Price is moving slowly higher as last analysis expected it to.

Summary: Price is at support. For the short term, a new high above 1,327.81 and then above the yellow best fit channel would indicate an end to the downwards swing and the start of a new upwards swing. An upwards swing here may make a new high above 1,365.68.

The target is at 1,286 if the downwards swing continues.

The mid term picture still expects that Gold is within a B wave correction which may continue for several weeks.

Only a new low below 1,236.54 would signal a strong bear market for Gold.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last in-depth historic analysis with monthly and several weekly charts is here, video is here.

There are multiple wave counts at this time at the weekly and monthly chart levels. In order to make this analysis manageable and accessible only two will be published on a daily basis, one bullish and one bearish. This does not mean the other possibilities may not be correct, only that publication of them all each day is too much to digest. At this stage, they do not diverge from the two possibilities below.

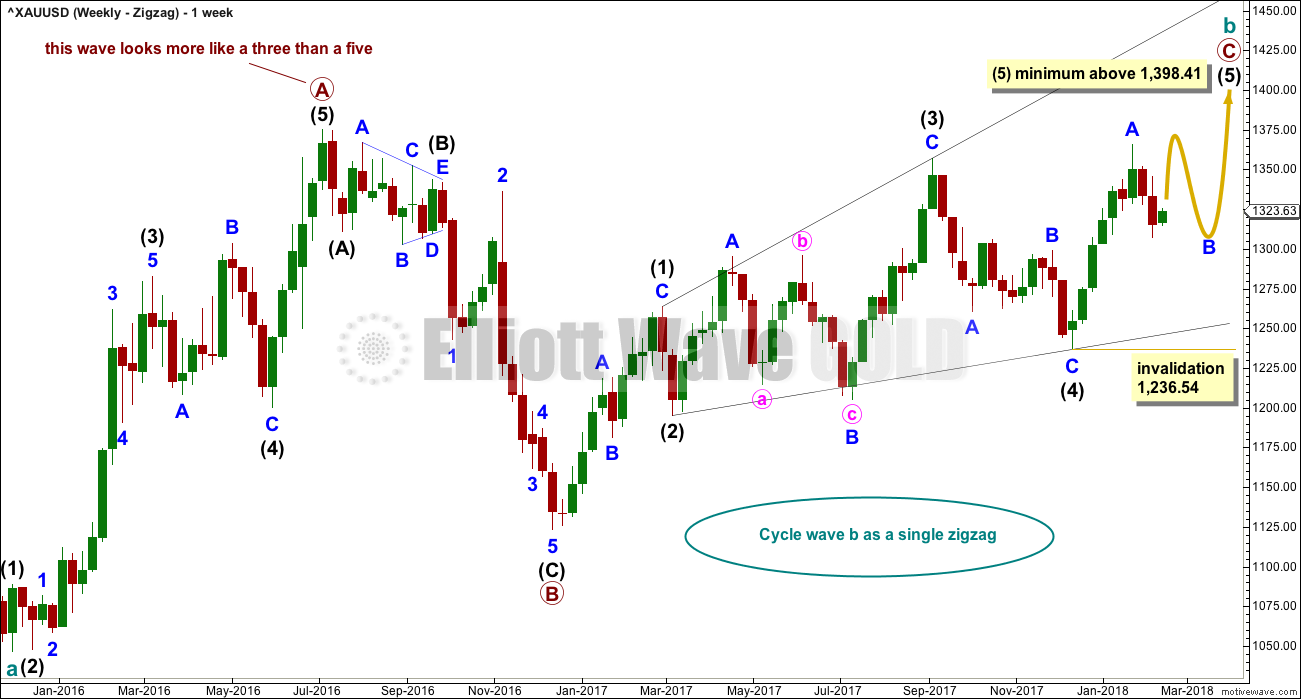

BULLISH ELLIOTT WAVE COUNT

FIRST WEEKLY CHART

Cycle wave b may be a single zigzag. Zigzags subdivide 5-3-5. Primary wave C must subdivide as a five wave structure and may be either an impulse or an ending diagonal. Overlapping at this stage indicates an ending diagonal.

Within an ending diagonal, all sub-waves must subdivide as zigzags. Intermediate wave (4) must overlap into intermediate wave (1) price territory. This diagonal is expanding: intermediate wave (3) is longer than intermediate wave (1) and intermediate wave (4) is longer than intermediate wave (2). Intermediate wave (5) must be longer than intermediate wave (3), so it must end above 1,398.41 where it would reach equality in length with intermediate wave (3).

Within the final zigzag of intermediate wave (5), minor wave B may not move beyond the start of minor wave A below 1,236.54.

Within intermediate wave (1), the correction labelled minor wave B was over within one week. Within intermediate wave (2), the correction labelled minor wave B was too quick to be seen on the weekly chart. Within intermediate wave (3), the correction labelled minor wave B was over in 12 weeks, one short of a Fibonacci 13. Within intermediate wave (4), the correction labelled minor wave B was over in a Fibonacci 8 weeks. As each actionary wave is extending in time as well as price, the correction of minor wave B within intermediate wave (5) may be longer than that within intermediate wave (3). At this early stage, a Fibonacci 13 or possibly even 21 weeks may be expected. This expectation is a rough guideline; flexibility is essential when B waves unfold.

This first weekly chart sees the upwards wave labelled primary wave A as a five wave structure. It must be acknowledged that this upwards wave looks better as a three than it does as a five. The fifth weekly chart below will consider the possibility that it was a three.

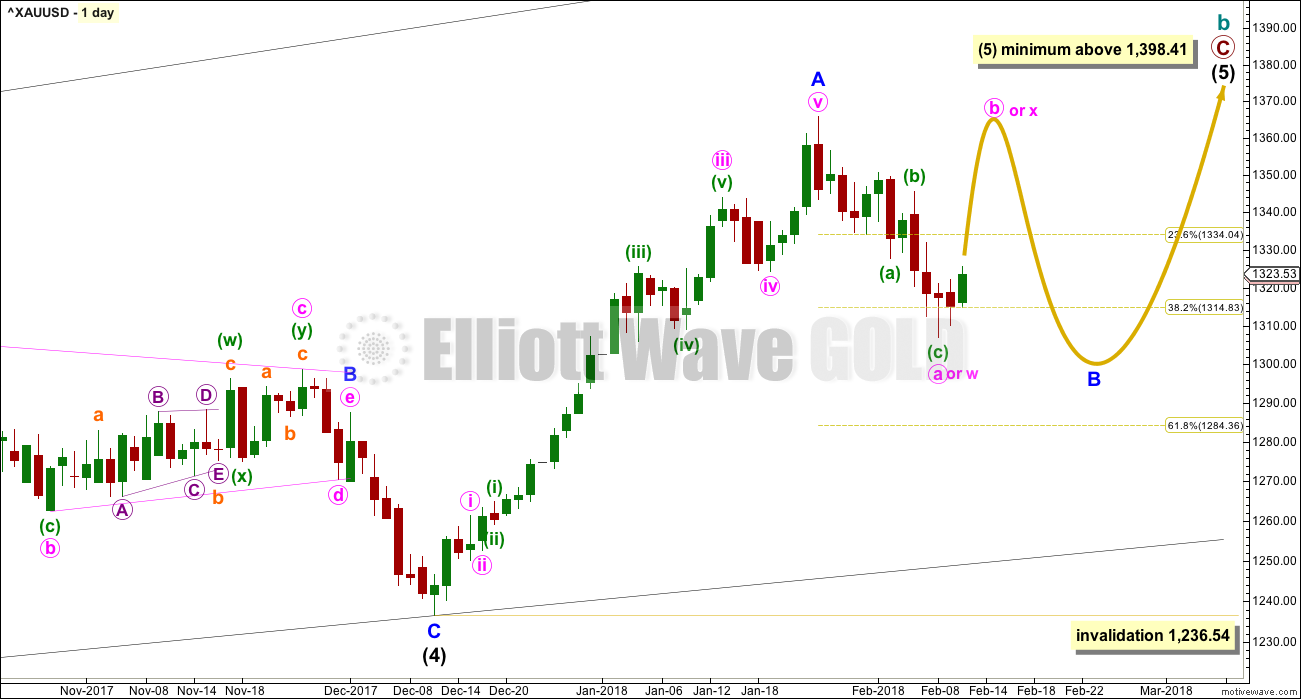

FIRST DAILY CHART

Within the ending diagonal, intermediate wave (5) must sub-divide as a zigzag.

Minor wave B may be a reasonably time consuming consolidation or a quicker sharper pullback within the upwards trend, and it may end about either of the 0.382 or 0.618 Fibonacci ratios (neither may be favoured).

There are more than 23 possible structures that minor wave B may take, and it is impossible until close to or at the end to have confidence which structure has unfolded. When B waves unfold, it is essential that analysis is flexible. B waves are analogous to either range bound consolidations or sharp corrections. As minor wave B unfolds, the labelling on the hourly chart for its sub-waves will change and alternates will be required from time to time.

The yellow arrow outlines the possible pathway for a flat or combination. These corrections are analogous to sideways range bound consolidations. Within both a flat and consolidation, minute wave b or x may make a new high above the start of minute wave a or w at 1,365.68.

Minor wave B may still be a triangle or zigzag. All possibilities must still be considered.

Minor wave B may not move beyond the start of minor wave A below 1,236.54.

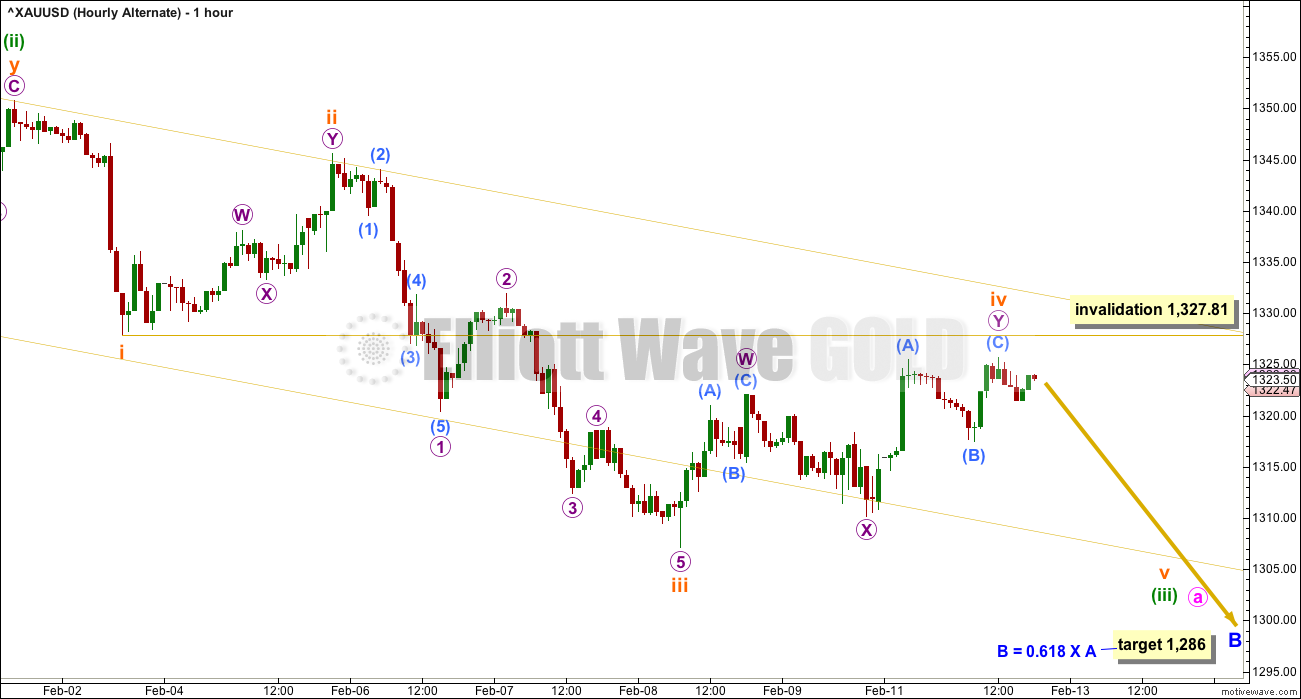

HOURLY CHART

Classic technical analysis still favours this first hourly chart. If an upwards swing is beginning about here, then this wave count expects it to be a B wave within a B wave, as minute wave b within minor wave B. The upwards swing for minute wave b would be expected to exhibit weakness in volume and divergence with indicators at its end. Weak volume today favours this wave count.

A zigzag downwards may be complete, which may be minute wave a. Within the zigzag, there is an excellent Fibonacci ratio between minuette waves (a) and (c).

If minute wave a has subdivided as a zigzag, then minor wave B may be any one of either a flat, triangle, combination or double zigzag.

Within flats and combinations, minute wave b or x may be very deep. Within a flat correction, minute wave b must retrace a minimum 0.9 length of minute wave a.

Within a triangle, there is no minimum requirement for minute wave b, but it does need to subdivide as a three wave structure.

All of a flat, combination or triangle would see price continue to find support here about 1,310 to 1,305, at least for the short to mid term.

Within a double zigzag, minute wave x should be relatively brief and shallow. (Note: A double zigzag would not follow the pathway of the yellow arrow here.)

Minute wave b or x may be beginning with a five up. If labelling of movement from the low of minute wave a is correct, then there may now be three overlapping first and second waves. This indicates some increase in upwards momentum over the next day or so.

ALTERNATE HOURLY CHART

An impulse downwards may be continuing. This may be minute wave a within a zigzag for minute wave b.

The middle of the impulse may have passed. If this is correct, then subminuette wave iv may now not move into subminuette wave i price territory above 1,327.81.

Both of subminuette waves ii and iv are here labelled as double zigzags, so there is no alternation in structure. This reduces the probability of this wave count today.

When minute wave a completes, then minute wave b should unfold. Minute wave b may be a quick sharp bounce, or it may be a very complicated time consuming sideways movement. It may not move beyond the start of minute wave a.

The final target for minor wave B for this wave count would now most likely be the 0.618 Fibonacci ratio of minor wave A at 1,286.

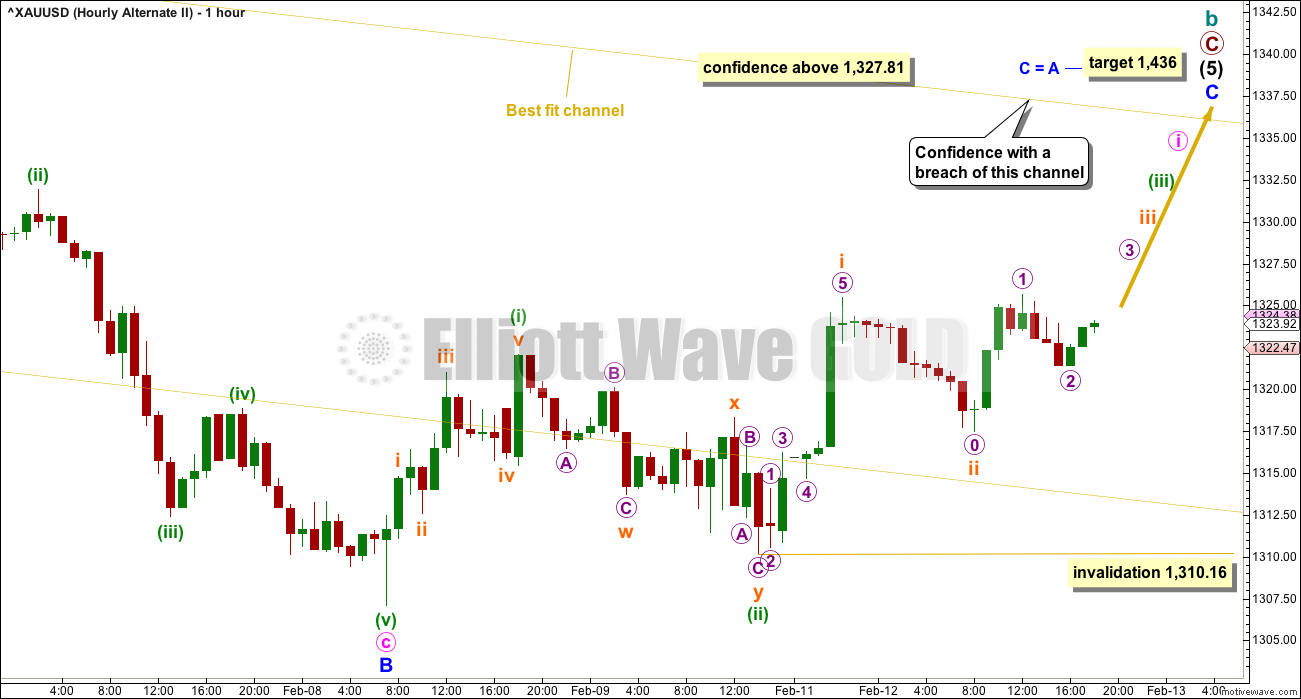

SECOND ALTERNATE HOURLY CHART

If a zigzag downwards is complete, then the possibility that minor wave B may be over in its entirety must be considered.

If price makes a new high above 1,327.81 and breaks above the yellow channel, then both the first hourly chart and this second alternate hourly chart will be valid.

If upwards movement shows strength, then this wave count may be favoured.

BEARISH ELLIOTT WAVE COUNT

FIFTH WEEKLY CHART

There were five weekly charts published in the last historic analysis. This fifth weekly chart is the most immediately bearish wave count, so this is published as a bearish possibility.

This fifth weekly chart sees cycle wave b as a flat correction, and within it intermediate wave (B) may be a complete triple zigzag. This would indicate a regular flat as intermediate wave (B) is less than 1.05 the length of intermediate wave (A).

If cycle wave b is a flat correction, then within it primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. The most common length of B waves within flats is from 1 to 1.38 times the length of the A wave. The target calculated would see primary wave B end within this range.

I have only seen two triple zigzags before during my 10 years of daily Elliott wave analysis. If this wave count turns out to be correct, this would be the third. The rarity of this structure is identified on the chart.

TECHNICAL ANALYSIS

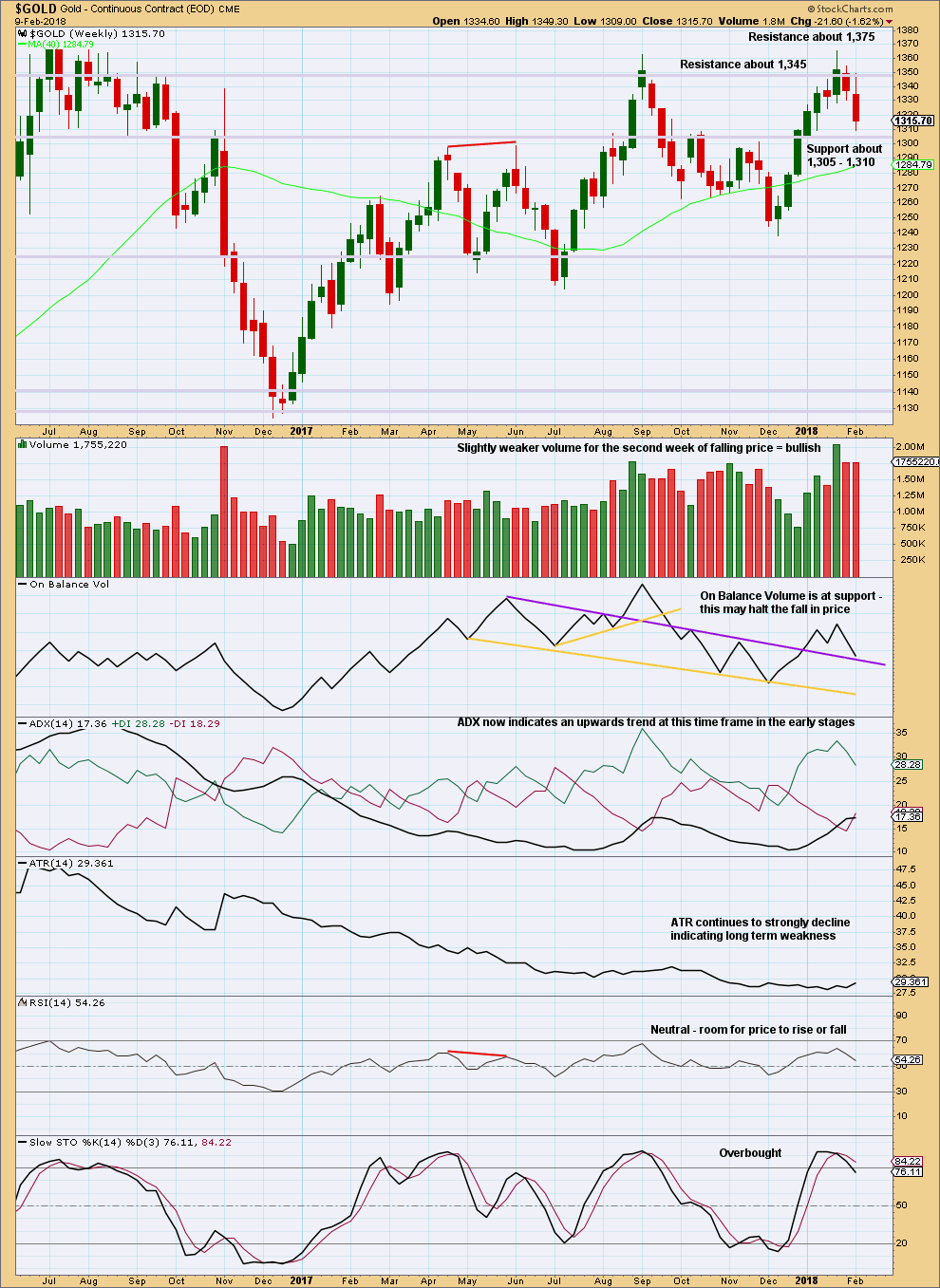

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support for price about 1,310 – 1,305 and support for On Balance Volume may halt the fall in price here.

However, RSI and Stochastics indicate there is plenty of room for price to fall further. If support about 1,310 – 1,305 gives way, then next support is about 1,225.

A breakout above 1,375 on a day with strong volume would have to occur for the bullish case to have strong confidence.

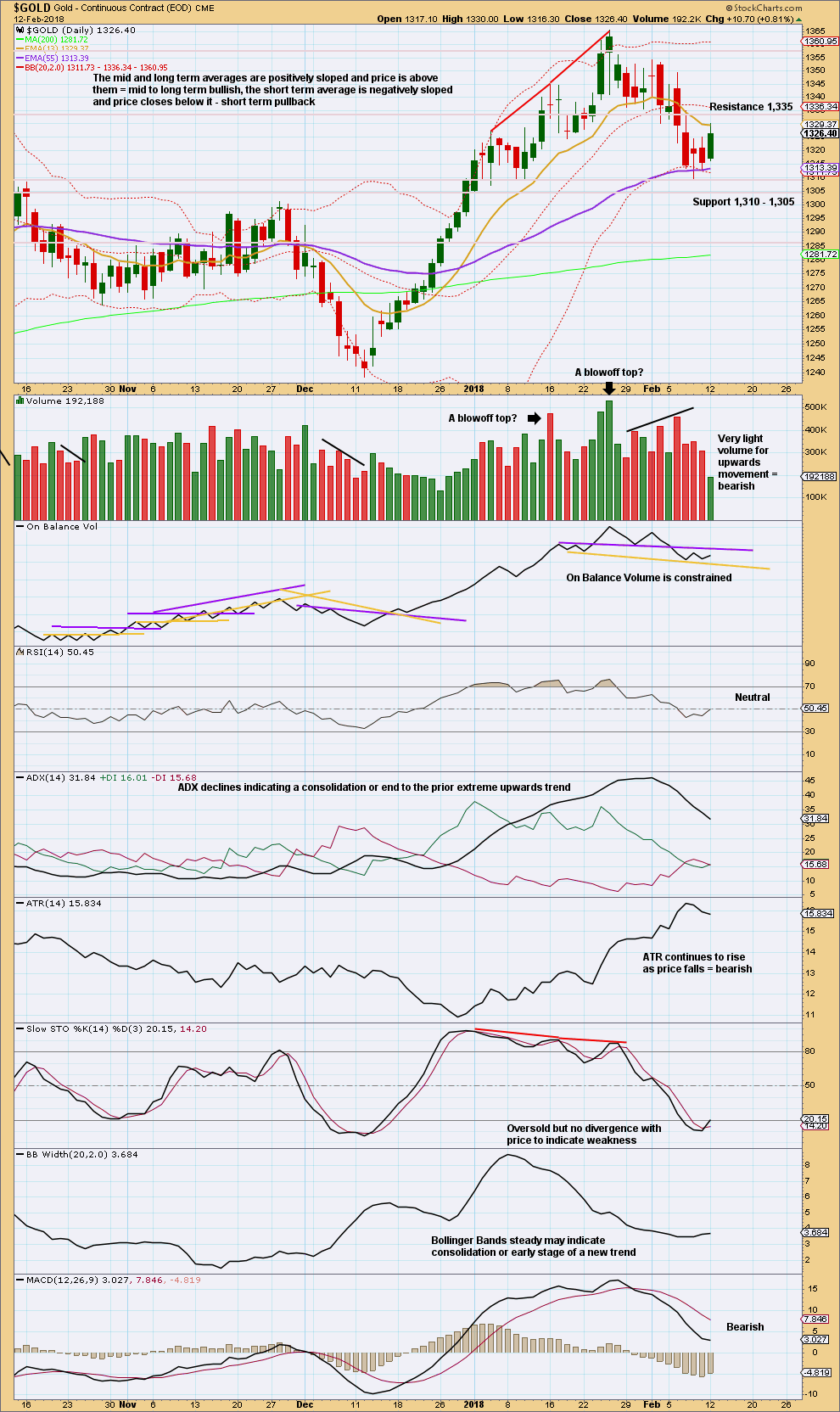

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Weak volume today favours the first hourly chart and alternate hourly chart. This may be a slow start to an upwards swing from support, or it may be a small consolidation within an ongoing downwards trend.

ADX still does not indicate a trend. On Balance Volume is still constrained.

This chart is mixed but still slightly more bearish than bullish.

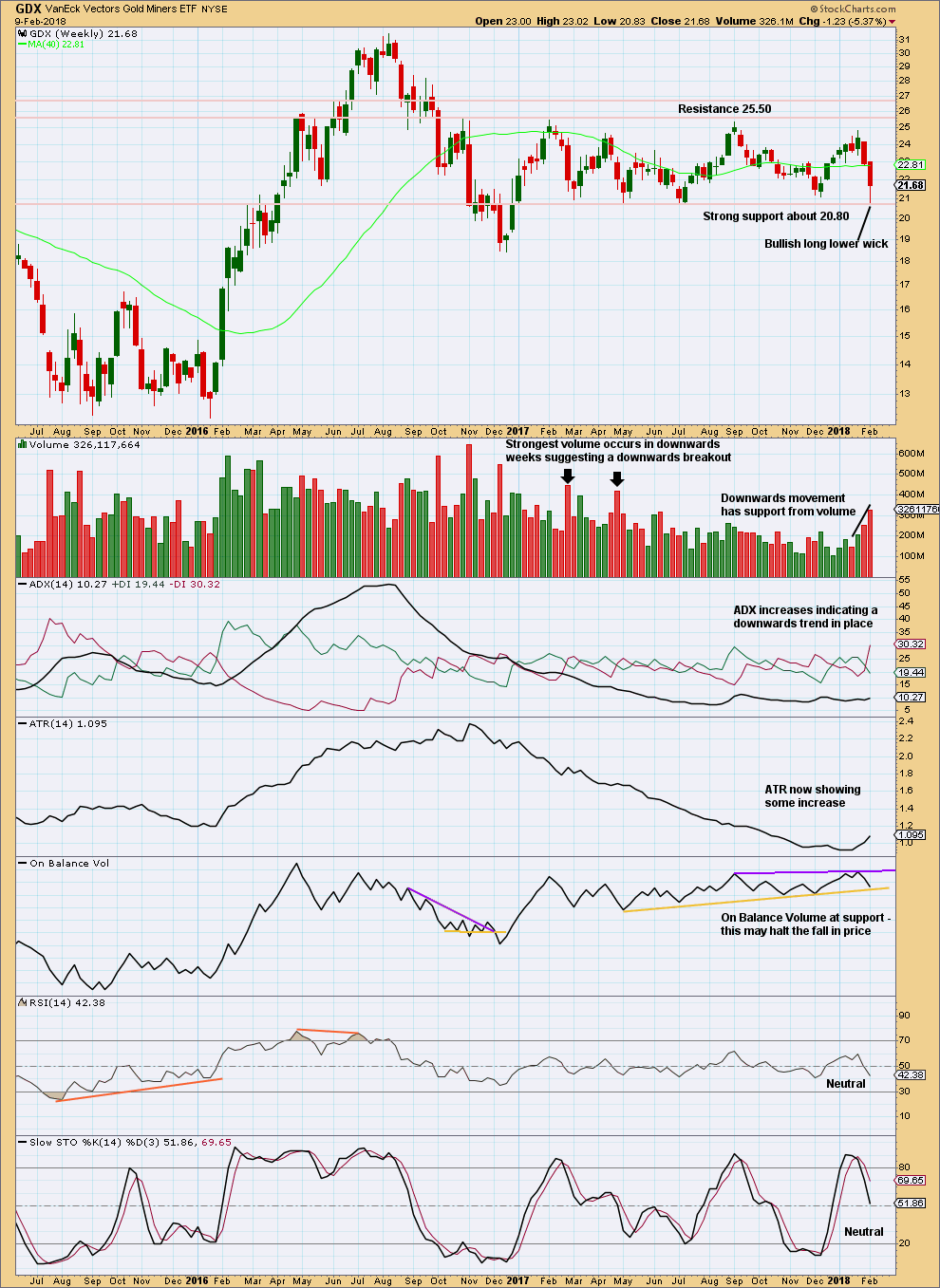

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Support about 20.80 has been tested at least five times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

In the first instance, expect this area to continue to provide support. Only a strong downwards day, closing below support and preferably with some increase in volume, would constitute a downwards breakout from the consolidation that GDX has been in for a year now.

Resistance is about 25.50. Only a strong upwards day, closing above resistance and with support from volume, would constitute an upwards breakout.

The long lower wick this week is fairly bullish. Look for an upwards swing now to resistance.

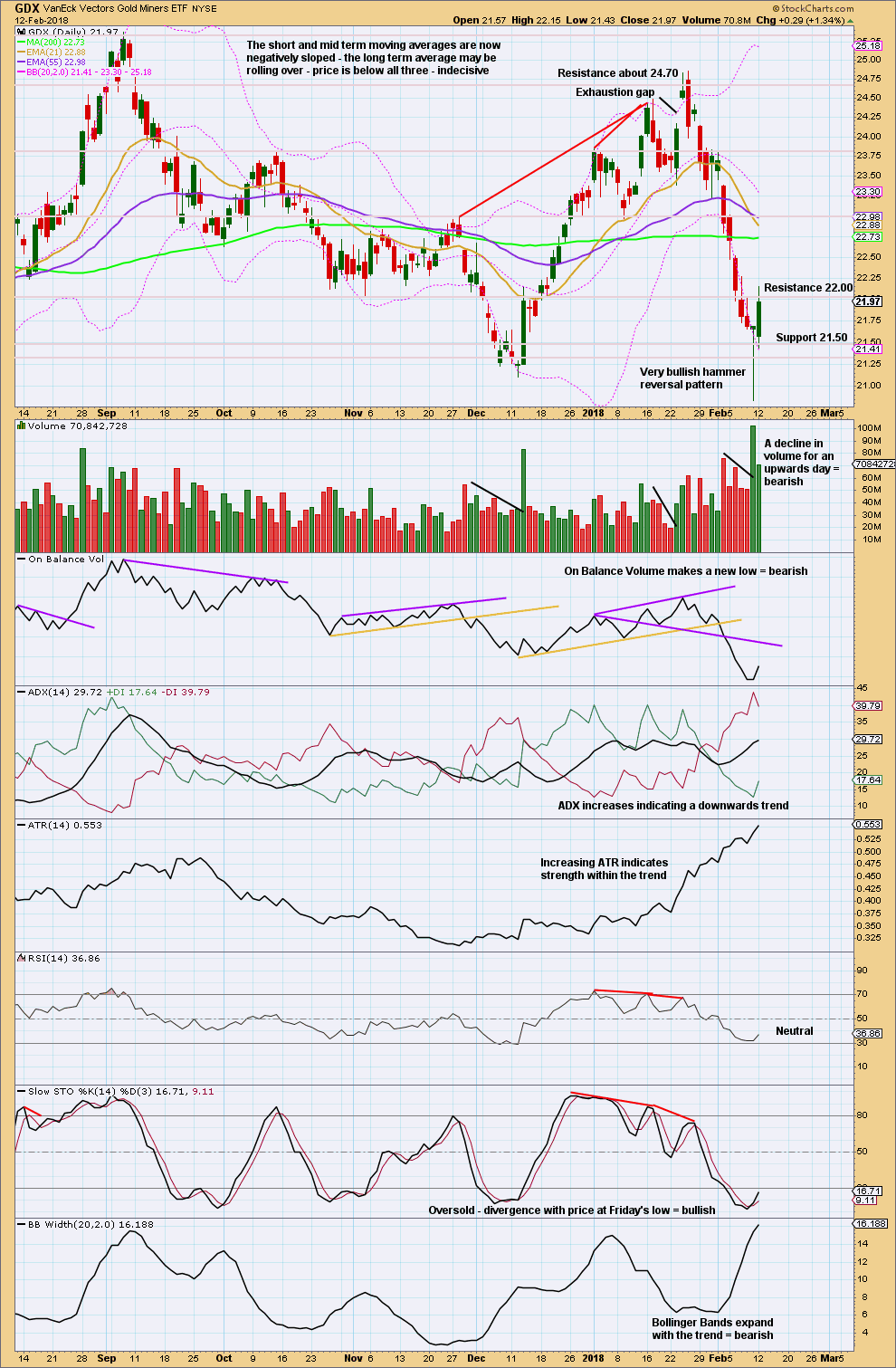

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Upwards movement has unfolded for GDX today as the last analysis expected. Some decline in volume is concerning for bulls, but GDX does sometimes start its new trends slowly.

Although ADX indicates a downwards trend is still in place (it is a lagging indictor), there is now a candlestick reversal signal at the low. Today’s candlestick is a strong Bullish Engulfing pattern, which is the strongest reversal pattern.

Published @ 07:11 p.m. EST.

Updated first hourly chart:

Price is finding resistance about the upper edge of that best fit channel which contains the movement down from the last high on 25th January.

There is first confidence now with a new high above 1,327.81.

The channel really needs to be breached by upwards movement before we can have reasonable confidence that this is a new wave up and not just a correction within an ongoing wave down.

Gold has been developing iHNS in 1 hr period. RS should be around 1322eesh and NL around 1331. ?

If this holds than Lara’s first hour chart should be in play here.

Thanks Lara for great work!

You’re welcome 🙂

I shared this ABX chart a couple of months ago. It’s the largest miner in the world and largest holding in GDX, so it’s important.

Looks good for a big move up. Earnings on 2/14 could provide a big pop.

https://www.tradingview.com/x/yD7vn75n/

Dreamer, thanks for sharing your thoughts. I think Nem is currently the largest holding of GDX. ABX is the 2nd biggest holding so far.

Yes. You’re right. Should have checked again before posting that thought.

GDXJ looks even better with a breakout of the channel and a possible back test tomorrow.

A zoomed-in look shows the .382 and .618 retracement targets.

https://www.tradingview.com/x/AKxFEx99/

Where is everybody? Anyone excited about going long here?

I’m definitely considering going long here. The silver to gold ratio is above 80 right now, and that usually doesn’t last long sending both higher with silver outpacing gold to lower the ratio.

That big reversal last Friday was a relief… but with this crazy market you never know if the lows will be tested again…

keep the analysis going Dreamer

😊

There are 2 gaps that need to close on the daily chart for GDX: 23.45 and 24.20.

However, there is also a big gap on the weekly gold chart at 1276 which should close also… the question is are we going to go up first then down, or go down first and then up and away…

One thing I do know, all those gaps have high probability of closing…

Gaps can go a long time without closing. GDX has gaps in April 2013 and August 2016 that are open also.

Tomorrow may be the last chance for a good GDX entry. At least an intermediate bottom looks to be in, but it may be a major bottom with a powerful move up starting.

A zoomed-in look shows the .382 and .618 retracement targets.

https://www.tradingview.com/x/bG8ynGAF/