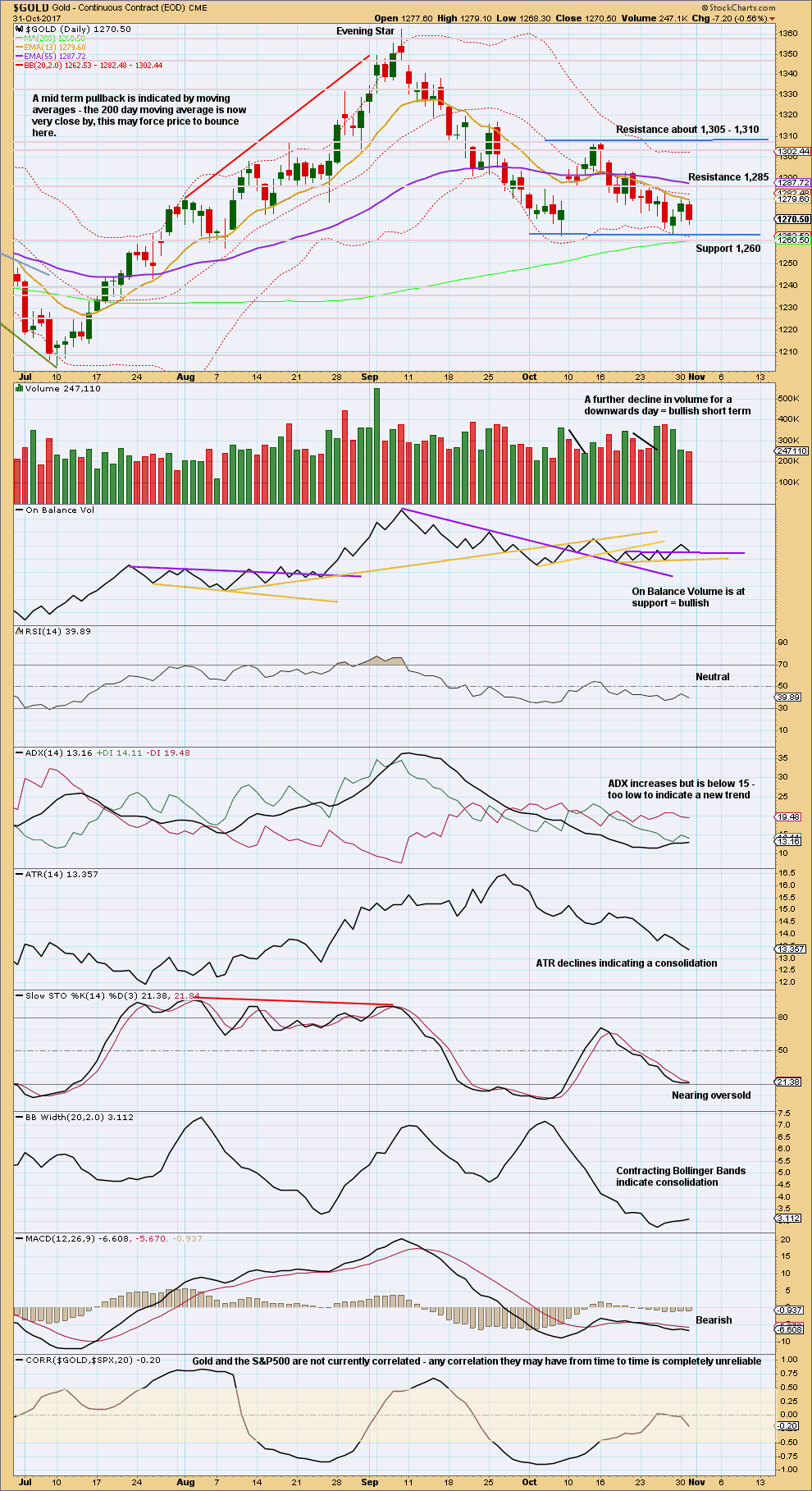

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is very clearly consolidating. Expect swings from support to resistance and back again. Use Stochastics in conjunction with support and resistance to signal when each swing ends. Be aware that trading a consolidating market is much more risky than trading a trending market, and reduce risk accordingly. Only experienced traders should consider trading the swings within a consolidation. Reduce risk to 1-3% of equity. Always trade with stops. Here, move stops to a little below support and above resistance to allow for overshoots; give the market room to move.

With Stochastics very close to oversold and price at support, an upwards swing may begin here or very soon. Look for resistance about 1,305 – 1,310. This also supports the second Elliott wave count.

Volume and On Balance Volume today give some slight indication that an upwards swing may begin about here.

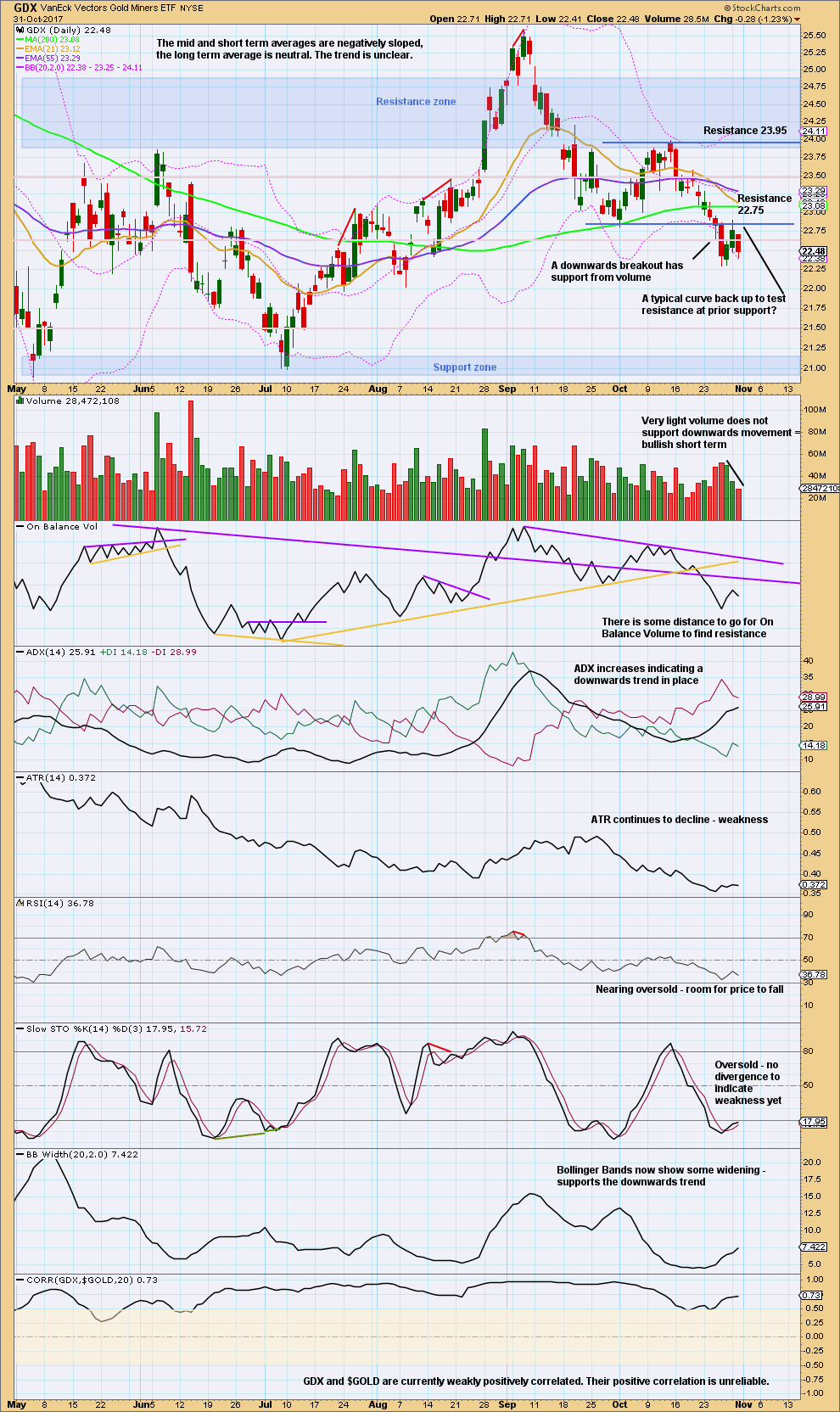

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The downwards movement after a downwards breakout below support today looks very weak, so it may be short lived. This is indicated today by very weak volume; price is falling of its own weight.

If price moves back above resistance at 22.75, then the consolidation zone may have to be widened. If this happens, then expect an upwards swing to next resistance about 23.95.

But the bottom line for GDX today is it is in a downwards trend. Assume GDX remains so while price remains below resistance at 22.75. With weakness today, traders should take profits or keep trailing stops tight.

Published @ 06:32 p.m. EST.

Okay guys, so I promised I’d show you a surfing video from my trip to Tonga.

The waves were coming in fairly straight onto the reef, so the rides were short.

Here’s one with my camera facing forward. You can see how shallow it is, only about 1ft of water below my board! Beautiful coral reef.

And here’s one facing back to show you how it looks to catch one of these little waves. A bit small, but still fun.

Awesome – to watch on screen! In real life, nope!

IRL it’s so much better 🙂 🙂 🙂

Updated hourly chart for first wave count (second is essentially the same, only the degree of labelling is one higher)

Another first and second wave unfolding.

Both wave counts expect an increase in upwards momentum next, for tomorrows session.

Price is starting to stabilize now after the typical crazy gyrations caused by the Fed statement. Gold is still up modestly and Silver is up big with the dollar also up. Seems to support higher prices near term.

looking quite a bearish retrace here. hoping it’s just a wave 2 retracement.

Lara, the weird spike in the First Hourly Count, second last candlestick, is absent in the Second Hourly Count. Perhaps that spike is one of those BarChart “mistakes”

I know. It’s gone now.