S&P 500

It was expected for Friday that price may move lower, which is what happened.

Summary: At this stage, it would be best to let price tell us if primary wave 3 is over or not.

Long upper candlestick wicks and a bearish short term volume profile support the idea that price may continue a little lower to begin the new week. The short term target is now at 2,892.

While price remains above 2,864.12, then this may still be another pullback within an ongoing upwards trend. The target is now at 3,012.

If price makes a new low by any amount at any time frame below 2,864.12, then some confidence that primary wave 4 has begun may be had. Targets are either 2,716.89 or 2,578.30. There is now enough bearishness from the AD line to take this possibility fairly seriously. Primary wave 4 is expected to be a large choppy consolidation, which may last about a Fibonacci 13 weeks.

The final target for this bull market to end remains at 3,616, which may be met in October 2019.

The biggest picture, Grand Super Cycle analysis, is here.

Last historic analysis with monthly charts is here, video is here.

MAIN ELLIOTT WAVE COUNT

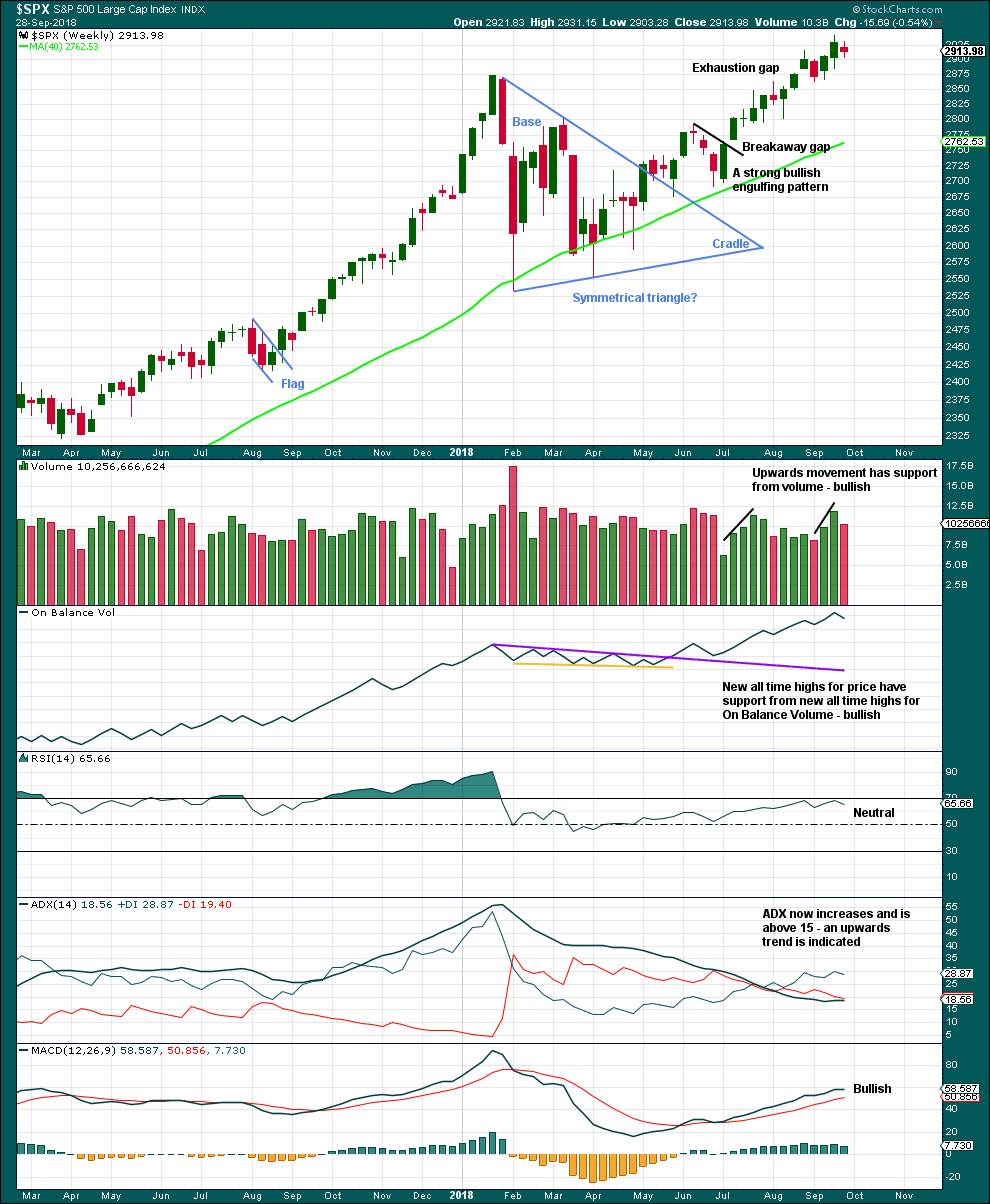

WEEKLY CHART

Cycle wave V must complete as a five structure, which should look clear at the weekly chart level and also now at the monthly chart level. It may only be an impulse or ending diagonal. At this stage, it is clear it is an impulse.

Within cycle wave V, the third waves at all degrees may only subdivide as impulses.

Intermediate wave (4) has breached an Elliott channel drawn using Elliott’s first technique. The channel is redrawn using Elliott’s second technique: the first trend line from the ends of intermediate waves (2) to (4), then a parallel copy on the end of intermediate wave (3). Intermediate wave (5) may end either midway within the channel, or about the upper edge.

There is perfect alternation and excellent proportion between intermediate waves (2) and (4).

At this stage, the expectation is for the final target to me met in October 2019. If price gets up to this target and either the structure is incomplete or price keeps rising through it, then a new higher target would be calculated.

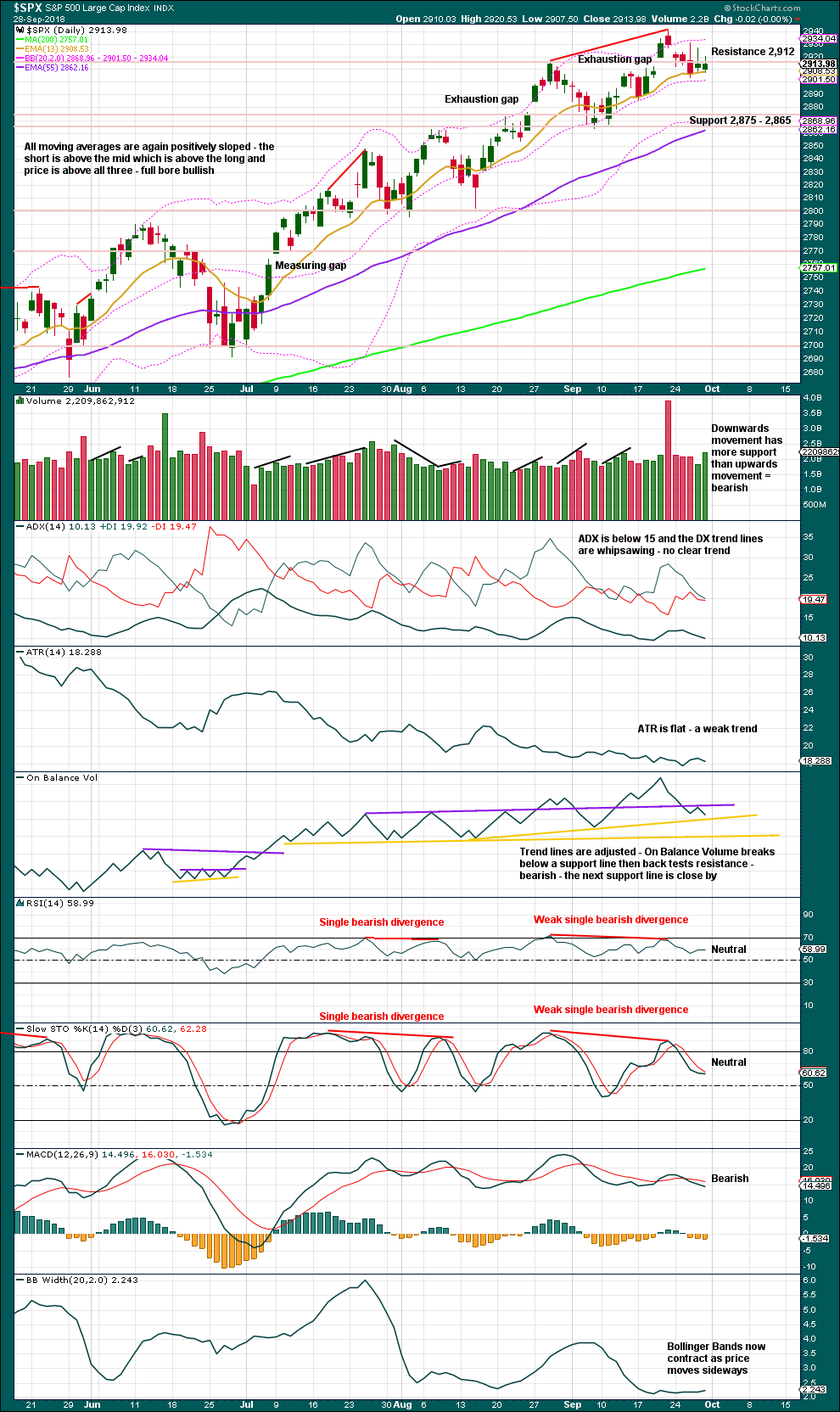

DAILY CHART

Intermediate wave (5) avoided a truncation now that it has a new high above the end of intermediate wave (3) at 2,872.87.

Intermediate wave (3) exhibits no Fibonacci ratio to intermediate wave (1). It is more likely then that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (1) or (3). Intermediate wave (5) has passed equality in length and 1.618 the length of intermediate wave (1). The next Fibonacci ratio in the sequence is 2.618 giving a target at 3,124. If the target at 3,012 is met and passed, then this would be the next calculated target.

A target for intermediate wave (5) to end is calculated at minor degree.

Intermediate wave (5) is unfolding as an impulse, and within it minor waves 1 through to 4 may now all be complete.

Within intermediate wave (5), minor wave 3 was extended. Minor wave 5 may also extend.

Minute wave ii may move a little lower to begin next week. The target for it to end is about 2,892, which is very close to 0.618 of minute wave i.

Minute wave ii may not move beyond the start of minute wave i below 2,864.12.

ALTERNATE ELLIOTT WAVE COUNT

DAILY CHART

It is possible to see now that primary wave 3 could be over at the last high by simply moving the degree of labelling within minor wave 5 up one degree.

It is reasonably common for the S&P to exhibit a Fibonacci ratio between two actionary waves within an impulse, and uncommon for it to exhibit Fibonacci ratios between all three actionary waves within an impulse. The lack of a Fibonacci ratio for minor wave 5 within this wave count is not of any concern; this looks typical.

Primary wave 4 would most likely end somewhere within the price territory of the fourth wave of one lesser degree. Intermediate wave (4) has its price territory from 2,872.87 to 2,532.69. Within this range sit two Fibonacci ratios giving two targets. The lower 0.382 Fibonacci ratio may be more likely.

Primary wave 2 unfolded as a shallow regular flat correction lasting 10 weeks. Primary wave 4 may exhibit alternation in structure and may most likely unfold as a zigzag, triangle or combination. A zigzag would be the most likely structure as these are the most common corrective structures and would provide the best alternation with primary wave 2.

Primary wave 4 may not move into primary wave 1 price territory below 2,111.05. However, the lows in primary wave 4 should not get close to this point. The lower edge of the teal channel on the weekly chart should provide very strong support.

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The symmetrical triangle base distance is 340.18. Added to the breakout point of 2,704.54 this gives a target at 3,044.72. This target has not yet been met.

This week completed an inside week with the balance of volume downwards and the candlestick closing red. Downwards movement within this week does not have support from volume. At this time frame, this week looks like a small pause within an ongoing upwards trend.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Closure of the last gap is bearish. The gap is now labelled an exhaustion gap.

The long upper wicks on the last three daily candlesticks are bearish.

Although the candlestick for Friday closed green, Friday saw downwards movement with a lower low and a lower high. Downwards movement has support from volume; the short term volume profile is bearish.

The bottom line remains that an upwards trend remains intact until price makes a new swing low. Look now for strong support about 2,875 – 2,865. If price makes a new swing low below 2,864.12, that would indicate a change from an upwards trend to either a larger sideways consolidation or a new downwards trend.

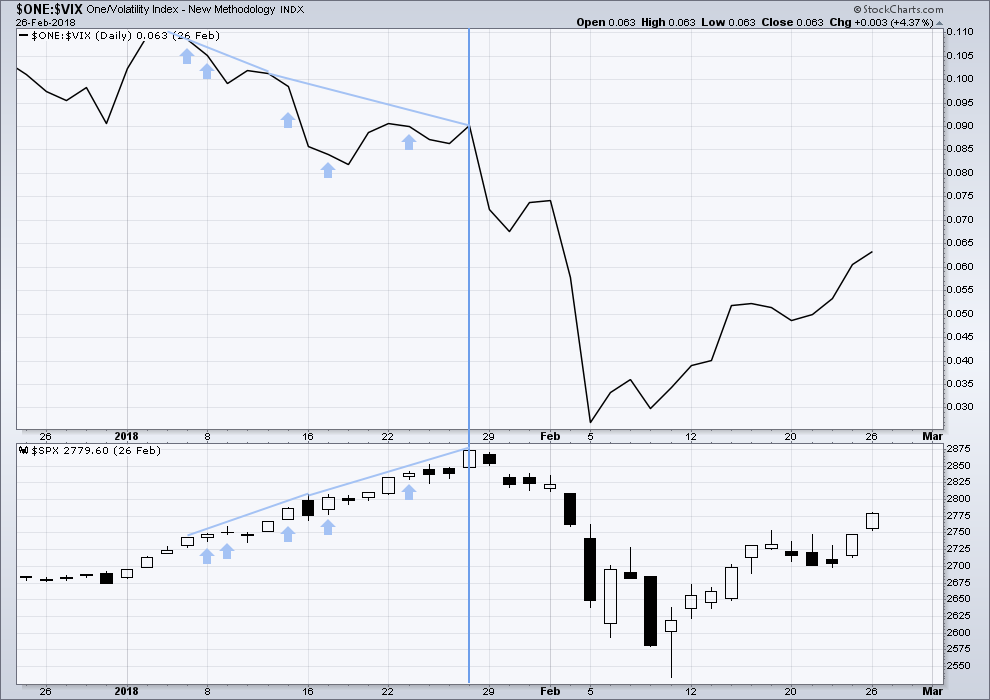

VOLATILITY – INVERTED VIX CHART

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

To keep an eye on the all time high for inverted VIX a weekly chart is required at this time.

Notice how inverted VIX has very strong bearish signals four weeks in a row just before the start of the last large fall in price. At the weekly chart level, this indicator may be useful again in warning of the end of primary wave 3.

At this time, there is mid term bearish divergence between price and inverted VIX: price has made another new all time high, but inverted VIX has not. This divergence may persist for some time. It may remain at the end of primary wave 3, and may develop further to the end of primary wave 5.

Downwards movement within this week has support from a normal increase in market volatility. There is no new short term divergence.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com. So that colour blind members are included, bearish signals

will be noted with blue and bullish signals with yellow.

Normally, volatility should decline as price moves higher and increase as price moves lower. This means that normally inverted VIX should move in the same direction as price.

There is mid term divergence with a new all time high from price not supported by a corresponding new all time high from inverted VIX. This divergence is bearish.

Downwards movement for Friday comes with a decline in market volatility as inverted VIX moves higher. This is short term bullish divergence.

Mid term bearish divergence between price and inverted VIX can be seen on both daily and weekly charts now. However, this may not be a good timing tool in identifying the end of primary wave 3; divergence may develop further before primary wave 3 ends.

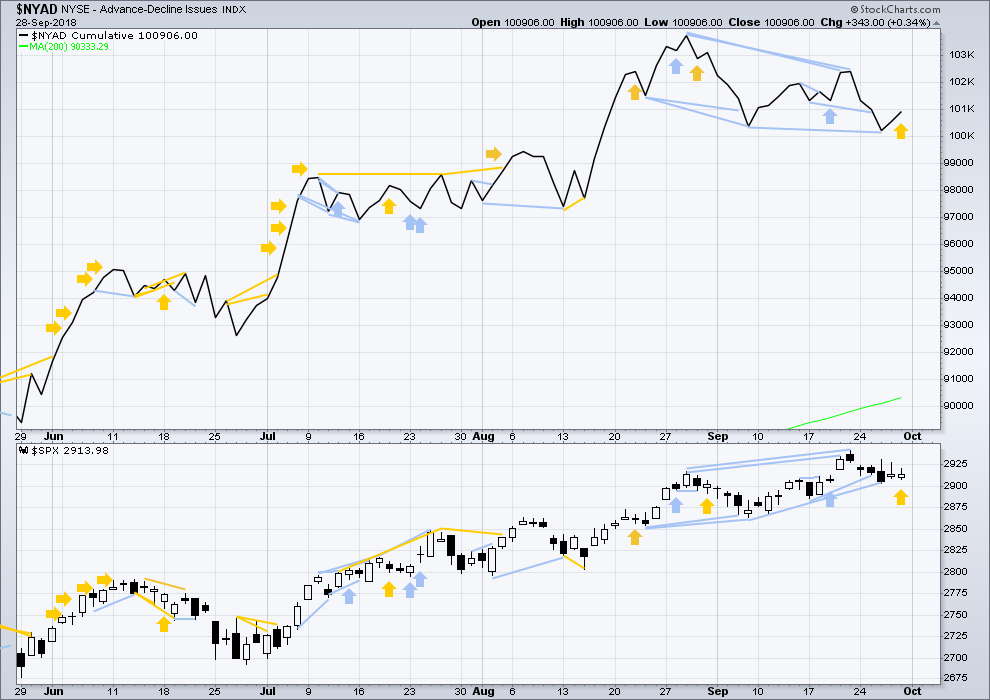

BREADTH – AD LINE

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

When primary wave 3 comes to an end, it may be valuable to watch the AD line at the weekly time frame as well as the daily.

There is still short term bearish divergence at the weekly chart level between price and the AD line. It is possible now that the end of primary wave 3 is quite close.

For the last completed week, price moved sideways. Downwards movement within the week has support from a decline in breadth.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is normally 4-6 months divergence between price and market breadth prior to a full fledged bear market. This has been so for all major bear markets within the last 90 odd years. With no longer term divergence yet at this point, any decline in price should be expected to be a pullback within an ongoing bull market and not necessarily the start of a bear market. New all time highs from the AD line on the 29th of August means that the beginning of any bear market may be at the end of December 2018, but it may of course be a lot longer than that. My next expectation for the end of this bull market may now be October 2019.

Breadth should be read as a leading indicator.

For Friday price moved lower, but market breadth has improved. This divergence is bullish for the short term.

There is now a cluster of bearish signals at the daily chart from the AD line; this offers now some reasonable support to the new alternate Elliott wave count.

All of small, mid and large caps made new all time highs on the 27th of August. There is a little divergence here in breadth with large caps continuing to make new all time today and small and mid caps lagging.

DOW THEORY

The following lows need to be exceeded for Dow Theory to confirm the end of the bull market and a change to a bear market:

DJIA: 23,360.29.

DJT: 9,806.79.

S&P500: 2,532.69.

Nasdaq: 6,630.67.

All of DJIA, DJT, S&P500 and Nasdaq have made recent new all time highs. This provides Dow Theory confirmation that the bull market continues.

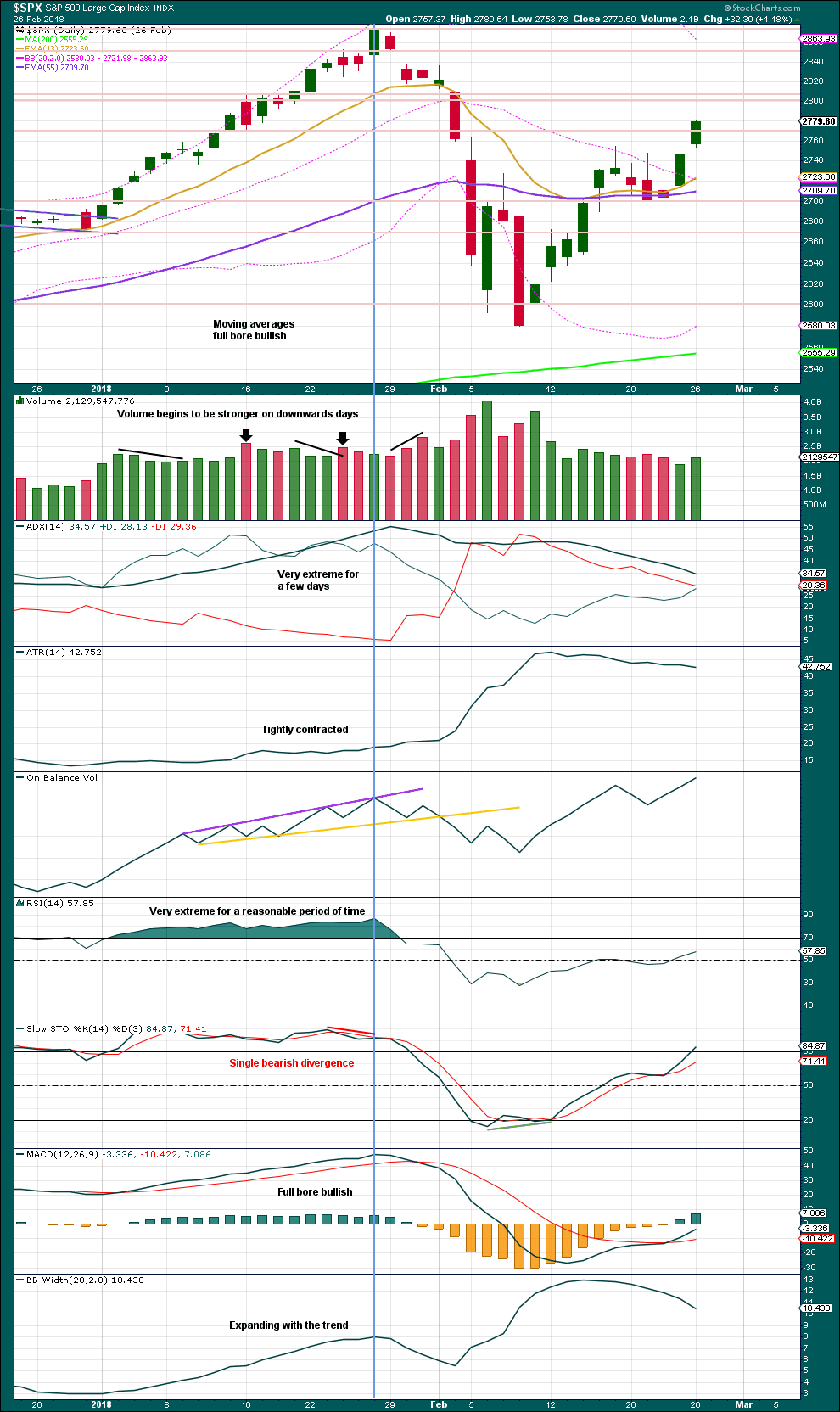

ANALYSIS OF THE END OF INTERMEDIATE WAVE (3)

TECHNICAL ANALYSIS

Click chart to enlarge. Chart courtesy of StockCharts.com.

This chart looked overly bullish at the end of intermediate wave (3). The only warning in hindsight may have been from volume spiking slightly on downwards days. There was no bearish divergence between price and either of RSI or On Balance Volume.

Single bearish divergence between price and Stochastics was weak, which is often an unreliable signal.

VIX

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

The strongest warning of an approaching intermediate degree correction at the daily chart level came from inverted VIX.

There was strong double bearish divergence at the high of intermediate wave (3), which is noted by the vertical line. There was also a sequence of five days of bearish divergence, days in which price moved higher but inverted VIX moved lower.

AD LINE

Click chart to enlarge. Chart courtesy of StockCharts.com.

This is a daily chart.

There was only single bearish divergence between price and the AD line at the end of intermediate wave (3). Approaching the high, there were no instances of price moving higher and the AD line moving lower.

Conclusion: When studying the behaviour of price and these indicators just before the start of intermediate wave (4), we may see some clues for warning us of primary wave 4. A cluster of bearish signals from VIX along with a bearish divergence from price and the AD line or On Balance Volume may warn of primary wave 4. The next instance will probably not behave the same as the last, but there may be similarities.

At this time, it does not look like primary wave 4 may begin right now, but we need to be aware of its approach.

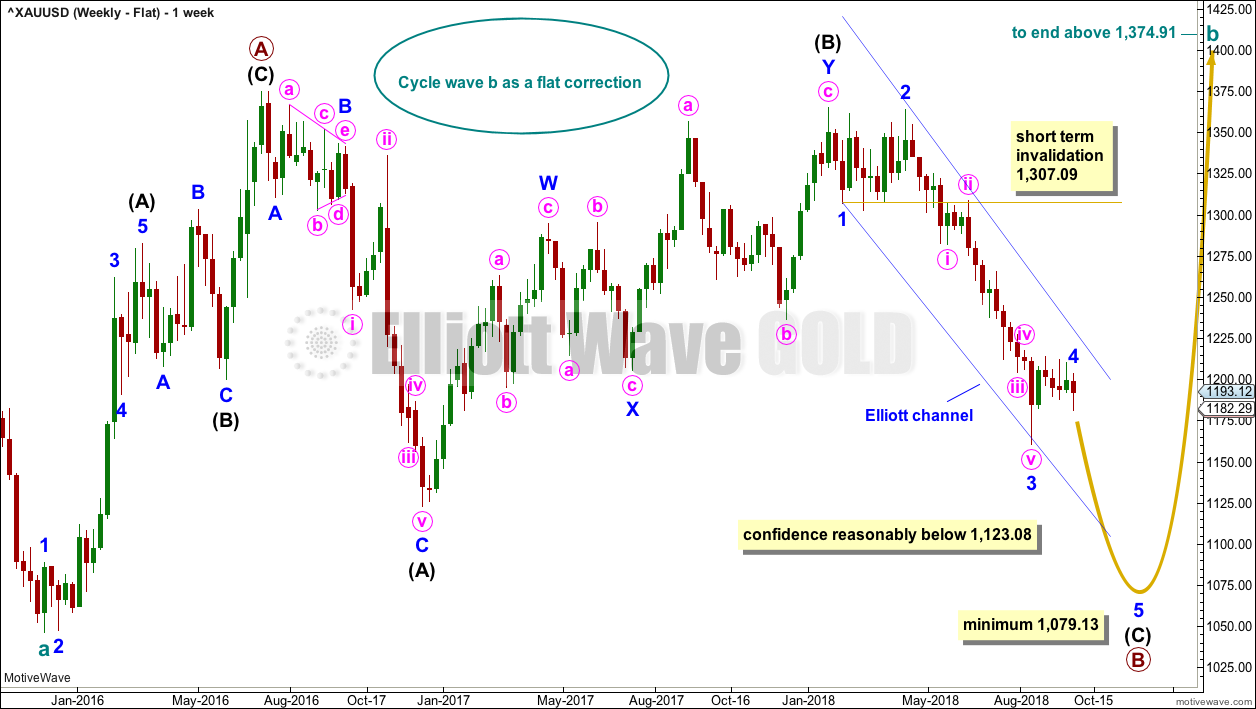

GOLD

After a five down from an Elliott wave triangle, a three up was expected to develop. This is what happened on Friday.

Summary: There are at this time multiple alternate wave counts because of the expectation that a cycle degree b wave is unfolding.

At this time, it may be best to use classic technical analysis as a guide as it offers some clarity.

A downwards breakout from an ascending triangle has completed, with support from volume and a strong bearish signal from On Balance Volume. The target is at 1,145. For the short term, look out for a throw back to test resistance at the lower triangle trend line on Monday / Tuesday before price moves down and away.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

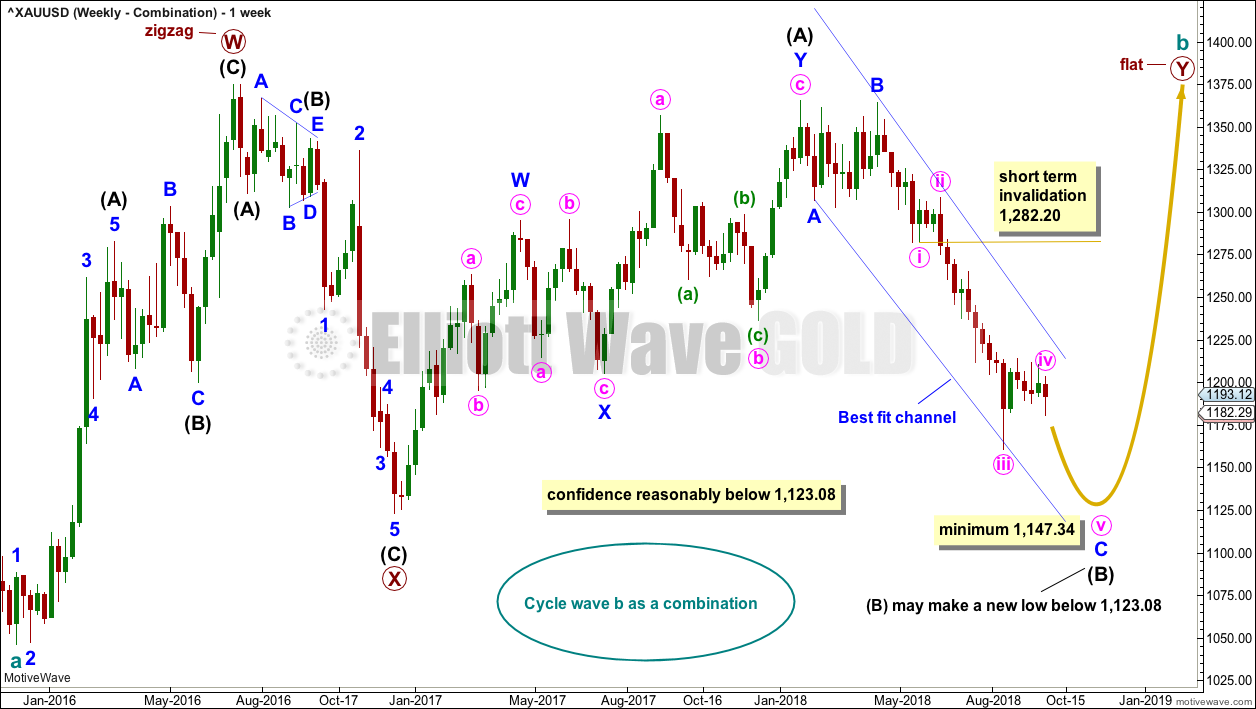

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – COMBINATION

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, flat, combination or double zigzag.

All four weekly wave counts are again considered at the end of this week. Only two shall be followed on a daily basis.

At this stage, this wave count may have a slightly higher probability than the other three weekly wave counts because it has more support from classic technical analysis.

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. My research on Gold so far has found that the most common two structures in a double combination are one zigzag and one flat correction. I have found only one instance where a triangle unfolded for wave Y. The most likely structure for wave Y would be a flat correction by a very wide margin, so that is what this wave count shall expect.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a single or multiple zigzag; for now it shall be labelled as a single. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Because the minimum requirement for intermediate wave (B) is not yet met, this wave count requires that minute wave v of minor wave C of intermediate wave (B) continues lower. This is the most immediately bearish of all four weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. I have found no examples of triple combinations for Gold at daily chart time frames or higher back to 1976. When the second structure in a double is complete, then it is extremely likely (almost certain) that the whole correction is over.

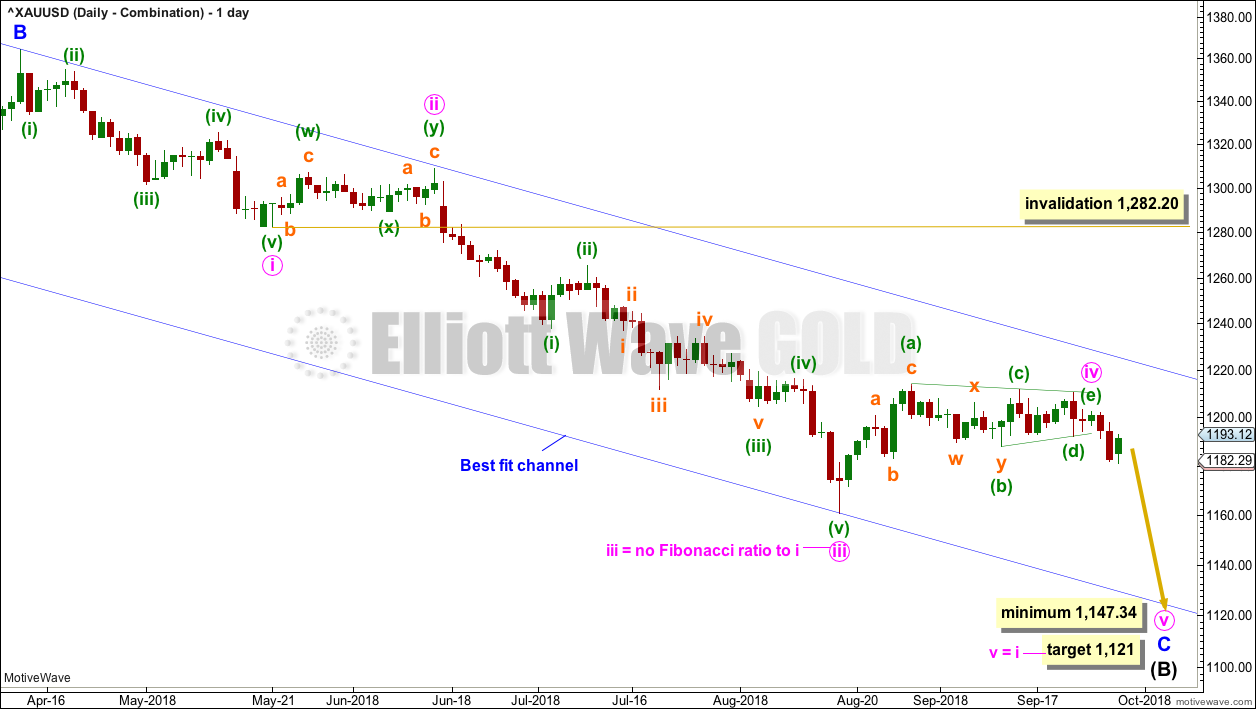

DAILY CHART – COMBINATION

Intermediate wave (B) may be unfolding lower as either a single or double zigzag. At this stage, a single zigzag will be considered; the expected direction nor minimum requirement at 1,147.34 do not differ from a double zigzag.

If intermediate wave (B) is unfolding as a single zigzag, then within it minor wave C must subdivide as a five wave impulse.

Minute wave iv looks like a complete regular contracting triangle. The downwards breakout from the triangle may be minute wave v.

Gold often exhibits surprisingly swift and short fifth waves out of its fourth wave triangles. If the target is wrong, then it may be too low.

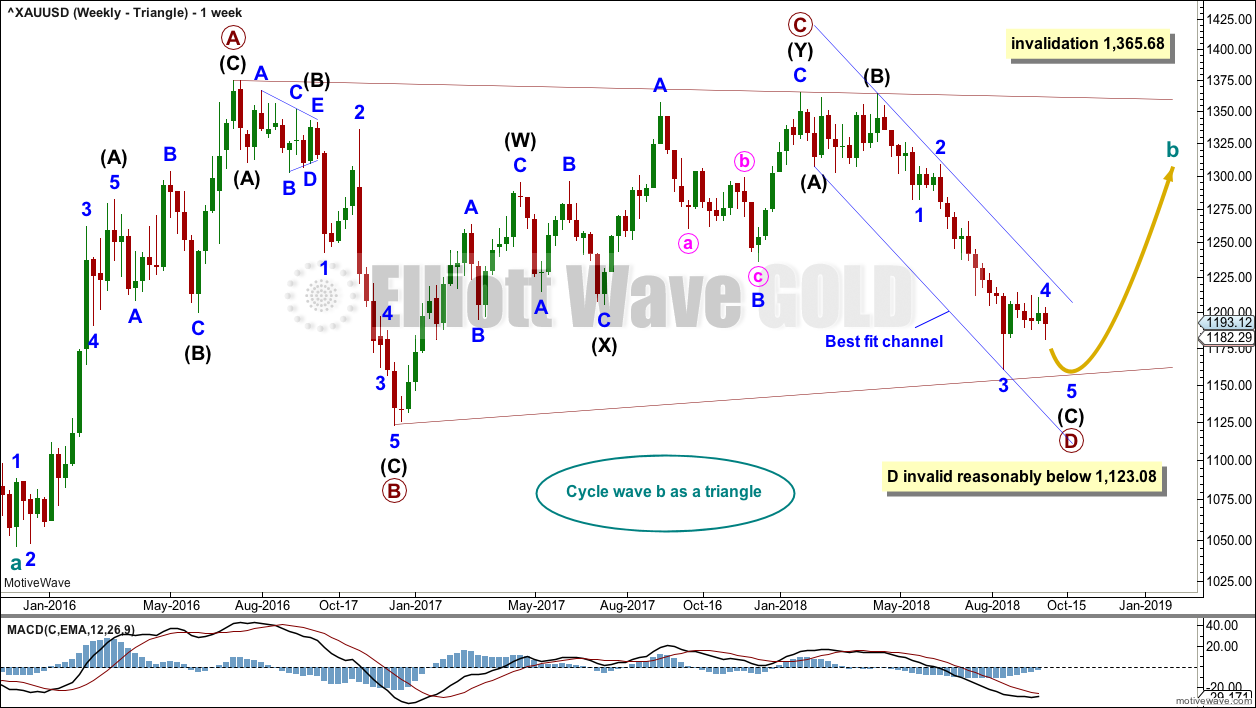

WEEKLY CHART – TRIANGLE

At the weekly chart level, the triangle so far has the best fit and look, but at this stage it no longer has good support from classic technical analysis. It is now judged to have a slightly lower probability than the combination wave count.

Cycle wave b may be an incomplete triangle. The triangle may be a contracting or barrier triangle, with a contracting triangle looking much more likely because the A-C trend line does not have a strong slope. A contracting triangle could see the B-D trend line have a stronger slope, so that the triangle trend lines converge at a reasonable rate. A barrier triangle would have a B-D trend line that would be essentially flat, and the triangle trend lines would barely converge.

Within a contracting triangle, primary wave D may not move beyond the end of primary wave B below 1,123.08. Within a barrier triangle, primary wave D may end about the same level as primary wave B at 1,123.08, so that the B-D trend line is essentially flat. Only a new low reasonably below 1,123.08 would invalidate the triangle.

Within both a contracting and barrier triangle, primary wave E may not move beyond the end of primary wave C above 1,365.68.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Primary wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best.

Primary wave D must be a single structure, most likely a zigzag.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

A channel is drawn on all charts about the downwards wave of primary wave D. Here, it is labelled a best fit channel. If this channel is breached by upwards movement, that may provide reasonable confidence in this weekly triangle wave count and the double zigzag count, and put serious doubt on the combination and flat wave counts.

After a slight new low, this wave count expects a consolidation for primary wave E to back test resistance at prior support, and then a significant new downwards wave for cycle wave C. For the long term, this is the most bearish wave count.

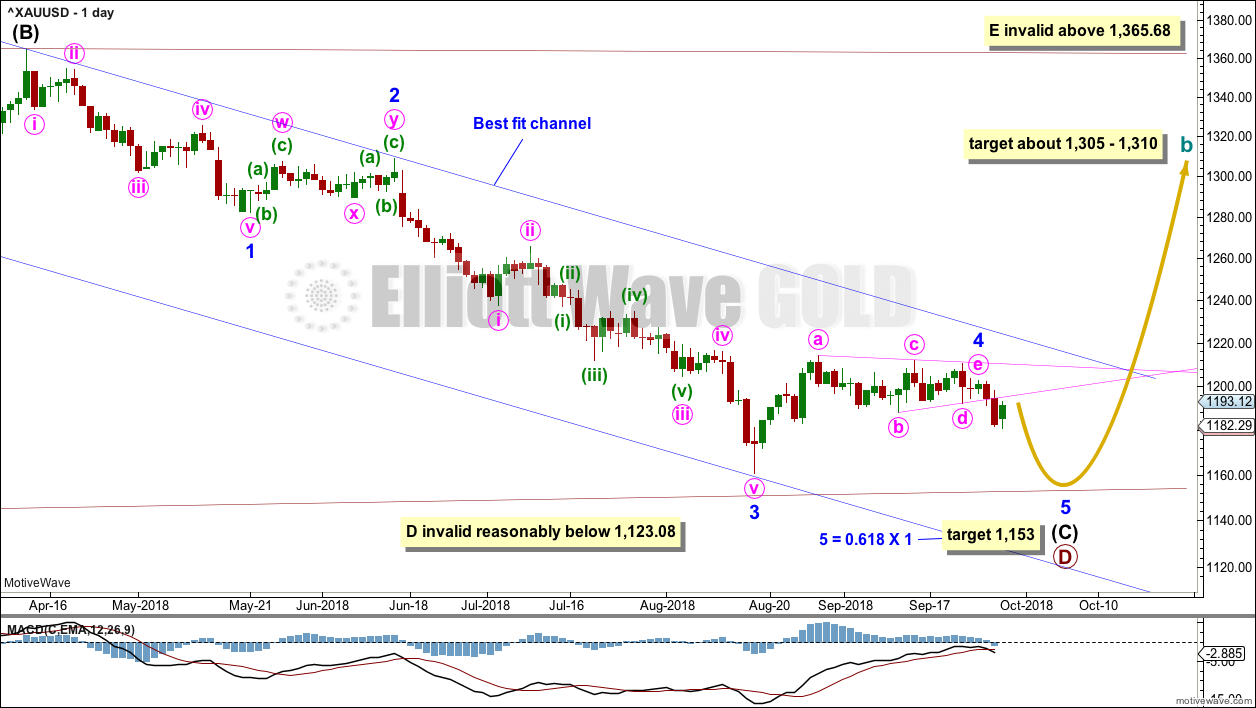

DAILY CHART – TRIANGLE

Intermediate wave (C) may be almost complete. The triangle for minor wave 4 may have ended. Minor wave 5 may be underway. A target is calculated for minor wave 5 to end that expects it to exhibit a Fibonacci ratio to minor wave 1, and would still see the B-D trend line of the triangle for cycle wave b have a reasonable slope.

Gold often exhibits surprisingly short and brief fifth waves out of its fourth wave triangles. This wave count expects this tendency. Minor wave 5 would most likely end at least slightly below the end of minor wave 3 at 1,160.75 to avoid a truncation. The target expects it to end only a little below this point.

DAILY CHART – TRIANGLE – ALTERNATE

Primary wave D may be complete.

If price moves above 1,203.57 by any amount at any time frame, then this alternate wave count would be indicated as most likely.

For strong confidence, this wave count now requires a breach of the upper edge of the blue best fit channel. This channel is drawn the same way on all weekly and daily charts, all on a semi-log scale.

Minor wave 1 may have been over on the 22nd of August.

Minor wave 2 may be a complete expanded flat correction. Within the expanded flat, at its end minute wave b must retrace a minimum 0.9 length of minute wave a.

Minute wave b may be complete at a 1.1 length of minute wave a. Minute wave c has ended below the end of minute wave a at 1,183.36, avoiding a truncation and a very rare running flat.

Minor wave 2 may not move beyond the start of minor wave 1 below 1,160.75.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle), and it should last at least a Fibonacci 13 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

This wave count looks at the possibility that a short false downwards breakout may have just occurred out of the triangle and may now be followed by a deep time consuming bounce.

WEEKLY CHART – FLAT

It is possible that cycle wave b may be a flat correction. Within a flat correction, primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. Primary wave B may make a new low below the start of primary wave A at 1,046.27 as in an expanded flat correction.

Only a new low reasonably below 1,123.08 would provide reasonable confidence in this wave count.

Intermediate wave (C) must subdivide as a five wave structure; it may be unfolding as an impulse. Within intermediate wave (C), minor waves 1 through to 4 may be complete. If it continues further, then minor wave 4 may not move into minor wave 1 price territory above 1,307.09.

The blue channel here is drawn using Elliott’s first technique. Minor wave 4 would be most likely to remain contained within this channel, and may find resistance about the upper edge if it gets there. A strong breach of this channel by upwards movement would reduce the probability of this wave count.

Minor wave 2 was a double zigzag lasting nine weeks. Minor wave 4 exhibits alternation as a triangle and reasonable proportion lasting six weeks.

WEEKLY CHART – DOUBLE ZIGZAG

Finally, it is also possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about two thirds complete.

Within the triangle of primary wave X, intermediate wave (C) may now be complete. It may not move beyond the end of intermediate wave (A) below 1,123.08. The A-C trend line for both a barrier and contracting triangle should have some reasonable slope. For the triangle of primary wave X to have the right look, intermediate wave (C) should end here or very soon indeed.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months. After the triangle is complete, then an upwards breakout would be expected from it.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

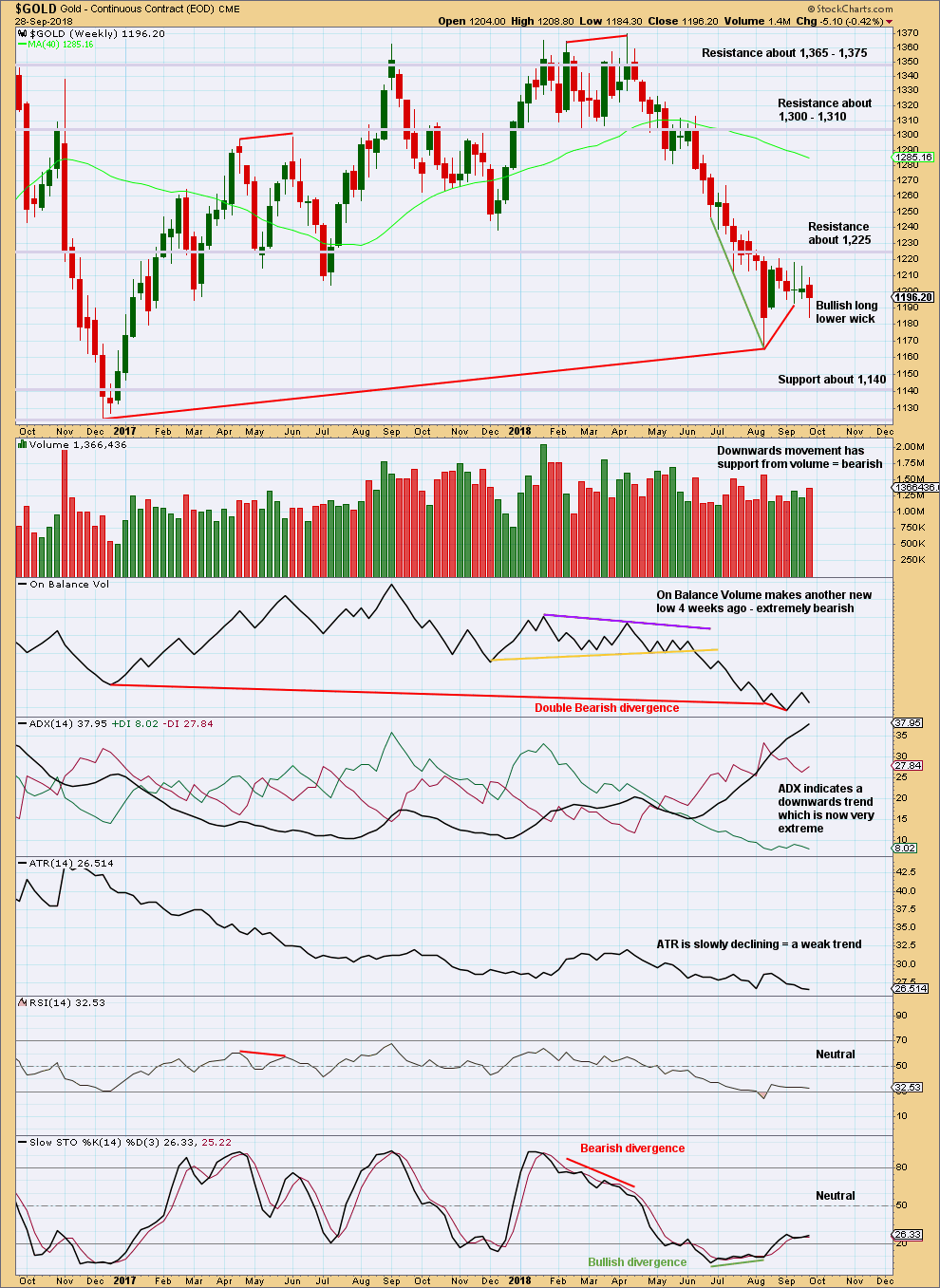

TECHNICAL ANALYSIS

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is lower than its prior point at the end of November 2015. This divergence is extremely bearish but does not rule out a consolidation unfolding here; the divergence does strongly support the Triangle wave count, which expects a consolidation or bounce up to test resistance now and then a continuation of a major bear market. It could also support the flat wave count that allows for a new low below 1,046.27 in coming months.

On Balance Volume has made another new low, but price has not. There is now double bearish divergence between price and On Balance Volume.

The consolidation of the last six weeks has brought RSI and Stochastics up from oversold, but ADX remains very extreme. If the downwards trend resumes here, then it may be limited by extreme indicators. The consolidation may continue further to relieve extreme ADX.

If price does continue lower, then look for next support about 1,140.

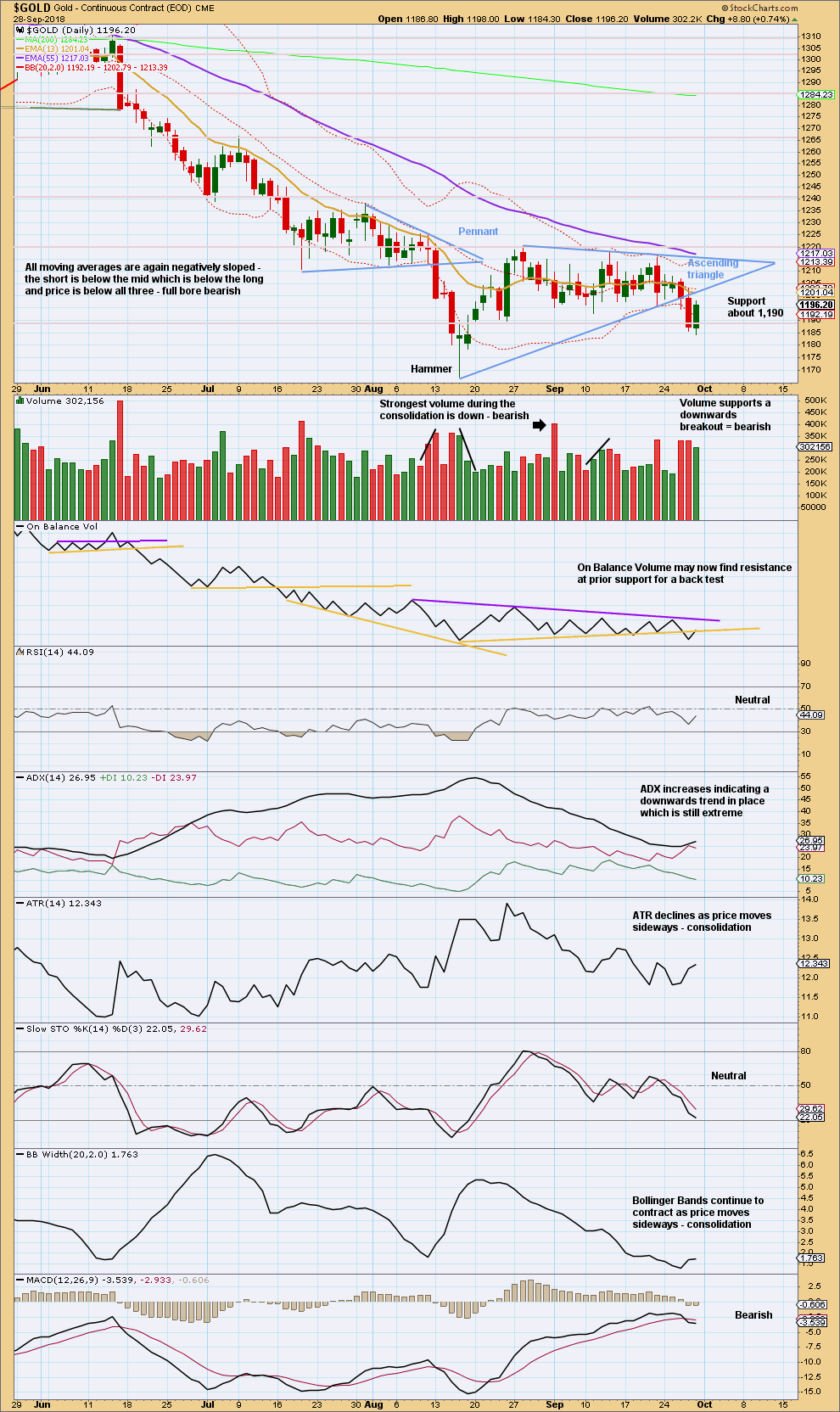

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A downwards breakout below the ascending triangle, with support from volume, has completed. Upwards movement for Friday so far looks like a typical throw back to resistance at the lower triangle trend line.

A target is calculated at 1,145 using the measured rule.

The bearish signal from On Balance Volume offers support to the view that price is breaking out from a triangle pattern and that it is likely now to make new lows. This bearish signal is strong because the trend line broken is long held, has a very shallow slope, and was tested multiple times.

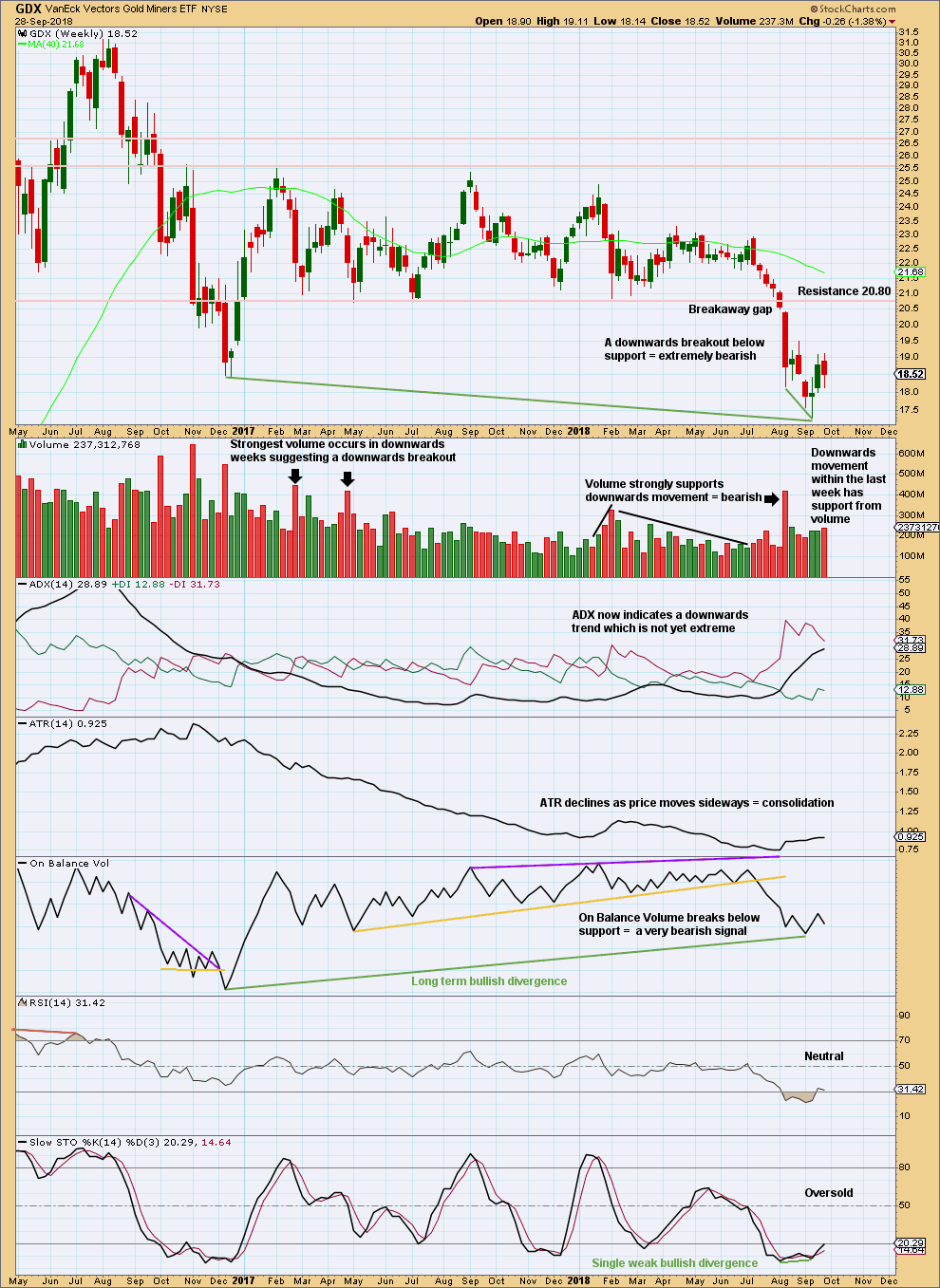

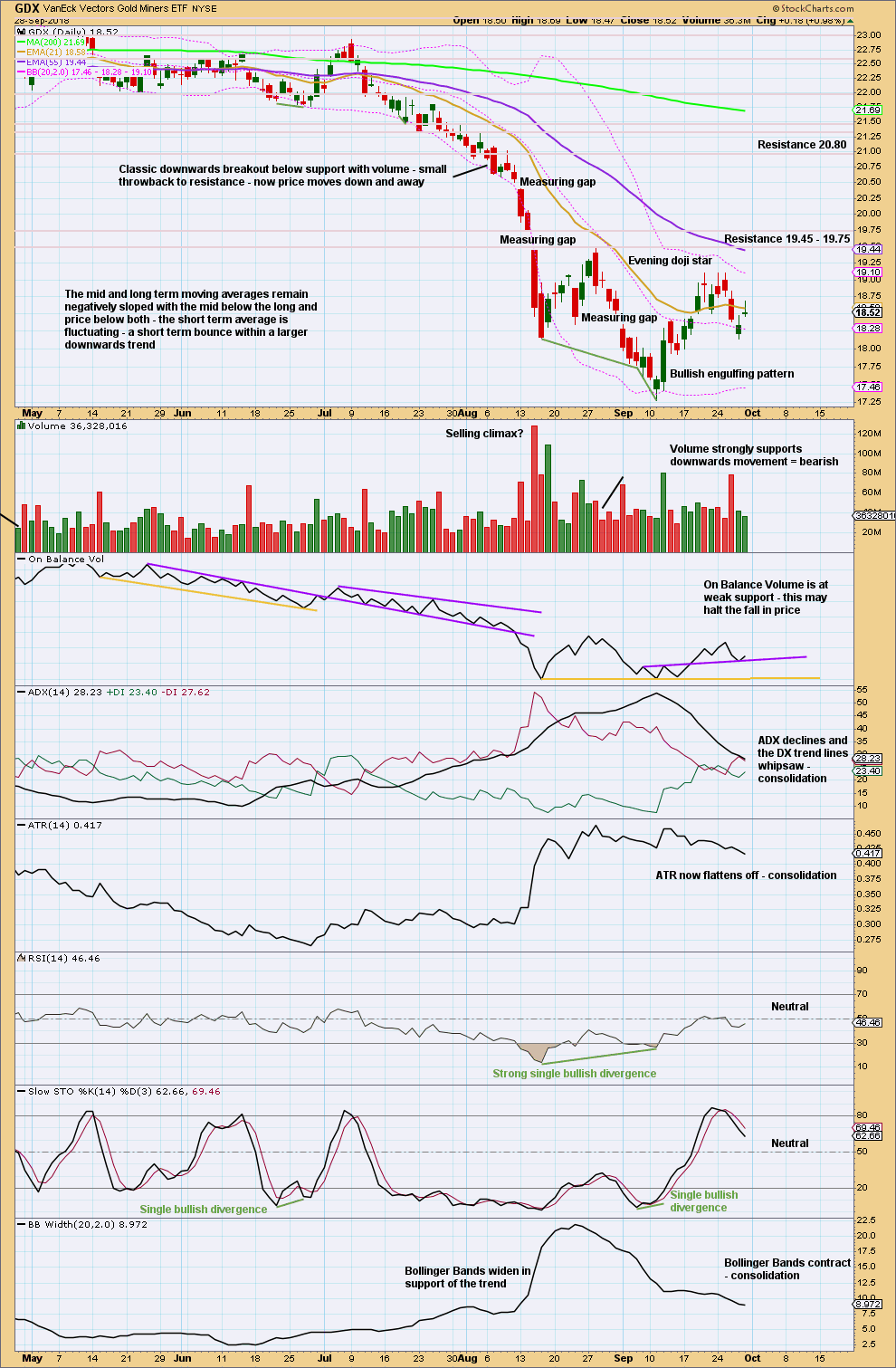

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

After a breakout, a technical principle is the longer that price consolidates sideways the longer the resulting trend may be expected to be. Also, the longer that price meanders sideways the more energy may be released after a breakout. This is what has happened for GDX.

A target for this downwards trend to end calculated using the measured rule is at 16.02. That is not yet met.

At the weekly chart level, there is a clear downwards breakout with a breakaway gap. As breakaway gaps should not be closed, they may be used to set stops that may be set just above a downwards breakaway gap.

The bullish divergence between price and On Balance Volume noted with green trend lines is also not a strong signal. On Balance Volume is a leading indicator; when it leads, it offers a signal, but it does not always lead price.

There is short term bullish divergence between price and Stochastics. A consolidation may develop here to relieve extreme conditions. The small bounce of the last two weeks has not yet lasted long enough to relieve extreme conditions, so it may continue either higher or sideways.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is consolidating after a strong downwards trend. Resistance is about 19.45 – 19.75. Support may be about 17.28. Expect price to swing from resistance to support and back again, and to not move in a straight line within each swing. Consolidations are characterised by very choppy overlapping movement.

At this time, expect a downwards swing to support to overall continue next week.

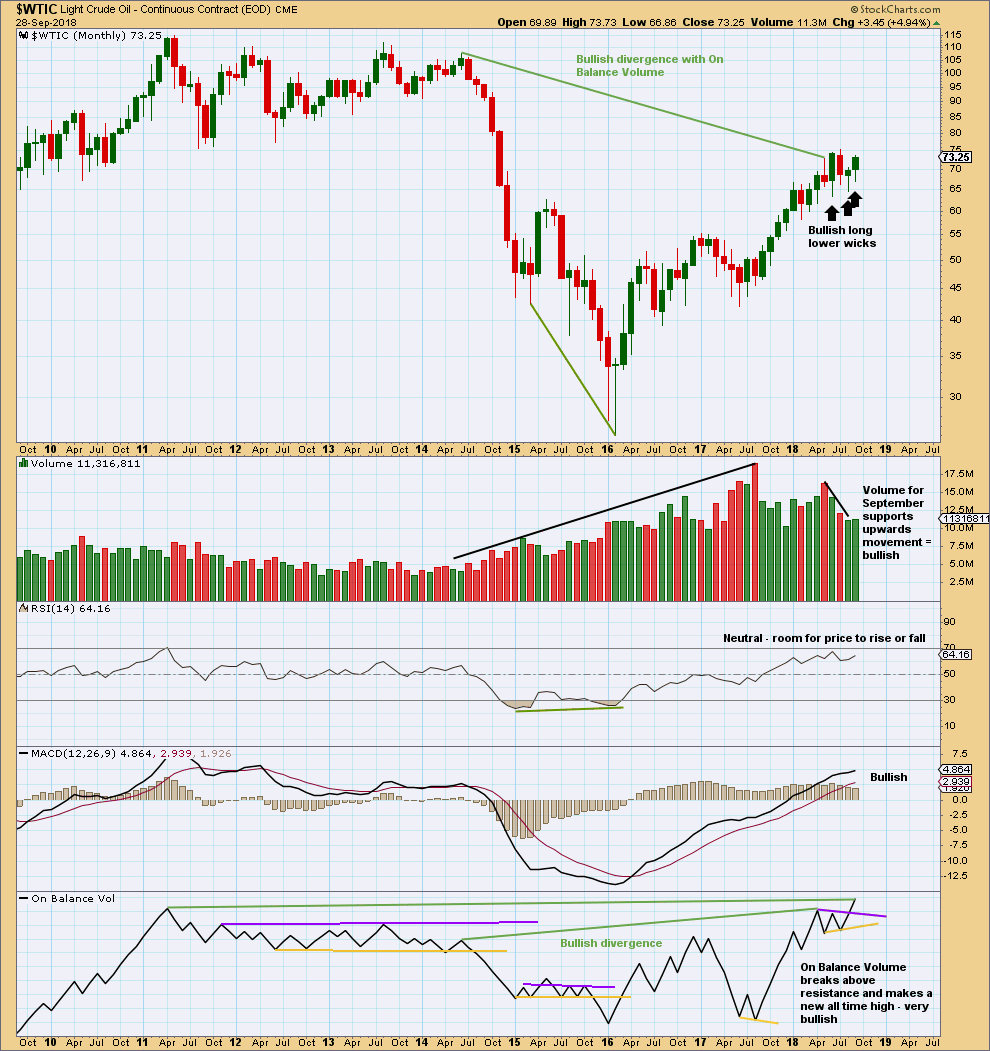

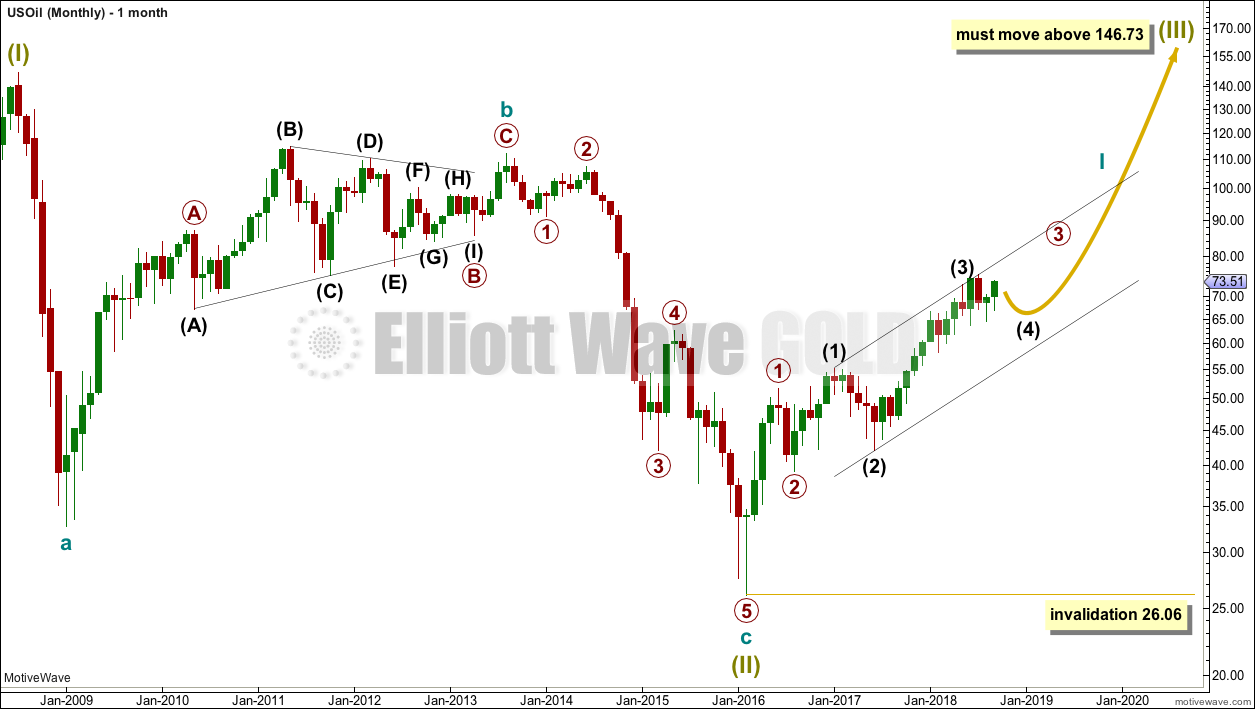

US OIL

More upwards movement was expected for the last week. The short term target was at 73.82. Price did move higher to reach 73.72 so far.

Summary: A multi month consolidation may come to an end in the next one to three weeks.

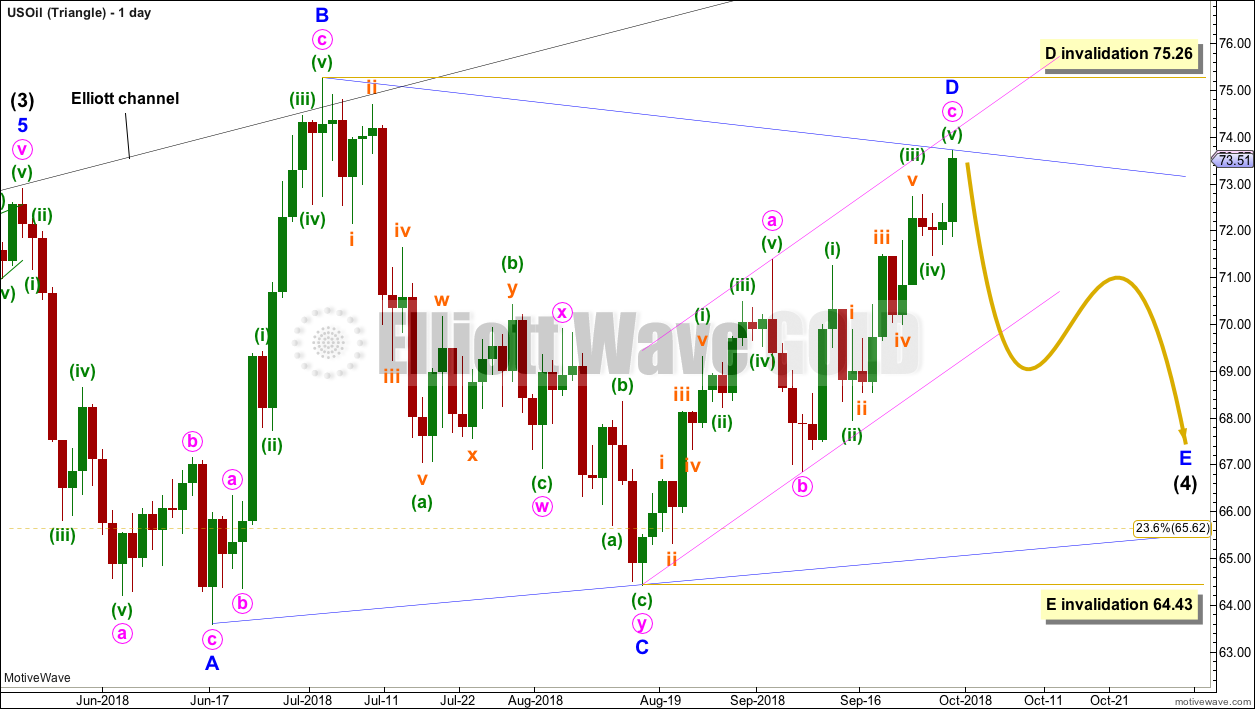

If price turns and moves lower for a final downwards swing without first reaching 74.18, then an Elliott wave triangle would be indicated. Look for the final downwards swing to look like a three wave structure and end short of the lower A-C triangle trend line.

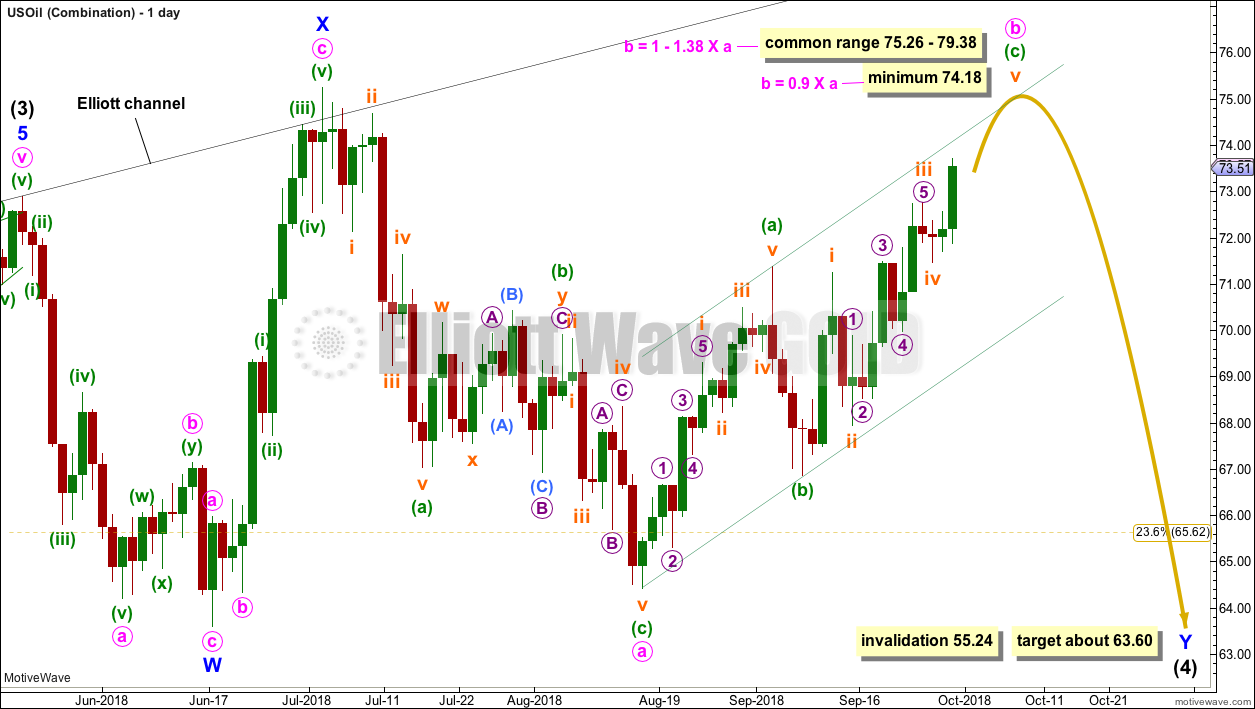

If the current upwards swing continues a little higher and reaches 74.18, then it may be a combination; an overshoot of resistance about 75.25 may occur before the upwards swing ends and a final downwards swing begins. If that happens, then look for the downwards swing to end about 63.60.

The larger trend remains upwards, so pullbacks may be used as opportunities to join the trend. If another downwards swing reaches support in the next few weeks, that may be the last opportunity for a very good entry point for a long position.

MAIN WAVE COUNT

MONTHLY CHART

The bear market for US Oil looks to be over and a new bull market looks to be in its early stages. The prior bearish wave count has been invalidated, leaving only this very bullish wave count.

A huge zigzag down to the last low may be complete and is labelled here Super Cycle wave (II).

Cycle wave b must be seen as complete in August 2013 for this wave count to work. It cannot be seen as complete at the prior major swing high in May 2011.

Cycle wave b is seen as a zigzag, and within it primary wave B is seen as a running contracting triangle. These are fairly common structures, although nine wave triangles are uncommon. All subdivisions fit.

Primary wave C moves beyond the end of primary wave A, so it avoids a truncation. But it does not have to move above the price territory of primary wave B to avoid a truncation, which is an important distinction.

If cycle wave b begins there, then cycle wave c may be seen as a complete five wave impulse.

Super Cycle wave (III) must move beyond the end of Super Cycle wave (I). It must move far enough above that point to allow room for a subsequent Super Cycle wave (IV) to unfold and remain above Super Cycle wave (I) price territory.

Cycle wave I may be incomplete. It may be unfolding as an impulse and may have now moved through the middle portion. Commodities have a tendency to exhibit swift strong fifth waves, and this tendency is especially prevalent for third wave impulses. Intermediate wave (5) to end primary wave 3 may be very swift and strong, ending with a blow off top.

When cycle wave I is complete, then cycle wave II may be a deep correction that may not move beyond the start of cycle wave I below 26.06.

Data from FXCM for USOil does not go back to the beginning of Super Cycle wave (I). Without an accurate known length of Super Cycle wave (I) a target cannot be calculated for Super Cycle wave (III) to end using Fibonacci ratios. The target for Super Cycle wave (III) may be calculated when cycle waves I, II, III and IV within it are complete. That cannot be done for many years.

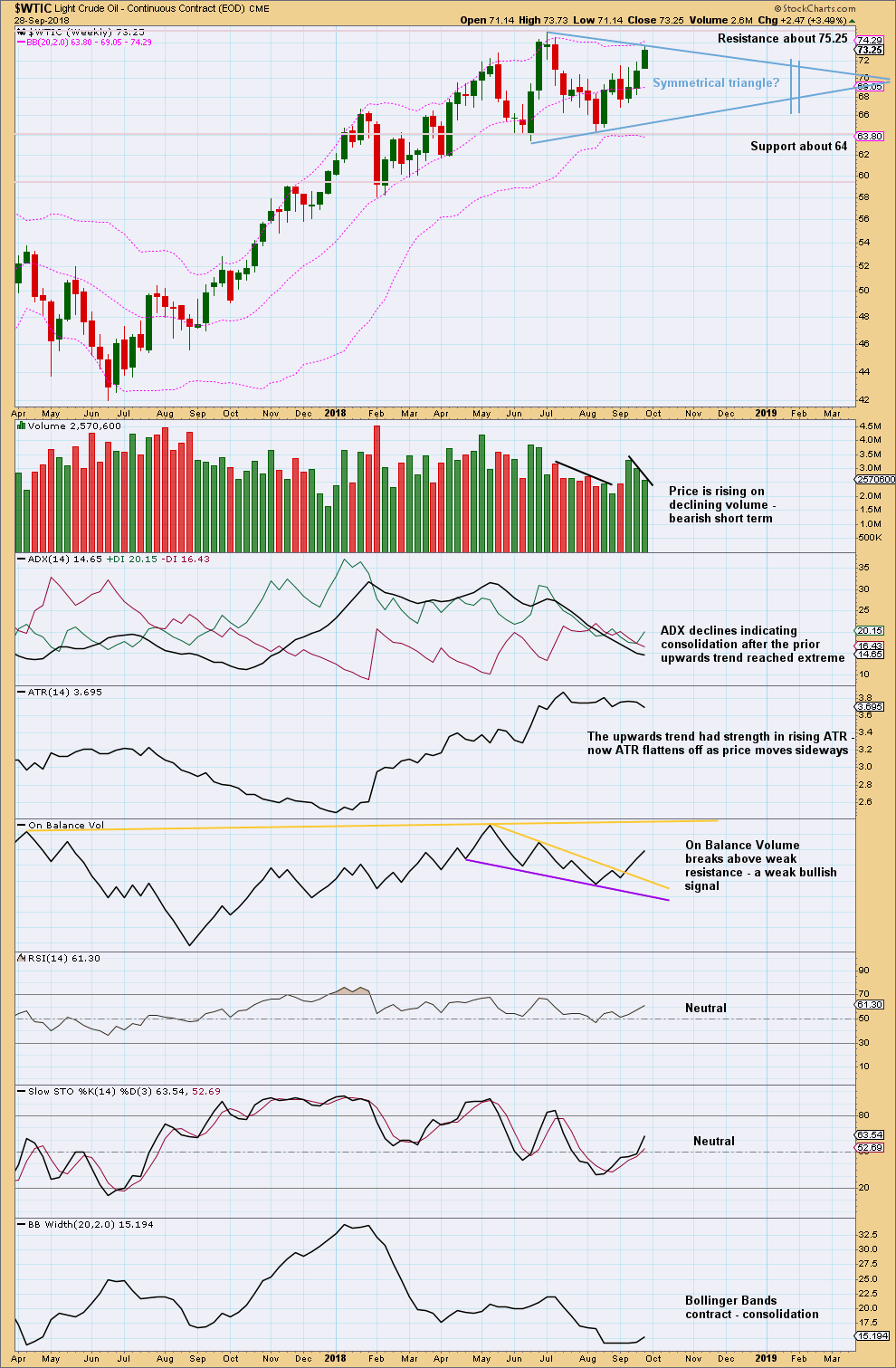

WEEKLY CHART

Intermediate wave (3) is now complete. There is no Fibonacci ratio between intermediate waves (1) and (3), and intermediate wave (3) is longer than 1.618 the length of intermediate wave (1).

This wave count fits with classic technical analysis at the monthly and daily chart levels.

Intermediate wave (2) was a deep double zigzag. Given the guideline of alternation, intermediate wave (4) may be expected to most likely be a shallow flat, triangle or combination. It may be about even in duration with intermediate wave (2), or it may be a little longer because triangles and combinations are more time consuming structures.

Intermediate wave (4) has now lasted 18 weeks. At the daily chart level, at this stage, I cannot see it as a complete corrective structure. The next expectation will now be for it to possibly complete in a further 3 weeks to total a Fibonacci 21. It may not exhibit a Fibonacci duration though (this is a rough guideline only).

Intermediate wave (4) may find support about the lower edge of the black Elliott channel. It may end within the price territory of the fourth wave of one lesser degree; minor wave 4 has its territory from 66.65 to 59.13.

At this stage, only two structural options fit for intermediate wave (4) at the daily chart level: a triangle and a combination. They are both equally valid and have about an even probability.

Because the last wave down to support, ending on the 16th of August, now looks like a complete structure and will only subdivide as a three, it cannot be wave C of a flat correction. For this reason, a flat correction at this time does not fit and has been discarded.

TRIANGLE

Intermediate wave (4) may be unfolding as a triangle.

Minor wave A is seen as a single zigzag, which has a reasonable look. Minor wave B is also seen as a single zigzag.

Minor wave C may have been a complete double zigzag, which has a very good fit. C waves are the most common triangle sub-waves to subdivide as a multiple, so this labelling fits with a common pattern.

Minor wave D may now be a complete zigzag. Within minor wave D, minute waves a and c are very close to equality. A breach of the pink channel about minor wave D would provide strong indication that minor wave D is over and minor wave E is underway.

It is still possible that minor wave D may continue a little higher.

Minor wave D within a contracting triangle may not move beyond the end of minor wave B above 75.26. The A-C trend line has a shallow slope, so the upper B-D trend line should have a reasonable slope for the triangle trend lines to have a reasonable rate of convergence. A contracting triangle would have a sloping B-D trend line, so this looks most likely.

Minor wave D within a barrier triangle may end about the same level as minor wave B at about 75.26, so that the B-D trend line is essentially flat. A barrier triangle here would not produce triangle trend lines that converge at a reasonable rate. This would not have the right look. A barrier triangle looks unlikely.

A final zigzag down for minor wave E would most likely end reasonably short of the A-C trend line. Minor wave E may not move beyond the end of minor wave C below 64.43.

COMBINATION

Intermediate wave (4) may be unfolding as a double combination.

The first structure in a double combination may be a complete zigzag labelled minor wave W. There is a little disproportion within minute wave a between the corrections of minuette waves (ii) and (iv), but this is slight enough to be acceptable for this market.

The double is joined by a complete three in the opposite direction, a zigzag labelled minor wave X. X waves within combinations have no minimum nor maximum allowable length, and may make new price extremes beyond the start of wave W as this one does. The only guideline in terms of depth for X waves is that they are normally very deep.

The second structure in a double combination would most likely be a flat correction as the two most common structures in a double combination are one zigzag and one flat.

Within a possible flat correction for minor wave Y, minute wave a looks like a completed three. Minute wave b must now retrace a minimum 0.9 length of minute wave a, and it may move beyond the start of minute wave a as in an expanded flat. So far minute wave b exhibits weakness: at the high for this week, there is bearish divergence between price and Stochastics on the daily chart, and volume is declining as price rises on the weekly chart.

Minute wave b may be subdividing as a single zigzag. Within the zigzag, minuette wave (c) must complete as a five wave structure. While minute wave b continues to move higher, downwards pullbacks may find support about the lower edge of the small channel drawn about it.

When minute wave b is complete, then minute wave c would need to end at least slightly below the end of minute wave a at 64.43 to avoid a truncation.

The purpose of the second structure in a double combination is to take up time and move price sideways. To achieve this purpose minor wave Y would be most likely to end about the same level as minor wave W about 63.60.

TECHNICAL ANALYSIS

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The larger trend remains upwards.

The last three months have seen price move sideways. Three long and lower monthly wicks are bullish. Now September shows support from volume for upwards movement; the short term volume profile is now bullish.

On Balance Volume gives a bullish signal this month, breaking above resistance. On Balance Volume has also made a new high above the prior high of May 2011. As On Balance Volume should be read as a leading indicator, price may follow through with a new high above May 2011’s high.

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It is upwards weeks during the consolidation that have strongest support from volume. This looks like a continuation pattern. The breakout would most likely be upwards.

For the short term, with volume not supporting upwards movement, a downwards pullback or swing to support may occur. At this time frame, ADX still indicates price is most likely in a consolidation and not yet back within an upwards trend.

The symmetrical triangle is drawn on the weekly chart, and the upper trend line is again slightly adjusted this week. Symmetrical triangles most commonly break out 73% – 75% of the distance from base to cradle. This distance is noted with vertical lines on the chart. With adjusted trend lines, this would now be in about 19 – 20 weeks.

If the upper edge of the triangle trend line needs to again be adjusted, then the length of the triangle from base to cradle would increase. If the upper trend line becomes horizontal, then an ascending triangle would be indicated, which commonly break out close to 61% of the distance from base to cradle.

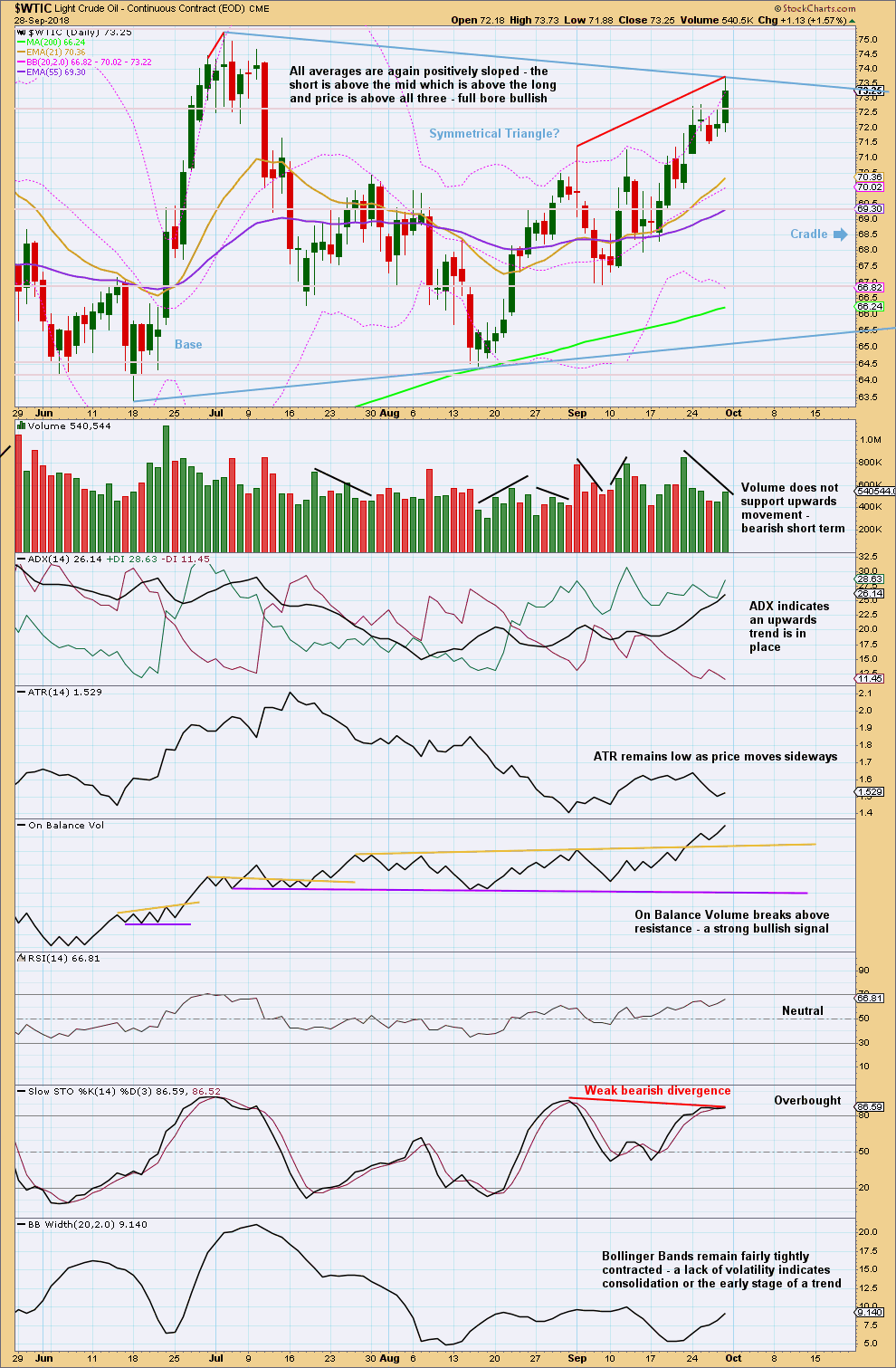

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Within this short term upwards trend there is now: weak volume, low ATR, contracted Bollinger Bands, and some divergence between price and Stochastics at the last high.

Look for a pullback or downwards swing to support.

—

Always practice good risk management as the most important aspect of trading. Always trade with stops and invest only 1-5% of equity on any one trade. Failure to manage risk is the most common mistake new traders make.

Updated triangle wave count:

Now looking for minor wave 2 to last several days and end either about the 0.382 or 0.618 Fibonacci ratios.

For members looking for a long position this may provide a nice entry point. Risk is at 66.86.

Remember, the other idea of a combination remains valid.

Combination wave count update:

Now a final deep downwards swing. This does not have as much support from classic TA at this time. That may change if downwards movement shows strength.

Hi Laura,

An example double three W-X-Y of Minute degree being considered for this question, please.

1. would I be in order to label a w-x-y (double zigzag) of Minuette degree as the sub waves of Minute W ?

2. would I be in order to label a double three w-x-y of Minuette degree as the sub waves of Minute X?

I have attached a diagram for easy reference, following your color scheme for the degrees – Pink for Minute, Green for Minuette and Orange for Sub Minuette.

Thanks.

Hi Dave, good questions.

This isn’t a valid wave count. The maximum number of corrective structures within a multiple is three. And so to label multiples within multiples, multiplies the number of corrective structures beyond three and violates the Elliott wave rule.

The is by far the most common error I see in work calling itself Elliott wave online. And so this is the easiest way to spot whether or not that work is worthy of your consideration.

The rule refers to W, Y and Z (if there is one, they are rare). None of these may be labelled multiples.

The rule does not refer to X waves, they may be any corrective structure including a multiple, but that is not common. Because the rule states the maximum number of corrections is three, and it does not refer to X waves. They are joining waves, and not counted in the three.

I hope this all makes sense? Let me know if you need anything clarified.

This is one of the most important lessons I can teach you, IMO, about Elliott wave.

Thank you “Maestro”, Master, Teacher!!

I know Maestro is more for music, while master kind of sounds masculine. However, teacher alone does not suffice to honor your expertise in EWT.

This is what sets you apart from the crowd. I have seen so many analysis out there with this wave form. I do remember your comments along these lines from some time ago, but could not locate it and hence my question.

Yes, your answer is crystal clear and sincerely appreciated. Remember, my Word document? This goes in there.

I looked up Robert Prechter’s ‘A SUMMARY OF RULES AND GUIDELINES FOR WAVES’ again and saw the relevant sentence

“.. “double three” flat combination comprises (in order) a zigzag and a flat, a flat and a zigzag, a flat and a flat, a zigzag and a triangle or a flat and a triangle.”

The “a”, meaning “one”, is the operative word. It makes perfect sense now after your explanation.

Once again, thank you very much, Lara.

Dave

I also looked at a chart of yours for weekly combination for Gold and saw even more clearly the combination rule that you explained in my previous question.

The Primary Y at first look ‘seems’ to have a W-X-Y inside it. Making me wonder. However, upon closer examination, I see that the immediate next lower degree of Intermediate has only an A-B-C flat. The W-X-Y inside is actually of Minor degree within the Intermediate A.

Superb.

Sincerely thank you for being a great teacher, Lara.

And StockCharts shows another upwards day with support from volume.

This does not look like a B wave, it looks like intermediate wave (4) is over.

The wave count below in which I see intermediate wave (4) complete today increases in probability with another strong upwards day closing above prior resistance.

A classic TA technique is to wait for a breakout and then enter in the direction of the trend after a breakout is confirmed. It today has support from volume then have a little confidence in the upwards trend continuing. I don’t have StockCharts data for today’s session yet.

US Oil updated:

First, classic TA.

There is an upwards trend in place. Right now price is at resistance and RSI and Stochastics are overbought, but there is no candlestick reversal at the high. Price could continue to move higher and conditions could remain extreme for a while, but it looks reasonably likely that some pullback could happen here before that happens.

Bollinger Bands now expanding with the trend is pretty bullish.

Look out now for any surprises to be to the upside.

Combination wave count updated:

This EW count now expects another big downwards swing to end below 64.43.

This is possible, but the TA chart doesn’t really support it.

Triangle chart updated:

It is just possible that intermediate wave (4) is over as a triangle. But I really do not like the quick conclusion. Sometimes triangles do this, but it is uncommon. This looks a little forced. But then, this market does not always have really good looking EW structures.

This wave count outlines the surprise to the upside possibility. A pullback about here may be relatively brief and shallow, as the pull up of a strong fifth wave may face minor 2 to be more shallow than second waves usually are.

Price has managed to just close above prior resistance on an upwards day with some support from volume…. but prior resistance was 75.27 (StockCharts data) and the close on 1st October was only 75.30 and although volume was stronger than the prior two days it was not strong compared to much of the rest of the consolidation.

It’s a bullish sign, but I’d have more confidence that the consolidation really is over if we can see another upwards day with a higher close.

The trend is up, pullbacks are opportunities. Look out for intermediate wave (5) to build strength and maybe end with a blowoff top in coming weeks.

Hi Laura, since WTI has passed 75.26, would you say that only the combination count is valid now. Thanks for the update.

Updated charts above

Lara,

We now have a triple divergences on the EWO as well many other indicators. When the daily 13 ema starts to roll over I’m going to look for short entry. I would expect some strength to the down side.

Hello Lara, do you have analysis of s&p500 on daily basis? It’s quite volatile these days… always hit my SL … and thanks…

Yes, I do. Over at ElliottWaveStockMarket.com I am analysing the S&P each day, including hourly charts.

Here in Lara’s Weekly I am designing my analysis to take a longer term view at the bigger picture, to avoid smaller whipsaws in the market and focus on the larger trend.

Take a look at how you are calculating where to place stop losses. If they keep being taken out then perhaps allow the market more room to move. There are several ways to decide where to place them; Elliott wave invalidation points, just beyond breakaway or measuring gaps, just beyond the last swing low (in a bull market) are some methods. How you do it is up to your particular trading style and risk appetite.

The daily S&P analysis is USD60 per month and is published each day the New York exchange trades.

Hi Lara

Thanks for the weekly analysis

Why is $74.18 for WTI critical line for the type of triangle and how was 74.18 determined. I can see how the rest fits but can’t see what technical item(s) drive to $74.18.

Thanks in advance for your help

74.18 is the minimum requirement for a flat within a combination.

This is how it works:

If price turns down before 74.18 then the combination count is not valid, only the triangle is valid.

If price reaches up to 74.18 then both counts are valid.

If price reaches up to reasonably above 75.26 then only the combination would remain valid.

Does that makes sense?

It matters in determining how low the final downwards swing may go, and so in looking for an entry point.

Thanks Lara

I have a lot to learn

Kind regards

No worries, I’m here to teach.

And corrections are quite complicated.

If you’re keen on learning EW then I recommend a copy of Frost and Prechter, “Elliott Wave Principle” 10th edition. Use pages 86 – 91, the list of all the rules and guidelines. Read them all once a day (should be done in about 10 minutes) and within a week or so it will start to stick. Then following my analysis will get easier.

Unless of course you are lucky enough to have a photographic memory!