A bounce was expected to continue. Price began the week to make new highs and thereafter a pullback has remained above the short term invalidation point.

Summary: Look for a bounce to continue to reach above 16.961. The bounce may slightly overshoot resistance to end about 17.109. Thereafter, a new big downwards trend may develop.

A new high above 17.680 would be very bullish. The target would be at 20.395.

Last monthly charts can be viewed here.

New updates to this analysis are in bold.

ELLIOTT WAVE COUNTS

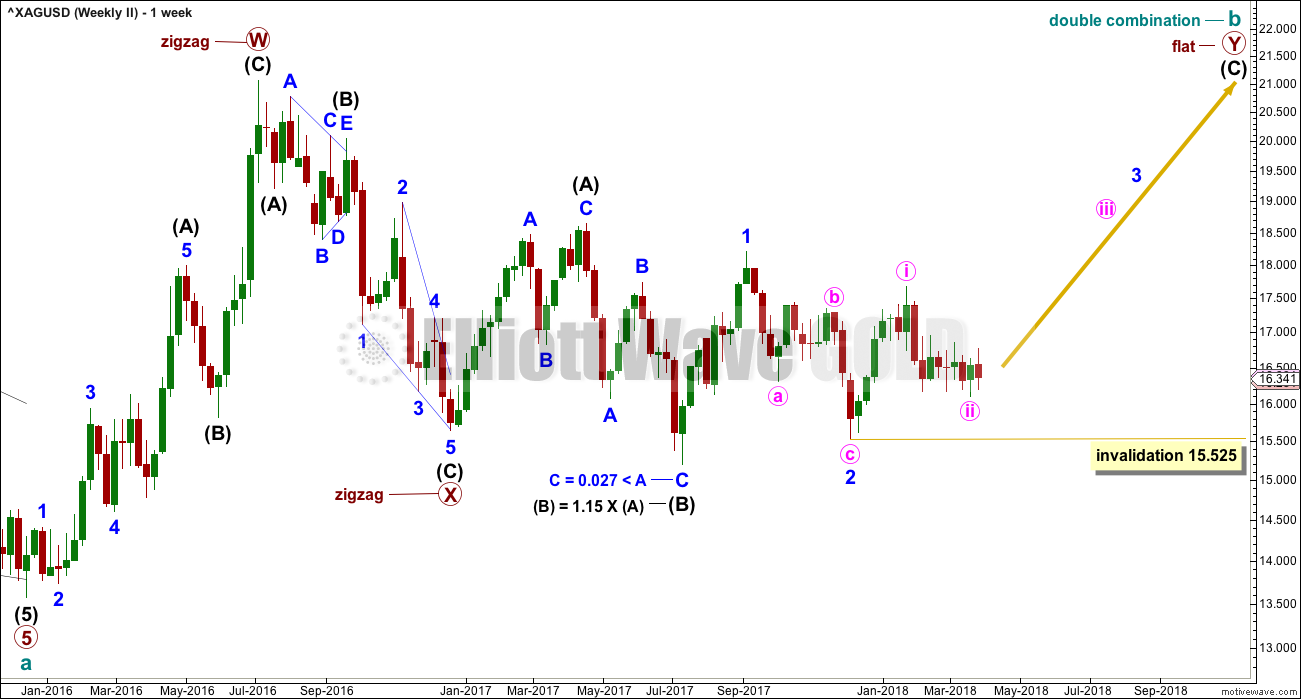

MAIN WAVE COUNT

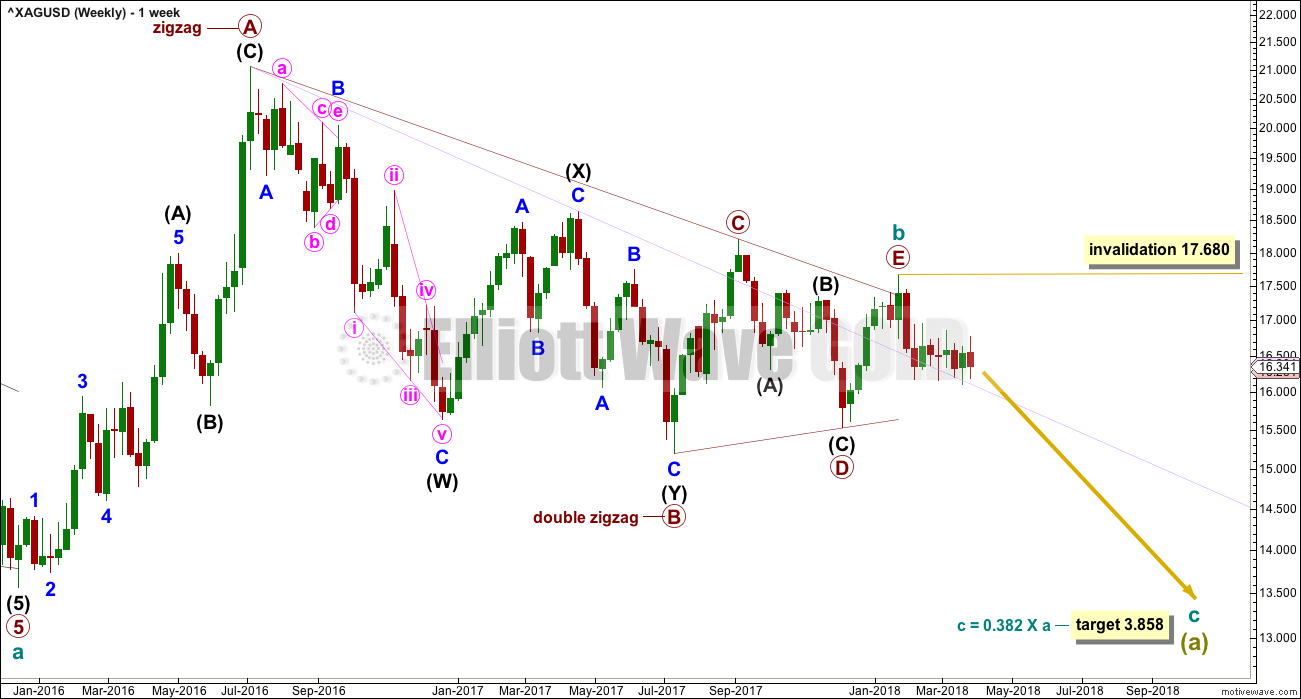

WEEKLY CHART

The main wave count expects that the bear market, which began from the April 2011 high, is incomplete.

Cycle wave a is seen as a five wave impulse for this main wave count. There are multiple corrective structures possible still for cycle wave b.

This first weekly chart sees cycle wave b as a now possibly complete regular contracting triangle.

Primary wave E of the triangle may have ended with an overshoot of the A-C trend line. If this wave count is correct, then price should have reversed already. Within the new downwards trend, no second wave correction may move beyond the start of the first wave above 17.680.

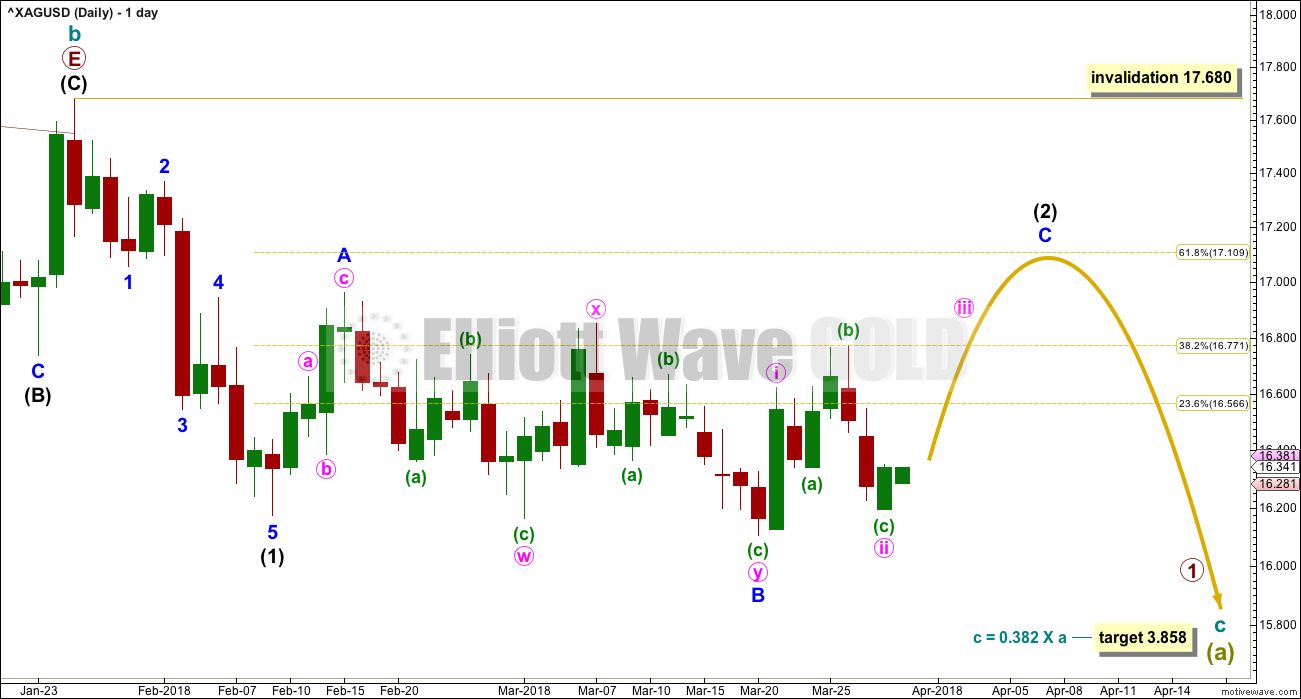

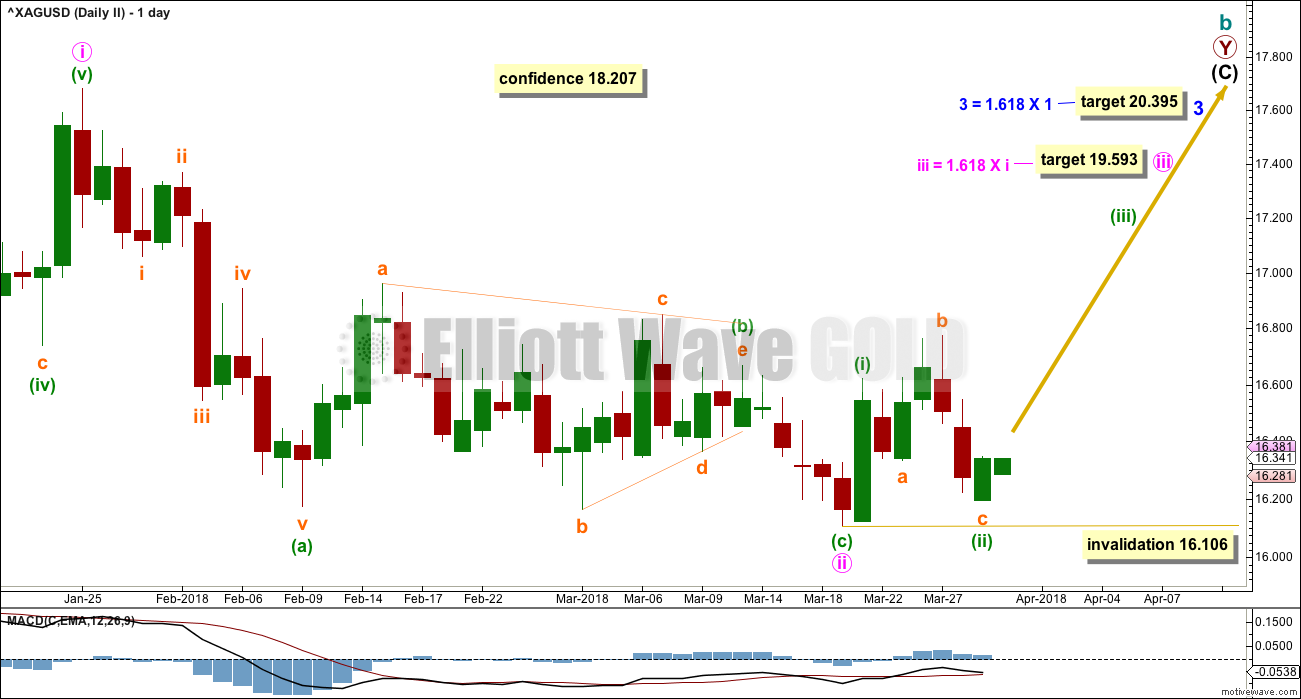

DAILY CHART

Intermediate wave (1) down subdivides well as a five wave structure.

Intermediate wave (2) may be an incomplete flat correction. If minor wave B is over at the last low, then it would be a 1.09 length of minor wave A, indicating an expanded flat. It is possible still that minor wave B may move a little lower.

Minor wave C upwards would be very likely to make at least a slight new high above the end of minor wave A at 16.961 to avoid a truncation and a very rare running flat. Minor wave C may end about the 0.618 Fibonacci ratio of intermediate wave (1) at 17.109.

Minor wave C must subdivide as a five wave structure, either an impulse or an ending diagonal. It may be either at this stage. Within minor wave C, the correction for minute wave ii may not move beyond the start of minute wave i below 16.106. A new low below 16.106 would indicate minor wave C has not begun and minor wave B may be moving lower.

Intermediate wave (2) may not move beyond the start of intermediate wave (1) above 17.680.

SECOND WAVE COUNT

WEEKLY CHART

Cycle wave b may be completing as a double combination: zigzag – X – flat. The second structure, a flat correction for primary wave Y, may be underway.

Within a flat correction, intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 15.938. Intermediate wave (B) has met this minimum requirement; the rule for a flat correction is met. Intermediate wave (B) is longer than 1.05 times the length of intermediate wave (A) indicating this may be an expanded flat. Expanded flat corrections are the most common type. Normally their C waves are 1.618 or 2.618 the length of their A waves.

The target calculated would see primary wave Y to end close to same level as primary wave W about 21.062. The purpose of combinations is to take up time and move price sideways. To achieve this purpose the second structure in the double normally ends about the same level as the first.

While the combination wave count at the weekly chart level does not currently work for Gold, it does still work for Silver. They do not have to complete the same structures for cycle wave b, and fairly often their structures are different.

At this stage, the duration of minor wave 2 now looks wrong. This wave count is now less likely.

If minute wave ii continues lower, it may not move beyond the start of minute wave i below 15.525.

DAILY CHART

Minute wave ii may now be a complete zigzag. Minute wave iii may have begun. The most common Fibonacci ratios are used to calculate targets for minute wave iii and minor wave 3.

Within minute wave iii, no second wave correction may move beyond the start of its first wave below 16.106.

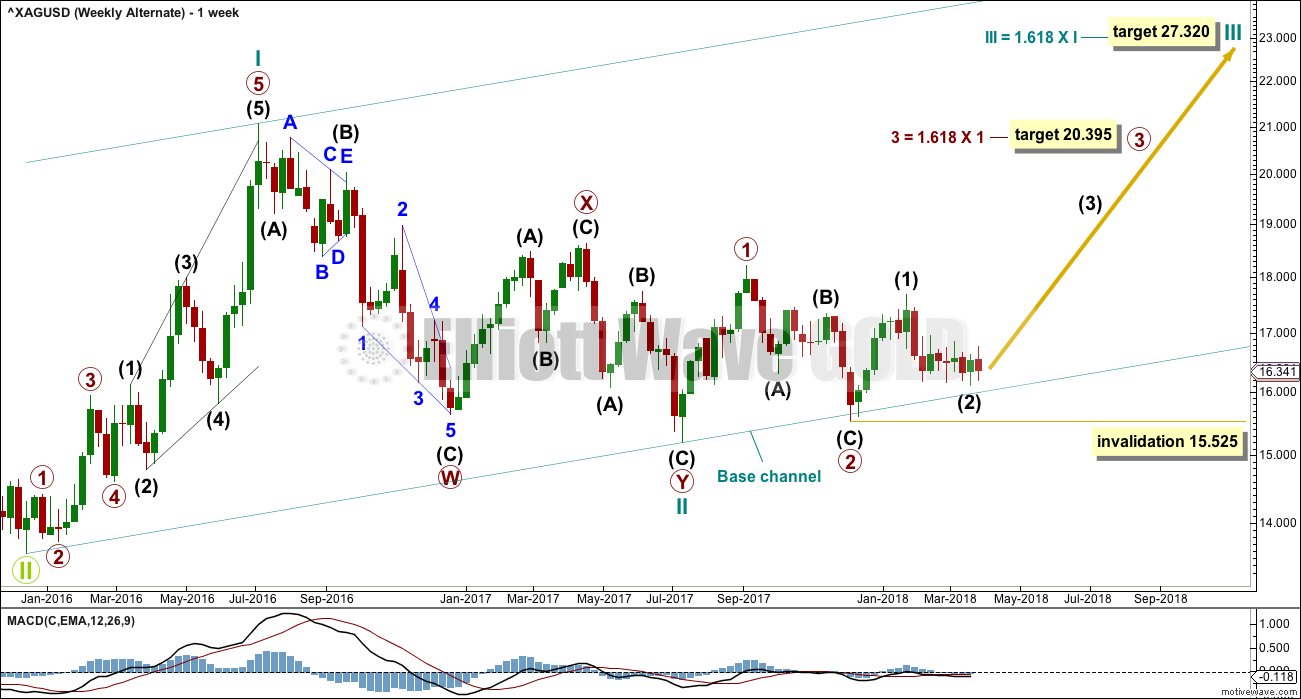

ALTERNATE WAVE COUNT

WEEKLY CHART

This alternate wave count looks at the possibility that the bear market may be over for Silver and a new bull market may have begun.

A series of three overlapping first and second waves may now be complete for cycle waves I and II, primary waves 1 and 2, and intermediate waves (1) and (2).

A third wave now at three large degrees may be beginning.

Targets calculated for third waves assume the most common Fibonacci ratios to their respective first waves. As price approaches each target, if the structure is incomplete or price keeps rising through the target, then the next Fibonacci ratio in the sequence would be used to calculate a new target.

Within primary wave 3, intermediate wave (2) may not move beyond the start of intermediate wave (1) below 15.525.

The large base channel about cycle waves I and II nicely shows where primary wave 2 found support. A lower degree second wave correction should find support (in a bull market) about a base channel drawn about a first and second wave one or more degrees higher. If this base channel is breached at the daily chart level with one full daily candlestick below and not touching it, then the probability of this alternate wave count would be reduced.

DAILY CHART

Intermediate wave (2) may now be a complete zigzag. Intermediate wave (3) may have begun. Intermediate wave (2) ended above the base channel.

A target is calculated for intermediate wave (3), which expects the most common Fibonacci ratio.

Within intermediate wave (3), minor wave 2 may not move beyond the start of minor wave 1 below 16.106.

TECHNICAL ANALYSIS

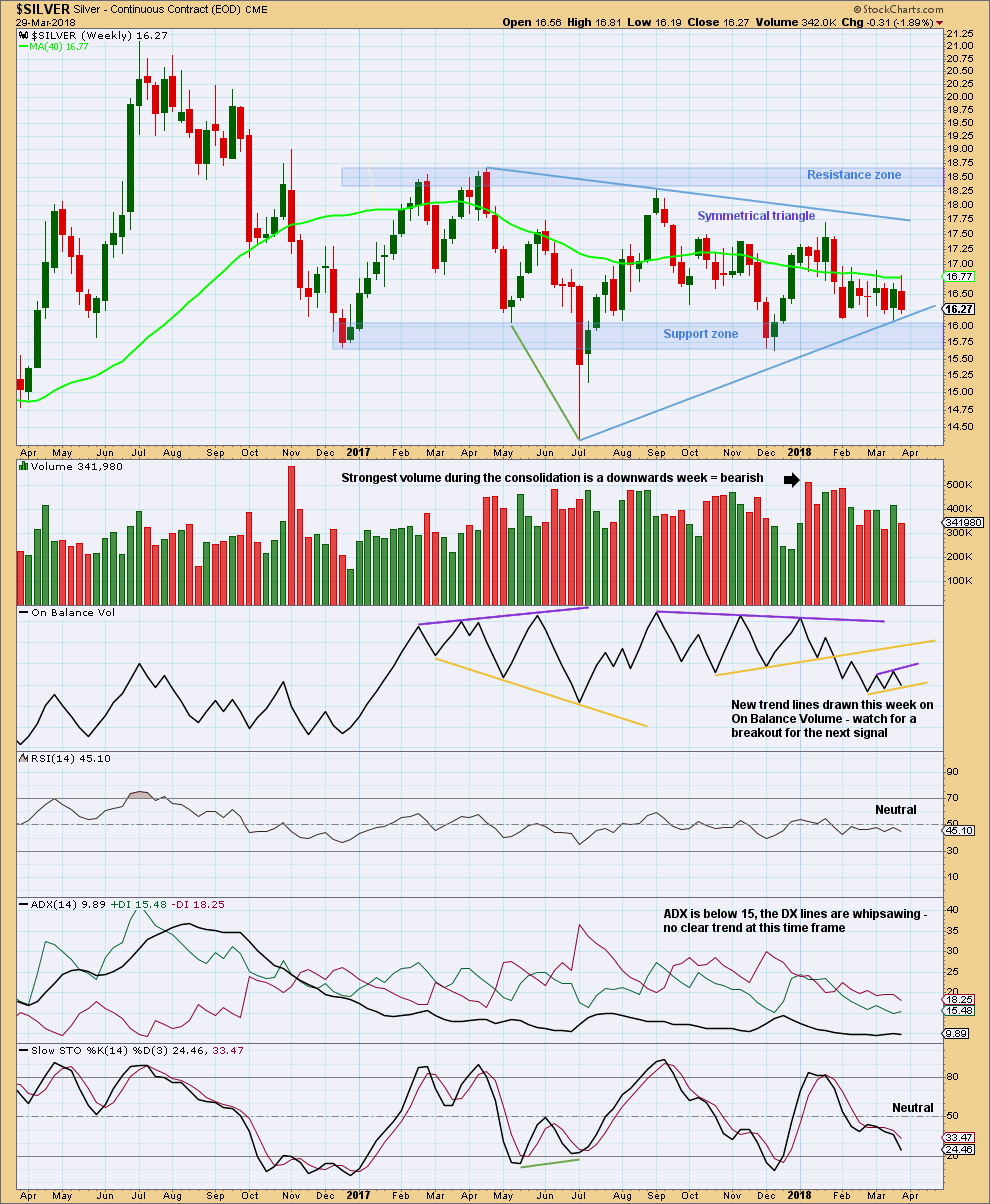

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains within the support and resistance zone.

The last two signals at the weekly chart level from On Balance Volume have been bearish. This may offer more support to the main Elliott wave count, which expects an eventual downwards breakout from the large consolidation zone but does not preclude another bounce within the consolidation first.

Price is nearing support and Stochastics is nearing oversold. Look out for an upwards bounce within the consolidation here or very soon as a reasonable possibility.

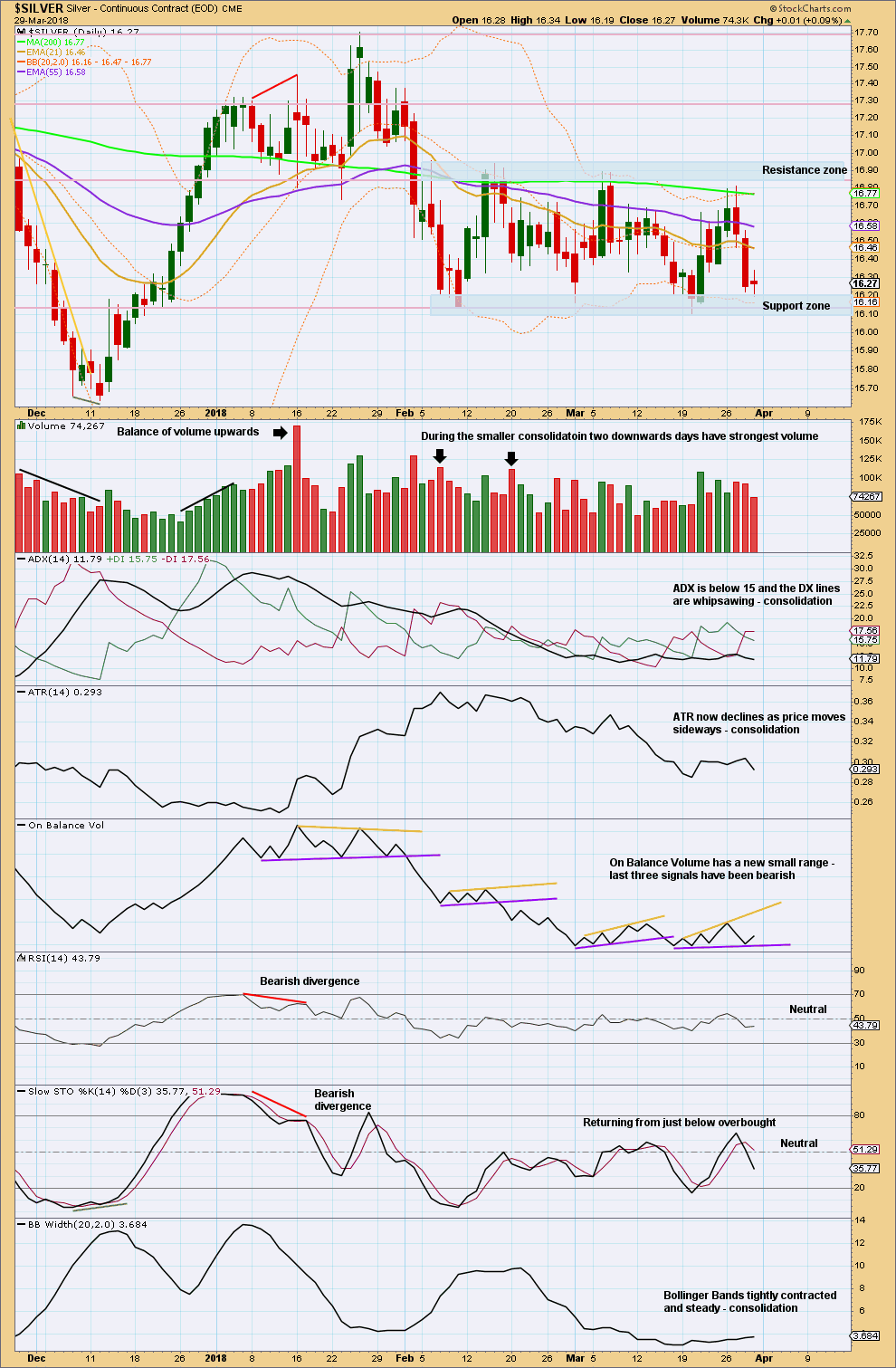

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the daily chart level, there is a smaller and clearer consolidation zone with resistance about 16.80 to 16.95 and support about 16.20 to 16.10. It is two downwards days during this consolation that have strongest volume, suggesting a downwards breakout may be more likely than an upwards breakout. This does not always work, but it does work more often than it fails. This supports the main Elliott wave count.

An upwards breakout should have support from volume for confidence. An upwards breakout would be an upwards day closing above resistance. A downwards breakout does not require support from volume, but when that happens it adds more confidence. A downwards breakout would be a downwards day closing below support.

Expect swings from resistance to support and back again while price remains within the consolidation. Do not expect price to move in a straight line, because that is not how price typically behaves within a consolidation.

Usually, Stochastics can be used during a consolidation to indicate when each swing ends. This is when Stochastics reaches overbought or oversold while price is at resistance or support. However, Stochastics is falling short of overbought and oversold in this current consolidation.

Currently, price is just at support and Stochastics is neutral. Allow for a little more downwards movement further into support. Look out for an upwards swing to begin very soon.

Published @ 10:11 p.m. EST on 30th March, 2018.

I’m going to sit tight on this and see where we sit in a couple of days. If it runs up a bit, that may be a time to grab a short with a tight stop.