Price has moved lower for the week exactly as the last analysis expected.

The upper edge of the channel on the daily chart continues to provide resistance.

Summary: The short-term target is at 13.524. Look for bounces to continue to find resistance at the upper edge of the best fit channel on daily charts.

The long-term target remains at 10.05.

At the end of the week, the volume profile is now bearish. This supports the Elliott wave count.

Monthly charts were reviewed here.

ELLIOTT WAVE COUNTS

MAIN WAVE COUNT

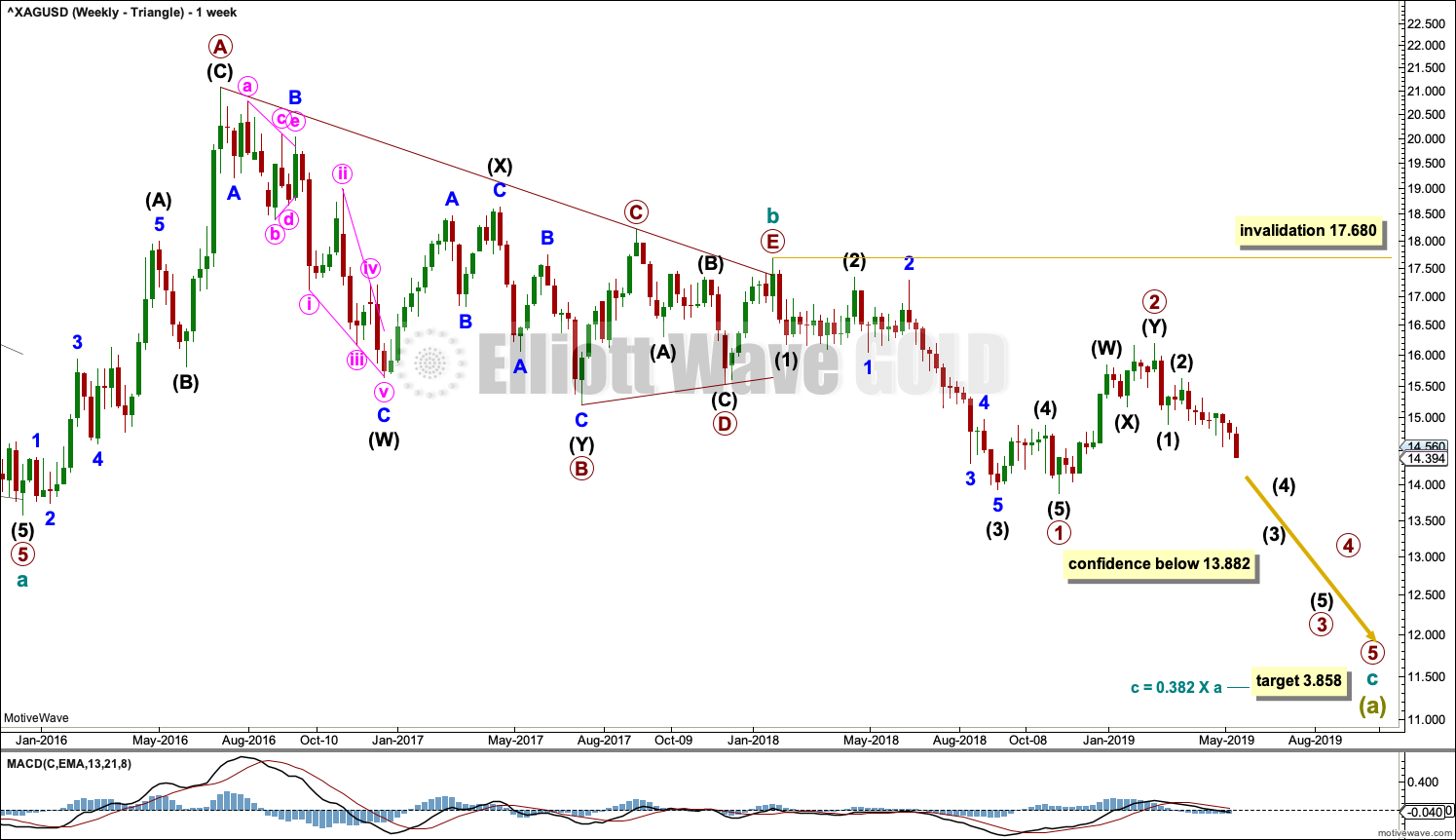

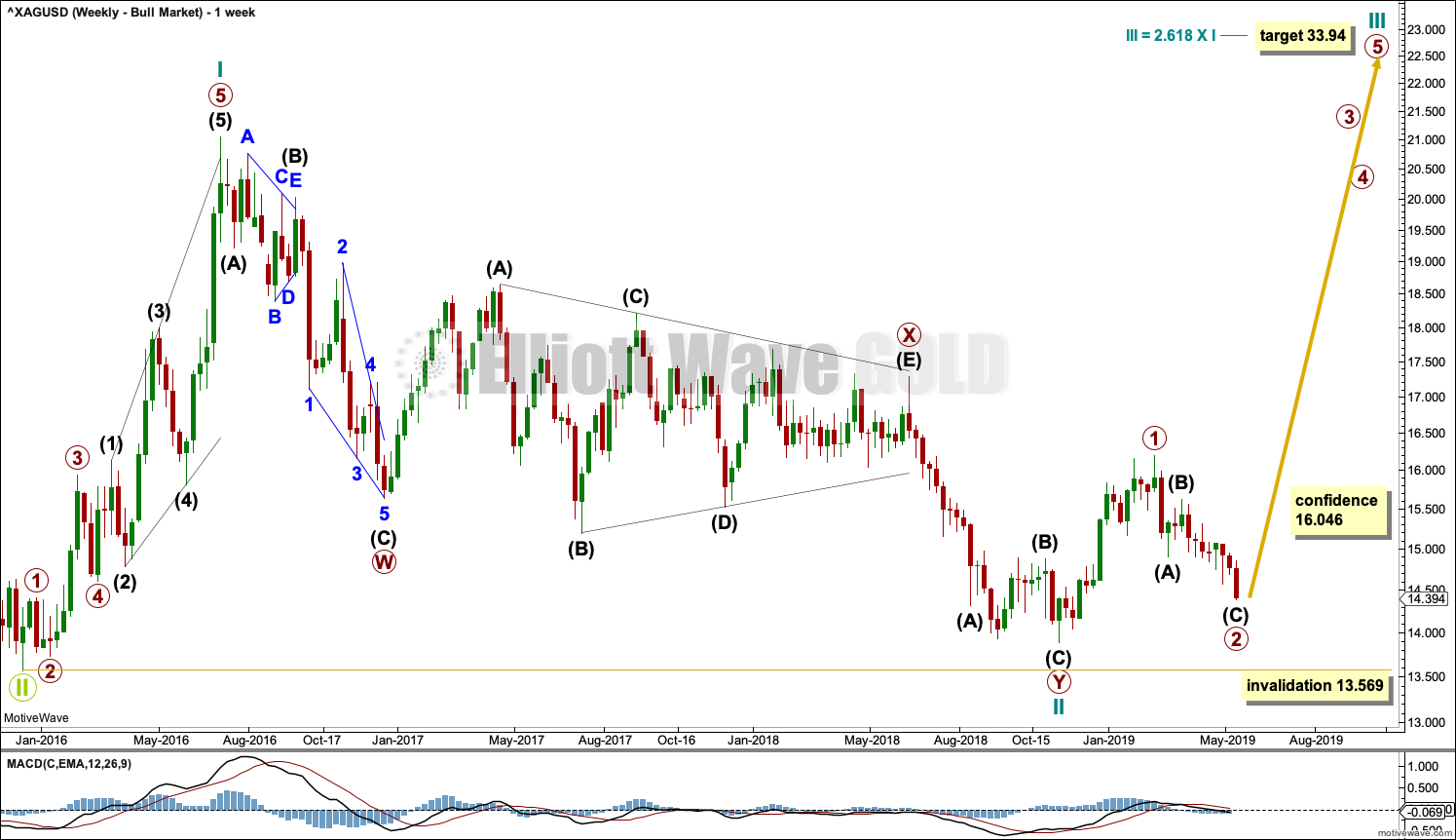

WEEKLY CHART – TRIANGLE

The basic Elliott wave structure is five steps forward followed by three steps back. At this time, it is expected that Silver is within a very large three steps back pattern that began at the all time high in April 2011.

Three steps back are almost always labelled in Elliott wave as A-B-C. This Elliott wave count expects that wave A is incomplete, and this is labelled Super Cycle wave (a).

The Elliott wave structure for Super Cycle wave (a) may be a zigzag. Zigzags subdivide 5-3-5. Within this zigzag, cycle waves a and b may be complete. Cycle wave c must subdivide as a five wave Elliott wave structure, most likely an impulse.

Within the impulse of cycle wave c, if primary wave 2 continues higher, it may not move beyond the start of primary wave 1 above 17.680.

Within the zigzag of Super Cycle wave (a), it would be extremely likely for cycle wave c to move below the end of cycle wave a at 13.569 to avoid a truncation. The target would see this achieved.

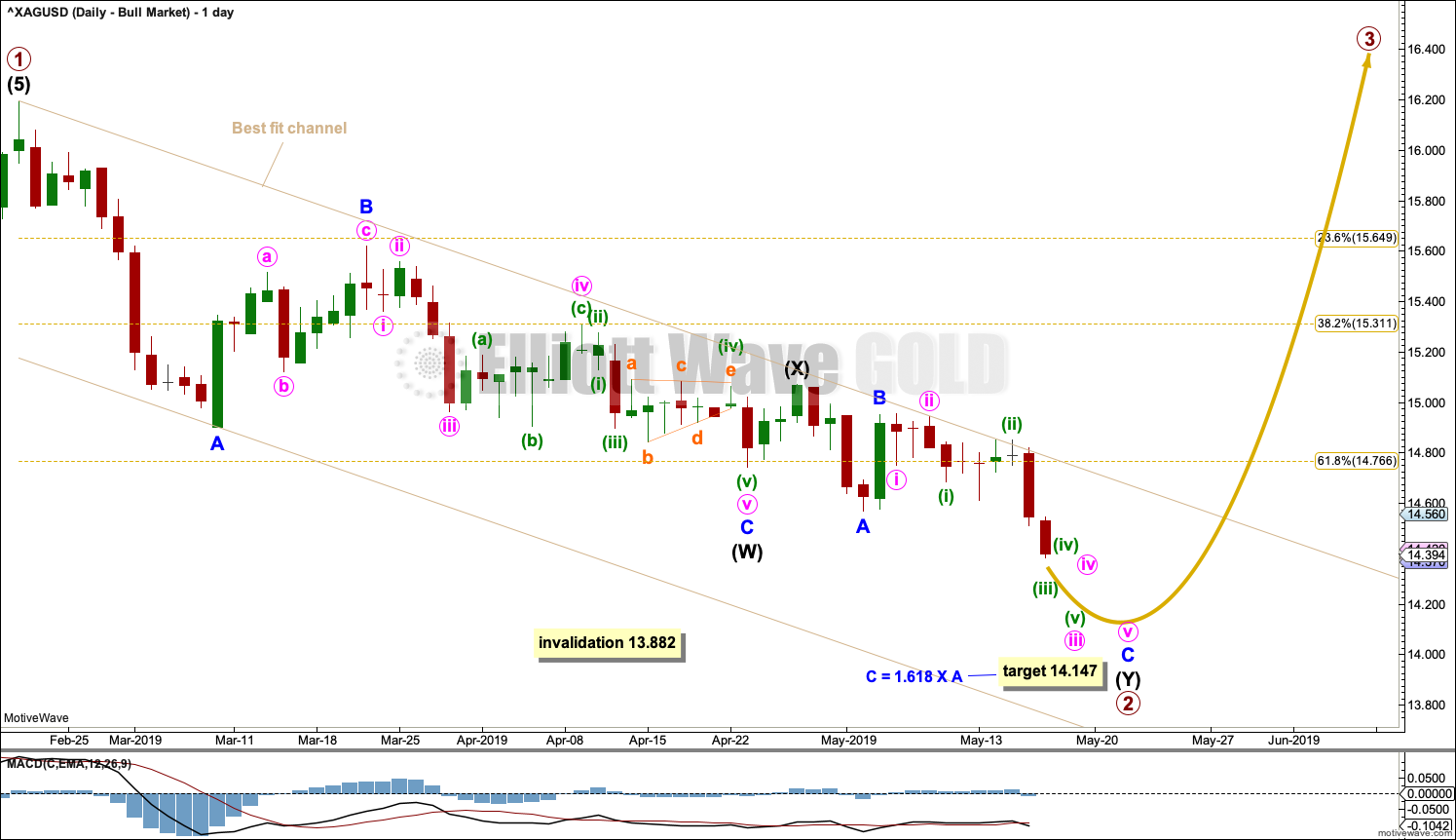

The daily chart below focusses on price movement from the end of primary wave 2.

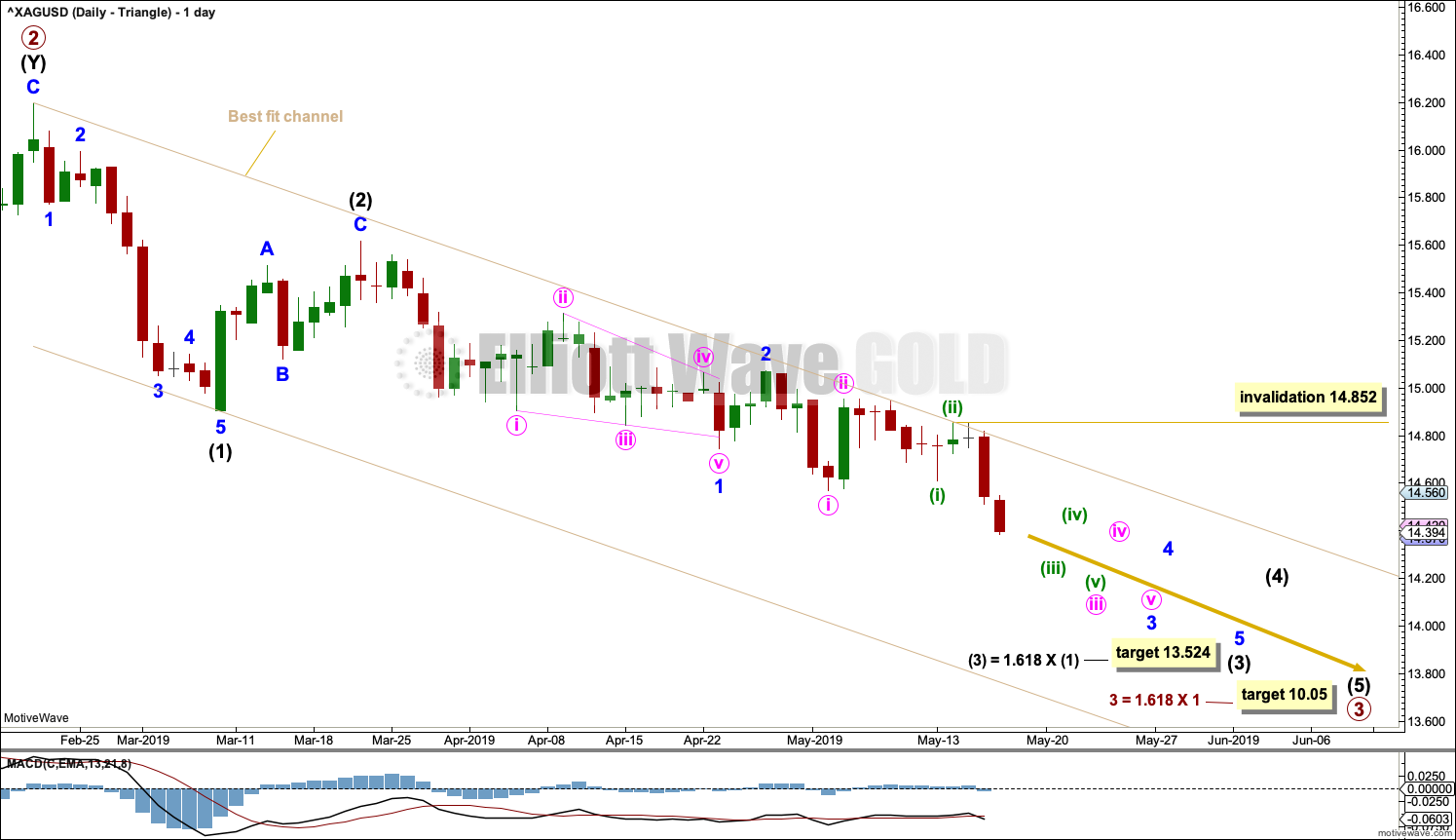

DAILY CHART – TRIANGLE

Primary wave 3 may only subdivide as a five wave impulse. Within this impulse, intermediate waves (1) and (2) may be complete.

Intermediate wave (3) may only subdivide as a five wave impulse. Within this impulse, minor waves 1 and 2 may be complete.

Minor wave 3 may only subdivide as a five wave impulse. Within this impulse, minute waves i and ii may be complete.

Minute wave iii may only subdivide as a five wave impulse. Within this impulse, minuette waves (i) and (ii) may be complete.

Minuette wave (iii) may only subdivide as a five wave impulse. Within this impulse, no second wave correction may move beyond the start of its first wave above 14.852.

The upper edge of the best fit channel may continue to provide resistance for bounces along the way down.

Targets are calculated for both of intermediate wave (3) and primary wave 3. The targets expect these third waves to exhibit the most common Fibonacci ratio to their counterpart first waves.

At this stage, this wave count for Silver now sees a series of five overlapping first and second waves complete. This wave count now expects a strong increase in downwards momentum as the middle of a third wave unfolds. Any one or more of the ends of these third waves may end with a selling climax.

ALTERNATE WAVE COUNT

WEEKLY CHART – BULL WAVE COUNT

This alternate Elliott wave count sees the three steps back pattern as complete and a new bull market beginning for Silver at the low in December 2015.

A new bull market should begin with a five wave structure upwards. This is labelled cycle wave I.

Following five steps forward should be three steps back. This is labelled cycle wave II. The Elliott wave corrective structure of cycle wave II is labelled as a double zigzag, which is a fairly common structure.

If it continues any further, then cycle wave II may not move beyond the start of cycle wave I below 13.569.

DAILY CHART – BULL WAVE COUNT

If cycle wave II is over, then the new trend up for cycle wave III should begin with a five wave structure. This is labelled primary wave 1. The structure may now be complete.

Five steps up should be followed by three steps back, labelled primary wave 2. Primary wave 2 may now be continuing lower as a double zigzag. A target is calculated for the second zigzag to end.

Primary wave 2 may not move beyond the start of primary wave 1 below 13.882.

The best fit channel is drawn in the same way on both daily charts.

TECHNICAL ANALYSIS

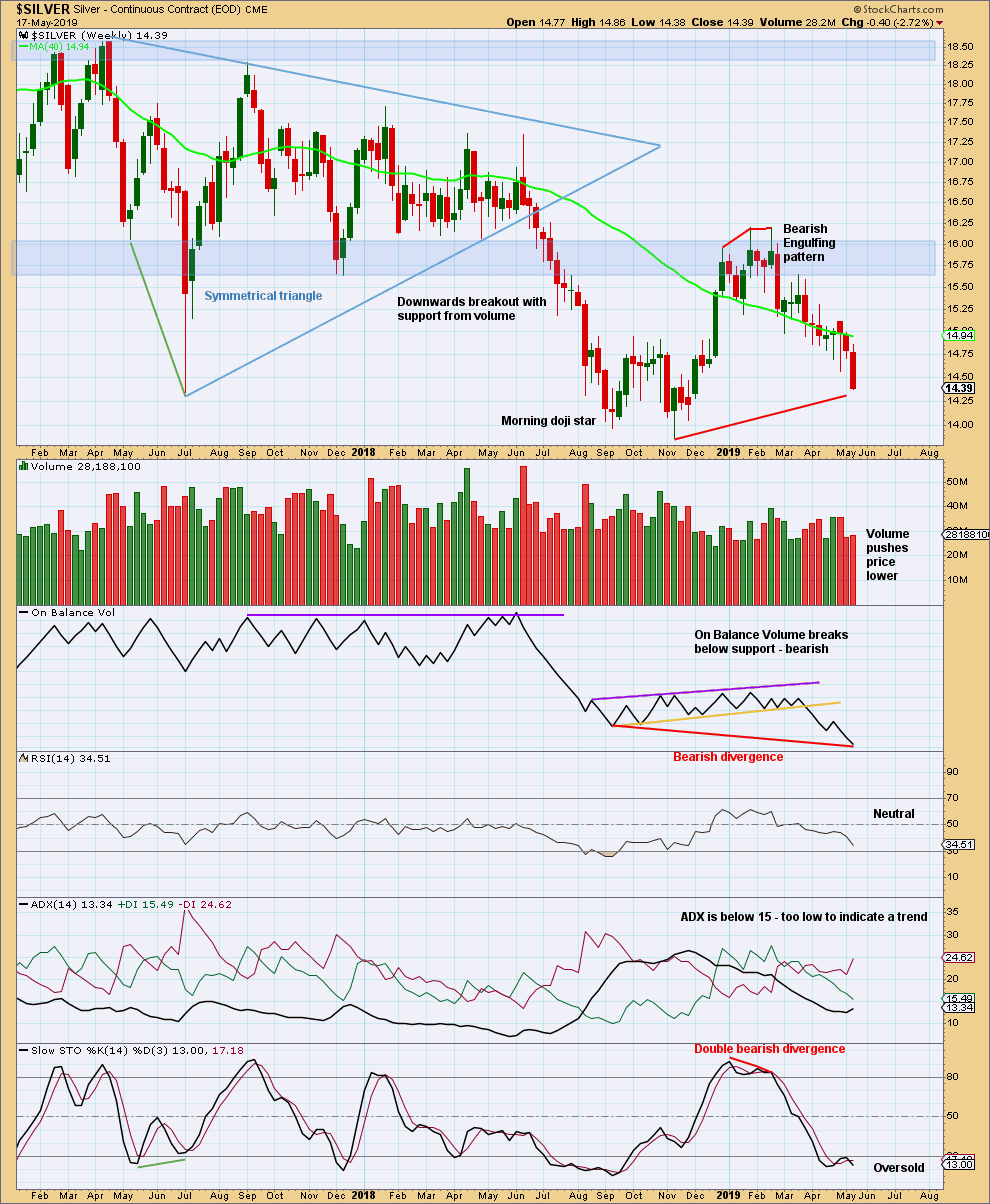

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong downwards week saw price close about the low for the week with support from volume. This suggests more downwards movement next week.

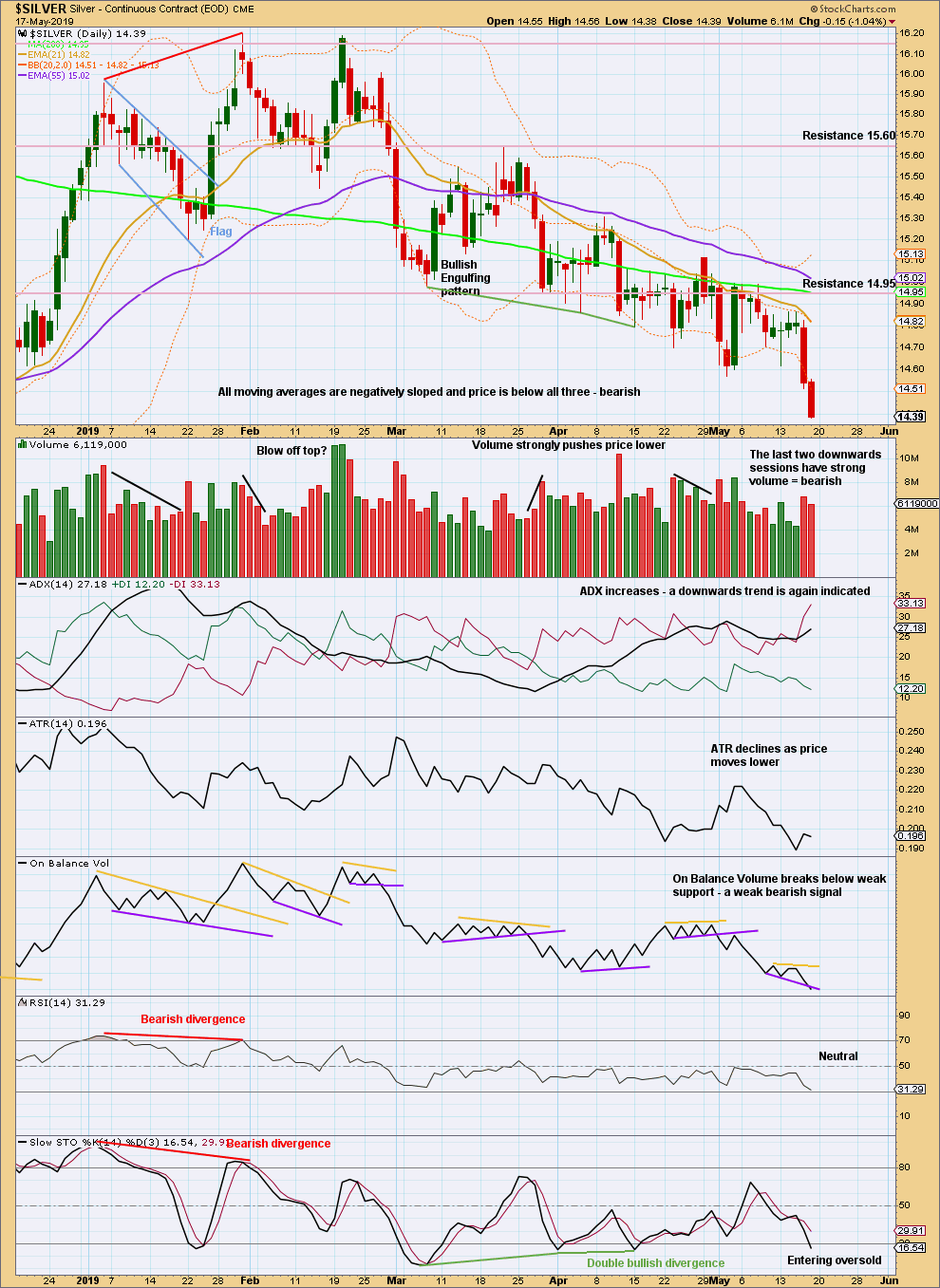

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

There is now a series of multiple lower lows and lower highs from the high on the 31st of January. There is clearly a downwards trend for Silver and ADX agrees. Volume for the last two strong downwards days is relatively heavy, pushing price lower. It is reasonable to expect more downwards movement next week.

Published @ 12:02 a.m. EST on May 19, 2019.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Summer doldrums for silver are the usual. There isn’t much catalyst right now but I’m leaning towards the bullish scenario as the commercials keep going Long as the specs go short. Right now after this latest dump the specs are at there highest net negative since they were at -37k as a best guess. This happened last year too though and the price kept going down for a bit it before it rebounded. Gold still has some room to go down but I think they will both rebound strong.

I notice that last year, looking at the lows of 11th September and 14th November 2018, as price made a slight new low, the large speculators did not match that with a deeper negative position.

11th September price 14.230, large speculators -27,403

14th November price 14.175, large speculators -17,145

At this time there is no bullish divergence, and so yes, it would be a safe assumption to expect price may fall here.

I’m always hesitant to use CoT data though after reading Briese. It’s not just as simple as looking for divergence, and the data he calculates from the CoT reports I could not find easily.

But I think there may be some value in keeping an eye on it for sure.