A quick analysis today with a bullish and a bearish Elliott wave count, and classic technical analysis.

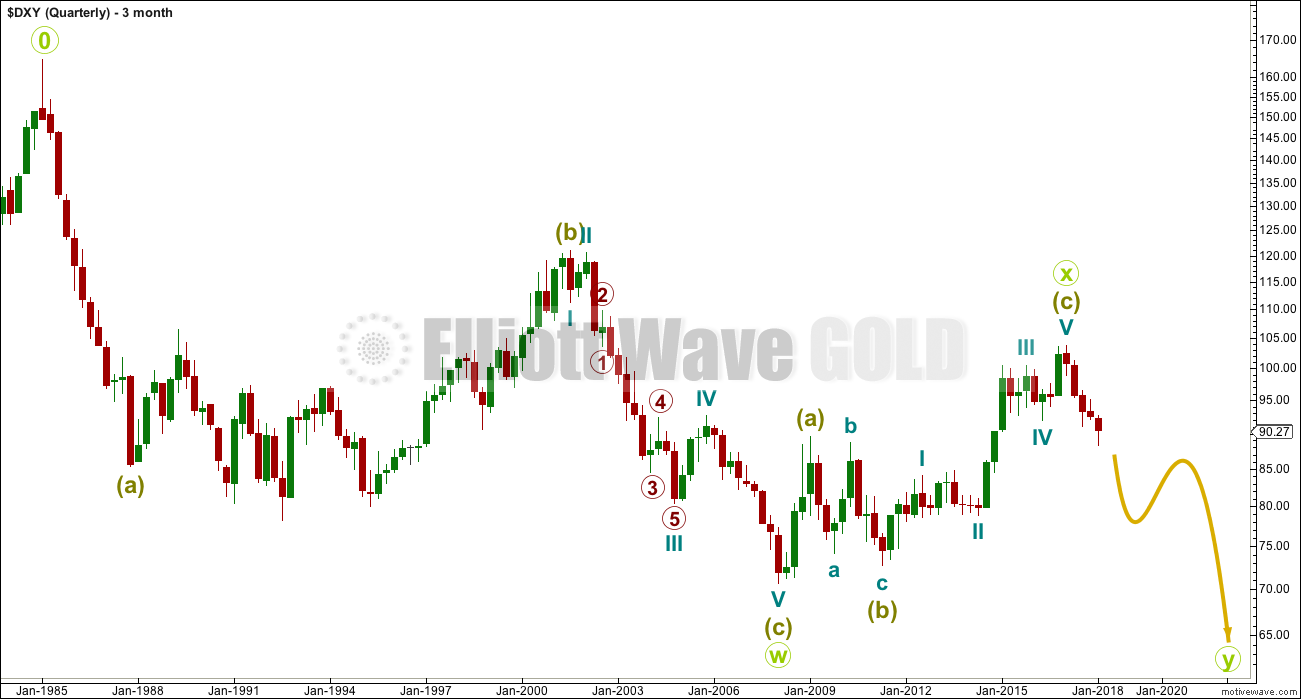

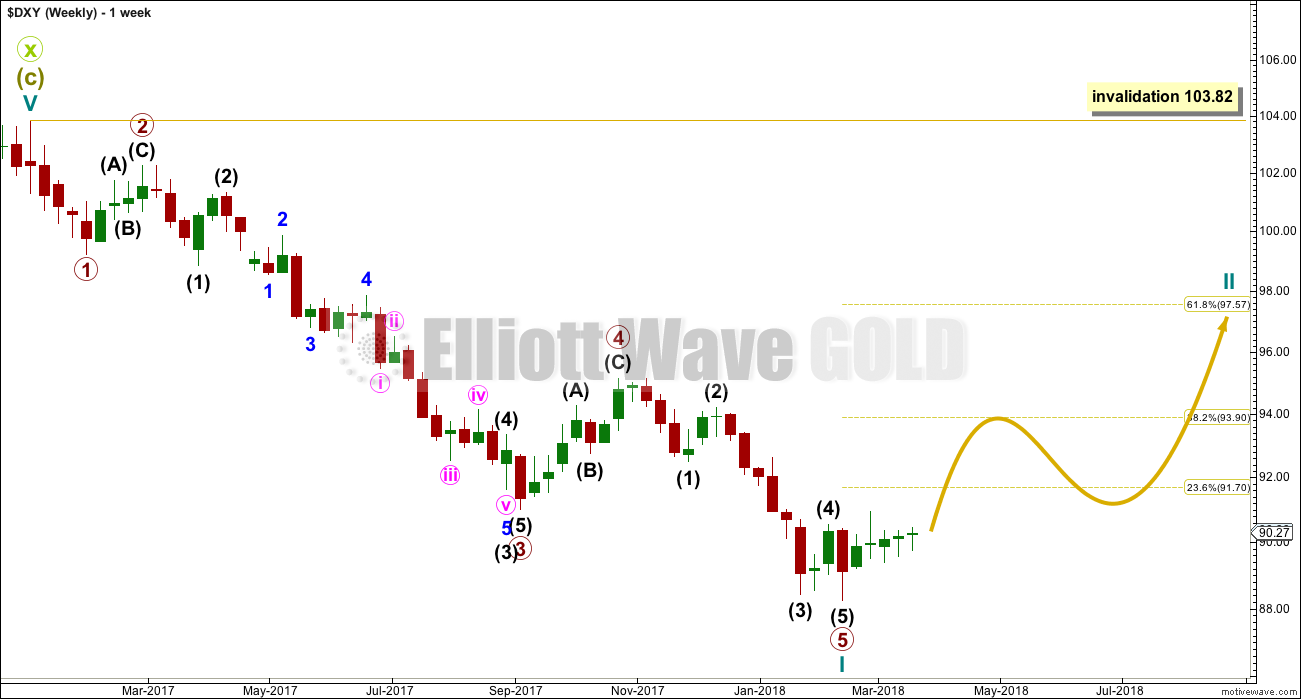

BEARISH ELLIOTT WAVE ANALYSIS

QUARTERLY CHART

A huge double zigzag may be continuing lower.

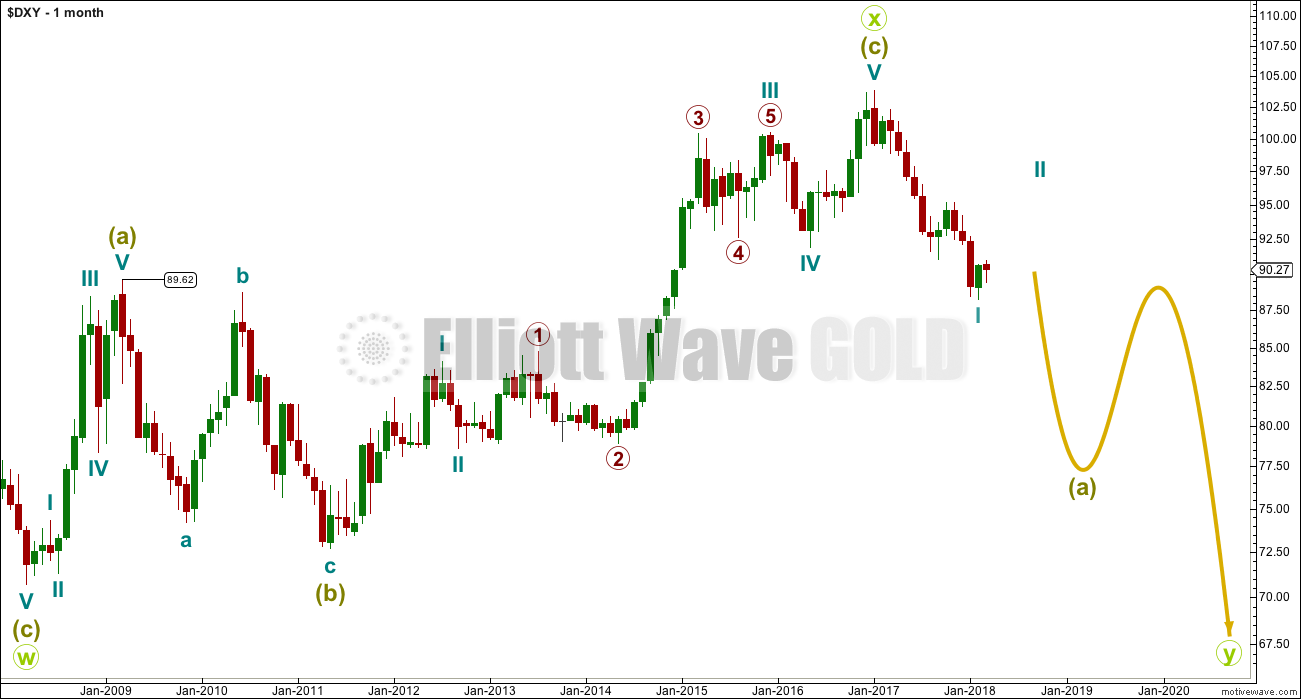

MONTHLY CHART

This cannot be a fourth wave correction within an ongoing impulse higher because a new low below 89.62 has recently occurred, which would be back in first wave price territory.

That indicates the last big wave up may be a completed three, and for that reason this is my main wave count.

WEEKLY CHART

A five down may be complete within the new trend. This should be followed by a three up that may correct to about the 0.618 Fibonacci ratio at 97.57.

Cycle wave II may not move beyond the start of cycle wave I above 103.82.

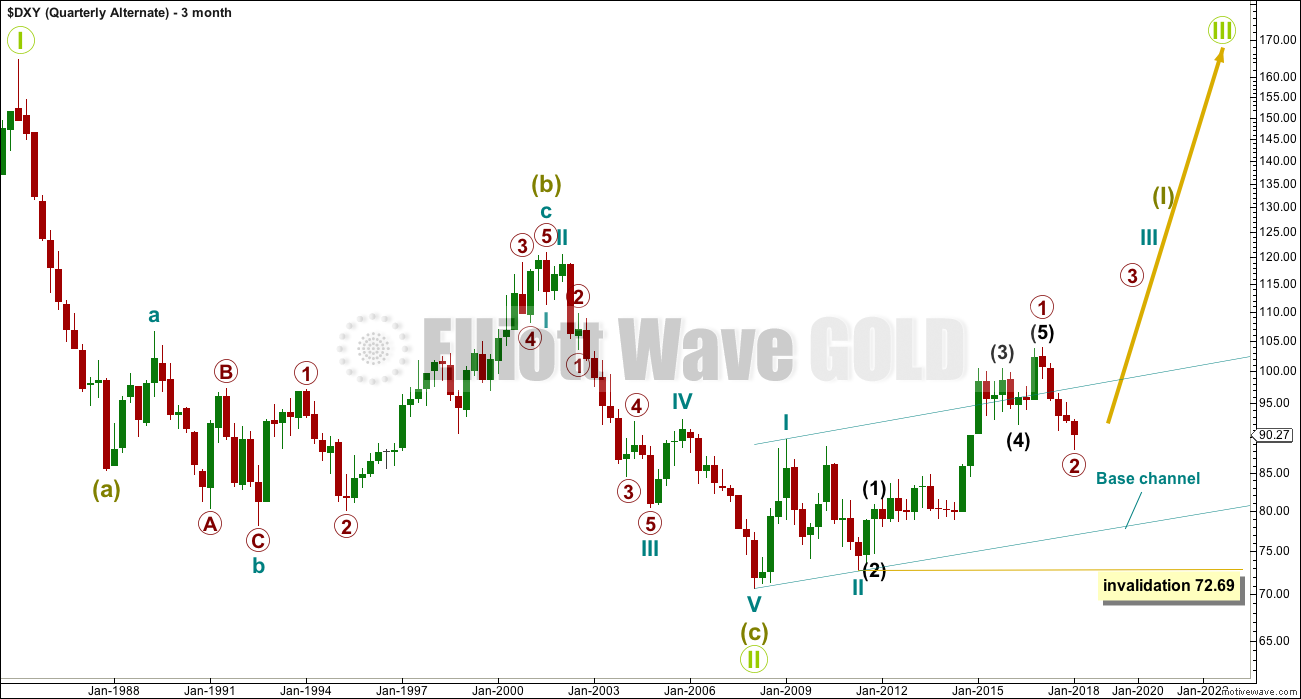

BULLISH ELLIOTT WAVE ANALYSIS

QUARTERLY CHART

A single zigzag down to the last major low may still be complete.

A new upwards trend may continue. So far there may be two overlapping first and second waves. Primary wave 2 may not move beyond the start of primary wave 1 below 72.69.

Primary wave 2 should find strong support at the lower edge of the teal base channel if it gets down that low.

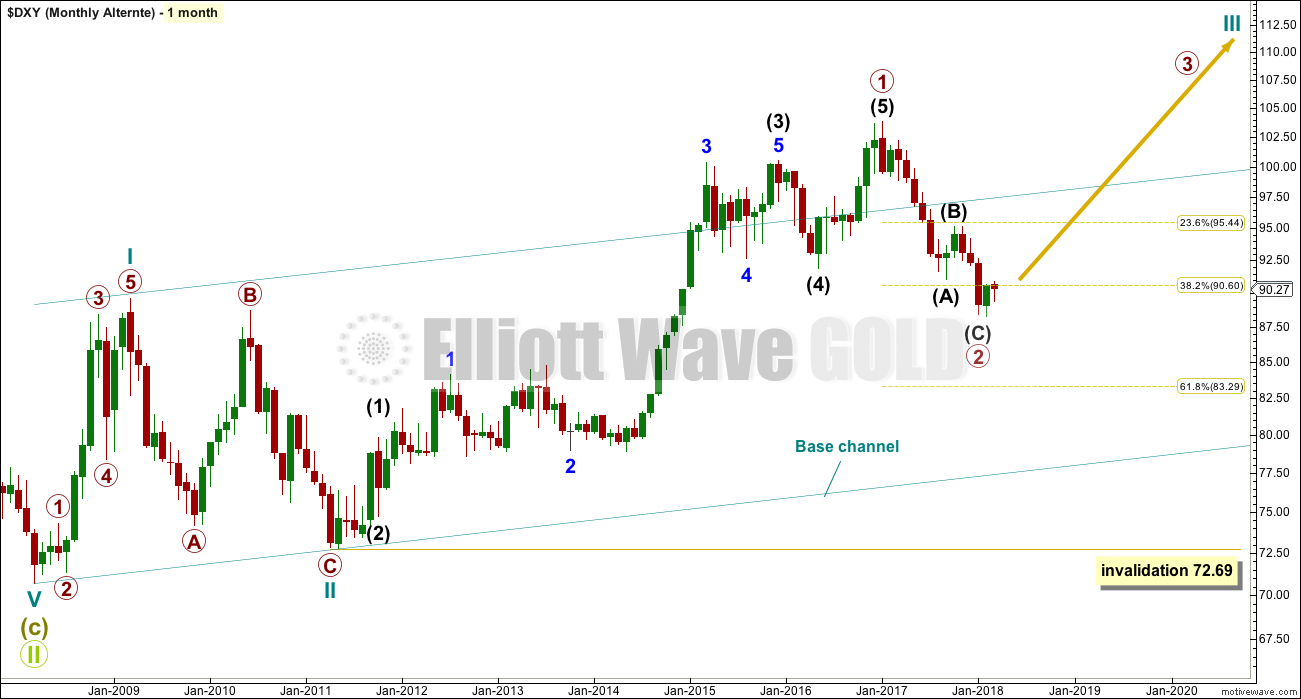

MONTHLY CHART

Primary wave 2 may be a complete zigzag. However, this wave down can also be seen as a five and primary wave 2 may yet continue lower.

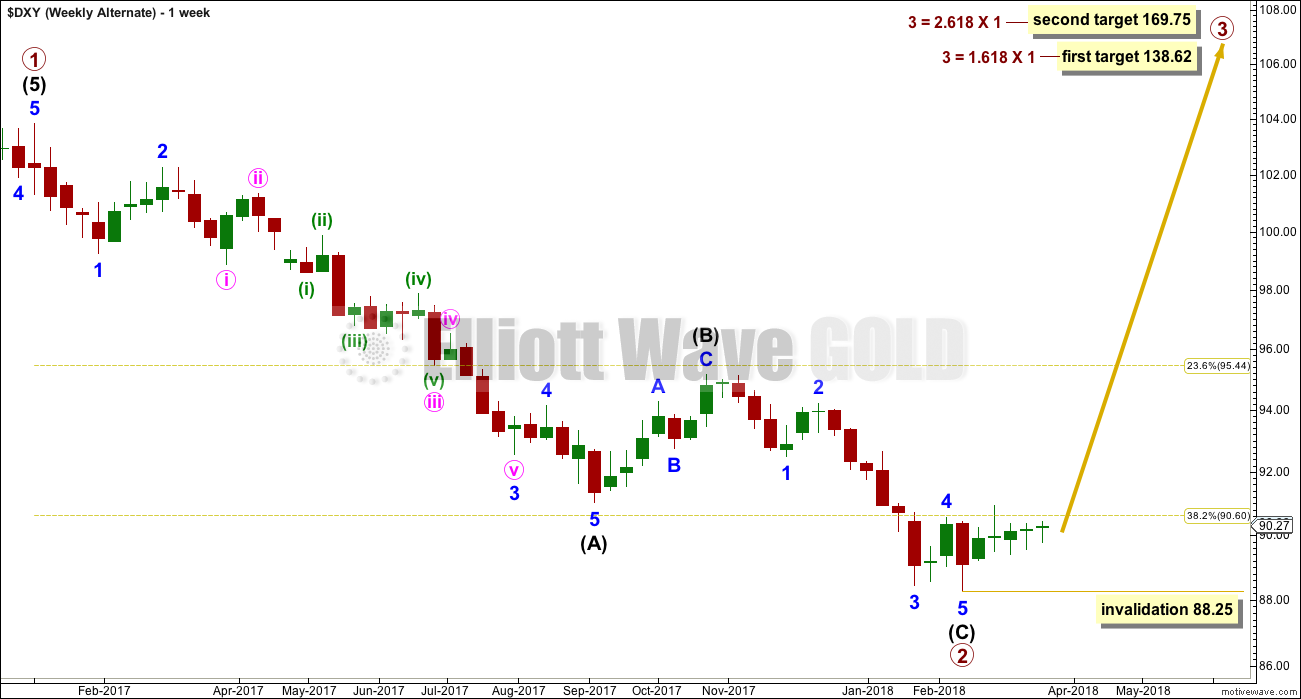

WEEKLY CHART

This bullish wave count sees the last wave down as a completed zigzag. If this is correct, then within primary wave 3 no second wave correction may move beyond its start below 88.25.

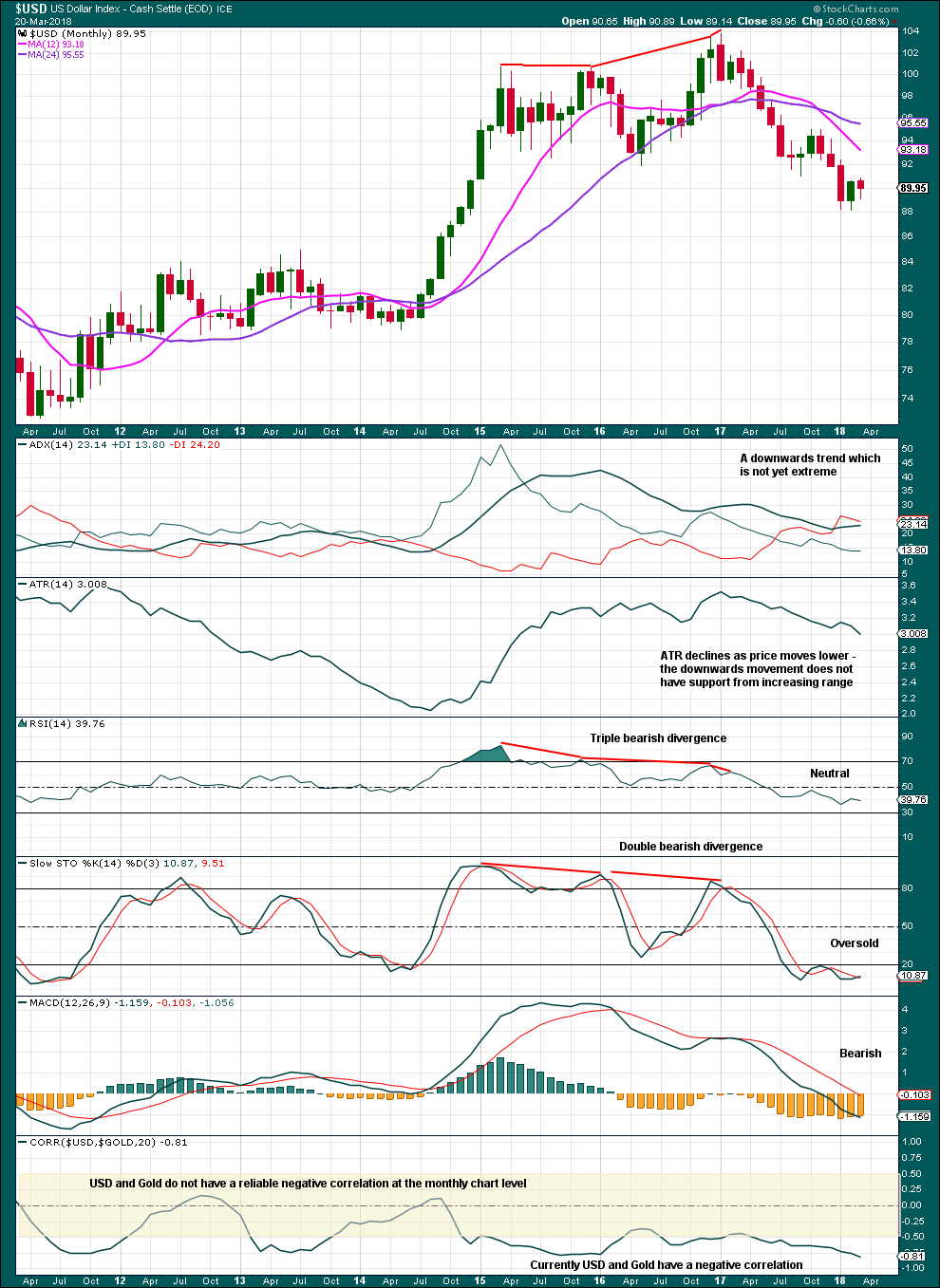

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

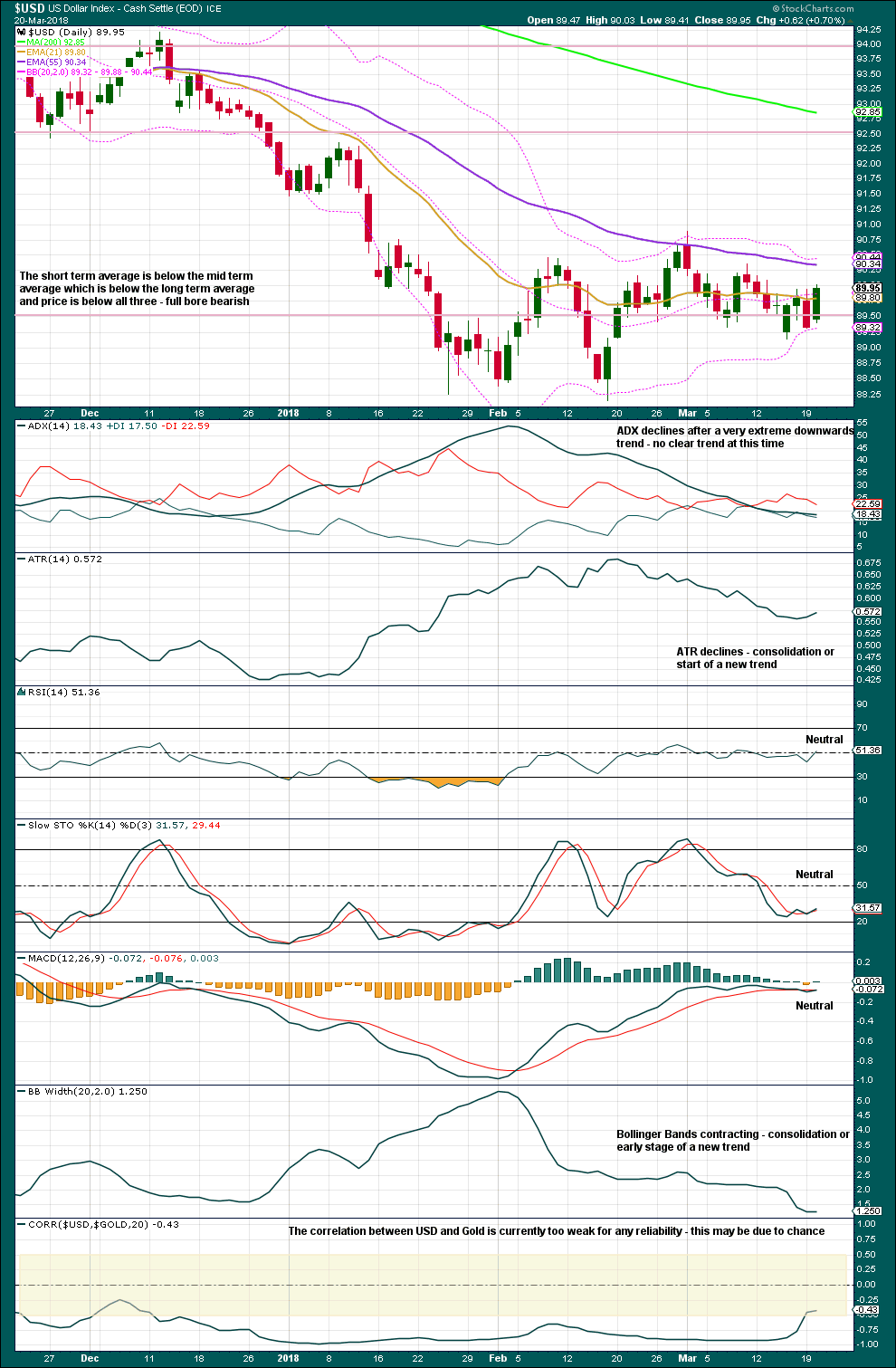

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

This analysis is published @ 04:56 a.m. EST.

THANK YOU !!!!

Thank you Lara, appreciate the update 😍

You’re welcome