Last analysis on the 10th of June expected a deep correction for a B wave. Price has mostly moved sideways, and has now formed a fairly well defined consolidation zone. A correction has developed, but at this stage it is not deep.

New updates to this analysis are in bold.

BEARISH ELLIOTT WAVE ANALYSIS

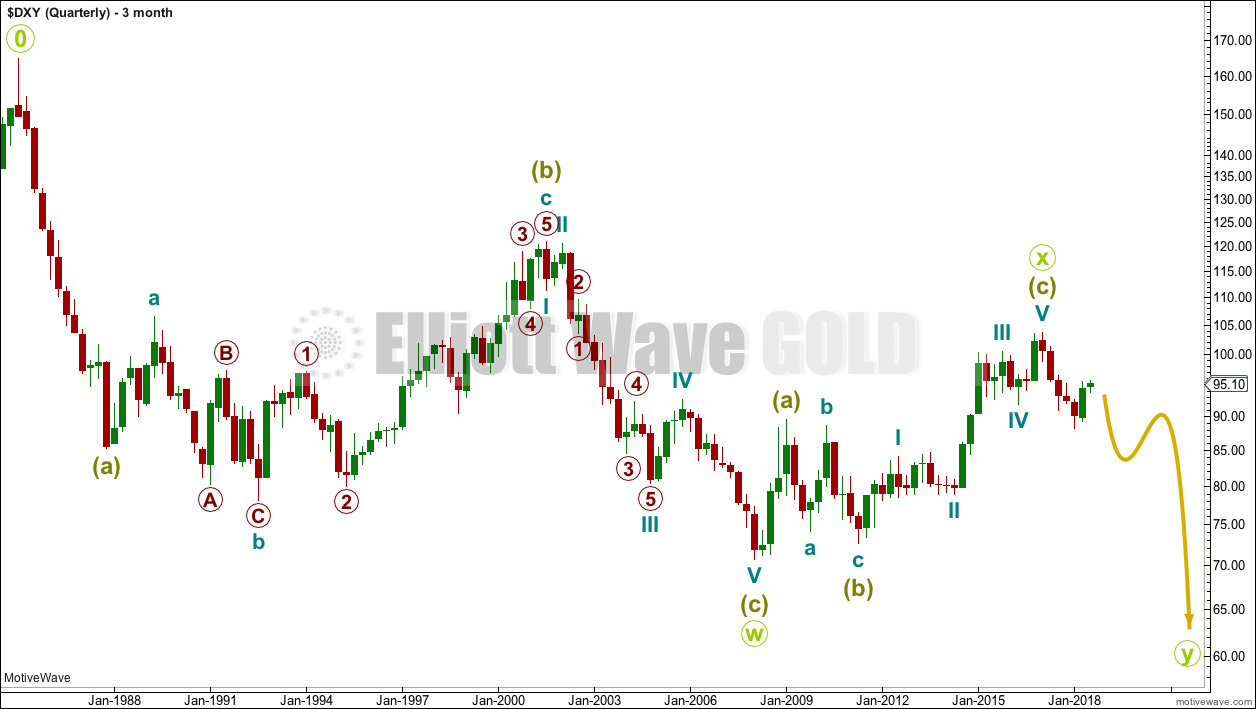

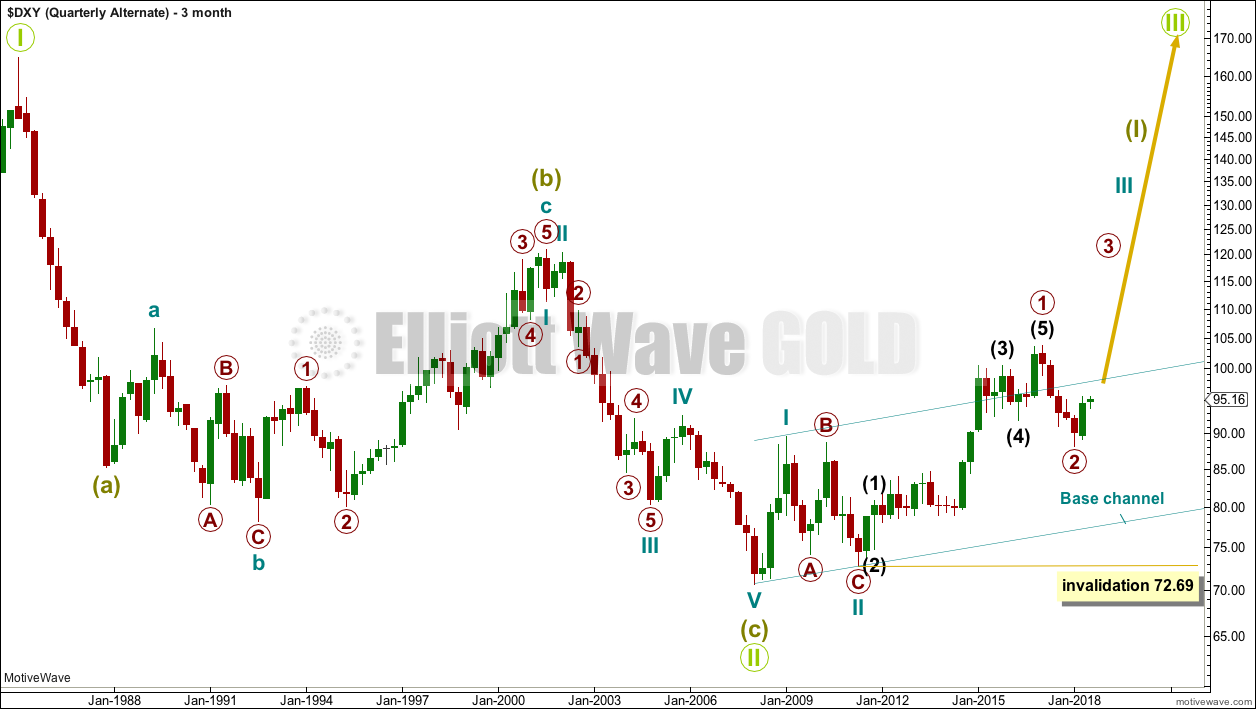

QUARTERLY CHART

The wave count begins at 0.

A huge double zigzag may be continuing lower.

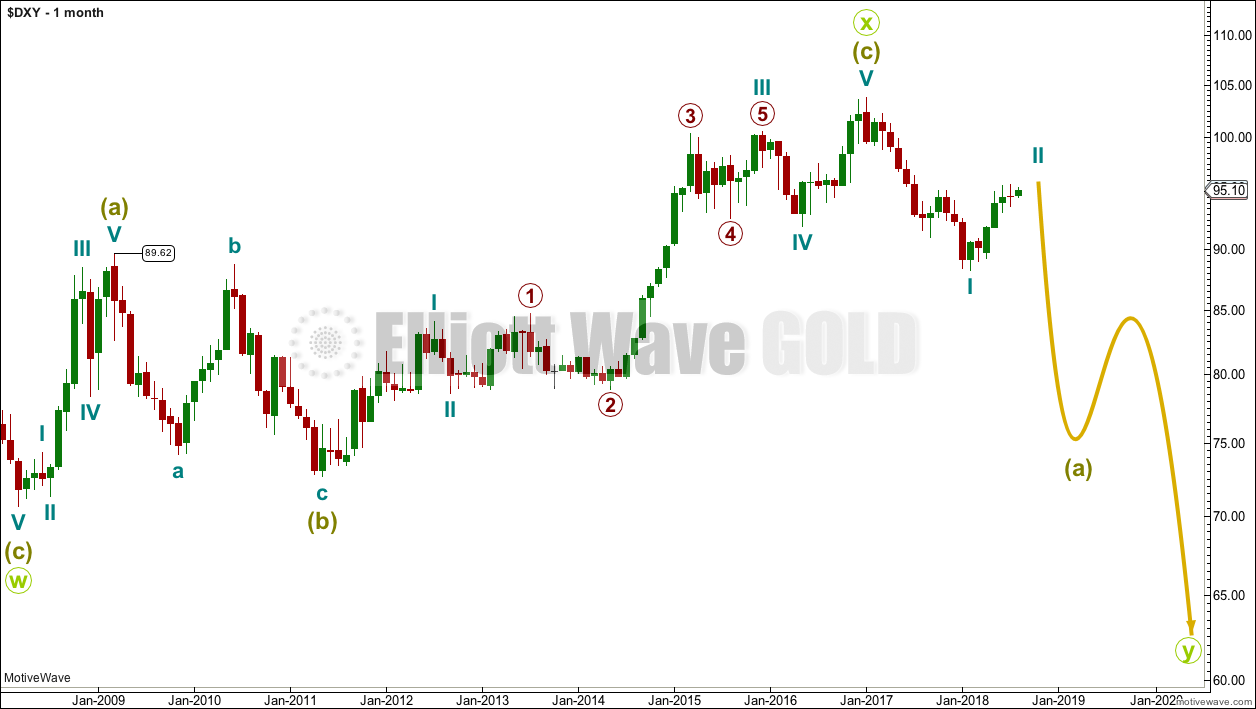

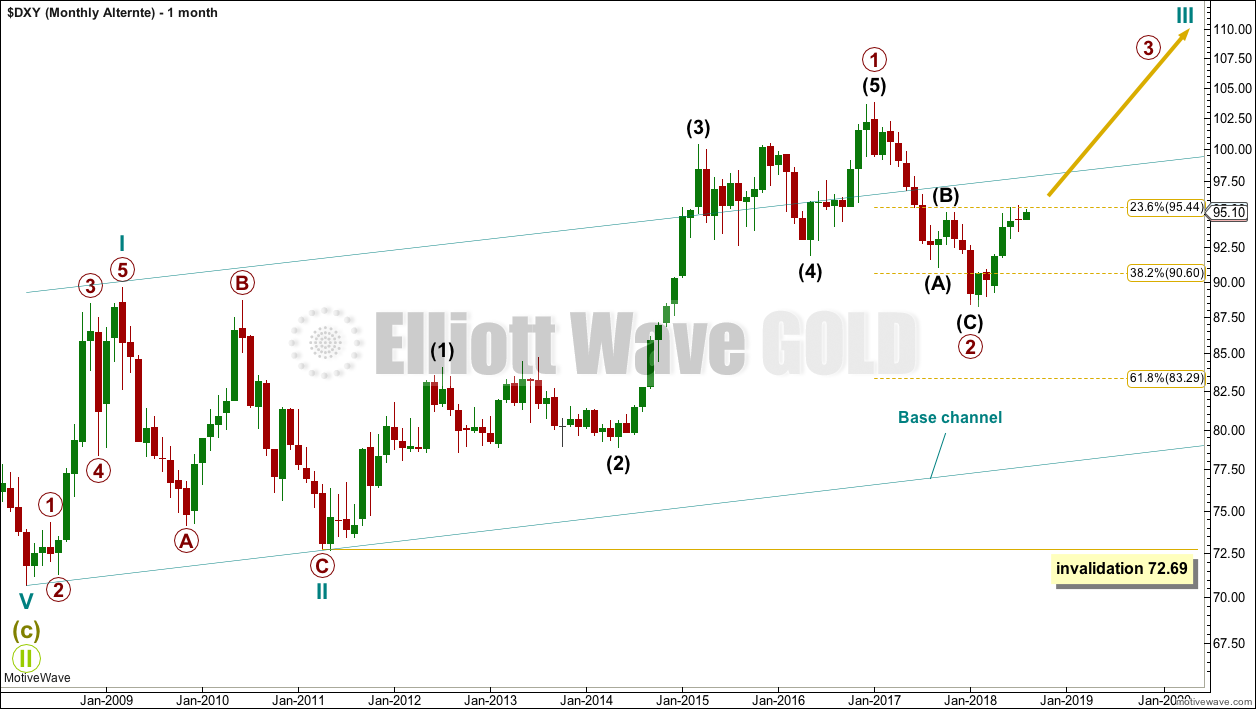

MONTHLY CHART

Downwards movement from the high in January 2017 cannot be a fourth wave correction within an ongoing impulse higher because a new low below 89.62 would be back in first wave price territory.

That indicates the last big wave up may be a completed three, and for that reason this is my main wave count.

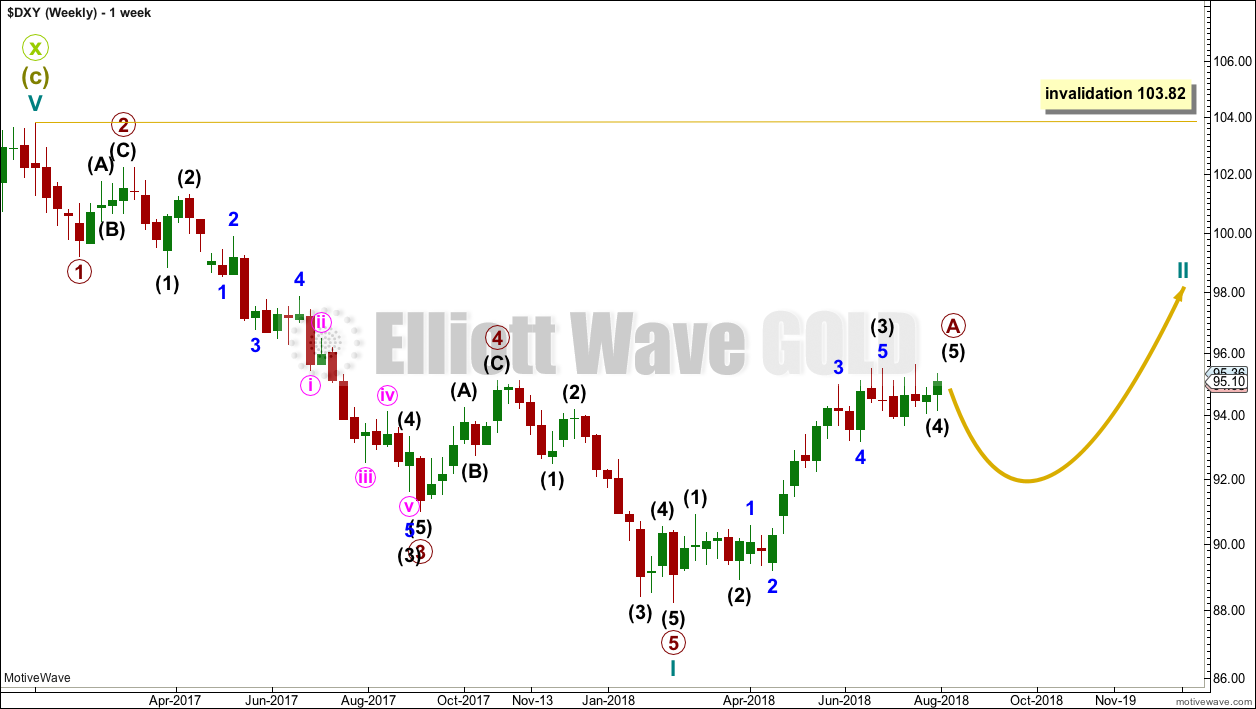

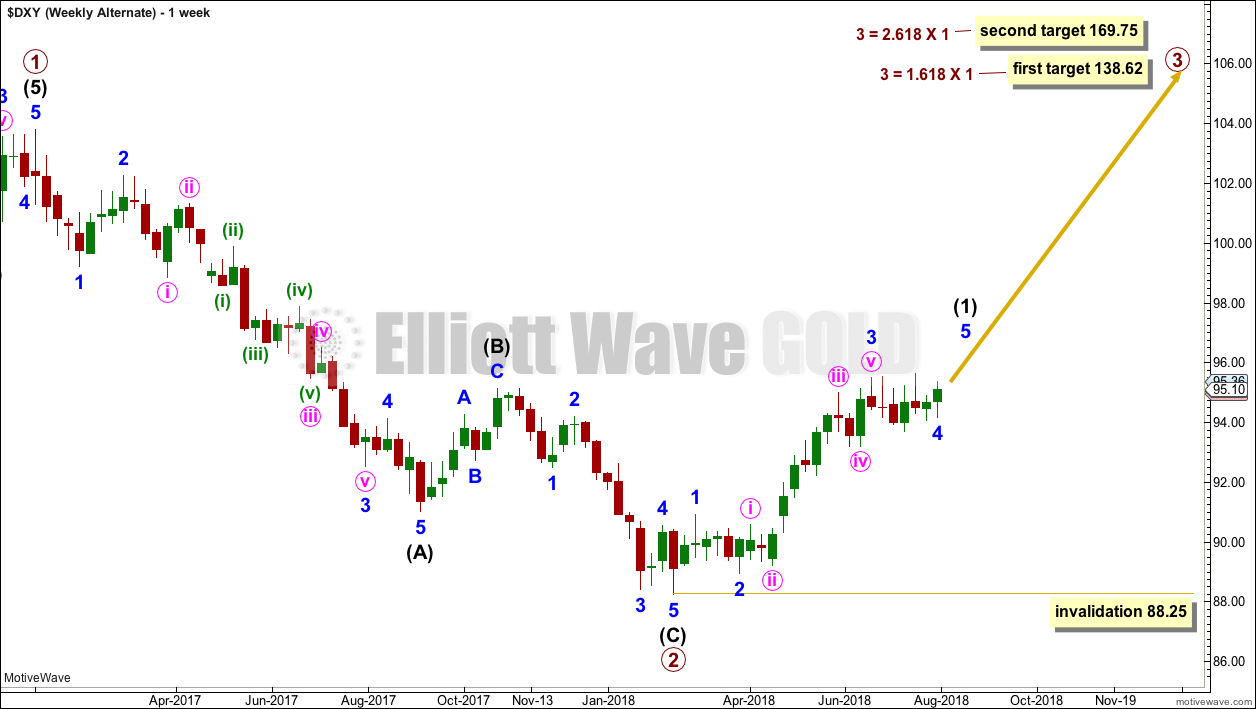

WEEKLY CHART

Cycle wave I downwards fits very well as a five wave impulse. This may be reasonably expected to be followed by a three wave structure upwards.

So far upwards movement has developed a little more since last analysis. This now looks like an almost complete five up.

If cycle wave II is beginning with a five up, then it may be unfolding as a zigzag, which is the most common type of corrective structure.

When primary wave A is a completed five wave impulse, then primary wave B should begin.

Cycle wave II may not move beyond the start of cycle wave I above 103.82.

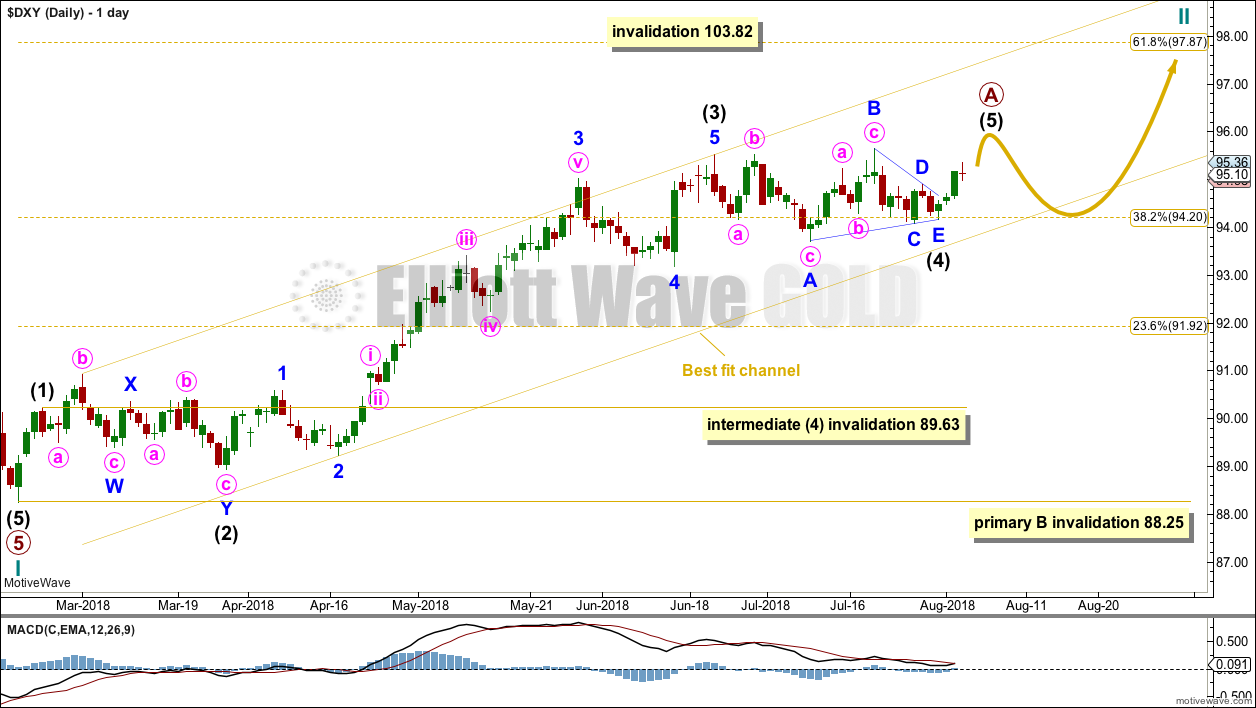

DAILY CHART

So far primary wave A fits very well as an almost complete five wave impulse.

There is excellent alternation between the double flat correction of intermediate wave (2) and the triangle of intermediate wave (4). There is no adequate Fibonacci ratio between intermediate waves (1) and (3).

Within intermediate wave (3), there are no adequate Fibonacci ratios between minor waves 1, 3 and 5.

So far primary wave A remains contained within a channel. When price breaks out of the lower edge of the channel, then that may be an indication that primary wave A is complete and primary wave B may then have begun.

While primary wave A looks incomplete, intermediate wave (4) may not move into intermediate wave (1) price territory.

When primary wave A could be complete, then the following correction for primary wave B may not move beyond the start of primary wave A.

Primary wave B may be any one of more than 23 possible corrective structures. It may be choppy and overlapping as a combination, flat or triangle, or it may be a more brief sharp pullback as a zigzag. It may be expected to last anywhere from about 4 to 8 months.

BULLISH ELLIOTT WAVE ANALYSIS

QUARTERLY CHART

A single zigzag down to the last major low may still be complete.

A new upwards trend may continue. So far there may be two overlapping first and second waves. Primary wave 2 may not move beyond the start of primary wave 1 below 72.69.

Primary wave 2 should find strong support at the lower edge of the teal base channel if it gets down that low.

MONTHLY CHART

Primary wave 2 may be a complete zigzag. However, this wave down can also be seen as a five and primary wave 2 may yet continue lower.

WEEKLY CHART

This bullish wave count sees the last wave down as a completed zigzag. If this is correct, then within primary wave 3 no second wave correction may move beyond its start below 88.25.

TECHNICAL ANALYSIS

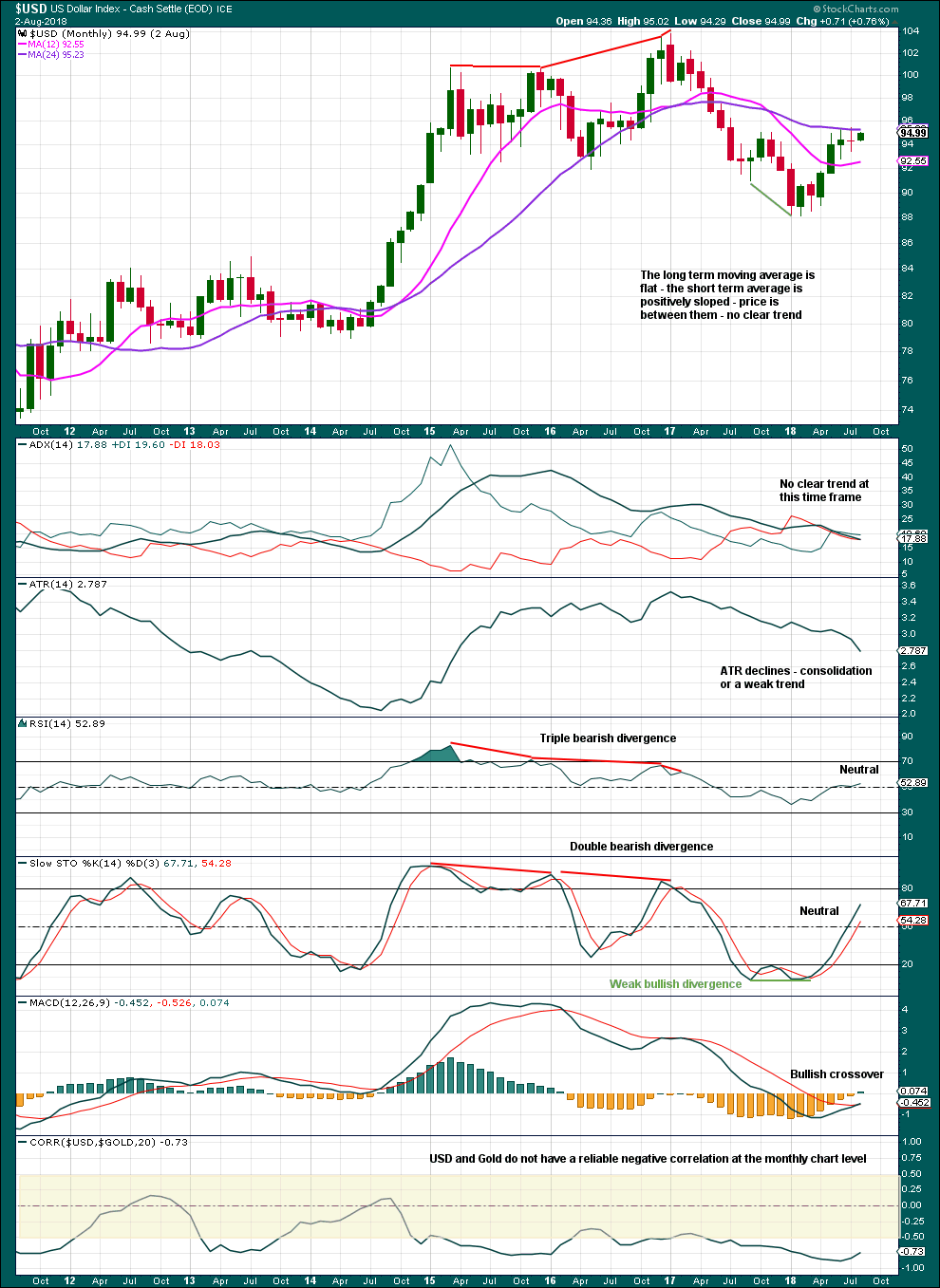

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

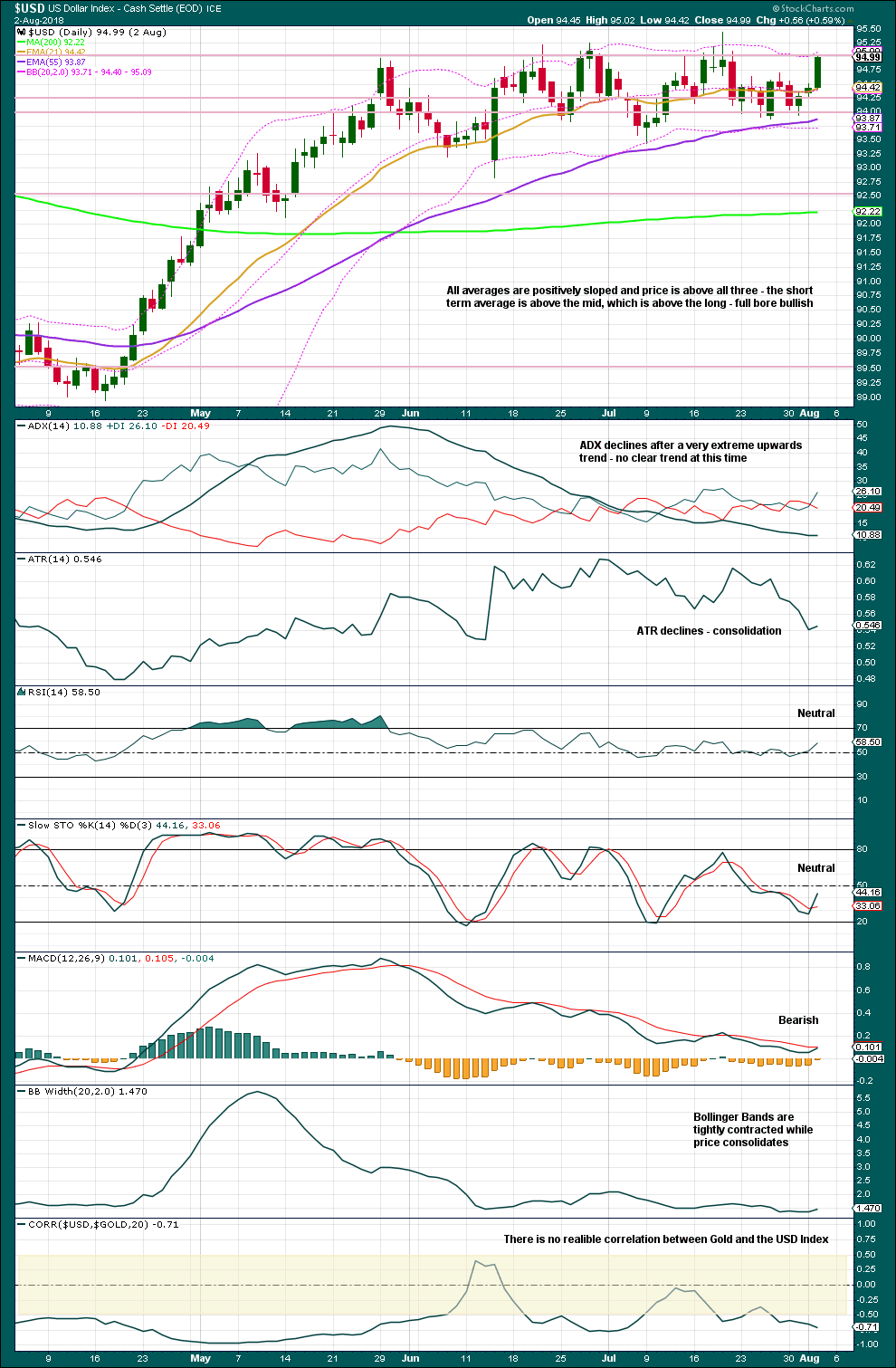

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is consolidating with resistance in a zone about 95.00 to 95.45 and support in a zone about 93.45 to about 92.85. Unfortunately, neither StockCharts nor BarChart provide volume data for the USD Index. If they did, then the direction of the day with strongest volume would be an indicator of the most likely breakout direction from the consolidation.

Published @ 08:53 p.m. EST on 4th August, 2018.