Price continued higher towards the target, which was at 61.42, but this has been exceeded now by 2.11.

Summary: The target for upwards movement to end is now at 67.86. If this target is wrong, it may now be too high.

New updates to this analysis are in bold.

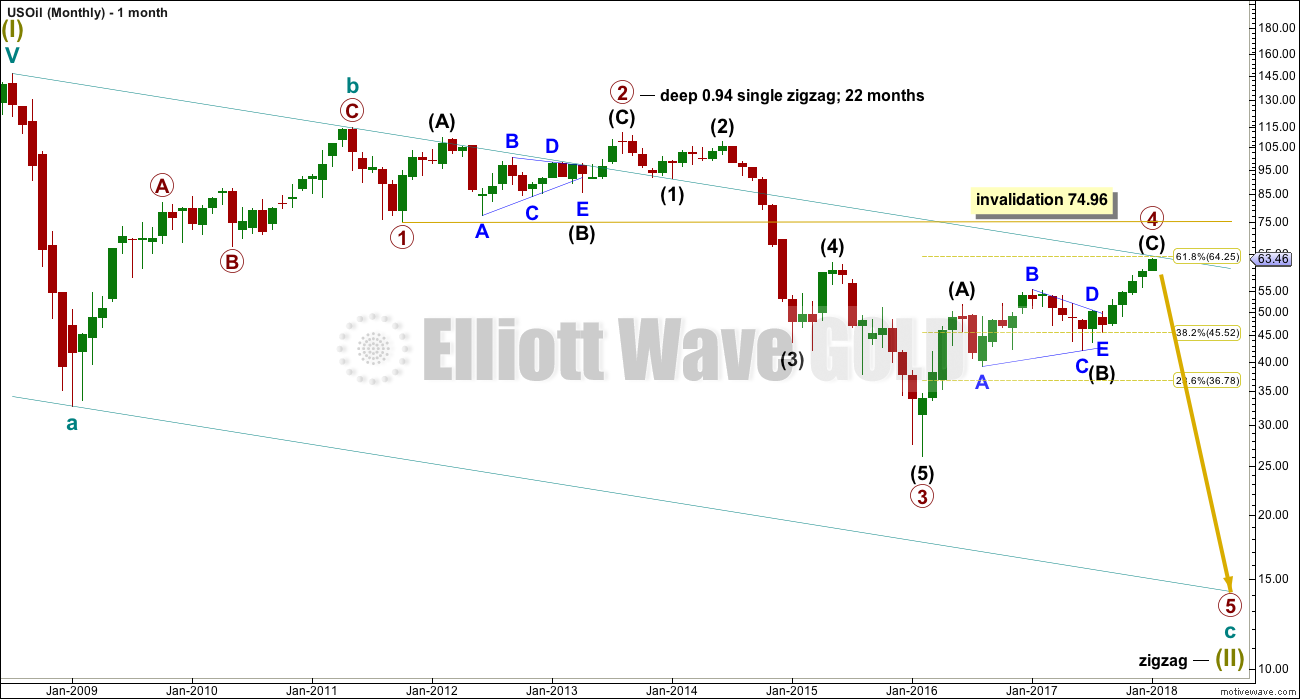

MONTHLY ELLIOTT WAVE COUNT

Within the bear market, cycle wave b is seen as ending in May 2011. Thereafter, a five wave structure downwards for cycle wave c begins.

Primary wave 1 is a short impulse lasting five months. Primary wave 2 is a very deep 0.94 zigzag lasting 22 months. Primary wave 3 is a complete impulse with no Fibonacci ratio to primary wave 1. It lasted 30 months.

There is alternation in depth with primary wave 2 very deep and primary wave 4 relatively shallow. There is inadequate alternation in structure, both are zigzags. So far primary wave 4 has lasted 23 months. At this stage, there is almost perfect proportion between primary waves 2 and 4.

Primary wave 4 may not move into primary wave 1 price territory above 74.96.

WEEKLY ELLIOTT WAVE COUNT

Intermediate wave (C) must subdivide as a five wave structure, either an impulse or an ending diagonal. Within intermediate wave (C), minor waves 1 through to 3 may now be complete. Minor wave 4 may or may not be complete. It may not move into minor wave 1 price territory below 49.82.

When intermediate wave (C) may again be seen as complete, then a trend change would be expected and a target for primary wave 5 downwards would be calculated. At this stage, for this wave count, a target cannot be calculated for it to end because the start of primary wave 5 is not known.

An Elliott channel is added to this possible zigzag for primary wave 4. A breach of the lower edge of this channel would provide a very strong indication that primary wave 4 should be over and primary wave 5 should be underway.

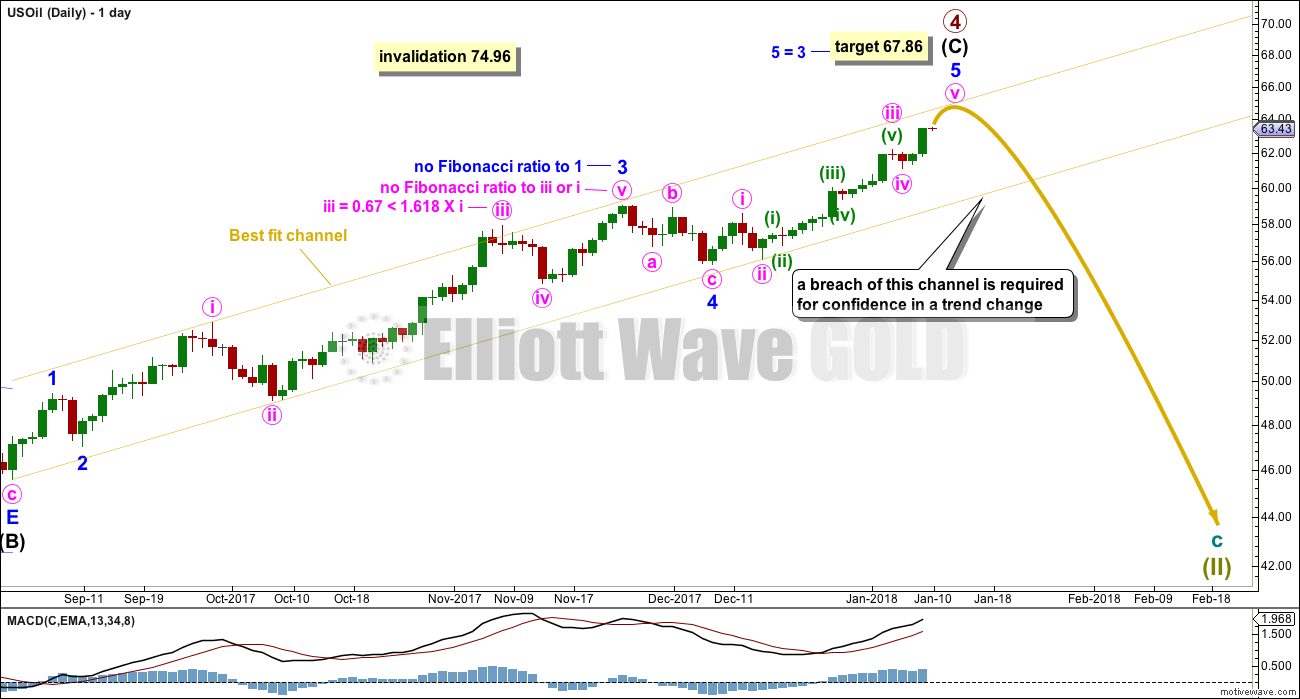

DAILY ELLIOTT WAVE COUNT

Intermediate wave (C) must complete as a five wave structure. For this wave count, it looks like a possible impulse.

Within intermediate wave (C), minor wave 5 has now passed the most likely Fibonacci ratio of equality in length with minor wave 1. The next Fibonacci ratio in the sequence would be 1.618 the length of minor wave 1, which too has been passed.

The next third most likely Fibonacci ratio of equality in length with minor wave 3 is used to calculate a new target.

The structure of minor wave 5 can be seen now as either complete or almost complete. It may end sooner rather than later now.

Always assume that the trend remains the same until proven otherwise. Assume the upwards trend remains intact while price remains within the yellow channel. When the channel is breached by downwards movement, then that shall be the earliest indication of a potential trend change to down.

When the start of primary wave 5 is known, then a target for it to end may be calculated. That cannot be done yet.

TECHNICAL ANALYSIS

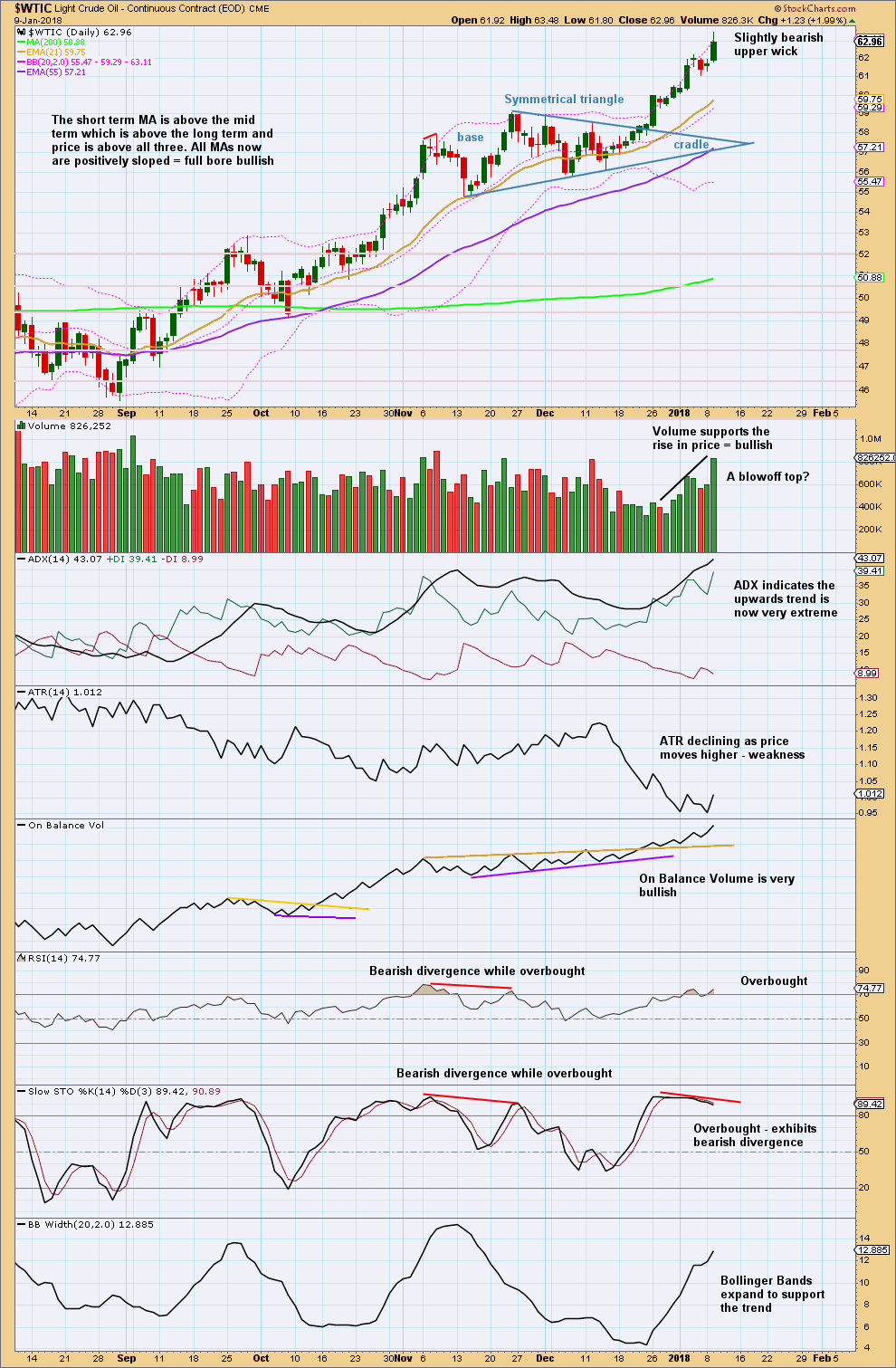

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A target calculated from the triangle using the width of the triangle base of 4.24 and added to the breakout point about 58.30 is at 62.54. That target has been exceeded.

Very extreme ADX, declining ATR, overbought RSI and Stochastics, weakness in Stochastics, and along with a possible blow off top today, all indicate this upwards trend may end here or very soon.

The last three blow off tops on this chart were: the 5th of September, 2017, the 6th of November, 2017, and the 22nd of November, 2017. In all three cases the final high was met one or two days afterwards. Look out for that to possibly happen again here.

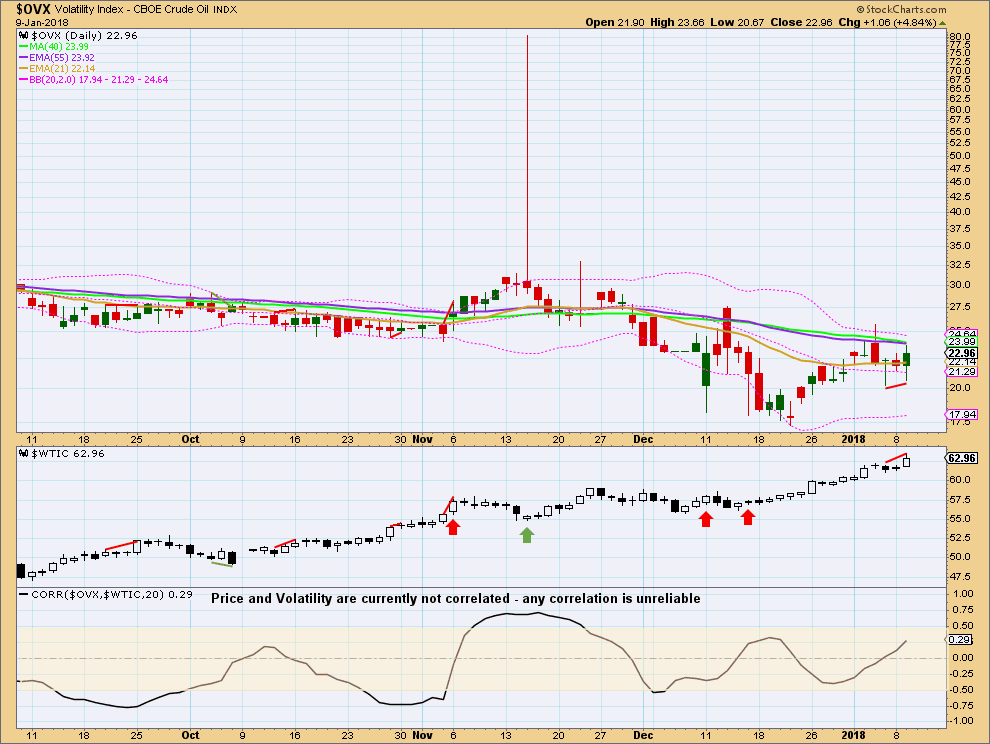

VOLATILITY INDEX

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is short term bearish divergence: price has made a new high, but volatility has not shown a normal corresponding decline. This supports the idea of a high in place here or within a very few days.

Published @ 09:49 p.m. EST.

Must be close to a top. Sentiment @ 95 is unsustainable

That’s a really nice summary table dreamer. Is it direct from MBH or is it compiled by someone else?

As to whether we’ve seen the final top, I’m not so sure yet. Monday/Tuesday will probably be good for a ‘C’ wave down but I’m waiting for the action after that to be sure.

PS Just seen the post under my name. I’m ‘johno’ of prior posts. Seems to revert after periods of not posting.

It’s from

http://tag618.com

That’s the only place I’ve found to get DSI data free.

Lara can fix your moniker if desired. 🙂

Oil has not printed an upper wick of today’s length in a very long time… can’t see one in a last 12 month charts. Looks ripe for a reversal here…

Thank you