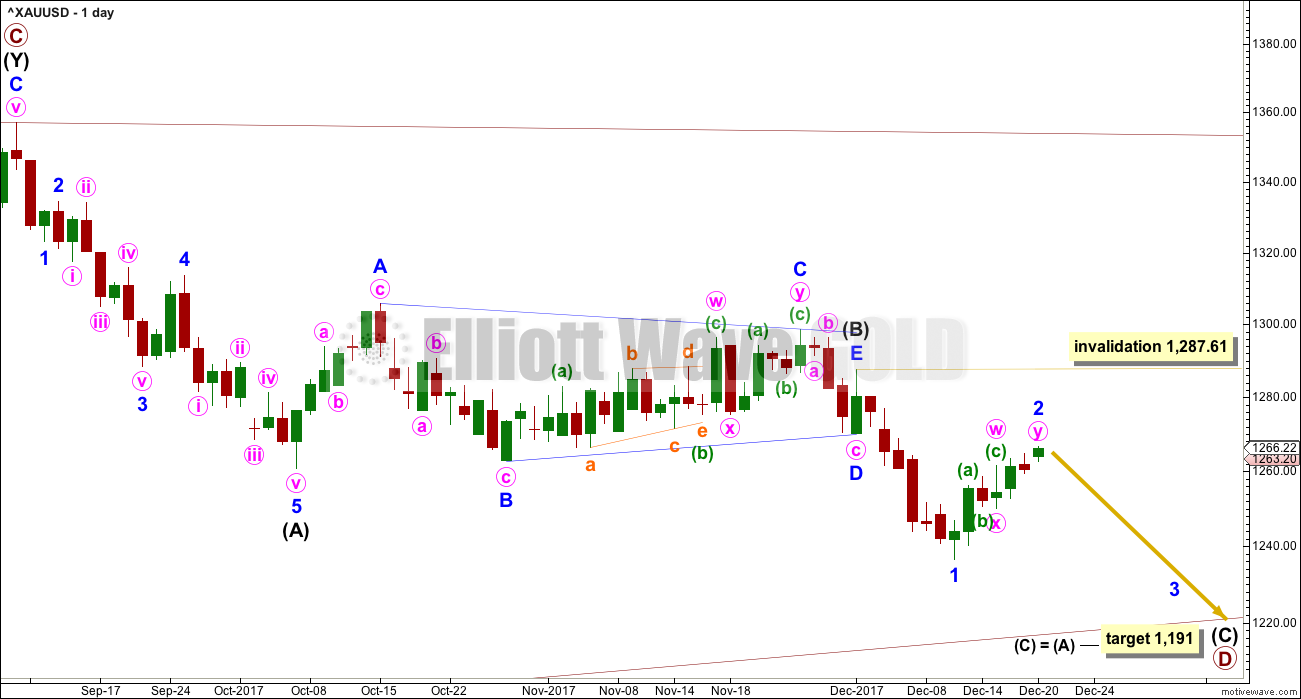

More upwards movement was expected towards a target at 1,268 to 1,270. Price has reached up to 1,266.70, just 1.30 short of the target zone so far.

Summary: Upwards movement is either over here or may continue a little higher. If it does continue a little higher, then the upper edge of the target zone at 1,270 should be favoured.

Thereafter, a third wave down should begin.

Always trade with stops and invest only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

MAIN ELLIOTT WAVE COUNT

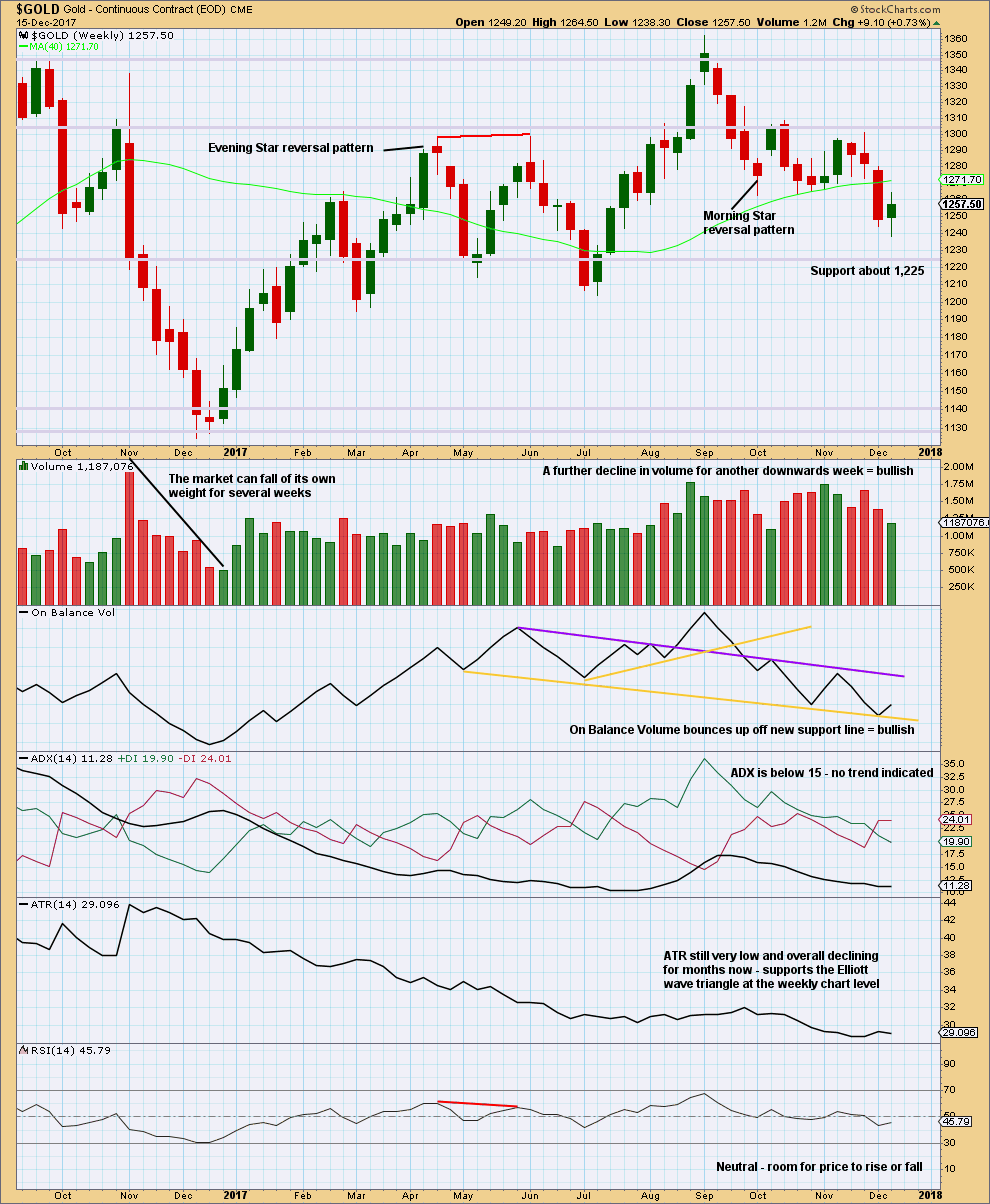

WEEKLY CHART

All wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

All wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave A. Primary wave A lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The B-D trend line should have a reasonable slope for this triangle to have the right look, because the A-C trend line does not have a strong slope. A barrier triangle has a B-D trend line that is essentially flat; if that happened here, then the triangle trend lines would not converge with a normal look and that looks unlikely.

Primary wave D should be a single zigzag. Only one triangle sub-wave may be a more complicated multiple, and here primary wave C has completed as a double zigzag; this is the most common triangle sub-wave to subdivide as a multiple.

Primary wave D of a contracting triangle may not move beyond the end of primary wave B below 1,123.08.

At its completion, primary wave D should be an obvious three wave structure at the weekly chart level.

For this one weekly chart, two daily charts are presented below. They look at intermediate wave (B) in two different ways, and are presented now in order of probability.

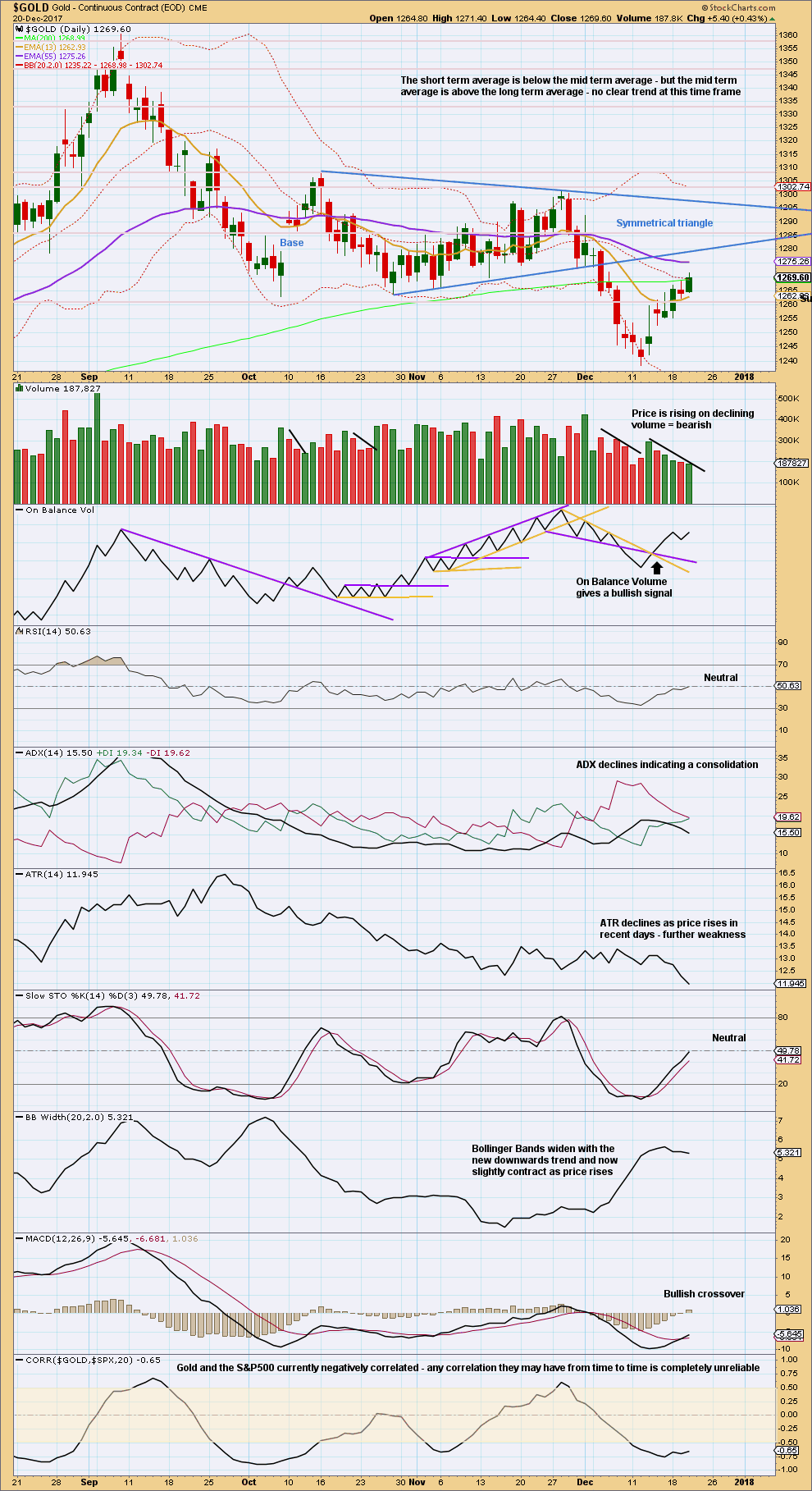

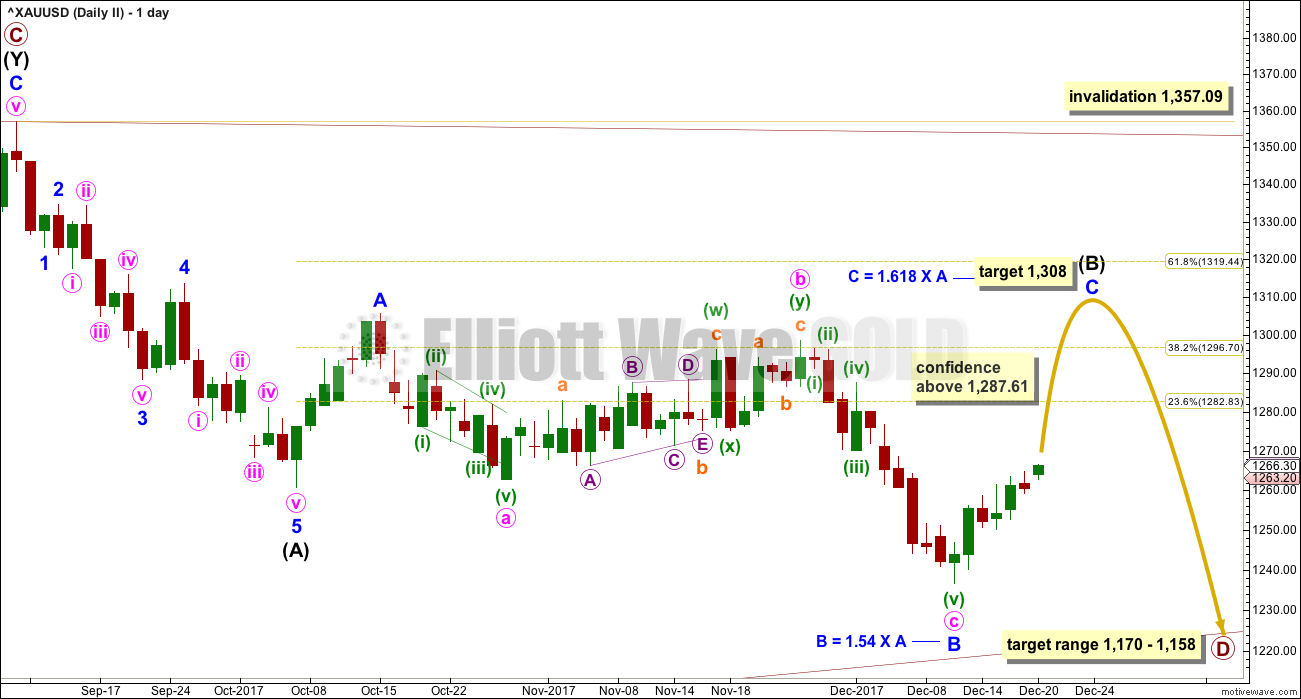

DAILY CHART

Both daily charts are identical up to the low labelled intermediate wave (A).

This first daily chart shows intermediate wave (B) as a now complete regular contracting Elliott wave triangle. This has support from what looks like a classic downwards breakout from the symmetrical triangle identified on the technical analysis chart below.

The target assumes that intermediate wave (C) may exhibit the most common Fibonacci ratio to intermediate wave (A).

Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 1 may now be complete.

Minor wave 2 so far has lasted six days while minor wave 1 lasted seven days. Minor wave 2 may be over here, or it may continue a little further and be closer in proportion to minor wave 1.

Intermediate wave (A) lasted twenty sessions. Intermediate wave (C) may be about even in duration as well as length, so twenty or twenty-one sessions looks likely. The next Fibonacci ratio in the sequence would be thirty-four, and it is possible intermediate wave (C) could be this long lasting.

At its end, minor wave 2 may present an opportunity to join the downwards trend in time to catch a third wave down.

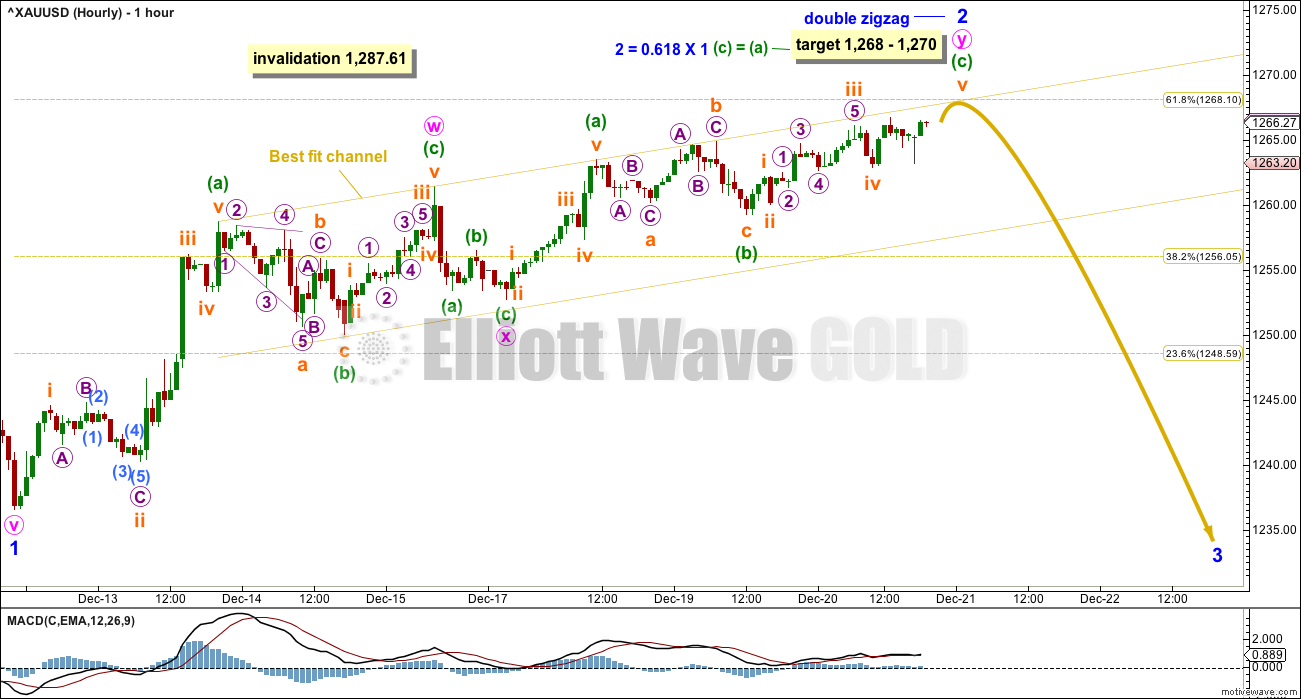

HOURLY CHART

Minor wave 2 so far fits best as a double zigzag structure. These are very common. The second zigzag exists to deepen the correction when the first zigzag does not move price deep enough, and sometimes also when it does not last long enough. Minute wave w ending at only 0.49 of minor wave 1 and lasting only three days fits this description.

Minute wave y is deepening the correction and taking up more time.

When the best fit channel is clearly breached by downwards (not sideways) movement, then it shall provide an indication that minor wave 2 may be over and minor wave 3 may have begun. When the start of minor wave 3 is known, then a target may be calculated for it to end, but that cannot be done yet.

Minor wave 2 could be labelled as complete at today’s high, and at the hourly chart level the structure would have a completed look to it. However, on the five minute chart, the last small downwards wave from the high does not look like a five wave structure and looks very much like a three. This suggests that minor wave 2 is not over and price is still moving higher.

The bottom line is to allow for the possibility that price may continue higher while price remains within the channel. There will be greater risk to any short positions opened while price remains within the channel.

Members with a lower tolerance for risk may choose to wait for confidence in a trend change by a clear breach of the best fit channel.

Minor wave 2 may not move beyond the start of minor wave 1 above 1,287.61.

SECOND DAILY CHART

It is very important to always consider an alternate when a triangle may be unfolding. Triangles are very tricky structures, and may even be invalidated after one thinks they are complete.

It is still possible that intermediate wave (B) may be completing as a flat correction.

Within the flat correction, both minor waves A and B are threes. Minor wave B has retraced more than the minimum 0.9 length of minor wave A.

With minor wave B now a 1.54 length to minor wave A, an expanded flat is now indicated. Minor wave C of an expanded flat would most commonly be about 1.618 the length of minor wave A.

Now minor wave C may be required to move price upwards to end at least above the end of minor wave A at 1,305.72 to avoid a truncation.

A new high above 1,298.70 is required now for confidence in this wave count. If the upwards wave does not reach up to 1,298.70, then this second wave count will be discarded.

There should be something wrong or “off” about B waves. In this instance, the last downwards wave has some strength. While the market fell of its own weight, On Balance Volume gave bearish signals. Classic technical analysis does not support this wave count, so it looks unlikely now.

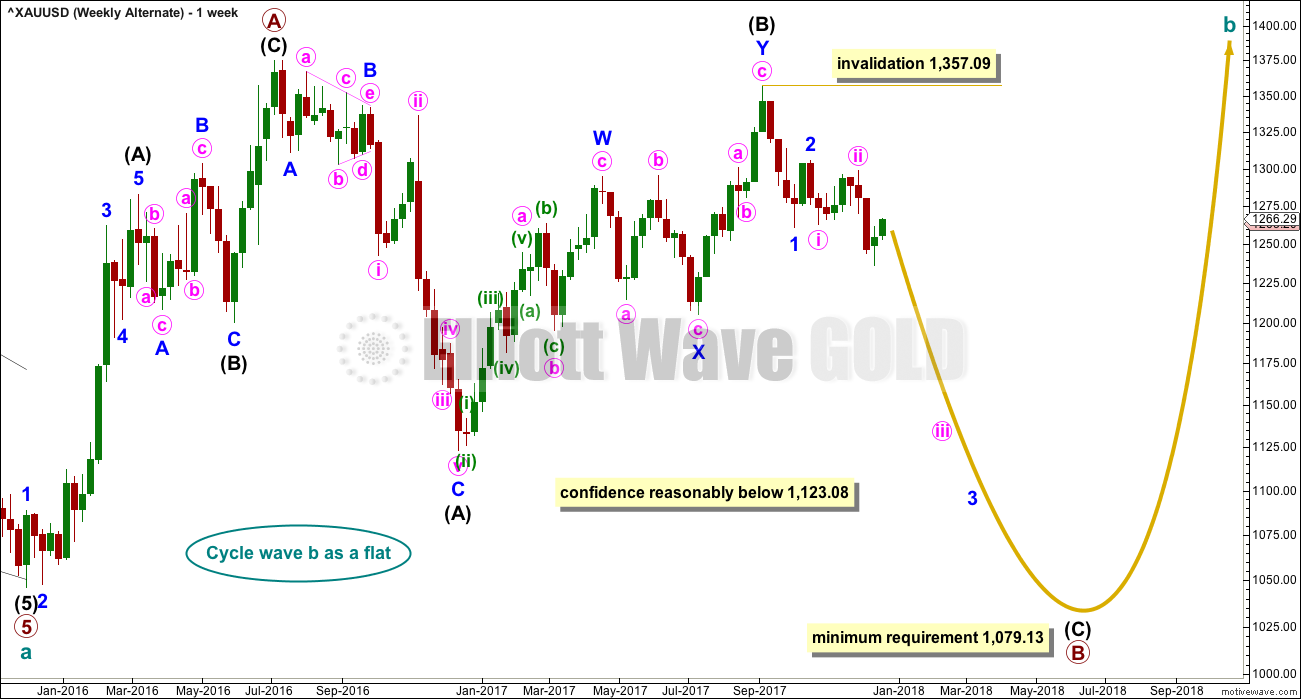

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

All wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

Cycle wave b may be a flat correction. Within a flat primary, wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The market is falling of its own weight. Next support is about 1,225.

The small real body of the last weekly candlestick puts the trend from down to neutral.

The support line for On Balance Volume is redrawn. A bounce up this week may be bullish.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is rising on declining volume for five days in a row now. Volume today was lightest since the 11th of December. This is bearish.

Rising price also comes with now clearly declining ATR. Normally, a healthy trend has increasing ATR, so this too is bearish.

A throwback to the lower edge of the symmetrical triangle is unlikely (that happens only 37% of the time). So we should expect this bounce to end very soon before it gets that high.

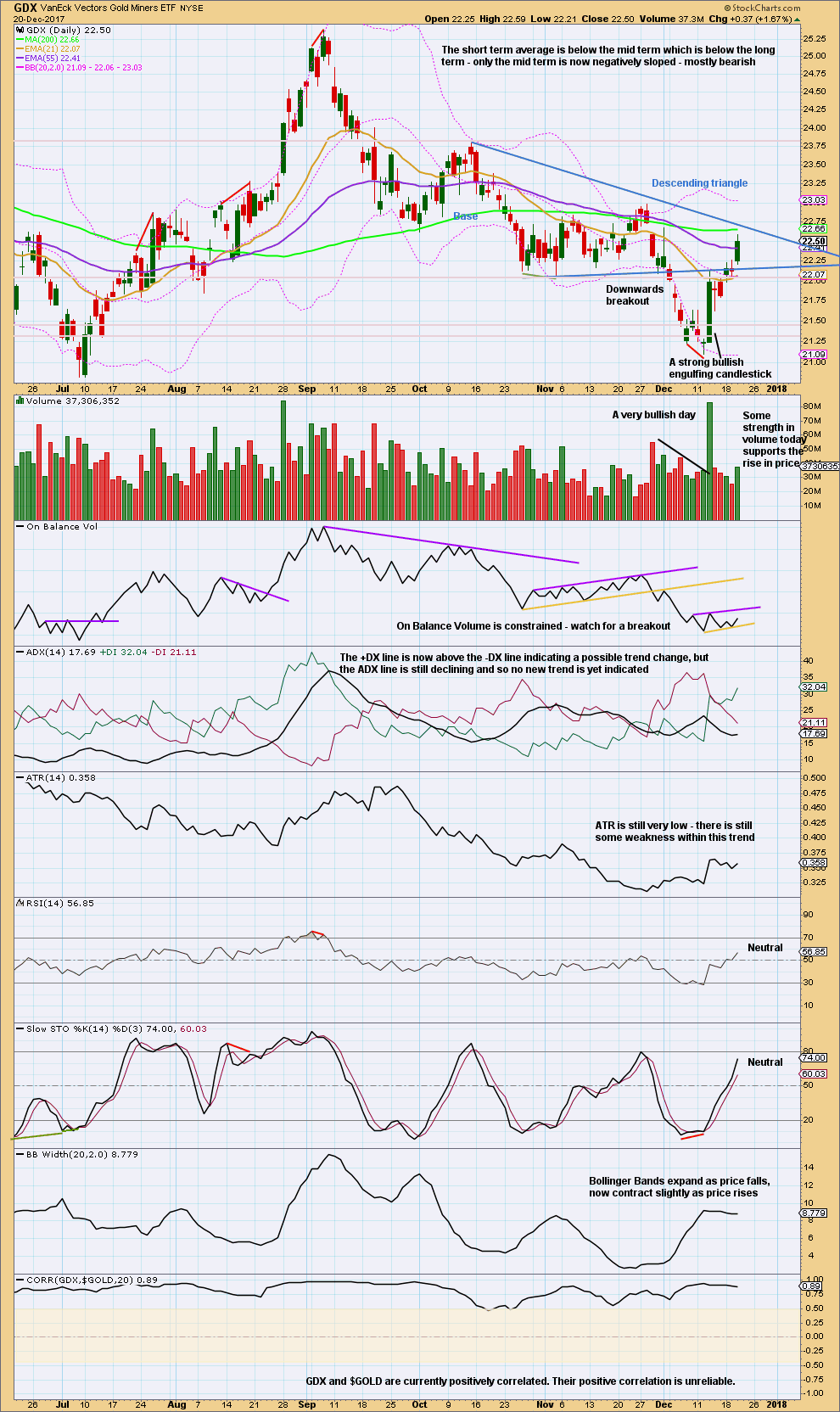

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Strength from volume today indicates price may continue higher now, or equally likely this could be a small blow off top. The upper triangle trend line may offer resistance here.

ADX, ATR and Bollinger Bands all still at this time indicate this upwards movement looks more likely to be a counter trend movement than a new trend. At this stage, that is the conclusion with the data in hand.

TRADING ADVICE

Short positions opened on or before 1st of December, and particularly any short positions opened above 1,287.61, may still be held for traders with a longer term horizon.

The trend for now is down. Bounces are opportunities to enter the trend. All trades should remain with the trend.

Members are advised today to enter short, with stops just above 1,280, if price gets up to 1,268. Alternatively, members with a lower risk tolerance may prefer to wait for the channel on the hourly chart to be breached before entering short.

If price does not rise to the target and breaks down below the channel on the hourly chart, then enter short there. The break must be with clearly downwards movement, not sideways.

Adjust position size so that only 1-5% of equity is risked on this one trade.

Published @ 07:55 p.m. EST.

If I’ve got this right, then minor 2 needs another high up into that small $2 target zone to complete.

I have subminuette v as an ending expanding diagonal. If that’s right, then micro 5 must be longer than micro 3 to meet the EW rules for wave lengths of expanding diagonals. That means micro 5 needs to move above 1,268.13, the point at which it would reach equality with micro 3.

And so despite this very small weak upwards day the analysis remains pretty much unchanged, with the sole exception of time expectations. I had expected it to be over already, but it isn’t quite done yet.

100% 👍

seems everyone has already gone on holiday!

no sign of a wave 3 movement so far!

Gold third waves can sometimes be deceptively slow at the start…! 🙂

No signs of a third wave indeed. With stochastic remains bullish, ADX dropping and 1262 appears to be holding, imo a break above 1268-69 could likely target 1274-77. Lets see what happens.

I think the second wave isn’t yet finished. It’s at a very tired end.

Can I get a chart €/$. I ask because it is starting up..

This is my daily count for EURUSD.

I’ll publish monthly and weekly later today as a free analysis.