Price remains range bound.

A new Elliott wave count this week has a good fit.

Summary: Silver has had a very long consolidation from about November 2016 to July 2017. A technical principle is the longer price consolidates the stronger and longer lasting the next trend may be.

The breakout was down. The long-term target for the current downwards trend remains at 12.08.

The larger trend remains down until proven otherwise.

For the short term, expect sideways movement for a few weeks before the downwards trend resumes.

Monthly charts were reviewed here.

New updates to this analysis are in bold.

ELLIOTT WAVE COUNTS

MAIN WAVE COUNT

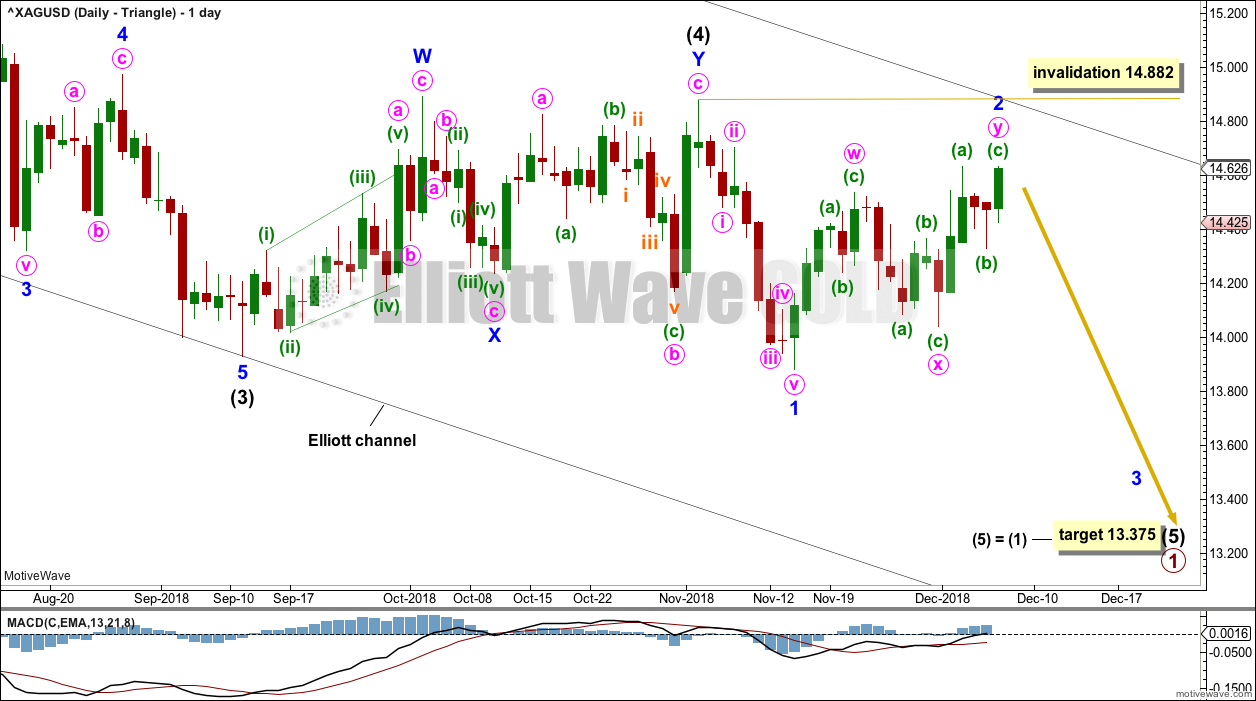

WEEKLY CHART – TRIANGLE

This first wave count has good support from classic technical analysis, so it will be favoured. This wave count looks likely.

The first wave count expects that the bear market, which began from the April 2011 high, is incomplete.

Cycle wave a is seen as a five wave impulse for this main wave count.

This first weekly chart sees cycle wave b as a now possibly complete regular contracting triangle.

Primary wave E of the triangle may have ended with an overshoot of the A-C trend line.

Within cycle wave c, primary wave 1 may be an incomplete impulse. Within primary wave 1, intermediate waves (1), (2), and (3) may be complete. This week a new alternate wave count looks at the possibility that intermediate wave (4) may continue a little further sideways.

Intermediate wave (4) may not overlap into intermediate wave (1) price territory above 16.173.

Intermediate wave (2) was a deep 0.77 flat correction lasting ten weeks. Intermediate wave (4) may exhibit alternation as a shallow combination or triangle.

The Elliott channel is drawn from the ends of intermediate degree waves. Intermediate wave (4) remains contained within this channel. If intermediate wave (4) breaches the channel, then the channel would need to be redrawn using Elliott’s second technique.

DAILY CHART – TRIANGLE

Intermediate wave (4) may be a complete double combination.

Within intermediate wave (5), minor wave 1 fits well as a complete impulse. Minor wave 2 may have moved higher this week as a double zigzag. Minor wave 2 may not move beyond the start of minor wave 1 above 14.882.

Silver behaves like a typical commodity. It often exhibits swift strong fifth waves. While this tendency is especially prevalent for its fifth waves to end third wave impulses one degree higher, it can also show up for fifth waves to end first wave impulses. Look out for the possibility that intermediate wave (5) may be very swift and strong, ending with a selling climax. This is not a certainty, but the possibility exists and so we should be aware of it.

There is no adequate Fibonacci ratio between intermediate waves (3) and (1). This makes it more likely that intermediate wave (5) may exhibit a Fibonacci ratio to either of intermediate waves (3) or (1); the most common Fibonacci ratio for a fifth wave is equality in length with the first wave.

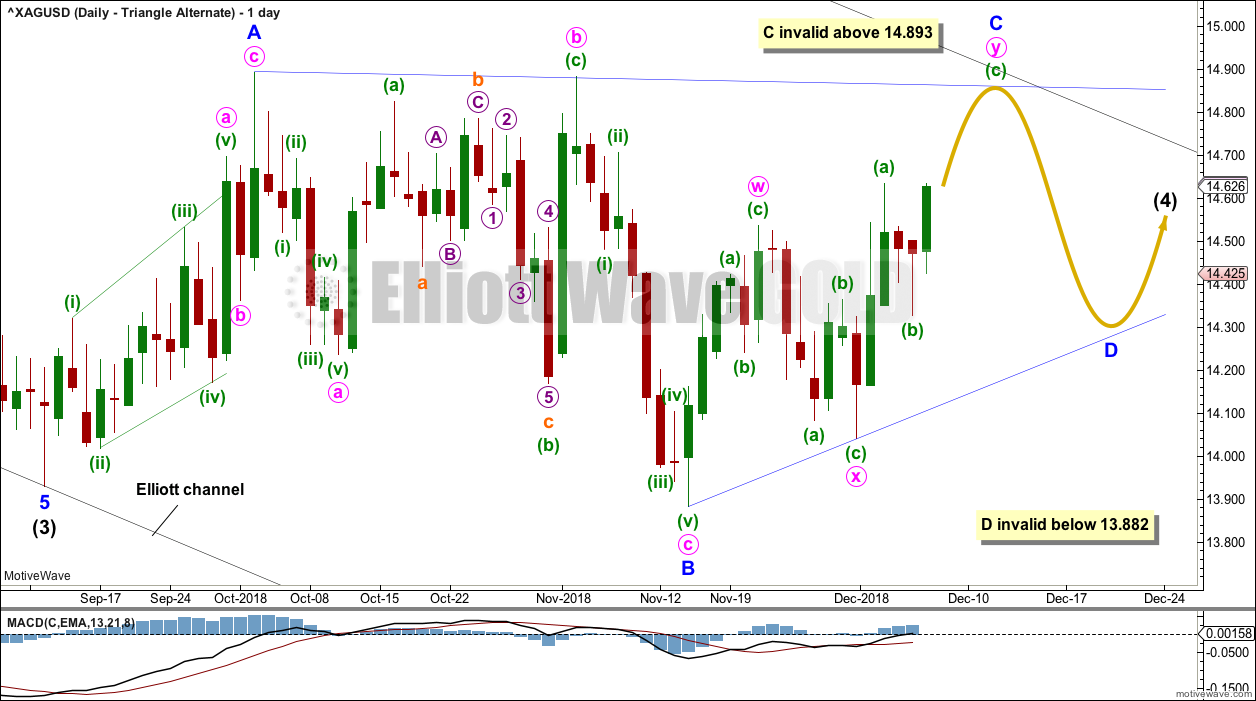

DAILY CHART – TRIANGLE ALTERNATE

It is possible that intermediate wave (4) may be continuing sideways as a running contracting triangle.

Elliott wave triangles normally adhere very well to their trend lines, and the triangle trend lines are often tested within triangle sub-waves. The high labelled minute wave b within minor wave B may be a test of the A-C trend line, and may show where the A-C trend line may sit. This may show where minor wave C may end, at resistance at this trend line.

Because the A-C trend line has a very shallow slope the B-D trend line would most likely have a reasonable slope, so that the triangle trend lines do not look close to parallel. Elliott wave triangle trend lines normally converge at a reasonable rate. Minor wave D may end about the level shown, so that the B-D trend line has a reasonable slope and may have had a test for the low of minute wave x.

Within both a contracting and barrier triangle, minor wave C may not move beyond the end of minor wave A above 14.893.

Within a contracting triangle, minor wave D may not move beyond the end of minor wave B below 13.882.

A barrier triangle here would be very unlikely as the trend lines would look too close to parallel for a normal look.

This wave count would expect choppy overlapping sideways movement for a few more weeks.

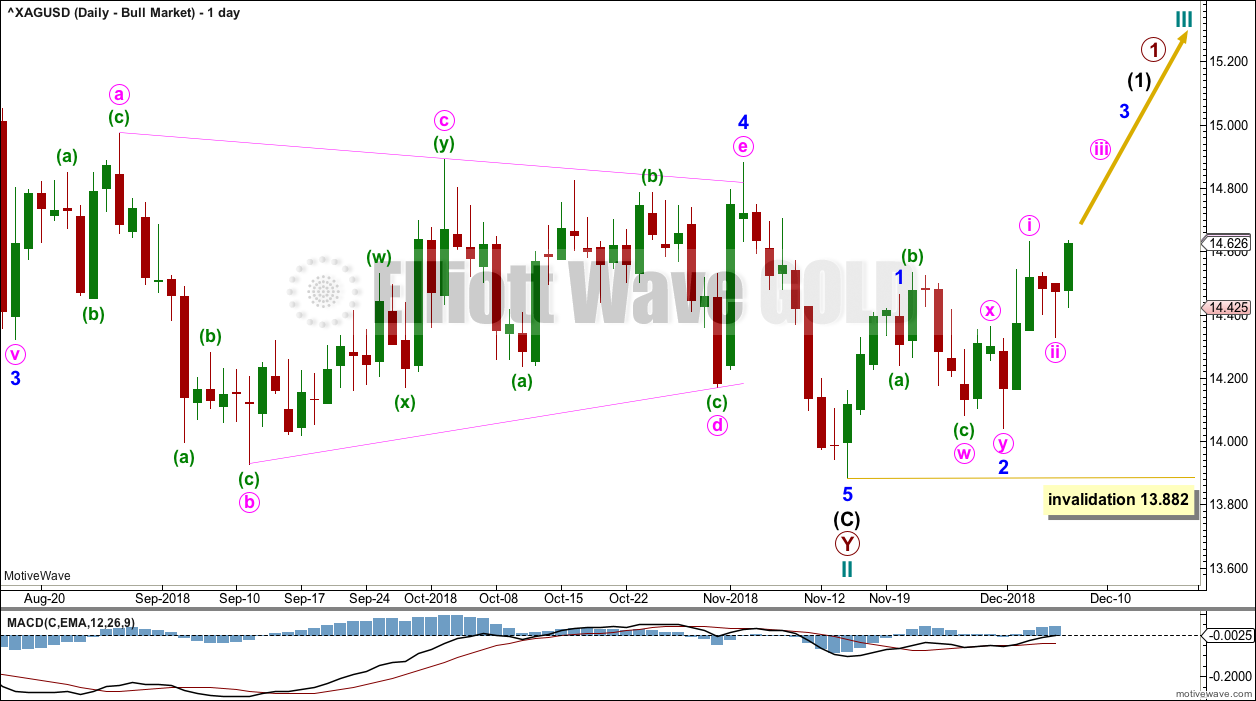

ALTERNATE WAVE COUNT

WEEKLY CHART – BULL WAVE COUNT

Cycle wave II may be a complete double zigzag. Cycle wave II would be very deep at 0.96 of cycle wave I. This is typical behaviour for the first second wave correction within a new trend for commodities.

A five wave impulse (down) for intermediate wave (C) may be complete. However, the disproportion between minor waves 2 and 4 gives this part of wave count the wrong look.

If it continues any further, then cycle wave II may not move beyond the start of cycle wave I below 13.569.

DAILY CHART – BULL WAVE COUNT

If cycle wave II is over, then the new trend up for cycle wave III should begin with a five wave structure.

Cycle wave III may only subdivide as an impulse. So far primary wave 1 would be incomplete.

Within primary wave 1, intermediate wave (1) may be incomplete.

Within intermediate wave (1), minor wave 1 may be complete. Minor wave 2 may be a double combination. Minor wave 2 may not move beyond the start of minor wave 1 below 13.882.

TECHNICAL ANALYSIS

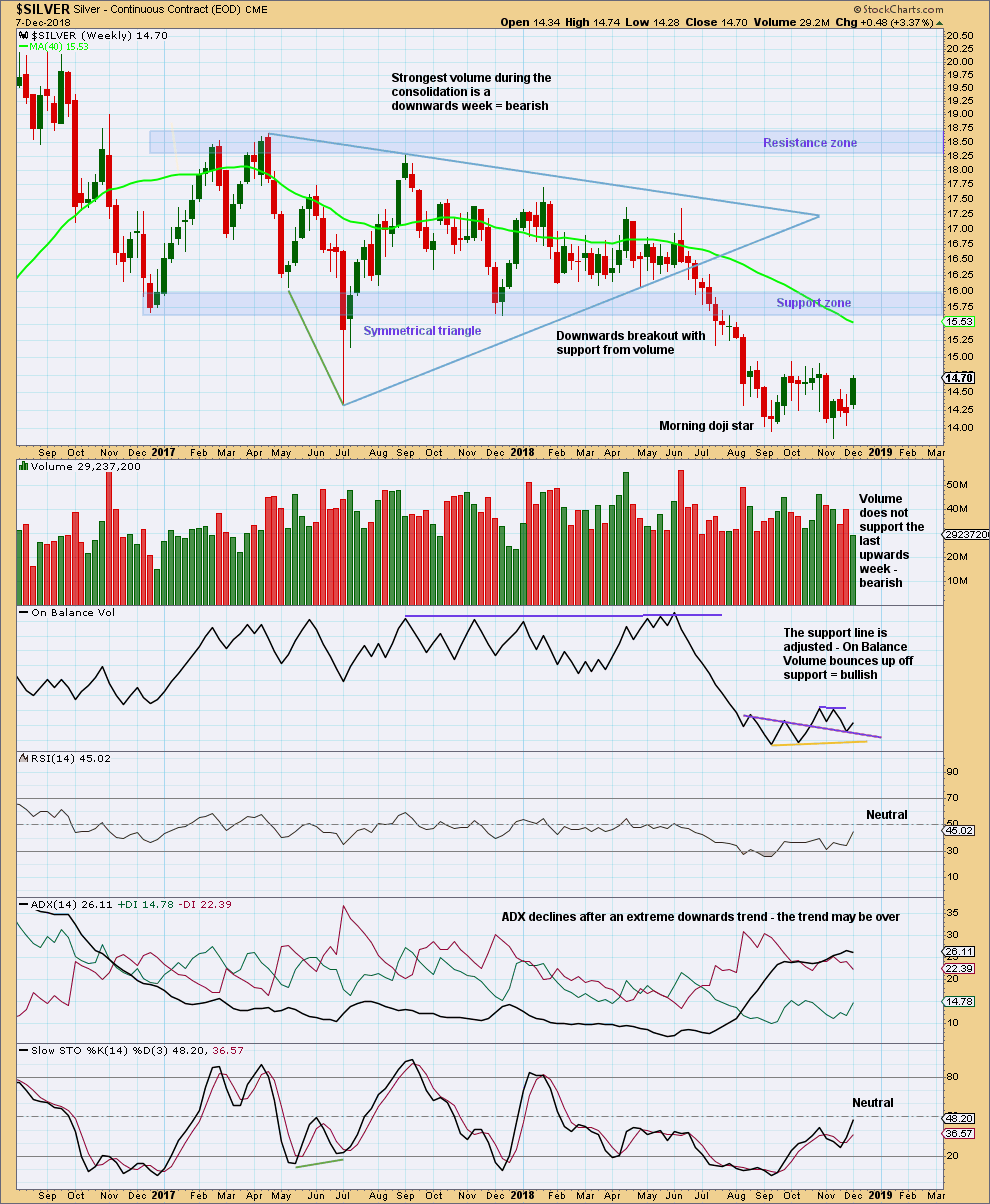

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Silver has seen a classic downwards breakout from the shaded support zone, which then provided resistance for a small back test.

A target from the breakout of the symmetrical triangle is about 12.08.

This week looks like a reasonably strong upwards week, but the lack of volume is concerning for the short term. Upwards movement may be limited. Look for resistance above about 14.90 – 14.95.

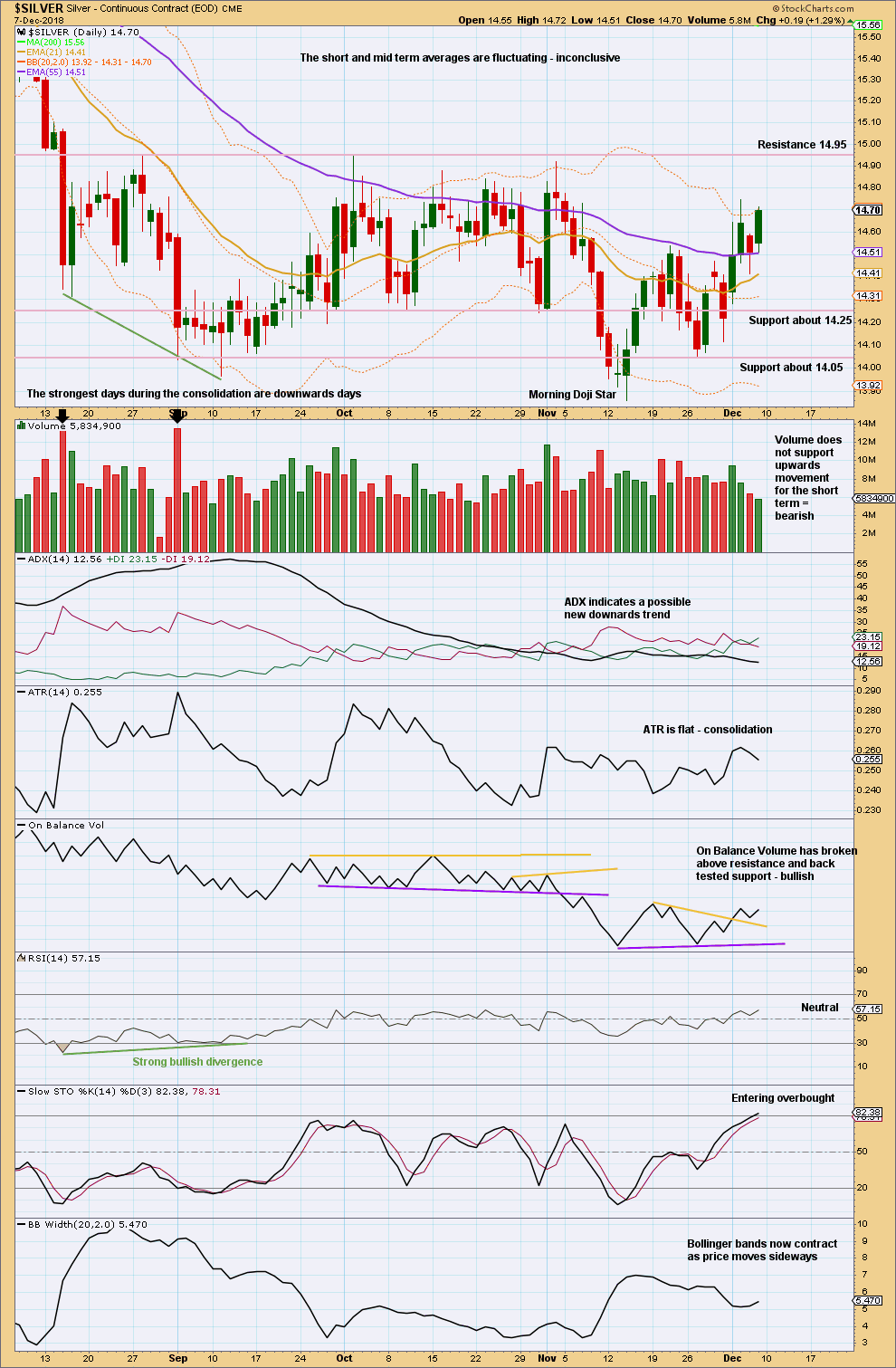

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price is nearing resistance. Stochastics is entering overbought. Expect a little more upwards movement to about 14.95. A bullish signal from On Balance Volume supports this view for the short term.

Published @ 02:46 p.m. EST on December 9, 2018.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.