Downwards movement continues exactly as expected towards the Elliott wave target, and price remains below the short term invalidation point on the hourly chart.

The channel on the hourly chart is redrawn, and it should be used to indicate when this downwards wave is complete.

Summary: The short term target is about 1,236. While price remains within the redrawn channel on the hourly chart and below 1,251.17, assume the trend remains down. A breach of the channel and a new high above 1,251.17 would indicate a second wave bounce has arrived.

The Elliott wave target for downwards movement to end is at 1,191. The lower Elliott wave target may be met in about three weeks time.

I will leave it up to members to decide on when to take profits, as each trader may have a different preferred time frame for trading. For maximum profits, positions entered prior to the breakout may possibly be held until the target is reached.

The trend for now is down. Bounces are opportunities to enter the trend.

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

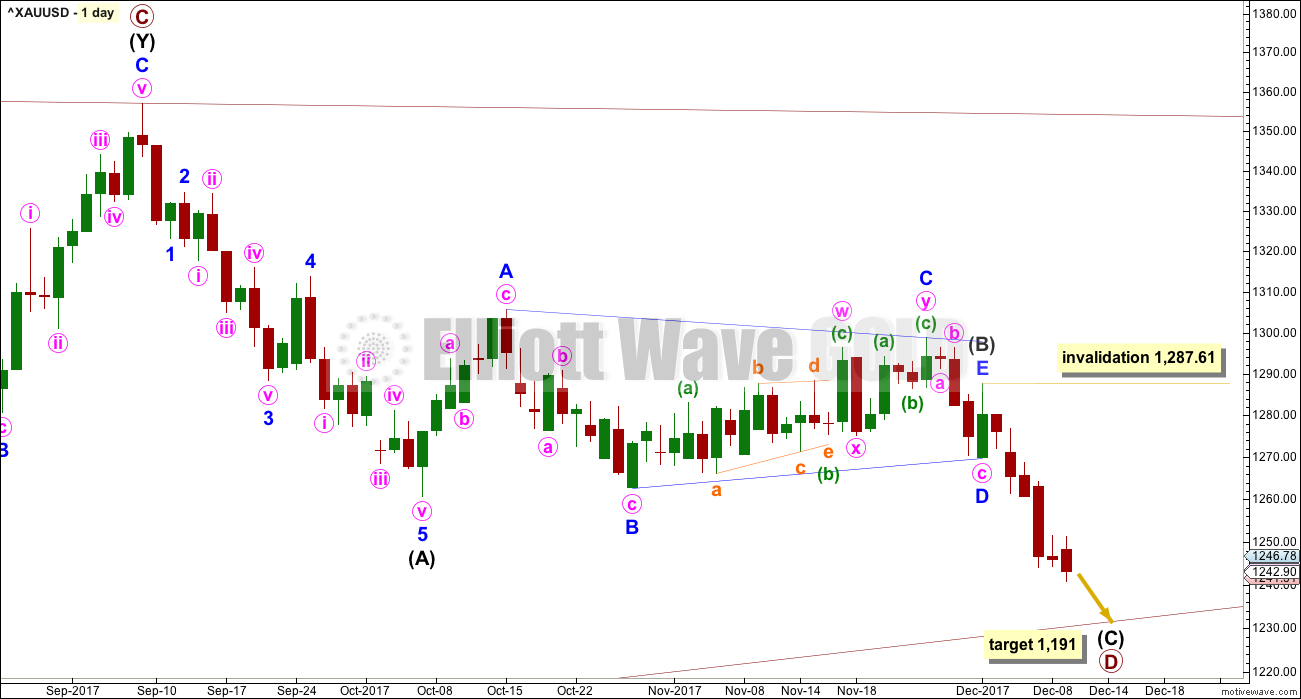

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART

All wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

All wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave A. Primary wave A lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

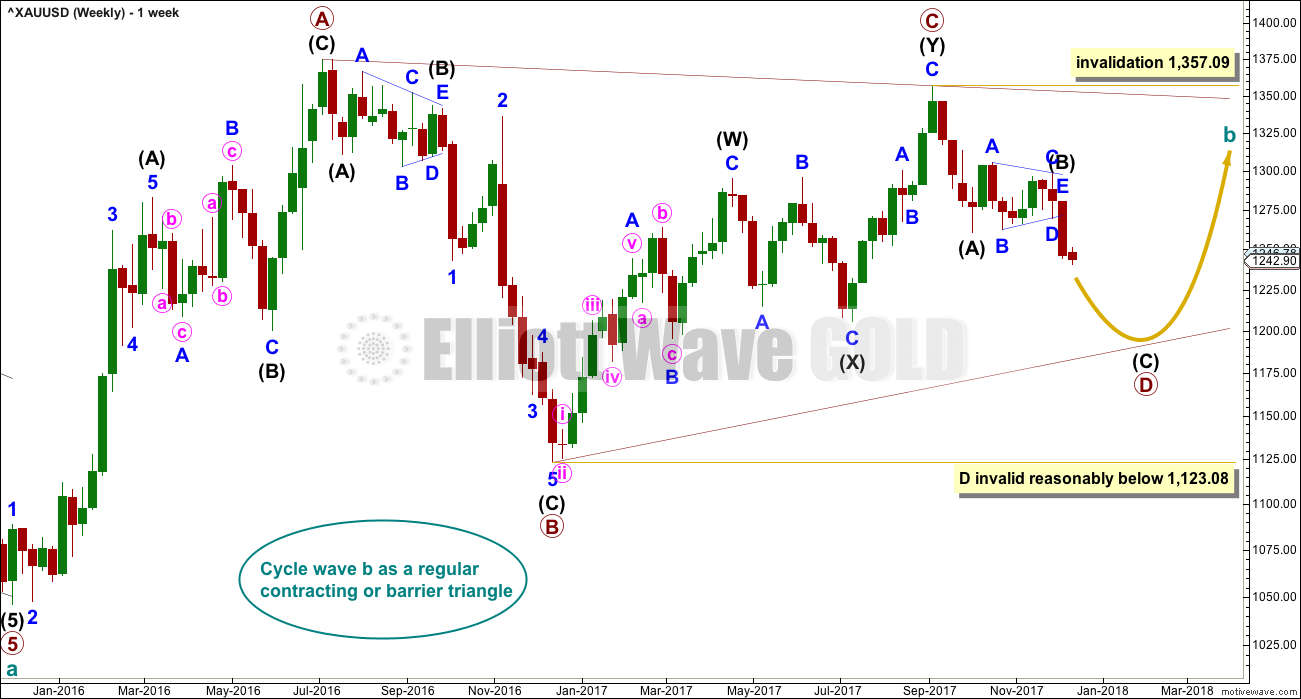

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The B-D trend line should have a reasonable slope for this triangle to have the right look, because the A-C trend line does not have a strong slope. A barrier triangle has a B-D trend line that is essentially flat; if that happened here, then the triangle trend lines would not converge with a normal look and that looks unlikely.

Primary wave D should be a single zigzag. Only one triangle sub-wave may be a more complicated multiple, and here primary wave C has completed as a double zigzag; this is the most common triangle sub-wave to subdivide as a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08.

At its completion, primary wave D should be an obvious three wave structure at the weekly chart level.

For this one weekly chart, two daily charts are presented below. They look at intermediate wave (B) in two different ways, and are presented now in order of probability.

DAILY CHART

Both daily charts are identical up to the low labelled intermediate wave (A).

This first daily chart shows intermediate wave (B) as a now complete regular contracting Elliott wave triangle. This has support from what looks like a classic downwards breakout from the symmetrical triangle identified on the technical analysis chart below.

The target assumes that intermediate wave (C) may exhibit the most common Fibonacci ratio to intermediate wave (A).

Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), the second wave correction to come, which will be labelled minor wave 2, may not move beyond the start of the first wave above 1,287.61.

Intermediate wave (A) lasted twenty sessions. Intermediate wave (C) may be about even in duration as well as length, so twenty or twenty-one sessions looks likely.

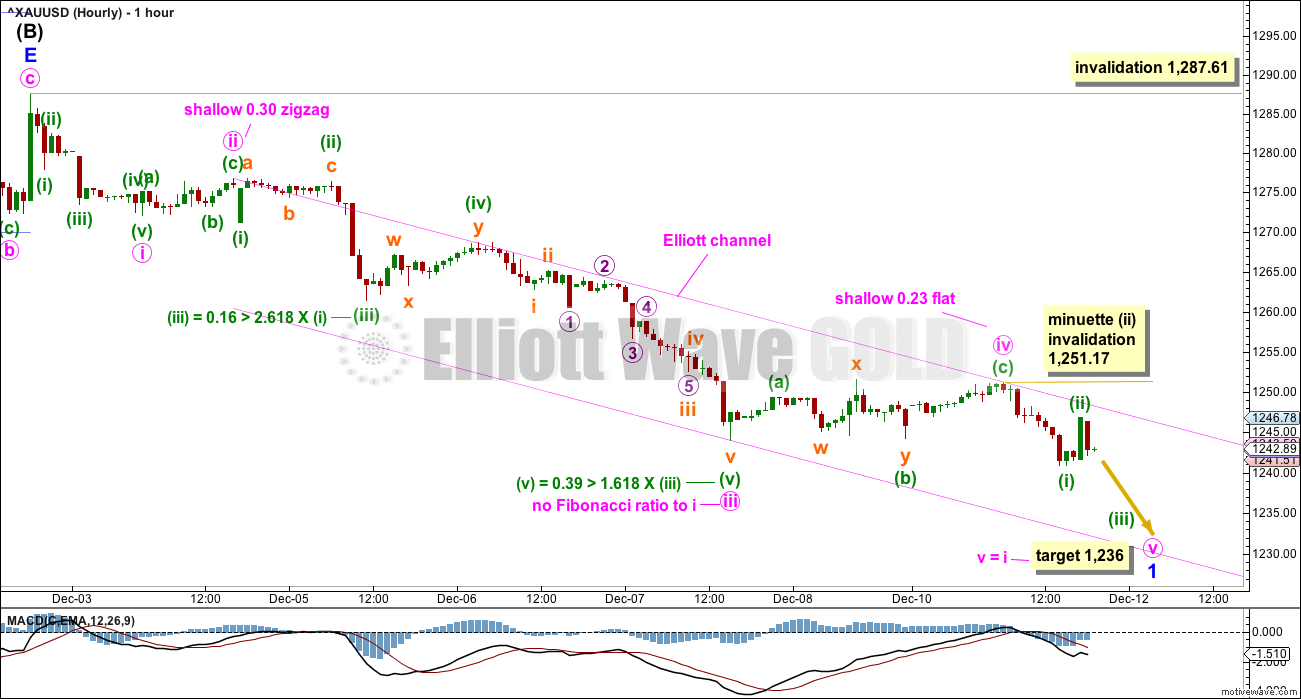

HOURLY CHART

At this stage, it is possible that minor wave 1 is close to completion as labelled. It is also possible that it was over just a few hours ago at the last low, if the degree of labelling within minute wave v is moved up one degree.

For now, assume the downwards trend remains intact while price remains within the pink Elliott channel and below 1,251.17.

If minuette wave (ii) were to move higher, then it may not move beyond the start of minuette wave (i) above 1,251.17. A new high above 1,251.17 could not be part of minute wave v, so minute wave v would have to be over at that stage.

The target for minor wave 1 expects the most common Fibonacci ratio between minute waves i and v.

If minute wave v was over at the last low, then it would be just 0.73 longer than 0.618 the length of minute wave i.

When minor wave 1 is complete, then minor wave 2 should last a few days. It may be deep, close to the 0.618 Fibonacci ratio of minor wave 1, but it does not have to be. It is possible it could be brief and shallow.

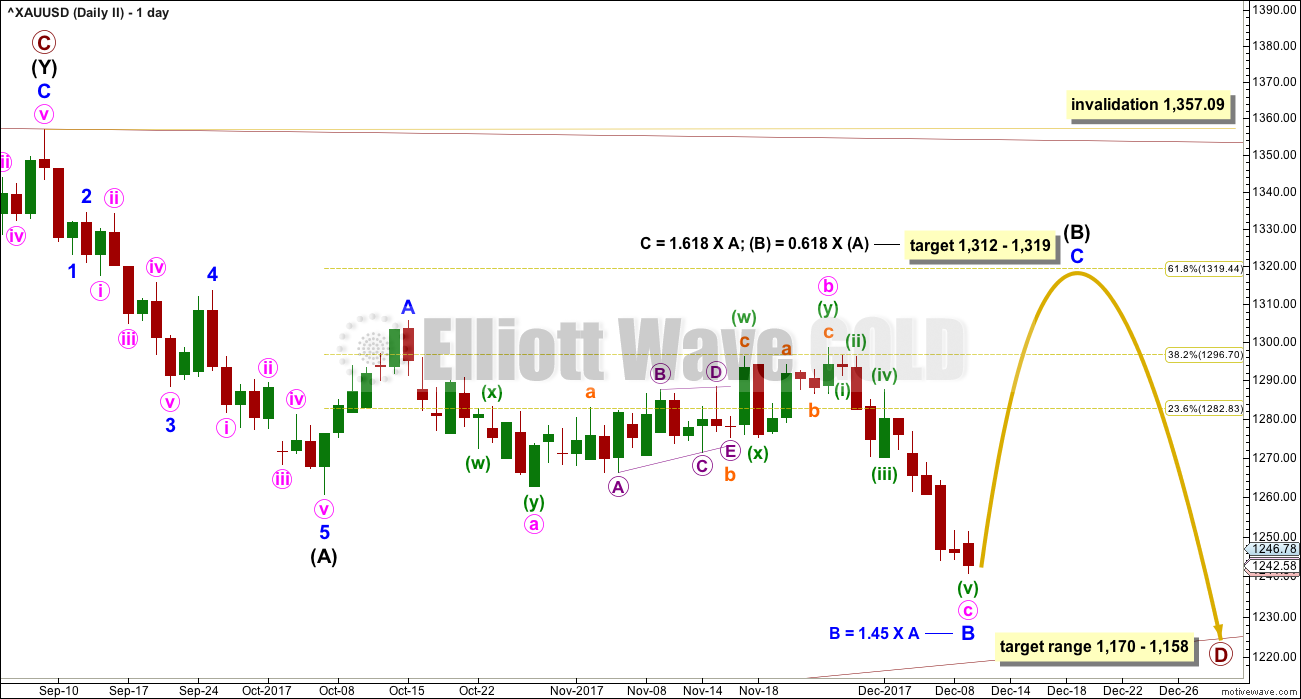

SECOND DAILY CHART

It is very important to always consider an alternate when a triangle may be unfolding. Triangles are very tricky structures, and may even be invalidated after one thinks they are complete.

It is still possible that intermediate wave (B) may be completing as a flat correction.

Within the flat correction, both minor waves A and B are threes. Minor wave B has retraced more than the minimum 0.9 length of minor wave A.

With minor wave B now a 1.45 length to minor wave A, an expanded flat is now indicated. Minor wave C of an expanded flat would most commonly be about 1.618 the length of minor wave A.

Now minor wave C may be required to move price upwards to end at least above the end of minor wave A at 1,305.72 to avoid a truncation.

A new high above 1,298.70 is required now for confidence in this wave count.

There should be something wrong or “off” about B waves. In this instance, the downwards wave of the last two weeks has some strength. While the market is falling of its own weight, On Balance Volume is very bearish. Classic technical analysis does not support this wave count, so it looks unlikely now.

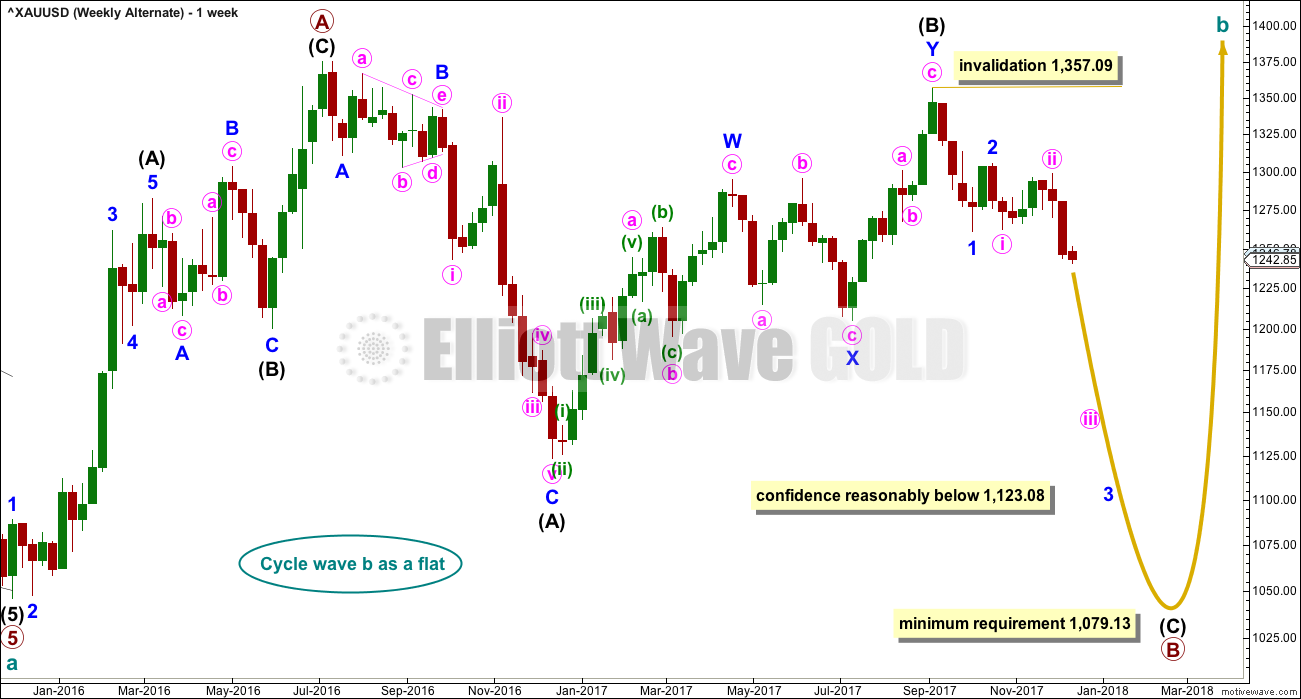

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

All wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

Cycle wave b may be a flat correction. Within a flat primary, wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below.

TECHNICAL ANALYSIS

WEEKLY CHART

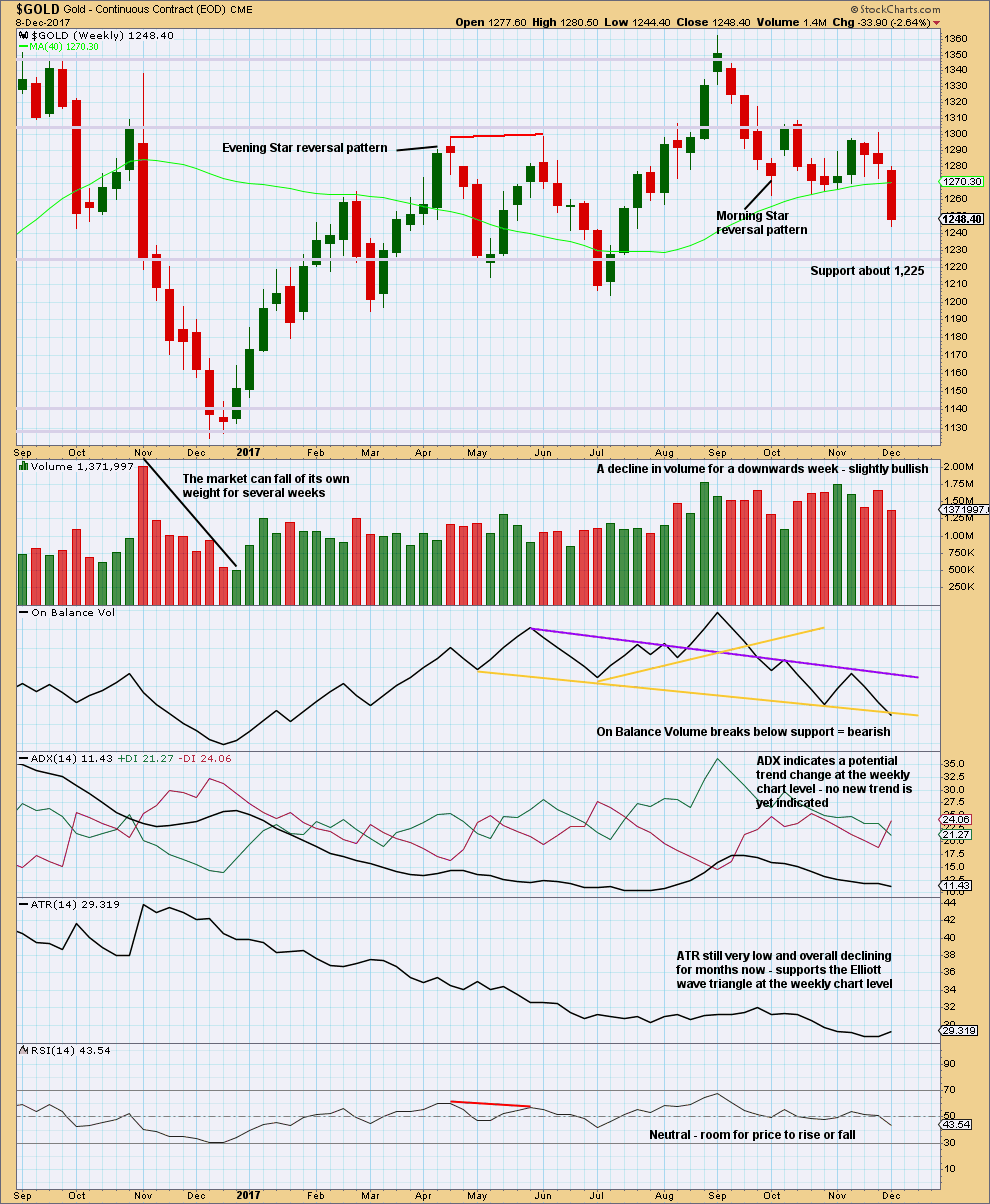

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has broken below support this week, which was about 1,262. The market this week fell of its own weight, but this can continue for several weeks as recent evidence noted on this chart for November 2016 shows.

The last signal given from On Balance Volume was bearish. Now On Balance Volume gives another clear bearish signal this week. With On Balance Volume now fairly bearish, this offers support to the main Elliott wave count.

DAILY CHART

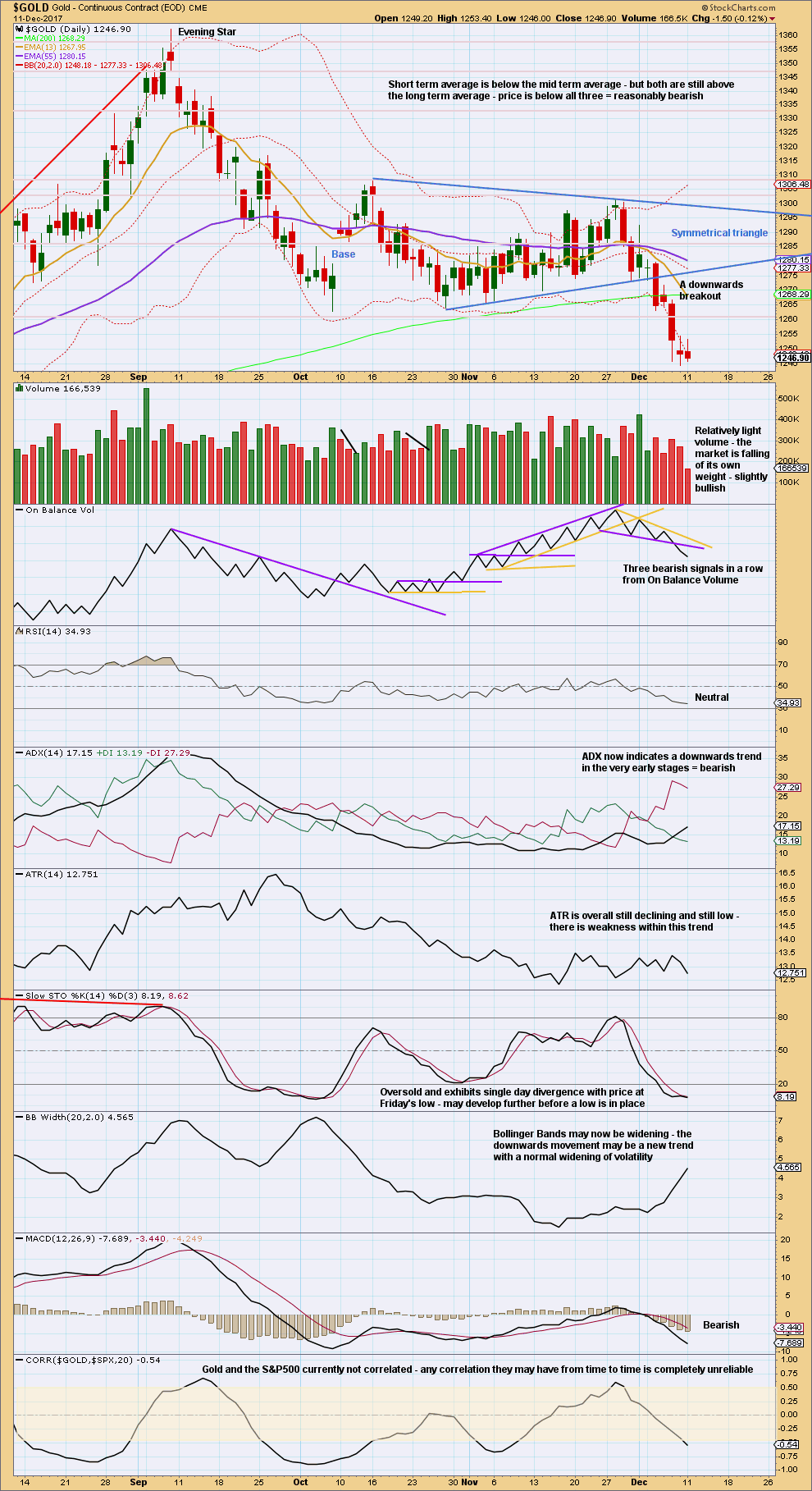

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated using the symmetrical triangle is about 1,228.

Members are warned that a throwback to the lower trend line of the triangle is unlikely.

The strongest signal that ADX can give is when the black ADX line rises up from low levels and from below both directional lines. When ADX then reaches 15, it signals a new trend. This is the situation now with ADX, and it indicates a downwards trend is beginning, that it should still be in its early stages.

With RSI not yet oversold and Stochastics only just now oversold, there is still room for price to fall further here.

Only declining ATR indicates some weakness. This is exactly the kind of weakness which should be expected as a triangle moves towards maturity, and this strongly supports the main Elliott wave count.

On Balance Volume remains very bearish. Give this indicator weight; it works well with trend lines.

GDX DAILY CHART

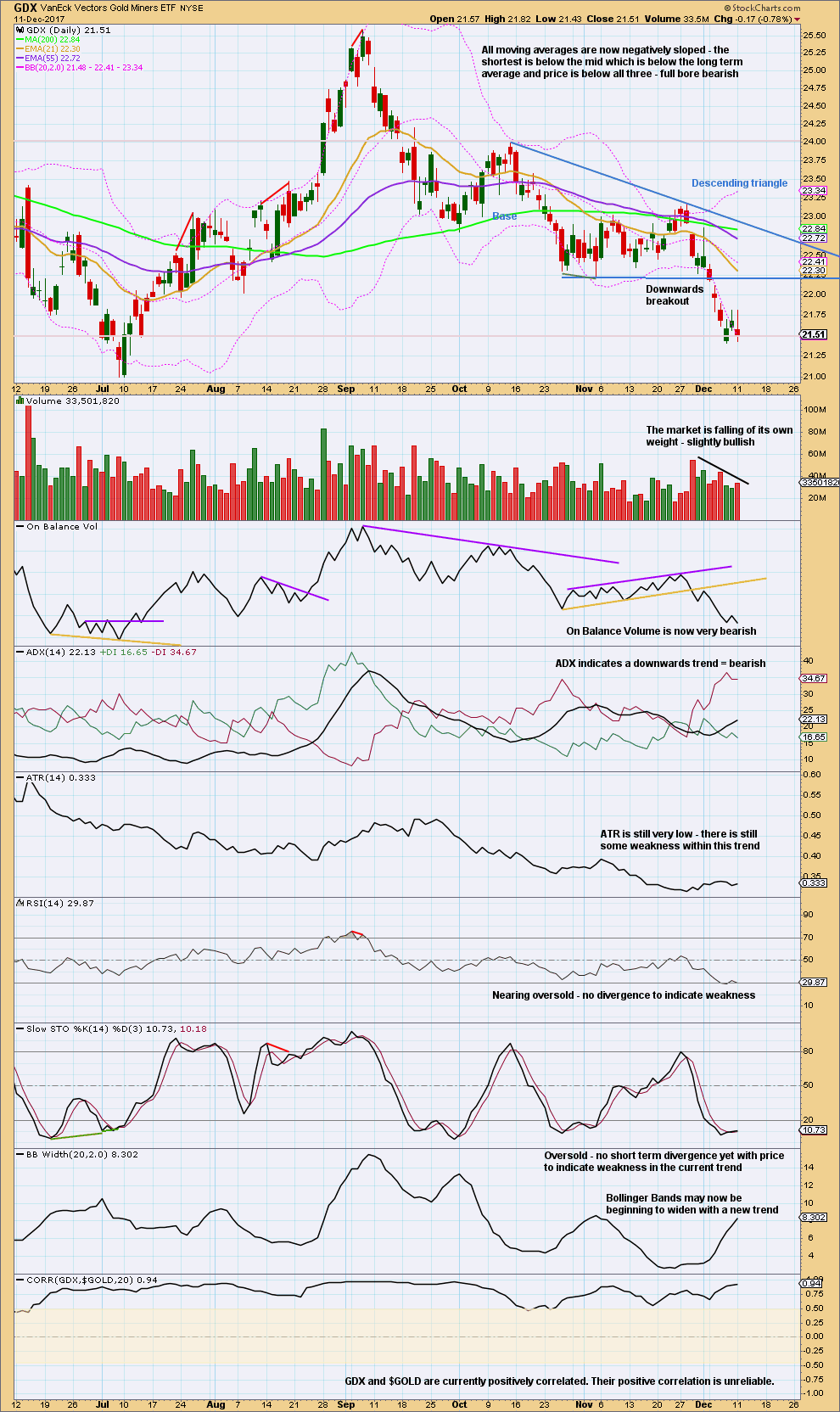

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated from the width of the triangle and applied to the breakout point is at 20.43.

There is a next area of support about 21.00.

The last two daily candlesticks have long upper wicks; this looks bearish for the short term.

RSI can remain further oversold before price is ready to turn. Stochastics can remain oversold for a reasonable time before price is ready to turn.

Only ATR indicates weakness in this market at this time.

Published @ 08:19 p.m. EST.

The target 1,236 is met but the structure is incomplete for this last fifth wave.

New target calculated using the next Fibonacci ratio in the sequence, 1.618.

While price remains within this channel assume the wave is incomplete and price should keep going down. This channel is working very well.

When a trend is down, bounces are opportunities to join the trend.

Joining the downwards trend here may be for a shorter term trade.

The end of minor 2 (when it comes, sometime this week I expect) will offer another entry opportunity to join the downwards trend for a longer term trade.

Members with short positions opened prior to the triangle breakout may still hold onto those for maximum profits.

It would appear that you are expecting a very swift and brief second wave considering how long minor one down lasted (about two weeks). I suppose a swift minor two does not necessarily preclude a deep minor two… 🙂

Lara,

As always I have a question!

In a triangle, only one of the waves may be complex and that is usually C. Complex, meaning a double three or a triple three (WXY or WXYXZ). Can any of the other waves be a double zigzag (WXY) or can they only be zigzags (ABC), please?

Thank you kindly.

They can only be single A-B-C.

Only one sub-wave may be a multiple. Multiples are labelled W-X-Y (and rarely -X-Z)

Except… one sub-wave may be a multiple, and then E may be a triangle. Forming a nine wave triangle with one sub-wave within those 9 waves a multiple.

Thank you very much, Lara. You are wonderful, I remember seeing an image of a 9 wave triangle in Prechter’s book and was not sure what to make of that – now I see.

You’re welcome 🙂

Last year in December, the SPX topped on Tuesday, Dec 13th, one day before the FED hiked rates, and then declined for the next 12 trading days before bottoming on December 30th.

We potentially have the same setup now. The FED is expected to announce a rate hike on Wednesday, so maybe the SPX will put in a top tomorrow and then decline for a couple of weeks?

A technical look at the SPX supports this. This would also support a move up in Gold and GDX as Lara expects.

Yep! VIX also signaling an impending change via clear divergence with upward SPX movement today. I think we will indeed see some kind of retreat.