Last Elliott wave analysis of GDX was almost a year ago.

Summary: The situation is now somewhat clearer after a strong breakout from a very long consolidation. Only one Elliott wave count is now published for GDX.

It is my opinion based upon experience that this market does not have sufficient volume for reliable Elliott wave analysis, which is why I do not provide it on a regular basis. Classic technical analysis would be a better approach for this market, which is why I provide it daily to members.

For members who are interested in an Elliott wave count of GDX, I am providing it here. This analysis should be used only as a general guide. For a more reliable guide see the daily GDX technical analysis provided at the end of each Gold analysis.

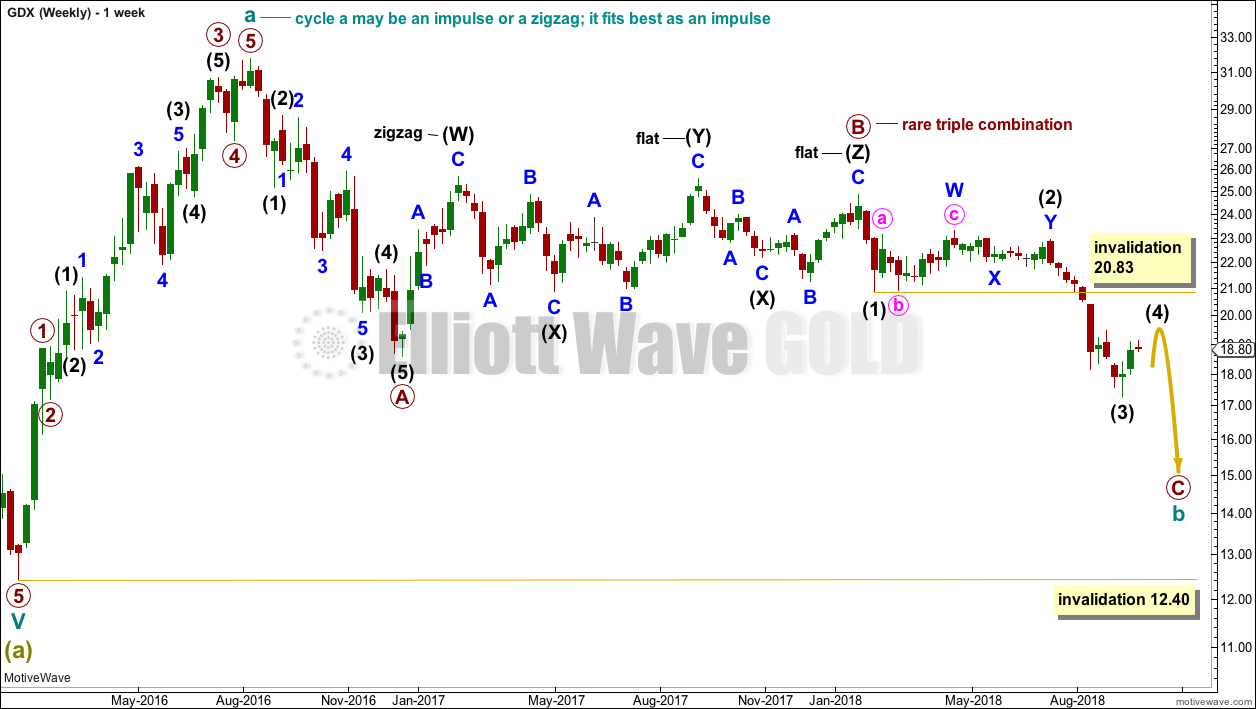

MONTHLY CHART

From September 2011 to January 2016 this downwards wave fits best as a five wave impulse. The downwards five is labelled Super Cycle wave (a). If this downwards wave is a five, then it should be followed by a three up and then another five down.

The following three up labelled Super Cycle wave (b) would most likely be incomplete, and it would likely last longer to have better proportion to Super Cycle wave (a).

Super Cycle wave (b) would most likely subdivide as a zigzag, although it may also be a flat, triangle or combination. None of the more than 23 possible corrective structures can be eliminated because it is not possible to have full confidence on the structure of cycle wave a within it.

If cycle wave a is a five wave structure (which it fits best as), then Super Cycle wave (b) would be indicated as unfolding as a zigzag. Within the zigzag, cycle wave b may not move beyond the start of cycle wave a below 12.40.

If cycle wave a is a three wave structure (a zigzag), then Super Cycle wave (b) may be any one of a flat, triangle or combination. Within an expanded flat, running triangle or combination, wave b (or x) may move beyond the start of wave a (or w) below 12.40.

The weekly chart below looks at the structure of Super Cycle wave (b) so far.

WEEKLY CHART

If cycle wave a is an impulse, then cycle wave b may not move beyond its start below 12.40.

If price makes a new low below 12.40, then cycle wave a would need to be relabelled as a zigzag.

Cycle wave b looks best as an incomplete zigzag. The last strong downwards wave looks like a third wave, which is labelled intermediate wave (3).

The structure of primary wave B is very difficult to analyse. Although it looks like a triangle, and a triangle will fit, a triangle looks wrong. The trend lines would either not converge or would not be adhered to.

After considering several different possible structures the only one which has a good fit is a very rare triple combination.

Primary wave C must complete as a five wave impulse. So far intermediate waves (1), (2) and (3) may now be complete. Intermediate wave (4) may not move into intermediate wave (2) price territory above 20.83.

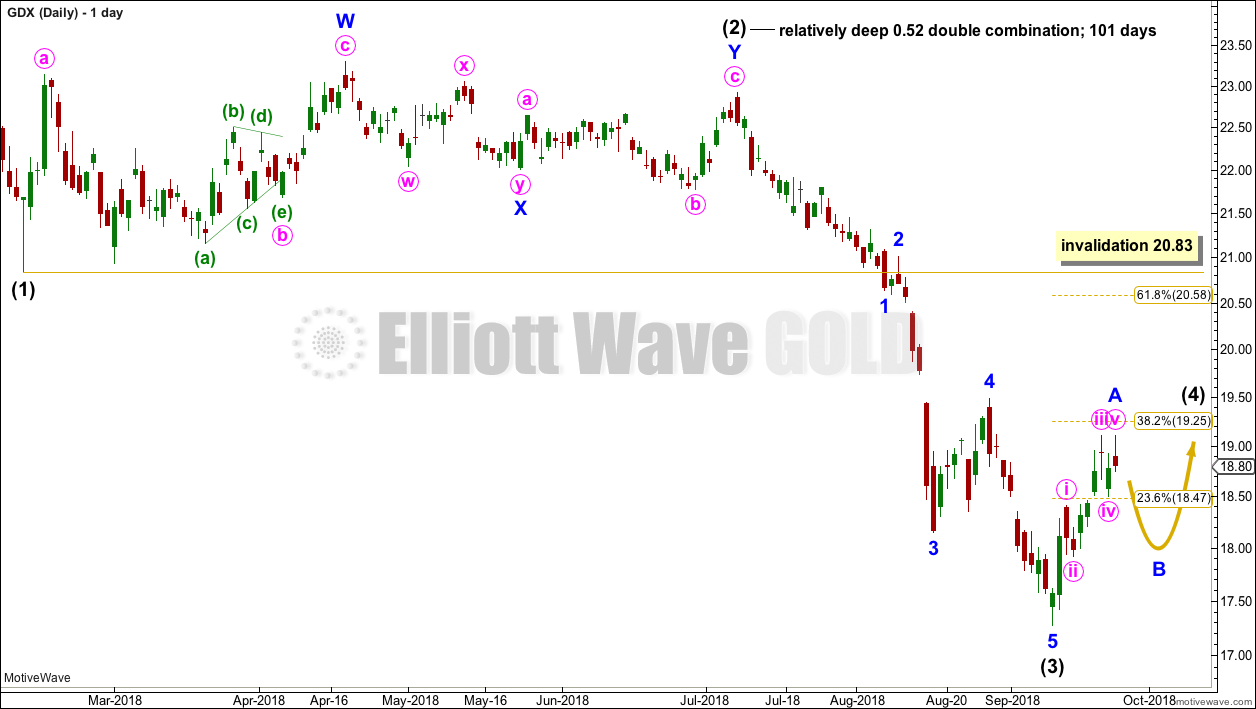

DAILY CHART

Intermediate wave (4) would most likely subdivide as a zigzag or zigzag multiple to exhibit alternation with the combination of intermediate wave (2).

Intermediate wave (4) may end close to the 0.382 Fibonacci ratio to exhibit alternation in depth with intermediate wave (2).

So far minor wave A looks like it may be a complete five wave impulse. If that piece of this wave count is correct, then minor wave B may not move beyond the start of minor wave A below 17.28.

Minor wave B may move sideways for several sessions, or it could be a quick sharp pullback over in just a few days. There are multiple structural options for minor wave B; B waves exhibit the greatest variety in structure and price behaviour.

When minor wave B is a complete corrective structure, then minor wave C would be most likely to make at least a slight new high above the end of minor wave A at 19.11 to avoid a truncation. Minor wave C may end only slightly above the end of minor wave A at 19.25 to see intermediate wave (4) end about the 0.382 Fibonacci ratio.

Published @ 04:36 a.m. EST.

Thanks for the update Lara. Good to see you also had a difficult time with the sideways movement of Primary B…

LOL I sure did. That took a while.

I’ll only ever consider a very rare triple when all other options have been thoroughly considered and discarded.