Last week’s analysis expected a downwards trend to resume, which is exactly what has happened.

Summary: The short-term target is at 13.524.

The long-term target remains at 10.05.

Monthly charts were reviewed here.

New updates to this analysis are in bold.

ELLIOTT WAVE COUNTS

MAIN WAVE COUNT

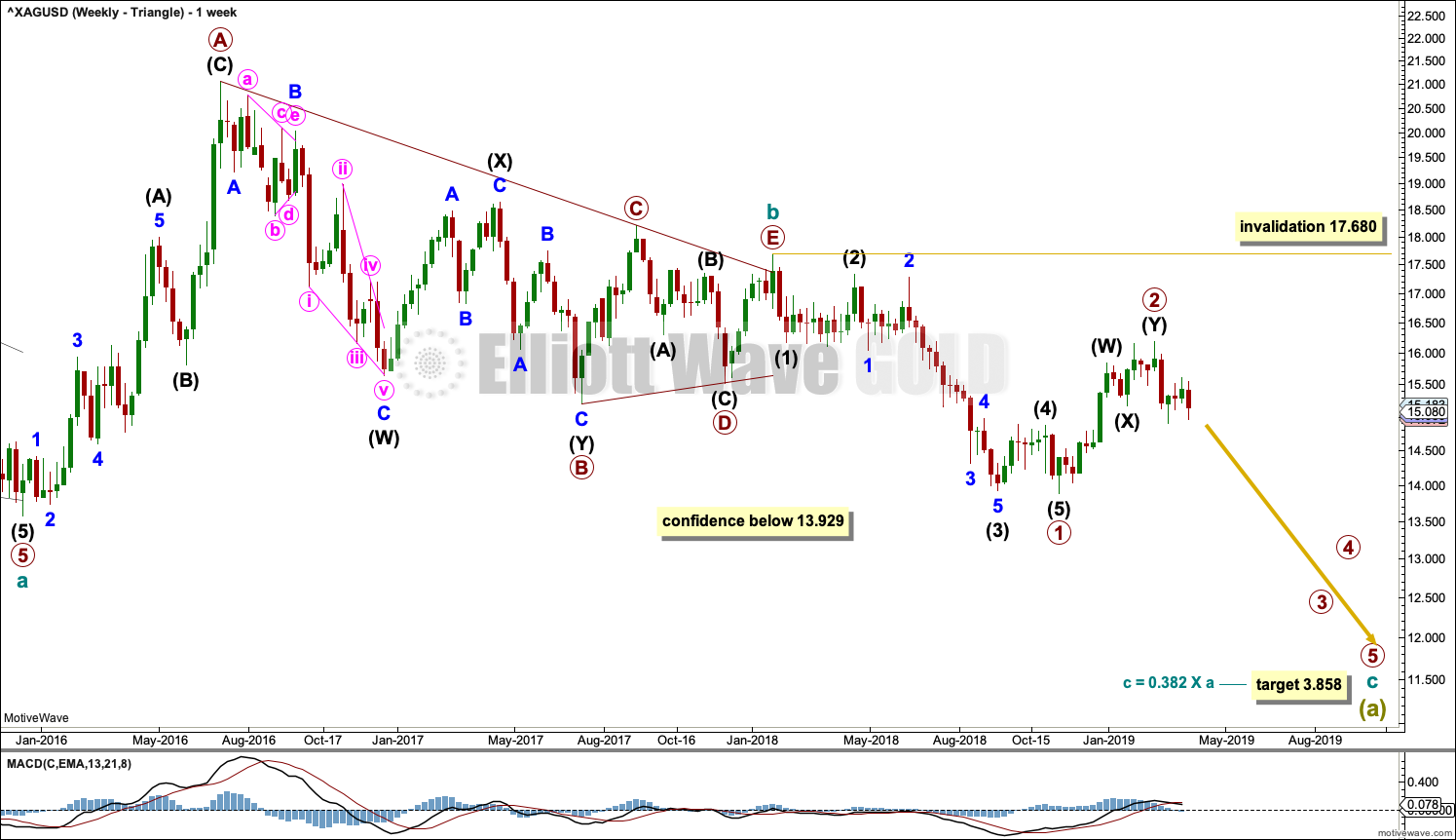

WEEKLY CHART – TRIANGLE

This first wave count has good support from classic technical analysis, so it will be favoured. This wave count looks likely.

The first wave count expects that the bear market, which began from the April 2011 high, is incomplete.

Cycle wave a is seen as a five wave impulse for this main wave count.

This first weekly chart sees cycle wave b as a now possibly complete regular contracting triangle.

Primary wave E of the triangle may have ended with an overshoot of the A-C trend line.

Within cycle wave c, primary waves 1 and 2 may now both be complete.

If it continues higher, then primary wave 2 may not move beyond the start of primary wave 1 above 17.680.

Cycle wave c needs to move below the end of cycle wave a below 13.569 in order to avoid a truncation.

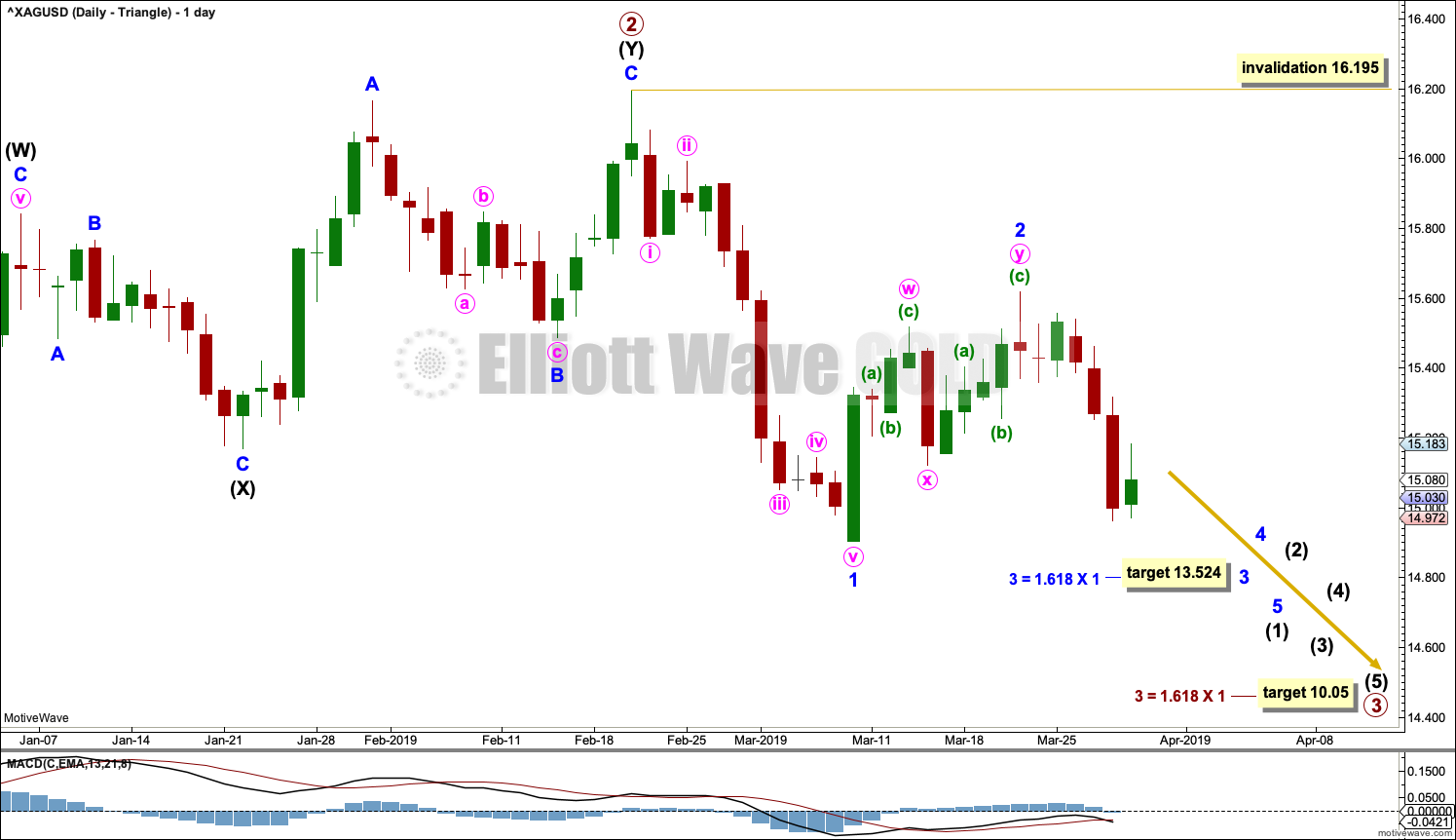

DAILY CHART – TRIANGLE

A target is calculated for primary wave 3 to reach the most common Fibonacci ratio to primary wave 1.

Primary wave 3 may only subdivide as an impulse. Within primary wave 3, intermediate wave (1) may be incomplete. Within intermediate wave (1), minor wave 2 may not move beyond the start of minor wave 1 above 16.195.

Minor wave 1 lasted 12 days, just one short of a Fibonacci 13. Minor wave 2 lasted 9 days, one longer than a Fibonacci 8. Minor wave 2 may have ended just short of the 0.618 Fibonacci ratio. This week minor wave 2 is relabelled as a complete double zigzag. This has a better fit and is still a fairly common structure.

Minor wave 3 must move below the end of minor wave 1. When this rule is met, further confidence that minor wave 3 should be underway may be had. At that stage, the invalidation point may be moved to the end of minor wave 2.

A target is calculated for minor wave 3 that expects it to exhibit the most common Fibonacci ratio to minor wave 1.

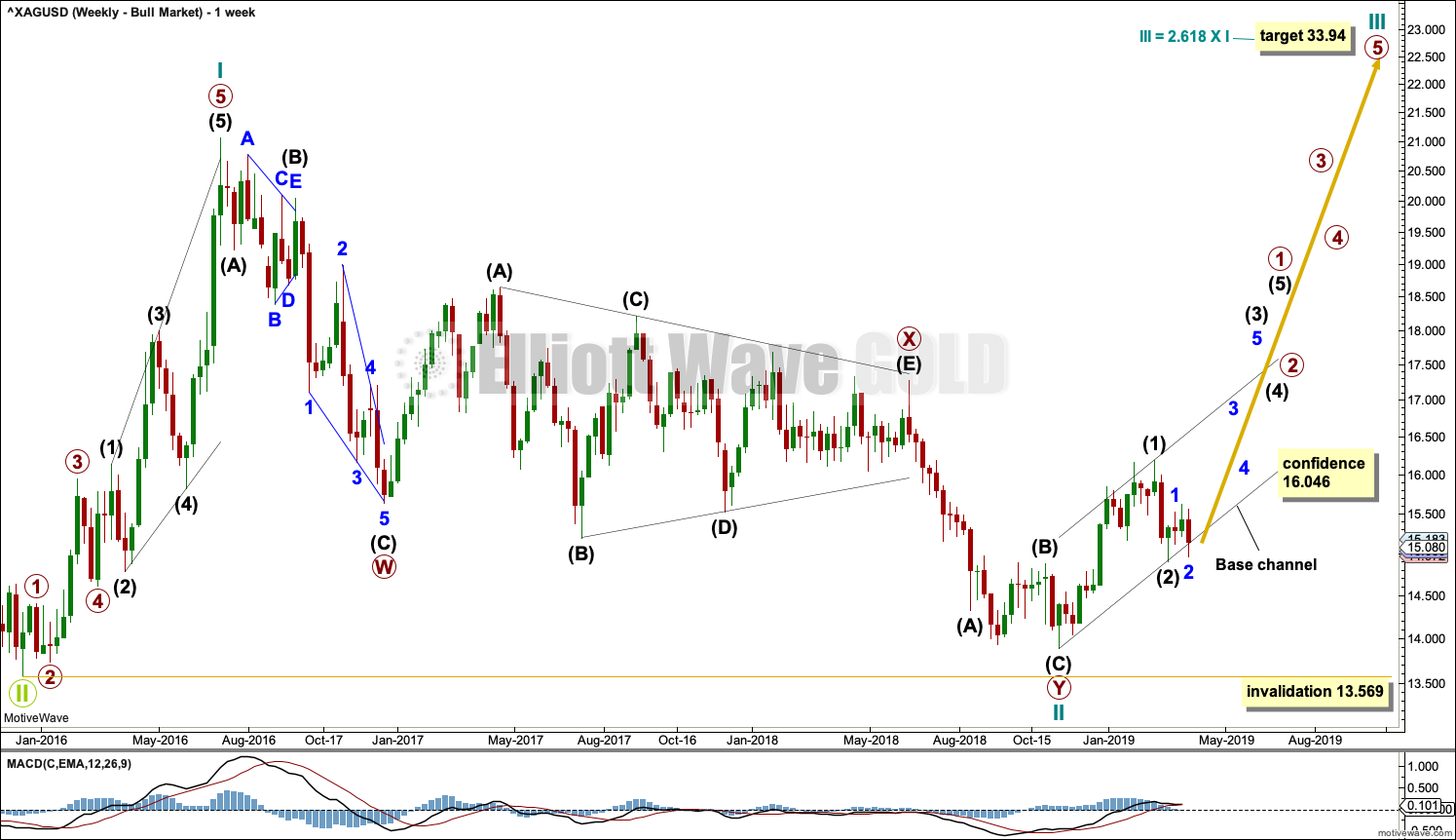

ALTERNATE WAVE COUNT

WEEKLY CHART – BULL WAVE COUNT

Cycle wave II may be a complete double zigzag. Cycle wave II would be very deep at 0.96 of cycle wave I. This is typical behaviour for the first second wave correction within a new trend for commodities.

If it continues any further, then cycle wave II may not move beyond the start of cycle wave I below 13.569.

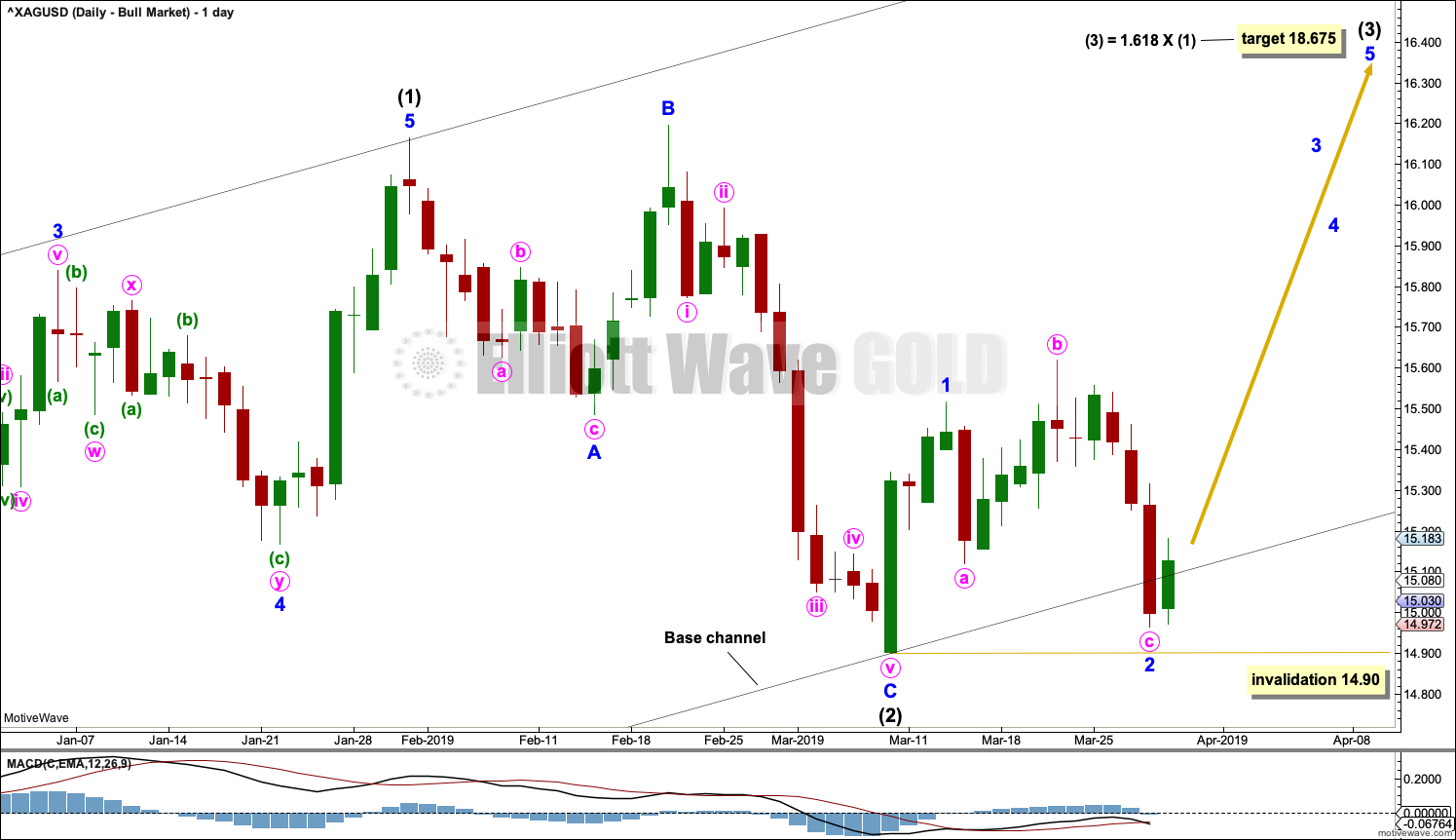

DAILY CHART – BULL WAVE COUNT

If cycle wave II is over, then the new trend up for cycle wave III should begin with a five wave structure. This is labelled intermediate wave (1). The structure may now be complete.

Intermediate wave (2) may now be a complete regular flat correction.

Intermediate wave (3) must subdivide as an impulse. Within intermediate wave (3), minor wave 1 may be complete. Minor wave 2 may this week have moved sideways and lower as an expanded flat correction.

There is now an overshoot of the lower edge of the base channel, which is copied over from the weekly chart. This is a small indication that this wave count may be wrong, but it is not enough to discard the count. Base channels in bull markets usually provide support for lower degree second waves, but not always.

TECHNICAL ANALYSIS

WEEKLY CHART

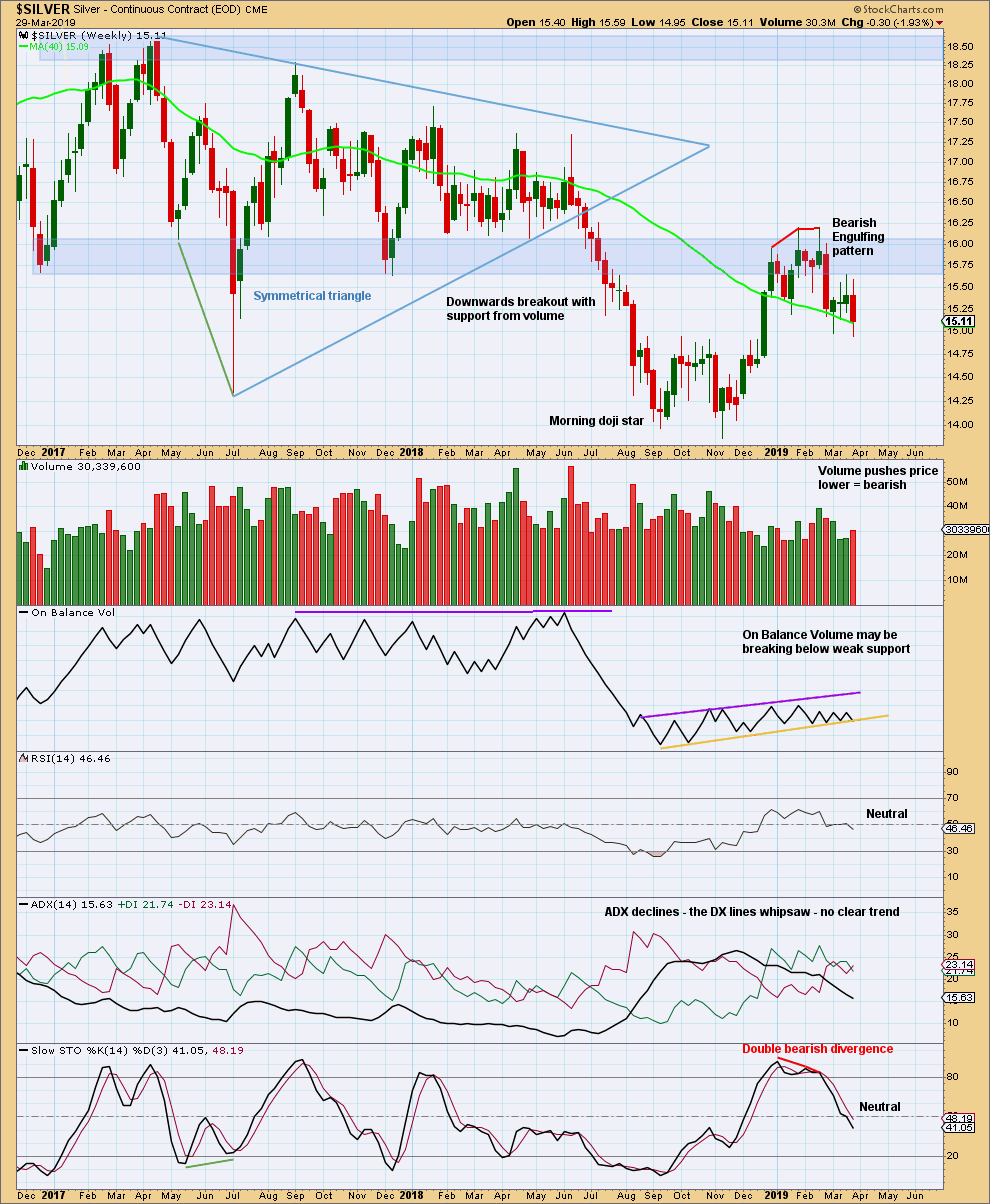

Click chart to enlarge. Chart courtesy of StockCharts.com.

The breach of the support line by On Balance Volume is not clear enough for confidence this week. It is a weak bearish indication at this stage.

With volume this week pushing price lower, it looks likely that next week may see price continue to move lower.

DAILY CHART

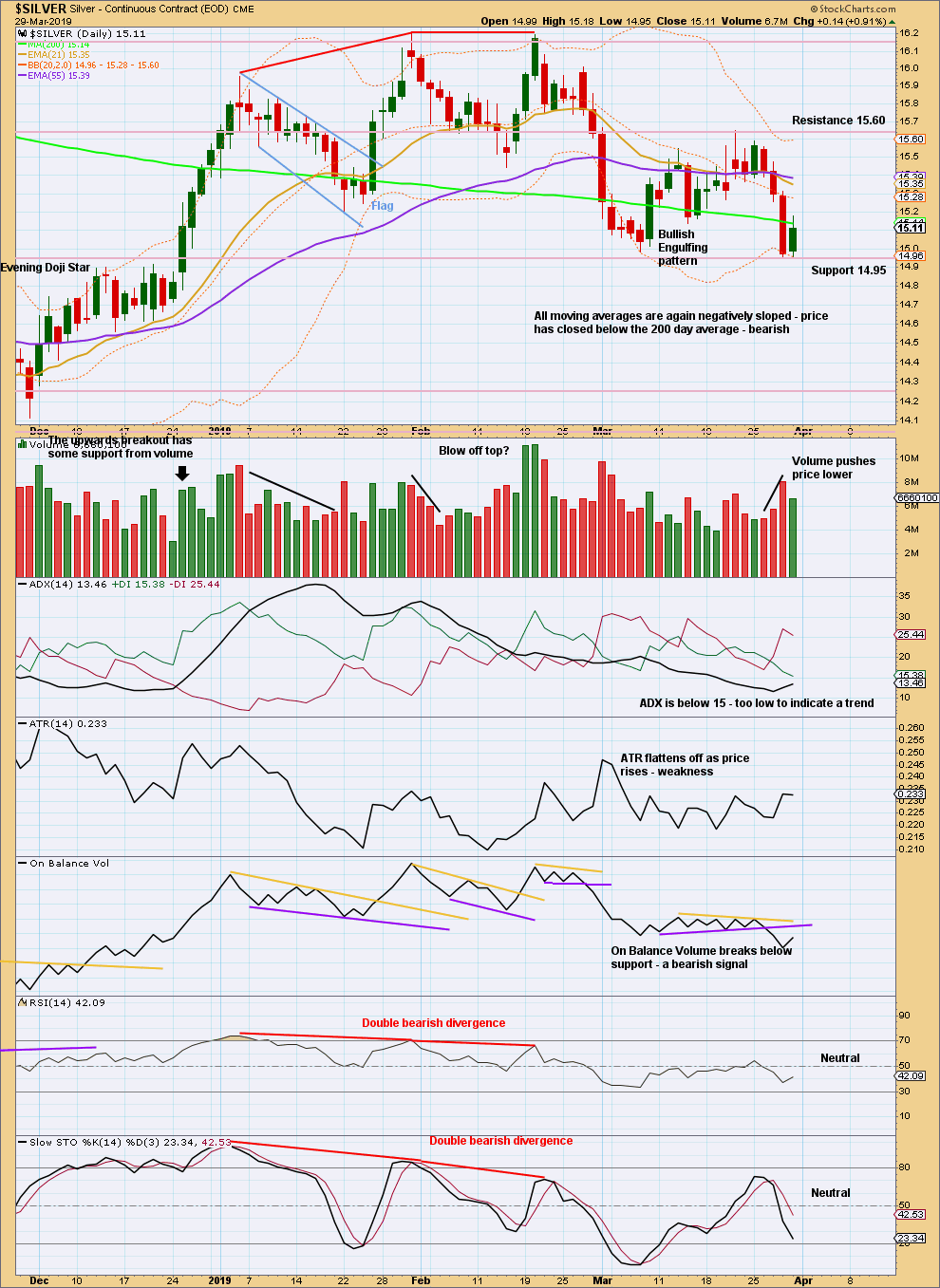

Click chart to enlarge. Chart courtesy of StockCharts.com.

Price remains range bound with support about 14.95 and resistance about 15.60. For the short term, the bearish volume profile and bearish signal from On Balance Volume suggest a downwards breakout may be imminent, but it has not happened yet. A close below 14.95 would be a downwards breakout that does not need support from volume for confidence; but if volume does support it, then more confidence may be had.

Published @ 08:45 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.