Price has behaved exactly as yesterday’s first hourly chart expected. A consolidation looks to have arrived.

Summary: Look now for price to move either lower for a pullback or sideways for a multi week consolidation that may last about 8 to 12 weeks. If this expectation for duration is wrong, it may be too much; the consolidation could end more quickly.

All wave counts expect that price may not make a new high above 1,357.09.

New updates to this analysis are in bold.

Last monthly charts for the main wave count are here, another monthly alternate is here, and video is here.

Grand SuperCycle analysis is here.

MAIN ELLIOTT WAVE COUNT

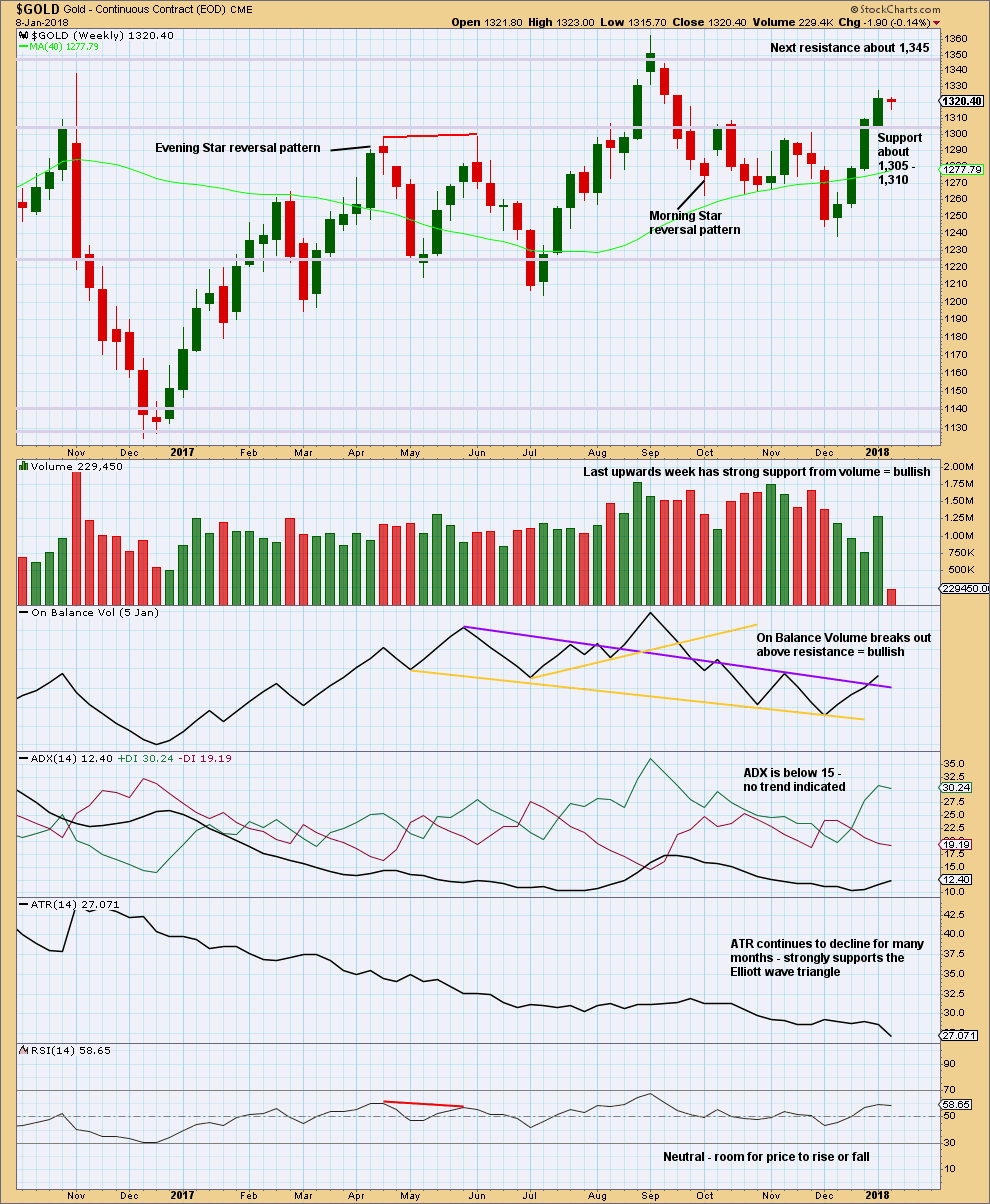

WEEKLY CHART

All wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

All wave counts then expect cycle wave b began in December 2015.

There are more than 23 possible corrective structures that B waves may take. It is important to always have multiple wave counts when B waves are expected.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave A. Primary wave A lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

The triangle trend lines have a normal looking convergence. Primary wave D now looks fairly likely to be complete, and it looks like an obvious three wave structure at the weekly chart level.

Primary wave E should also be most likely to look like an obvious three wave structure at the weekly and daily chart levels. That means that within it intermediate wave (B) should be fairly time consuming.

Primary wave E would most likely end reasonably short of the upper A-C trend line. If it does not end there, then the next less likely place for it to end would be with a slight overshoot of the A-C trend line.

When primary wave E is complete, then the whole structure for cycle wave b may be complete. At that stage, a downwards breakout would be expected.

Primary wave E may not move beyond the end of primary wave C above 1,357.09.

To find out how long the current intermediate wave (B) within primary wave E may last, we may look back to other B waves within this large triangle of cycle wave b. Within primary wave A, intermediate wave (B) lasted 12 weeks. Within primary wave B, intermediate wave (B) lasted 10 weeks. Within primary wave C, intermediate wave (X) (the equivalent position to a B wave) lasted 12 weeks, and within primary wave D, intermediate wave (B) lasted 9 weeks.

The current intermediate wave (B) that has just begun within primary wave E may be expected to last about 8 to 12 weeks. However, it does not have to be this long lasting. E waves of triangles can often be the quickest of all triangle waves, and so intermediate wave (B) may last only a few weeks.

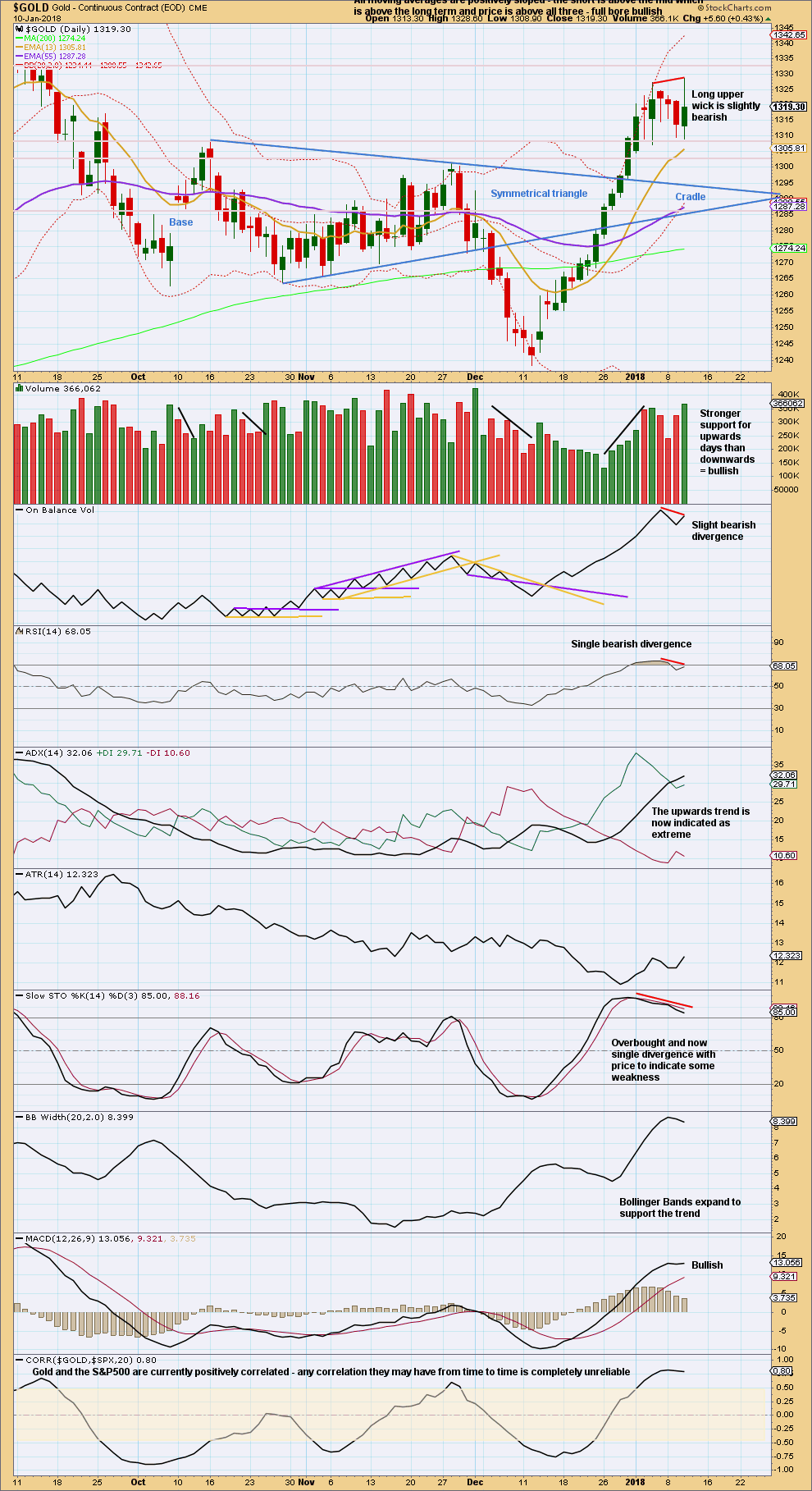

FIRST DAILY CHART

This first wave count follows on directly from the weekly chart above. It looks at primary wave E underway as a single zigzag. Zigzags subdivide 5-3-5. So far only wave A of the zigzag of primary wave E may be complete.

On previous hourly charts, the last two days of sideways movement breached channels drawn about intermediate wave (A). At the daily chart level, this recent movement now looks to be too large to be part of intermediate wave (A), so it looks like intermediate wave (A) is over and the next wave for intermediate wave (B) has begun.

The trend lines of the triangle of intermediate wave (B) within primary wave D are extended outwards. The point in time at which triangle trend lines cross over will often see a trend change (although not always a major trend change). That may be the point in time at which primary wave E ends, or it may be where intermediate wave (B) within primary wave E ends. At today’s calculation that would be on the 4th of February.

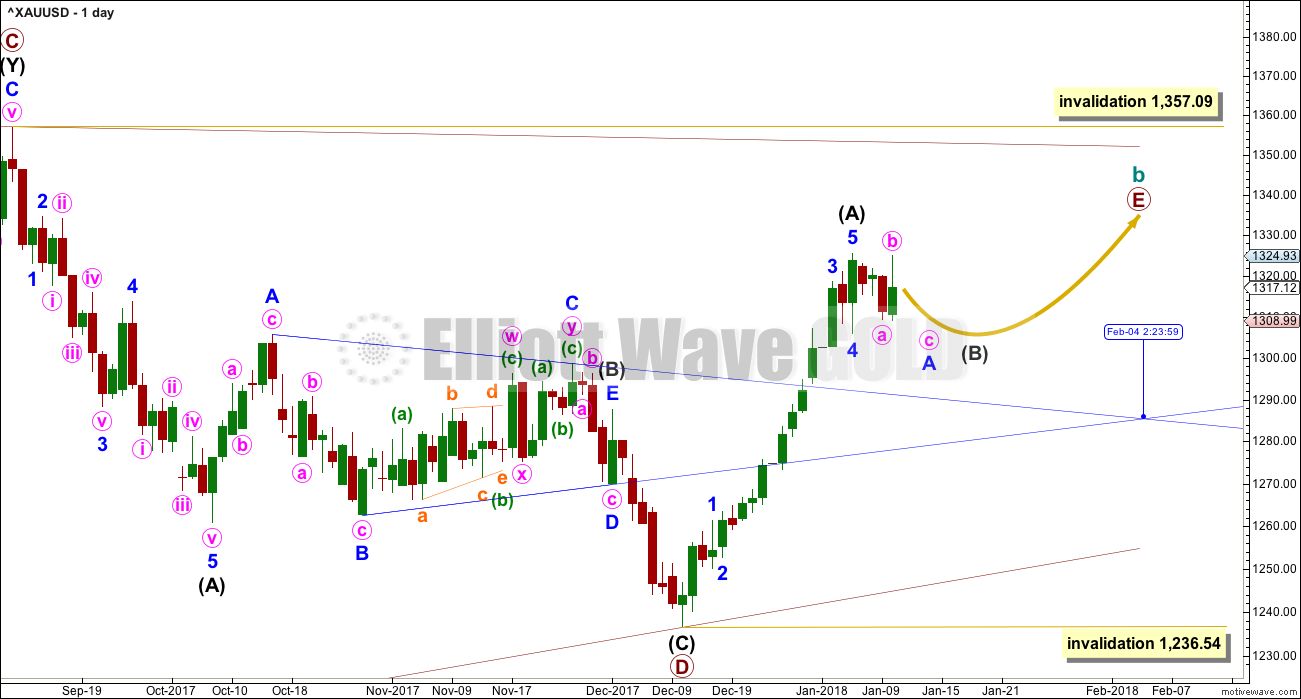

HOURLY CHART

There are more than 23 possible corrective structures that B waves may take. It is impossible to tell until they are almost complete which structure is unfolding. Analysis during B waves should focus on identifying when they are over and not on trying to pick each little swing within them.

B waves are analogous to typical range bound consolidations or sharp pullbacks.

Because there are still multiple structural options for intermediate wave (B), it must be expected that as it continues further the labelling within it will change at the hourly chart level.

At this stage, it looks like a three wave structure downwards was complete from the high labelled intermediate wave (A). This is now labelled minute wave a.

This looks to have been followed by a three wave structure upwards, which is labelled minute wave b.

This indicates a flat correction may be unfolding, as flats subdivide 3-3-5. A five down should now be expected for minute wave c to end at least slightly below the end of minute wave a, at 1,309.26, so that a truncation is avoided.

The type of flat indicated is a regular flat because minute wave b is less than 1.05 the length of minute wave a. The minimum requirement of minute wave b to be at least 0.9 the length of minute wave a has been met.

If minor wave A is unfolding as a flat correction, then the larger correction for intermediate wave (B) may be either a flat correction, double combination or double flat. All of these structures begin with a three, which would be the flat correction of minor wave A.

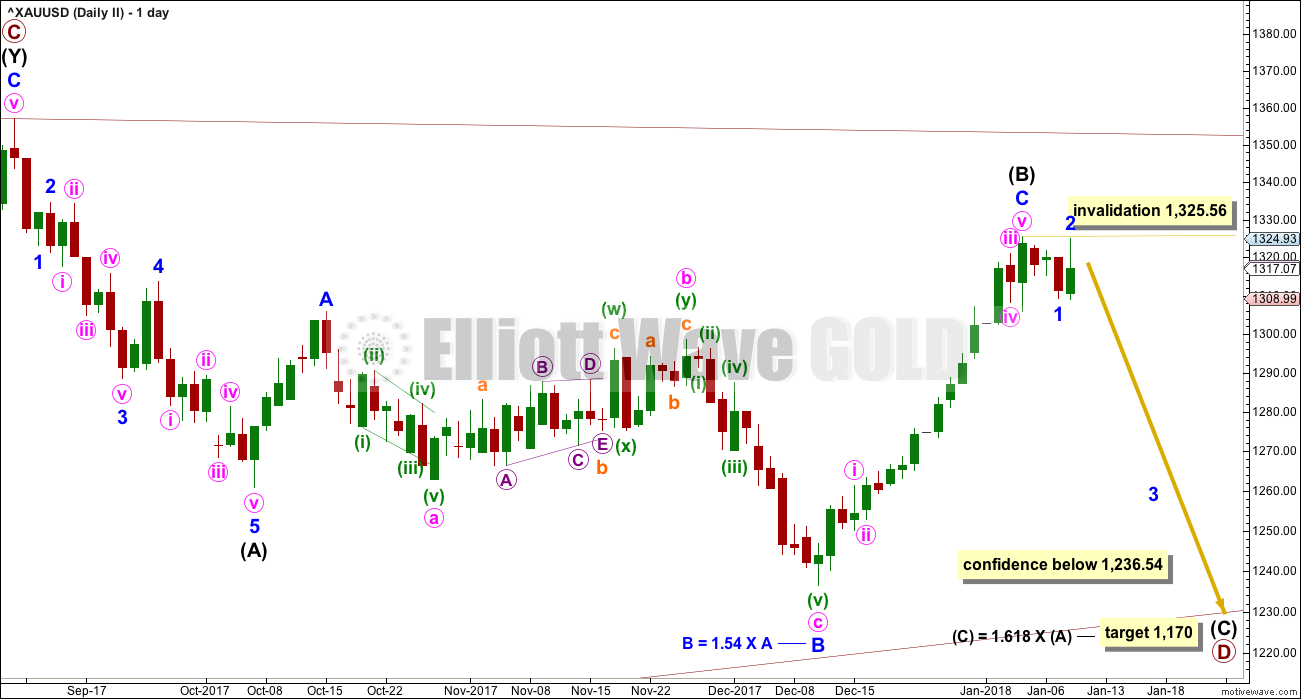

SECOND DAILY CHART

It is possible that within the large triangle for cycle wave b primary wave D may still be incomplete. Within primary wave D, intermediate wave (B) may be complete as a flat correction.

The target for intermediate wave (C) would see primary wave D have a normal length to primary wave C.

Intermediate wave (B) should now be over and intermediate wave (C) should now have begun. Within intermediate wave (C), no second wave correction may move beyond the start of its first wave above 1,325.56.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

All wave counts are identical to the low labelled cycle wave a. Thereafter, they look at different possible structures for cycle wave b.

Cycle wave b may be a flat correction. Within a flat primary, wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below.

Within intermediate wave (C), minor wave 2 may not move beyond the start of minor wave 1 above 1,357.09.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Now that price has again broken above resistance at 1,305 to 1,310, that area may now provide support. Next resistance is about 1,345.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Short term volume is bullish, but divergence now with On Balance Volume, RSI and Stochastics is bearish. Overall, it looks like a consolidation within the upwards trend is beginning, which may be needed to resolve extreme and overbought conditions.

Resistance so far is about 1,330 and support is about 1,310 – 1,305.

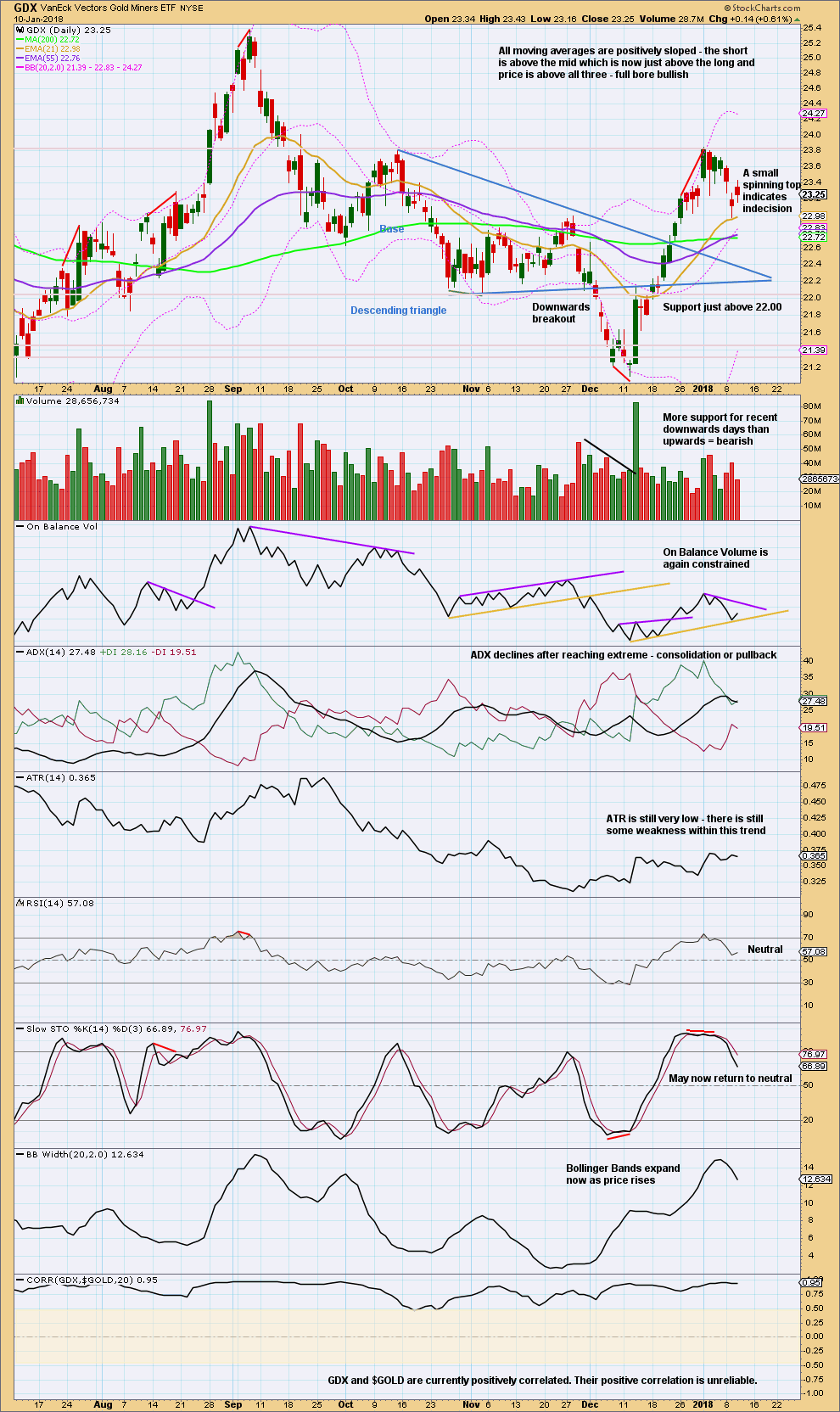

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It looks like GDX too has either ended its upwards trend, or has begun a consolidation or pullback here. Look for support just above 22.00.

Published @ 05:30 p.m. EST.

It looks like minute b is not over and may be continuing higher as a double zigzag.

If a flat correction is unfolding then the most common type is an expanded flat which would see minute b reach a minimum 1.05 of minute wave a, or longer. That point is given on the chart.

When that is done then a swing lower for minute c to end below minute a so that a truncation is avoided.

Overall the expectation is the same. Choppy, overlapping movement in a typical range bound consolidation.

Lara today’s high in April Gold futures was higher than that on Jan 4 whereas this high was not breached on the Cash.

Am I right in assuming this is bearish and that April’s chart is an expanded flat or a triangle compared to the regular flat in the Cash?

That assumption looks reasonable and would meet EW rules.

Cash and futures will often have slight differences, and different wave counts. They’re not exactly the same market.

Good thanks Lara