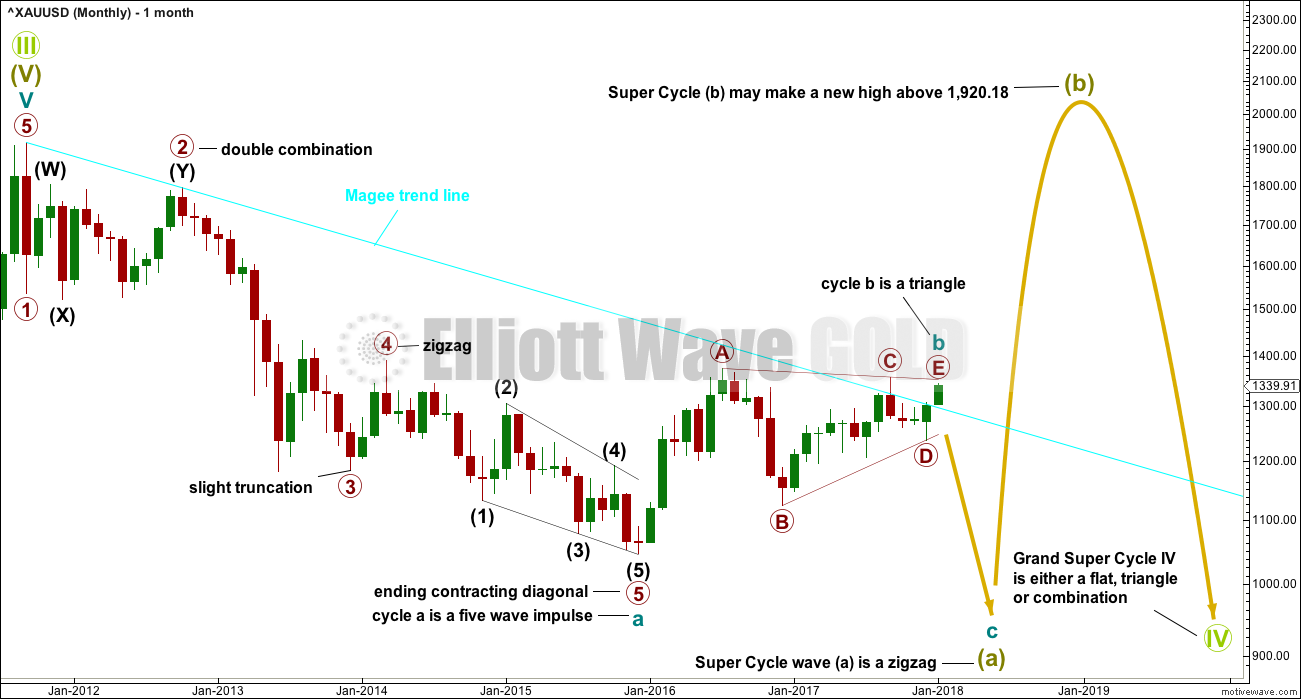

All possibilities are considered, and it is time to step back and look at Elliott wave monthly charts.

Summary: The main wave count expects a trend change to a new bear market to last one to several years, and the target is 470. However, for confidence in this view, first a new low below 1,324.93 and then a breach of the Elliott channel on the hourly charts by downwards movement is required.

A new alternate expects overall upwards movement from here. It would be confirmed if price makes a new high reasonably above 1,357.09.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

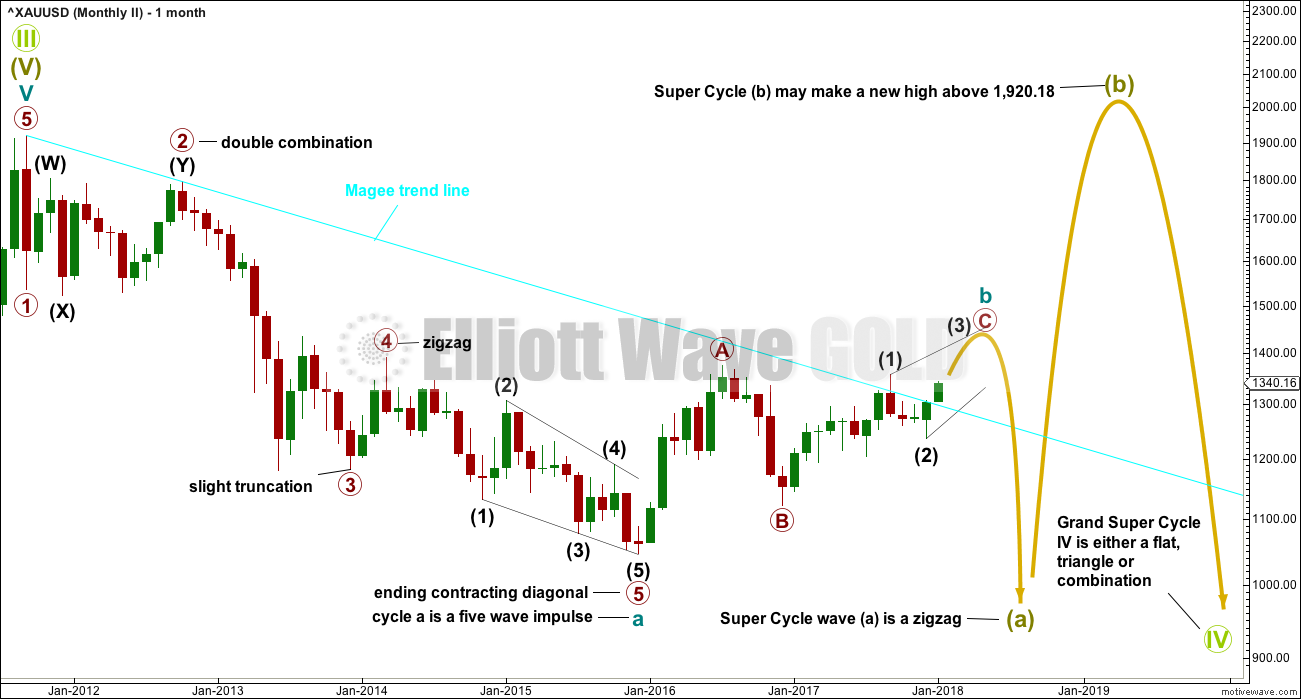

MAIN ELLIOTT WAVE COUNT

MONTHLY CHART

The main wave count will look at the large downwards wave from the all time high as a five wave impulse. For this main wave count, it will be labelled as cycle wave a, within a zigzag for Super Cycle wave (a).

It is also possible to move the degree of labelling up one degree and see this as a five wave structure complete for Super Cycle wave (a).

Both degrees of labelling would be valid, but in the interests of keeping charts and ideas to a manageable level only one shall be published at this stage. The difference will not be material for at least a year and probably more.

If cycle wave a is a five, then cycle wave b may not move beyond its start above 1,920.18.

Cycle wave b may be any one of more than 23 possible corrective structures. This main wave count considers the possibility of a regular contracting triangle, which may now be complete.

Cycle wave c would most likely reach about equality in length with cycle wave a.

If this wave count unfolds as expected, then a huge zigzag downwards may be complete when cycle wave c completes. That would then be expected to be followed by a huge three wave structure upwards, most likely another zigzag for Super Cycle wave (b), which may make a new all time high.

The larger structure for Grand Super Cycle wave (IV) would be starting out with a huge zigzag downwards, indicating either a flat, triangle or combination.

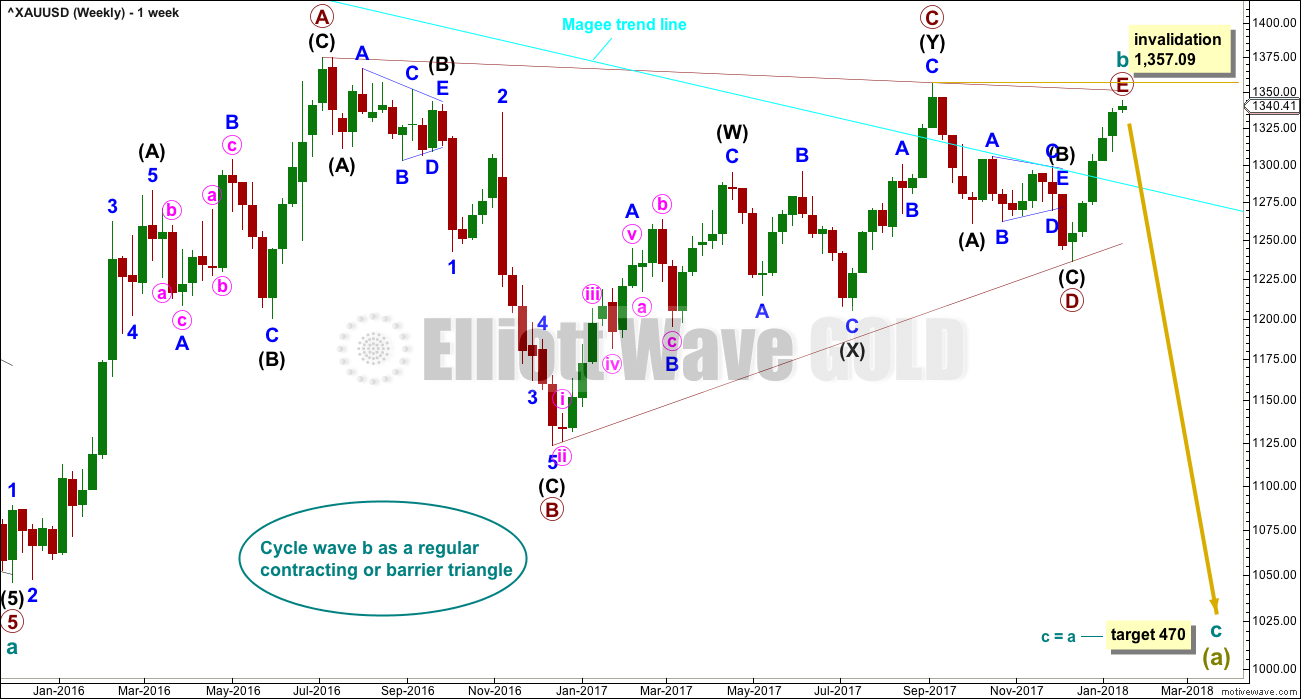

WEEKLY CHART

All main wave counts expect that Gold completed a large five down from the all time high in November 2011 to the low of December 2015, which is seen on the left hand side of both weekly charts.

If this analysis is correct, then the five down may not be the completion of the correction. Corrective waves do not subdivide as fives; they subdivide as threes. The five down is seen as cycle wave a within Super Cycle wave (a).

Cycle wave b began in December 2015.

It looks unlikely that cycle wave b may have been over at the high labelled primary wave A. Primary wave A lasted less than one year at only 31 weeks. Cycle waves should last one to several years and B waves tend to be more time consuming than other Elliott waves, so this movement would be too brief for cycle wave b.

This wave count looks at cycle wave b to be most likely a regular contracting triangle.

All sub-waves must subdivide as threes within an Elliott wave triangle, and four of the five sub-waves must be zigzags or multiple zigzags, and the most common sub-wave to be a multiple is wave C. Only one sub-wave may be a more complicated multiple. This triangle meets all these rules and guidelines; all subdivisions fit perfectly at all time frames. It is the main wave count for these reasons, and thus is judged to have the highest probability.

The triangle trend lines have a normal looking convergence. Primary wave D now looks fairly likely to be complete, and it looks like an obvious three wave structure at the weekly chart level.

While primary wave E should also most likely look like an obvious three wave structure at the weekly and daily chart levels, it does not have to do this. It is possible that primary wave E could be over, falling reasonably short of the A-C trend line and being relatively quick. E waves of triangles can often be the quickest of all triangle waves.

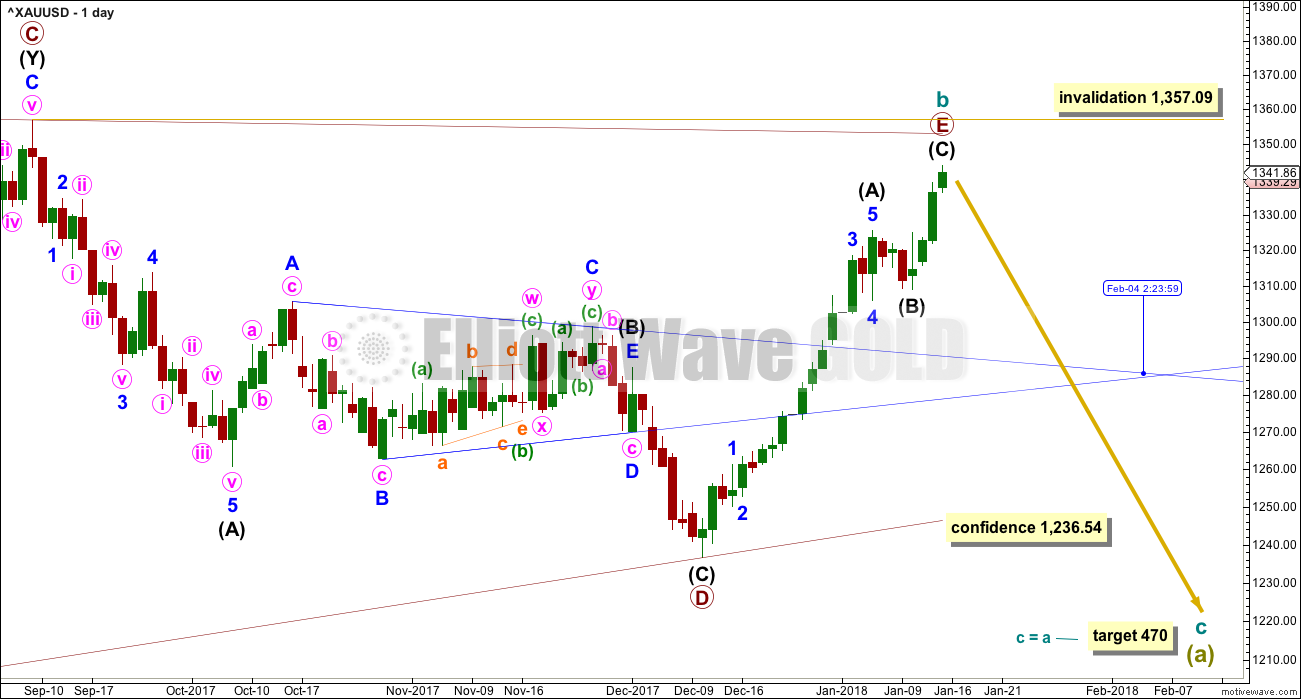

DAILY CHART

This first wave count follows on directly from the weekly chart above. It looks at primary wave E as a single zigzag. Zigzags subdivide 5-3-5.

It is possible again today that the zigzag for primary wave E may be complete. It looks like a zigzag at the daily chart level. E waves of triangles can be surprisingly quick. A very good example of this is here on this daily chart: the triangle labelled intermediate wave (B) within primary wave D also came to a quicker than expected end.

The target calculated for cycle wave c assumes the most common Fibonacci ratio to cycle wave a.

If primary wave E continues higher, it may not move beyond the end of primary wave C above 1,357.09. A new high by any amount at any time frame would immediately invalidate this wave count.

HOURLY CHART

Primary wave E may still be seen as a completed zigzag. Intermediate wave (C) may be a completed five wave impulse.

With a little more upwards movement to begin the week, there is now a Fibonacci ratio at intermediate degree and a Fibonacci ratio at minor degree within intermediate wave (C).

A new low below 1,324.93 would add a little confidence in this wave count. A clear breach of the black Elliott channel by downwards movement is required for reasonable confidence.

While price remains within the channel, accept the possibility that it may continue higher.

ALTERNATE HOURLY CHART

The labelling here for intermediate wave (C) is different to the main hourly wave count.

Minor wave 3 may have been over at the last high.

Minor wave 4 may not move into minor wave 1 price territory below 1,324.93.

The invalidation / confirmation point remains the same.

The target would see primary wave E overshoot the A-C trend line on the daily chart, but the wave count would remain valid.

SECOND WAVE COUNT

MONTHLY CHART

This second wave count is the same as the first main wave count up to the low labelled cycle wave a. It sees the large wave down as a completed five.

Thereafter, it looks at a different possible structure for cycle wave b. Cycle wave b may be a single zigzag.

WEEKLY CHART

If cycle wave b is a single zigzag, then the upwards wave labelled here primary wave A must be seen as a five wave structure. But this is problematic because (within primary wave A) intermediate wave (4) lasted 12 weeks whereas intermediate wave (2) only lasted 2 weeks. While disproportion between corrective waves does not violate any Elliott wave rules, it does give a wave count the wrong look.

Gold is typical of commodities in that it often exhibits swift strong fifth waves, leading to blowoff tops in bull markets and selling climaxes in bear markets. This tendency is most often seen in Gold’s third waves. When this happens the strong fifth wave forces the fourth wave correction that comes before it to be more brief and shallow than good proportion to its counterpart second wave would suggest. When this happens the impulse has a curved three wave look to it at higher time frames.

It is acceptable for a wave count for a commodity to see a curved impulse which has a more time consuming second wave correction within it than the fourth wave correction.

The impulse has a more time consuming fourth wave than the second in this case though, giving the wave the look of a zigzag. This is unusual, and so the probability of this wave count is low.

Low probability does not mean no probability, so this wave count is possible; when low probability outcomes do occur, they are never what was expected as most likely.

Primary wave C must subdivide as a five wave structure, either an impulse or an ending diagonal. Because the upwards wave of intermediate wave (1) fits as a zigzag and will not fit as an impulse, an ending diagonal is considered.

Ending diagonals require all sub-waves to subdivide as zigzags.

Within intermediate wave (1), to see this wave as a zigzag, minor wave B is seen as a double flat correction. In my experience double flats are extremely rare structures, even rarer than running flats. The rarity of this structure further reduces the probability of this wave count.

Intermediate wave (3) must move beyond the end of intermediate wave (1) above 1,357.09.

THIRD WAVE COUNT

WEEKLY CHART

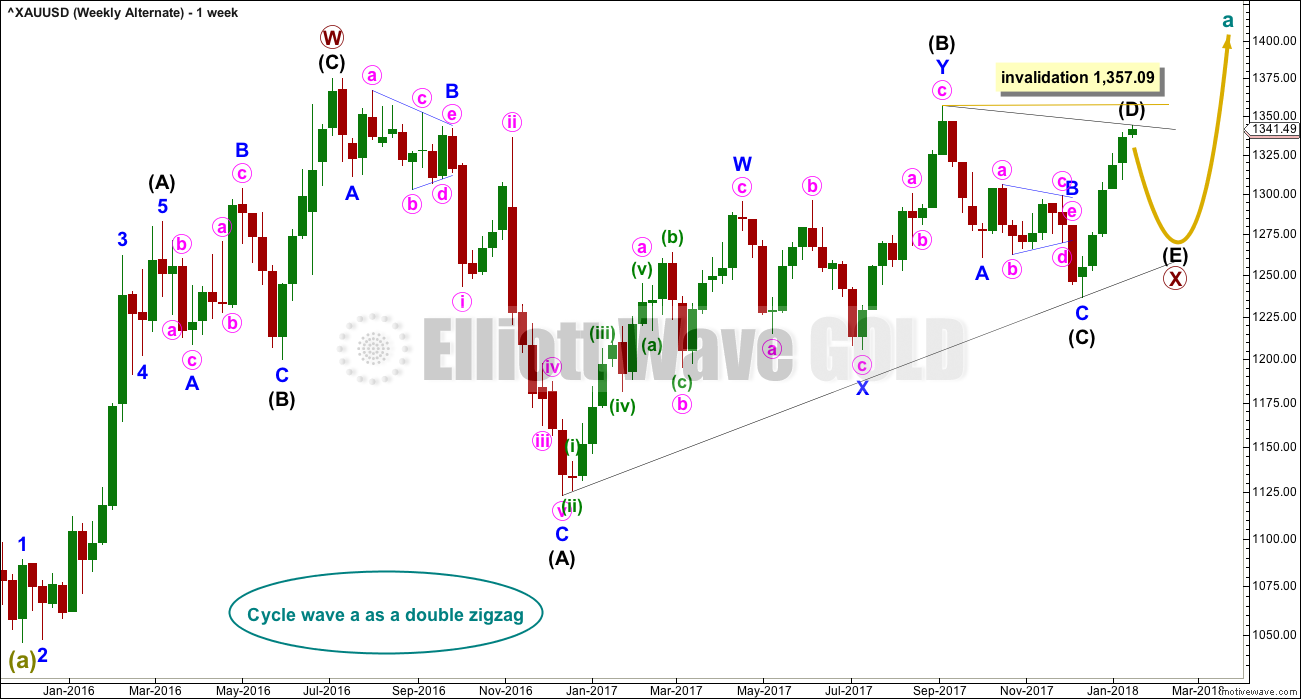

Cycle wave a is still seen as a completed five wave structure. This third wave count looks at cycle wave b as a possible double zigzag.

A triangle may be completing as an X wave within a double zigzag for cycle wave b.

Now the upwards wave labelled here primary wave W is seen as a zigzag. This has a better fit than the first alternate.

Within the triangle for primary wave X, intermediate waves (A) through to (C) may be complete. Intermediate wave (D) may also be complete, but there is room for it to still move higher. If the triangle for primary wave X is a regular contracting triangle, then intermediate wave (D) may not move beyond the end of intermediate wave (B) above 1,357.09. If the triangle is a barrier triangle, then intermediate wave (D) should end about the same level as intermediate wave (B), so that the (B)-(D) trend line remains essentially flat. In practice, this means that intermediate wave (D) may end slightly above 1,357.09 and this wave count would remain valid.

This is why a new high reasonably above 1,357.09 only would invalidate this wave count. This invalidation point is not black and white.

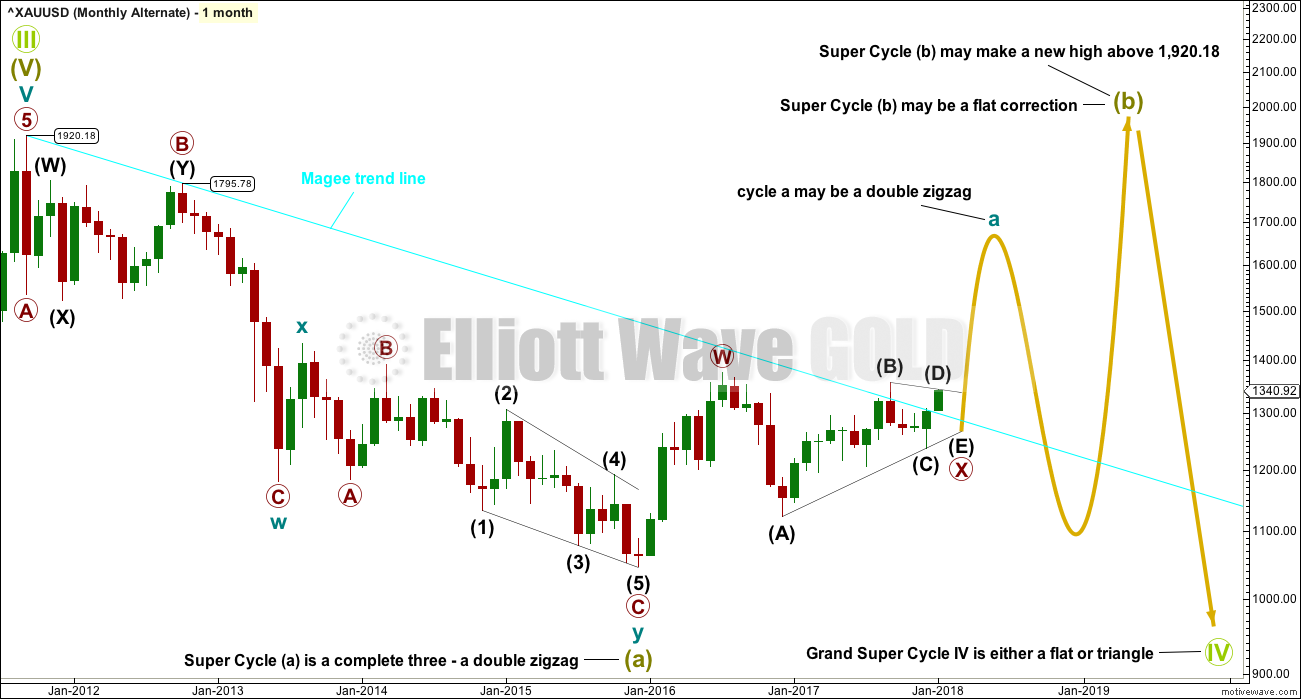

ALTERNATE ELLIOTT WAVE COUNT

MONTHLY CHART

The large wave down from September 2011 to November 2015 may also be seen as a three wave structure, a double zigzag.

If the big wave down is a multiple three wave structure, then Grand Super Cycle wave (IV) may be either a flat or triangle. It may not be a combination because they may not have multiples within multiples.

If Grand Super Cycle wave (IV) is a flat correction, then within it Super Cycle wave (b) must retrace a minimum 0.9 length of Super Cycle wave (a) at 1,832.79.

If Grand Super Cycle wave (IV) is a triangle, then there is no minimum requirement for Super Cycle wave (b). There is only the structural requirement that it should be a three wave structure.

Super Cycle wave (b) would most likely be a single or multiple zigzag and would most likely be reasonably deep.

If cycle wave a within Super Cycle wave (b) is a three wave structure, then Super Cycle wave (b) may be a flat correction. It could also be a triangle, but that would not be able to meet the expected depth.

WEEKLY CHART

If a double zigzag is unfolding upwards, then within it primary wave X may be a triangle.

This alternate is the same as the third weekly chart for the main wave count for the short to mid term.

The second wave count for the main wave count would work here in exactly the same way. Cycle wave a may also be a single zigzag.

TECHNICAL ANALYSIS

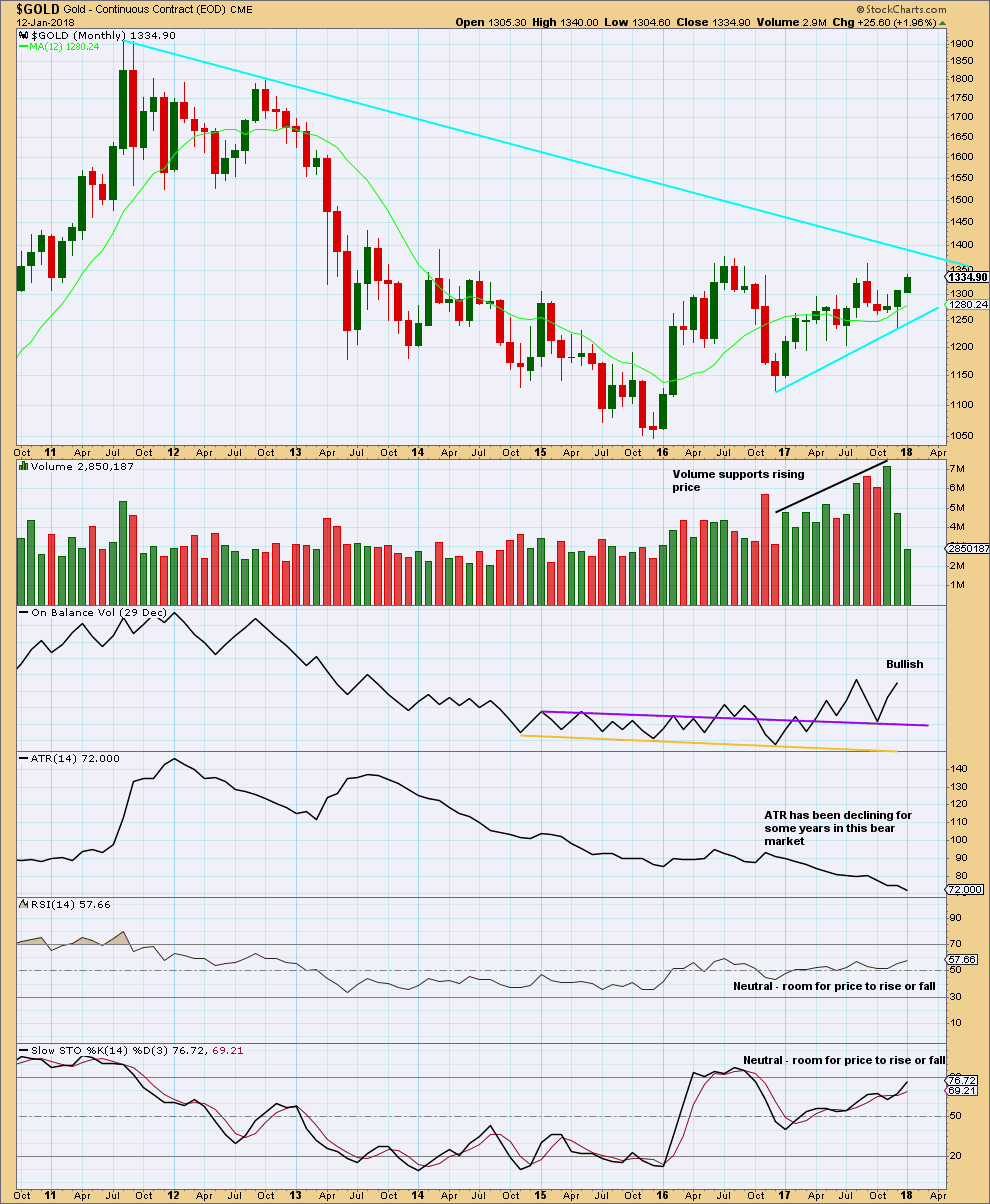

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Notice that the cyan Magee bear market trend line is not breached with Stock Charts data. Both Stock Charts and my Motive Wave use a semi-log scale, but there appears to be a slight difference in the two. For confidence in a trend change, this line should be breached on both sets of data.

This chart is fairly bullish. It is concerning though that ATR is still declining.

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Now that price has again broken above resistance at 1,305 to 1,310, that area may now provide support. Next resistance is about 1,345.

Stochastics is added this week. Price is range bound in a weekly level consolidation. As price swings from resistance to support and back again, Stochastics may be used to assist to see where each swing may end and the next begin. Price is nearing resistance at 1,345 and Stochastics is just entering overbought. It looks reasonable to expect the upwards swing to end soon; there is a little room for price to rise still.

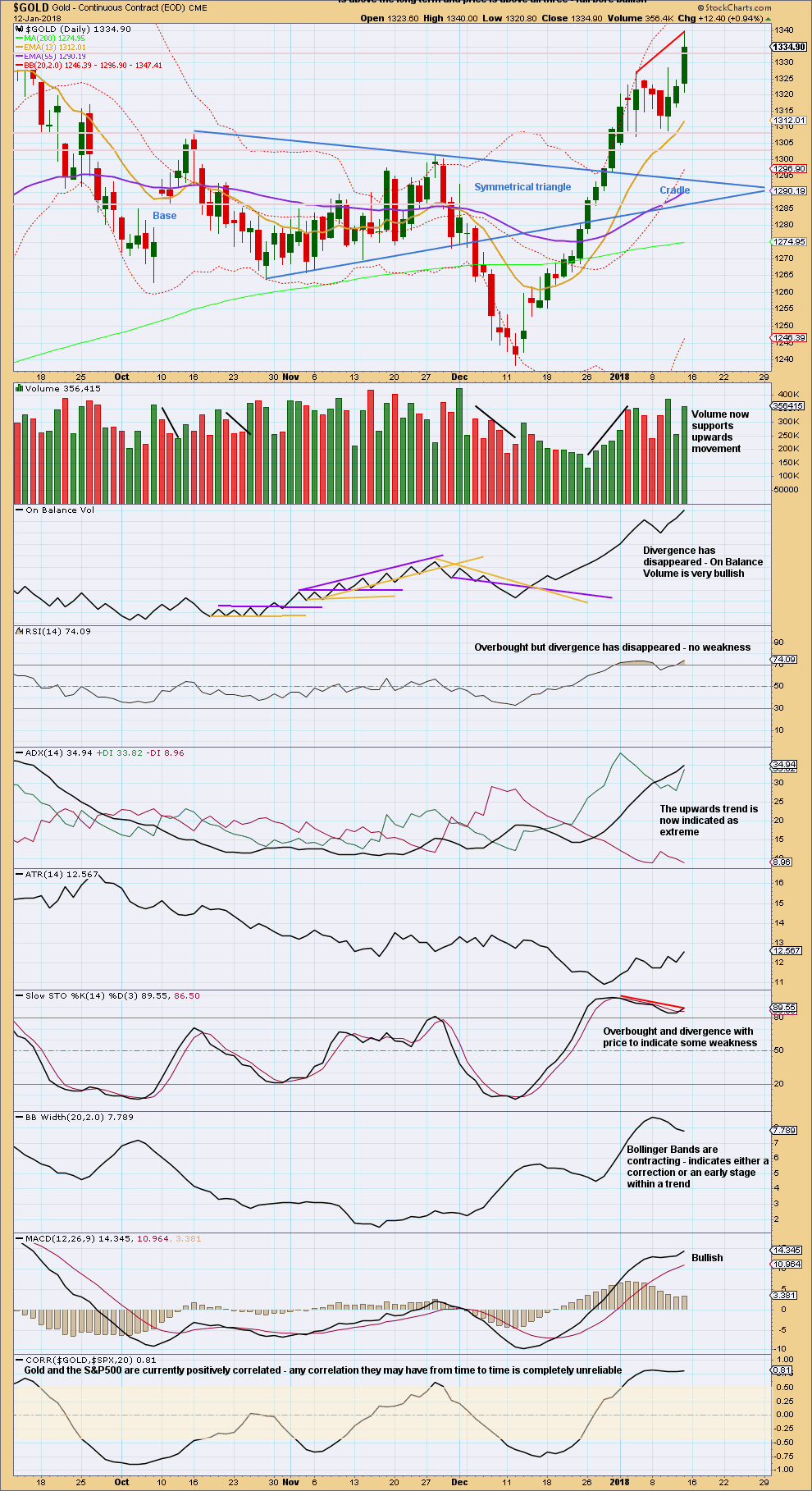

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Because New York is closed for Monday (Martin Luther King public holiday) and Stock Charts give NY session only data, this daily analysis cannot be updated until New York opens again.

Next resistance is on the weekly chart about 1,345.

Divergence with RSI has simply disappeared. RSI is overbought, but it can remain so for a reasonable length of time when Gold has a strong bull trend.

Stochastics is overbought and exhibits clear divergence with price, but this can develop further into multiple divergence before the bull trend ends.

ADX indicates the trend is extreme, but this can persist for reasonable periods of time when Gold has a strong bull trend.

There is room still for price to rise further.

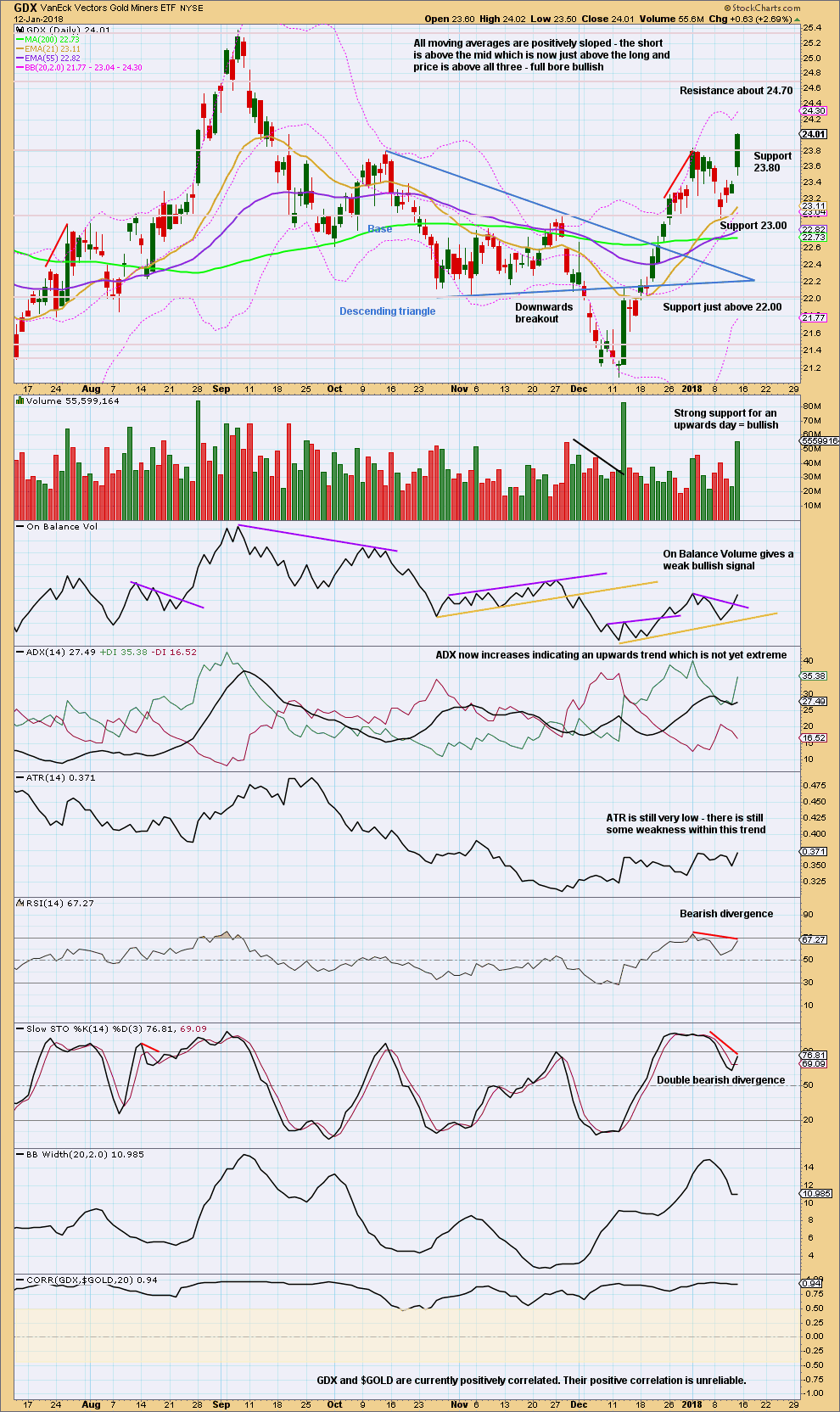

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price has broken above resistance with support from volume. Next resistance is about 23.70.

However, for GDX there is weakness exhibited by divergence in both RSI and Stochastics. This may yet disappear, but for now it exists.

The bullish signal given by On Balance Volume is weak because the trend line breached on Friday is short held, reasonably sloped and tested only twice before.

Published @ 08:26 p.m. EST.

I hope that this analysis has answered the questions posed a day or so ago about the big wave down to the low in end November 2015.

I am also hoping that I’ve made the EW situation as clear as I can for the monthly chart level.

If any members are still confused please post your questions and I’ll do my best to answer them.

Although price has moved lower today, we still do not have either of the two conditions met for confidence in a trend change.

So this analysis is still at an uncertain point right now.

Updated main hourly chart:

Updated alternate hourly chart:

Wow!!!

Please add this post and the video to gold historical 👍 ☺️

Dreamer: Agree with you. This is indeed a very comprehensive E/W analysis. A masterpiece! Simply superb. Lucky (privileged) those of us who are subscribed here. Thank you Lara.

I agree. This post belongs on Historical page as well . Thanks Lara!!

Although I do not know If will be alive when Super cycle wave V begins.

All those left behind enjoy golds impulsive ride after wave IV is complete!!!

May be Lara will write about to those new young one about our frustration.

They deserve a lough our sufferung.

I’ve added it to historical, thanks guys for the reminder.

That took ages yesterday. It’s actually kinda confusing, these large corrections. If this is Grand Super Cycle degree then it’s still not halfway done. And that point in time for a fourth wave correction usually sees multiple structural options open….

I wish I wish Gold was just in a simple impulse up, like the S&P is. That would make my job and your profits so much easier.

2nd Nat Gas Idea

https://www.tradingview.com/x/pKmwmuN7/

and this looks like an excellent alternate idea….

not sure I really like the look of X though; technically that would be a double ZZ, but the second ZZ hasn’t deepened the correction, its the equivalent of truncated

Yep. I saw that truncation on the (Y) of X wave. I knew you would catch it. The only other thing I see is a really brief X wave (complete where I have (W) labeled). Then the move down could be complete at the 2016 low. We would need to see the current sideways correction during 2017 / 2018 turn out to be something other than a triangle so that it could be a 2nd wave for a new bull move up to continue much higher. Thanks again!

Lara, thanks for the monthly chart updates. I’ll take some time to study them.

Recently I’ve been trading Natural Gas. I’m trying to determine the longer term weekly pattern and whether or not a move to new lows is in play over the next year.

One thing that I struggle with is that Trading View data only goes back to 2003. I think StockCharts goes back to 1992 if you want to look at that. I have 2 ideas that I will post. If you could please give me your thoughts on them it would be much appreciated. Thank You.

https://www.tradingview.com/x/xL6bCYhw/

This ending diagonal looks really good Dreamer. And that resistance line looks pretty strong too.

Thank you Lara. I appreciate the feedback!