A final upwards swing was expected by the strongly preferred Elliott wave count. This is again exactly what has happened.

An Elliott wave triangle and a classic symmetrical triangle are identified. Members are given trading advice and a most likely breakout direction, along with a possible target.

Summary: Members please note: the second wave count is strongly preferred.

It is possible that the Elliott wave triangle is complete at Friday’s high. It is also possible that price may move a little higher for another day or so before the triangle completes. Look out for a downwards breakout next week, and do not be surprised if it comes quickly now. The target for now is at 1,191.

If hedging, then a long position should already be entered with stops just below 1,262.52. Short positions may be entered now with stops just above 1,298.70. If going short only, then positions may be entered here.

Members with lower risk appetites may wait for a clear breakout before entering in the direction of the breakout. Do not wait for a pullback or throwback because it may not happen. A position should be entered upon a breakout.

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

To avoid swapping wave counts over while cycle wave b continues, they will be labelled in the order they were developed: first, second and third. At this time, the second wave count is preferred because its Elliott wave structure has a better fit and has more support from classic technical analysis.

FIRST ELLIOTT WAVE COUNT

WEEKLY CHART

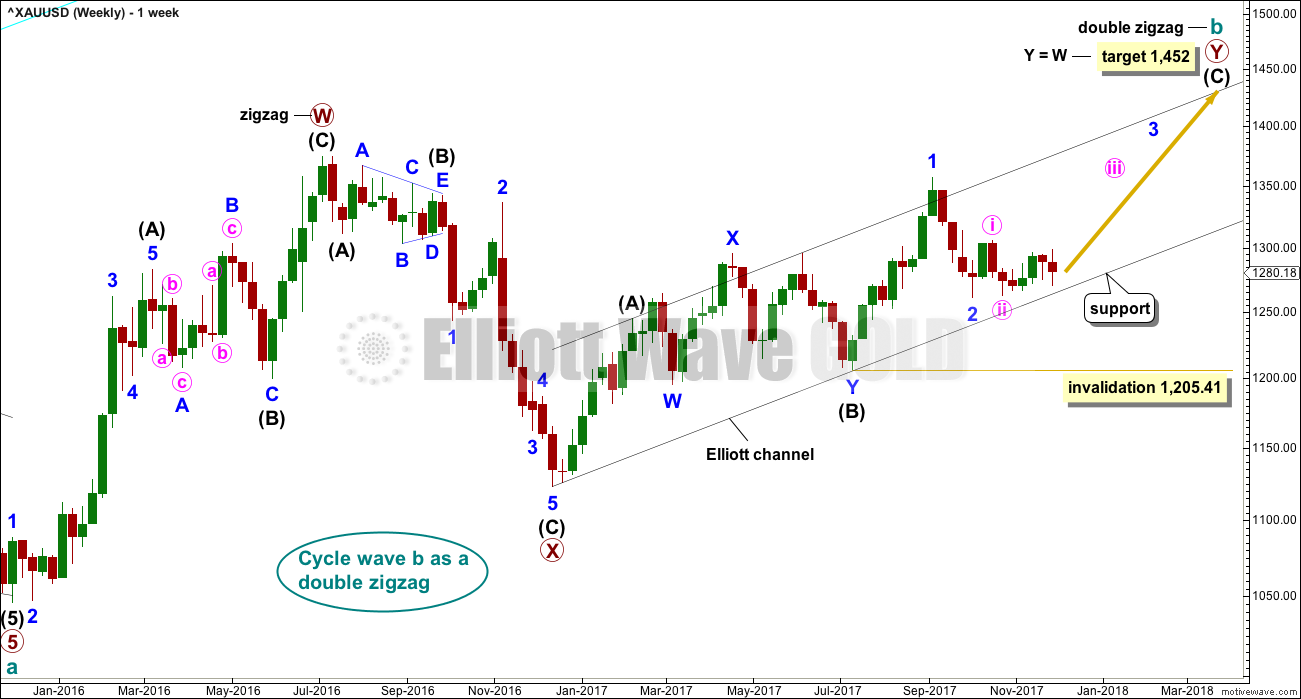

Both wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

Both wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave W. Primary wave W lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This first wave count expects that cycle wave b may be an incomplete double zigzag.

While this first wave count is entirely possible, there are three problems now which reduce its probability.

1. Cycle wave b is a double zigzag, but primary wave X within the double is deep and time consuming. While this is possible, it is much more common for X waves within double zigzags to be brief and shallow.

2. Intermediate wave (B) within the zigzag of primary wave Y is a double flat correction. These are extremely rare, even rarer than running flats. The rarity of this structure must further reduce the probability of this wave count.

3. Although intermediate wave (C) should be continuing so that primary wave Y ends substantially above the end of primary wave W, the duration of minor wave 2 within it now looks to be too large at the weekly time frame.

Within intermediate wave (C), no second wave correction may move beyond the start of its first wave below 1,205.41. However, prior to invalidation, this wave count may be discarded if price breaks below the lower edge of the black Elliott channel. If this wave count is correct, then intermediate wave (C) should not break below the Elliott channel which contains the zigzag of primary wave Y upwards.

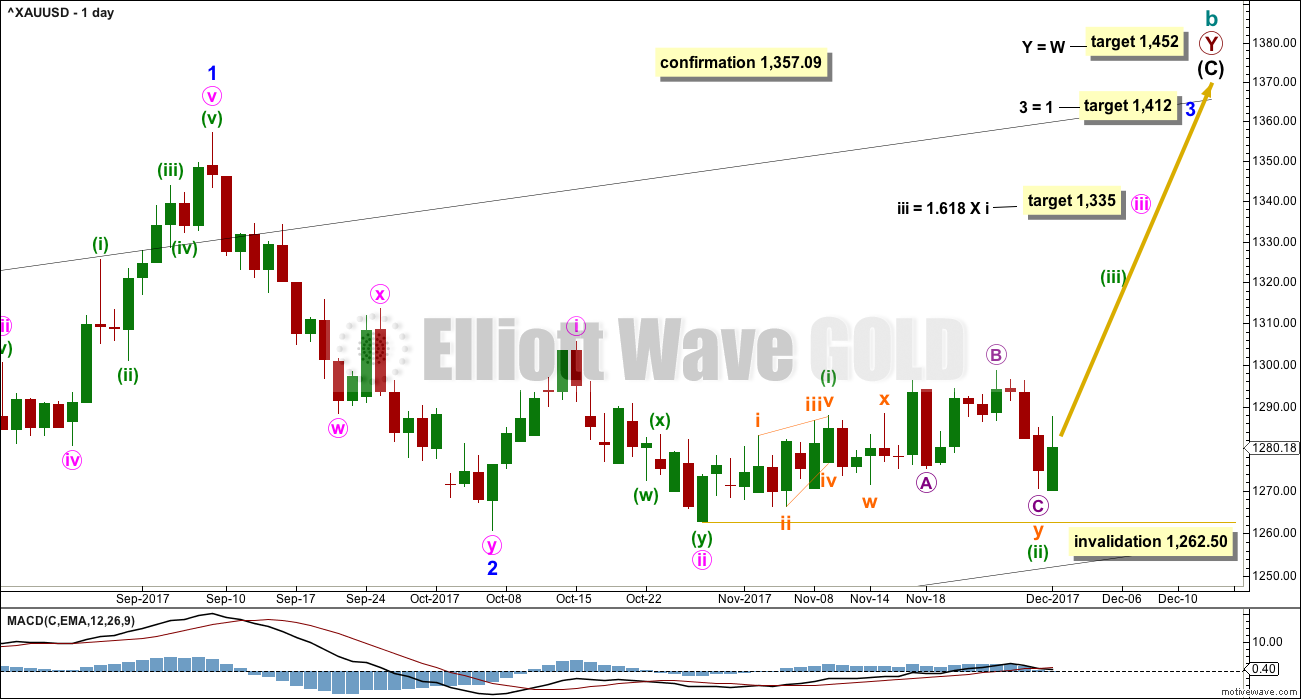

DAILY CHART

The analysis will focus on the structure of intermediate wave (C). To see details of all the bull movement for this year see daily charts here.

Intermediate wave (C) must be a five wave structure, either an impulse or an ending diagonal. It is unfolding as the more common impulse.

Minor wave 1 was a long extension. The target for minor wave 3 expects that too may be a long extension. If this is the case, then minor wave 5 may be shorter (only two actionary waves in an impulse may be extended).

The target for minute wave iii fits with higher targets and expects it to exhibit the most common Fibonacci ratio to minute wave i.

If price makes a new high above 1,357.09, then the second wave count below would be discarded and more confidence may be had in this first wave count.

This first wave count now expects there should be a series of three overlapping first and second waves: minor, minute, and minuette. This expects a strong increase in upwards momentum that should begin very soon if this wave count is correct.

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,262.50.

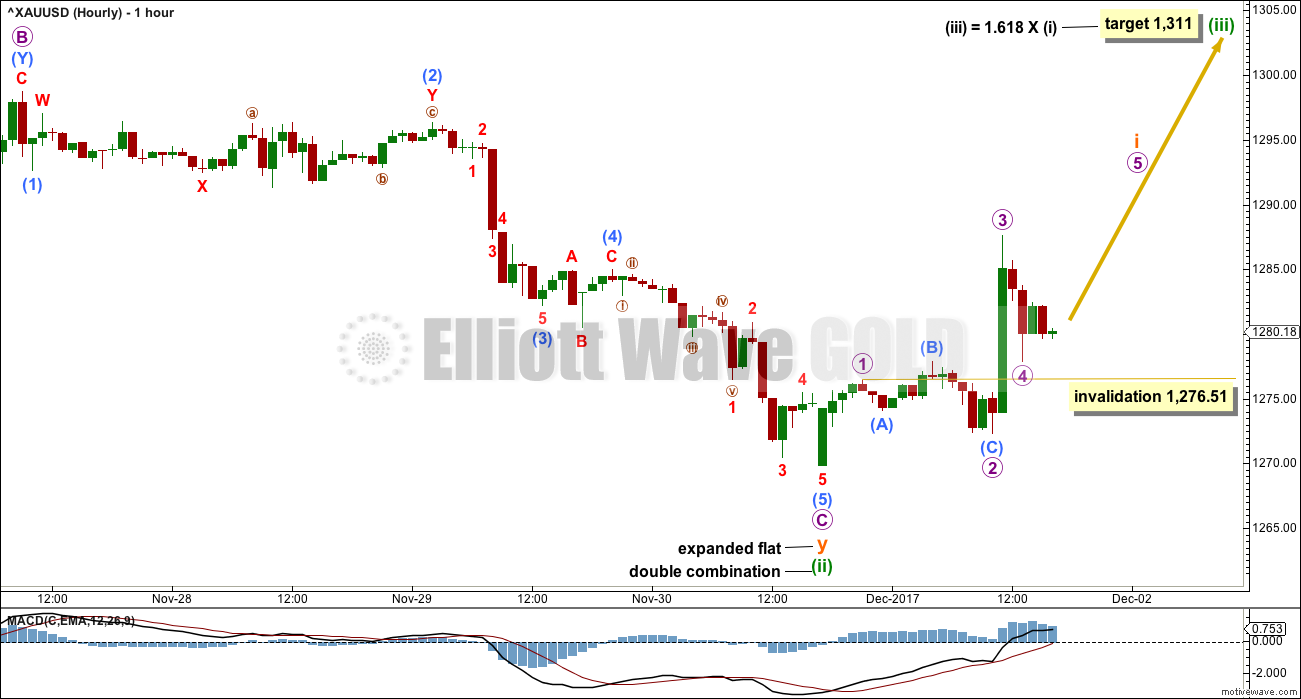

HOURLY CHART

Minuette wave (ii) should now be complete. It will subdivide as a double combination, and the second structure in the double is now a completed expanded flat correction.

Minuette wave (iii) should have begun with upwards movement on Friday. If this wave count is correct, then a five up should develop. Within that first five up, micro wave 4 may not move into micro wave 1 price territory below 1,276.51.

Again, this first wave count and the third wave count see subdivisions at the hourly chart level in exactly the same way. Only the degree of labelling is different, which for this first wave count it is one degree lower. Only one hourly chart will be provided for the two wave counts.

SECOND ELLIOTT WAVE COUNT

WEEKLY CHART

Both wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The B-D trend line should have a reasonable slope for this triangle to have the right look, because the A-C trend line does not have a strong slope. A barrier triangle has a B-D trend line that is essentially flat; if that happened here, then the triangle trend lines would not converge with a normal look and that looks unlikely.

Primary wave D should be a single zigzag. Only one triangle sub-wave may be a more complicated multiple, and here primary wave C has completed as a double zigzag. This is the most common triangle sub-wave to subdivide as a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08.

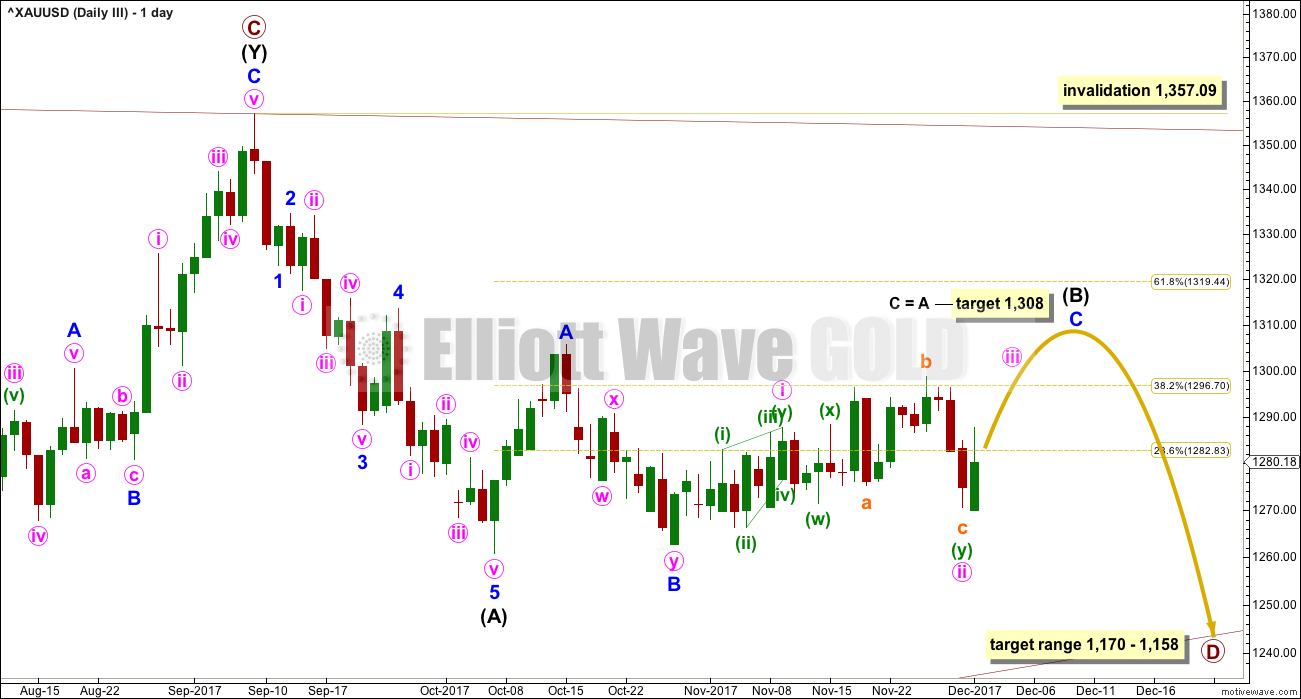

At its completion, primary wave D should be an obvious three wave structure at the weekly chart level. Within primary wave D, intermediate wave (B) is incomplete. At this stage, it looks like intermediate wave (B) may be unfolding as a triangle. This now has a better fit at the daily and hourly chart level. At its conclusion, intermediate wave (B) should look like a corrective structure at the weekly chart level.

While it is possible now that intermediate wave (B) may have been over at Friday’s high, it is also possible that the final wave of minor wave E could continue further. If it does continue further, it would have a better look at the weekly chart level.

DAILY CHART

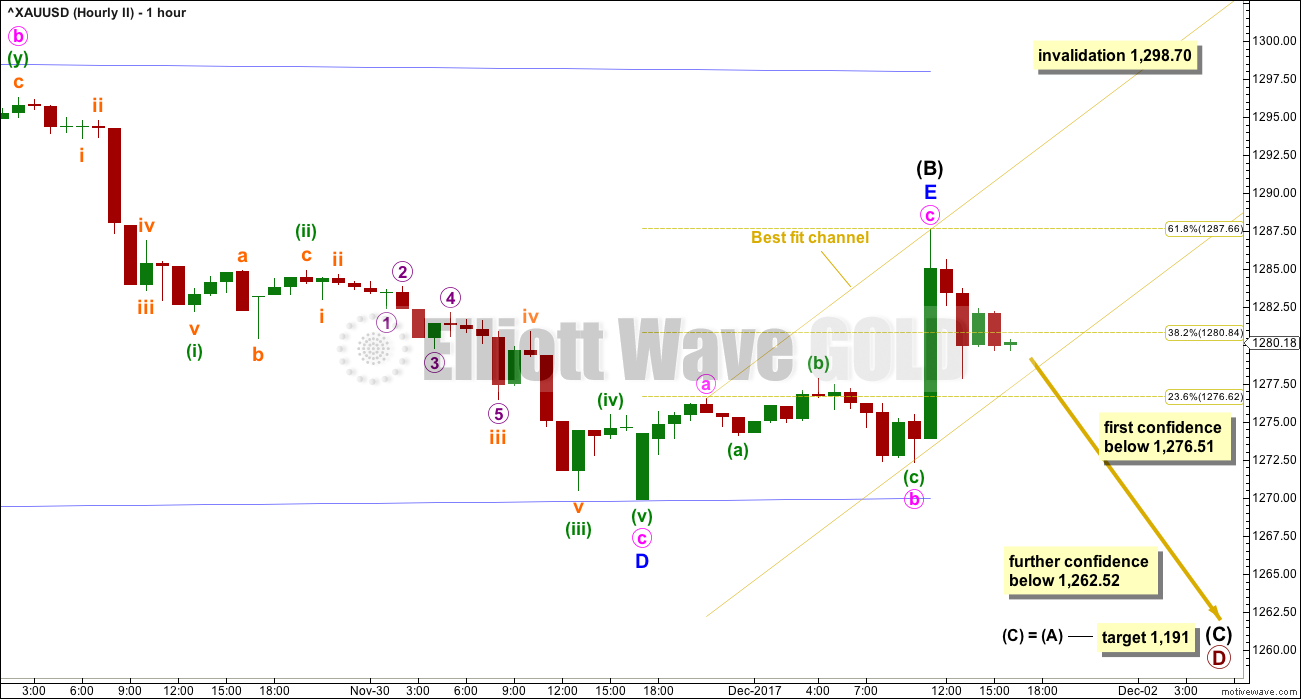

This is the preferred wave count.

A common length for triangle sub-waves is from 0.8 to 0.85 the length of the prior wave. Primary wave D would reach this range from 1,170 to 1,158.

Primary wave D should subdivide as a zigzag, and within it intermediate wave (B) may now possibly be complete, or it may continue a little further so that minor wave E within it has a clearer three wave look to it at the daily chart level. Minor wave E may not move beyond the end of minor wave C above 1,298.70.

If minor wave E is over, then it would have fallen reasonably short of the A-C trend line. At this point, the depth of minor wave E looks fairly typical.

Reasonable confidence now may be had in this wave count if price makes a new low below 1,262.52. At that stage, both the other two daily wave counts would be invalidated. That would also provide a classic downwards breakout form the symmetrical triangle identified on the technical analysis chart below.

HOURLY CHART

The downwards sub-wave for minor wave D looks best as a three wave structure at both the hourly and daily chart levels. This fits best for this second wave count.

Now the upwards movement for Friday fits well as a three wave structure. It is possible that minor wave E could be over, ending almost perfectly at the 0.618 Fibonacci ratio of minor wave D.

It is also possible that minute wave c within minor wave E could continue higher; only minuette wave (i) within an impulse may be complete. If minor wave E does continue higher, then it would still be most likely to fall short of the upper blue A-C trend line. Minor wave E may not move beyond the end of minor wave C above 1,298.70.

Earliest confidence in this wave count would come with a new low below 1,276.51. Further and reasonable confidence would come with a new low below 1,262.52.

The target expects to see the most common Fibonacci ratio between intermediate waves (C) and (A). Intermediate wave (A) lasted 20 days; if intermediate wave (C) were also to be even in duration, it too may last about 20 days.

THIRD ELLIOTT WAVE COUNT

DAILY CHART

At the weekly chart level, this third wave count is the same as the second wave count.

This third wave count looks at intermediate wave (B) as a zigzag or flat correction. Within intermediate wave (B), minor wave C would need further upwards movement for the structure to complete. The target at 1,308 remains the same.

Minor wave C must subdivide as a five wave structure. So far within it, minute waves i and ii may be complete.

Analysis of most recent movement is seen in the same way as for the first wave count.

At the hourly chart level, this third wave count sees subdivisions for most recent movement of the last few weeks in the same way as the first wave count. The degree of labelling would be one degree higher.

Because this third and the first wave count are the same at the hourly chart level, only one will be published at this time.

TECHNICAL ANALYSIS

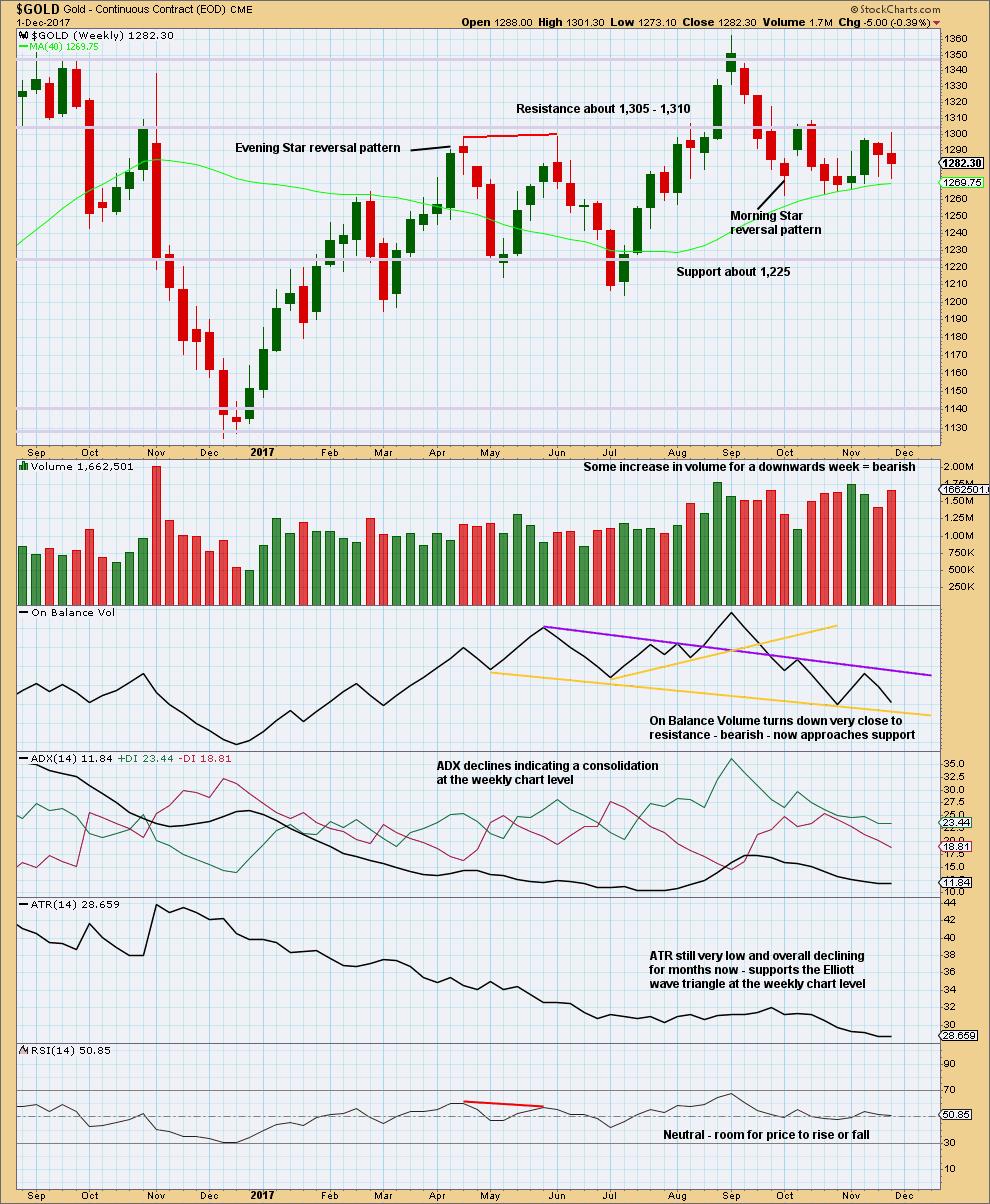

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is still constrained. The last signal given was bearish.

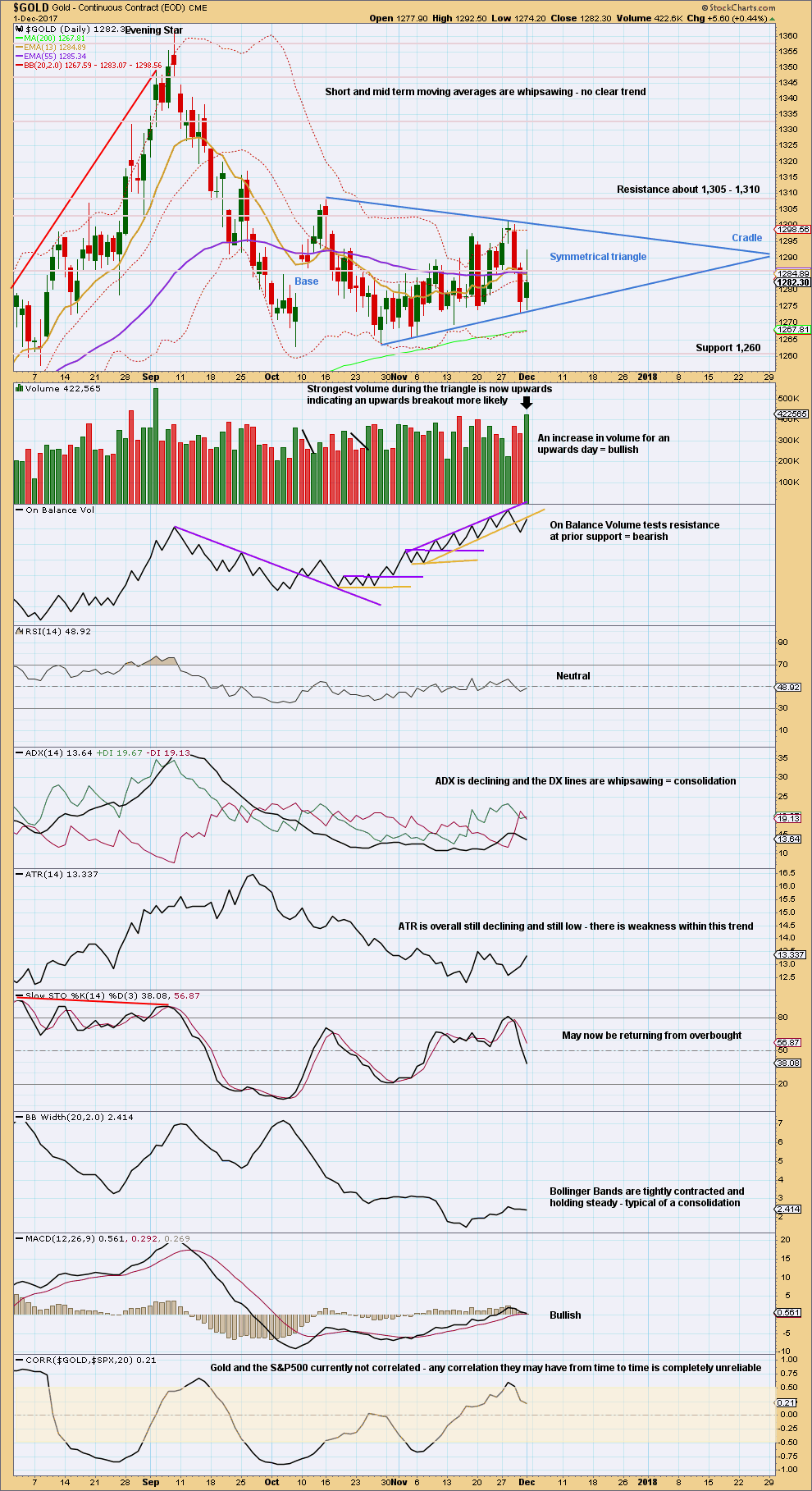

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A classic symmetrical triangle looks now to be forming. Regarding triangles from Kirkpatrick and Dhalquist:

“The breakout is usually upward (54% of the time). Symmetrical triangles have many false breakouts and must be watched carefully. A trick breakout system must be used that allows for such false moves. The breakout commonly occurs between 73% and 75% of the length of the triangle from base to cradle… Throwbacks and pullbacks occur 37% to 59% of the time, respectively, and, as in most patterns, when they occur, they detract from eventual performance. This implies that for actual investement or trading, the initial breakout should be aced upon, and if a pullback or throwback occurs, the protective stop should be tightened. It does not imply that a pullback or throwback should be ignored, but that instead, performance expectations should be less than if no pullback or throwback had occurred.”

On trading triangles:

“The ideal situation for trading triangles is a definite breakout, a high trading range within the triangle, an upward-sloping volume trend during the formation of the triangle, and especially a gap on the breakout… An initial target for these patterns is calculated by adding the be distance – the vertical distance between the initial upper and lower reversal point prices – to the price where the breakout occurred.”

For the very short term, the long upper wick on Friday’s candlestick is bearish; however, strong volume for that day is bullish. This suggests price may move a little higher Monday and / or Tuesday; it if does, it should find strong resistance at the upper edge of the triangle trend line.

At the end of the week, the strongest volume during the triangle is now for an upwards day for Friday. However, On Balance Volume contradicts this signal. On Balance Volume has given a bearish signal with a break below support and now a back test of resistance, which is bearish. I would give more weight to signals from On Balance Volume with its trend lines. I would still be expecting a downwards breakout from the triangle now.

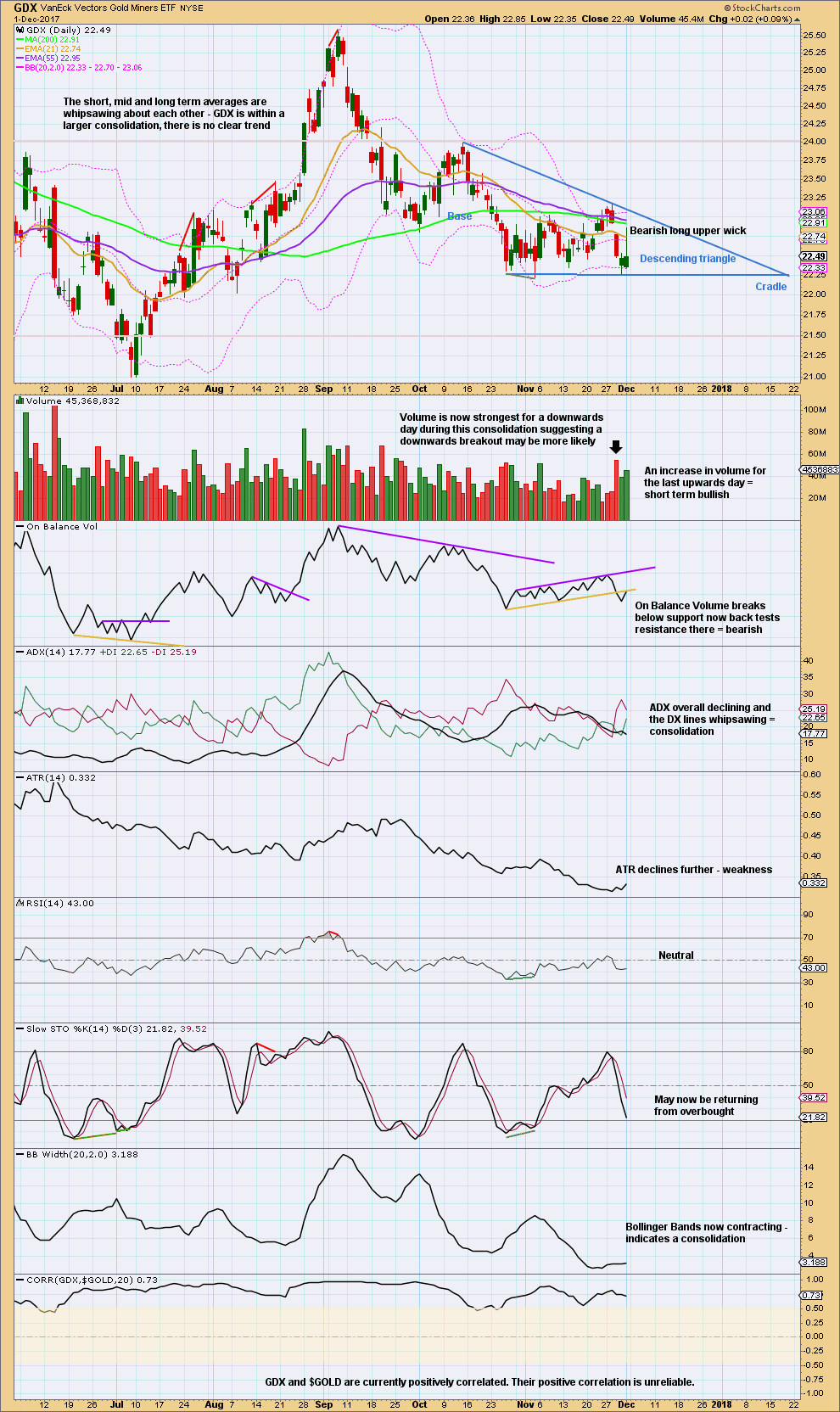

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A descending triangle looks to be forming now for GDX. From Kirkpatrick and Dhalquist regarding descending triangles:

“The breakout is more common to the downside (65%), but the upward breakout is more reliable and profitable… This formation can be stretched high and wide and is sometimes difficult to recognise. The trend lines defining its boundaries are almost never exact and are loaded with false intra-bar breakouts. A strict breakout strategy is required… However, prices often explode out of it and produce sizeable gains. It can also be wild and guarantee an exciting ride. It will break out and run, break out and pull back to its trend line, break out and pull back to its cradle, or break back through the cradle, create a sizeable trap, and then reverse back in its original breakout direction and run. In other words, when you enter on a breakout from a descending triangle, the subsequent action must be watched carefully.”

Published @ 7:50 p.m. EST on 2nd December, 2017.

When triangles complete price normally moves very swiftly out of them. This downwards movement does not meet that expectation. And so for that reason I’m going to label the triangle as incomplete today.

This is an idea I outlined briefly in the video.

Minor wave D may be close to completion. The triangle may still need a final short zigzag upwards for minor wave E.

Because for the triangle to remain valid minor D cannot move reasonably below minor B at 1,262.50, a new low reasonably below this point would be a downwards breakout and signal an end to the triangle. That is still an important price point.

But first, if this idea is correct we may see yet another week of slow grinding sideways movement 🙁

This may not work out as hourly charts often have many options, but for now it looks like a possibility for the FIRST hourly count. It will work with Lara’s BarChart data also. We should know soon if this is in play or not.

https://www.tradingview.com/x/fOVRVapD/

Thank you kindly, Dreamer.

Comparing to Oil, Gold is not really doing much. It would be much more interesting to trade Oil and have 2 updates/ week if possible?

What do other members think? Do we really need daily updates in this sideways market of Gold? – unless there is some really exiting things happening?

IMO we need once a week updates of both Gold and Oil.

Giving daily updates with hourly charts and blow by blow accounts… only serves to highlight volatility we should be ignoring and shift focus on minutae away from the bigger picture. It leads to overtrading, more losses and lower profits.

Well….. 1st chart is eliminated

On to 2nd chart. It’s been 2 months – lets do it

12/3/17. 6.22PM. ET. XAUUSD = 1274.40

Making an early call I see… price really needs to move below 1,262.52 for more confidence in the second count. The 1st count is not dead yet…