An inside day for Monday sees price remain above the invalidation point on the hourly Elliott wave count.

A new alternate idea for the very short term is presented today.

Summary: A low may again be in place. Confidence may be had with a new high above 1,227.46.

A target for a strong bounce here is about 1,304, which may be reached in several weeks. Along the way up, there may be either a sharp pullback or a sideways time consuming consolidation.

Always trade with stops to protect your account. Risk only 1-5% of equity on any one trade.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts and several weekly alternates is here, video is here.

Weekly charts are last updated here. Only one weekly chart will be published on a daily basis. All may be reviewed on a once a week basis.

MAIN ELLIOTT WAVE COUNT

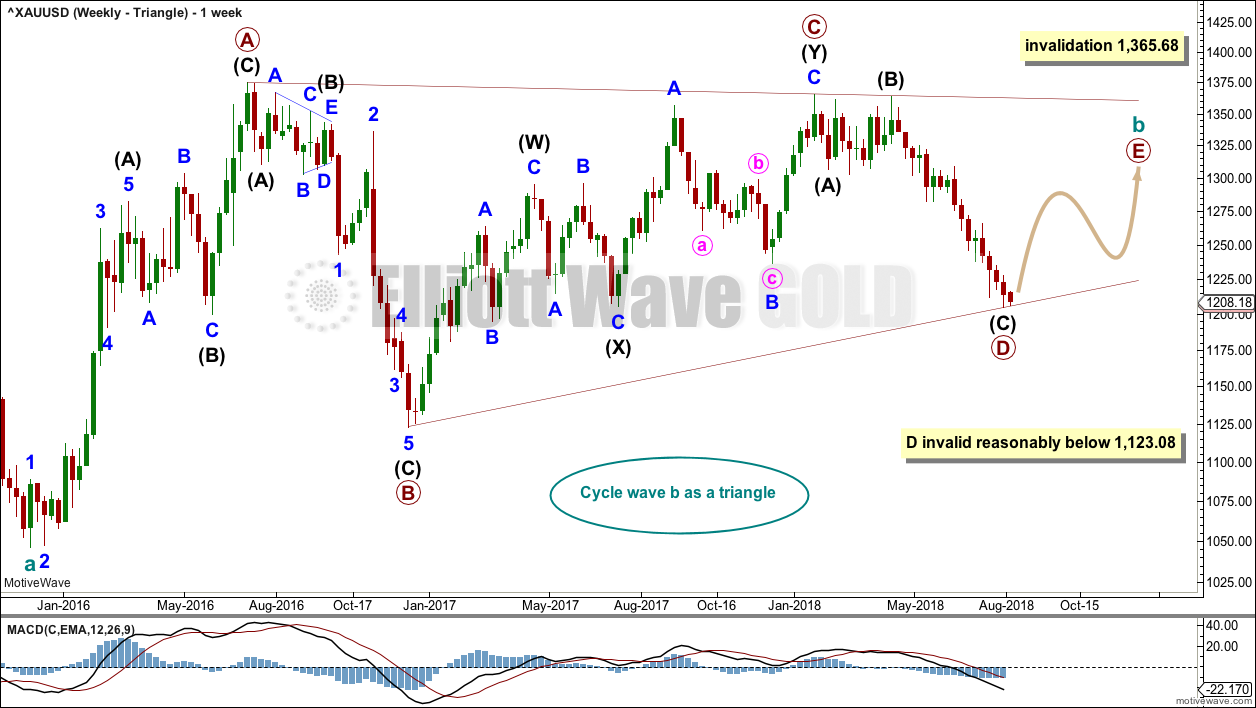

WEEKLY CHART – TRIANGLE

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, flat, combination or double zigzag. All four weekly charts were reviewed in last end of week analysis, and may be again reviewed at the end of this week. At this time, all four weekly charts expect some upwards movement here.

While the direction does not diverge for these four weekly wave counts, only one weekly wave count shall be published on a daily basis, so that the analysis is manageable for me to publish and for members to digest. Note: This does not mean that the remaining three counts may not be correct.

The triangle so far has the best fit and look.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

DAILY CHART – TRIANGLE

Primary wave D may again be over. The structure may again be complete at all wave degrees.

Minor wave 5 may have ended almost exactly at the lower edge of the blue Elliott channel.

A target is calculated for primary wave E to end. Primary wave E must subdivide as a zigzag. It may last several weeks.

The main hourly chart today expects that primary wave D is over. A new alternate hourly chart today looks at the possibility it may still continue to one more low.

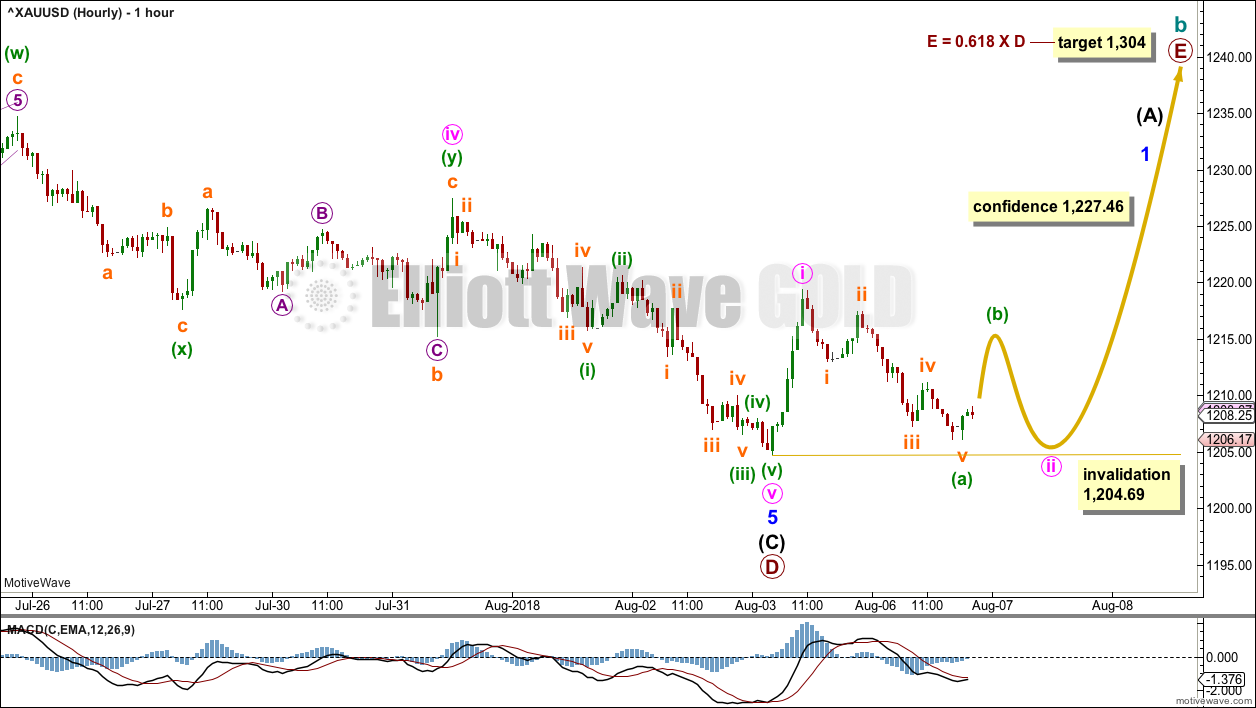

HOURLY CHART

Minute wave iv may have been a double combination. Minute wave v is a complete impulse.

The bounce up during Friday’s session is very strong and has good support from volume. Downwards movement now for Monday’s session has very light volume; this may be a second wave correction, which is labelled minute wave ii. The first second wave correction in a new trend for Gold is usually very deep. At this stage, minute wave ii looks like an incomplete zigzag; only a five down for minuette wave (a) may be complete. A five wave structure cannot be a complete correction, so one more small wave down for minuette wave (c) would be expected.

Minute wave ii may not move beyond the start of minute wave i below 1,204.69.

A new high now above 1,227.46 would invalidate the new hourly alternate wave count below and provide some confidence that a low should be in place.

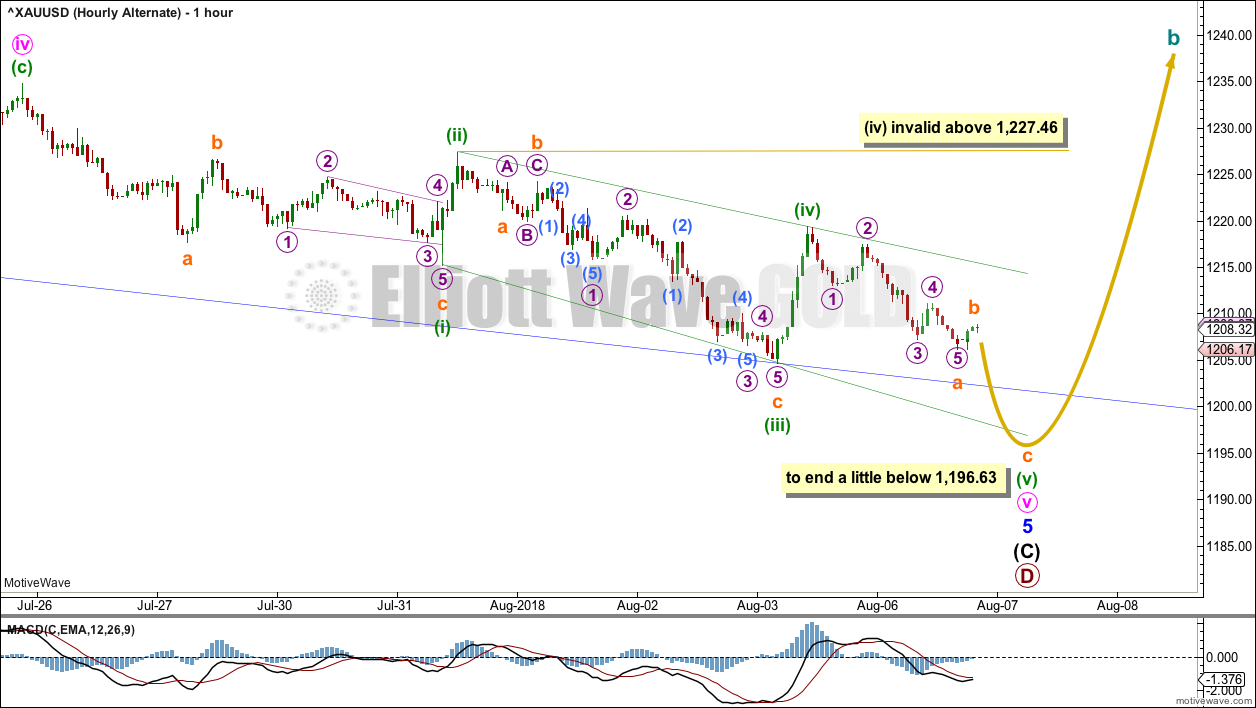

ALTERNATE HOURLY CHART

Minute wave iv may have been over earlier as a single zigzag. Minute wave v may have begun at that point. This has a slightly better look for minute wave iv, but there would then be no alternation in structure between minute waves ii and iv because both would be single zigzags.

The overlapping within minute wave v means that an impulse will not at this stage fit. But an ending diagonal will fit, and the diagonal would be expanding: minuette wave (iii) is longer than minuette wave (i), minuette wave (iv) is longer than minuette wave (ii), and the trend lines diverge. Minuette wave (v) must be longer than minuette wave (iii), so that all rules for an ending expanding diagonal are met.

Ending diagonals require all sub-waves to subdivide as zigzags. Minuette wave (v) must subdivide as a zigzag.

Within the diagonal, minuette wave (iv) must overlap into minuette wave (i) price territory. This rule is met. Minuette wave (iv), if it continues any further, may not move beyond the end of minuette wave (ii) above 1,227.46.

TECHNICAL ANALYSIS

WEEKLY CHART

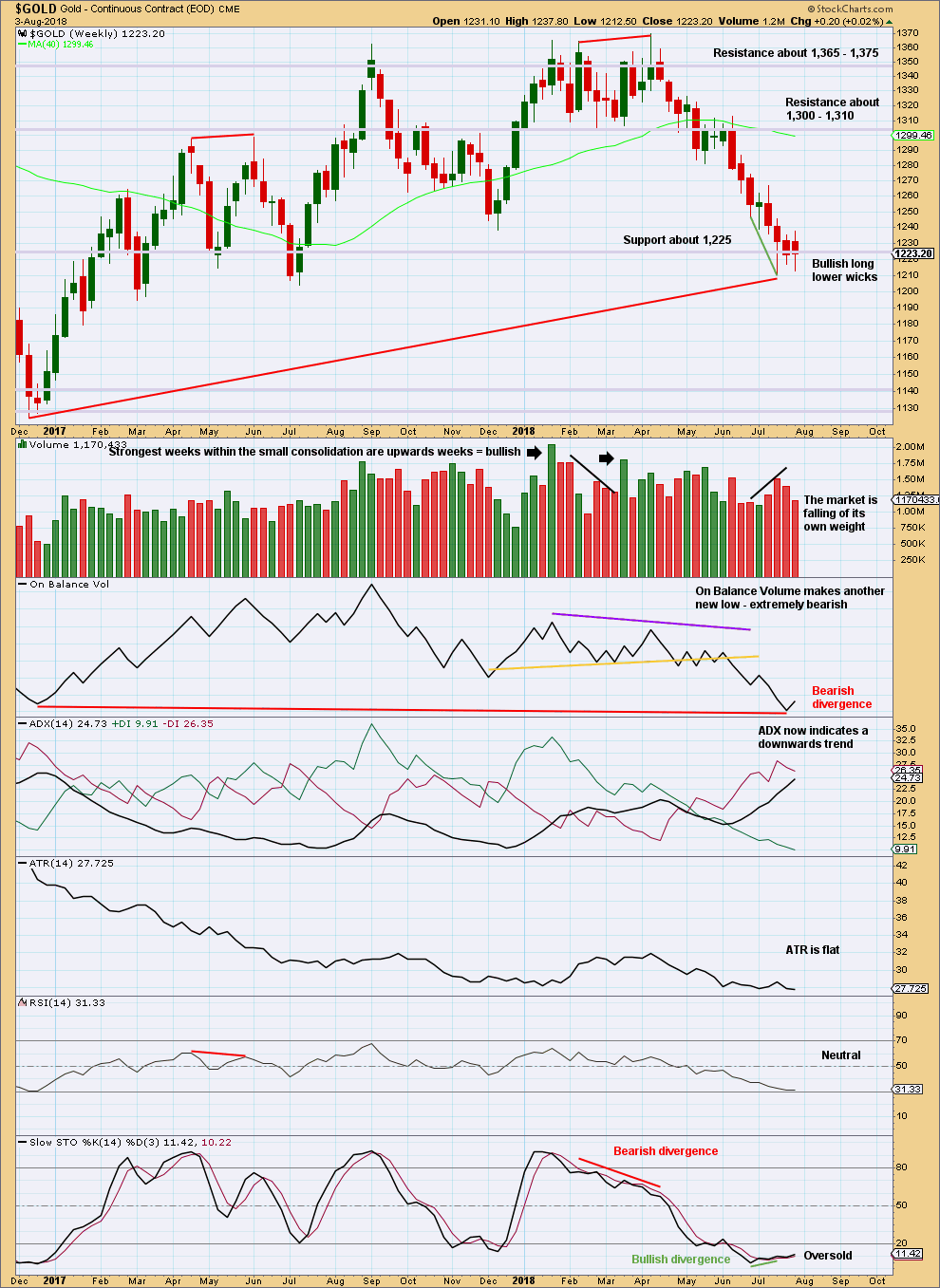

Click chart to enlarge. Chart courtesy of StockCharts.com.

At the end of last week, BarChart data has made a new low but StockCharts data has not.

The long term picture for this chart is bearish due to the long term bearish divergence between price and On Balance Volume. The short term is bullish due to long lower candlestick wicks and single short term divergence between price and Stochastics at last lows.

DAILY CHART

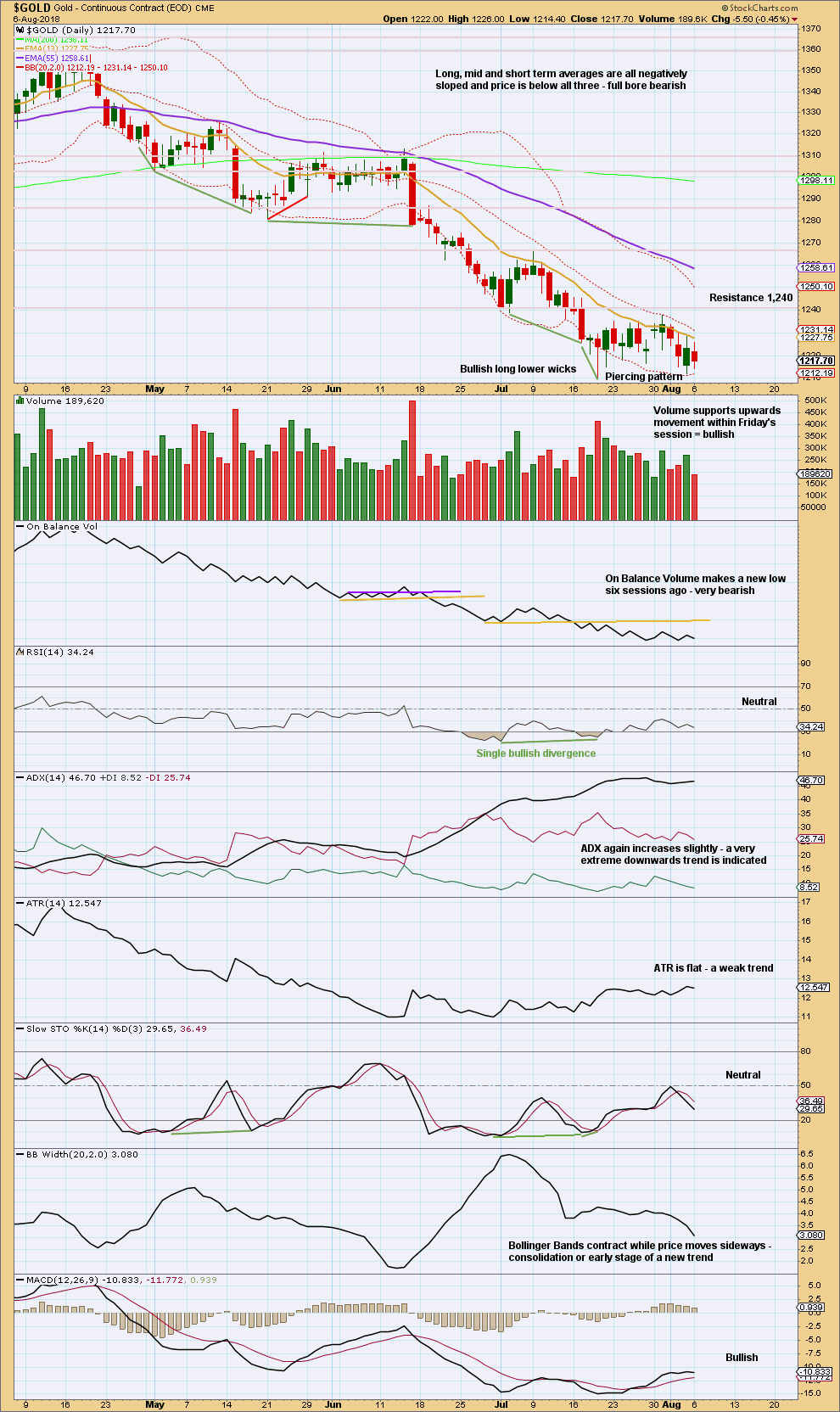

Click chart to enlarge. Chart courtesy of StockCharts.com.

It sill looks like a low may be in: the short term volume profile is bullish; there is a bullish candlestick reversal pattern at the last low; and, there was bullish divergence between price and Stochastics and RSI.

The downwards trend is extreme and stretched. It is time to look for a low. That does not mean price may move a little lower before it turns, only that a low should be anticipated here.

GDX WEEKLY CHART

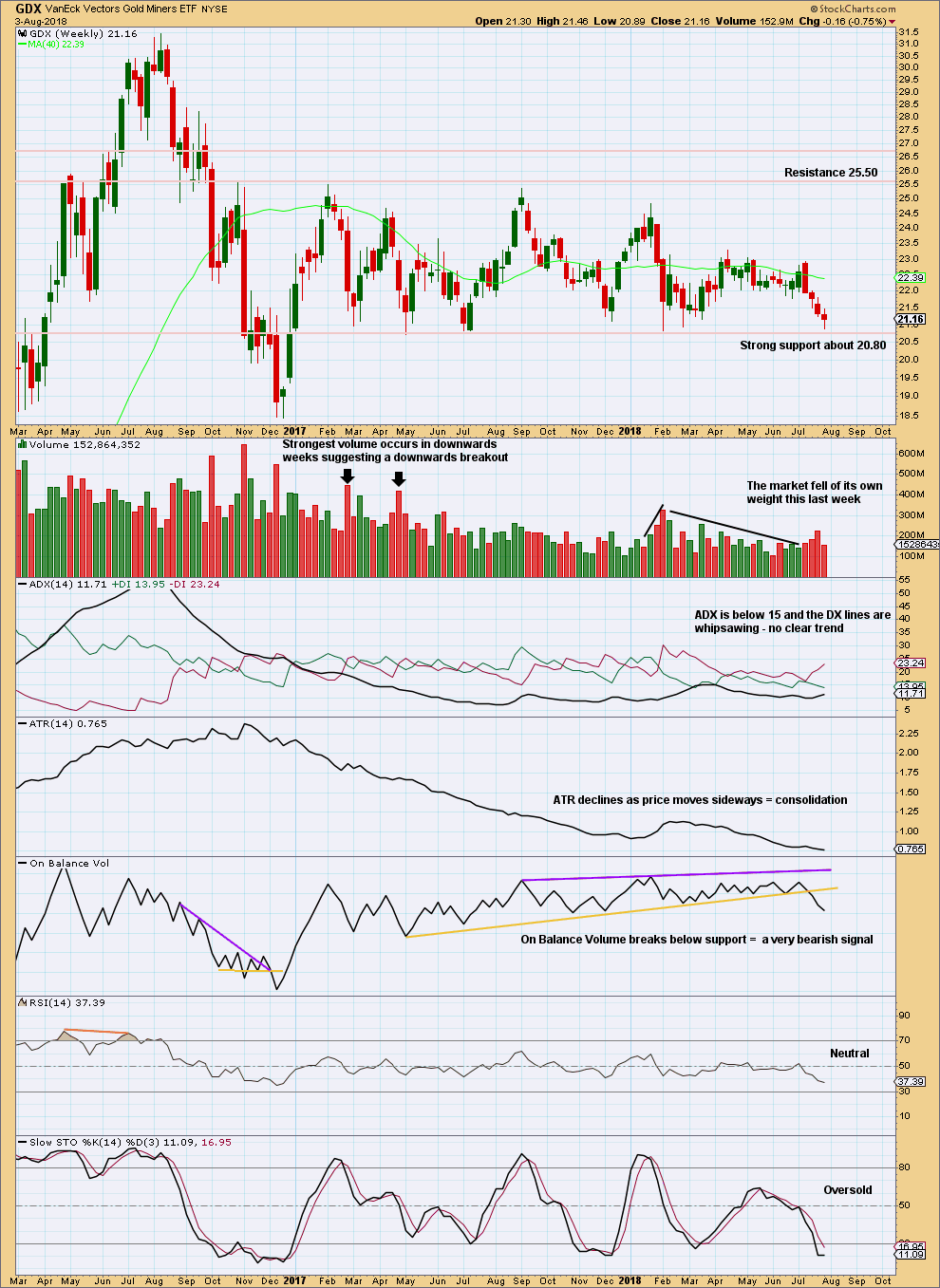

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX has been range bounce since January 2017. This is a very long sideways consolidation. The longer it continues, the more sustained the eventual breakout will be. Volume suggests the breakout may more likely be downwards.

Support about 20.80 has been tested about eight times and so far has held. The more often a support area is tested and holds, the more technical significance it has.

Price is now almost at support about 20.80. Stochastics is now oversold. Normally, it would be reasonable to expect that downwards movement may end here and an upwards swing may develop. But the very bearish signal from On Balance Volume suggests a downwards breakout may be about to happen.

A downwards breakout would require a close below support. If it has support from volume, it would be very bearish; but that is not necessary for a downwards breakout, because the market may fall of its own weight.

GDX DAILY CHART

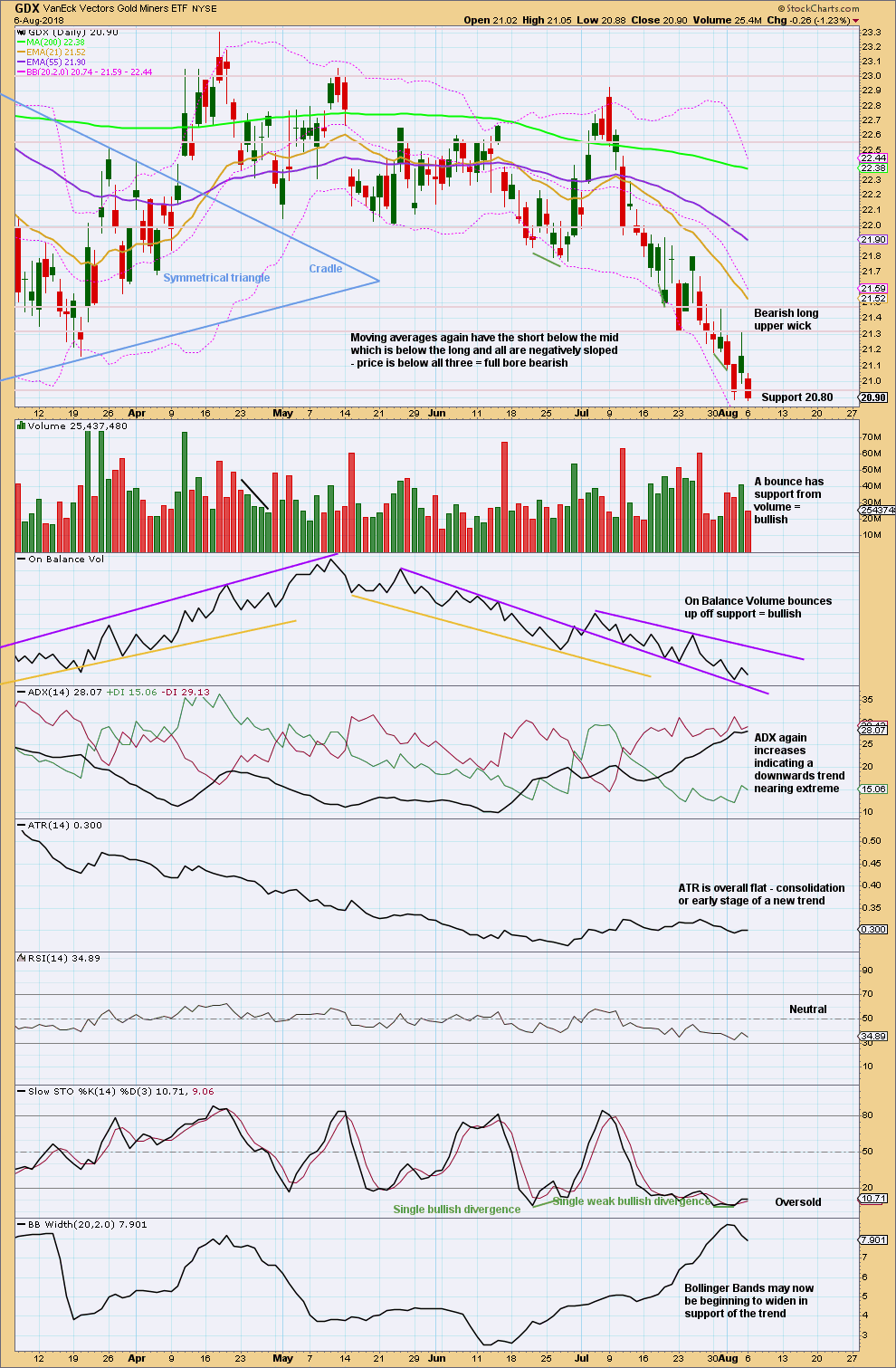

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is now at very strong support. In the first instance, at least expect some bounce here to relieve oversold conditions. Thereafter, look out for a possible downwards breakout.

Published @ 10:15 p.m. EST.

Gold and silver prices will not move till GSR breaks below 78 then 75.

I know members must be getting tired of me postings about GSR.

Lara: is there a long term /short term wave count for these ratios: GSR and BGMI/GOLD??

Lara, Might be a small triangle forming on the hourly since Friday?

main hourly chart updated:

alternate updated:

you’ll notice both need more downwards movement short term