Another small range day while New York is closed for the 4th of July leaves the Elliott wave counts unchanged.

Summary: Price has come down to test support at prior resistance just above 1,375 and bounced up strongly from there. The bounce looks strong enough to suggest the back test may be complete, which favours the bullish Elliott wave count.

The bullish wave count has a long-term target at 1,693 for cycle wave III to end.

A new low by any amount at any time frame now below 1,346.45 would invalidate the bullish wave count and give confidence to the bearish wave count.

Grand SuperCycle analysis is here.

Last monthly charts are here. Video is here.

Overall, the bearish wave counts still have a higher probability based upon Elliott wave structures. However, it would be best to leave price to invalidate either the bullish or bearish scenario before having confidence in which is correct.

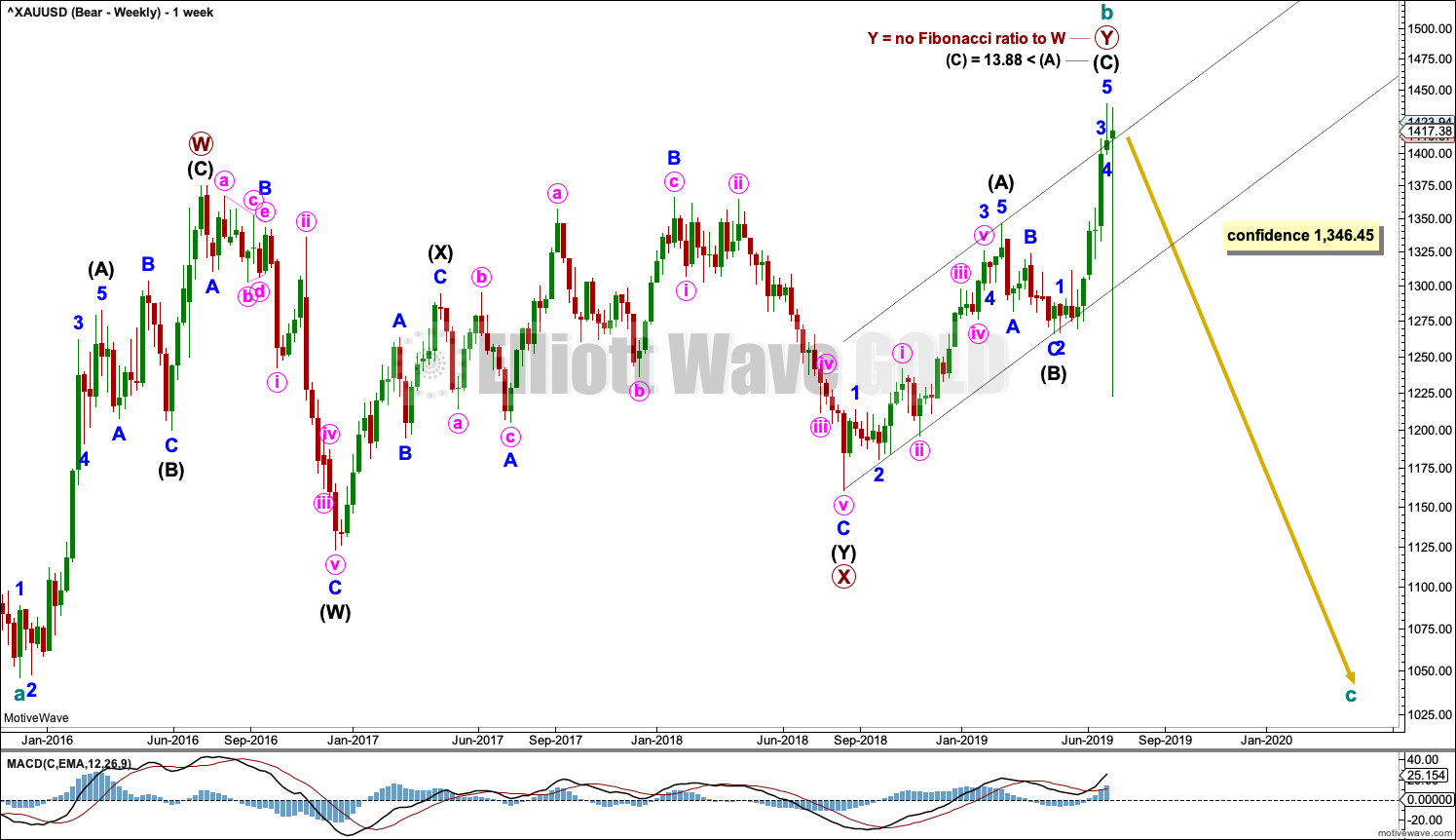

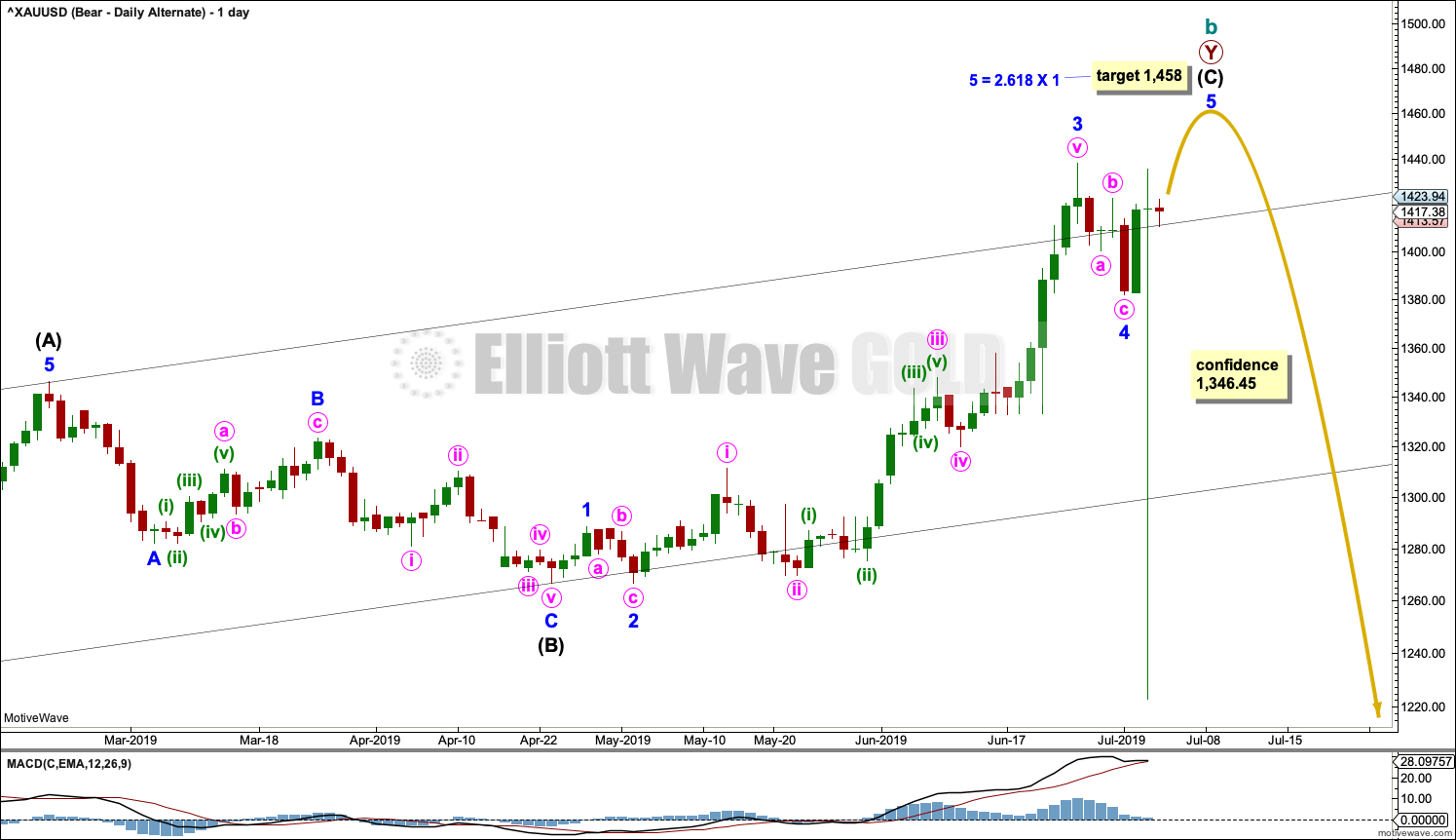

BEARISH ELLIOTT WAVE COUNTS

FIRST WEEKLY CHART

A note about the price spike on this data from Barchart for 3rd July: I have emailed Barchart to ask them to check their data feed. I expect this is a corruption of data and may be fixed prior to next analysis. Because of the extreme nature of this particular spike I am choosing to ignore it in today’s analysis. However, if it remains and if Barchart tell me it is correct, then it would be included in the analysis.

Note: The price spike visible on daily and weekly charts is not visible on time frames lower than daily. It is for this reason that the spike is highly suspicious and is today ignored.

It remains possible that the bear market for Gold may yet continue when cycle wave b is complete, and it is possible that cycle wave b may be complete at the high. Cycle wave b may be a double zigzag.

Double zigzags are common structures, but within them their X waves are almost always single zigzags that are relatively brief and shallow. However, X waves may be any corrective structure, including a multiple.

The maximum number of corrective structures in a multiple is three. This count of three refers to W, Y and Z. To label any one of W, Y or Z as multiples violates this Elliott wave rule. However, X waves may be labelled as multiples and here the rule is met. X waves do occasionally subdivide as multiples.

This wave count sees primary wave X as a complete double combination: zigzag – X – expanded flat.

Primary wave Y may be a complete zigzag. The purpose of a second zigzag in a double zigzag is to deepen the correction when the first zigzag does not move price far enough. This purpose has been achieved.

A new low now by any amount at any time frame below 1,346.45 would invalidate the bullish wave count below and provide some confidence in this wave count.

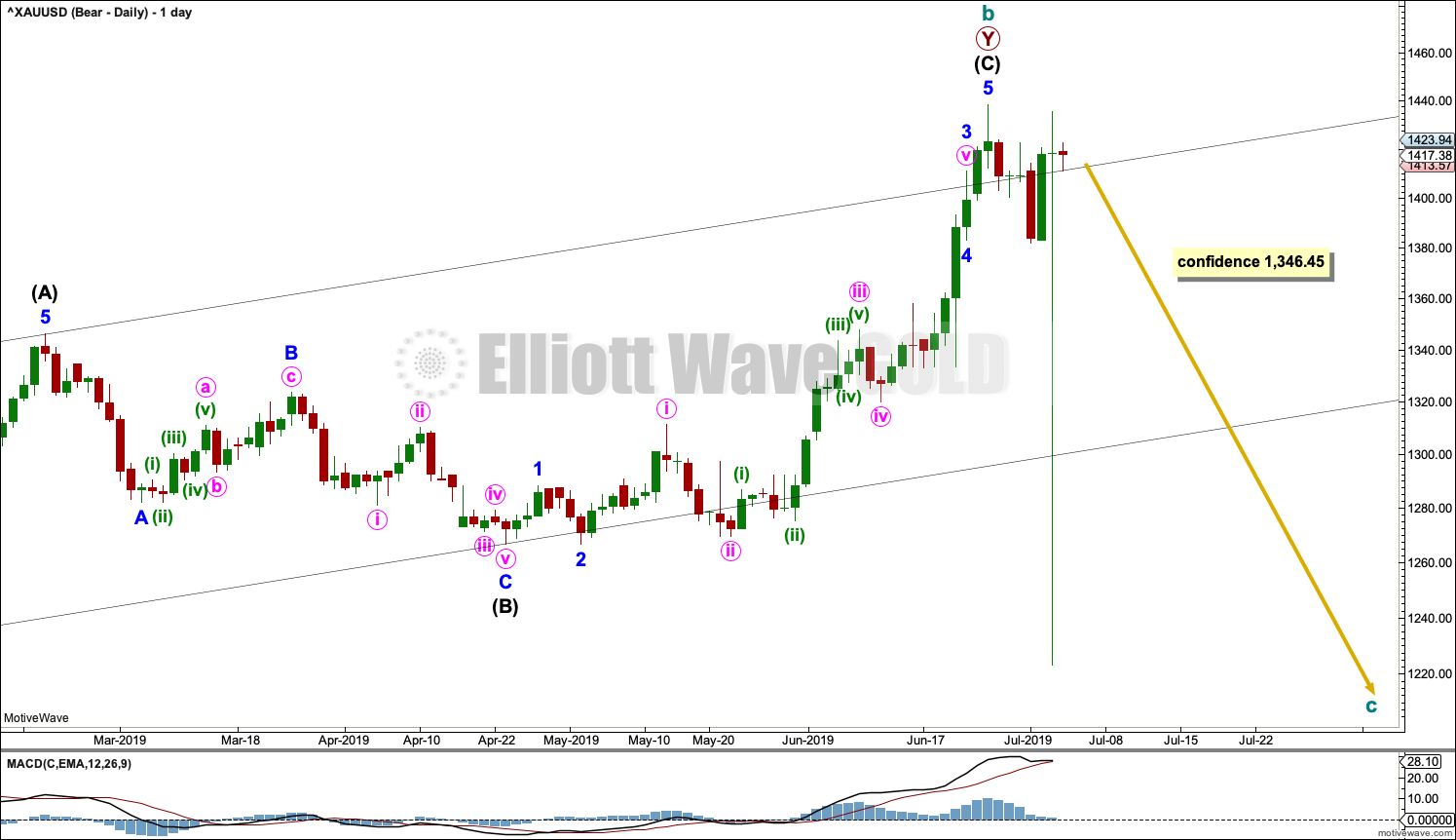

DAILY CHART

This chart focusses on the impulse of intermediate wave (C).

Intermediate wave (C) may be a complete impulse; the structure may now be complete at all time frames. There is a bearish candlestick reversal pattern on StockCharts data.

This wave count now requires a new low below 1,346.45 for confidence.

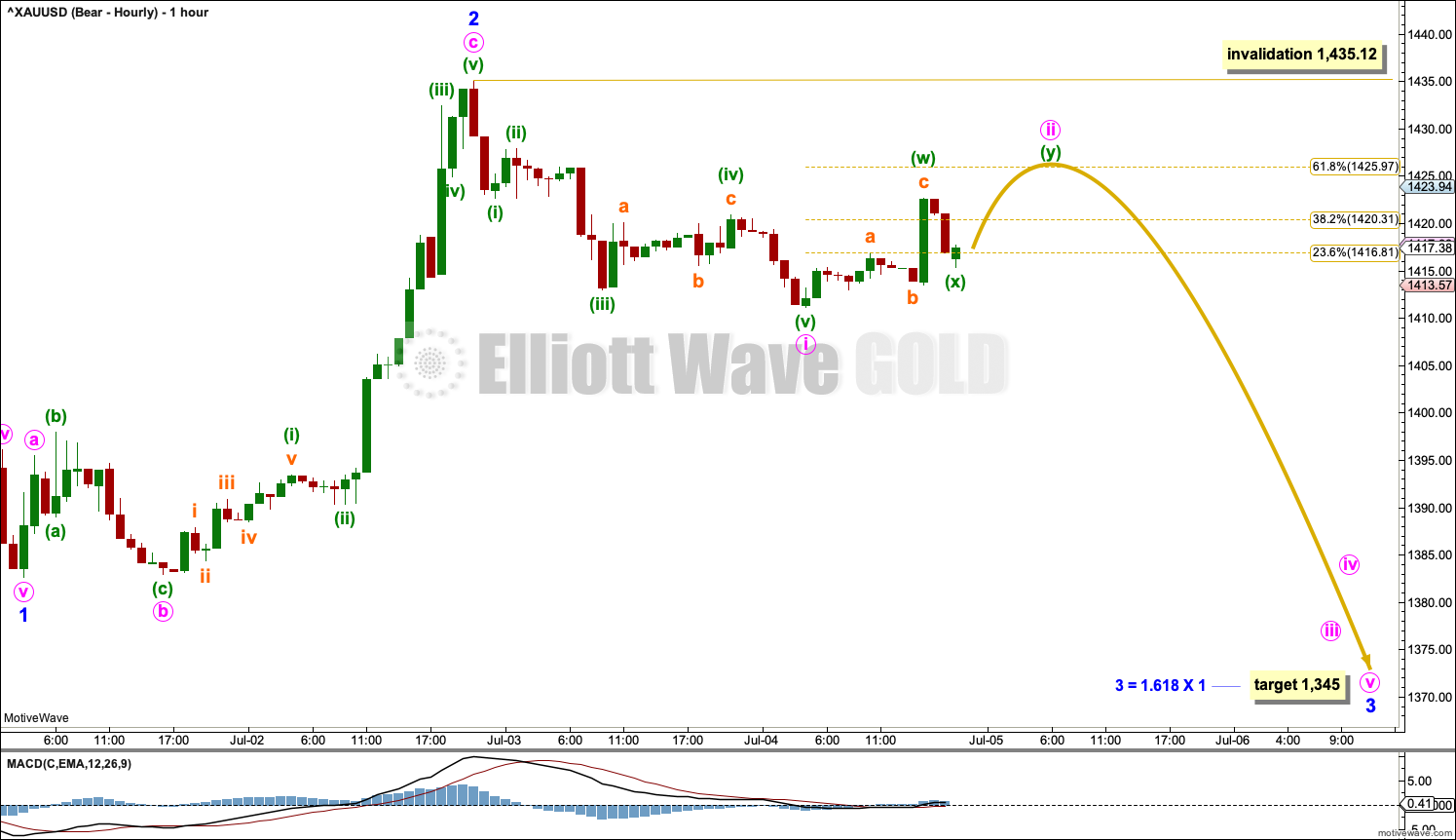

HOURLY CHART

If there has been a trend change at cycle degree at the last high, then a five down should develop first on the hourly chart and then on the daily chart. The first five down is labelled minor wave 1, and it may be complete.

Minor wave 2 may now also be complete as a zigzag. The first second wave correction within a new trend for Gold is usually very deep, and so the depth here for minor wave 2 above the 0.618 Fibonacci ratio follows common behaviour for this market.

Minor wave 3 may only subdivide as an impulse. Within the impulse, minute wave ii may not move beyond the start of minute wave i above 1,435.12. A target is calculated for the end of minor wave 3, which expects it to exhibit the most common Fibonacci ratio to minor wave 1.

Minute wave ii may be incomplete. It may continue higher as a double zigzag. When it may be complete, then a third wave down at two degrees may exhibit an increase in downwards momentum.

SECOND DAILY CHART

It is also possible that intermediate wave (C) may be an incomplete impulse and the last three sessions may be another correction within an ongoing upwards trend.

A target is calculated for minor wave 5 to end. About this target intermediate wave (C) would also be closer to equality in length with intermediate wave (A).

SECOND HOURLY CHART

If intermediate wave (C) is an incomplete five wave impulse, then within it minor wave 4 may be over at the last swing low. Minor wave 5 would now need to complete as a five wave structure higher up to the target.

This wave count is the same for the short term as the bullish hourly chart, with the exception of the target here being much lower.

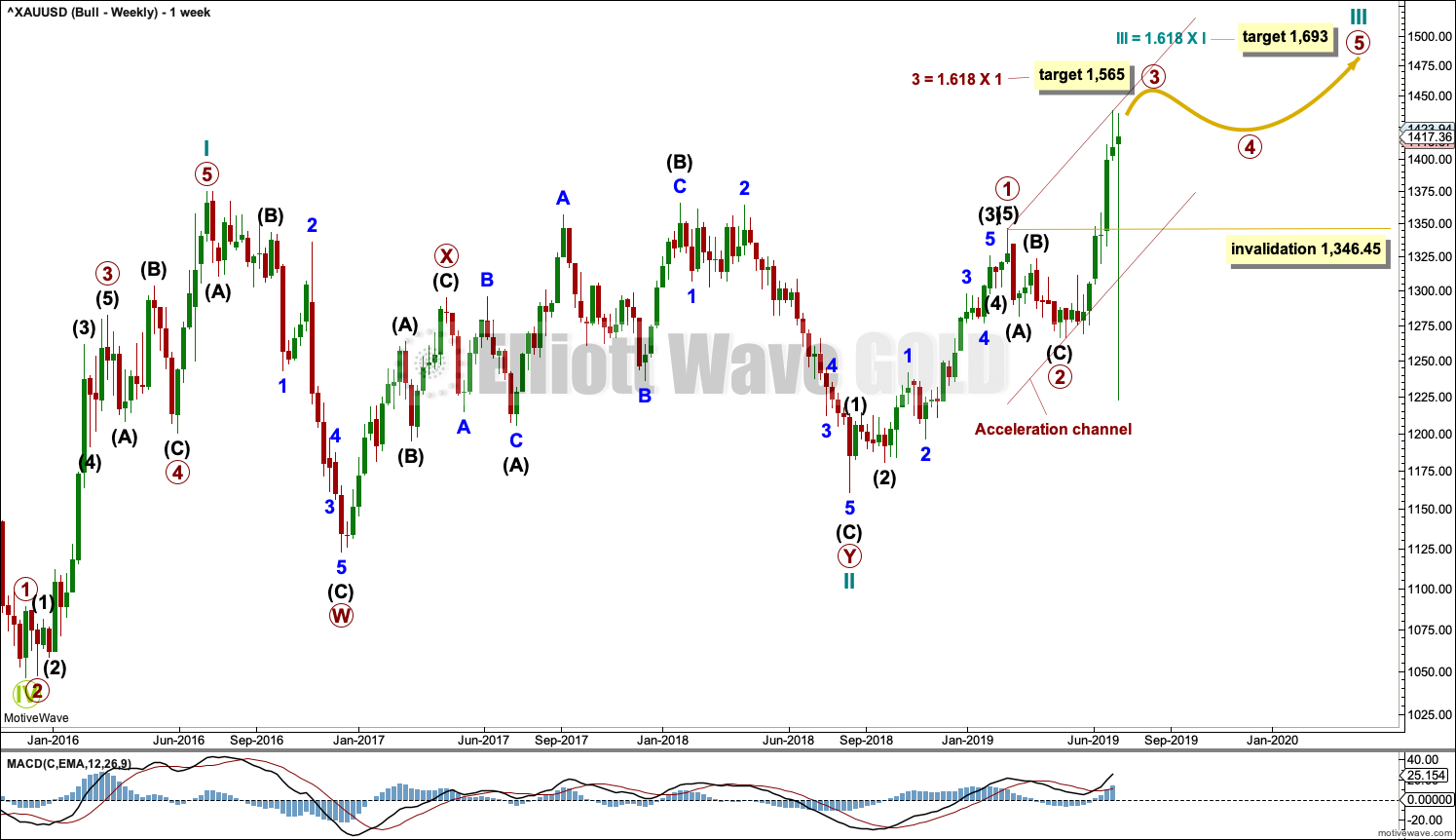

BULLISH ELLIOTT WAVE COUNT

WEEKLY CHART

This wave count sees the the bear market complete at the last major low for Gold in November 2015.

If Gold is in a new bull market, then it should begin with a five wave structure upwards on the weekly chart. However, the biggest problem with this wave count is the structure labelled cycle wave I because this wave count must see it as a five wave structure, but it looks more like a three wave structure.

Commodities often exhibit swift strong fifth waves that force the fourth wave corrections coming just prior and just after to be more brief and shallow than their counterpart second waves. It is unusual for a commodity to exhibit a quick second wave and a more time consuming fourth wave, and this is how cycle wave I is labelled. This wave count still suffers from this very substantial problem, and for this reason two bearish wave counts are still considered above as they have a better fit in terms of Elliott wave structure.

Cycle wave II subdivides well as a double combination: zigzag – X – expanded flat.

Cycle wave III may have begun. Within cycle wave III, primary waves 1 and 2 may now be complete. If it continues lower as a double zigzag, then primary wave 2 may not move beyond the start of primary wave 1 below 1,160.75.

Cycle wave III so far for this wave count would have been underway now for 45 weeks. It may be beginning to exhibit some support from volume and increasing ATR. If this increase continues, then this wave count would have some support from technical analysis.

Draw an acceleration channel about primary waves 1 and 2: draw the first trend line from the end of primary wave 1 to the last high, then place a parallel copy on the end of primary wave 2. Keep redrawing the channel as price continues higher. When primary wave 3 is complete, then this channel would be drawn using Elliott’s first technique about the impulse. The lower edge may provide support.

Primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

DAILY CHART

This daily chart focusses on the impulse of primary wave 3.

Primary wave 3 may only subdivide as an impulse. Primary wave 3 has now moved above the end of primary wave 1, meeting a core Elliott wave rule.

When it arrives, primary wave 4 may not move into primary wave 1 price territory below 1,346.45.

Intermediate wave (5) may exhibit further strength. The target for primary wave 3 is calculated using the most common Fibonacci ratio to primary wave 1.

The structure of primary wave 3 as an incomplete impulse for this wave count is seen in exactly the same way as the incomplete impulse for intermediate wave (C) in the second bearish daily chart.

Look out now for the possibility of another blow off top as intermediate wave (5) to end primary wave 3 comes to an end.

HOURLY CHART

Intermediate wave (4) may now be complete and intermediate wave (5) may have begun.

Intermediate wave (5) may subdivide as either an impulse or an ending diagonal. Fifth waves to end third wave impulses one degree higher almost always subdivide as impulses, so that will be the expected Elliott wave structure for intermediate wave (5).

Within intermediate wave (5), the first five up for minor wave 1 may be incomplete. When minor wave 1 may be complete, then minor wave 2 may not move beyond the start of minor wave 1 below 1,382.64.

Minor wave 1 may be unfolding higher as an impulse. Within minor wave 1, minute wave i may be complete and minute wave ii may be unfolding lower as a double combination.

TECHNICAL ANALYSIS

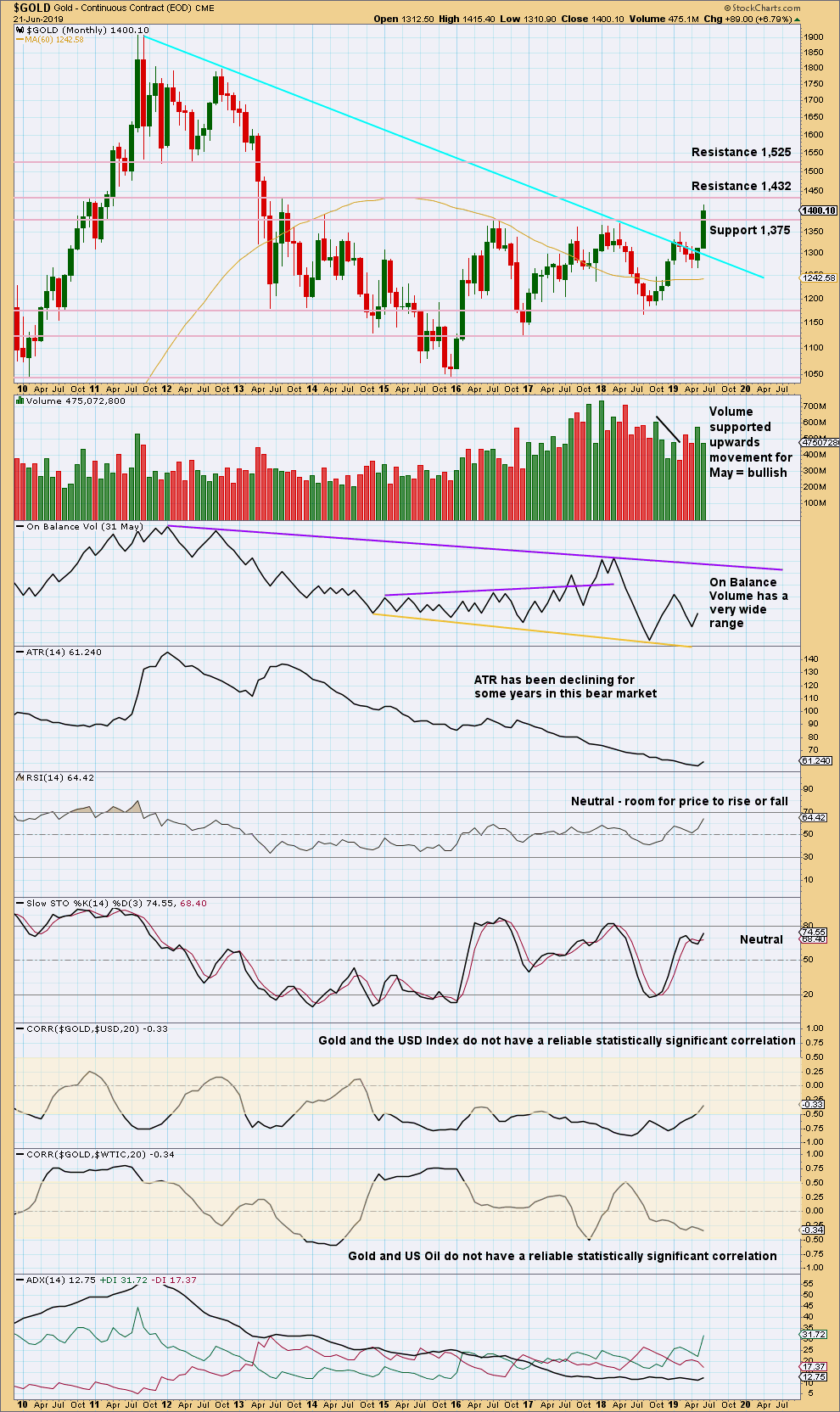

MONTHLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold has effected an upwards breakout above multi-year resistance and above the cyan bear market trend line. Look for next resistance identified on the chart.

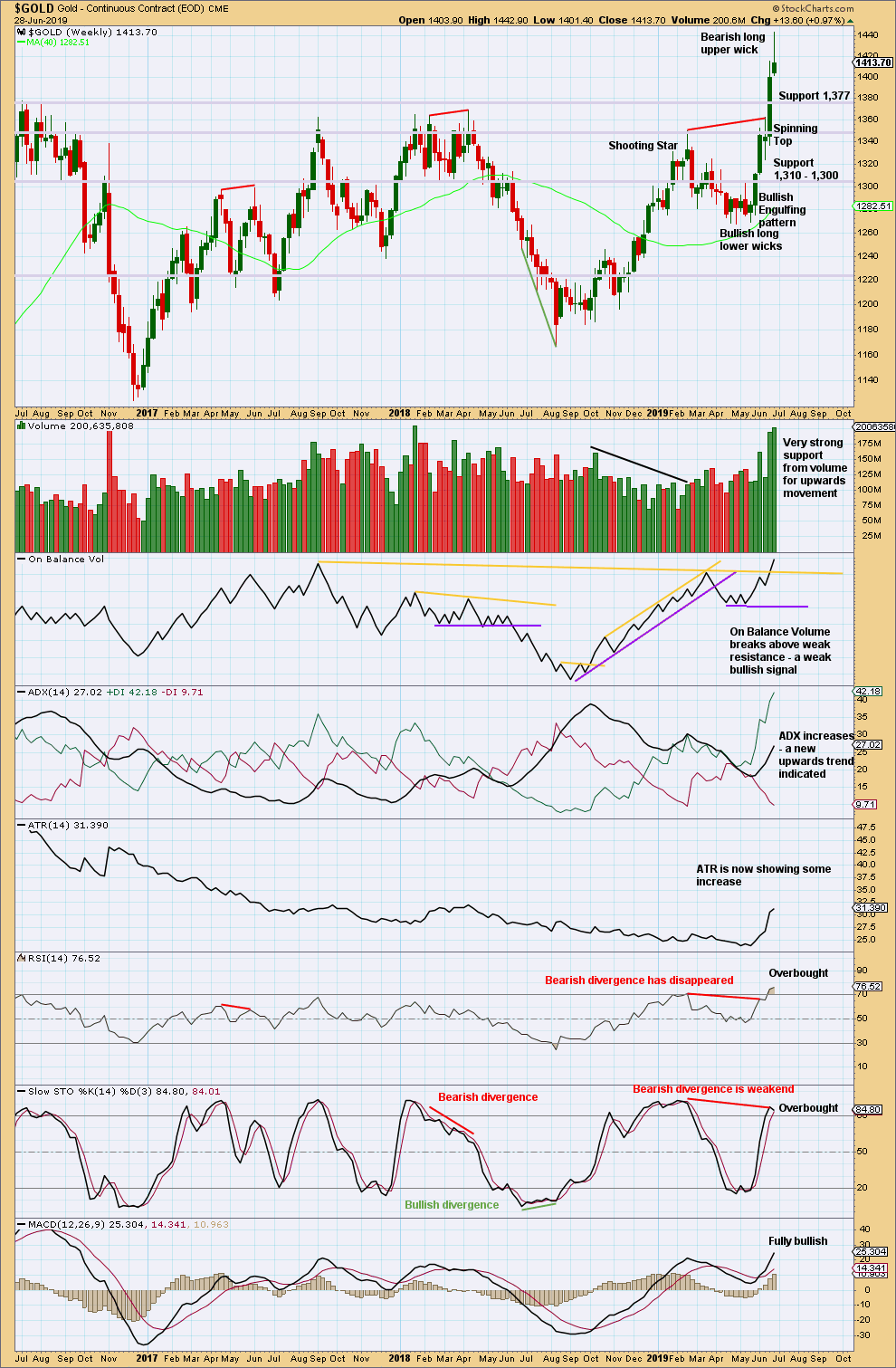

WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Gold has broken out of a multi-year consolidation, which saw resistance about 1,375. The breakout has support from volume, so confidence may be had in it.

Price now has some strength with rising ATR. Conditions are overbought. A pullback or consolidation may begin here before the upwards trend resumes.

The bullish signal from On Balance Volume is weak only because the line breached had only 3 tests. However, it is a bullish signal and would tend to support the bullish Elliott wave count.

Look now for strong support about 1,375 for a possible back test.

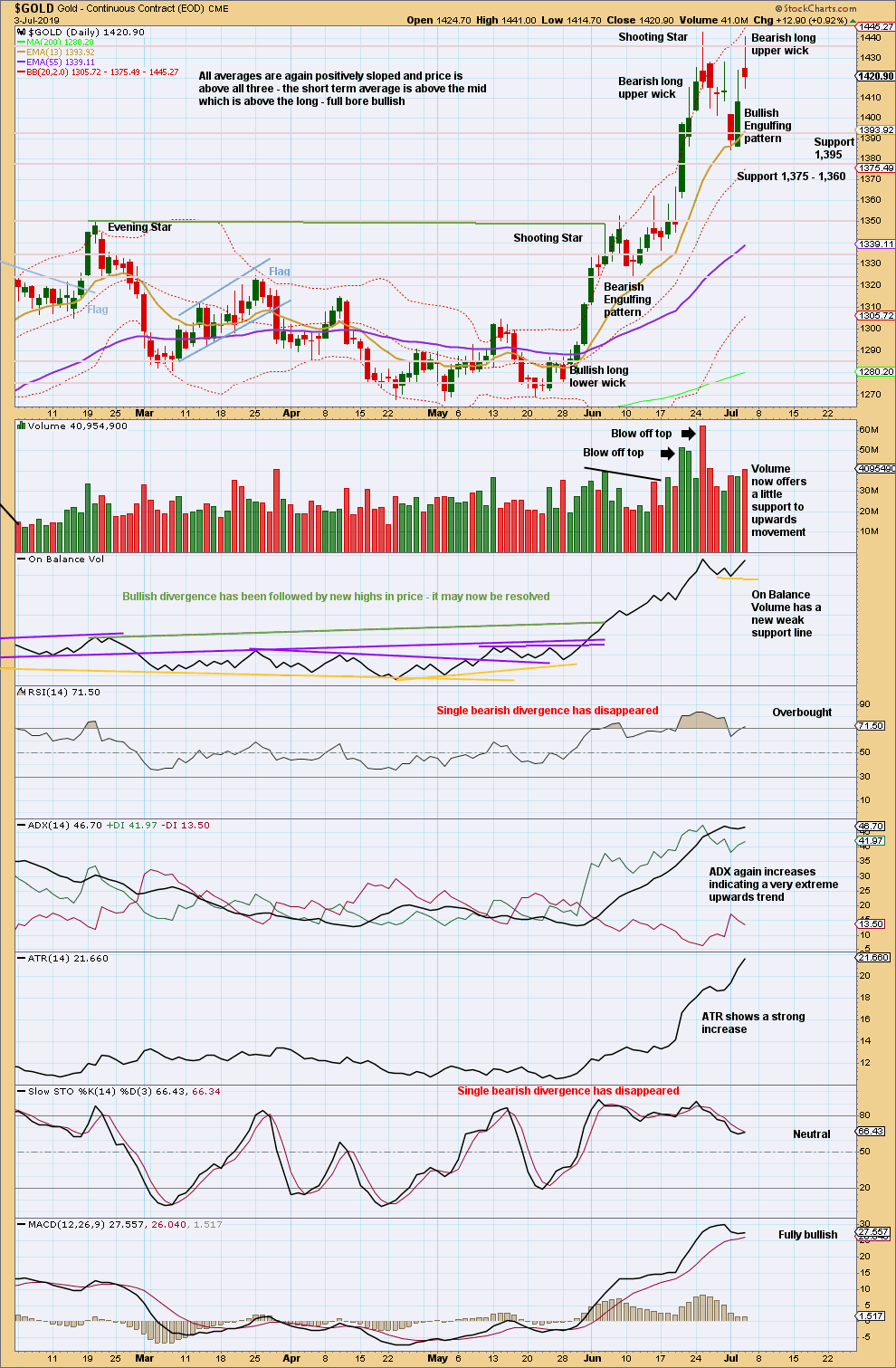

DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

Stockcharts data is New York session only data. With New York closed for the 4th of July holiday, there is no new data to analyse today.

It is common to see price curve down and back test support at prior resistance after a breakout, and that may now be complete. The candlestick for Monday does not have support from volume, but it does have greater ATR and completes a strong Bullish Engulfing pattern.

However, the trend is again indicated as very extreme. RSI is again overbought and Stochastics remains fairly close to overbought. If this back test is now complete, it did not last long enough to bring conditions down from very extreme. There is risk here that the back test may continue further sideways and lower closer to 1,375.

Overall, this chart is bullish and supports the bullish Elliott wave count.

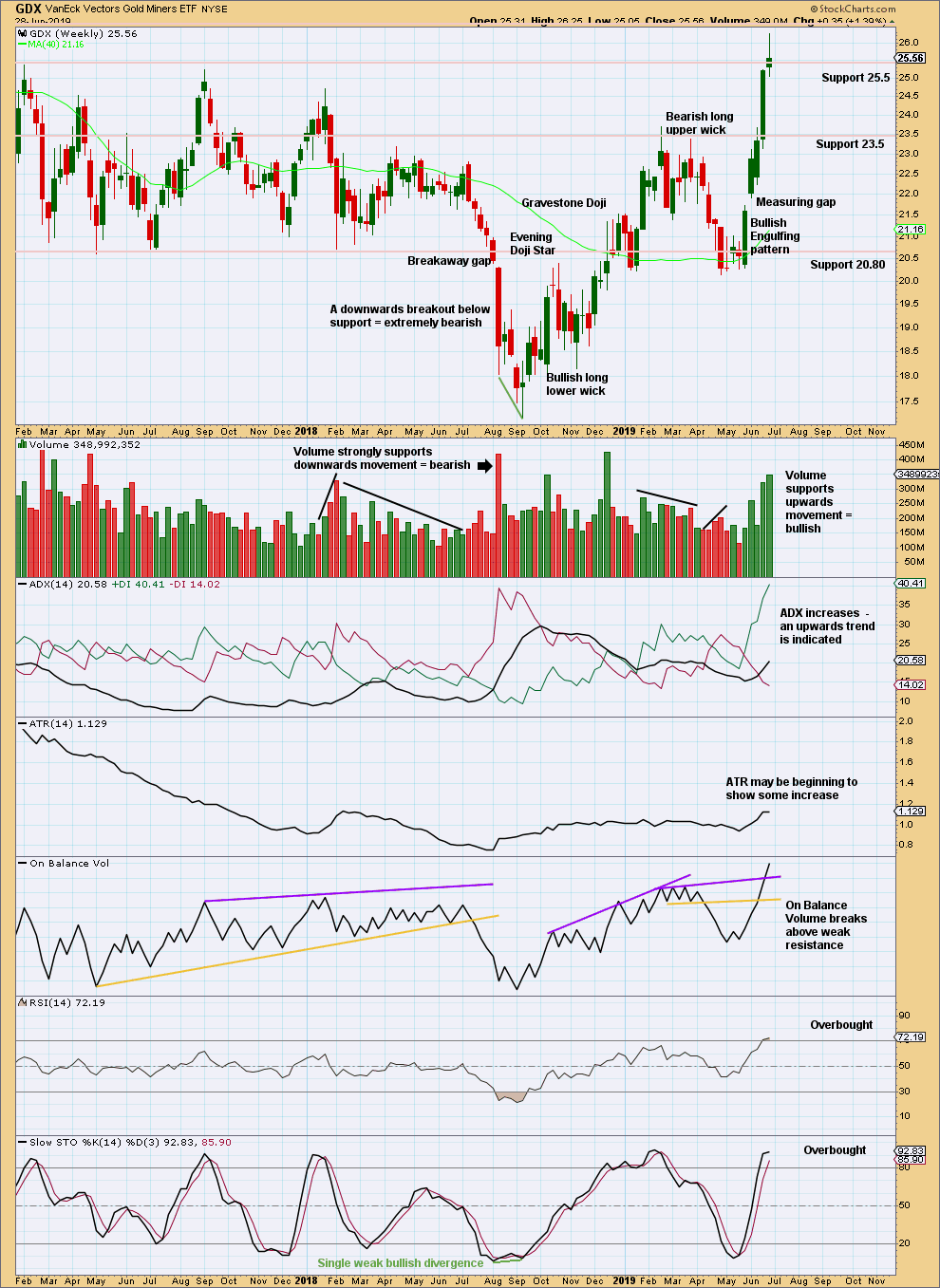

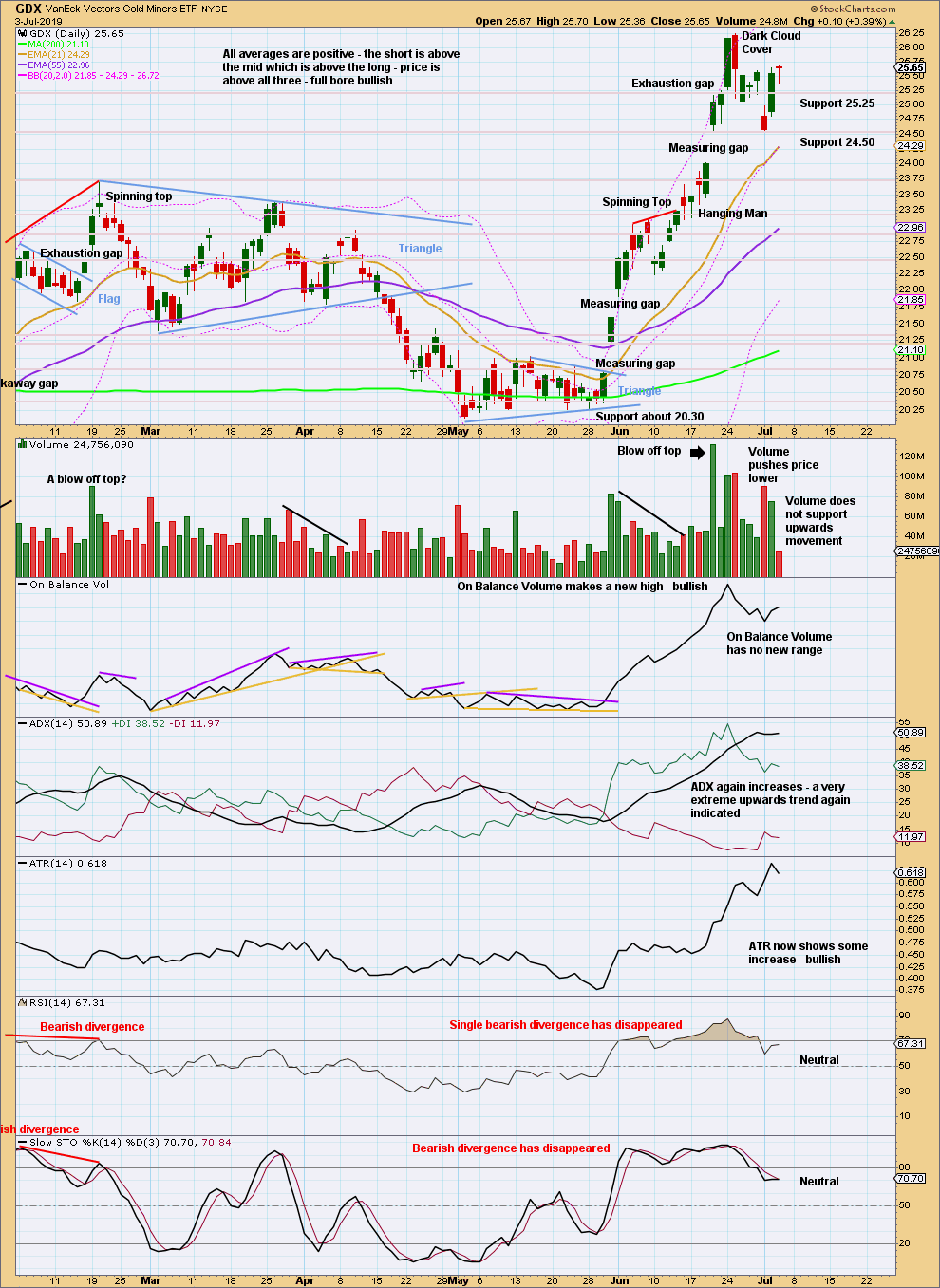

GDX WEEKLY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The upwards trend continues, but conditions are now overbought. This can continue for a while during a strong trend. At this stage, there are no signs of a reversal.

GDX DAILY CHART

Click chart to enlarge. Chart courtesy of StockCharts.com.

The last gap is closed, so it is now renamed an exhaustion gap. This indicates the possibility of a trend change. In conjunction with a bearish candlestick reversal pattern in the Dark Cloud Cover, a trend change here may be reasonably likely.

A trend change may be either a 180 degree reversal, or equally as likely a change to sideways as price consolidates to relieve extreme conditions, before continuing the upwards trend.

For GDX the trend remains very extreme.

Published @ 10:10 p.m. EST.

—

Careful risk management protects your trading account(s).

Follow my two Golden Rules:

1. Always trade with stops.

2. Risk only 1-5% of equity on any one trade.

—

New updates to this analysis are in bold.

I’m surprised there are no comments about that huge spike in Barchart data. They’ve responded to my support request and will be fixing it. So far, it’s still there.

Hourly chart for the first bear count updated:

I may yet need to move the degree of labelling within minor 3 down one degree, the count now has the middle of it passed today but it has not yet moved below the end of minor 1 so that looks too short.

Either way, an impulse may be completing lower. Within it minuette (iv) may not move into minuette (i) territory.

Hourly bull chart updated:

Minute ii now fits as a completed double zigzag, much deeper than this count expected but remaining just above the invalidation point.

Nice! Thanks for the updates.

That’s how I was reading it … Monday we should know where we are going

Could move mostly sideways Monday-