An upwards day with support from volume breaks above resistance.

Resistance zones will be used as targets.

Summary: A short term target is about 1,287. Tomorrow may begin with a small sideways consolidation for a fourth wave, then be followed by more upwards movement.

The final target for this bounce to end is at strong resistance about 1,305 – 1,310.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, a flat, a combination, and a double zigzag.

At this stage, they will now be presented roughly in order of probability. The triangle and the double zigzag wave counts have about an even probability; the combination and flat wave counts now look less likely.

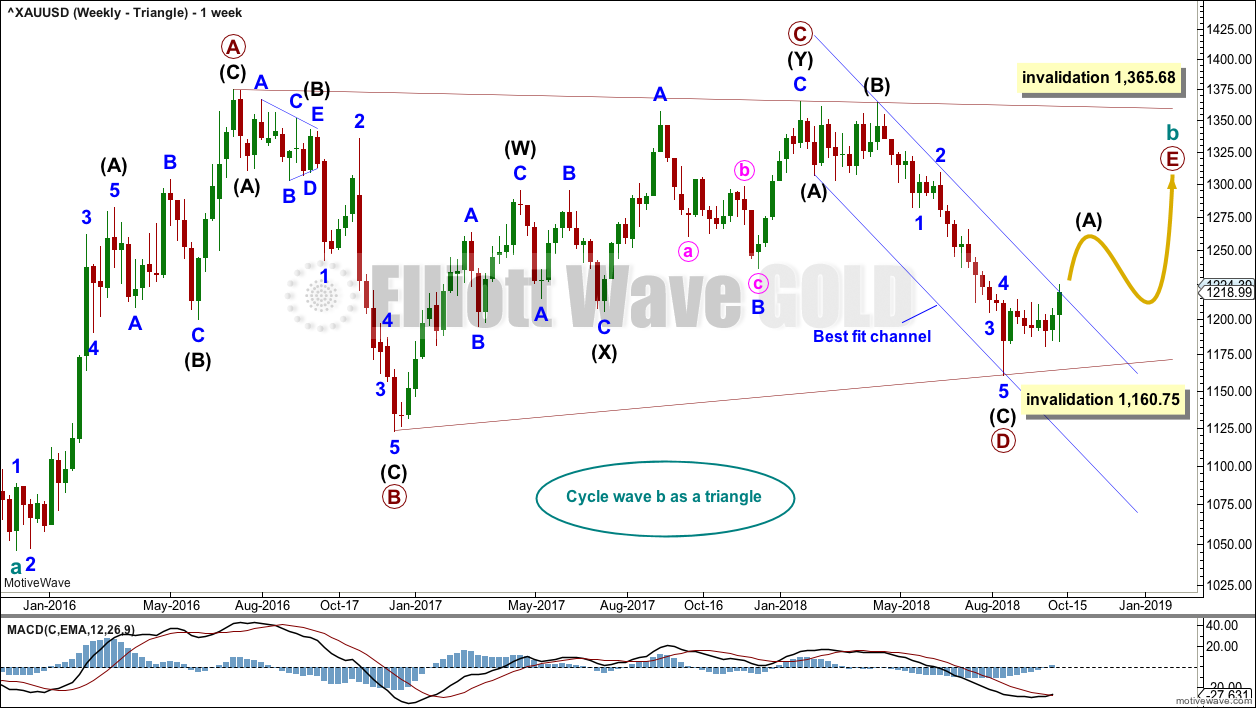

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

Cycle wave b may be an incomplete regular contracting triangle. Primary wave E may not move beyond the end of primary wave C above 1,365.68. Within primary wave E, intermediate wave B may not move beyond the start of intermediate wave A below 1,160.75.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best. Primary wave E would most likely be a single zigzag. It is also possible that it may subdivide as a triangle to create a rare nine wave triangle.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

A channel is drawn on all charts about the downwards wave of primary wave D. Here, it is labelled a best fit channel. This channel was breached by today’s upwards movement, providing reasonable confidence in this weekly triangle wave count and the double zigzag count, and putting serious doubt on the combination and flat wave counts.

Primary wave E may now continue higher as a large three wave structure.

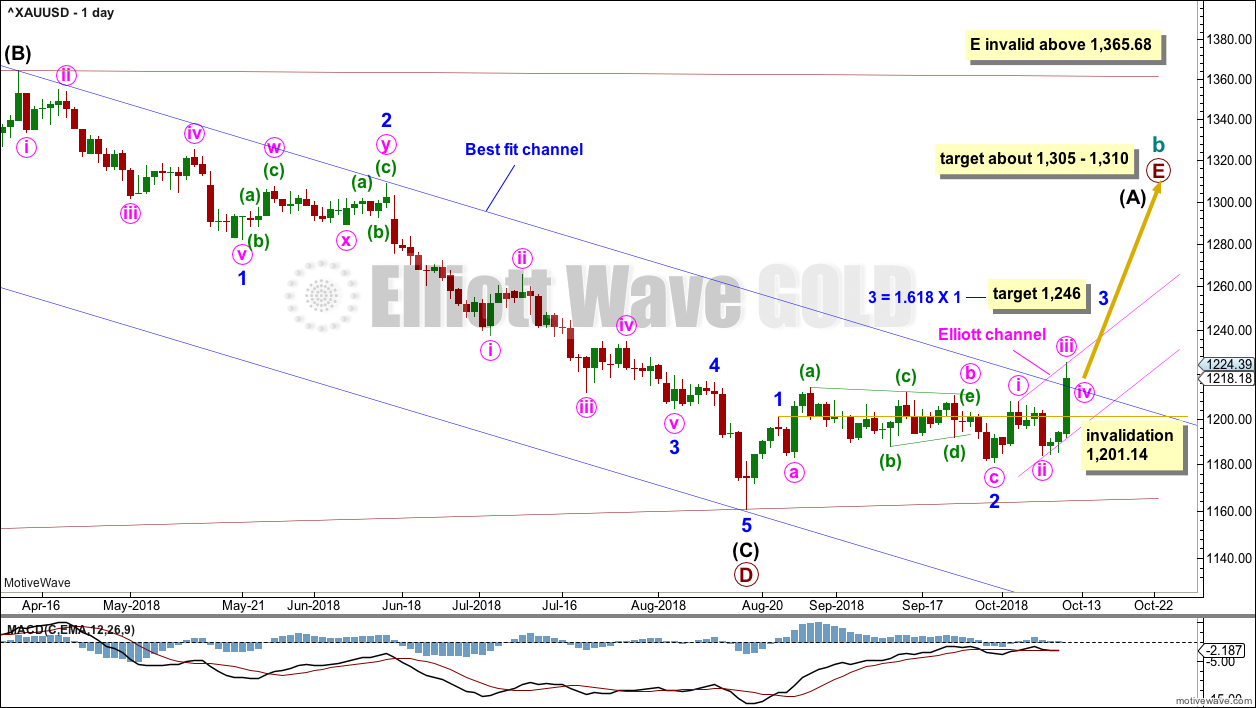

DAILY CHART – TRIANGLE

Primary wave D may be complete.

Minor wave 1 may have been over on the 22nd of August.

Minor wave 2 may be a complete expanded flat correction.

Minor wave 3 may only subdivide as an impulse. So far that would be incomplete. A target is calculated for minor wave 3 to end using the most common Fibonacci ratio to minor wave 1. The next target would be about 1,287 where minor wave 3 would reach 2.618 the length of minor wave 1.

Draw an Elliott channel about minor wave 3. Draw the first trend line from the ends of minute waves i to iii, then place a parallel copy on the low of minute wave ii. Minute wave v may end about the upper edge of this channel. If minute wave v exhibits typical commodity like behaviour, then it may be very strong and may end with a strong overshoot of the i-iii trend line.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle), and it should last at least a Fibonacci 13 weeks. It may also last a total Fibonacci 21 or 34 weeks. So far it has lasted only 8 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

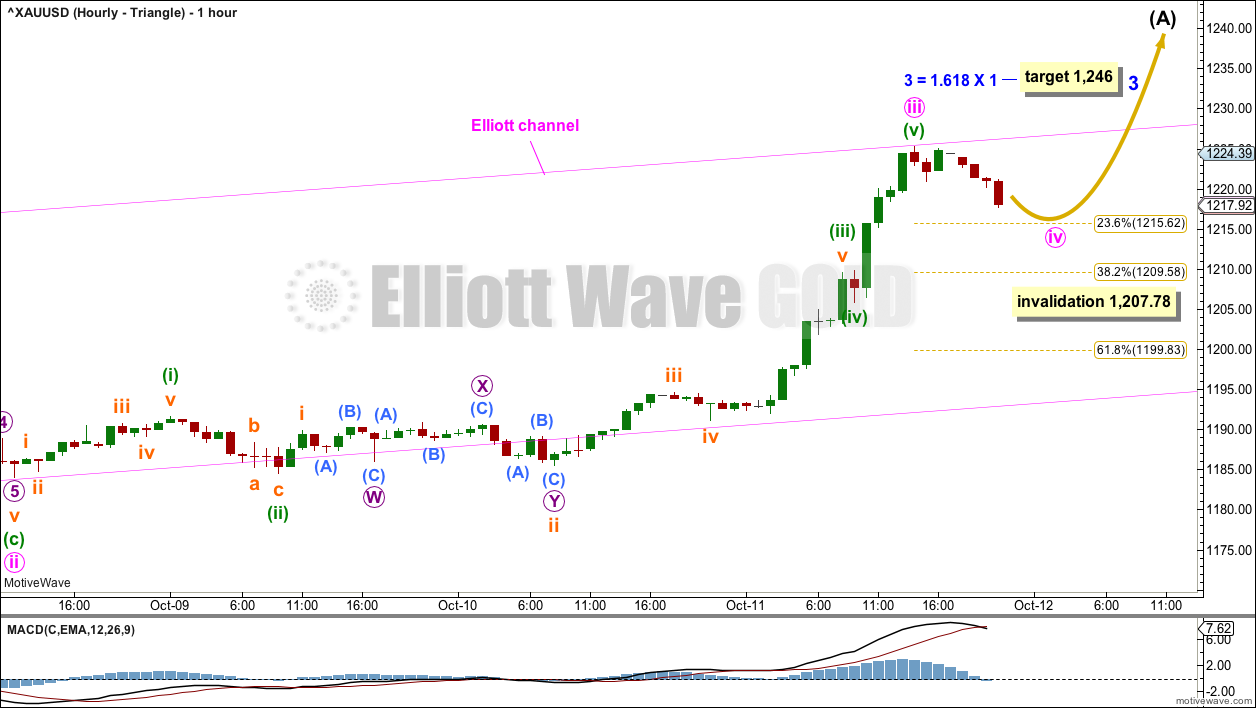

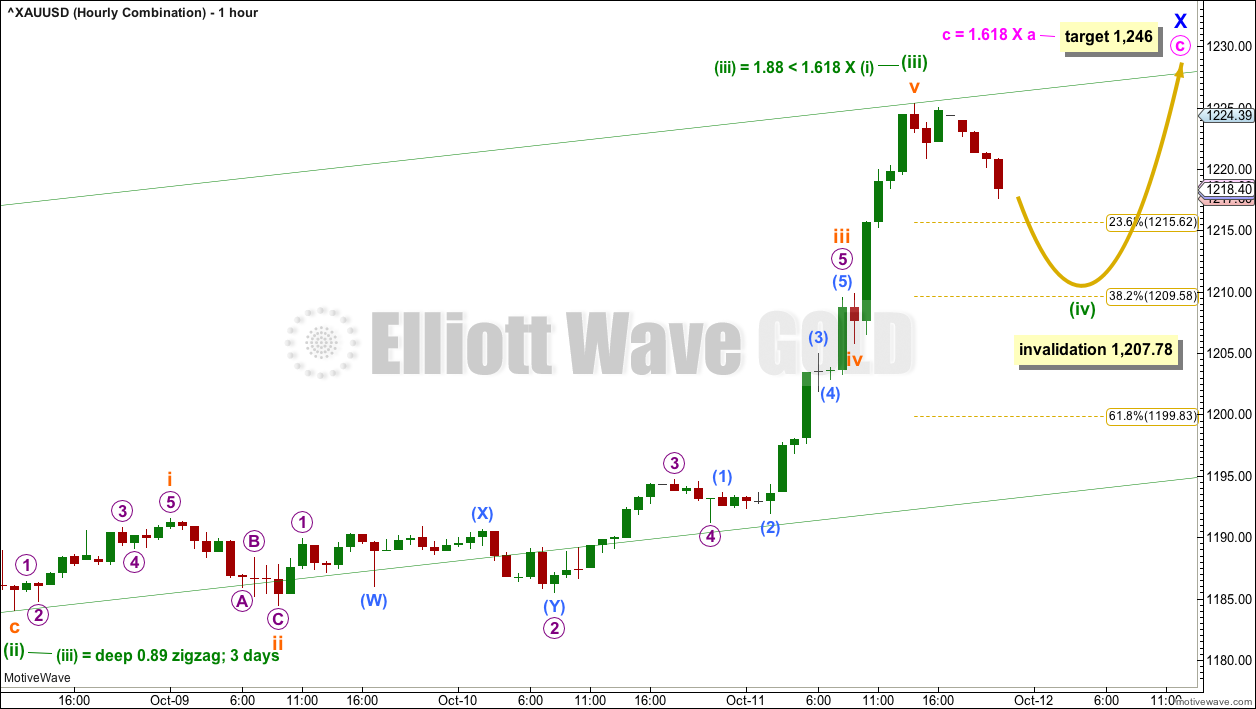

HOURLY CHART – TRIANGLE

Minor wave 3 may only subdivide as an impulse.

Within the impulse, minute waves i, ii and now iii may be complete.

Minute wave ii was a very deep 0.89 zigzag. Minute wave iv may last about one to a very few days and exhibit alternation as a shallow flat, triangle or combination. Minute wave iv may not move into minute wave i price territory below 1,207.78.

Gold has a tendency, typical of commodities, to exhibit very swift and strong fifth waves. This tendency is especially prevalent for fifth waves to end third wave impulses. Look out for the possibility of minute wave v to end minor wave 3 to be very swift and strong; it may end with another blowoff top.

WEEKLY CHART – DOUBLE ZIGZAG

It is also possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about three quarters complete.

Within the triangle of primary wave X, intermediate wave (C) should be complete. Within intermediate wave (D), minor wave B may not move beyond the start of minor wave A below 1,160.75.

Intermediate wave (D) would most likely subdivide as a single zigzag. The subdivisions at the daily and hourly chart level for this wave count would be the same as for the first triangle wave count above; a zigzag unfolding higher would be labelled A-B-C.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

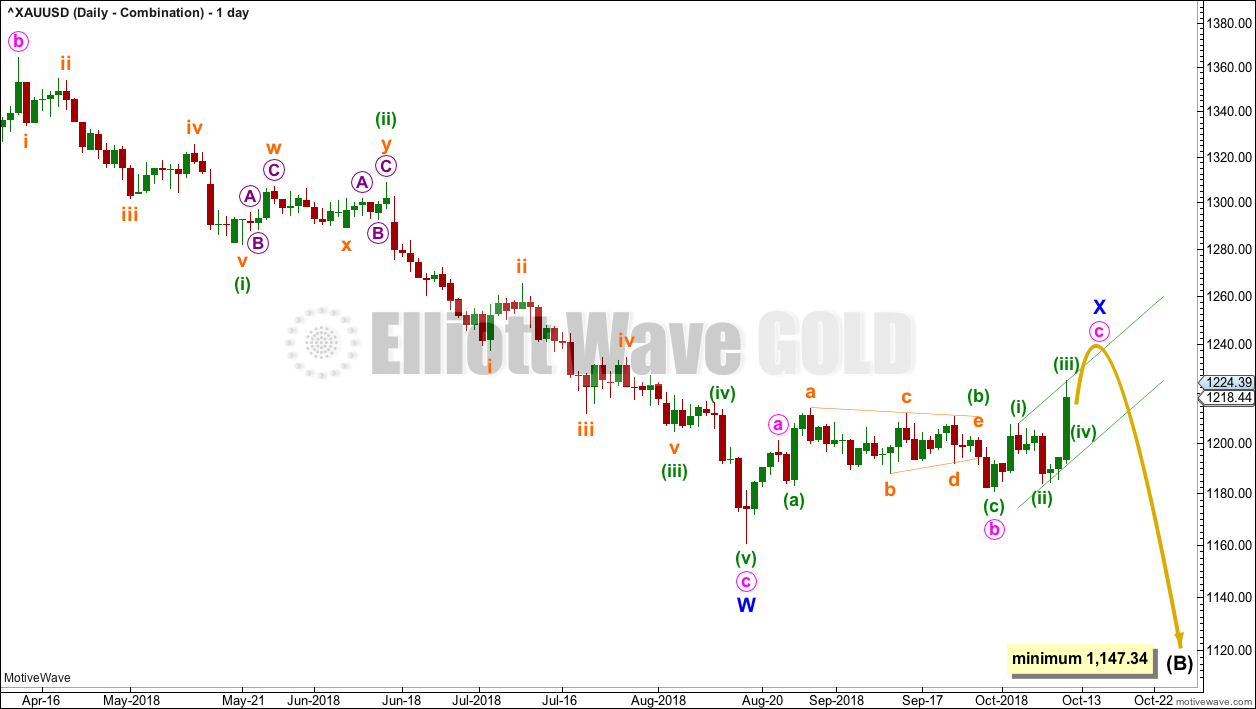

WEEKLY CHART – COMBINATION

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. My research on Gold so far has found that the most common two structures in a double combination are one zigzag and one flat correction. I have found only one instance where a triangle unfolded for wave Y. The most likely structure for wave Y would be a flat correction by a very wide margin, so that is what this wave count shall expect.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a double zigzag. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Because the minimum requirement for intermediate wave (B) is not yet met, this wave count requires that intermediate wave (B) continues lower. This is the most immediately bearish of all four weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. I have found no examples of triple combinations for Gold at daily chart time frames or higher back to 1976. When the second structure in a double is complete, then it is extremely likely (almost certain) that the whole correction is over.

DAILY CHART – COMBINATION

Intermediate wave (B) may be unfolding lower as a double zigzag.

The first zigzag may be complete, labeled minor wave W. The double may now be joined by an incomplete three in the opposite direction, a zigzag labelled minor wave X. X waves within double zigzags are usually fairly shallow and often also reasonably brief. Minor wave X may end fairly soon.

This wave count now expects that the upwards breakout may turn out to be false.

HOURLY CHART

Minor wave X must complete as a zigzag. Within the zigzag, minute wave c is unfolding as an impulse.

Within the impulse of minute wave c, minuette wave (iv) may not move into minuette wave (i) price territory below 1,207.78.

When minuette wave (iv) may be complete, then another upwards wave for minuette wave (v) would complete a five wave impulse for minute wave c. The most common Fibonacci ratio is used to calculate a target for minute wave c to end.

WEEKLY CHART – FLAT

It is possible that cycle wave b may be a flat correction. Within a flat correction, primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. Primary wave B may make a new low below the start of primary wave A at 1,046.27 as in an expanded flat correction.

Only a new low reasonably below 1,123.08 would provide reasonable confidence in this wave count.

Intermediate wave (C) must subdivide as a five wave structure; it may be unfolding as an impulse. Within intermediate wave (C), minor waves 1 through to 4 may be complete. If it continues further, then minor wave 4 may not move into minor wave 1 price territory above 1,307.09.

The blue channel here is drawn using Elliott’s first technique. Minor wave 4 would be most likely to remain contained within this channel, and may find resistance about the upper edge if it gets there. A strong breach of this channel by upwards movement would reduce the probability of this wave count.

Minor wave 2 was a double zigzag lasting nine weeks. Minor wave 4 exhibits little alternation as a single zigzag and reasonable proportion lasting seven weeks.

TECHNICAL ANALYSIS

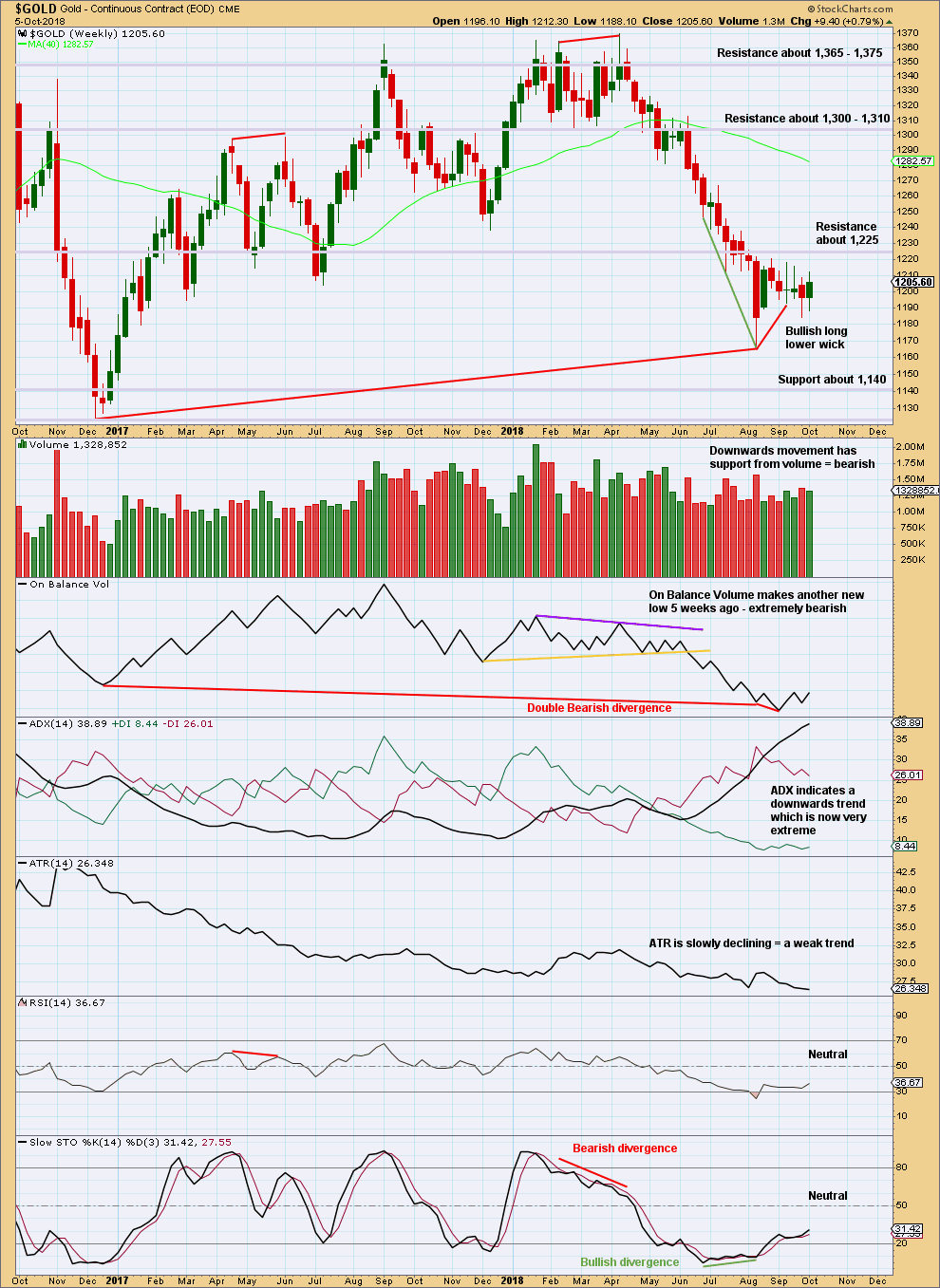

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume is lower than its prior point at the end of November 2015. This divergence is extremely bearish but does not rule out a consolidation unfolding here; the divergence does strongly support the Triangle wave count, which expects a consolidation or bounce up to test resistance now and then a continuation of a major bear market. It could also support the flat wave count that allows for a new low below 1,046.27 in coming months.

On Balance Volume has made another new low, but price has not. There is now double bearish divergence between price and On Balance Volume.

The consolidation of the last seven weeks has brought RSI and Stochastics up from oversold, but ADX remains very extreme. If the downwards trend resumes here, then it may be limited by extreme indicators. The consolidation may continue further to relieve extreme ADX.

If price does continue lower, then look for next support about 1,140.

The short term volume profile remains bearish.

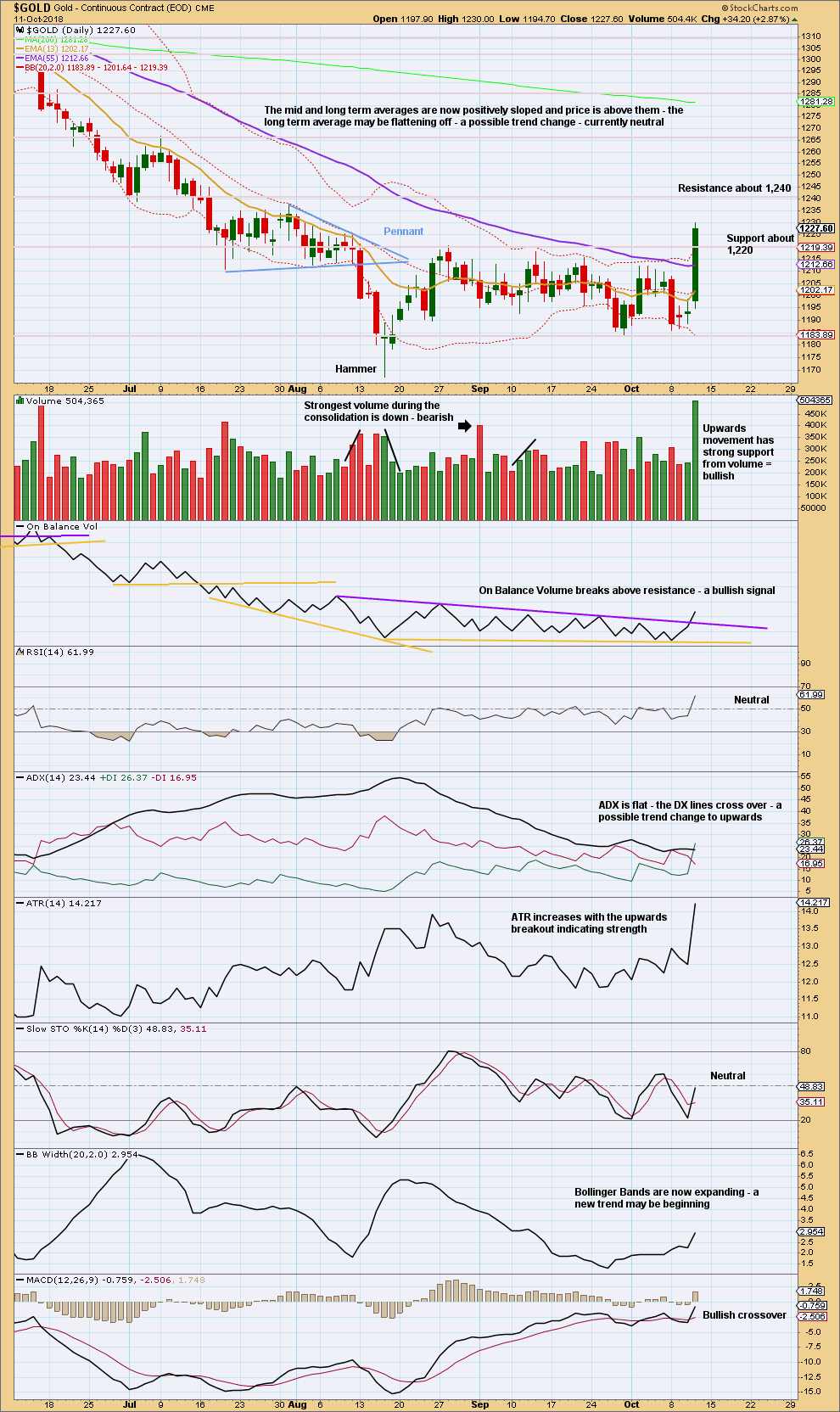

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

With strong support from volume, today completes an upwards breakout above resistance at 1,220. It would now be fairly common to see price curve down and test support about 1,220 before moving up and away.

There is resistance above about 1,240.

While today looks like a blowoff top with very strong volume, the close and high are close together. There is no upper wick to suggest weakness here.

The bullish signal from On Balance Volume is strong: the trend line breached was long held and tested multiple times, and it has a shallow slope. This adds confidence today in an upwards breakout.

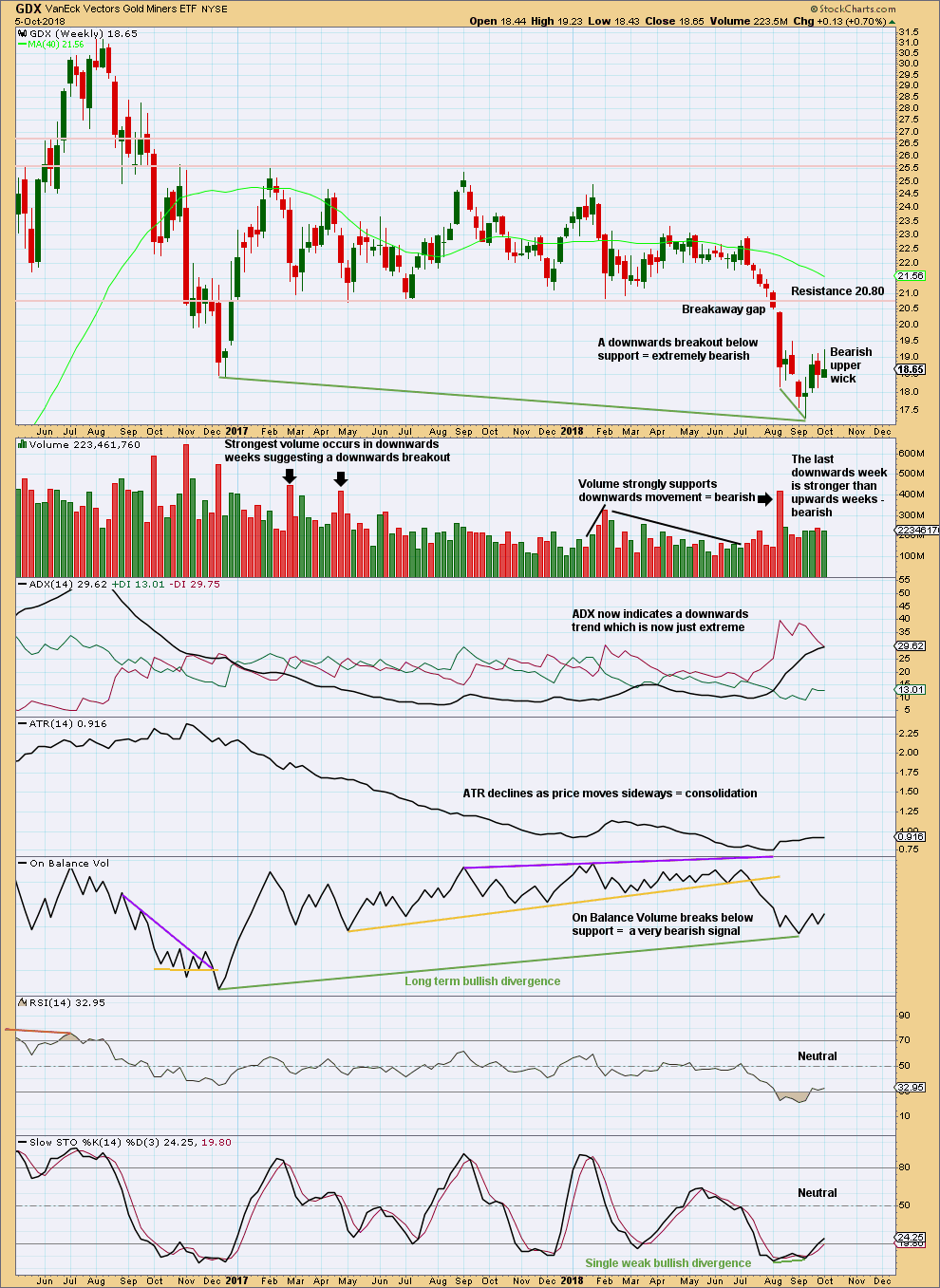

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

After a breakout, a technical principle is the longer that price consolidates sideways the longer the resulting trend may be expected to be. Also, the longer that price meanders sideways the more energy may be released after a breakout. This is what has happened for GDX.

A target for this downwards trend to end calculated using the measured rule is at 16.02. That is not yet met.

At the weekly chart level, there is a clear downwards breakout with a breakaway gap. As breakaway gaps should not be closed, they may be used to set stops that may be set just above a downwards breakaway gap.

The bullish divergence between price and On Balance Volume noted with green trend lines is also not a strong signal. On Balance Volume is a leading indicator; when it leads, it offers a signal, but it does not always lead price.

The consolidation may continue to relieve extreme conditions.

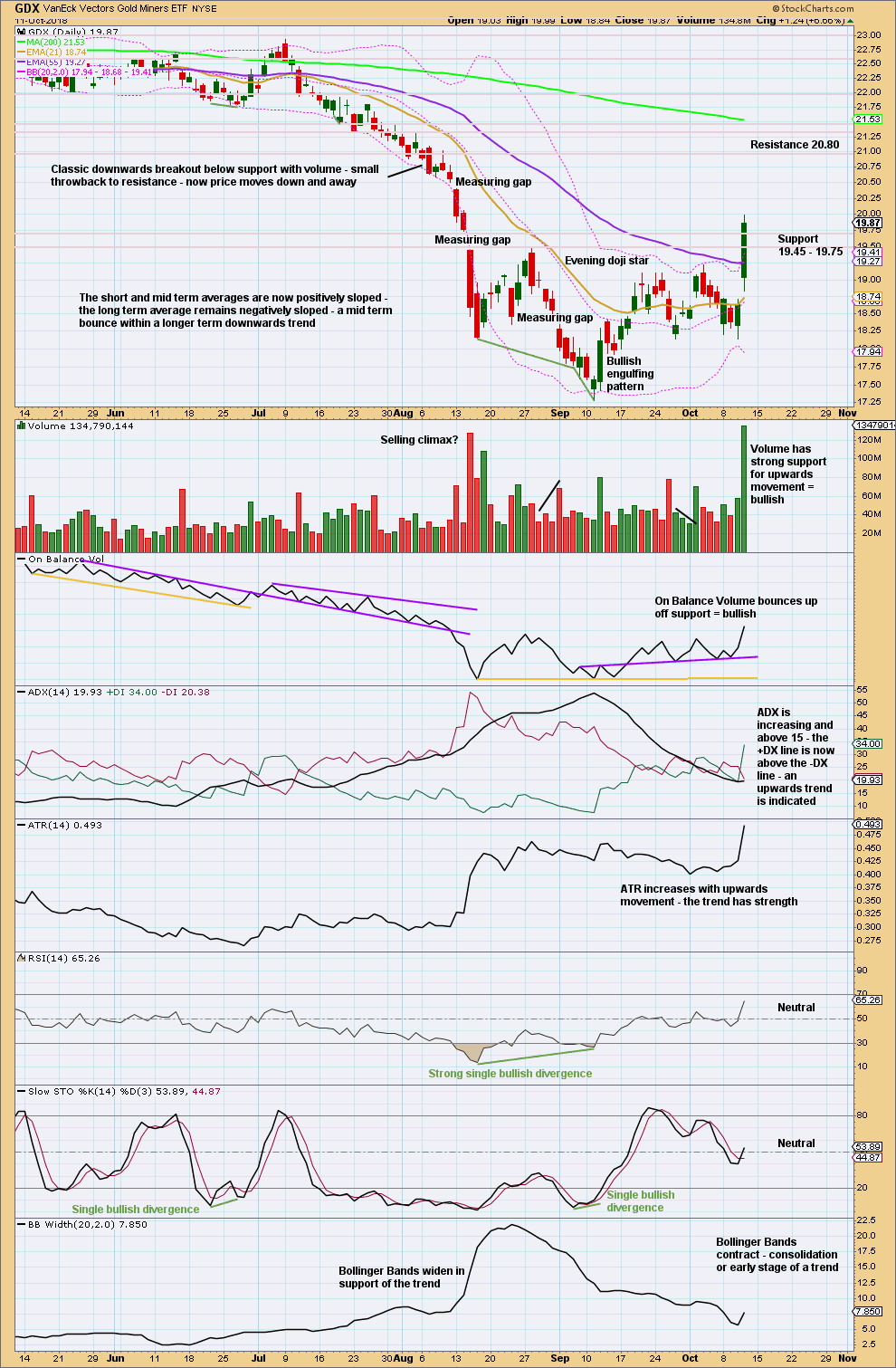

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

It now looks like GDX may be curving back up to test very strong resistance about 20.80. If it does get up to this point, then that may offer a very good entry point for a short position which may be held for a reasonably long term.

Published @ 11:08 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Triangle hourly chart updated:

Minute iv looks like it may continue sideways for another one to very few days. Maybe about 2-3.

Then an upwards wave for minute v to end minor 3 about the target.

Hi Lara,

Thank you for your analysis. I want to make sure, I understand your analysis. I interpreted your view of gdx yhat there is very limited upside potential at about 20.80. Does this mean there won’t be a significant rally as pog approach’s 1300? Or do you mean we have to visit gdx at $16 before a substantial gdx rally? Or do you mean something else all together? I’m very confused. I thought gdx almost always rally’s with gold? Or is that just a false expectation? I don’t have much experience trading gold stocks. I’m trying to learn.

A few more questions relates to oil. wti went down to 70.50 nearly to triangle support. Do you still favor the triangle wave count? Final question can you do an analysis of XOP the s$poil and gas index? I know the final question is a big request. I am a new member to this site, but I was a member of Lara weekly prior to that and I’ve been a member of your ewstockmarket for about 6 months. I hope you consider doing that when you have time. I can’t thank you enough for sharing your Expertise!

For GDX: now that resistance at 19.45 to 19.75 has been broken, that area may now provide support.

With resistance there broken, next very strong resistance for GDX is about 20.80.

Look at the weekly chart for GDX. See that long sideways movement which began back in January 2017. That’s a huge consolidation. The longer price consolidates, the longer the resulting trend may be. Support about 20.80 was tested multiple time and held for a year and 7 months.

The breakout below 20.80 was on the week of 6th August, downwards.

I am now expecting that GDX may be turning up to test resistance at 20.80 which was prior support.

If it does that, then the probability of resistance at 20.80 holding is very high. A test there may present an excellent opportunity for a short position which may be held for months.

Regarding the expectation that GDX and Gold move together, rather than assuming they do or should, look at the correlation coefficient between the two. Stockcharts have this tool. They are often positively correlated, but this can break down to 0 at times, so the correlation is unreliable.

For an explanation of how a correlation coefficient should be used, read this article.

When you’re logged in and reading the daily analysis, go to “categories” on the RH side bar and choose “education” from the drop down box. Have a scroll through, you may find some helpful stuff there.

Your questions re Oil will be answered in this end of week analysis which I’m just about to begin now.

I’ll take a look at XOP for you. I might be able to get to that next week, but I have to do Bitcoin first. I’m not at home this week, I’m travelling.

Hi Lara,

I will look through all of your educational materials. I noticed that you have some suggested reading from ewi. I was once a subscriber of their service. Not to over inflate your ego, but you are light years better (and worth every penny) at chart analysis then anyone at ewi. The way you combine classical and Elliott wave analysis is awesome. The EWI people are far too bearishly biased very much in contrast to your unbiased approach. It is refreshing to hear you comment that you don’t even watch the news. I feel like the folks at ewi use Elliotwave analysis to confirm their biased opinion which defeats the purpose of analysis. Thank you for your detailed response. I have belonged to many advisory services in the past and yours is hands down the best and simply top notch! I found you quite by accident surfing on the web, I feel lucky I did. I look forward to your xop analysis. Happy travels!

Thank you very much. It’s always really nice to hear my work is appreciated.