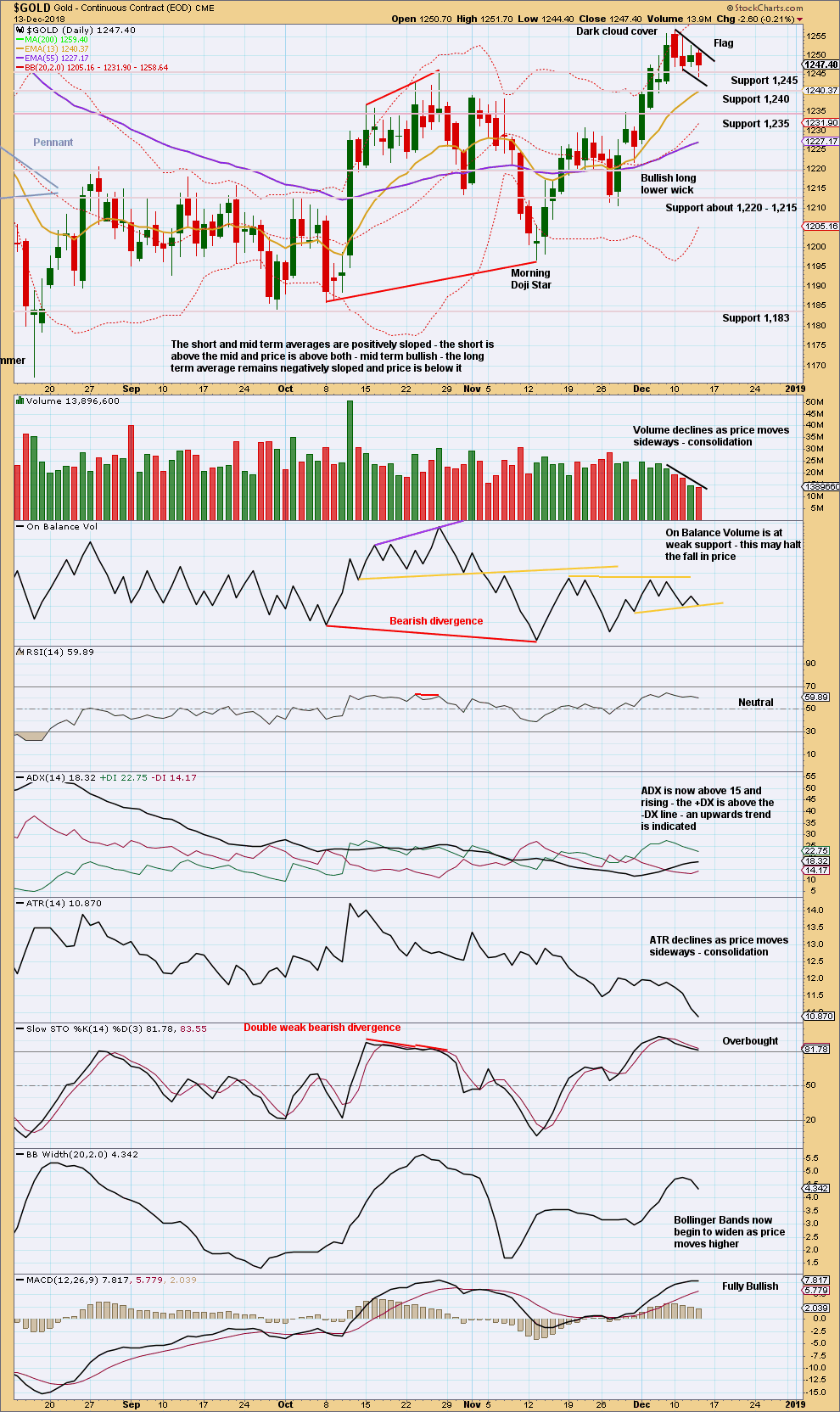

More sideways movement was expected for the very short term. This pattern may now be identified on the daily chart. The measured rule is used to calculate a target.

Summary: For the very short term, a small pullback to about 1,235 may continue, lasting about another 3 days. Support below is at 1,245, 1,240 and 1,235.

Thereafter, the upwards trend may resume. The mid-term target is now a small range at 1,294 to 1,295.

The final target for this bounce to end is about 1,305 – 1,310.

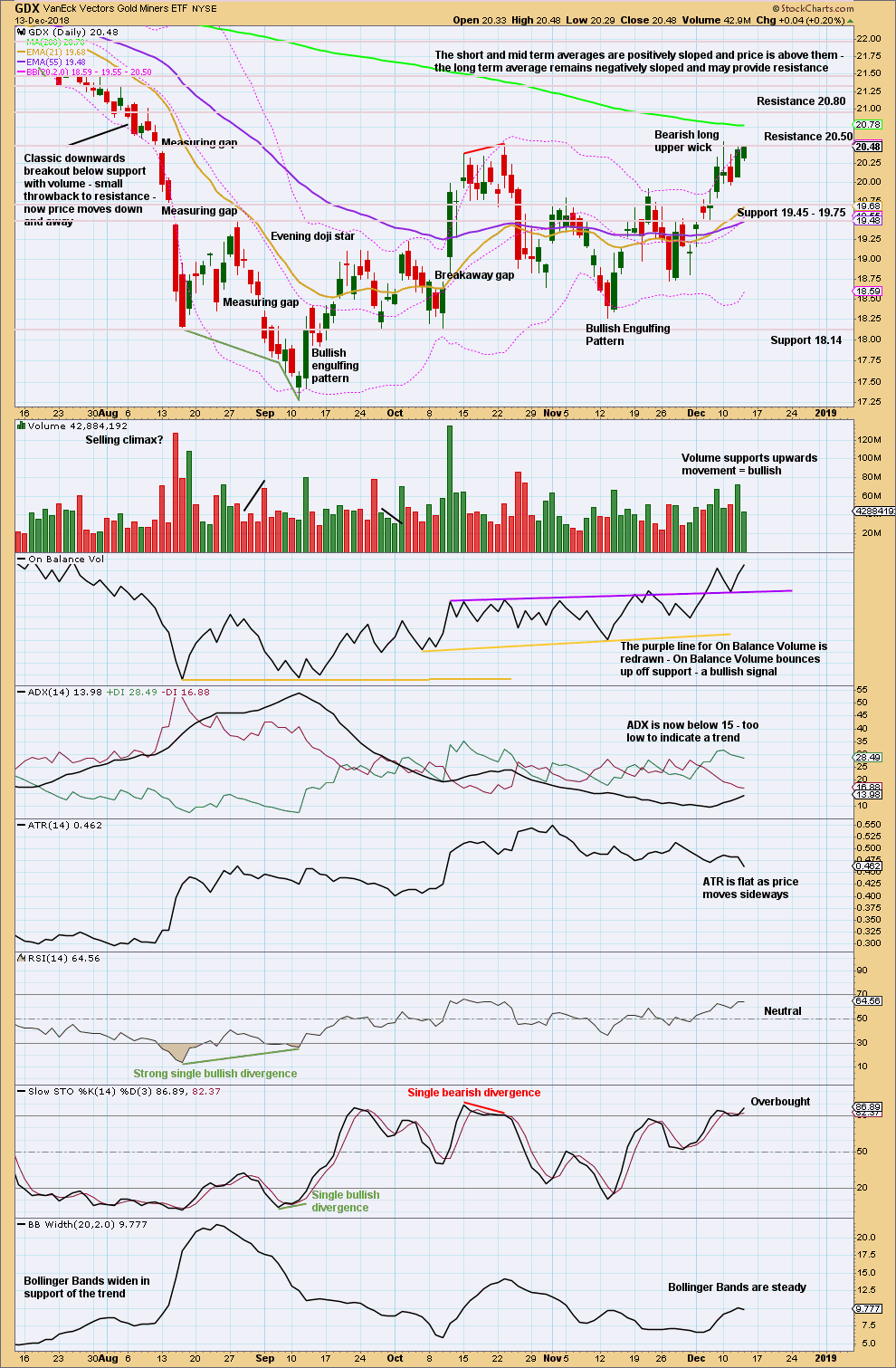

For GDX, because there is strength in today’s upwards movement, it is again possible that GDX may move higher to more closely test 20.80.

New updates to this analysis are in bold.

Grand SuperCycle analysis is here.

Last historic analysis with monthly charts is here.

There are four remaining weekly wave counts at this time for cycle wave b: a triangle, a flat, a combination, and a double zigzag.

At this time, the Triangle wave count may again be slightly more likely.

MAIN ELLIOTT WAVE COUNT

WEEKLY CHART – TRIANGLE

Cycle wave b may be an incomplete regular contracting triangle. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Within primary wave E, intermediate waves (A) and (B) may be complete. Intermediate wave (C) must subdivide as a five wave structure. Within intermediate wave (C), minor wave 2 may not move beyond the start of minor wave 1 below 1,181.06.

Four of the five sub-waves of a triangle must be zigzags, with only one sub-wave allowed to be a multiple zigzag. Wave C is the most common sub-wave to subdivide as a multiple, and this is how primary wave C for this example fits best. Primary wave E would most likely be a single zigzag. It is also possible that it may subdivide as a triangle to create a rare nine wave triangle.

There are no problems in terms of subdivisions or rare structures for this wave count. It has an excellent fit and so far a typical look.

When primary wave E is a complete three wave structure, then this wave count would expect a cycle degree trend change. Cycle wave c would most likely make new lows below the end of cycle wave a at 1,046.27 to avoid a truncation.

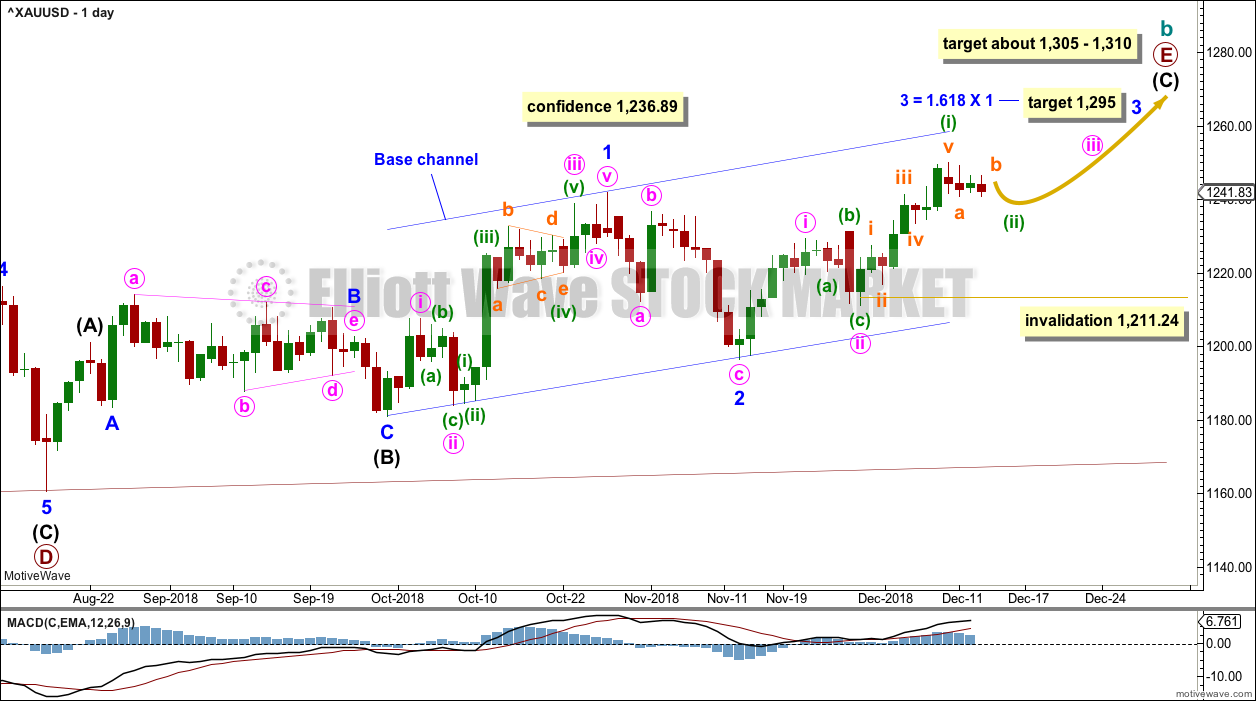

DAILY CHART – TRIANGLE

Primary wave E should now be underway for this wave count.

Primary wave E should subdivide as a zigzag. Intermediate waves (A) and (B) may now be complete. Intermediate wave (C) may be underway.

Minor wave 1 fits perfectly as a five wave impulse. Minor wave 2 should be complete as a deep zigzag. Minor wave 3 may now exhibit an increase in upwards momentum, and it should have support from volume. The target for minor wave 3 expects it to exhibit a common Fibonacci ratio to minor wave 1.

Minor wave 3 may only subdivide as an impulse. Within minor wave 3, minute waves i and ii may now be complete. Within minute wave iii, minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,211.24.

A target for primary wave E is the strong zone of resistance about 1,305 to 1,310. Primary wave E is most likely to subdivide as a zigzag (although it may also subdivide as a triangle to create a rare nine wave triangle). It may last a total Fibonacci 21 or 34 weeks. So far it has lasted 13 weeks. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

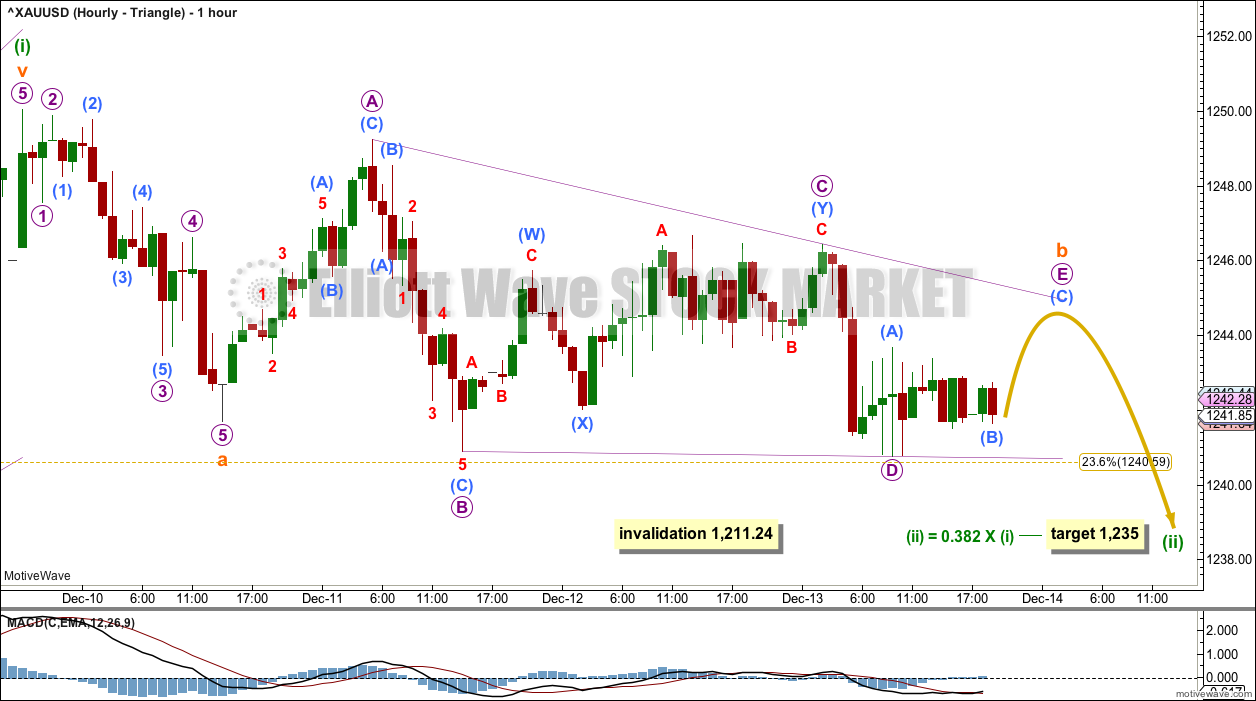

HOURLY CHART – TRIANGLE

Minuette wave (ii) may not move beyond the start of minuette wave (i) below 1,211.24.

Minuette wave (ii) may be any corrective structure except a triangle.

At this stage, minuette wave (ii) may be a zigzag with a running barrier triangle for subminuette wave b within it. The triangle for subminuette wave b would be incomplete.

No upper invalidation point is given again today. It is still possible that minuette wave (ii) may not complete as a zigzag; it may still complete as another corrective structure such as an expanded flat or combination. These possibilities allow for a new high as part of minuette wave (ii).

It is still impossible to tell with confidence what structure may complete for the correction of minuette wave (ii). The labelling within it may again change as the structure continues to unfold. Focus will be on identifying when a complete corrective structure can be seen, which is not the case today.

Minuette wave (ii) may be relatively brief and shallow due to the strong upwards pull of the middle of a third wave.

Minuette wave (i) lasted a Fibonacci 8 days. Minuette wave (ii) may last a Fibonacci 5 days, which would see it now continue for a further two days. The 0.382 Fibonacci ratio about 1,235 may be final support.

WEEKLY CHART – DOUBLE ZIGZAG

It is possible that cycle wave b may be a double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle would be about three quarters complete.

Within the triangle of primary wave X, intermediate wave (C) should be complete. Within intermediate wave (D), minor waves A and B may be complete. Minor wave C must subdivide as a five wave structure. Within minor wave C, minute wave ii may not move beyond the start of minute wave i below 1,181.06.

Intermediate wave (D) would most likely subdivide as a single zigzag.

This wave count may now expect choppy overlapping movement in an ever decreasing range for several more months.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

WEEKLY CHART – COMBINATION

If cycle wave b is a combination, then the first structure in a double may be a complete zigzag labelled primary wave W.

The double may be joined by a three in the opposite direction, a zigzag labelled primary wave X.

The second structure in the double may be a flat correction labelled primary wave Y. My research on Gold so far has found that the most common two structures in a double combination are one zigzag and one flat correction. I have found only one instance where a triangle unfolded for wave Y. The most likely structure for wave Y would be a flat correction by a very wide margin, so that is what this wave count shall expect.

Within a flat correction for primary wave Y, the current downwards wave of intermediate wave (B) may be a double zigzag. Intermediate wave (B) must retrace a minimum 0.9 length of intermediate wave (A) at 1,147.34. Intermediate wave (B) may move beyond the start of intermediate wave (A) as in an expanded flat.

Because the minimum requirement for intermediate wave (B) is not yet met, this wave count requires that intermediate wave (B) continues lower. This is the most immediately bearish of all four weekly wave counts.

When intermediate wave (B) is complete, then intermediate wave (C) would be expected to make at least a slight new high above the end of intermediate wave (A) at 1,365.68 to avoid a truncation. Primary wave Y would be most likely to end about the same level as primary wave W at 1,374.91, so that the whole structure takes up time and moves price sideways, as that is the purpose of double combinations.

While double combinations are very common, triples are extremely rare. I have found no examples of triple combinations for Gold at daily chart time frames or higher back to 1976. When the second structure in a double is complete, then it is extremely likely (almost certain) that the whole correction is over.

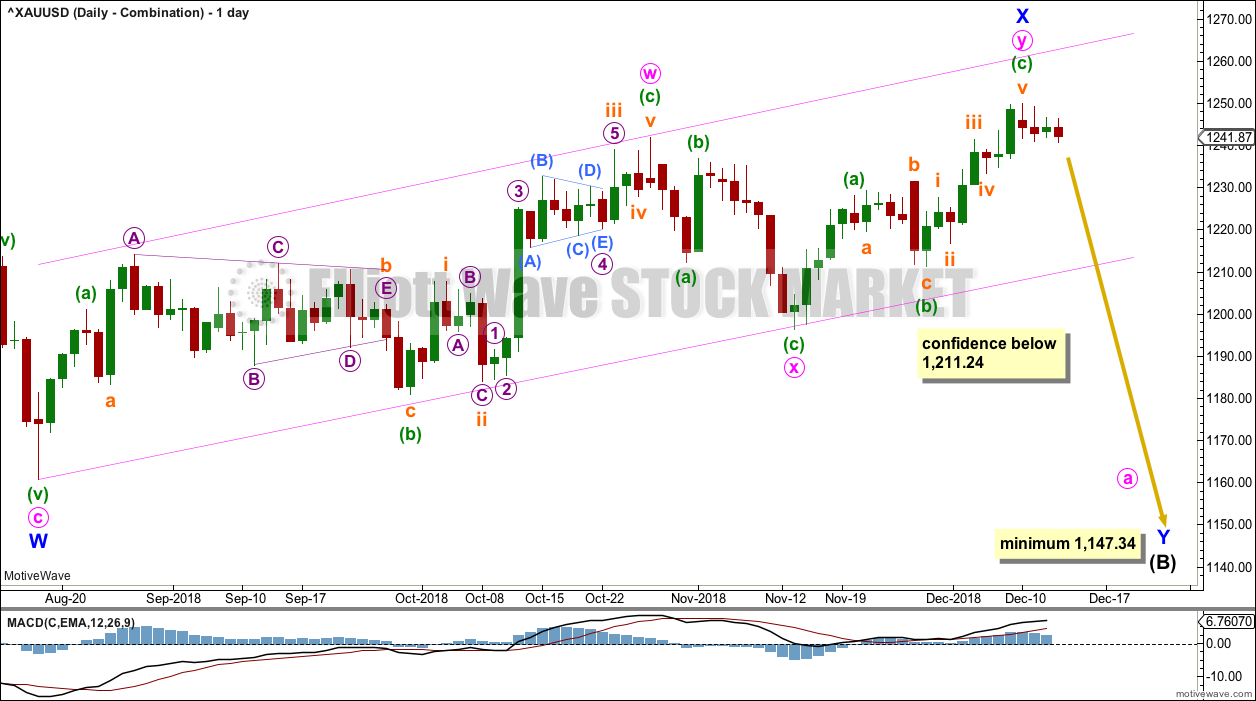

DAILY CHART – COMBINATION

Minor wave X may be a complete double zigzag.

The maximum number of corrective structures within a multiple is three. This number refers to W, Y and Z. Each of W, Y and Z may only be simple corrective structures; they may not be multiples. However, the total of three does not include X waves, so X waves may be any corrective structure including multiples and the Elliott wave rule is not violated.

While X waves may be multiples, they very rarely are. The probability of this wave count is reduced.

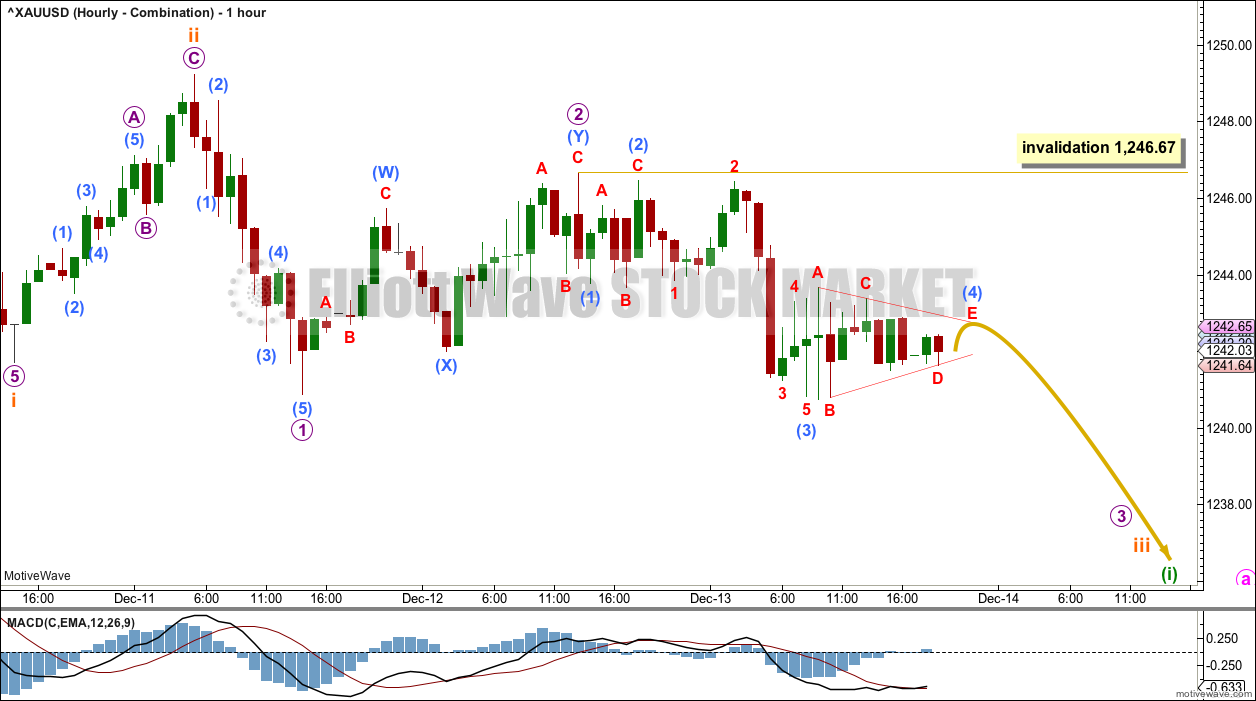

HOURLY CHART – COMBINATION

This wave count now expects a downwards trend to 1,147.34 minimum.

Within the new trend of minor wave Y, minute wave a must subdivide as a five wave structure (most likely an impulse).

Within minute wave a, the degree of labelling is moved down one degree today. Minuette wave (i) may be an incomplete impulse.

Within minuette wave (i), subminuette waves i and ii may be complete. Within subminuette wave iii, micro waves 1 and 2 may be complete. Within micro wave 3, sub-micro waves (1), (2) and (3) may be complete. Sub-micro wave (4) may be a small incomplete running contracting triangle.

Within micro wave 3, no second wave correction may move beyond the start of its first wave. This invalidation point allows for the possibility that labelling within micro wave 3 may be wrong.

WEEKLY CHART – FLAT

It is possible that cycle wave b may be a flat correction. Within a flat correction, primary wave B must retrace a minimum 0.9 length of primary wave A at 1,079.13 or below. Primary wave B may make a new low below the start of primary wave A at 1,046.27 as in an expanded flat correction.

Only a new low reasonably below 1,123.08 would provide reasonable confidence in this wave count.

Intermediate wave (C) must subdivide as a five wave structure; it may be unfolding as an impulse. Within intermediate wave (C), minor waves 1 through to 3 may be complete. Today minor wave 4 is relabelled as possibly incomplete as a double zigzag.

Minor wave 2 lasted 9 weeks. If minor wave 4 is now complete, then it has lasted 17 weeks. Minor wave 4 would be longer in duration than minor wave 2 by a reasonable margin. For Gold this is unusual, so the probability of this wave count is further reduced.

TECHNICAL ANALYSIS

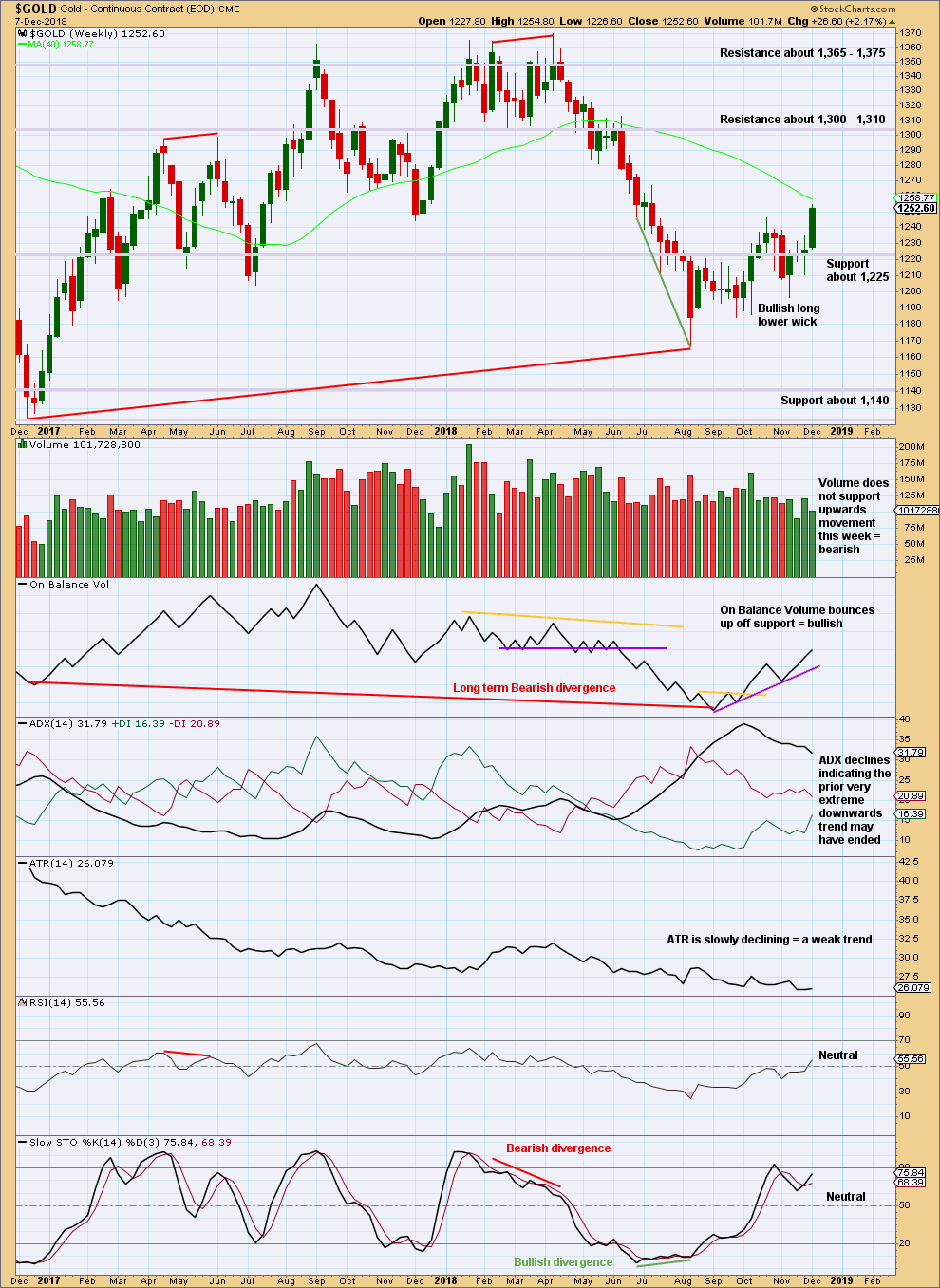

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

On Balance Volume has made a lower low than its prior low at the end of November 2015. This divergence is extremely bearish but does not rule out a consolidation unfolding here; the divergence does strongly support the Triangle wave count, which expects a consolidation or bounce up to test resistance now and then a continuation of a major bear market. It could also support the flat wave count that allows for a new low below 1,046.27 in coming months.

A strong upwards week makes a new high. There is a series of higher highs and higher lows since mid August. There is strong resistance above about 1,300 to 1,310.

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

ADX now indicates an upwards trend in place. Price has made a series of higher highs and higher lows since the 16th of August, the basic definition of an upwards trend.

A flag pattern may be forming. Using the measured rule gives a target at 1,294. This adds confidence because the target is very close to the Elliott wave target. Volume supports the flag pattern.

A new support line is added to On Balance Volume. It has very weak technical significance.

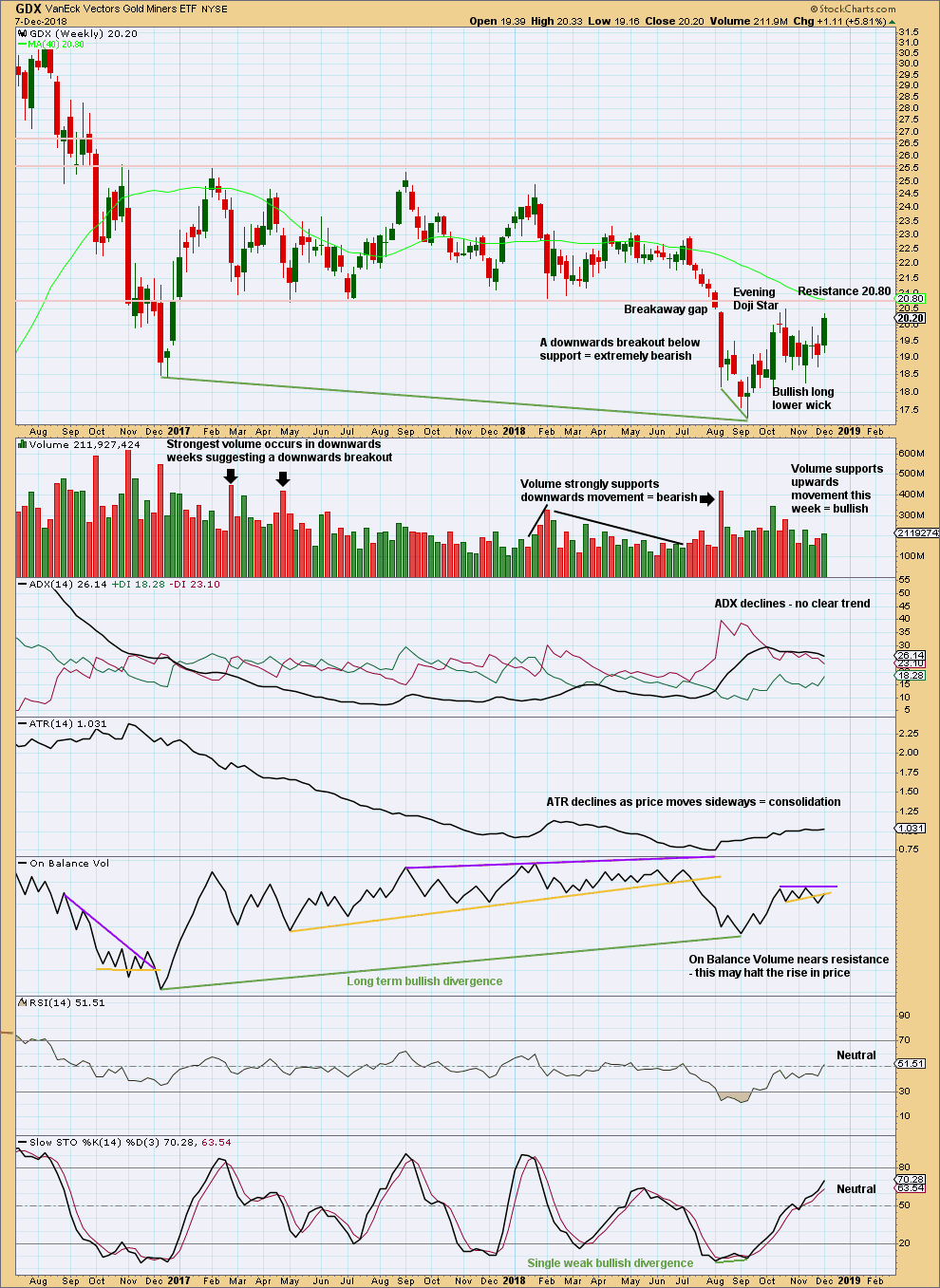

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

GDX had a large consolidation that lasted from January 2017 to August 2018. A downwards breakout below support at 20.80 in early August 2018 is highly significant. The breakout had support from volume, which adds confidence.

The breakaway gap has its low at 20.51. This gap is closed, but the target for the resulting movement following the long consolidation remains. The current bounce may still find strong resistance about 20.80.

The target is at 16.02.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Strong resistance still remains above about 20.50 and 20.80. It is again possible that price may now move a little higher to more closely test 20.80.

Published @ 10:00 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

Micro wave E of the triangle for subminuette b may have itself subdivided into a small triangle, effectively creating a (rather rare) nine wave triangle.

I’ve seen a couple of these before, most notably there is currently one on the monthly chart for US Oil.

Anyway, subminuette c now looks like a quick sharp impulse which looks complete. There is a Morning Doji Star bullish reversal pattern at the low on today’s hourly chart. It looks like the small pullback is complete.

Some members may have not received my email earlier this week with Christmas / New Year holiday dates. So I copy it here:

Dear Elliott Wave Gold Members,

It’s that time of the year again.

Once a year I need to take a holiday. I take two weeks over Christmas / New

Year because it includes two less open sessions and so means I only miss

analysis for eight sessions.

This year there will be no analysis from Monday 24th December 2018 to

Friday 4th January 2019.

Analysis will resume on Monday 7th January 2019 and I will prepare a video

for each of Gold and US Oil for you on this day as well.

This is necessary so that I can continue to provide you with analysis long

term. If I did not take a break once a year I would burn out.

I have some excellent news to add at this time. I am currently training a

new analyst on Elliott wave and technical analysis. She may be ready to

begin to publish analysis under my supervision over the next few weeks.

I wish all our members a very Merry Christmas and Happy New Year. May you

all be safe and healthy, and lets all look forward to profits next year.

Lara, hi. Been watching quietly for a while. Finally have a question for you….

Does Gold’s weekly combination chart have an upward invalidation point? Would it be the high of Minor x within Intermediate B?

That’s an excellent question.

At the weekly chart level, minor X could certainly continue higher. There is no Elliott wave rule stating a limit to its length.

And so at the daily chart level I’ve purposefully not added an invalidation point. It’s possible still that minuette (c) could extend higher. Or that minor X could continue as a triple zigzag.