An inside day with relatively weak volume fits the expectations for some consolidation after a blow off top. The final target zone remains the same.

Summary: This upwards trend is expected to end above 1,346.45 but not above 1,365.68. Along the way up, one more small multi day consolidation or shallow pullback for a fourth wave may have again just begun.

Grand SuperCycle analysis is here.

Last monthly charts are here. Video is here.

MAIN ELLIOTT WAVE COUNT

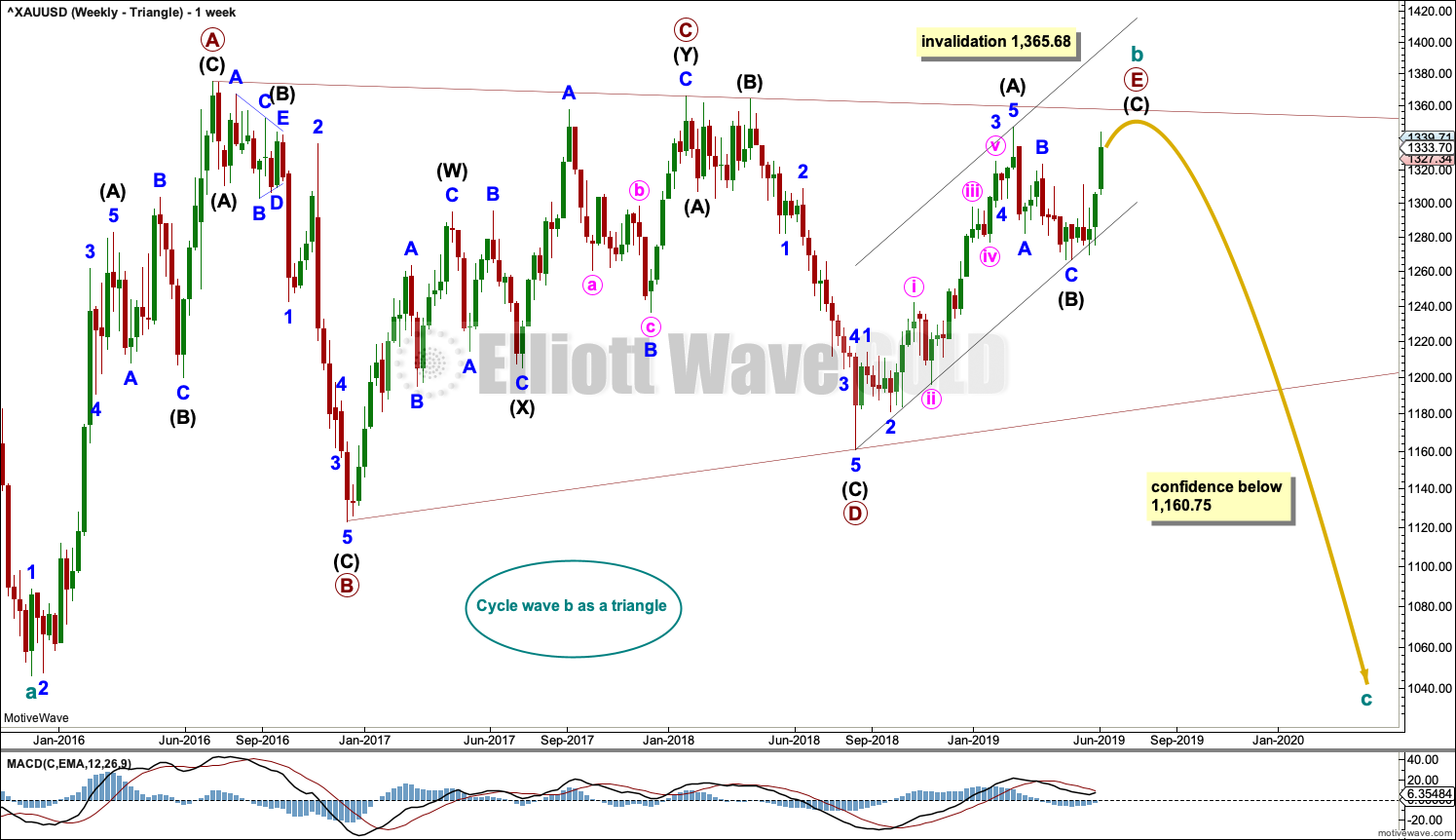

WEEKLY CHART – TRIANGLE

The basic Elliott wave structure is five waves up followed by three waves back (in a bull market). At this time, the preferred Elliott wave count sees Gold as still within three waves back, which began at the all time high in September 2011.

Five waves up are labelled 1,2,3,4,5. Three waves back are labelled A,B,C.

This wave count sees Gold as now about two thirds through the three waves back. The three wave structure is labelled cycle waves a, b and c.

The triangle for cycle wave b may still be incomplete. The final sub-wave of primary wave E may be an incomplete zigzag. Within the zigzag of primary wave E, intermediate wave (C) would be very likely to make at least a slight new high above the end of intermediate wave (A) to avoid a truncation.

Primary wave E may either undershoot or overshoot the A-C trend line. Primary wave E may not move beyond the end of primary wave C above 1,365.68.

Draw a channel about the zigzag of primary wave E using Elliott’s technique. Draw the first trend line from the start of intermediate wave (A) to the end of intermediate wave (B), then place a parallel copy on the end of intermediate wave (A). While intermediate wave (C) continues higher, the lower edge of the channel should provide support. Copy the channel over to the daily chart.

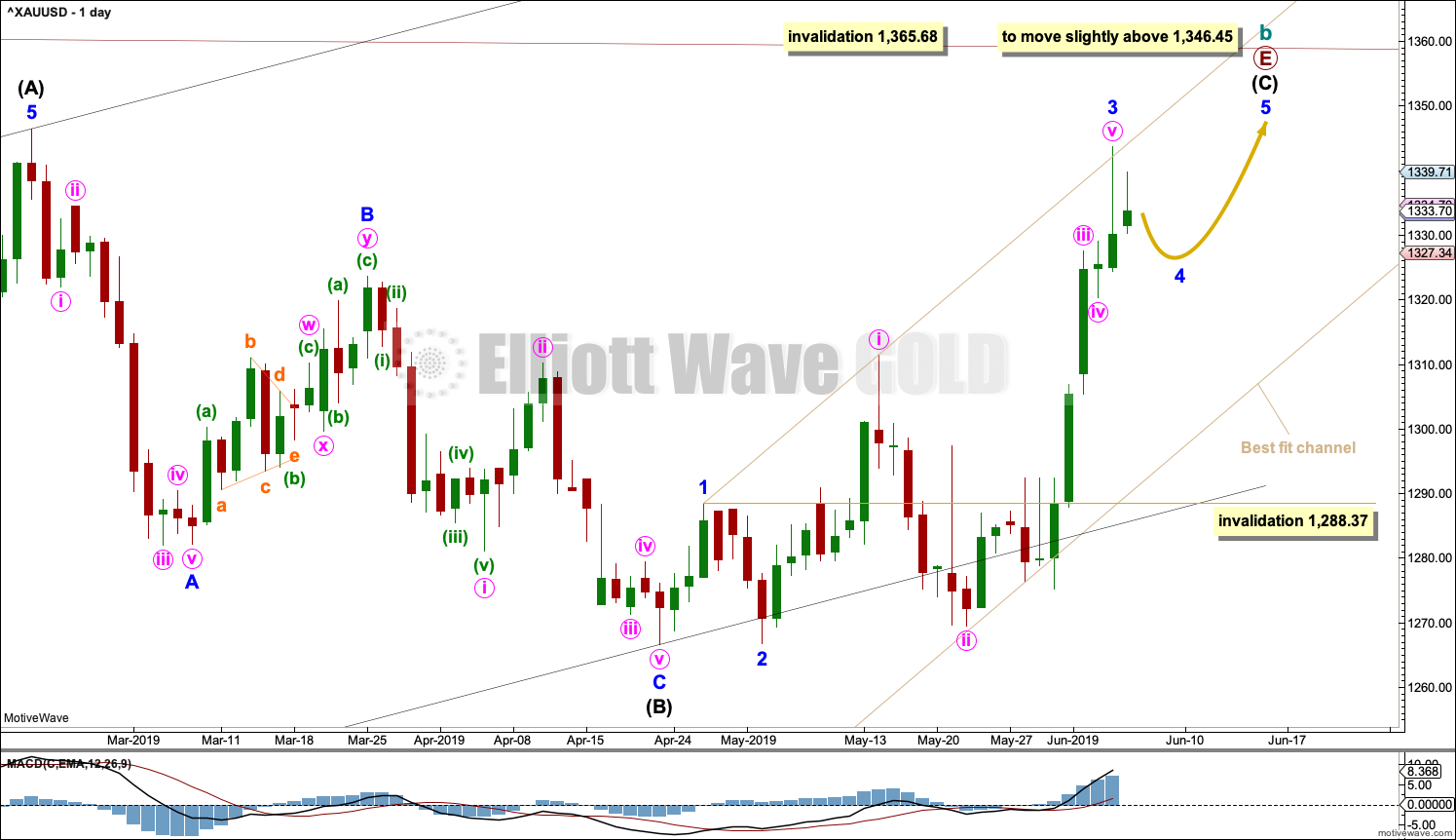

DAILY CHART – TRIANGLE

The final zigzag of primary wave E must subdivide 5-3-5. Intermediate wave (C) must subdivide as a five wave motive structure, most likely an impulse.

Within the impulse of intermediate wave (C), minor waves 1 and 2 may be complete.

Minor wave 3 may only subdivide as an impulse.

Minor wave 3 does not look like a clear five wave impulse on the daily chart, but this is a fairly typical look for Gold’s impulses at higher time frames. Typical of commodities, Gold will exhibit swift strong fifth waves that force fourth waves coming just prior and after to be more brief and shallow than their counterpart second waves. This causes five wave structures for Gold to have a three wave look at higher time frames.

Minor wave 4 may not move into minor wave 1 price territory below 1,288.37. Minor wave 4 may be expected to very likely be relatively brief and shallow.

When minor wave 4 may be complete, then the Fibonacci ratio between minor wave 5 and either of minor waves 1 or 3 may be used to calculate a target for minor wave 5 to end.

HOURLY CHART – TRIANGLE

It is possible that minor wave 3 could be over.

A reasonable target for minor wave 4 may be the 0.236 Fibonacci ratio of minor wave 3. Minor wave 2 lasted 4 sessions as a zigzag. Minor wave 4 may be more brief; it may last only one or two sessions. Minor wave 4 may most likely be a shallow sideways flat, combination or triangle.

It is also possible that minor wave 4 may be a little longer lasting than minor wave 2 as sideways flats, triangles and combinations tend to be longer lasting than zigzags.

Focus over the next few sessions will be on identifying when minor wave 4 may be complete. Today it does not look complete. More sideways movement may be required to complete the structure.

A short and sharp upwards breakout would be expected for minor wave 5 to follow it. Now that minor wave 3 does not exhibit a Fibonacci ratio to minor wave 1, minor wave 5 would be fairly likely to exhibit a Fibonacci ratio to minor waves 1 or 3, and the most likely ratio would be equality in length with minor wave 1 at $21.76.

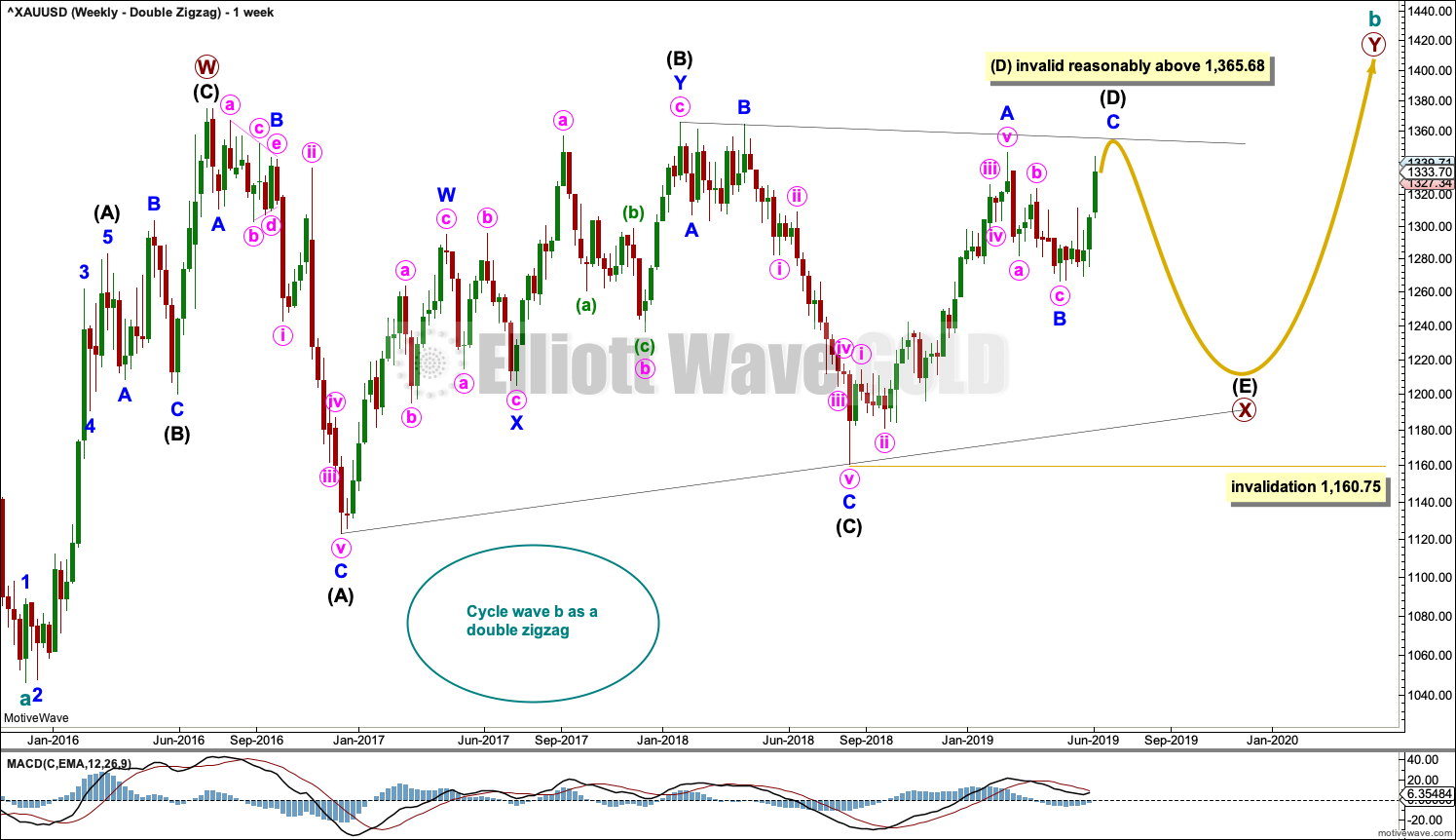

WEEKLY CHART – DOUBLE ZIGZAG

This wave count is identical to the first weekly chart up to the low labelled cycle wave a. Thereafter, a different Elliott wave corrective structure is considered for cycle wave b.

It is possible that cycle wave b may be an incomplete double zigzag or a double combination.

The first zigzag in the double is labelled primary wave W. This has a good fit.

The double may be joined by a corrective structure in the opposite direction, a triangle labelled primary wave X. The triangle may be incomplete.

Within multiples, X waves are almost always zigzags and rarely triangles. Within the possible triangle of primary wave X, it is intermediate wave (B) that is a multiple; this is acceptable, but note this is not the most common triangle sub-wave to subdivide as a multiple. These two points reduce the probability of this wave count in terms of Elliott wave.

Intermediate wave (D) of a contracting triangle may not move beyond the end of intermediate wave (B) above 1,365.68.

Intermediate wave (D) of a barrier triangle may end about the same level as intermediate wave (B); as long as the (B)-(D) trend line remains essentially flat the triangle will remain valid. This is the only Elliott wave rule that is not black and white. In practice, intermediate wave (D) may end slightly above intermediate wave (B) at 1,365.68 and this wave count would remain valid. The (B)-(D) trend line is carefully laid to sit across the end of intermediate wave (B) and minor wave B within intermediate wave (C). This may show exactly where intermediate wave (D) ends if this wave count is correct.

Primary wave Y would most likely be a zigzag because primary wave X would be shallow; double zigzags normally have relatively shallow X waves.

Primary wave Y may also be a flat correction if cycle wave b is a double combination, but combinations normally have deep X waves. This would be less likely.

This wave count has good proportions and no problems in terms of subdivisions.

ALTERNATE ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the three waves back now complete at the last major low for Gold in November 2019.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. The probability of this wave count is low due to this problem.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. If it continues lower as a double zigzag, then primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

Cycle wave III so far for this wave count would have been underway now for 42 weeks. It should be beginning to exhibit some support from volume, increase in upwards momentum and increasing ATR. However, ATR continues to decline and is very low, and momentum is weak in comparison to cycle wave I. This wave count lacks support from classic technical analysis.

TECHNICAL ANALYSIS

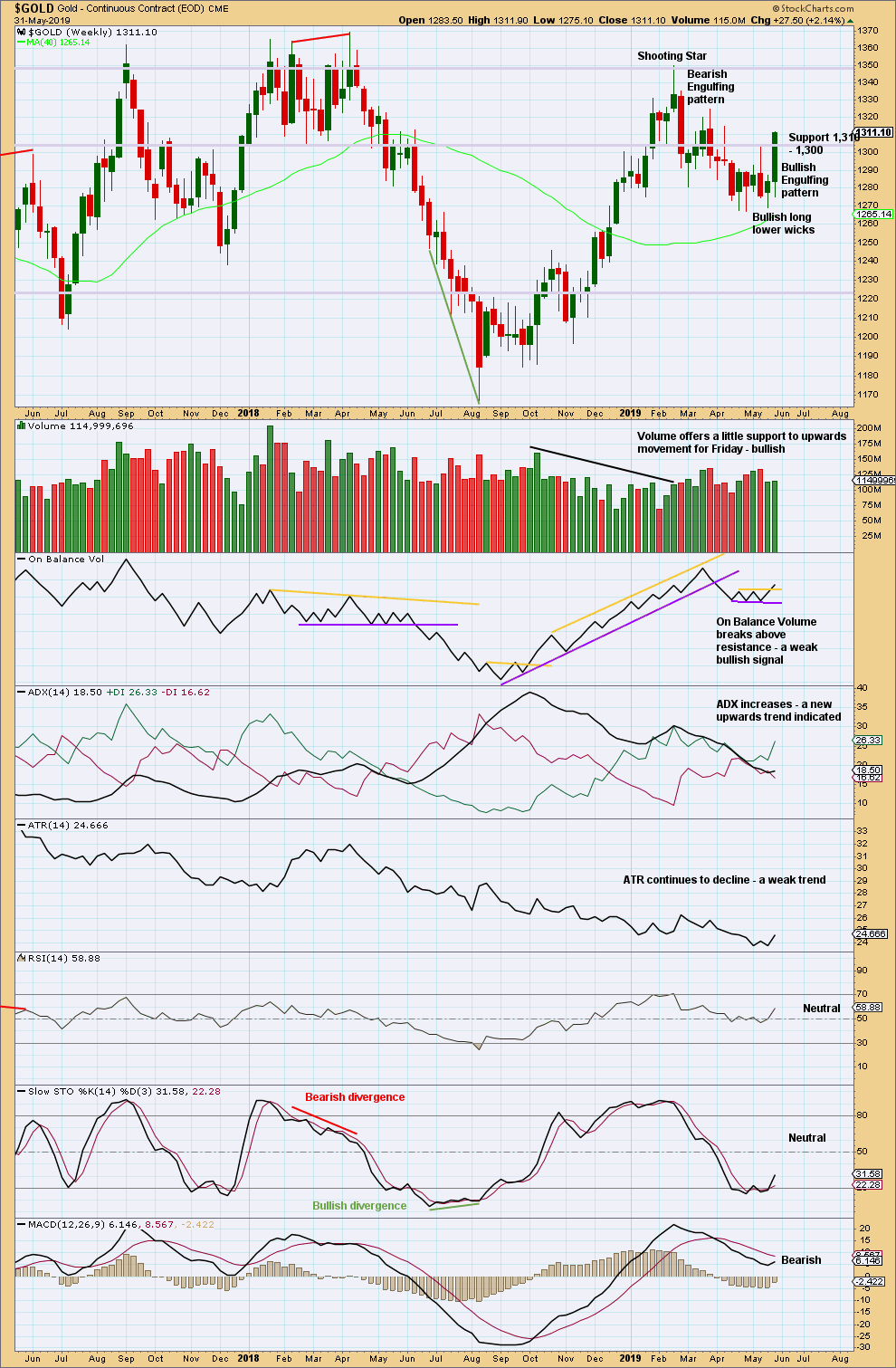

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A very strong upwards week with a long lower wick, support from volume and an almost shaven head looks bullish. More upwards movement looks extremely likely this week. This expectation may now be fulfilled by strong upwards movement on Monday, or it may yet be followed by more.

Overall, low and flat to declining ATR now supports both the main Elliott wave count and the double zigzag Elliott wave count.

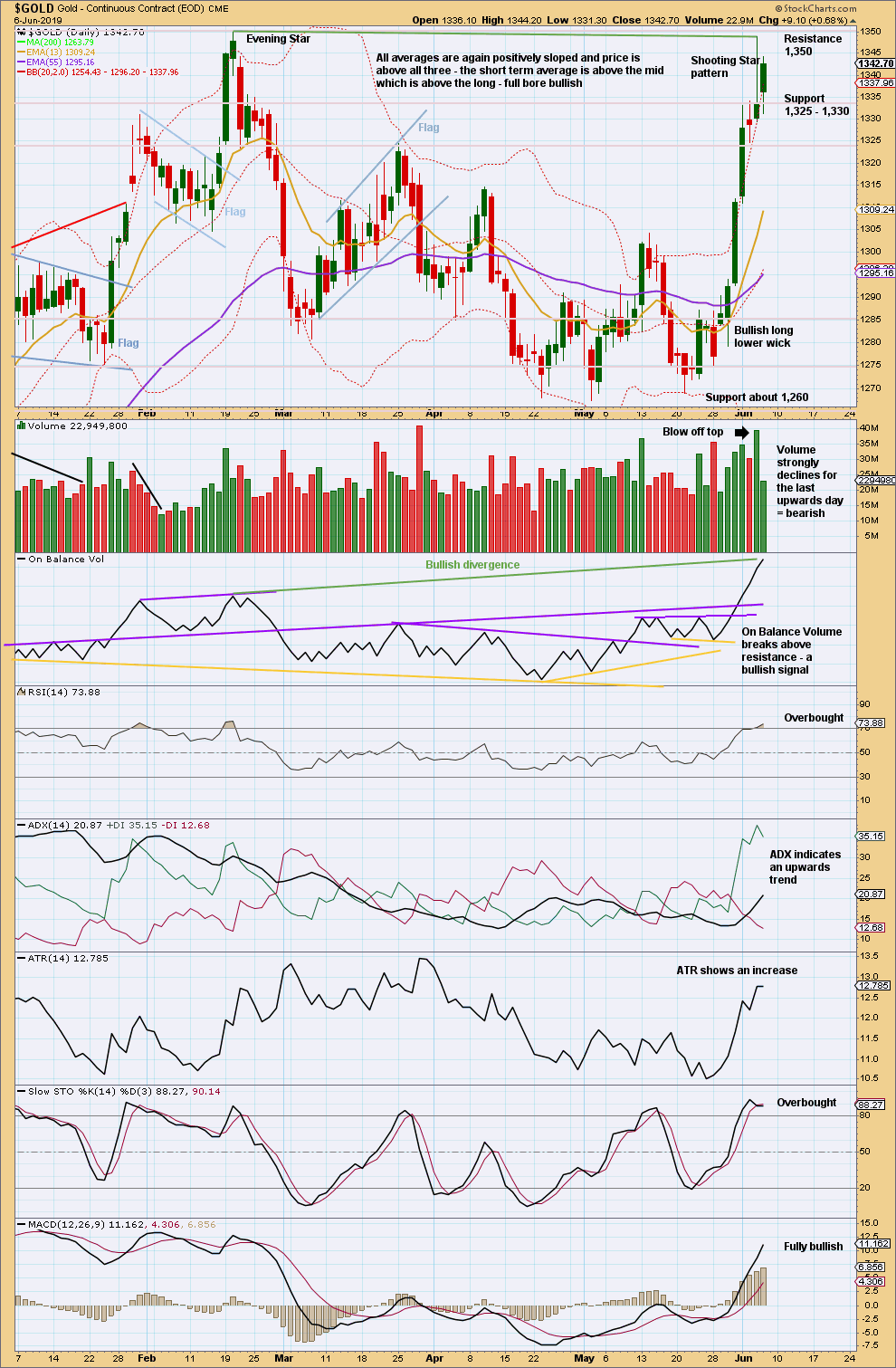

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A strong Shooting Star pattern is a bearish reversal. In conjunction with a further increase in volume, this may be a blow off top. Blow off tops are often followed by a little consolidation before a final high.

Today an inside day closes green with the balance of volume upwards, but volume shows a sharp decline. Volume has not supported upwards movement within this last session. This session looks like the start of a consolidation. Support may be about 1,325 to 1,330 and resistance about 1,350.

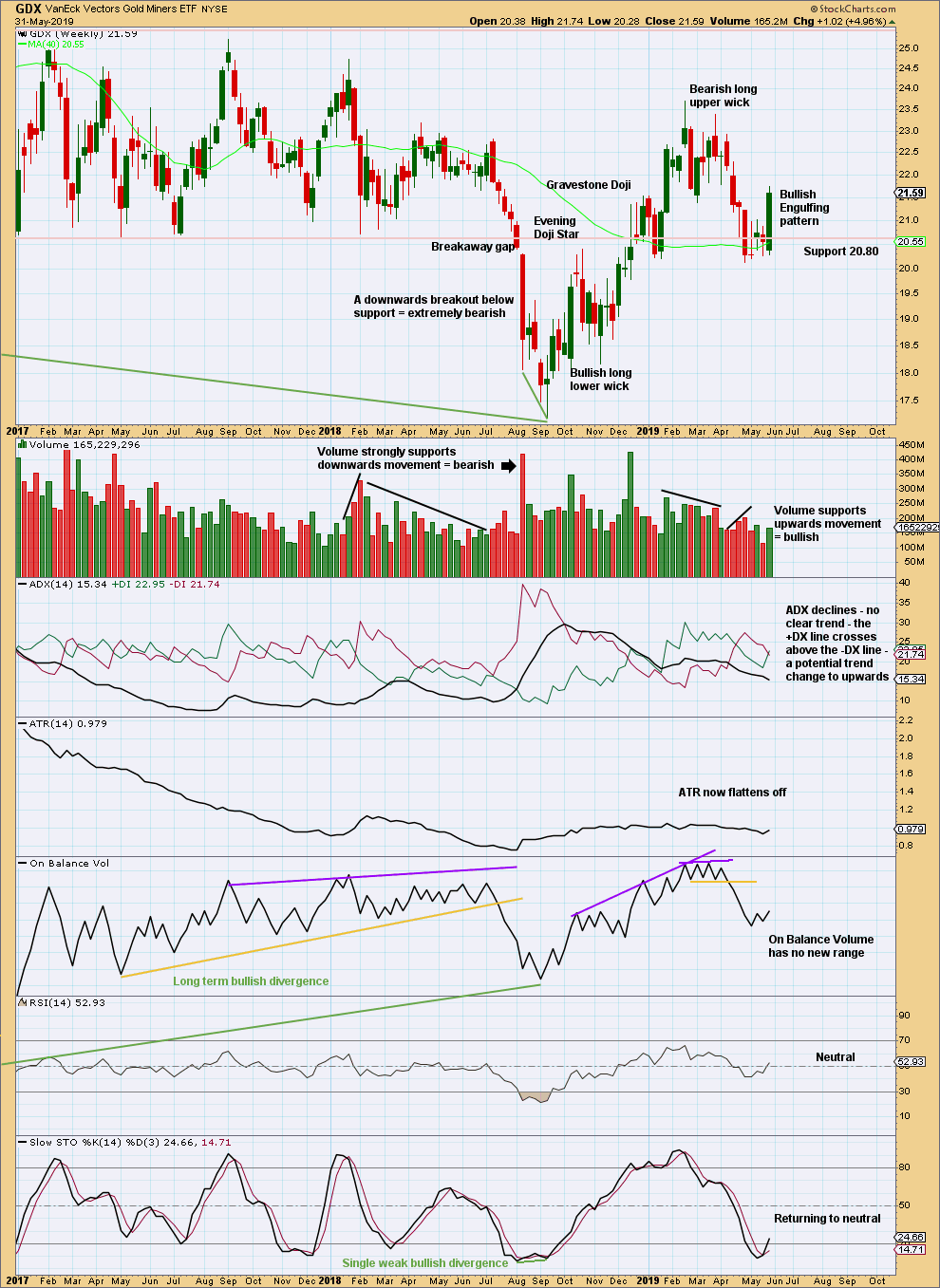

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

A very strong Bullish Engulfing candlestick pattern, which has support from volume, strongly suggests more upwards movement this week.

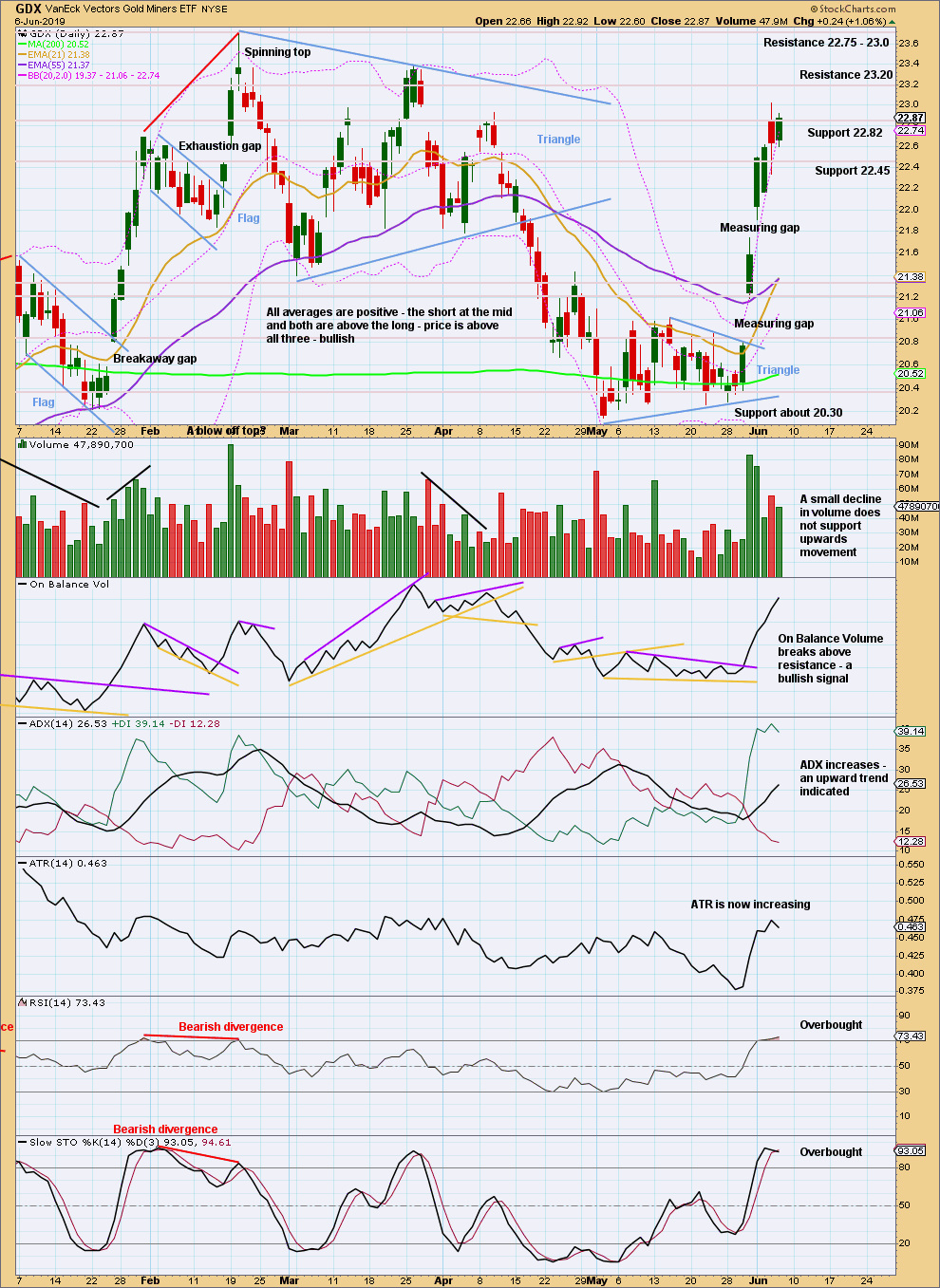

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last measuring gap may now provide support. It may remain open at 21.74.

An inside day with lighter volume today moves price mostly sideways. After a strong upwards movement some consolidation here may be expected. Resistance may be about 23.20 and support about 22.82 or 22.45.

Published @ 06:35 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

Hourly chart updated:

If todays upwards movement shows weakness then this may be how I will label the hourly chart. Minor 4 may be an expanded flat. It could also be a running triangle.